Uncategorized

China Mobile reports 2018 net profit of $17.58 billion; 5G accomplishments and 2019 plans

2018 Financial Overview:

On March 20, 2019, China Mobile (the world’s largest wireless carrier by subscribers and revenue) reported a 3.1% increase in net profit for 2018 to 117.78 billion yuan ($17.58 billion). The company focused on reducing costs and increasing operational efficiency. Telecommunications service revenue fell a reported 0.4% but grew 3.7% in comparable terms to 670.9 billion yuan. China Mobile’s net profit was aided by the listing of the company’s tower division China Tower in August last year.

2018 Highlights:

- China Mobile reported a 4.3% increase in its total customer base for the year to 925 million, of which 713 million are 4G customers – a 9.7% increase from 2017.

- However, mobile ARPU fell 8% to 53.1 yuan as a result of strong competition.

- Total wireline broadband subscribers increased by 39% to 157 million, of which 147 million were household broadband customers. Household broadband blended ARPU grew 3.2% to 34.4 yuan.

- The company’s four growth engines are: personal mobile market, home broadband market, corporate market, emerging business

- IoT revenue +40.2% to RMB7.53 bil

- ICT, Cloud Computing, Big Data Revenue Revenue =RMB4.19 bil which was +75.3%

- Boasted 2.41 mil 4G base stations with an industry-leading 4G network coverage capability

- Realized NB-IoT continuous coverage in areas at township level and above across China

- Achieved household broadband access capability of ≥100Mbps.

- More efficient deployment of CDN edge nodes resulted in ongoing enhancements to customer perception

- Maintained a backbone network with a further enhanced transmission and loading capability.

- Performance of international submarine cables, cross-border terrestrial cables and PoPs was substantially lifted

“2018 was a challenging year for telecommunications operators. Competition amongst peers changed in characteristics as products and services have become homogenized while cross-sector challenges have intensified. The value of traditional telecommunications business rapidly diminished, coupled with multiple challenges from a complex and rapidly-changing policy environment,” China Mobile chairman Yang Jie said.

“In order to counter market competition, overcome the major obstacles in the ongoing reforms and enhance management, we continued to encourage everyone across the Company to take the ‘Big Connectivity’ strategy even further and implement the integrated development of the four growth engines.”

2018 5G Accomplishments:

- Permitted to adopt 2.6GHz and 4.9GHz frequency bands for trials

- Network tests and application trials in 17 cities

- Developed 5G Ecology:

• 5G Joint Innovation Centre

• 5G Device Forerunner Initiative

• 5G Joint Innovation Industry Fund

2019 Goals dor 5G: Construct end-to-end network infrastructure; Promote 5G commercialization:

• Develop NSA and SA networks concurrently with SA (stand alone- no LTE) as the primary goal

• Promote 4G/5G synergistic development and expedite 4G VoLTE

• Join hands with the industry supply chain to develop devices supporting multiple modes, bands and form factors

• Share end-to-end smart technology capabilities and serve vertical industries

Work together to build an open and win-win innovative ecosystem. Promote 5G cross-industry integration:

- Culture and entertainment

- Smart transportation

- Smart city

- Smart manufacturing

- Remote healthcare

https://www.chinamobileltd.com/en/ir/webcasts/pre190321.pdf

China Mobile on 5G (from Press Release):

We will continue to conduct tests on the 5G network and perform trials on business applications to ensure the precommercial launch of 5G services this year. We aim to provide direction and leadership for 5G development, exploring suitable 5G products and business models with industry partners. To build a strong foundation for the ongoing transformation towards an intelligent network, we will speed up the pace of network upgrades and strengthen our core capabilities. The Company will expand into new retail business and strive for the large-scale development of our own branded intelligent hardware. We will build up our capabilities in key business areas and develop an open and shared innovative ecosystem. In order to realize a win-win situation, we will continue to enhance the collaborative opening-up efforts, reinforcing industrial cooperation,investment planning and international expansion.

http://mms.prnasia.com/00941/20190321/2018ARPressRelease_ENG.pdf

SD-WAN revenue hits $359 million in Q4 2018; Data Center Networking Highlights

By Josh Bancroft, senior analyst, DC and enterprise SDN, Networked Services, IHS Markit.

Highlights

Software-defined networking (SD-WAN) software revenue, including appliance and control and management software, rose 26 percent quarter over quarter to reach $359 million in the fourth quarter (Q4) of 2018. VMware led SD-WAN market revenue share with 20 percent, followed by Cisco at 14 percent and Aryaka at 12 percent, according to the “Data Center Network Equipment Market Tracker” from IHS Markit.

Editor’s Notes:

- VMware and Cisco acquired SD-WAN start-ups Velocloud and Viptela, respectively in 2018 which enabled them to lead this market.

- There are many types of SD-WANs, none of which are based on standards. Here’s an article describing the different SD-WAN “flavors”

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

In the fourth quarter, vendors began to reap the rewards of partnering with multiple managed-service providers, systems integrators and telcos. Revenue deal sizes have been rising, and the number of enterprise sites deploying SD-WAN continues to grow.

