Uncategorized

Gartner Analysis & Predictions: Enterprise Network Infrastructure and Services

by : Bjarne Munch | To Chee Eng | Greg Young | Danellie Young | Vivek Bhalla | Andrew Lerner |Danilo Ciscato of Gartner Group

Overview:

This new Gartner Group report is on the key impacts of digital business, cloud and orchestration strategies. In particular, IT leaders must continue to focus on meeting enterprise needs for expanded WAN connectivity, application performance and improved network agility, without compromising performance.

Key Findings:

- As enterprises increasingly rely on the internet for WAN connectivity, they are challenged by the unpredictable nature of internet services.

- Enterprises seeking more agile WAN services continue to be blocked by network service providers’ terms and conditions.

- Enterprises seeking more agile network solutions continue to be hampered by manual processes and cultural resistance.

- Enterprise’s moving applications to public cloud services frequently struggle with application performance issues.

Recommendations:

IT leaders responsible for infrastructure agility should:

- Reduce the business impact of internet downtime by deploying redundant WAN connectivity such as hybrid WAN for business-critical activities.

- Improve WAN service agility by negotiating total contractual spend instead of monthly or annual spend.

- Improve agility of internal network solutions by introducing automation of all operations using a step-wise approach.

- Ensure the performance of cloud-based applications by using carriers’ cloud connect services instead of unpredictable internet services.

- Improve alignment between business objectives and network solutions by selectively deploying intent-based network solutions.

Strategic Planning Assumptions:

Within the next five years, there will be a major internet outage that impacts more than 100 million users for longer than 24 hours.

- By 2021, 25% of enterprise telecom contracts will evolve to allow for greater flexibility such as canceling services or introducing new services within the contract period, up from less than 5% today.

- By 2021, productized network automation (NA) tools will be utilized by 55% of organizations, up from less than 15% today.

- By YE20, more than 30% of organizations will connect to cloud providers using alternatives to the public internet, which is a major increase from 5% in 3Q17.

- By 2020, more than 1,000 large enterprises will use intent-based networking systems in production, up from less than 15 today.

Analysis:

Gartner Group has five predictions that represent fundamental changes that are emerging in key network domains, from internal networking to cloud services and WAN services.

two key aspects that the majority of Gartner clients struggle with:

- The increased interest in utilizing the internet for WAN connectivity continues to raise concerns about the performance of public internet services and performance of applications deployed in public cloud services. We discuss the risk that enterprises encounter due to the unpredictable nature of the internet, and we discuss how an enterprise can use MPLS to connect directly to public cloud services instead of using the internet.

- Enterprises continue to need new business solutions deployed faster, but remain hampered by the inability of network solutions and network services to respond fast enough and rectify performance issues fast enough. We discuss three options to improve network operations as well as network services.

Source: Gartner (December 2017)

Strategic Planning Assumptions

Strategic Planning Assumption: Within the next five years, there will be a major internet outage that impacts more than 100 million users for longer than 24 hours.

Analysis by: Andrew Lerner, Greg Young

Key Findings:

- We are increasingly seeing organizations use the internet as a WAN, and estimate that approximately 20% of Gartner clients in many geographic regions have at least some critical branch locations entirely connected via the internet.

- Most IT teams don’t have a detailed understanding of the multitude of applications and services that are being used on the public internet and/or their criticality. This is because of years of line of business (LOB)-centric buying and the proliferation of SaaS.

- While the internet is highly resilient, there are specific infrastructure and technology hot spots that, if compromised, could threaten the internet as a whole or large portions of it. This could be the result of natural disasters, man-made accidents or intentional acts.

- Natural disasters and man-made acts that could impact large portions of the internet include earthquakes, solar flares, electronic pulses, meteors, tsunamis, hurricanes, major cable cuts and network operator errors.

- Intentional acts include hacktivism, terrorism toward critical infrastructure, and/or coordinated distributed denial of service (DDoS) attacks, attacks against carrier- and ISP-specific components, and protocols (e.g., SS7).

While the probability of each of these events individually is small, the likelihood that at least some of them will occur over an extended period of time is actually surprisingly high. For example, even if there is only a 1% chance that any of the 11 examples identified above results in an outage within a year, there is a statistical likelihood of over 45% that at least one of them will occur over a five-year period. Further, to date, there have been indications that the internet is vulnerable to sizable outages:

- In 2008, millions of users and large portions of the Middle East and India were impacted by a cable cut. 1

- In 2016, a large DDOS attack resulted in many large e-commerce sites going down, including Twitter, Netflix, Reddit and CNN. 2

- In 2015, Telekom Malaysia created a routing problem that rendered much of the Level 3 network unavailable. 3

- It has been widely reported that 70% of all internet traffic goes thru Northern Virginia 4 and, while this might be an overstated, there’s no doubt that there are several major chokepoints in the internet infrastructure.

Market Implications:

At a minimum, an extended and widespread internet outage would cause dramatic revenue loss for enterprises, and could even create life-threating situations depending on what business the organizations is in. Initially, many organizations often brush this off by saying, “Well there’s not much we can do about it anyway” or “If there is a large internet outage due to a natural disaster, then personal safety is the priority and the enterprise connectivity is the least of our concerns.” However, there are very specific and actionable items that infrastructure and operations (I&O) leaders should take to mitigate the impact of a large outage.

Strategic Planning Assumption: By 2021, 25% of enterprise telecom contracts will evolve to allow for greater flexibility such as canceling services or introducing new services within the contract period, up from less than 5% today.

Analysis by: Danellie Young

Key Findings:

- Enterprise telecom contracts are typically fixed in both term duration and for the services required for procurement.

- Most larger revenue contracts ($1 million annually) require the enterprise to agree to minimum revenue commitments on an annual basis.

- Major WAN decisions are made by 31% to 47% of enterprises each year, including equipment refresh or carrier renegotiations (assuming the refresh cycle on routers is six years, and the average enterprise WAN service contract is three years).

- A large majority of enterprises are struggling with the cost, performance and flexibility of their traditional WAN contracts, further exacerbated by the proliferation of public cloud applications.

Market Implications:

Enterprise telecom contracts remain rigid and fixed, with specified services required to ensure compliance. Typically such contracts penalize customers when services are disconnected midterm. Enterprise telecom contracts are typically negotiated on 36-month cycles, based on either full-term or revenue commitments. Revenue commitments are set based on monthly spend, annual spend or total contract spending. Upon meeting the contract’s revenue commitment, the enterprise can then renegotiate or consider alternative services or providers since their financial obligation has been met. Terminating contracts early for convenience will typically levy penalties on the enterprise. These penalties range from 100% of the monthly recurring charges (MRCs) to a percentage of the MRCs to a declining portion through the remainder of the term (i.e., 100% in the first 12 months, 75% in months 13 to 24 and 50% through the end of the term).

