Open FAN

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

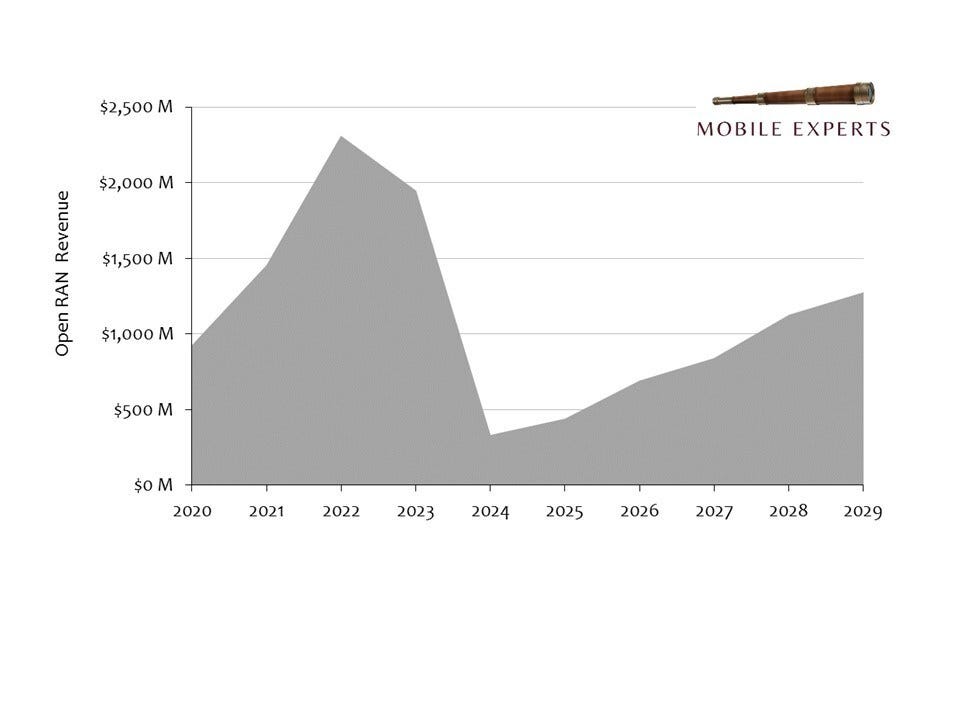

As expected, the Open RAN market ‘screeched to a halt’ during 2024. Mobile Experts released a new report on Open RAN, which it described as ‘the most bizarre market growth profile ever seen in the wireless market.’ After ‘great success’ with deployment in greenfield networks by the DISH Networks in the U.S., Rakuten in Japan and 1&1 in Germany, the market research firm is predicting a significant slump this year with a very slow recovery (see chart below).

“Our revenue chart for Open RAN looks like the Grand Canyon,” said Joe Madden, Principal Analyst at Mobile Experts. “All of the big clean-sheet O-RAN deployments have finished their major buildout phase, so now the market will transition to upgrades on legacy networks. But legacy networks will use Open RAN differently.”

“Many people don’t understand why legacy mobile operators are rejecting the original Open RAN business model and are choosing a Single Software business model instead. This report provides clear guidance on why the market is fundamentally changing.”

……………………………………………………………………………………………………………………………………

Comment and Analysis:

The original Open RAN business model called for multiple vendors to provide the equivalent of a disaggregated base station. That is why it was dubbed “Open.” However, legacy carriers prefer a closed solution, where a single vendor is the primary supplier of hardware and software for an Open RAN system. This limits the supply chain diversification that O-RAN was designed to promote and pushes out new vendors. Some examples of single vendor Open RAN solutions include:

-

AT&T and Ericsson: AT&T’s five-year, $14 billion Open RAN contract is a single vendor Open RAN deal.

- Deutsche Telekom and Nokia: Deutsche Telekom’s contract with Nokia includes the initial deployment of Fujitsu radios in Northern Germany.