For the foreseeable future, both direct and channel sales will continue to drive SD-WAN market growth. In the IHS Markit “Edge Connectivity Strategies North American Enterprise” survey in February 2019, respondents showed a clear bias for consuming SD-WAN with self-managed on-site hardware and software, or as a standalone managed service bundled with connectivity. However, by 2019 they expect to shift to managed services bundled with other network functions virtualization (NFV) services and connectivity.

“Telcos want to utilize the high speeds and network-slicing capability of 5G, along with the application-traffic steering capability of SD-WAN, to support the industrial internet of things and other new edge applications,” said Josh Bancroft, senior research analyst at IHS Markit. “The telcos view SD-WAN as a key way to ensure various traffic types are automatically steered to the appropriate links. It can also guarantee IoT traffic is prioritized over 5G, and other applications are automatically routed over broadband.”

“If they haven’t done so already, SD-WAN vendors should consider adding IoT-specific features to their offering, such as application identification, prioritization and protocol translation functionality on SD-WAN appliances,” Bancroft said.

Following are some additional data center network market highlights:

- Application delivery controller revenue declined 4 percent quarter over quarter and 7 percent year over year in Q4 2018, reaching $438 million.

- Virtual ADC appliances comprised 35 percent of ADC revenue in Q4 2018.

- F5 revenue declined by 8 percent, quarter over quarter, in Q4 2018, but the company still garnered 47 percent of ADC market share. Citrix followed F5 with 27 percent, and A10 came in third with 8 percent.

Data Center Network Equipment Market Tracker

With forecasts through 2023, this IHS Markit report provides quarterly worldwide and regional market size, vendor market share, analysis and trends for data center Ethernet switches by category and market, application delivery controllers by category, and software-defined WAN (SD-WAN) appliances and control and management software. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, CradlePoint, Cato, Dell, F5, FatPipe, Fortinet, HPE, Huawei, Hughes, InfoVista, Juniper, KEMP, Nokia (Nuage), Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, Versa, ZTE and others.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Dell’Oro: #1 Huawei increased market share at the expense of Ericsson, Nokia and ZTE; Mobile CAPEX flat; 5G Market Forecasts

Top Telecom Equipment Vendors:

According to a new Dell’Oro Group report, the top seven telecom equipment makers as of 3Q 2018 are: Huawei, Nokia, Ericsson, Cisco, ZTE, Ciena, and Samsung. Huawei has captured a 29 percent share of the global telecom equipment market, increasing its market share by 8 percentage points since 2013. Huawei’s revenue share improved by two percentage points of market share annually in each of the past five years. That’s despite huge challenges in the U.S., UK, Australia and some European telecom markets due to security and backdoor issues.

During the same time period, Ericsson’s and Nokia’s market share declined about one percentage point annually on average until 2018 when both vendor held their market share flat. ZTE’s share, which had typically been at 10 percent, dropped two percentage points in 2018 due to the U.S. ban that caused the company to shut down portions of its business during the second quarter.

Additional key takeaways from the reporting period include:

- Following three years of decline, the overall telecom equipment market grew 1 percent year-over-year in 2018. The positive turn in the year was due to higher demand for Broadband Access, Optical Transport, Microwave, and Mobile RAN. The remaining equipment—Carrier IP Telephony, Wireless Packet Core, SP Router and Carrier Ethernet Switch—declined in the year. The two largest equipment markets in the year were Mobile RAN and Optical Transport.

- The worldwide Mobile RAN market surprised on the upside and performed better than expected in 2018. In addition to the strong focus on LTE and LTE-Advanced, the shift toward 5G NR (3GPP Release 15 New Radio – Non Stand Alone) continued to accelerate throughout the year.

- The worldwide Optical Transport market continued to expand for a fourth consecutive year driven by strong sales of DWDM equipment in China and to large Internet content providers for data center interconnect (DCI).

According to TelecomLead.com estimates, Huawei generated revenue of around $38 billion from carrier business, $10 billion from enterprises and $52 billion from phones and other devices — in 2018.

- Huawei said in December 2018 that it expects total revenue to increase 21 percent to $109 billion in 2018.

- Nokia Networks business revenue was 20.121 billion euro (–2 percent) or $22.82 billion last year.

- Ericsson’s revenue was SEK 210.8 billion (+3 percent) or $22.58 billion in 2018.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Mobile Operator CAPEX:

The latest GSMA report indicates that mobile operator CAPEX reached $161 billion in 2018 and is forecast to be $161 in 2019 and $160 billion in 2020. 5G related CAPEX will grow to $123 billion in 52 markets in 2020 from $81 billion in 19 markets in 2019 and $41 billion in two markets in 2018.