Currently, contracts are split between term and revenue commit contracts, whereby most of the revenue commitments are made on an annualized basis. Alternatively, a small number (5%) are offered or negotiated with total contract values tied to them. Total contract revenue commitments enable the enterprise to meet the obligation earlier in their contract and provide the opportunity to negotiate new lower rates and a new contract, and to solicit competitive proposals before the full 36-month cycle terminates.

In addition to traditional voice and data services, many networking vendors now offer SD-WAN functionality products, while carriers and managed service providers (MSPs) are beginning to launch and roll out managed SD-WAN services as an alternative to managed routers. Contract flexibility will be needed to allow the enterprise the flexibility to migrate to new solutions, without financial risk or paying early termination fees on services. Thus, while we anticipate rapid adoption of SD-WAN and virtualized customer premises equipment (vCPE) solutions in the enterprise, SD-WAN by itself will not improve contractual conditions.

………………………………………………………………………………………………………………………………

US Ignite adds 5 New Communities to Smart Gigabit Communities Program

U.S. Ignite’s smart cities project, called the Smart Gigabit Communities program, is a National Science Foundation (NSF) funded program that provides assistance to areas looking to advance gigabit technologies. The nonprofit group’s five new participants are Red Wing, Minn.; Eugene-Springfield, Ore.; Lexington, Ky.; Lincoln, Neb.; and the San Francisco Bay area.

………………………………………………………………………………………………………………

Backgrounder:

U.S. Ignite stimulates the creation of next-generation applications and services that leverage advanced networking technologies to build the foundation for smart communities, including cities, rural areas, regions, and states. The nonprofit organization helps to accelerate new wired and wireless networking advances from research to prototype to full-scale smart community and interconnected national deployments.

………………………………………………………………………………………………………………….

U.S. Ignite said in a press release that each of the communities will begin participating by using their new SGC support to find answers to civic challenges through gigabit enabled apps, tools and other solutions. At the same time, they will also be expected to contribute their insights and technologies with fellow SGC communities. The sharing is designed to create a network for smart city collaboration, a group that now includes 25 national and international communities.

Representing leaders in the San Francisco Bay Area, executive director of the City Innovate Foundation, Kamran Saddique, said that the Bay Area’s participation represents significant support for local cities in developing advanced infrastructure and solving common social problems.

“Smart communities and the Internet of Things are a set of modern digital technologies, civic innovations and social changes that have come together to create the opportunity to drive fundamental changes in government, business and society,” Saddique said in a statement. “Our participation in the US Ignite SGC network will help us to leverage these technologies to enhance the quality of life for the San Francisco Bay Area.”

The City Innovate Foundation is responsible for a number of civic tech and smart city programs that involve the cities San Francisco, Oakland, San Leandro and West Sacramento. Two of its major initiatives include SuperPublic, a Bay Area smart city innovation lab, and the national Startup in Residence program that coordinates partnerships between cities and tech startups.

An SGC requirement is that all cities that join the program must be investing in gigabit connectivity. San Francisco is preparing for a $1.3 billion citywide municipal internet network that will spread high-speed connectivity throughout the city.

Like San Francisco, the other four recently added communities expressed a similar eagerness and optimism to receive SGC’s support. Lexington Mayor Jim Gray said he was “ecstatic” to join the network and looks forward to “unparalleled innovations in the coming months and years,” while in Eugene, Oregon, Mayor Lucy Vinis said she was “thrilled” and expected gigabit connectivity in the community to drive education, healthcare, transportation and advanced manufacturing.

In Lincoln, Nebraksa, Mayor Chris Beutler is counting on the smart city support to bolster its own gigabit internet service that is coming to the city by 2019. A partnership with the internet service provider Allo is expected to connect gigabit fiber to more than 105,000 residences and 20,000 businesses and government offices.

“This public-private partnership creates the digital infrastructure that gives our entrepreneurs and students high-speed internet, supercomputer access to researchers and other innovators across the nation to build next-generation technology,” Beutler said in a statement.

Reference:

IHS Markit: VMware acquires top SD-WAN vendor VeloCloud; 3Q17 SD-WAN revenue reaches $116M

Highlights:

SD-WAN (appliance + control and management software) revenue reached $116M in 3Q17, up 18% quarter-over-quarter (QoQ) and up 2.8x year-over-year (YoY). VeloCloud led the SD-WAN market with 22% share of 3Q17 revenue, Aryaka was in second place with 18%. Silver Peak rounded out the top 3 with 12%, according to the DC Network Equipment market tracker early edition from IHS Markit.

“The majority of SD-WAN solutions at first focused on virtualizing the WAN connection problem bringing automation, reliability, and agility to the enterprise WAN using overlays. Current use cases include direct connect for branch offices to the Internet and increased reliability through automated fail-over for a better user experience,” said Cliff Grossner, Ph.D., Senior Research Director and Advisor for the Cloud and Data Center Research Practice at IHS Markit.

Worldwide SD-WAN revenue (US$M)-3Q-2017:

|

VeloCloud |

|

$26.0 |

|

|||

|

Aryaka |

|

$21.3 |

|

|||

|

Silver Peak |

|

$14.1 |

|

|||

|

Viptela |

|

$9.5 |

|

|||

|

InfoVista |

|

$4.4 |

|

|||

|

Citrix |

|

$4.4 |

|

|||

|

Talari |

|

$4.1 |

|

|||

|

TELoIP |

|

$3.9 |

|

|||

|

FatPipe |

|

$3.8 |

|

|||

|

Cisco |

|

$3.1 |

|

|||

|

Huawei |

|

$2.8 |

|

|||

|

CloudGenix |

|

$2.5 |

|

|||

|

Riverbed |

|

$1.7 |

|

|||

|

ZTE |

|

$0.6 |

|

|||

|

Other |

|

$14.2 |

|

|||

|

Total SD-WAN |

$116.2 |

|||||

| Source: IHS-Markit | ||||||

“With the WAN connectivity problem well understood and solutions ramping in deployments, SD-WAN vendors are beginning to offer additional services such as WAN optimization and virtual firewall. The next important challenge for SD-WAN vendors to solve is providing connectivity with SLAs and security for the multi-cloud,” said Cliff Grossner.

More Market Highlights:

· 3Q17 ADC revenue increased 5% from 2Q17 and decreased 5% from 3Q16

· Virtual ADC appliances stood at 28% of 3Q17 ADC revenue

· F5 garnered 45% ADC market share in 3Q17 with revenue down 4% YoY. Citrix had the #2 spot with 29% of revenue, and A10 (8%) rounded out the top 3 market share spots.

Data Center Network Equipment Report Synopsis:

The IHS Markit Data Center Network Equipment market tracker is part of the Data Center Networks Intelligence Service and provides quarterly worldwide and regional market size, vendor market share, forecasts through 2021, analysis and trends for (1) data center Ethernet switches by category [purpose built, bare metal, blade and general purpose], port speed [1/10/25/40/50/100/200/400GE] and market segment [enterprise, telco and cloud service provider], (2) application delivery controllers by category [hardware-based appliance, virtual appliance], and (3) software-defined WAN (SD-WAN) [appliances and control and management software]. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, Dell, F5, FatPipe, HPE, Huawei, InfoVista, Juniper, KEMP, Radware, Riverbed, Silver Peak, Talari, TELoIP, VeloCloud, Viptela, ZTE and others.