- NTT DOCOMO and Nokia: NTT DOCOMO will use Nokia as its vendor to deploy Open RAN.

- Verizon and Nokia and Samsung Networks: Verizon has been using “Open RAN-capable” virtual RAN (vRAN) systems from Nokia and Samsung Networks for several years, but that is not true Open RAN as per O-RAN Alliance specs. Verizon could evolve its vRAN deployments with Samsung Networks into an Open RAN architecture, following the recent appointment of Open RAN advocate Yago Tenorio as its CTO.

–>Meanwhile, there are still no official standards for Open RAN- only O-RAN Alliance specs.

The new report lays out the expected revenue in hardware (radios, servers, antennas) and software (vDU, vCU, RIC, xApp, rApp, and dApp) through 2029, as major operators like AT&T, Vodafone, Verizon, Telus, DoCoMo, and others begin to buy mobile infrastructure from alternative vendors.

“The US Government is pumping hundreds of millions of dollars into Open RAN,” continued Mr. Madden. “But sadly, the biggest challenge of Open RAN will not be addressed by NOFO and other government grants. Each grant will be too small to fix the fundamental economic challenge of Open RU hardware. The market will solve the problem anyway, without government help. Get our report for the details.”

Here’s a chart of Open RAN revenue by year:

Subscribers to the Open RAN 2024 report will receive:

- Full access to the 40-page Open RAN 2024 report;

- Clear breakdowns of the 5-year forecast in an Excel spreadsheet;

- Detailed technical background and architectural analysis;

- Insight into the pace of upcoming projects with legacy operators; and

- Access to the analysts behind the reports.

References:

https://www.telecoms.com/open-ran/open-ran-market-fell-83-in-2024

https://mobile-experts.net/reports/p/oran24?rq=open%20RAN

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN

Parallel Wireless deploys 1,500 Open RAN sites across Africa; partners with Hotspot Network in Nigeria

DISH Wireless Awarded $50 Million NTIA Grant for 5G Open RAN Center (ORCID)

Deutsche Telekom Network Day: Fiber, Mobile Network, Open RAN and 5G SA Launch in 2024

NTT DOCOMO OREX brand offers a pre-integrated solution for Open RAN

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Multi-G Initiative to drive Open RAN Software Interfaces and increase innovation

Cohere Technologies, Intel, Juniper Networks, Mavenir and VMware intend to collaborate to develop the industry’s first framework for a multi-generational (Multi-G), software-based Open RAN architecture. The Multi-G initiative would define frameworks, interfaces, interoperability testing, and evaluation criteria that would provide the interfaces to support full coexistence of 4G, 5G, and future waveforms.

Intel’s FlexRAN platform is used by most current virtualized RAN (vRAN) deployments; Mavenir has a strong presence in providing open RAN equipment and software; and Juniper Networks and VMware are both contributing their work with the RAN intelligent controller (RIC). Cohere’s contribution is through its Universal Spectrum Multiplier software that can be integrated by RAN vendors or as an “app” into a telco cloud platform.

Intel’s involvement in this initiative is significant from an industry perspective due to the breadth of FlexRAN adoption. It also puts the chip giant a step ahead of competitors like Qualcomm, Arm and AMD that are aggressively targeting the Open RAN silicon market.

The new Multi-G framework would disaggregate RAN intelligence and scheduling functions, enabling future code releases of Intel’s FlexRAN reference architecture to support higher capacity, software-defined deployments for 4G, 5G and next generation wireless waveforms and standards.

This effort would help drive higher performance and connectivity across satellite, private and ad-hoc networks, and autonomous vehicles, increasing new service and revenue opportunities for telecommunications and mobile operators.

“This is going to make the network programmable all the way from layer one to the highest layers of the architecture,” said Cohere Technologies’ CEO Ray Dolan. “It’s not that open RAN is incomplete or not vibrant or not working, it is.” Right now, it has opened most of the parts that are what I’ll say are less controversial than the E2 interface. It’s opened the radio interfaces and the antenna interfaces, and so it’s established. But it hasn’t established the proper E2 interfaces completely. And that’s widely accepted as a fact. And in order for, I believe, for open RAN to really achieve its full vision, it needs to open that E2 interface because that’s where the innovation will come. Because that’s where all of the complexity in the marketplace is.”