Mobile operators will invest around $480 billion worldwide between 2018 and 2020 in mobile CAPEX. Their investment focus will be 3G, 4G, 5G roll outs; and network optimization; capabilities beyond core telco.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

5G Market:

5G is on track to account for 15 per cent of global mobile connections by 2025, as the number of 5G network launches and compatible devices ramps up this year, according to a new GSMA report. The 2019 global edition of the GSMA’s flagship Mobile Economy report series reveals that a further 16 major markets worldwide will switch on commercial 5G networks this year, following on from the first 5G launches in South Korea and the US in 2018. It is calculated that mobile operators worldwide are currently investing around $160 billion per year (CAPEX) on expanding and upgrading their networks, despite regulatory and competitive pressures.

“The arrival of 5G forms a major part of the world’s move towards an era of Intelligent Connectivity, which alongside developments in the Internet of Things, big data and artificial intelligence, is poised to be a key driver of economic growth over the coming years,” said Mats Granryd, Director General of the GSMA. “While 5G will transform businesses and provide an array of exciting new services, mobile technology is also helping to close the connectivity gap. We will connect more than a billion new people to the mobile internet over the next few years, spurring adoption of mobile-based tools and solutions in areas such as agriculture, education and healthcare, which will improve livelihoods of people around the world.”

The new GSMA report reveals that:

- The number of 5G connections will reach 1.4 billion by 2025 – 15 per cent of the global total. By this point, 5G is forecast to account for around 30 per cent of connections in markets such as China and Europe, and around half of the total in the US;

- 4G will continue to see strong growth over this period, accounting for almost 60 per cent of global connections by 2025 – up from 43 per cent last year;

- The number of global IoT connections will triple to 25 billion by 2025, while global IoT revenue will quadruple to $1.1 trillion;

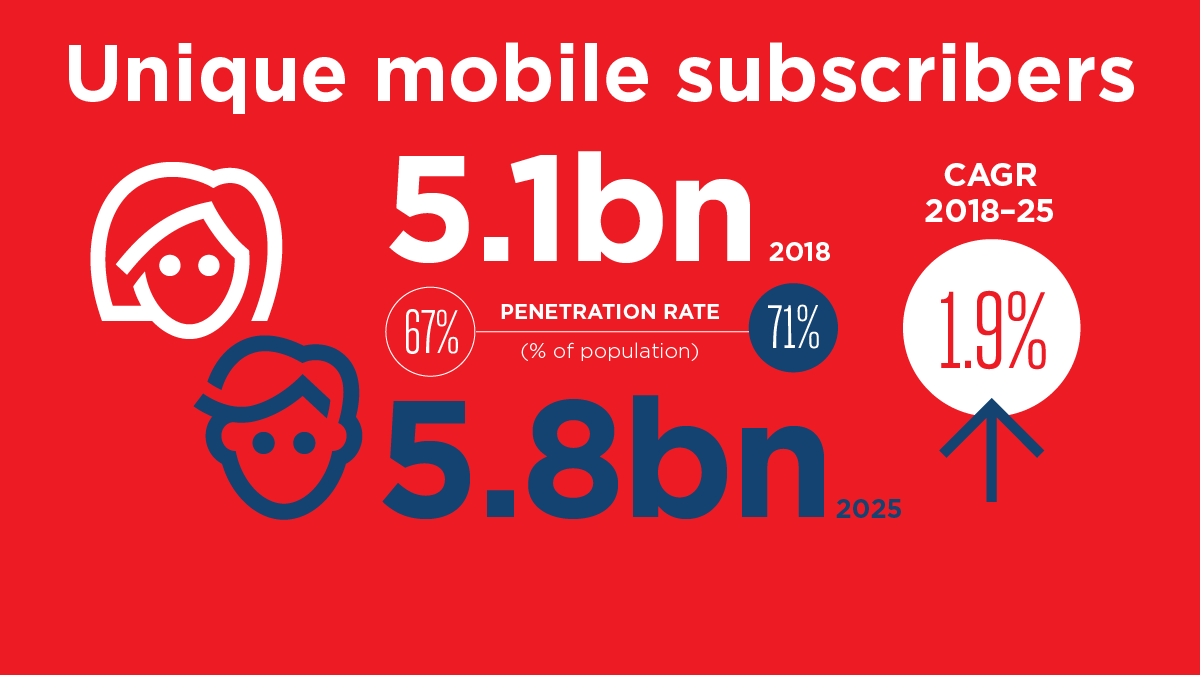

- One billion new unique mobile subscribers2 have been added in the four years since 2013, bringing the total to 5.1 billion by the end of 2018, representing about two thirds of the global population;

- More than 700 million new subscribers are forecast to be added over the next seven years, about a quarter of these coming from India alone;

- An additional 1.4 billion people will start using the mobile internet over the next seven years, bringing the total number of mobile internet subscribers globally to 5 billion by 2025 (more than 60 per cent of the population).

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

According to Telecomlead.com, Huawei has signed 30 plus 5G commercial contracts. Huawei has delivered over 40,000 5G base stations for commercial use. Huawei has 50 plus 5G engagements with customers. Nokia has 20 plus 5G contracts, and almost 100 5G engagements with customers. Samsung shipped 36,000 5G base stations – mainly to operators in the US and Korea — in 2018.