……………………………………………………………………………………………………………………………………

From a Nov 15, 2017 press release:

According to the IHS Markit Data Center and Enterprise SDN Hardware and Software Biannual Market Tracker, SD-WAN is currently a small market, totaling just $137 million worldwide in the first half of 2017 (H1 2017). However, global SD-WAN hardware and software revenue is forecast to reach $3.3 billion by 2021 as service providers partner with SD-WAN vendors to deploy overlay solutions — and as virtual network function (VNF)–based solutions become more closely integrated with carrier operations support systems (OSS) and business support systems (BSS).

“Currently, the majority of SD-WAN revenue is from appliances, with early deployments focused on rolling out devices at branch offices,” Grossner said. “Moving forward, we expect a larger portion of SD-WAN revenue to come from control and management software as users increasingly adopt application visibility and analytics services.”

More highlights from the IHS Markit data center and enterprise SDN report:

- Globally, data center and enterprise software-defined networking (SDN) revenue for in-use SDN-capable Ethernet switches, SDN controllers and SD-WAN increased 5.4 percent in H1 2017 from H2 2016, to $1.93 billion

- Based on in-use SDN revenue, Cisco was the number-one market share leader in the SDN market in H1 2017, followed by Arista, White Box, VMware and Hewlett Packard Enterprise

- Looking at the individual SDN categories in H1 2017, White Box was the frontrunner in bare metal switch revenue, VMware led the SDN controller market segment, Dell held 45 percent of branded bare metal switch revenue and Hewlett Packard Enterprise had the largest share of total SDN-capable (in-use and not-in-use) branded Ethernet switch ports

…………………………………………………………………………………………………………………………………………………………………..

Editor’s Notes:

We’ve repeatedly pounded the table that there are no standards for SD-WANs, despite efforts by MEF [1]. That implies single vendor SD WAN with vendor lock-in and no interoperability between SD-WANs from different vendors.

Note 1. MEF says it will standardize the managed services that SD-WAN network operators deliver, by developing open APIs, along with common terminology and components. This effort builds on MEF’s Lifecycle Service Orchestration effort. Please refer to this MEF document.

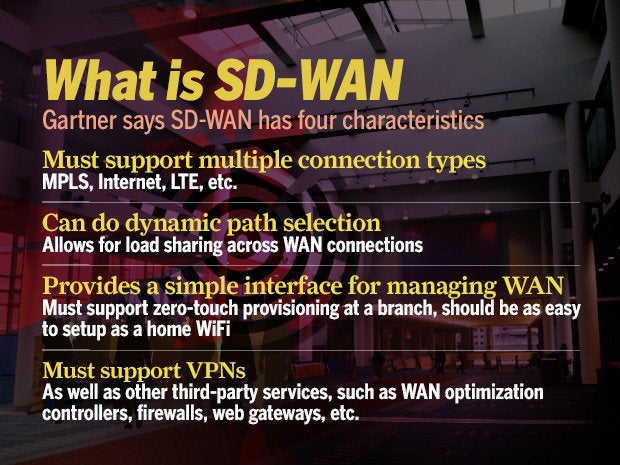

Note 2. Gartner’s definition of SD-WAN

More from Gartner on SD-WANs:

Enterprise network leaders face enormous challenges adapting and changing their managed WAN services to meet constantly changing business needs for new applications, new offices, more users, cloud services and digital business. Based on hundreds of client inquiries and recent Research Circle surveys, a key obstacle is that traditional network services are too slow in meeting these needs, and network leaders need alternative solutions that can meet their evolving needs faster. Compared to traditional WAN services, managed SD-WAN services (including various WAN connectivity services) are emerging with promises of greater agility, flexibility, control and cost-efficiency.

Gartner recommends that network leaders seeking managed WAN services use end-to-end managed SD-WAN and connectivity services to create agile and cost-effective managed WAN services. However, they must avoid buying into overinflated expectations created by the market hype that ignores the limitations of current services. To avoid the inevitable disappointment that follows unfulfilled expectations, network leaders should outline their service requirements, and use these to define evaluation criteria for a balanced analysis of service benefits and limitations.’

Source: Gartner (December 2017)

Enterprise network leaders face enormous challenges adapting and changing their managed WAN services to meet constantly changing business needs for new applications, new offices, more users, cloud services and digital business. Based on hundreds of client inquiries and recent Research Circle surveys, a key obstacle is that traditional network services are too slow in meeting these needs, and network leaders need alternative solutions that can meet their evolving needs faster. Compared to traditional WAN services, managed SD-WAN services (including various WAN connectivity services) are emerging with promises of greater agility, flexibility, control and cost-efficiency.

Gartner recommends that network leaders seeking managed WAN services use end-to-end managed SD-WAN and connectivity services to create agile and cost-effective managed WAN services. However, they must avoid buying into overinflated expectations created by the market hype that ignores the limitations of current services. To avoid the inevitable disappointment that follows unfulfilled expectations, network leaders should outline their service requirements, and use these to define evaluation criteria for a balanced analysis of service benefits and limitations.’

Source: Gartner (December 2017)

Current WAN services take too long to roll out and are too difficult to relocate or terminate, and network leaders are looking for ways to improve this. Network leaders see SD-WAN as a new opportunity to create more agile branch office connectivity due to appliances’ support of “zero-touch-configuration.” Vendors are fueling these expectations with reports of very fast site rollout with reports of 20 to 30 sites deployed overnight, compared to six to 10 sites per week for a traditional managed router service. However, SD-WAN does not change fundamental limitations of connectivity services, for example:

- Fast site deployments are only available for 4G/LTE access services or in cases where the provider already has a wired access service to the building (although in many cases these still require one to two weeks to provision).

- Network leaders who need new wired access services still need to plan for 14 to 90 days (or longer) from order to provisioning.

- All wired branch office connections, private or public, still require network leaders to sign a contract of fixed duration, making it a problem for network leaders to move or terminate a site without financial penalties.

Network leaders who need new WAN sites deployed with short notice should request managed SD-WAN with embedded LTE services. While many providers do not yet offer this service, there are providers in select countries that courier SD-WAN appliances with LTE embedded to customer sites instead of sending a technician. The best-case scenario is only six hours from order placement to on-site delivery of the appliance. Combined with self-service, where the enterprise plugs in the SD-WAN appliance to the LAN and powers up the device, the site can be operational within a day in the best case. However, network leaders who do not want their office staff to plug in the appliance need to plan for up to a week for a technician to be on-site, depending on location.

However, besides expense, the performance limitations of 4G/LTE include lower bandwidth than fiber, lack of geographic coverage and lack of QoS. Also, most of these services are based on using the internet as backhaul to the provider’s internet gateway. This means that, for larger sites and critical applications, network leaders should only employ 4G/LTE connectivity as an interim primary connection until a fiber connection has been deployed.