The E2 work basically taps into the near real-time xApps running in a RIC to monitor and optimize an operator’s RAN deployment – typically either a vRAN or open RAN – and across different spectrum bands. This in turn allows an operator to support more stringent service-level agreements (SLAs) and private network deployments that can generate more revenues.

Ahead of the group’s first meeting in May 2023, telecommunications leaders worldwide are already sharing support for the collaborative initiative:

Vodafone Group

“This commitment from Intel, Mavenir, Juniper Networks, and Cohere, with a software programmable L1 stack, is fully aligned with the vision of Open RAN and will bring us one step closer to the scale deployment of software-defined RAN,” said Yago Tenorio, Vodafone Fellow and Director of Network Architecture, and Chairman of the Telecom Infra Project (TIP). “This has huge potential for significant performance and capacity benefits for all existing cellular networks. We strongly endorse this initiative, and we look forward to seeing the critical interfaces published into the relevant O-RAN Alliance and TIP Working Groups.”

Telstra

“Cohere’s Universal Spectrum Multiplier technology has the potential to unlock new architectural capabilities and opportunities for the RAN beyond today’s architecture,” said Iskra Nikolova, Network and Infrastructure Engineering Executive at Telstra. “We’re pleased to support this initiative and look forward to working with Cohere and the group to define the framework and accompanying critical interfaces.”

Bell

“A genuine Multi-G framework will enhance the benefits of Cohere’s Universal Spectrum Multiplier, strengthen Open RAN vendor flexibility down to the silicon layer, and allow old and new waveforms to coexist— beyond 5G,” said Mark McDonald, Bell’s Vice President, Wireless Access. “Bell looks forward to working with Cohere and partners later this year to further test this architecture.”

Hear from the Collaborators:

Intel Corporation

“This Multi-G framework, enabled by Intel FlexRAN – which is fully software programmable down to L1 – will enable faster O-RAN adoption and unlock new innovations,” said Sachin Katti, senior vice president and general manager of the Network and Edge Group at Intel Corporation.

Mavenir

“As the leading Open RAN partner, we’re excited to be part of the Multi-G initiative which promises to bring 4G and 5G spectral efficiencies gains not possible with incumbent solutions,” said Bejoy Pankajakshan, EVP-Chief Technology and Strategy Officer at Mavenir. “Unlike traditional DSS (Dynamic Spectrum Sharing) techniques which reduces 4G and 5G performance, with our Multi-G collaboration with Cohere and Intel, Mavenir can provide a true spectrum co-existence solution, which deploys 5G on the same spectrum assets as 4G dramatically improving the ROI per Hz on the existing 4G spectrum.”

Juniper Networks

“As more 5G deployments are underway, there is still a large installed base of 4G networks that can benefit from the intelligence, control and automation enabled by an Open RAN Intelligent Controller (RIC) architecture,” said Raj Yavatkar, CTO of Juniper Networks. “Juniper Networks has already demonstrated innovative 4G and 5G use cases with our Juniper Non-RealTime RIC and Near-RealTime RIC that can provide more flexibility to network operators. We are excited to add our expertise and join the Multi-G framework initiative, which will not only help to accelerate Open RAN adoptions but will also spur further innovation across multiple generations of mobile networks to enhance the network operator experience.”

VMware

“VMware is already paving the way for more programmable and intelligent Open RAN networks with our VMware RIC and our Service Management Orchestration Framework (SMO) for end-to-end RAN automation, assurance and optimization,” said Sanjay Uppal, GM & SVP, Service Provider Business Unit, VMware. “We are pleased to join other industry leaders to pioneer in the development of the industry’s first framework for a Multi-G, software-programmable architecture that will further encourage innovation and fast-track the adoption of Open RAN globally.”