According to Dave Bolen of Dell’Oro Group, Cisco, Ericsson, Huawei, Nokia, and ZTE are the top-five wireless/ mobile packet core infrastructure vendors. At MWC 2019 in Barcelona, each put on a spectacular show with massive stands demonstrating its end-to-end technology prowess empowering 5G use cases, all enabled with their respective cloud-native cores. Their stands were packed with customers and potential customers leading to thousands of meetings. Each vendor had its share of press releases with 5G deals around the globe that are too numerous to name here. Links to the happenings at MWC19 from each of the top-five vendors may be found at Cisco, Ericsson, Huawei, Nokia, and ZTE.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

http://www.delloro.com/delloro-group/telecom-equipment-market-2018

http://www.delloro.com/dave-bolan/5g-mwc19-barcelona-observations-its-all-about-the-core

https://www.gsma.com/r/mobileeconomy/

https://www.gsmaintelligence.com/research/?file=5a33fb6782bc75def8b6dc66af5da976&download

IDC Directions 2019: Autonomous Infrastructure and the Evolution of the Self-Driving Network

Abstract (by Rohit Mehra, IDC Analyst):

Network transformation is well on its way with the evolution of SDN and SD-WAN, leading to flexible network architectures taking hold from the cloud to the enterprise edge, powered by intelligent automation. Increasing use of streaming analytics and pervasive visibility, enhanced by ML and AI, is creating a next-generation, agile network that self-remediates performance issues and proactively responds to security threats. The result will be greater operational efficiencies, improved user experience, and verified SLAs that ensure delivery of meaningful business outcomes. The network is a foundation layer for enabling secure, scalable and efficient use of Cloud, Edge and IoT Applications.

……………………………………………………………………………………………………………………………………………………

Please see comments below this post for Alan’s thoughts on Rohit’s presentation at IDC Directions 2019.

Network Requirements Continue to Expand:

▪Fast and adaptive

▪ Capacity on-demand

▪ Edge-to-Cloud Latency

▪ Network-level security

▪ Analytics capable of yielding new insights and driving digital transformation (DX)

▪ Bridge cloud and telco domains

▪ Global reach

“Self-driving” Networks are now needed to be Automated, Orchestrated and Optimized Network System. Traditional networks break down as they scale (get larger) and increase workloads, making automation essential in future networks, e.g. 5G.

………………………………………………………………………………………………………………………………………………………………………….

Definitions:

Network automation is a methodology in which software automatically configures, provisions, manages and tests network devices. It is used by enterprises and service providers to improve efficiency and reduce human error and operating expenses. Network automation tools support functions ranging from basic network mapping and device discovery, to more complex workflows like network configuration management and the provisioning of virtual network resources. Network automation also plays a key role in software-defined networking, network virtualization and network orchestration, enabling automated provisioning of virtual network tenants and functions, such as virtual load balancing.

Digital Transformation (DX):

IDC defines DX as the continuous process by which enterprises adapt to or drive disruptive changes in their operations, customers, and markets. Today, many businesses are implementing DX without success, and some fail entirely. In part, this is due to pervasive technology shifts that are changing how organizations transact business, address customer expectations, operate and secure products and services, and compete in the marketplace.

………………………………………………………………………………………………………………………………………………………………………….

IDC maintains that virtualization has matured from simple partitioning and encapsulation to leveraging the mobility of virtual machines to improve management and operations of IT environments. Virtualization 2.0 includes a host of new use cases that range from high availability and disaster recovery to hosted clients and true utility computing. Note that this information was not discussed by Rohit, but rather assumed to be known by the session attendees.

………………………………………………………………………………………………………………………………………………………………………….

Emergence of AI-based Network Automation:

✓ Simpler declarative management, enhanced verification and closed-loop processes

✓Network will accurately apply/enforce intent

✓Respond in near real-time to application, network and security events

Limitations of Classical Network Monitoring:

- Lack of pervasive, end-to-end visibility across physical/virtual/cloud

- Minimal application context

- Limited, spotty Analytics

- Frequently complex/costly

- Ping/SNMP/S flow/Trace route

- Unable to capture real-time network events

The Case for Streaming Telemetry In Support for Visibility and Analytics (see Alan’s Comment in box below article):

Infrastructure at Scale Demands Streaming Network Telemetry! Hyperscalers have deployed streaming telemetry extensively because it can provide millions of updates per second: Time stamped at source (for real time and network forensics)

▪ Event-driven, subscription-based

▪ Vendor support for standards based streaming telemetry • e.g., Cisco, Arista, Juniper, Ciena, Nokia

Optimization of apps/user experience (48% 0f respondents), plus security (41%) are top priorities for AI-enabled network automation:

IDC asked: What do you see as the most important aspects of an AI-enabled Network Automation solution? (Pick 3). Here’s the ordered ranking:

- Optimize and enhance application availability/performance and user experience 48%