……………………………………………………………………………………………………………………………………………………………………………………………………

Because of the performance issues that still plague the internet in most parts of the world, the majority of enterprises are not replacing MPLS with internet services. Instead, based on client inquiries, Gartner estimates that around 60% of global WANs use both internet and MPLS in concert in a hybrid WAN that sends critical application traffic over the MPLS and everything else over the internet.

Enterprise experience has shown that for a global managed hybrid WAN, network planners can obtain at least 30% expense savings compared to traditional managed WAN (see “Cloud Adoption Is Driving Hybrid WAN Architectures” ). Network planners that want to replace their global MPLS with internet should progress selectively, and choose a few sites in areas where the internet is most likely to be of good quality. For these sites, demand a two- to four-month pilot as a condition of signing a new WAN contract. Remember that all internet providers and services are not the same. Use only a select few and do not disaggregate internet providers, as WAN and application performance will suffer.

ITU-R WP5D: Guidelines for evaluation of radio interface technologies for IMT-2020

ITU-R Working Party 5D: draft new Report ITU-R M.[IMT-2020.EVAL]

“Guidelines for evaluation of radio interface technologies for IMT-2020”

Backgrounder:

Among other work items, the October 2017 ITU-R WP5D meeting discussed proposals to correct minor errors and insert editorial improvements in draft new Report ITU-R M.[IMT-2020.EVAL]. Proposals to introduce some corrections including range of working distance in Indoor Hotspot channel models were agreed and reflected in the new version of the document.

Selected sections of this EVAL draft report follow (see NOTE at the end of the post and Comment in the box below it)…….

Introduction:

Resolution ITU-R 56 defines a new term “IMT-2020” applicable to those systems, system components, and related aspects that provide far more enhanced capabilities than those described in Recommendation ITU-R M.1645.

In this regard, International Mobile Telecommunications-2020 (IMT-2020) systems are mobile systems that include the new capabilities of IMT that go beyond those of IMT-Advanced.

Recommendation ITU-R M.2083 “IMT Vision – Framework and overall objectives of the future development of IMT for 2020 and beyond” identifies capabilities for IMT‑2020 which would make IMT-2020 more efficient, fast, flexible, and reliable when providing diverse services in the intended usage scenarios.

The usage scenario of IMT-2020 will extend to enhanced mobile broadband (eMBB), massive machine type communications (mMTC) and ultra-reliable and low latency communications (URLLC).

IMT-2020 systems support low to high mobility applications and much enhanced data rates in accordance with user and service demands in multiple user environments. IMT‑2020 also has capabilities for enabling massive connections for a wide range of services, and guarantee ultra‑reliable and low latency communications for future deployed services even in critical environments.

The capabilities of IMT-2020 include:

– very high peak data rate;

– very high and guaranteed user experienced data rate;

– quite low air interface latency;

– quite high mobility while providing satisfactory quality of service;

– enabling massive connection in very high density scenario;

– very high energy efficiency for network and device side;

– greatly enhanced spectral efficiency;

– significantly larger area traffic capacity;

– high spectrum and bandwidth flexibility;

– ultra high reliability and good resilience capability;

– enhanced security and privacy.

2. Scope:

These features enable IMT-2020 to address evolving user and industry needs.

The capabilities of IMT-2020 systems are being continuously enhanced in line with user and industry trends, and consistent with technology developments.

This Report provides guidelines for the procedure, the methodology and the criteria (technical, spectrum and service) to be used in evaluating the candidate IMT-2020 radio interface technologies (RITs) or Set of RITs (SRITs) for a number of test environments. These test environments are chosen to simulate closely the more stringent radio operating environments. The evaluation procedure is designed in such a way that the overall performance of the candidate RITs/SRITs may be fairly and equally assessed on a technical basis. It ensures that the overall IMT‑2020 objectives are met.

This Report provides, for proponents, developers of candidate RITs/SRITs and independent evaluation groups, the common evaluation methodology and evaluation configurations to evaluate the candidate RITs/SRITs and system aspects impacting the radio performance.

This Report allows a degree of freedom to encompass new technologies. The actual selection of the candidate RITs/SRITs for IMT-2020 is outside the scope of this Report.

The candidate RITs/SRITs will be assessed based on those evaluation guidelines. If necessary, additional evaluation methodologies may be developed by each independent evaluation group to complement the evaluation guidelines. Any such additional methodology should be shared between independent evaluation groups and sent to the Radiocommunication Bureau as information in the consideration of the evaluation results by ITU-R and for posting under additional information relevant to the independent evaluation group section of the ITU-R IMT-2020 web page (http://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx)

Evaluation guidelines:

IMT-2020 can be considered from multiple perspectives: users, manufacturers, application developers, network operators, service and content providers, and, finally, the usage scenarios – which are extensive. Therefore, candidate RITs/SRITs for IMT-2020 must be capable of being applied in a much broader variety of usage scenarios and supporting a much broader range of environments, significantly more diverse service capabilities as well as technology options. Consideration of every variation to encompass all situations is, however, not possible; nonetheless the work of the ITU-R has been to determine a representative view of IMT‑2020 consistent with the process defined in Resolution ITU-R 65, Principles for the process of future development of IMT‑2020 and beyond, and the key technical performance requirements defined in Report ITU-R M.[IMT-2020.TECH PERF REQ] – Minimum requirements related to technical performance for IMT-2020 radio interface(s).

The parameters presented in this Report are for the purpose of consistent definition, specification, and evaluation of the candidate RITs/SRITs for IMT-2020 in ITU-R in conjunction with the development of Recommendations and Reports such as the framework, key characteristics and the detailed specifications of IMT-2020. These parameters have been chosen to be representative of a global view of IMT-2020 but are not intended to be specific to any particular implementation of an IMT-2020 technology. They should not be considered as the values that must be used in any deployment of any IMT-2020 system nor should they be taken as the default values for any other or subsequent study in ITU or elsewhere.

Further consideration has been given in the choice of parameters to balancing the assessment of the technology with the complexity of the simulations while respecting the workload of an evaluator or a technology proponent.

This procedure deals only with evaluating radio interface aspects. It is not intended for evaluating system aspects (including those for satellite system aspects).

The following principles are to be followed when evaluating radio interface technologies for IMT‑2020:

− Evaluations of proposals can be through simulation, analytical and inspection procedures.

− The evaluation shall be performed based on the submitted technology proposals, and should follow the evaluation guidelines, using the evaluation methodology and the evaluation configurations defined in this Report.

− Evaluations through simulations contain both system-level and link-level simulations. Independent evaluation groups may use their own simulation tools for the evaluation.

− In case of evaluation through analysis, the evaluation is to be based on calculations which use the technical information provided by the proponent.

− In case of evaluation through inspection the evaluation is to be based on statements in the proposal.

The following options are foreseen for proponents and independent external evaluation groups doing the evaluations.

− Self-evaluation must be a complete evaluation (to provide a fully complete compliance template) of the technology proposal.

− An external evaluation group may perform complete or partial evaluation of one or several technology proposals to assess the compliance of the technologies with the minimum requirements of IMT-2020.

− Evaluations covering several technology proposals are encouraged.

Overview of characteristics for evaluation:

The characteristics chosen for evaluation are explained in detail in § 3 of Report ITU-R M.[IMT‑2020.SUBMISSION −Requirements, evaluation criteria and submission templates for the development of IMT‑2020] including service aspect requirements, spectrum aspect requirements, and technical performance requirements, the last of which are based on Report ITU‑R M.[IMT-2020.TECH PERF REQ]. These are summarized in Table 6-1, together with their high level assessment method:

− Simulation (including system-level and link-level simulations, according to the principles of the simulation procedure given in § 7.1 below).

− Analytical (via calculation or mathematical analysis).

− Inspection (by reviewing the functionality and parameterization of the proposal).

……………………………………………………………………………………………………………..

TABLE 6-1 Summary of evaluation methodologies:

| Characteristic for evaluation | High-level assessment method | Evaluation methodology in this Report | Related section of Reports ITU-R M.[IMT-2020.TECH PERF REQ] and ITU-R M.[IMT‑2020.SUBMISSION] |

| Peak data rate | Analytical | § 7.2.2 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.1 |

| Peak spectral efficiency | Analytical | § 7.2.1 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.2 |

| User experienced data rate | Analytical for single band and single layer;

Simulation for multi-layer |

§ 7.2.3 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.3 |

| 5th percentile user spectral efficiency | Simulation | § 7.1.2 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.4 |

| Average spectral efficiency | Simulation | § 7.1.1 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.5 |

| Area traffic capacity | Analytical | § 7.2.4 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.6 |

| User plane latency | Analytical | § 7.2.6 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.7.1 |

| Control plane latency | Analytical | § 7.2.5 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.7.2 |

| Connection density | Simulation | § 7.1.3 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.8 |

| Energy efficiency | Inspection | § 7.3.2 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.9 |

| Reliability | Simulation | § 7.1.5 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.10 |

| Mobility | Simulation | § 7.1.4 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.11 |

| Mobility interruption time | Analytical | § 7.2.7 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.12 |

| Bandwidth | Inspection | § 7.3.1 | Report ITU-R M.[IMT-2020.TECH PERF REQ], § 4.13 |

| Support of wide range of services | Inspection | § 7.3.3 | Report ITU-R M.[IMT-2020.SUBMISSION], § 3.1 |

| Supported spectrum band(s)/range(s) | Inspection | § 7.3.4 | Report ITU-R M.[IMT-2020.SUBMISSION], § 3.2 |

Section 7 defines the evaluation methodology for assessing each of these criteria.

………………………………………………………………………………………………………….

IMPORTANT NOTE: The excerpts shown above are not final and subject to change at future ITU-R WP 5D meetings. The remainder of this draft report is much too detailed for any tech blog. Note that development of the detailed specs for the RIT/SRIT chosen won’t start till early 2020!

………………………………………………………………………………………

References:

http://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx

……………………………………………………………………………………………..

For a glimpse at what ITU-T and 3GPP are doing to standardize the network aspects/core network for IMT 2020 please refer to this post:

New ITU-T Standards for IMT 2020 (5G) + 3GPP Core Network Systems Architecture

Also note that 3GPP’s New Radio spec (3GPP release 15) is ONLY 1 candidate for the IMT 2020 Radio access Interface Technology (RIT). There are expected to be several others.

Ericsson Files 5G Patent; Teams up with Bharti Airtel on 5G Evolution & Massive MIMO

1. Ericsson Files End-to-End “5G” Patent Application:

Ericsson has filed what it is calling a “landmark” end-to-end “5G” patent application incorporating numerous inventions from the vendor.

The patent application combines the work of 130 Ericsson inventors and contains the vendor’s complementary suite of 5G innovations.

“[The application] contains everything you need to build a complete 5G network – from devices, the overall network architecture, the nodes in the network, methods and algorithms, but also shows how to connect all this together into one fully functioning network,” Ericsson principal researcher Dr Stefan Parkvall said.

“The inventions in this application will have a huge impact on industry and society: they will provide low latency with high performance and capacity. This will enable new use cases like the Internet of Things, connected factories and self-driving cars,” he added.

Ericsson has filed a worldwide patent with the World Intellectual Property Organization (WIPO) and a U.S. patent with the U.S. Patents and Trademarks Office (USPTO).

Reference:

https://www.telecomasia.net/content/ericsson-files-end-end-5g-patent-application

……………………………………………………………………………………..

2. Ericsson & Bharti Airtel “5G” Partnership:

“Ericsson will work with Bharti Airtel on creating a strategic roadmap for evolution of the (wireless) network to the next-gen 5G technology,” Ericsson Senior Vice President and Head of Market Area South East Asia, Oceania and India, Nunzio Mirtillo told reporters in New Delhi, India, according to the Economic Times (see references below).

On Friday November 17th, Ericsson showcased the first live “5G” end-to-end demonstration here using its 5G test bed and 5G New Radio (“NR” specified by 3GPP).

The company already has 36 such MoUs with global telecom operators. Under these agreements, Ericsson is trialing 5G technology and other solutions across verticals with these telcos.

Ericsson had earlier said that timely deployment plan for 3.3-3.6GHz band is crucial for the 5G network rollout in India. The band has already been identified as the primary band for the introduction of 5G services in the country before 2020.

Ericsson India Country Manager Nitin Bansal said, ” Besides telcos, startups, enterprises and academia have to come together to develop 5G use cases in India.”

Mr. Bansal said that Ericsson through its partnership with IIT-Delhi is evaluating 5G use cases around Healthcare, automotive and education verticals.

Earlier this year, Bharti Airtel had inked a similar pact with telecom gear maker Nokia to expand their partnership to areas like 5G technology standard and management of connected devices. Hence, it remains to be seen if both wireless network equipment vendors will be supplying base stations to Bharti Airtel.

India plans to roll out 5G services for consumers by 2020 and to achieve that objective, the government has this week set up a high-level forum that will evaluate and approve road maps and action plans to bring in the latest technology in the country.

References:

Operators around the globe gearing up for 5G: Ericsson survey

Cignal AI’s Forecast for 100G & 400G Coherent WDM Shipments

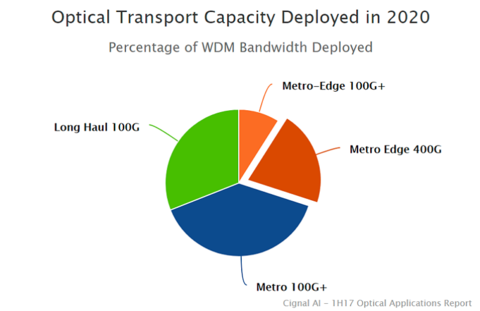

Ciena and Cisco rank as the predominant vendors of 100G and 400G Coherent WDM optical network equipment for 2017, respectively according to Cignal AI in their Optical Applications Report. The networking component and equipment market research firm notes that 400G coherent WDM system shipments are ramping up this year. The market research firm estimates that 400G technology will account for nearly one-quarter of all deployed WDM bandwidth in 2020.

The report also predicts that revenue for equipment originally designed for the data center interconnect (DCI) market will reach $1 billion by 2019, as these systems become widely adopted outside of traditional DCI applications.

Editor’s Note:

The lead author is the very well respected Andrew Schmitt, formerly with Infonetics (now IHS-Markit). Both 100G and 400G coherent will be widely adopted at the edge of the network by the end of 2021, according to the market research firm.

…………………………………………………………………………………

Cignal Al said that Cisco is growing 100G port deployments faster than all other vendors in the market. Meanwhile, Chinese coherent 100G port deployments grew at a healthy pace in the first half of 2017.

Complementing the 400G and 100G growth are two other key innovations—compact modular equipment and packet-OTN switching.

While modular equipment was initially designed to accommodate data center deployments, a host of traditional incumbent, wholesale, and cable MSOs will use these systems incorporated with open software to build disaggregated optical networks.

Cignal Al noted that compact modular equipment spending more than tripled in the first half of 2017 over the same period last year. Ciena, Cisco, and Infinera are the dominant suppliers for this sector. At the same time, traditional service providers such as Verizon are expanding advanced packet-OTN deployments. Packet-OTN systems revenue grew in the double digits in the first half of 2017, up from the same period in 2016. Cignal Al said Verizon’s deployment of these systems is rising and will affect vendor market share more materially in the second half of 2017.

“Cignal AI has close relationships with equipment and component manufacturers, as well as end users, and these relationships give us a unique insight into the optical equipment market. From this vantage point, we can forecast emerging technologies such as coherent 400G WDM usage,” states Andrew Schmitt, lead analyst for Cignal AI. “Pluggable 400G ZR modules should enter the market by 2019, and they will be the final nail in the coffin for 10G WDM networks.”

100G+ Coherent WDM:

- 400G coherent WDM volume starts to ramp this year, led by Ciena deployments and then followed by other suppliers six to nine months later.

- The introduction of small form factor 100G and 400G pluggable models will spur the largest optical market transformation since the “Optical Reboot” of 2012-2015 by virtually eliminating most 10G WDM deployments from the world’s optical infrastructure.

- Both 100G and 400G coherent will be widely adopted at the edge of the network by the end of 2021.

- Cisco is growing 100G port deployments faster than all other vendors in the market.

- Despite widespread expectations to the contrary, Chinese coherent 100G port deployments grew at a healthy pace in the first half of 2017.

About the Report:

This report tracks optical equipment spending and port shipments for specific types of equipment designed to meet the needs of a specific application. Cignal AI collects shipment information and guidance from equipment companies as well as the supply chain each quarter, and estimate each companies shipments in each of the defined categories. Forecasts are based on expected spending and shipment trends for given applications on a regional basis.

The report features revenue-based market size and share for the hardware categories and detailed port-based market size and vendor market share for 100G+ shipments. Vendors examined include Acacia, Adtran, ADVA Optical Networking, Ciena, Cisco, Coriant, ECI Telecom, Fujitsu, Huawei, Infinera, Inphi, NTT Electronics (NEL), Nokia and ZTE.

The report contains details on the following areas:

- Compact Modular hardware market share and forecasts

- 100G+ Coherent port shipments vendor market share

- 100G, 200G, and 400G+ Coherent and Direct Detect port shipments and forecast

- Advanced Packet-OTN Switching market share and forecasts

References:

https://cignal.ai/2017/09/cignal-ai-issues-industrys-first-forecast-for-400g-coherent-wdm-shipments/

https://cignal.ai/2017/09/1h17-optical-applications-report/

https://cignal.ai/marketresearch/opteq_ap/

http://www.ciena.com/insights/what-is/What-Is-Coherent-Optics.html

http://www.gazettabyte.com/home/2017/9/15/has-coherent-optical-transmission-run-its-course.html

https://www.nextplatform.com/2017/09/14/rare-peek-inside-400g-cisco-network-chip/amp/

https://www.cisco.com/c/en/us/solutions/service-provider/100-gigabit-solution/index.html

http://www.ciena.com/insights/articles/Move-Over-200G-400G-is-the-New-Sexy.html

Addendum:

Vodafone New Zealand just announced the world’s first live deployment of a 400G per wavelength optical system to carry core IP traffic between its Auckland data centers, using Ciena’s WaveLogic Ai coherent optics. AT&T’s recent trial of 400GbE also used Ciena’s WaveLogic Ai chipset

These two factors, illustrated above, enable the transport of 400Gb/s per wavelength and 30.4Tb/s of capacity per fiber, higher capacity than any other solutions available on the market, according to Ciena.

IHS Markit: Top 5 Trends in Telecom Infrastructure Sharing in Emerging Markets

By Stéphane Téral, executive director of research and analysis, mobile infrastructure and carrier economics, IHS Markit

Editor’s Note: Two Charts from GSMA are inserted into Stephane’s post below.

Overview:

As service providers operate in saturated markets everywhere in the world, they increasingly focus on customer satisfaction and retention and on business and network transformation, which require increasing dedicated resources. However, significant revenue growth may no longer be achievable, so it is necessary to de-emphasize network operations through outsourcing and managed services as well as network sharing to preserve margins and sustain cash flow.

GSMA says annual mobile revenue growth will be 1 to 2% annually till 2020 (when 5G first starts to be deployed). \

…………………………………………………………………………………………………………………………………..

Below are five trends IHS Markit Technology is seeing in telecom infrastructure sharing in emerging markets:

Trend #1: Nigeria is the most successful network sharing country. Africa, India, and Latin America are three geographies where network sharing has been working well. Although India pioneered network outsourcing back in 2005 and since has moved fast to network sharing and managed services, it is EMEA that is leading this area now with network sharing deals all across Eastern Europe and Africa. We can’t really pick a particular country because consolidation among service providers led to pan-African shared networks. However, in Africa I think Nigeria, the most populous African country, is the most successful and innovative telecom infrastructure country.

Trend #2: IHS Towers is the largest tower company in emerging countries

EMEA-based IHS Towers has become the largest of its kind (www.ihstowers.com) and is contributing to the success of Nigeria. The IHS Towers business model consists of buying the cell towers from the service providers, and leasing and managing those towers for the service providers. This allows the company to minimize operational expenditures (opex costs), and service providers can better focus on the customer experience.

Trend #3: We’ll see more HIS Towers-like companies in the future

Mobile subscriptions are at saturation everywhere in the world, putting pressure on revenue growth. Therefore, more and more service providers will sell their towers to companies like IHS Towers, which is in a strong position to keep growing. There is also the opportunity for others to create competition in the tower business.

Trend #4: The tower business is moving from emerging to developed countries

This is already happening in Italy. Given the revenue crunch across Western Europe, it is only a matter of time before we see more and more service providers selling their towers to a towerco specialist.

Trend #5: Network function virtualization (NFV) will provide the next wave of operational efficiencies in network sharing

By moving more network functions from hardware to software, using off-the-shelf IT components and platforms, the cost of network nodes decreases and new services can be turned up and down at a power of a click. Overall, with the concept of network slicing, it will become easier to share networks among several service providers.

GSMA says regions where mobile subscriber penetration is lower will experience higher revenue growth through 2020.

…………………………………………………………………………………………………………………………………………………….

Many of the themes discussed in this research note are explored in greater depth in IHS Markit’s recent Mobile Infrastructure Market Tracker report.

For information on purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in EMEA at +44 1344 328 300 or [email protected]; or APAC at +604 291 3600 or [email protected]

References:

BSNL & Coriant to cooperate on 5G, IoT, SDN/NFV, MEC in India

Indian state-owned telecom operator BSNL has signed a Memorandum of Understanding (MoU) with U.S. and German based Coriant to chart the path to 5G and IoT in the country.

In a statement, Coriant said it will help BSNL to lay foundation for innovation in network architectures and services leveraging 5G, IoT, SDN/NFV and mobile edge computing (MEC) technologies.

“5G represents an enormous leap forward in capacity and throughput speeds, and we are pleased to team with our long-term technology partner Coriant to tap into these capabilities and explore real-world use cases for next-generation services and applications,” BSNL CMD Shri Anupam Shrivastava said.

Under the terms of MoU, BSNL and Coriant will cooperate to develop 5G and IoT use cases, such as rural connectivity, connected healthcare, industrial automation, public safety, video surveillance, energy and agriculture.

The agreement also includes research programs, knowledge sharing, and workshops focused on the latest networking trends and hyper-scale architectures designed to support the delivery of commercial 5G services and applications.

“BSNL’s vision aligns nicely with our strategy of driving innovation in purpose-built 5G solutions and architectures,” said Shaygan Kheradpir, CEO and Chairman, Coriant. “We look forward to our joint work and the opportunity to help BSNL fast track development toward a 5G and IoT future and bring the value of these technologies to India and its citizens.”

The partnership with Coriant indicates BSNL’s latest push in 5G. Earlier this year BSNL formed a partnership with Nokia to build a 5G-ready network.

BSNL has recently been offering 4G mobile data plans like this week’s Plan 429, which provides 1 GB/day of free data and unlimited local and STD calls [1] for 90 days (except Kerala center). This move is among the many data and call offers posted by top telcos in the post-Reliance Jio era. BSNL has also maintained its mobile subscriber base over the last year, which would look forward to these plans.

Note 1. STD calls refers to any calls outside one’s home state in India

…………………………………………………………………………………………………….

About BSNL:

Bharat Sanchar Nigam Limited (abbreviated BSNL) is an Indian state-owned telecommunications company headquartered in New Delhi. It was incorporated on 15 September 2000 and took over the business of providing of telecom services and network management from the erstwhile Central Government Departments of Telecom Services (DTS) and Telecom Operations (DTO), with effect from 1 October 2000 on a going concern basis.

About Coriant:

Coriant delivers innovative and dynamic networking solutions for a fast-changing and cloud-centric business world. The Coriant portfolio of SDN-enabled, edge-to-core packet optical networking and DCI solutions enables network operators to cost-efficiently scale network capacity, reduce operational complexity, and create the resilient foundation for a new generation of mobile, video, and cloud services. Coriant serves leading network operators around the world, including mobile and fixed line service providers, cloud and data center operators, Web 2.0 content providers, cable MSOs, government agencies, and large enterprises. With a distinguished heritage of technology innovation and service excellence, Coriant is helping its global customers maximize the value of their network infrastructure as demand for bandwidth explodes and the communications needs of businesses and consumers continue to evolve. Learn more at www.coriant.com and follow us on Twitter for the latest @Coriant news and information.

References:

http://www.coriant.com/company/press-releases/BSNL-And-Coriant-Enter-Into-Agreement.asp

https://www.telecomasia.net/content/bsnl-coriant-team-5g-push-india

Windstream’s Enhanced Cloud Connect Service vs Zayo’s/Others (Google Comment)

Backgrounder:

During the early years of public cloud computing/storage, users had few good options to securely connect to the cloud service provider(s) of their choice- unless that same cloud service provider (CSP) offered an IP-MPLS VPN that terminated at its cloud point of presence (PoP). Both Century Link (via Savvis acquisition) and AT&T offered that access solution for customers of its cloud computing services.

Equinix’s Cloud Exchange and AT&T’s Netbond made it much easier by offering an intermediate network/switching center to connect to any one of several CSPs, which provide good quality, secure cloud connections with the flexibility to change CSPs without re-configuring the customer’s cloud access network.

However, there’s no industry standard API or common set of processes these cloud interconnect service providers follow. That’s not really a problem as long as they provide secure and reliable connectivity to multiple CSPs.

We examine a few Cloud Connection services in this blog post, including Windstream’s just announce offering.

Windstream Cloud Connect Service:

The Windstream Cloud Connect service now offers software-defined WAN (SD-WAN) and wavelength connectivity. It provides connectivity to Amazon Web Services, Oracle Fast Connect, Salesforce, Google Cloud, IBM Bluemix and Microsoft Azure cloud services.

Windstream Cloud Connect service was launched just over a year ago, with cloud connectivity via: switched Ethernet, MPLS, VPN and point-to-point services to AWS and Azure ExpressRoute.

Speeds currently available for Windstream Cloud Connect range from 50 Mbps to 10 Gbps, the company said in today’s press release. The offering is supported by technical assistance engineers who are available 24/7, the company said.

The company intends to compete, at least in part, based on cost with its Cloud Connect offering. “We are confident that Windstream Cloud Connect will deliver a better and more cost-effective experience for large and mid-sized enterprises than any of our competitors,” said a Windstream executive in today’s previously reference press release.

Joseph Harding, Windstream’s executive vice president and enterprise chief marketing officer, told Channel partners the offering creates new opportunities for medium and large enterprises across all verticals that are looking to move their traffic to hyperscale providers to enable their cloud initiatives.

“By offering customers this connectivity, we give our partners the ability to meet the growing service and bandwidth needs of their customers,” he said. “With the expectation for cloud services in the United States to double in the next five years, it’s a trend we believe our partners will be interested in.”

…………………………………………………………………………………………………………

Zayo’s CloudLink Service:

Zayo Group is one of several other network providers offering public cloud connect services. The company’s CloudLink delivers “the Fast Lane to the cloud that you require – addressing your public internet network connectivity issues. And is delivered on a global network by a trusted, consultative, and flexible partner – Zayo.”

CloudLink provides direct network connectivity to over 50 cloud service providers and over 150 cloud on-ramps globally. Whether you need multiple cloud connections or just one, we utilize our industry-leading fiber communications infrastructure across Dark Fiber, Wavelengths, Ethernet and IP Services, including pre-provisioned network connections up to 10Gbps, to deliver cloud connectivity solutions more flexibly, cost effectively, and with greater performance than traditional network service providers and cloud exchanges.

CloudLink as a subnetwork connecting enterprise customers to CSPs via Zayo’s global network (Source: Zayo Group)

………………………………………………………………………………………………………

CloudLink provides enterprises and data centers with an on-ramp to Zayo’s secure network, supporting high-performance bandwidth options across dark fiber, layer-1, -2, and -3 configurations, and scalable connectivity directly to all major cloud providers. API integration enables efficient provisioning, and as demand increases to actively manage network topologies, software-defined network (SDN) technology will support full automation and dynamic network configurations.

Other Cloud Connect Network Providers:

“Our business is to provide access network connectivity. By putting our POPs in key data centers and central offices and then interconnecting over 250 suppliers, we connect anywhere — cable to ILECS, Fiber Providers to CLECs, etc. We basically manage a network of networks.Now it’s not a pure resale model. We will go in very opportunistically and source managed and dark fiber to connect where there is demand. In fact last year we lit seven metro rings that connected many of the carrier hotels, data centers and ILEC LSOs that we were getting demand to and from.

And then on top of it all we built a Marketplace application that allows our customers to type in an address and we’ll push back to them all the products we have at that address. And it could be Ethernet, fiber, internet, broadband, cable — you name it.

The final and fastest growing segment is our business services group focused on application, over the top, and cloud service providers. What we do there is jointly sell the circuit that delivers the application — because the customer really needs both. So we have customers like 8×8, Mindshift and Thinking Phones.

They bring opportunities to us. Today most of those guys, particularly the cloud service providers like Google and AWS, aren’t interested in buying the circuit and bundling it. So it’s a joint sale. We become the carrier of record for that service.”

China’s 5G network trials announced; commercial service in 2020

China’s three main telecommunications providers are proceeding smoothly with a 5G pilot in major cities such as Shanghai and Beijing, the state-owned Economic Information Daily reported, citing unspecified sources close to the telcos and the communications ministry.

During the later half of this year, China Mobile, China Telecom and China Unicom will start the 5G pilot in major cities such as Beijing, Shanghai, Chongqing, Nanjing, Suzhou and Ningbo, the report said. Around 10 cities from provinces such as Jiangxi, Hainan, Shanxi, Shandong, Hebei will also be selected for the pilot.

–>That will position China for the commercial implementation of a 5G network as early as 2020, the report stated. China Telecom said it expects to launch commercial 5G services in 2020.

…………………………………………………………………………………………….

Editor’s Note: Again, the ITU-R standards for 5G (IMT – 2020) won’t be completed till the end of 2020.

…………………………………………………………………………………………….

Separately, China Telecom plans to trial 5G networks in six cities across the country. China Telecom will carry out field trials in six cities, as well as develop R&D applications and services in cooperation with partners from various industries.

“We are deeply devoted to engaging in 5G standard formulation and technology trial runs while proactively exploring and researching the networking plan for the evolution from 4G,” the company said.

According to China Telecom’s chairman and CEO Yan Jie, the business model for commercial 5G service “will not be like 4G, 3G and 2G, where you have universal, comprehensive, seamless network coverage”. The executive believes that LTE and next-generation technologies will certainly coexist for a long time. He also announced that China Telecom is open to cooperation with market competitors China Mobile and China Unicom on future infrastructure deployments.

China Mobile, the world’s largest mobile telephony operator in terms of subscribers, will wait until 5G technologies and business models are more mature to determine the capex of its future 5G network infrastructure, China Mobile chairman Shang Bing recently said during the telco’s earnings call presentation.

The executive said China Mobile is currently focusing on 5G tests and that is key for the telco to consider the return of investments of its future 5G networks. China Mobile plans to conduct 5G field tests over the next two years, with large-scale pre-commercial trials planned in 2019 and commercial deployments in 2020.

……………………………………………………………………………………………………..

This past May, China completed planning of a 30-site 5G test field in Huairou district. The trial has been planned by the IMT-2020 (5G) Promotion Group. Operators participating in the IMT-2020 Promotion Group include China Mobile, China Telecom, China Unicom and Japanese telecoms operator NTT DoCoMo. Vendors which are part of the initiative include Huawei, ZTE, Ericsson, Nokia, Datang and Samsung. Chipset and test measurement vendors Qualcomm, Intel, Mediatek, Ctec, Keysight Technologies and Rohde & Schwartz are also part of the initiative.

During the pilots, the carriers will construct base stations and carry out application and technological tests. “Once commercial use of 5G becomes a reality, it will lay a network basis for the development of industries, including the Internet of Things, Big Data, artificial intelligence and cloud computing,” said Huang Yuhong, vice director of China Mobile Research Institute.

The increase in speed from 4G to 5G will bring about increases in connectivity to other sectors such as big data, drones and home appliances, according to analysts interviewed by Economic Information Daily.

The communication industry will step into a new development stage after the 5G network is commercialized. As well as the aforementioned sectors, such industries as chips, electronic components and smart hardware will also be upgraded and enjoy huge development potential, the report added.

…………………………………………………………………………………………………………

This past June, a report from China’s Acadaemy of Information and Communications Technology, as detailed by the South China Morning Post, predicts China’s three carriers–China Mobile, China Unicom and China Telecom–will spend $411 billion on deploying 5G networks in the decade ending in 2030.

According to reports, the government agency expects peak spending to hit in 2023, as well as that the as-yet un-standardized network standard will have broader implications for the Chinese economy, accounting for 3.2% of GDP in 2025.

Reporting on the key takeaways of the report in Business Insider, Rayna Hollander wrote, “Legacy and emerging mobile services and technologies alike will see more adoption due to 5G speeds…[which]will power nascent tech like augmented and virtual reality (VR), connected homes, M2M communications, and large-scale operations of IoT devices.”

Jefferies analyst Edison Lee told the South China Morning Post, “We believe this paper represents the government’s official position on 5G, and its analysis largely explains why China will aggressively support 5G roll-out.”

Telecom industry watcher Xiang Ligang told the China Daily:

“The report underestimates the impact of 5G on social economy. It isn’t yet more than five years since 4G was launched, but it has had a huge influence in boosting the development and popularization of mobile payments.”

…………………………………………………………………………………………………

References:

http://www.atimes.com/article/chinas-advanced-5g-network-set-adoption-2020/

http://en.ce.cn/main/latest/201707/06/t20170706_24050396.shtml

https://www.telecompaper.com/news/china-telecom-to-launch-5g-trial-networks-in-6-cities–1209462

Report: China will spend $411 billion on 5G from 2020 to 2030

IEEE ComSoc Webinar: 5G: Converging Towards IMT-2020 Submission