Open RAN Policy Coalition

“Defining new interfaces that supercharge developing and future networks is critical for the success of open networks,” said Diane Rinaldo, Executive Director of the Open RAN Policy Coalition. “This will foster innovation and add flexibility, which will improve our competitiveness.”

Cohere Technologies

“We are pleased to work with world-class partners and operators to accelerate the deployment of Multi-G, open networks with significant performance improvements,” said Ray Dolan, CEO of Cohere Technologies. “Cohere is committed to a software-based, open architecture that can drive faster innovation and deliver critical revenue growth and profitability for the industry.”

………………………………………………………………………………………………………………………………………………………….

About Cohere Technologies:

Cohere is the innovator of Universal Spectrum Multiplier (USM) software for 4G, 5G, and Multi-G O-RAN. USM improves mobile networks up to 2x by MU-MIMO, enabling existing devices in any FDD and TDD spectrum band. Cohere is the creator of the Orthogonal Time Frequency Space (OTFS) wireless system, and is headquartered in San Jose, Calif. (USA). Website: www.cohere-tech.com Twitter: @Cohere_MultiG

References:

https://www.cohere-tech.com/press-releases/multi-g-initiative

LightCounting: Open RAN/vRAN market is pausing and regrouping

ATIS and O-RAN Alliance MOU may be a prelude to Open RAN standards in North America

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

ATIS and O-RAN Alliance MOU may be a prelude to Open RAN standards in North America

ATIS today announced it has executed a memorandum of understanding (MoU) with the O-RAN ALLIANCE to further both organizations’ mutual objectives to advance the industry towards more intelligent, open, virtualized and global standards-compliant mobile networks.

The MoU notes that ATIS and the O-RAN ALLIANCE will collaborate on advancing the state-of-the-art of open radio access network, including Open RAN security and stakeholder requirements for Open RAN. It also addresses the opportunity for ATIS translation of O-RAN ALLIANCE specifications to Open RAN standards to advance the adoption of Open RAN in North America.

“This agreement with the O-RAN ALLIANCE brings the power of ATIS’ 3GPP leadership and its contributions to the continued evolution of 5G, coupled with ATIS’ leadership for 6G and beyond as part of its Next G Alliance, to advance the development of open RAN technologies,” said ATIS President and CEO Susan Miller. “The MoU combines the forces of ATIS and the O-RAN ALLIANCE to connect the present to the future for the open RAN ecosystem, advancing the promise of a robust open RAN marketplace.”

“Continuing the work toward open radio access networks is critical in unlocking the full potential of 5G in North America and will lay the foundation for future generations of wireless technology,” said Igal Elbaz, Chair of ATIS Board of Directors and Network CTO of AT&T. “ATIS and the O-RAN ALLIANCE combining their expertise and resources and ATIS’ adoption of O-RAN specifications to ATIS Open RAN standards will help accelerate the industry’s implementation of open RAN.”

The MoU also addresses participation, by invitation, in meetings of each other’s working groups where appropriate, and promoting and endorsing each other’s events (e.g., conferences and plugfests) or activities (e.g., publication of work results) in areas of mutual interest and with prior consent of the other party.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Analysis:

ATIS’ board is composed of top executives from AT&T, Verizon, T-Mobile, Ciena and Comcast. It’s the group that has previously addressed topics including secure supply chain, robocalls and hearing aid compatibility for cellphones. And it’s also the association behind the new Next G Alliance, which is working to organize a comprehensive U.S. strategy around future 6G technologies.

Also note that ATIS represents 3GPP in ITU-R WP 5D and presents all their IMT contributions on 5G/IMT 2020/ITU-R M.2150. If 3GPP ever includes Open RAN in its specifications, it’s very likely that those will be presented by ATIS to ITU-R for 5G or even 4G LTE.

“Standards-based open RAN will help create a more receptive marketplace for open RAN technology, advance its development and drive adoption in North America,” added ATIS’ VP of technology and solutions, Mike Nawrocki, in a statement to Light Reading.