- Implement security policies, including visibility into encrypted traffic 41%

- Work across multiple networks (on-premises and cloud-based) 38%

- Reduce cost and complexity of network operations 36%

- Simplicity in network deployment, management and operations 36%

- Incorporate streaming telemetry data for real-time visibility and insights 36%

- Leverage existing network infrastructure and/or software defined networking (SDN) deployment 35%

- Anticipate network outages and plan for network changes 30%

Automation at the Network Edge:

▪ Network platforms can leverage aggregate data from 1000s of deployments

▪ Crowd-sourced data is then dynamically applied to similar environments (anonymized)

▪ Benefits include dynamic scaling and mitigation of performance and/or security issues as they arise

Carrier Networks: The Automation Imperative – complexity across carrier networks continues to grow

▪ Multiple-generations of technology

• Ethernet, MPLS, Broadband IP VPNs

• 3G, 4G, 5G cellular

▪ Physical / Virtual

• VMs and Container based VNFs

• Evolution of Telco Cloud

▪ Cloud Aspirations

▪ Monetization Roadmap

The 5G Promise Is Not Achievable Without Significantly Enhanced Automation

▪ Network Slicing is key to delivering on the 5G promise (yet there are no implementable standards for network slicing; they are all proprietary implementations)

▪ Predicated upon automated provisioning, service chaining of cloud-native network components

▪ Automated traffic optimization across fronthaul, mid-haul and back-haul key to efficiency and customer experience

Security Analytics:

▪Traffic Analytics and Behavior Modeling

▪AI-enabled Anomaly Identification

▪Automated, Policy-based Remedial Actions (e.g. Quarantine)

AI-enabled Capacity Planning and Optimization:

▪ AI-powered network automation platforms monitor and assist with network capacity requirements and dynamically optimize flows

▪ Cloud-enabled Day 1 network provisioning and management automation that meets IT and business needs

Automating Enterprise Network Operations:

▪ AI-powered network operations create self-healing networks

• System monitors operations

• Detects performance degradations

• Determines root cause

• Automatically remediates the problem before it impacts users

▪ AI-powered Helpdesk Automation

• User Interfaces leverage Natural Language Processing for queries, e.g. Q: Why is my Wi-Fi coverage weak on the fourth floor? A: Switch to the 2.5Ghz Band

▪ Automated QoS and App Performance Guarantees

• Operator specifies minimum quality of service levels, system automatically maintains those in real time

• Resources are spun up to ensure and maintain service levels

Self-Driving Networks Require Closed-Loop Visibility and Automation:

▪ Self-driving networks will rely on streaming telemetry and closed-loop automation to detect and proactively respond to traffic-management issues and security threats

▪ Feedback loop from AI/ML to policy/intent will provide the ability to Visualize, Correlate and Predict- key ingredients for automation

▪ Requires a robust eco-system of network, visibility/analytics and AI solutions, SI/SPs

Take a Pragmatic Approach to Network Automation:

❖ Pick the right network automation use case(s)

❖ Getting automation right is mission critical

❖ Ensuring Clean, Relevant and Secure Data will be foundational to building AI-enabled network automation

❖ Developing Skills for Network Automation will be key to success

❖ Vendors can do their part by making products simpler to consume, deploy, manage

Final Thoughts on Network Autonomy:

- Journey has begun: We are now at the cusp of major advances thanks to areas such AI, visibility and analytics, streaming telemetry, etc.2

- Broad Applicability: Autonomous Networks will extend from Cloud to the Enterprise/IoT Edge, and will also be foundational to 5G Rollouts

- Augment, not Replace IT: AI-enabled network automation augments human capabilities

- Be Judicious: Move forward judiciously, with caution, leveraging automation lessons from other IT domains

Rohit Mehra: [email protected] +1 (508) 935-4343

Gartner: Magic Quadrant for Data Center Networking

Gartner: Magic Quadrant for Global Network Services has Orange Business #1

Summary:

Driven by cloud IT service adoption, the market for global enterprise network services is undergoing a generational shift in both technologies and the provider landscape. Infrastructure and operations leaders must adapt their network sourcing approaches to reflect this transformation.

Market Definition/Description:

-

WAN transport services, used to form hybrid WANs and underpin managed software-defined WAN (SD-WAN) services — These include MPLS, Ethernet services and internet services, including dedicated internet access (DIA), broadband and cellular.

-

Carrier-based cloud interconnect — This refers to direct MPLS, internet and/or Ethernet connections to leading providers of cloud services, including infrastructure as a service (IaaS), platform as a service (PaaS) and software as a Service (SaaS). These services improve the performance, availability and security of connectivity to critical cloud services, compared with generic public internet access. The option to insert network functions, such as firewalling and WAN optimization (which are often virtualized), into these connections is increasingly common.