In the U.S., Dish Network is in the midst of building a nationwide 5G network that adheres to Open RAN specifications. However, it’s unclear whether Dish will be able to profit from its embrace of open RAN. AT&T has told this author they are interested in deploying Open RAN for 5G if it is more economical than legacy RANs. Neither Verizon or T-Mobile has expressed interest in Open RAN.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About ATIS:

As a leading technology and solutions development organization, the Alliance for Telecommunications Industry Solutions (ATIS) brings together the top global ICT companies to advance the industry’s business priorities. Our Next G Alliance is building the foundation for North American leadership in 6G and beyond. ATIS’ 160 member companies are also currently working to address 5G, illegal robocall mitigation, quantum computing, artificial intelligence-enabled networks, distributed ledger/blockchain technology, cybersecurity, IoT, emergency services, quality of service, billing support, operations and much more. These priorities follow a fast-track development lifecycle from design and innovation through standards, specifications, requirements, business use cases, software toolkits, open-source solutions and interoperability testing.

ATIS is accredited by the American National Standards Institute (ANSI). The organization is the North American Organizational Partner for the 3rd Generation Partnership Project (3GPP), a founding partner of the oneM2M global initiative, a member of the International Telecommunication Union (ITU) and a member of the InterAmerican Telecommunication Commission (CITEL). For more information, visit www.atis.org. Follow ATIS on Twitter and on LinkedIn.

About O-RAN ALLIANCE:

The O-RAN ALLIANCE is a world-wide community of more than 300 mobile operators, vendors, and research & academic institutions operating in the Radio Access Network (RAN) industry. As the RAN is an essential part of any mobile network, the O-RAN ALLIANCE’s mission is to re-shape the industry towards more intelligent, open, virtualized and fully interoperable mobile networks. The new O-RAN specifications enable a more competitive and vibrant RAN supplier ecosystem with faster innovation to improve user experience. O-RAN based mobile networks at the same time improve the efficiency of RAN deployments as well as operations by the mobile operators. To achieve this, the O-RAN ALLIANCE publishes new RAN specifications, releases open software for the RAN, and supports its members in integration and testing of their implementations.

For more information, please visit www.o-ran.org.

References:

https://www.lightreading.com/open-ran/open-ran-gets-helping-hand-in-us/d/d-id/782703?

https://www.lightreading.com/open-ran/the-growing-pains-of-open-ran-/a/d-id/782247

https://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=9946966

Dish Network to FCC on its “game changing” OpenRAN deployment

Telecom Infra Project introduces Open FAN to promote multi-vendor interoperability

The Telecom Infra Project (TIP) has announced a new initiative for “open fixed access networks (FAN)” at the FYUZ conference in in Madrid, Spain. The Open FAN initiative is being led by Telefónica, Telecom Italia, and Vodafone. As in the mobile radio access network, the goal is to ensure products from competing vendors can be combined in the same fixed access network. That is the essence of true interoperability.

The work will focus on improving interoperability and diversity in the access network, accelerating innovation and boosting capacity in the last mile through the transition from GPON to XGS-PON. Specifically, Open FAN is targeting the link between optical line terminals (OLTs) and optical network terminals (ONTs), the boxes that sit at either end of a fiber connection. Integration with SDN controllers, the traffic cops of the network, is another priority. Open FAN has just become the latest TIP sub-group, part of the fixed access project group.

……………………………………………………………………………………………………………………………………………………….

TIPs Fixed Broadband Project Group is developing a new generation of open and disaggregated technologies that help operators increase the availability of fast and reliable broadband services across the world. The goal of the TIP fixed access sub-group is to build access networks capable of delivering high speed connectivity over the last mile. The primary objective for this group is to achieve a high degree of interoperability in the access domain, including:

- East-west interworking and integration between network elements

- Northbound integrations to OSS and network management systems

……………………………………………………………………………………………………………………………………………………….