-

Managed software-defined WAN (SD-WAN) services — While some enterprises are renewing their existing MPLS or hybrid WANs, virtually all new managed global network deployments seen by Gartner in 2018 were managed SD-WAN networks, a trend we expect to see continue through 2019 and beyond. These services are based on edge devices with zero-touch configuration, able to dynamically route traffic over different links based on policies under central policy management control (see “Technology Insight for Software-Defined WAN [SD-WAN]”). SD-WAN improves WAN agility by allowing easier and faster deployment of new sites, flexibility in the link types used, and simplified addition of new applications to the network. In addition, SD-WAN services typically provide significantly enhanced levels of application visibility compared to traditional managed router services.

-

Network on-demand services — Network on-demand services from NSPs enable enterprises to make real-time changes to access/port bandwidth, change the WAN service types delivered over a network port and, in some cases, even add and remove endpoints, such as connections to cloud providers all under software control. They are controlled by the enterprise, via the provider’s web portal or APIs. Many providers are using software-defined networking (SDN) to deliver this functionality.

-

Network function virtualization (NFV) services — This functionality is the replacement for purpose-built hardware devices, such as routers, security devices or WAN optimizers, with software running on industry-standard hardware equipment (see “Network Function Virtualization Will Enable Greater WAN Agility and Flexibility”). It can be run in virtual customer premises equipment (vCPE), which consists of on-site x86-based servers, supporting multiple virtualized network functions. Alternatively, some functions can run NFV service nodes, located in the provider’s network; although, in this case, some form of on-premises device will still be needed. NFV allows network functions to be activated on demand and consumed on an “as a service” basis, seeking to improve both the agility and cost-effectiveness of the enterprise WAN.

-

vCPE — vCPE is the use of industry-standard, x86-based servers, rather than function-specific appliances, at enterprise premises to deliver enterprise network edge functions, such as WAN edge routers, including SD-WAN, WAN optimization controllers (WOCs), and security functions such as firewalls. (See “Innovation Insight for Virtual CPE.”)

What’s Changed?

The inclusion and exclusion criteria for this year’s Magic Quadrant, although similar to prior years, have been adjusted to reflect these trends.

Magic Quadrant

Figure 1. Magic Quadrant for Network Services, Global

Source: Gartner (February 2019)

………………………………………………………………………………………………………………………………………………………………….

https://www.gartner.com/document/code/354862?ref=ddisp&refval=354862

Gartner: Enterprise Network Service Prices Continue to Decline

Prices for enterprise fixed and mobile network services around the globe have declined from 2017 through 2018 by up to 20%, with further declines expected through 2019. Highlights:

-

Since 2012, overall network service prices in the developed world have declined by 5% to 20% annually, depending on the specific service and geography, but enterprises often fail to achieve the full potential savings.

-

Prices for nonstandard or legacy network services see little decrease or even increases.

-

Although network technology improvements can reduce an operator’s cost of delivering service, network service providers (NSPs) will only pass on savings to customers when they’re pressured to do so.

-

By 2020, 10 Mbps Ethernet access to Multiprotocol Label Switching (MPLS) or internet services will be priced lower than T1 or E1 access to the same services, from a premium of up to 1.5 times today’s T1/E1 price.

-

By 2020, MPLS pricing in mature markets will equalize with business-grade internet services, down from the 10% to 20% premium in 2018.

-

By 2020, the cost of 5G enterprise cellular services will be priced at a premium of 10% or less above 4G cellular services.

There is considerable country-to-country variation within regions. The countries with a greater degree of competition (three or more viable choices for a service) have seen larger price decreases than countries that have little or no competition. We have noted with an asterisk (*) the regions in which there is either too little data or where large variations in pricing exist, negating any meaningful “average” price trend.

…………………………………………………………………………………………………………………………………………………………………………………………..

The North American telecommunications market is very mature, with highly competitive conditions. Within all five service group categories, there are more than three providers. Since the competitive landscape has seen some consolidation, the only truly viable way for Gartner clients to take advantage of these conditions is to create a competitive RFP.

- T1 or any other TDM-based access to any network services should be treated as legacy and only used when no other access services are available. These prices are not changing, and Gartner predicts they could possibly increase in the near future as providers are eager to shed those amortized assets.

- The pricing of MPLS and direct internet access, over optical Ethernet access, continues to converge with internet access typically not more than 10% to 15% cheaper than MPLS, while Ethernet services remain significantly cheaper. Broadband internet access pricing is not decreasing significantly, although average speeds are continuing to increase, as are the number of providers in the market.

- SIP trunking is fully mature, and existing ISDN lines should be replaced with SIP as soon as the contractual opportunity arises.

- Cellular is a mature service, with 4G LTE the default network technology for most voice, messaging and data plans. While 3G network fallback still is available for areas of weak 4G coverage, providers do not differentiate service plans or prices for the two technologies. Data plan cost reductions primarily have occurred due to more competitive negotiated discounts from standard or rate card prices. Standards-based 5G technology providing higher data speeds, lower latency and the ability to support significantly higher cellular endpoint density than 4G LTE will begin commercial availability in 2020 and later.

-

Avoid sourcing services that are not part of provider’s standard portfolio, even if this means accelerating the depreciation of nonstandard devices or losing some functionality of nonstandard configurations.

-

Migrate away from legacy network services, even if it means replacing edge devices, while seeking improved pricing from the provider in return for adopting the current offerings.

-

Ensure you are fully aware of any end-of-life announcements for network services you are using and aim to migrate away from such services.

IHS Markit: Cloud and Mobility Driving Enterprise Edge Connectivity in North America

IHS Markit Survey: Cloud and mobility driving new requirements for enterprise edge connectivity in North America

By Matthias Machowinski, senior research director, IHS Markit, and Joshua Bancroft, senior analyst, IHS Markit

Highlights

- By 2019, 51 percent of network professionals surveyed by IHS Markit will use hybrid cloud and 37 percent will adopt multi-cloud for application delivery.

- Bandwidth consumption continues to rise. Companies are expecting to increase provisioned wide-area network (WAN) bandwidth by more than 30 percent annually across all site types.

- Data backup and storage is the leading reason for traffic growth, followed by cloud services

- Software-defined WAN (SD-WAN) is maturing: 66 percent of surveyed companies anticipate deploying it by the end of 2020.

- Companies deploying SD-WAN use over 50 percent more bandwidth, than those who have not deployed it. Their bandwidth needs are also growing at twice the rate of companies using traditional WANs.

Analysis

Based on a survey of 292 network professionals at North American enterprises, IHS Markit explored the evolving requirements for enterprise edge connectivity, including WAN and SD-WAN. The study revealed that enterprise IT architectures and consumption models are currently undergoing a major transformation, from servers and applications placed at individual enterprise sites, to a hybrid-cloud model where centralized infrastructure-as-a-service (IaaS) complements highly utilized servers in enterprise-operated data centers. This process allows organizations to bring the benefits of cloud architectures to their own data centers – including simplified management, agility and scalability – and leverage the on-demand aspect of cloud services during peak periods. Respondents also reinforced the viewpoint that the hybrid cloud is a stepping stone to the emerging multi-cloud.

Changing business demographics is sparking the trend of more centralized applications: enterprises are moving closer to their customers, partners, and suppliers. They are adding more physical locations, making mobility a key part of their processes and taking on remote employees to leverage talent and expertise.

Following the current wave of application centralization, certain functions requiring low latency will migrate back to the enterprise edge, residing on universal customer premises equipment (uCPE) and other shared compute platforms. This development is still in its infancy, but it is already on the radar of some companies.

Hybrid cloud is an ideal architecture for distributed enterprises, but it is also contributing to traffic growth at the enterprise edge. Extra attention must be paid to edge connectivity, to ensure users don’t suffer from slow or intermittent access to applications. Performance is a top concern, and enterprises are not only adding more WAN capacity and redundancy, but also adopting SD-WAN.

The primary motivation for deploying SD-WAN is to improve application performance and simplify WAN management. The first wave of SD-WAN deployments focused on cost reduction, and this is still clearly the case, with survey respondents indicating their annual mega-bits-per-second cost is approximately 30 percent lower, with costs declining at a faster rate than in traditional WAN deployments. These results show that SD-WAN can be a crucial way to balance runaway traffic growth with budget constraints.

SD-WAN solutions not only solve the transportation and WAN cost reduction issue, but also help enterprises create a fabric for the multi-cloud. Features like analytics to understand end-user behaviour, enhanced branch security and having a centralized management portal all make SD-WAN an enticing proposition for enterprises looking to adopt a multi-cloud approach.

Enterprise Edge Connectivity Strategies North American Enterprise Survey

This IHS Markit study takes explores how companies are advancing connectivity at the enterprise edge, in light of new requirements. It includes traditional WAN and SD-WAN growth expectations, growth drivers, plans for new types of connectivity and technologies, equipment used, feature requirements, preferred suppliers, , and spending plans.

NTT Communications leads APAC telco cloud market; Telstra and Orange close behind

Japanese telecommunications network provider NTT Communications is the market leader in the Asia-Pacific telecom cloud segment, and is well placed to maintain its position, according to GlobalData. In a new report, the market research company said NTT Communications has carved out a lead due to its software-defined capabilities, wide network and data center coverage and an expanded portfolio thanks to its integration with sister companies. According to the report, the cloud market landscape is evolving in the Asia-Pacific region. While web-scale players such as Amazon, Google, Microsoft and Alibaba are continually expanding in the regions, telecoms operators are carving out a niche by offering integrated network and cloud services.

NTT Communications is the leader in the APAC telco cloud services market with the highest overall score based on four categories – cloud portfolio, data center footprints, software-defined infrastructure and supplemental services.

“Cloud products offered by telcos are comparable in terms of technical capabilities and ecosystem partners,” GlobalData analyst Alfie Amir said. “What differentiates NTT Communications from the rest is its wide footprint and presence in the region to address data residency and latency requirements, as well as its software-defined capabilities which offer better workload management and service orchestration,” he added.