Participants are currently drawing up technical requirements for a so-called “pizza box” OLT that can be delivered to the local telco. They will issue a request for information later this year as they assess the technical capabilities of vendors and their “readiness” for open FAN.

“The disaggregation of OLTs represents a valuable opportunity to broaden the telecom supply chain, which we’ve seen has become more important than ever during recent times,” said Paolo Pellegrini, TIM’s access innovation project manager, in telling remarks. “TIM is excited about the opportunities to work with a new generation of hardware and software suppliers who can bring innovative solutions that will help us build more cost-effective and efficient networks.”

Data from Omdia, owned by Informa, shows that just three vendors controlled 85% of the market for OLTs last year. Two of them, Huawei and ZTE, are Chinese, leaving Nokia as the only other supplier. The lack of alternatives explains why the UK government was less restrictive in fixed than it was in mobile when clamping down on Chinese vendors.

TIP probably hopes interoperability will boost competition in a market for passive optical network (PON) products worth about $8 billion in sales last year. If operators could more easily buy OLTs separately from ONTs, developers could focus resources on one area. An OLT specialist would not require an ONT capability to compete.

Today, mixing FAN products from different vendors is problematic, said a source at TIP, and Nokia seems to agree.

“It is not easy to do, but it is something that we do,” said Federico Guillén, the head of Nokia’s network infrastructure business group, during an interview at the recent Network X event in Amsterdam. “If you do this, you have to put in some rules for how the OLT and the ONT communicate and set a lower denominator, which means you are missing some features. Interoperability doesn’t come for free.”

Telecom already has an interface for connecting OLTs to ONTs, called OMCI (for ONT management control interface). But when it comes to multi-vendor interoperability, this does not seem to have delivered. “It was perfectly standardized, and everyone was implementing and following, but they were choosing different options,” said Stefaan Vanhastel, the chief technology officer for Nokia’s fixed network unit.

Nokia served about 24% of the global PON market last year, according to Omdia’s data, but has increased its presence in OLTs, according to Guillén. A backlash against Huawei in many countries outside China has probably helped. “Our market share is growing, especially where we want it to grow, which is the OLT side,” he told Light Reading. “The ONT side is a very crowded space.”

Specialists may find that challenging Nokia in the FAN is just as hard as it is in the RAN. Last year it pumped €4.2 billion (US$4.2 billion) into research and development, including investments in the silicon platforms that support higher-speed broadband services. At Network X, it announced a new OLT, branded Lightspan MF-14, that provides an upgrade path to 100G-capable networks. “Operators have a solution that will be reusable as line cards are upgraded over time,” said Julie Kunstler, chief analyst with Omdia. “This has lots of capacity and ONTs will be upgraded as needed.”

The new TIP Open FAN subgroup expects to issue an RFI to establish the technical capabilities and readiness of suppliers to deliver such a solution later in the year, with test and validation to follow.However, there was no mention of network equipment vendor support for open FAN in the TIP’s statement and without that it could struggle. If enough operators urge change, those vendors may have to budge – but the wariness of Ericsson and Nokia about open RAN illustrates just how difficult that could be. Open FAN also appears to lack an equivalent of the O-RAN Alliance, the group developing open RAN specifications. TIP has previously distanced itself from specifications development. If an alternative to OMCI is needed, who takes the lead?

Whether open FAN becomes as big a deal as open RAN is doubtful. For one thing, operators spent about $37 billion less on FAN products last year than on RAN kit, according to Omdia’s numbers. Most of their fixed-line capex goes into civil engineering, and no amount of interoperability or virtualization will save money there.

Despite the muscle of Huawei, Nokia and ZTE, the market was also growing more competitive before open FAN was a thing, according to Omdia’s Kunstler. Ciena, an optical equipment vendor based in the US, and Sterlite, an Indian firm that sells fiber-optic cable, are just two examples of companies moving into a PON market forecast to generate nearly $16 billion in annual sales by 2027.

References:

https://telecominfraproject.com/wp-content/uploads/Fixed-Access-UCD_v1.0_20220628.pdf