Australia-based Telstra and France-based Orange Business Services are in second and third place. While these providers have similar capabilities to NTT Communications, they are slightly behind with their footprints in the region. However, they are rapidly closing the gap, with Orange Business Services having partnered with Huawei to drive expansion in the region – particularly in China, and Telstra recently announcing a partnership with Equinix for direct access to more infrastructure globally.

The initiatives by telco cloud providers to add software defined capabilities, expand their footprints and enhance service capabilities are in-line with enterprises’ digital transformation directions. Enterprises today are looking for cloud providers with extensive cloud portfolios, not just the traditional IaaS, PaaS, and SaaS, but also cloud-based IT services such as IoT platform, UCaaS, security and marketplace that offer various horizontal and vertical applications.

“The APAC cloud market is still growing fast as the market emerges, while the competition is getting more intense driven by the web-scale players,” Amir said. “Telcos need to continue to leverage their network strengths and at the same time, include latest technologies such as self-service tools, analytics and AI in their offerings to gain competitive advantage,” he added.

Above illustration courtesy of K-Hits which has a report on the global telecom cloud market.

Reference:

SP Telecom deploys VeloCloud/VMware’s SD-WAN technology in Singapore

SP Telecom has launched Singapore’s first software-defined wide area network (SD-WAN). It’s based on VMware NSX SD-WAN by VeloCloud which VMware acquired last year. This will provide businesses with a low latency wide-area network that is automated and infrastructure-independent, to deliver robust and more secure networking services. Coupled with SP Telecom’s network management and consultancy services, this collaboration will expand SP Telecom offerings to meet growing customer demand to more securely run, manage, and connect any application from cloud to device.

The new SD-WAN services will provide businesses with the ability to automate and prioritize business-critical traffic to travel over faster, more secure connections, as well as set backup options for downed traffic links. This optimization of high traffic volume that enables near real-time access to rapidly changing data, is a key benefit crucial for mission-critical industries such as telecommunications, financial services, and the media and entertainment verticals.

In a multi-cloud era, where businesses operate in an increasingly complex environment, VMware NSX SD-WAN combined with SP Telecom’s diverse and utility-base data network provides simplicity, enabling greater flexibility to:

- support virtualized services from the cloud, connecting branch offices and mobile users to any type of data centers such as enterprise, cloud, or software-as-a-service;

- enable bandwidth expansion economically;

- provide optimal connectivity and access to the cloud and on-premises;

- accelerate new site deployments through zero-touch automated deployment.

SP Telecom’s data network is truly diverse, with network paths running along the Singapore power grid, enabling network resiliency for business-critical functions. Furthermore, this data network is enhanced with superior latency performance for more efficient processes. This reduces the risk of outage that could occur due to power or active equipment failure. Part of its network consultancy services, SP Telecom analyses and optimizes the network to deliver cost savings and efficiency. The connectivity and consultancy services, bundled with the new SD-WAN offering, will enable businesses to innovate fast and more securely by delivering robust performance for cloud applications, all through zero-touch deployment, the automation of network infrastructure implementation. Velocloud says their SD-WAN reduces the branch office footprint with a single click with seamless insertion and chaining of virtualized services on premise and in the cloud.

SP Telecom has more than 1M km of fiber connecting more than 100 sub-stations (data centers and commercial buildings) in Singapore as per this graphic:

Figure above courtesy of SP Telecom

……………………………………………………………………………………………………………………………………………………………………………………

“Smart and discerning businesses are competing to offer differentiated end-user experiences, and with advanced connectivity, they can go-to-market quickly and roll out new innovations to meet the changing demands of customers,” said Titus Yong, Chief Executive Officer of SP Telecom. “This is precisely why we are enhancing our portfolio with VMware’s NSX SD-WAN on VeloCloud, a game-changer that will provide our enterprise customers with the best-in-class network infrastructure that they need to sharpen their competitive edge and win in a digital era.”

NSX SD-WAN is touted by Velocloud as the industry-leading SD-WAN solution. One that enables customers to deliver better cloud and application performance with full visibility, metrics, control, and automation of all devices and user endpoints, and lower overall costs. VMware NSX SD-WAN provides an extensible platform for enterprises and telcos to integrate both on-premise and cloud services under the same consistent business policy framework. It’s said to eliminate data center backhaul penalties with a cloud-ready network to provide an optimized direct path to public and private enterprise clouds.

“We are shifting from a model of data centers to centers of data at the network’s edge. This new networking approach, virtual cloud networking, is required to manage the hyper-distribution of applications and data,” said Sanjay K. Deshmukh, vice president and managing director, Southeast Asia and Korea, VMware. “By deploying VMware SD-WAN by VeloCloud as part of a Virtual Cloud Network, SP Telecom can provide enterprise customers with consistent, pervasive connectivity and intrinsic security for applications, data, and users from the data centers to the cloud and the branch. VMware SD-WAN will enable their customers to streamline the digital transformation journey by providing superior application performance with significantly reduced network complexity,” he added.

References: