Uncategorized

NFV Open Source (OPNFV) Reaches Critical Juncture at Beijing Summit

The OPNFV Summit – June 12-15th in Beijing, China – marks a critical moment in the development and acceptance of the open-source network functions virtualization technology by telecoms and others, said Heather Kirksey, Director of the Open Platform for NFV (OPNFV) project within the Linux Foundation. Ms. Kirksey told Light Reading that network operators “are engaging in open source in the right way now.”

Instead of showing up in large numbers with lists of demands or problems that need solving, “they are at the table working, contributing code and addressing problems.” Kirksey cites AT&T’s “Nirvana stack” (presented by AT&T’s Paul Carver at the 2017 Open Networking Summit) as an example of how open source is becoming a critical element of AT&T’s future networking protocol work.

Having initially used Juniper Network’s Contrail SDN controllers in its AT&T Integrated Cloud, the network operator is now looking at an open source ODL-based controller running on top of OPNFV software/firmware (see chart below).

AT&T’s “Nirvana” SDN Stack, as presented by Paul Carver at the 2017 Open Networking Summit

…………………………………………………………………………………………………………

“Within OPNFV itself, and working with other open source groups, we’ve had a big focus for us on what it means to have a healthy open source culture, what it means to be effective,” Kirksey said. “In terms of what TIP (Facebook’s Telecom Infrastructure Project) does, it’s their people and processes group. I think it is really interesting, it never would have dawned on me to take that on as a task within an open source group. But we focus on it a lot when we are building our own culture, hoping that will create seeds,” she added.

OPNFV has, from its outset, worked in collaboration with other groups and upstream code whenever possible, Kirksey said next week’s summit reflects some of that cooperation.

This week’s four-day event in Beijing kicks off with OPNFV Project‘s Design Summit, for the developer community to push forward on Euphrates, the next OPNFV release. But those first two days also include mini-summits for the Open Network Automation Platform (ONAP), OpenDaylight, DPDK, FD.io and the Cloud Native Computing Foundation, as well as its own mini-summit on data plane and VNF acceleration.

The event comes at an interesting time in the open source world, as debate rages on a few issues, including the commercial viability of open source and how it goes to market, and the way in which open source is being embraced by the carrier community. There is also much more discussion about how open source groups work together, versus duplicating work or working at cross purposes.

…………………………………………………………………………………………………..

OPNFV is under the Linux Foundation, which has become the dominant open source organization for open networking/software defined networking. Next week’s event will be the third OPNFV Summit and the first held in China. Many Chinese companies will attend, including: China Mobile, China Telecom, Huawei and ZTE. Didi Chuxing , the Chinese version of Uber, will also be present.

HPE’s Pradeep Sen (formerly with Verizon) will present a keynote at the OPNFV Beijing Summit. He will talk about “Cloudification and Disaggregation stages of the telco journey to the cloud, and what we in the industry, and open source and OPNFV in particular, need to pay attention to.”

Representatives from Orange and NTT DOCOMO will also present keynotes.

References:

http://events.linuxfoundation.org/events/opnfv-summit

Open Network Summit: ONAP Steals the Show with Broad Support

Cisco: Online video to account for 82% of all Internet traffic by 2021!

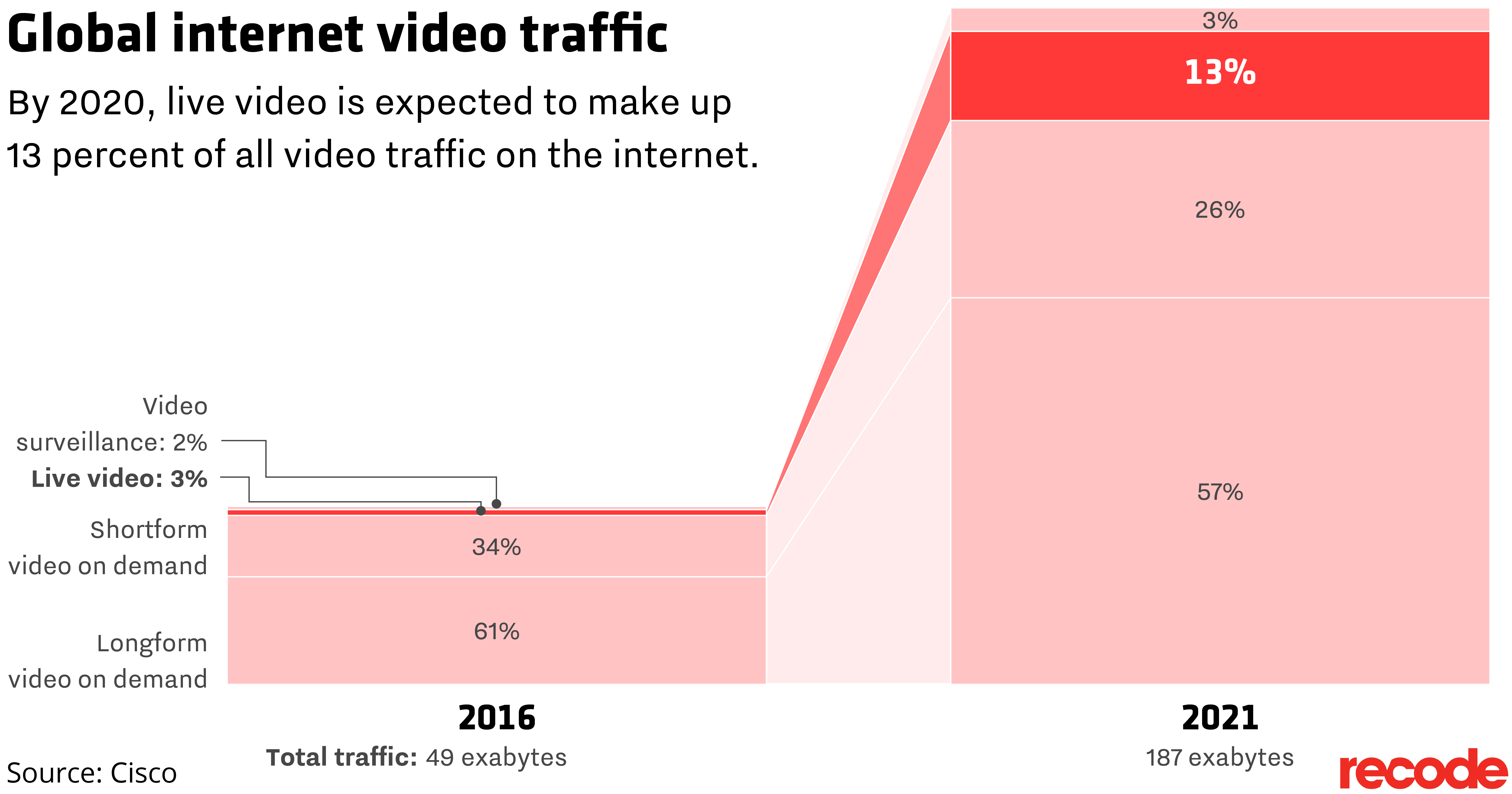

Online video will make up 82% of internet traffic in 2021, according to a Cisco forecast released this week. The amount of bandwidth consumed will grow as more video is consumed and higher-quality videos are watched. Live (real time or linear) video is expected to see the fastest rate of growth over the next four years. Video accounted for 73% of traffic in 2016.

Cord cutters generate twice as much internet traffic as those who still pay for regular TV, according to Cisco. The video bandwidth demand is coming from all types of internet video, including on-demand content like Netflix, web cam viewing and traditional TV options available over the internet (IP VoD).

/cdn.vox-cdn.com/uploads/chorus_asset/file/8650935/Cisco_global_ip_traffic_01.png)

Chart Courtesy of Recode: https://www.recode.net/2017/6/8/15757594/future-internet-traffic-watch-live-video-facebook-google-netflix

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

44% in 2016 –>58% by 2021

2.3 in 2016 –>3.5 by 2021

27.5 Mbps in 2016–>53.0Mbps by 2021

4. Average Traffic per Capita per Month

12.9 GB in 2016–>35.5GB by 2021

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Live video is set to be the fastest growing segment of internet video traffic thanks to new video offerings like Facebook Live, Twitter’s broadcast of live sports and live over-the-top bundles from companies like AT&T, YouTube and Hulu. It’s expected to grow to nearly 25 exabytes (25 billion gigabytes), about 13 percent of internet video traffic, by 2021, up from 1.6 exabytes, or 3 percent of video traffic last year.

2021 Forecast IP Traffic Highlights:

- Globally, IP traffic will grow 3-fold from 2016 to 2021, a compound annual growth rate of 24%.

- Globally, IP traffic will reach 278.1 Exabytes per month in 2021, up from 96.1 Exabytes per month in 2016.

- Global IP networks will carry 9.1 Exabytes per day in 2021, up from 3.2 Exabytes per day in 2016.

- Globally, IP traffic will reach an annual run rate of 3.3 Zettabytes in 2021, up from an annual run rate of 1.2 Zettabytes in 2016.

- Globally, IP traffic will reach 35 Gigabytes per capita in 2021, up from 13 Gigabytes per capita in 2016.

- Globally, average IP traffic will reach 847 Tbps in 2021, and busy hour traffic will reach 5.0 Pbps.

- In 2021, the gigabyte equivalent of all movies ever made will cross Global IP networks every 1 minutes.

Source: Cisco http://www.cisco.com/c/m/en_us/solutions/service-provider/vni-forecast-highlights.html

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Rreal-world impact of IoT:

Cisco anticipate the balance of power shifting from mobile phones/tablets to IoT connected devices. By 2019, IoT connections will account for more mobile additions than smartphones, tablets, and PCs. And by 2021, 638 million IoT modules will be added, while smartphone, tablet and PC additions will reach 381 million.

From a 5G perspective, there will be a slight impact over the next five years. The end of 2020 has been earmarked as the 5G finish line for a number of operators, though no-one should forget about 4G too quickly. Cisco predicts that by 2021, 5G will account for roughly 0.2% of mobile connections, though each connection will generate nearly 30 gigabytes per month, almost five times higher than the average 4G connection. These estimates would see 5G take 1.5% of the total traffic despite the modest number of connections.

“There are several issues that remain to be addressed before significant commercial 5G deployments commence (starting in 2020),” said Shruti Jain, one of Cisco’s analysts. “Can you imagine the impact of 5G on today’s data cap structures? Currently, top 1% of mobile users consume 30 GB of monthly data. When 5G is introduced, 30GB will be the average.”

As you can probably imagine, a lot of this traffic will be video, in fact 80% of it will be. Video will dominate IP traffic and overall Internet traffic growth representing 80% of all Internet traffic by 2021, up from 67% in 2016. This means there will be 1.9 billion Internet video users by 2021, as well as three trillion internet video minutes per month, about one million video minutes every second.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Chart Courtesy of Recode: https://www.recode.net/2017/6/8/15757594/future-internet-traffic-watch-live-video-facebook-google-netflix

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

http://www.cisco.com/c/en/us/solutions/service-provider/visual-networking-index-vni/index.html

Akamai: U.S. Internet speeds increased 22% YoY; IPv6 adoption is a conundrum

http://telecoms.com/482612/the-age-of-face-to-face-conversation-is-pretty-much-over/

LPWAN race for cellular IoT heats up with Vodafone’s successful test of NB-IoT

Vodafone said it has successfully carried out NB-IoT (Narrow Band – Internet of Things) interoperability tests, paving the way for a global rollout of NB-IoT services in the near future. The U.K.-based global wireless telco said it has tested modules made by Neul and Qualcomm with network equipment from Ericsson, Huawei and Nokia in multiple regions.

“All of these vendors’ NB-IoT radio access network (RAN) technology has been successfully interconnected with Vodafone’s IoT core network,” said Luke Ibbetson, head of R&D and technology strategy at Vodafone. “As a company committed to a multi-vendor strategy, we understand the importance of a healthy device and network ecosystem in delivering the best service to customers at a competitive price,” he said.

Vodafone deployed its first NB-IoT network in Spain in January 2017. It had previously announced plans to switch on networks in Germany, Ireland, and the Netherlands during the first quarter of this year, but as yet, no such launches have taken place.

Vodafone is a vocal proponent of NB-IoT, a low-power, wide-area network (LPWAN) technology that uses licensed spectrum to provide two-way communication over long distances and in hard-to-reach locations. It can support huge numbers of cheap, low throughput devices that consume very little power. It was standardized by the 3GPP in June 2016 as part of its work on LTE Release 13 (see reference below).

Vodafone prefers it to competing standards like ITU-R’s LTE CatM (or M1) and consortium generated LPWAN specifications like LoRaWAN (long range wide area networking). Promoted by the LoRa Alliance, it claims to offer similar performance to NB-IoT, but using unlicensed spectrum, opening the door to any company that wants to operate an IoT network, not just licensed spectrum holders.

And let’s not forget the leader in LPWANs- Sigfox, which claims to be “the only global operated LPWAN IoT network to provide high capacity and high service level while operating in the unlicensed ISM frequency bands.” 32 countries covered, low energy consumption, low cost, and compatible wireless technology (compatible with Bluetooth, GPS 2G/3G/4G and WiFi) are its touted advantages over other LPWANs

Author’s Note: We’ve written for well over a year on the many competing LPWAN specs and still believe there are way too many of them!

References:

https://www.totaltele.com//497213/Vodafone-hails-successful-NB-IoT-interoperability-tests

http://www.3gpp.org/news-events/3gpp-news/1785-nb_iot_complete

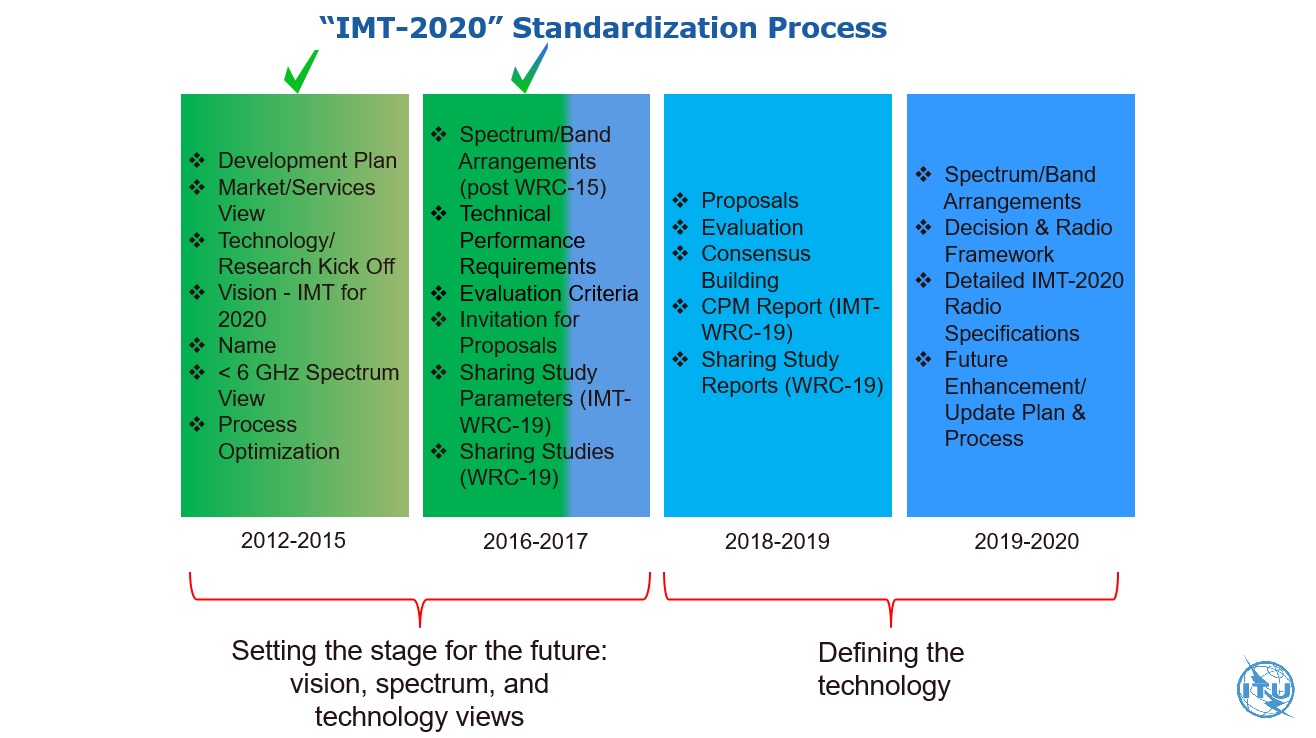

Selected Applications/Use Cases by Industry for ITU-R International Mobile Telecommunications (IMT) – 3G, 4G & 5G

Excerpts of a new ITU-R WP 5D Contribution by Intel- Document 5D/605-E, 6 June 2017

Background:

At the 26th meeting of ITU-R WP 5D, the working document towards a Preliminary Draft New Report ITU-R M.[IMT.BY.INDUSTRIES] on the use of the terrestrial component of International Mobile Telecommunications (IMT) by industry sectors was further developed as contained in Attachment 3.13 to Document 5D/530. In the annex to this contribution, Intel proposes edits and additions for the sections on water management, healthcare and smart homes for consideration at the 27th meeting of WP 5D to further progress the development of the working document.

Editor’s Note: The new draft report doesn’t attempt to identify which version of IMT (i.e. IMT 2000, IMT Advanced, IMT 2020 “5G”) is associated with the various use cases defined in section 4. See below Table of Contents and description of Use Cases or Applications.

………………………………………………………………………………………………………………………………………………………………………………………..

TABLE OF CONTENTS – The use of terrestrial component of International Mobile Telecommunications:

1 Introduction

2 Relevant ITU-R Recommendations and Reports

3 Capabilities of IMT technologies

3.1 Higher throughput

3.2 Quality of service

3.3 Use of spectrum

3.4 Energy efficiency

3.5 Mobility Management

3.6 Security Aspects of IMT systems

3.7 Coverage

3.8 Position

3.9 Clock Synchronization

4 Use Cases or Applications — Focus of this blog post!

4.1 Machine-Type Communication (MTC) aka Machine-to-Machine (M2M)

4.2 Broadband Public Protection and Disaster Relief (PPDR)

4.3 Transportation Applications

4.3.1 Intelligent Transport Systems (ITS)

4.3.2 Railways or High Speed Train Communication

4.3.3 Public Transportation

4.3.4 Logistics in Transportation

4.4 Utilities

4.4.1 Smart Grids

4.4.2 Water Management

4.5 Industrial Automation

4.5.1 Factory Automation

4.5.2 Process Automation

4.6 Remote control

4.6.1 Communication requirements

4.6.2 Mining

4.6.3 Construction site

4.6.4 Harbours

4.6.5 Surveying and inspection

4.6.6 Oil and gas

4.6.7 Remote surgery

4.7 Healthcare

4.7.1 Mobile Health Applications

4.7.2 Sustainability/Environmental

4.8 Education

4.9 Smart City

4.10 Wearables

4.11 Smart Homes

4.12 Agriculture

4.13 Enhanced Multi-media

4.13.1 Augmented Reality

4.13.2 Gaming

4.13.3 Media and entertainment

4.13.4 Broadcast content distribution

Introduction:

International Mobile Telecommunications (IMT) systems will be able to provide a significant improvement in performance and quality of current IMT services, such as Mobile Broadband (MBB), and also fulfil requirements of a wider range of telecommunication services including emerging services that had not traditionally employed IMT technologies. Such services or use cases raise stringent requirements on throughput, reliability, latency, mobility, number of concurrent connected devices, and energy efficiency among others. A use case is defined as a description of the behaviour of individual users, groups or users or an application process.

The original goal of IMT was to provide access to a wide range of telecommunication services supported by fixed and mobile telecommunication networks. This has been outlined in a number of ITU-R Recommendations, starting with M.687 and elaborated in others over the years, including the vision Recommendations ITU-R M.1645 and ITU-R M.2083.

However, the capabilities of IMT technologies have proven to be applicable to specific industries in wide-ranging closed environments. Some of these IMT applications have already been investigated (e.g., Report ITU-R M.2291 on PPDR) and others are in progress or under consideration as described in this Report. It is useful to cover in one Report all these applications of IMT in specific industry sectors, by referring to relevant Recommendations and Reports where they exist and addressing in the Report the remaining ones that have not yet been fully documented.

This Report provides information on the usage of IMT systems for emerging use cases or applications such as Intelligent Transport Systems (ITS), railways or high speed train communications, industry automation, remote control, etc. This Report does not preclude the development of new use cases or applications that exist or appear in future IMT technology development and deployment or other applications that can be provided by the satellite component of IMT or other systems.

……………………………………………………………………………………………………………………………………………………..

Selected Use Cases or Applications:

4.1 Machine-Type Communication (MTC) (also known as Machine-to-Machine (M2M) in some jurisdictions)

[Editor’s note: The document should provide the linkage between IoT and MTC. For instance, Rec. ITU-R M.2083 gives guidance on massive MTC (mMTC). Res. ITU-R 66 is also relevant. This section should also include information on narrowband and broadband MTC.]

The Internet of Things (IoT) is quickly emerging as a very significant agent of transformation as it blends the physical and digital worlds; indeed, billions of connected devices are forecasted by the year 20212. For service providers this represents an opportunity for increased revenues and for vertical networked industries; this represents more efficient operations.

Since MTC cuts across all verticals general aspects, it can be covered in this section.

4.2 Broadband Public Protection and Disaster Relief (PPDR)

The use of IMT for broadband public protection and disaster relief (PPDR) applications is covered in detail in Report ITU-R M.2291.with descriptions of the current and possible future use of international mobile telecommunications (IMT), including the use of long term evolution (LTE)3,

to support broadband PPDR communications as outlined in relevant ITU-R Resolutions, Recommendations and Reports. Report ITU-R M.2291 further provides examples for deploying IMT for PPDR radio communications, case studies and scenarios of IMT systems to support broadband PPDR applications such as data and video.

4.3 Transportation applications

4.3.1 Intelligent Transport Systems (ITS)

Intelligent Transport Systems (ITS) applications are typically classified into three groups: safety, traffic control and infotainment. Safety applications aim at protecting the road users (pedestrians), the driver and the vehicle itself. Examples of such applications include cooperative active safety systems to warn drivers about dangerous situations and intervene through automatic braking or steering to avoid accidents, cooperative driving applications, such as platooning, to reduce accidents and increase road safety and traffic efficiency. In addition, communications between vehicles and vulnerable road users (pedestrians, cyclists) through their mobile devices will be an important key element to improve traffic safety and to avoid accidents.

Due to their critical nature, the safety related applications have very strict requirements on latency, reliability and availability as they rely on timely and reliable exchange of information between vehicle to vehicle (V2V), between vehicles and pedestrians (V2P) and between vehicles and roadside units (V2I). V2V, V2I and V2P are commonly referred to as V2X which raise distinct challenges to the traditional wireless communication system. With some further advanced V2X services envisaged by the automotive industry, such as vehicle platooning, sensor data sharing and remote driving, it is expected to impact ultra-low latency, ultra-high reliability, extended coverage and higher data rate.

Increasingly, most vehicles are equipped with a multi-faceted infotainment system that delivers navigation, music, phone calls, and more, at the touch of a screen, turn of a knob, or buttons on the steering wheel, and some even with voice commands. They also use a touch screen so, in a way, they are very similar to smartphones.

In fact, smartphones may be emulated on the dashboard of the cars. Many of these vehicles can use IMT to provide this service. With IMT Broadcast, users can also watch TV shows and downstream services including movies, news, weather, and sports.

IMT technologies are envisaged to provide communications to different ITS application through the LTE-based V2X feature. In order to increase the reliability and availability with reduced latency, the safety related information should be able to be transmitted on a highly reliable direct link between the terminals that equipped with ITS applications. However, the direct communication may not reach sufficient coverage or provide proper resources when the terminals suffer from the situations e.g. some Non-Line of Sight (NLOS) cases or extremely high traffic jam. It is therefore the safety-related information can also be transmitted to the network and then be forwarded to the reception terminals in proximity.

[The LTE-based V2X system could provide two communication interfaces, i.e., the direct communication interface (sidelink- see section 4.3.1.2) and the cellular-based communication interface (both of the unicast and broadcast are supported), to support the strict transmissions for ITS application. This gives the flexibility to select a suitable transmission path based on the services and wireless environment. Furthermore, from the resource allocation perspective, a combination of the centralized and distributed resource allocation mechanism is supported to benefit to enable V2X services.]The LTE-based V2X covers both the operating scenario where the carrier(s) is dedicated to LTE-based V2X services (subject to regional regulation and operator policy including the possibility of being shared by multiple operators) and the operating scenario where the carrier(s) is in licensed spectrum also used for normal LTE operation.

4.3.1.1 Automotive Direct Communication over Sidelink [Editor’s note: Example use cases include engine alert and automatic maintenance scheduling, autonomous driving, collision avoidance, V2V]

4.3.1.4 Automated driving

Automated driving system (ADS), enhanced mobile cloud services, real-time traffic control optimizaion are examples of case in which low latency and high reliability can improve quality of life. Automated driving vehicles will be able to function when high speed data transmission allows for real-time information updates. It should be noted with referring Society of Automotive Engineers (SAE) international’s standards taxonomy and definitions for Terms Related to On-Road Motor Vehicle Automated Driving Systems.6 A taxonomy for motor vehicle with automated driving systems perform part or all of the dynamic driving task (DDT) on a sustained basis and range in level from no driving automation (level 0) to full driving automation (level 5). In SAE level 0 (no automation) to 2 (partial automation) human driver monitors the driving environment and in SAE level 3 (conditional automation) to 5 (full automation) automated driving system monitors the driving environment. As the levels increase, the need to be connected to a network increases as well.

It should also be noted in accordance with SAE international’s definition that active safety systems, such as electronic stability control and automated emergency braking, and certain types of driver assistance systems, such as lane keeping assistance, are excluded from the scope of this driving automation taxonomy because they do not perform part or all of the DDT on a sustained basis and, rather, merely provide momentary intervention during potentially hazardous situations. Due to the momentary nature of the actions of active safety systems, their intervention does not change or eliminate the role of the driver in performing part or all of the DDT, and thus are not considered to be driving automation.

It should, however, be noted that crash avoidance features, including intervention-type active safety systems, may be included in vehicles equipped with driving automation systems at any level.

For ADS-equipped vehicles (i.e., levels 3-5) that perform the complete DDT, crash avoidance capability is part of ADS functionality.

In the future, all cars will be connected to a network. Even automated driving at lower level will benefit from being connected to a network which will allows for navigation systems to be dynamically updated and breaks operations to be updated with data about the car itself. Automated systems in the middle level, since they sometimes require the car to drive autonomously, will need to be connected to a network in order to understand local road information quickly and make judgement about the driver and the car in order to make proper decisions. Since these decisions can be made in the cloud, data needs to be quickly transmitted between the car and the cloud, meaning IMT-2020 feature of low latency will be an important factor. In the end, however, any delay in the connection between the base station and the car will not be a concern, since the connection between the data center where information will be processed and the car is expected to be an end to end delay guaranteed network.

In order to have fully automated driving vehicles, IMT-2020 will be used for people who don’t drive. For example, an automated driving car can be ordered with a smartphone. These vehicles, which could include automated taxis or elderly care pick up service vehicles, will bring the customer to their destination. While enjoying a drive to their destination, customers are free from driving their car and could enjoy the free time provided to them on their trip. From 2020 when automated vehicles would be allowed on express way, organizations which manage expressways might provide automated vehicle users with entertainment such as films to enjoy during their trips. A car moving on an expressway, in order for a 4K movies to be delivered, will use IMT-2020 handover function. In these ways, the commute time inside automated vehicles will also utilize IMT-2020 services.

4.3.1.5 Collision avoidance

This system provides vehicle collision avoidance at intersections with bad visibility. To monitor cars, bicycles, and people that are entering an intersection in real time, video cameras are placed at the intersection, and image processes are carried out with a low-latency application server which is placed at a base band unit. When intersection ingresses are detected, a detection result is created, considering an alarm and a video, and it is transmitted to automobiles through low-latency IMT-2020 networks. The automobiles that received the detection result automatically slow down while the alarm, and the video is displayed on monitors. This system also predicts intersection ingresses by gathering traffic information from neighboring intersections.

4.3.2 Railways or High Speed Train Communication

High Speed Train Communication covers two main applications: broadband connectivity to the passengers and train control operations.

The first application focuses on providing amenities or entertainment for people spending lots of time in buses, trains, planes, e.g. for transportation. In the case of longer distance train trips, consumers may watch full movies, or tourists could watch streaming video of sight-seeing guidance having views from a various angles that can be selected by each tourist. In another case of a train accessing to a football stadium, fans on board the train share information and experiences with other fans by using their smartphone. Such a train can transport around one thousand passengers.

For this case of train accessing to the stadium, an IMT-2020 system needs to support high data rate transmission so that many users on board the train can simultaneously watch high definition video and/or exchange a huge amount of data. Subways have a capacity of many trains per hour and direction. Considering such a case as communications during the rush hour commute in the metropolitan area of one country, these railway passengers when going through a terminal station generate huge communication traffic.

As an example, the largest terminal station in one country’s metropolitan area, has eleven railway lines and a train of each line arrives every two minutes during peak rush hour. Assuming 90% of the “accumulating passengers” use cellular terminals, the number of cellular terminals exceeds 25,900. “Accumulating passengers” consist of (1) passengers getting on/off, (2) passengers staying on the train, and (3) people coming into/going off the station.

One example considers the area around the station as 200m x 500m, the density of cellular terminals is 259,000 UE/km2, and assuming user data rate in the year of 2020 as 20Mbit/s, the communication traffic per km2 reaches 5.18 Tbit/s/ km. Even though the data rates, latency and reliability requirements are not very stringent, this use case for train could become challenging in mobility requirement due to the high-speed of the trains, which can reach up to 500 km/h.

The second application focuses on train operations, control and diagnostics which requires robust and reliable communication. Trains operate under the condition that they are able to have real-time communication with train control, signalling zones, stations and among railcars and trackside equipment. Train operations do not require high data rates but reliability requirements are very stringent.

With the advances of IMT technologies8, it is possible to provide wide ranges of communication service for train passengers as well as enhanced train operations controls.

4.3.3 Public Transportation

[Editor’s note: Example use cases include flexible/adaptive bus/fleet management, and allowing more efficient routes.]

The user scenarios that provide comfortable experiences through advanced methods of transportation include driver assisting services such that provide comfortable rides by avoiding traffic jams or other obstacles, and computer-aided management of crowds during popular events.

Novel intelligent mechanisms based on the combination of tremendous amount of data from advanced sensing technology and emerging artificial intelligence methodologies will greatly enhance conventional expectations.

4.3.3.1 Location-Based Services

Both the private and public sectors are developing services that use Global Positioning System (GPS) and digital maps. These services are expected to continue to develop and evolve as they being to use high speed mobile and cloud based services enabled by IMT-2020.

In the future, it won’t only be people who are using electronic maps, but also self-driving vehicles will be able to function when high speed data transmission allows for real-time information updates. When this becomes a reality, digital maps will be able to be dynamically updated, including information on traffic jams and road construction. The low latency of IMT-2020 will enable these maps to be dynamically updated in real-time.

Municipalities also need hazard maps that can be updated in real-time to be used in times of disasters or evacuations. IMT-2020 will also assist in creating maps that will change in real-time in response to disaster information, just like the dynamic maps self-driving vehicles will use.]

Another example is the connected bus stop9 – a concept that incorporates IMT and RLAN small cell technology. Apart from the usual consumer uses for mobile broadband, the connected bus stop can support functionality that is particularly useful for commuters. This could include screens that display real-time information about bus movements and touch-screens that provide access to interactive maps, local news, tourist information and advertising. In addition, a closed-circuit television (CCTV) camera, panic button and push-to-talk functionality could be incorporated to increase security and make it easy for commuters to contact emergency services or the police.

4.3.4 Logistics in Transportation

It involves the bus/fleet management and also asset tracking related to items, equipment and also personnel management (daily activities, health control).

4.4 Utilities

[Editor’s note: Smart Grid, Water Management and Gas Metering]

4.4.1 Smart Grids

Smart grids will provide the information overlay and control infrastructure, creating an integrated communication and sensing network. The smart grid enabled distribution network provides both the utility and the customer with increased control over the use of electricity, water and gas. Furthermore, the network enables utility distribution grids to operate more efficiently than ever before.10

Smart grids envisage ubiquitous connectivity across all parts of utility network distribution grids from sources of supply grid, through network management centres and on to individual premises and appliances. Smart grid will require enormous 2-way data flows and complex connectivity which will be on a par with the internet. More information on the communication flows envisaged over the electricity supply grid is available in the ITU Technical Paper “Applications of ITU-T G.9960, ITU‑T G.9961 transceivers for Smart Grid applications: Advanced metering infrastructure, energy management in the home and electric vehicles”.11

4.4.1.1 Smart Grid requirements

In the Smart Grid area, there are many communication use cases, with varying requirements on latency, reliability, packet size and cycle times. Some use cases could have a high number of connected devices, while others have higher requirements on latency and reliability.

The U.S. Department of Energy performed a survey of communication requirements for the smart power grid12 that shows the different communication use cases and their respective requirements on latency and reliability. Reliability requirements range from 1-10-2 to 1-10-4 while the latency requirements can be in the order of [few/[range?] milliseconds. Some of the identified applications are Advanced Metering Infrastructure (AMI), Electric Transportation of large number of electric vehicles, Distributed Energy Resources and Storage applications for renewable energy sources, Distribution Grid Management, etc. So, for the application areas described above, the combined latency and reliability requirements can be met by the current and future development of IMT technologies.

Cellular networks under 3GPP responsibility (i.e. GSM/EDGE, WCDMA/HSPA and LTE) have evolved from providing telephony services to support a wide range of data applications, with in-built security and Quality of Service support. In recent 3GPP releases standardization enhancements for Machine-Type Communication (MTC) have also been introduced, including support for congestion control, improved device battery lifetime, ultra-low complexity devices, massive number of devices and improved indoor coverage. Smart meters are available with individual monitoring and control functions provided using 3GPP technologies. 13

3GPP has a variety of wireless standards that are applicable to first mile applications for power grid management systems. Recent releases of the 3GPP standards have introduced enhancements for Machine Type Communications (MTC), e.g.

Release 10:

• Delay tolerant access establishment (UMTS, HSPA+, LTE)

• Extended access barring (GSM/EDGE)

Release 11:

• Extended access barring (UMTS, HSPA+, LTE)

Release 12:

• UE power saving mode (GSM/EDGE, UMTS, HSPA+, LTE)

• Low complexity UE category (LTE)

Release 13:

• Extended DRX (GSM/EDGE, UMTS, HSPA+, LTE)

• Extended Coverage GSM Internet of Things (EC-GSM-IoT) (GSM/EDGE)

• LTE Physical Layer Enhancements for MTC (eMTC) (LTE)

• Narrow band Internet of Things (NB-IoT)

4.4.2 Water management

Wireless Communication is becoming an essential tool in managing the water quality and the environment surrounding the catchment area. In Africa, a telemetry project is aimed at investigating the atmospheric deposition of nutrients into the African Great Lakes, and how mobile phones can be used for environmental protection. The African Great Lakes (AGL) act as water sources for the Nile, Congo and Zambezi rivers. These lakes support the fishery and the agricultural industries around the AGL and are critical components of the economy and development of countries such as Zambia, Rwanda, Tanganyika and Malawi. Wireless monitoring is helping improve the water quality. Wireless networks are also being used to educate the people living around these lakes on pollution and land use. At present these wireless networks are using basic GSM systems but with IMT there will be opportunities to further improve monitoring systems.

In the United Kingdom, water authorities are investigating how IMT-2020 systems can be used for water management. In urban areas, Wireless sensor networks (WSN) promise to have significant impact on a broad range of applications related to environmental monitoring and water safety.

The convergence of the internet, telecommunications, and advancement in information technologies with techniques for miniaturization now provides vast opportunities for the application of low-cost wireless monitoring solutions for water management as well as for sewers.

In the United States, sensors are being utilized for applications such as managing water leaks and for water conservation. Sensors can help in identifying and managing leaks in water lines. Some studies have estimated that communities in the United States “can be losing as much [as] 30 percent of their product along the way to leaks in the distribution system.”15 To help with this, sensors and advanced metering infrastructure can be installed in treatment plants and underground pipes and help alert managers when leaks take place and identify how much water is being lost before it reaches the end-user. Smart meters allow people to know how they are using water and where they might be able to economize given their usage levels. In California, for example, “metering, when coupled with effective pricing structures, reduces water use by 15 percent to 20 percent.”16,17

Wireless networks already provide the following functions, but with IMT there are possibilities to do more:

– Improve monitoring and control of water flow over extended distances.

– Improve operator safety and efficiency by eliminating the need to travel to remote site locations for readings.

– With wireless radios, allow for any type of network topology, can self-heal, and provide reliability as well as capacity for future expansion.

Water authorities are already using wireless solutions for a variety of applications:

1. Pump station control.

2. Water quality monitoring.

3. Dam gauging and gate control.

4. Leakage detection in water distribution networks.

5. Early flood-warning systems.

6. Valve and flow meter stations.

7. Rainfall and runoff monitoring.

8. Tank level monitoring.

9. Camera surveillance.

10. Irrigation monitoring and control.

4.5 Industrial automation

4.5.1 Factory automation

4.5.2 Process automation

Process automation is defined as an automation application for industrial automation processes. It is typically associated with continuous operation, with specific requirements for determinism, reliability, redundancy, cyber security, and functional safety. Process Automation is typically used for continuous production processes to produce or process large quantities or batches of a certain product (like fluids, chemical, or an “endless” product like e.g. wires, cables). Process applications also require deterministic behaviour and therefore require low latencies in the range between 100 ms and a few seconds. Process automation can cover relatively large areas and so wide wireless transmissions ranges are required. The end nodes (sensors) in process automation applications potentially have to have a battery life of several years.

On the sensor level you can find mesh networks for field instruments, based on different wireless mesh protocols. The mesh structure helps to achieve a large range coverage with standard low power levels and be robust. On higher levels of the automation hierarchy e.g. at the control or enterprise level, where the data volume rises, so throughput, security and availability becomes more important, but real–time communication requirements decrease.

Process automation covers, for example, the following industries: oil & gas, refining, chemical, pharmaceutical, mining, pulp & paper, water & wastewater and steel.

4.6 Remote control

Remote control [led robots] will have great potential in many fields and provide commercial and societal profits. Construction and maintenance in dangerous areas, repair work in damaged nuclear or chemical plants, off-shore construction tasks are examples of such areas where the use of robots is very relevant. A prerequisite for the use of robots is a remote-control with real-time capability, high reliability and availability.

Depending on the type of applications, response times of less than a [few/[range?] milliseconds might be needed (e.g. for visual-haptic feedback). Some typical mobile robot applications are remote measurement, remote surgery and remote control in underground mining. Examples of specific applications are described in the following subsections.

For remote operation solutions to function effectively, sensory information like sounds and images needs to be transferred to the tele-operator from the equipment being controlled and its surroundings. Ensuring that audio and visual feeds are sent with minimal distortion enables the tele-operator to gain a good understanding of the remote environment, which leads to improved productivity and safety.

Remote operations would become even more efficient and intuitive if sensory data additional to the basic audio and visual information were included in the solution. Just as manual operations rely heavily on the human ability to balance and touch things, remote operation applications – whether industrial, medical, or recreational – can benefit greatly from the incorporation of this type of sensory information.

The addition of touch and balance to the operator feed can be achieved by the use of haptic interaction and force feedback. The ability for the operator to actually feel the vibrations when an object like an excavator bucket hits the ground, or to sense when a robot arm touches its target is highly valuable in terms of productivity, cost, and safety.

Additional sensors and technologies, like gyros, accelerometers, radars, lasers, lidars (Light Detection and Ranging), and thermal and IR sensors can be used to gain more information from the remote site and provide enhanced control at the operator end.

The negative effects of bad media quality, or an imperfect representation of the remote equipment and its surrounding environment, can be alleviated to some degree through training. Before full productivity can be achieved, operators require training and experience of operating equipment remotely – even if they have previously operated the same or similar equipment on-site.

Remote operation isn’t a one-size-fits-all solution. Owing to the range of equipment and the many potential scenarios in which remote applications apply, the array of use cases that could benefit from remote operation is extensive. An extra level of variation arises from the need to weave environmental parameters – such as rain, snow, dust, dirt, vibrations, and visibility – into system design. For example, remotely operating a dumper that moves cargo loads in and out of a mine is fundamentally different from performing surgery using a remote-controlled precision robot.

But even less obviously contrasting examples, like operating a dumper in differing visibility conditions, can present significant challenges for the technical solution.

4.6.1 Communication requirements

Securing a high-quality communication link between the control station and the machines being operated is key to accurate and effective remote operation. Existing solutions tend to use cable or RLAN to implement the last hop of this link. Cable provides low latency and high reliability, but it is costly to install and modify – which is significant when machines are constantly being moved from one site to another, such as in the construction industry. RLAN is a low-cost alternative that provides a certain degree of mobility – within the coverage area of the RLAN network. Both solutions require dedicated on-site installation and a connection to the control centre over the public internet or through a leased fixed-line connection.

To provide remote operation solutions with connectivity, standardized cellular systems offer a number of benefits over wired connections or RLAN. First, using an operator-managed cellular network eliminates the need to install on-site infrastructure. Second, cellular networks can offer widespread coverage and mobility solutions that can provide connectivity to mobile machinery and devices. Furthermore, as they use licensed frequency bands, cellular links are highly reliable, and the required level of security can be guaranteed. However, the requirements set by some use cases, which are of interest to society and certain industries, cannot easily be met by existing communication technologies.

A simple, quick and flexible on-site installation process is a basic requirement for many remote operation applications. Machines might be portable or driverless and may be required at different locations during the same working day. Job sites can be temporary and may grow, and their communication needs may change over time – which tends to be the case in construction and mining. For such environments, wireless solutions are preferable as they offer the desired level of flexibility and ease of installation, they can support equipment that is on the move, and do not require any cables.

For the most part, industrial companies expect global communications to be delivered with end‑to‑end (e2e) Service Level Agreements (SLAS), which they can handle themselves to some degree. Providing e2e SLAS, however, presents a challenge given that the system may span multiple public operator networks and even infrastructure owned by the enterprise itself.

High-definition video is a fundamental element of remote operation solutions. To deliver heavy video streams requires connection links with high minimum bitrates, especially when applications require high-resolution images, fast frame rates, stereoscopic video, immersive video, or multiple viewpoints (several camera feeds). Low media quality severely degrades the user experience, which inevitably leads to a drop in productivity. The exact bandwidth requirements are, however, highly dependent on the use case. Like most real-time applications, remote operation requires connection links with low latency and low jitter characteristics. To operate equipment (like an excavator or a robot) efficiently on a remote basis, the time lapse between the instant an operator sends a control instruction to the moment the equipment’s reaction is sensed by the operator must be as short as possible.

The toughest latency requirements occur in applications that include haptic interaction. A typical haptic control loop in a remote operation application requires latency to be below 10 ms18, and in some cases, the round trip time should not exceed [a couple] of milliseconds. To put this figure into perspective, current IMT-Advanced networks have an average latency of 30 ms, which in some cases can rise to 100 ms or more if packets are delayed.

Some degree of toleration to packet loss in remote operation applications is expected. However, packet loss may result in lost or delayed control commands, which can cause machinery to stop, can be costly, and can cause damage to equipment or even injury to personnel. So, to guarantee the continuous and safe operation of machinery, the communication link and the entire solution need to be highly reliable.

System outages or hijacked equipment resulting from a cyber-attack or other security intrusion can have severe consequences. Personnel safety is jeopardized, business continuity can be affected, and expensive equipment may be damaged. So, security is a key consideration when designing any remote operation system.

Proper audio and video feed synchronization is critical to provide the operator with a clear understanding of what is happening at the remote location. The synchronization requirements for remote operation solutions that incorporate haptic interaction and force feedback are much stronger than for a videoconference, for example. Without proper synchronization, the operator might receive confusing and contradictory messages, which has negative impact on user experience.

Mechanisms need to be in place to ensure that equipment can be stopped automatically in abnormal situations – like a machine malfunction, a collision, or the presence of unauthorized personnel. Tele-operated equipment may require additional sensors and functionality to detect potential risks and enable safe remote fault handling and recovery.

The communication requirements for remote operation can be summarized as follows:

– ease of deployment;

– minimum bitrate;

– low latency;

– reliability;

– security;

– emergency handling and recovery.

[Editor’s note: Review Report ITU-R M.2320, section 5.2.2 which may provide some guidance on how to address some of the technology trends mentioned below.]

IMT-2020 innovations related to media delivery, and core, radio-access and transport networks19 are expected to provide the technology needed for remote operation and other industrial mission-critical cases. To deliver an acceptable level of service experience for industrial remote operation, a number of performance requirements need to be set: minimum bitrate, maximum latency, and a permitted level of packet loss. By deploying service specific optimizations relating to scheduling, the requirements of several remote use cases may be met by modern IMT-Advanced based cellular systems. As IMT-Advanced continues to be enhanced with improvements such as latency reductions, it is expected to become ever more applicable for industrial applications.

However, some demanding use cases – such as the operation of fast-moving machine parts or scenarios that require accurate real-time control – place such stringent requirements on connectivity that they cannot be met by existing cellular solutions. But some technologies are being developed with these requirements in mind in order to provide the performance capabilities necessary for demanding industrial use cases.

Some of the main innovation areas for the IMT-Advanced evolution include: latency reduction, [license-assisted access/ unlicensed spectrum], new use cases, massive machine-type communication (mMTC), and massive MIMO (known as full-dimension MIMO in 3GPP). [Editor’s note: Clarification needed on [license-assisted access/ unlicensed spectrum].]

To support the requirements of the whole coverage area for high-load situations, special design characteristics need to be taken into consideration. The challenge arises when connections are congested or suffer from low data rate, causing the transfer rate over the radio link to drop temporarily below the code rate of the video stream. When this occurs, queuing delays follow, which in turn degrade user experience.

Low latency and high reliability are two key design criteria for potential new-radio interfaces in IMT-2020. To attain the levels of performance required for latency and reliability, a number of air interface design characteristics, like short radio frames and new coding schemes, will come into play.

To achieve low latency in the system, the time it takes to transmit a control command over the radio interface needs to be minimized. In IMT-2020, the time to transmit a single packet over the air – the Transmission Time Interval (TTI) – is expected to be a fraction of the TTI in IMT-Advanced. The TTI in IMT-Advanced is defined as 1 ms, whereas NR will be designed to deliver TTIs in the order of one or a few hundred microseconds20. Such low-order TTIs will enable short transmission times for short packages and facilitate retransmission without exceeding the latency bound.

The radio receiver needs to be able to decode received messages quickly. High-performance forward error correcting codes, such as turbo codes traditionally used for mobile broadband, are not optimal for transmission of short messages with high reliability requirements. Therefore, special forward error correcting codes such as convolutional codes are envisioned for latency-critical applications21.

A highly reliable radio link is needed to avoid transmission errors and time-consuming retransmissions. The level of reliability needed can be achieved with high diversity order of the communication through antenna or frequency diversity, which improves the probability of signal detection and correct reception of the transmitted radio signals.

Messages need to be transmitted over the communication link without scheduling delays. To minimize delays, service-aware scheduling algorithms can be applied to prioritize critical remote applications over other less critical communication.

Examples of remote operation and control applications exist everywhere, but the benefits that can be gained in mining and construction are easier to realize than in some other industries. Increased productivity, access to specialized expertise, improved safety and wellbeing, and reduced exposure to hazardous chemicals are just some of the gains that remote operation can bring. If configured appropriately, today’s IMT networks can support some industry applications, but the needs of other, more demanding, use cases can only partly be met by existing communication solutions. Future IMT-2020 systems are, however, being developed to meet challenging requirements like low latency, high reliability, global coverage, and a high degree of deployment flexibility – the key drivers supporting innovative business models.

4.6.2 Mining

The modern mine is crowded with vehicles and machines performing a variety of tasks, both on the surface and underground: trucks, drills, trains, wheel loaders, and robots designed for specific tasks are all typical examples. Mines are high-risk environments, and the ability to move people and equipment from one place to another is key, given that certain areas can take a considerable amount of time to reach22.

The ability to move driverless equipment into place quickly, say following a blast, is a potential time-saver when people are not permitted into the area until fumes have cleared. Benefits like this, combined with the fact that mines are typically found in remote locations, have led the mining industry to become an early adopter and developer of remote machine operation.

4.6.3 Construction sites

The incentives for the construction industry to implement remote operations are similar to those that apply in mining. In both industries, heavy machinery is required, such as excavators, wheel loaders, compactors, and haulers – all of which can be worked remotely to advantage. Unlike mining, machinery used in the construction industry moves from one site to the next, which requires a more flexible operating solution that can function without the need for fixed on-site infrastructure.

Research addressing remote operations for the construction application was demonstrated at MWC in 201523. The trials leading up to the demo aimed to determine the network requirements like latency and throughput, as well as the performance needs for the audio and video equipment – with a view to ensuring that IMT-2020 will meet the specifications.

4.6.4 Harbours

Large cargo ships can carry over 16,000 containers. Loading and unloading is a time-consuming process often requiring a number of cranes working simultaneously for many hours at a time. Traditionally, each operator sits on-site in the control cabin of the crane, high above ground. Cranes need to be operated with speed, precision, and consistency. With smart cranes and remote operation, safety and productivity levels can be increased, while operator stress levels can be reduced. The comfort of the control room offers many benefits in terms of wellbeing, as it:

– saves the time spent accessing a crane’s control cabin

– provides a favorable job environment with improved ergonomics

– reduces exposure to adverse weather conditions

– improves the security and safety of personnel.

Solutions to remotely operate cranes from a control room in the harbor, where the operator’s work is facilitated by a video feed from the crane24. Centralization is the natural next step in the development of this solution, enabling multiple cranes situated at different sites to be operated from the same station.

4.6.5 Surveying and inspection

Drones, robots, and vehicles that are remotely operated are suitable for applications like land and sea inspection, where the safety issues arising from the distances covered, adverse weather conditions, and hazardous terrain can be costly to address. Remote operations work well for these types of monitoring applications, and are ideal for observing industrial and construction sites in out-of-the way places, or large indoor venues and warehouse environments.

Video streams and other sensor data are fed back to the operator, enabling appropriate action to be taken. By combining remote inspection with remote manipulation, the level of automation can be raised. For example, a remotely operated robot in a data center can rapidly swap out a malfunctioning server, or respond to other types of hardware failures25.

4.6.6 Oil and gas

The oil and gas industry operates in environments that are harsh – both for people and equipment. Inspection, servicing, and operation of equipment as well as monitoring of leaks are just some of the routine applications. Remote operation is highly applicable to this industry, but to fully reap the potential benefits, equipment must remain functional without the need for regular on-site maintenance. One of the main benefits of remote operation is a reduction in the need for people to work in hostile environments, and frequent maintenance visits would negate this benefit26.

[Note: Section 4.6.7 moved below to section 4.7 to incorporate as a subsection on healthcare.]

4.6.7 Remote surgery

The use of teleoperation technology is emerging in the field of medicine. It enables surgeons to perform critical specialized medical procedures remotely – allowing their vital expertise to be applied globally. While this application area is still in its infancy, it is likely to become more widespread as the technology becomes more advanced (see also the section on healthcare below).

4.7 Healthcare

[Editor’s note: Example use cases include connected care, precision medicine, imaging and diagnostics, genomics/big data, and remote surgery.]

Healthcare is a rapidly expanding field that is using wireless networks. IMT 2020 technology has great potential to improve the quality of healthcare. Presently, there are simple applications such as reminding patients to take their medications. With the advent of smartphones there are now more sophisticated health applications. The medical device industry is now integrating wireless into their products. For example, blood pressure and heart rate can now be transmitted to a remote medical practitioner.

Looking forward, IMT 2020 advances in ultra-reliable, low latency (URLLC), massive machine type communications (mMTC) and enhanced mobile broadband (eMBB), have potential to impact health care service delivery across multiple applications. While mission-critical medical functions, such as remote surgery, require high reliability and availability with latency intervals that are down to a few milliseconds; monitoring devices and wearable medical equipment will require long battery life comparatively low data rate transmission. Enhanced mobile broadband applications, such as high resolution imaging and video conferencing have potential to be used for diagnostic purposes. IMT 2020 may enable these requirements and bring consistent, reliable user experiences to improve medical care.27

Health applications have a variety of not only throughput requirements, but also latency and reliability considerations

The lower the latency requirements of a specific health application, the larger the bandwidth needed to send a given amount of data. This becomes an important consideration for applications such as remote surgery.

Health applications often need ultra-reliable connections, which can include a combination of ultra-robust connections (heavy coding and retransmissions) with high throughput/low latency requirements. This also will require large bandwidths. A given application’s range and coverage requirements should be considered as well as bandwidth needs of the specific application:

Range and coverage requirements also depend on deployment scenarios – e.g. monitoring healthcare in rural clinics could require long range communications (i.e. low frequencies) to enable e-health services for vulnerable communities

Remote Surgery

The use of teleoperation technology is emerging in the field of medicine. It enables surgeons to perform critical specialized medical procedures remotely – allowing their vital expertise to be applied globally. While this application area is still in its infancy, it is likely to become more widespread as the technology becomes more advanced.

Clinical Wearables

Clinical wearables and remote sensors as well as many other devices that monitor and electronically transmit medical data such as vital signs, physical activity, personal safety, and medication adherence. As an example, the Michael J. Fox Foundation has pioneered work on devices that track the tremors associated with Parkinson’s disease.28 Rather than relying on patients’ self-reporting of the number and duration of tremors and how they have varied over time, doctors are deploying wearable motion sensors that provide reliable data in real time for many different aspects of the disease. This level of data is unprecedented and the ability to analyze it and identify patterns will help in determining things like whether symptoms are deteriorating and the possible causes of deterioration. Information regarding whether a particular kind of medication is helping patients or not and how that medication is being affected by the data points the devices are monitoring such as food intake, exercise, and the like, will also allow for novel applications.29

4.7.1 Mobile Health Applications

There are already thousands of medical apps available for smartphones, in what has been referred to as AppPharmacy. The trend is growing rapidly and existing apps can be used, for example, for the viewing, registration, fusion, and/or display for diagnosis of medical images. Other applications include use of the phone’s camera to analyze the absorption of red and infrared light by blood in the fingertip giving continuous access to heart rate and blood oxygen saturation level; immunization schedules; screening tools for jaundice by combining a smartphone app with a colour calibration card and cloud-powered analytics. Medicine is now going beyond the smartphone into smart consumer products. The Internet of Things (IoT) is driving a new world of connected healthcare. The availability of this continuous digital data is transformative, not just for the single consumer, but for humanity30.

In one particular study by Stanford University scientists it was found that smartwatches can detect the earliest symptoms of a cold, Lyme disease or diabetes, hinting at the potential of the technology for improving people’s health and well-being.

4.7.2 Sustainability/Environmental

[Editor’s note: Example use cases include adaptive air sensors, water management systems, and energy.]

4.8 Education

[Editor’s note: Example use cases include wireless real-time interactions, and virtual and augmented reality interactions without visual delay.]

4.9 Smart city

[Editor’s note: Example use cases include remote monitoring of roads and city infrastructure, and smart meters/parking, smart lighting, and logistics.]

Cities are growing at a rapid rate and smart infrastructure investments will prepare urban communities for the challenges ahead. To accelerate the planning and adoption of innovative urban infrastructure, many governments have launched Smart Cities Challenges to develop Smart Cities Plans together with local government, citizens, businesses and civil society (cf. ITU-T, Smart Sustainable Cities34). A number of Smart Sustainable City Cases have been reported. These initiatives will improve the quality of life for urban residents, through better city planning and implementation of clean, digitally connected technology including greener buildings, smart roads and energy systems, and advanced digital connectivity for homes and businesses.

4.10 Wearables

[Editor’s note: Example use cases include fully connected devices (no need for a smartphone tether), and tagged devices to assist with inventory management.]

4.11 Smart homes

[Editor’s note: Example use cases include remote security monitoring and controls (i.e. locks, high res camera surveillance, etc.) Applications for this section of the document are more on the consumer side.]

Smart Homes have been defined as the technological enrichment of the living environment in order to offer support to inhabitants and improve their quality of life36. Analysts predict that by 2020, the global market for smart home technology will reach USD 100 billion dollars with more than 50 connected devices in the average home.37 Advancements in IMT 2020 network connectivity and new radio solutions will allow interoperable smart home devices to connect rapidly and securely to content and services stored at the edge of the cloud, delivering home security, automation and high-quality video and entertainment services. The advancements around massive machine type communications is rapidly enabling the proliferation of connected devices, appliances, and things. This proliferation, augmented by technologies such as virtual and augmented reality, audio and video analytics, voice recognition and artificial intelligence, can enable a number of applications in the smart home.38

General Smart Home requirements, may include:

Throughput and latency to support both mMTC applications (i.e. connected appliances) as well as applications requiring enhanced mobile broadband (i.e. high definition video streaming for entertainment/gaming). Smart homes should also have the ability to communicate via IP.

Context awareness – Smart homes should be able to not only react to changes in the environment, but also perform AI-based reasoning and data analytics to take into account the preferences of the user inhabiting the smart home.

Physical device and network security in the home, including hardware, software, communications, data handling and user experiences – essentially end-to-end data and device protection.40

Other requirements may include: Sensory and movement recognition, device data collection and management, natural language, speech, and computer vision.

Smart Home Application Examples:

Vacation Mode – Smart home automation can manage different modes of use. The simple vacation mode voice command could automatically set the thermostat, lock doors, and windows activate the security system, close the blinds and adjust lights.

Cognitive Assistance: Smart home keeps track of important items and can confirm that family documents, prescription medicines, and mobile devices are safely packed for the family and ready to go for an upcoming trip.

Dashboard – dashboard view on mobile devices allows family to check on home at any time and view detailed data at a glance.

Anomaly Detection – while family is away, sensors detect a leak from the water heater. They are able to immediately schedule a plumber through a trusted app and confirm the repair.

Physical Access – the security system recognizes the neighbor who has come to water the plants and automatically lets her in. It can also verify the arrival of the plumber, grant him access and monitor his location and activities while he’s in the house.

Dynamic Reminders and contextual response – from a central family calendar, the home can adjust assistance to match changes. For example, a delayed flight can be tracked, enabling the home to automatically compensate with changes such as rescheduling airport pickup.

Voice controlled lighting, speakers, and security. Voice can also be used for complex scene creation programming. For example, a user stating: “Let’s watch a movie’ triggers TV to turn on, the lights to dim and the shades to close.

4.12 Agriculture

[Editor’s note: Example use cases include sensors with wireless connectivity for crop fields can help optimize growing and minimize use of water and fertilizers through more targeted application.]

Agriculture is rapidly adopting technology as it evolves from an industry entrenched in tradition to one that is fast embracing change. New technology is automating laborious tasks and providing farmers and growers with greater knowledge and insight into their crops. As technology evolves, so do the needs of the farmers.

Farmers, with the aid of smartphones, are adopting IoT technology to get accurate information about the weather and growing conditions, soil quality and moisture and other information that previously was unavailable or difficult to attain in real time. These advances are giving rise to precision farming systems (PFS), which use sensor data to measure crop yields, moisture levels, and terrain topography to enable the targeted application of fertilizer, which increases yields while reducing costs, and is more sustainable. Other PFSs can steer tractors using GPS data to cover a field more precisely and efficiently than a human driver could.41

Agriculture equipment manufacturers have also created connected platforms and vehicles along with a suite of start-ups intent on modernizing farming through increased technological insight. These platforms include an acoustic rain gauge that measures more than 40 observation streams including rain, hail, canopy leaf area, crop water demand, environmental stresses, microclimate,

and even air pollution. It is always on and always connected (built-in Bluetooth, Wi-Fi, and cellular).

These applications have built in security, flexibility (an API to plug the data into existing platforms), and control (farmers can choose how/when/what data to share); and with these applications, farmers are able to manage the response of crops to the weather and processors can predict future yield so they can make marketing decisions. 42 Applications leveraging big data analytics are also helping to transform the agricultural sector; with the advances from IMT-2020,

it is expected that this transformation could greatly enhance food production.

IMT-2020 based applications for plant farming include the following: sensor-based crop and soil monitoring, fertilizer/water management, environmental management (to control leaching of pesticides into surrounding soils/water bodies/drinking supplies), drone-based monitoring/imagery and precision viticulture (optimizing vineyard yield/performance). Examples of livestock farming applications include: electronic identification, automated livestock administration applications, reproduction optimization applications, feed formulation applications, and quality management applications.

General requirements43 for monitoring of farm conditions such as soil, water level, livestock and actuation of machinery (e.g. sprinklers, feeding) may include:

• Latency on the order of seconds to minutes.

• Non-critical reliability.

• Device density of approximately 104 / km2.

• Agricultural deployments including sensors to monitor crops, livestock, soil conditions, etc. that measure multiple variables may require requisite capacity to support massive agricultural deployments.

• Multiyear battery life for wireless sensors.

• Systems may support mobility from stationary to pedestrian speeds.

• Interworking and roaming may not be necessary for fixed sensors.

• Promote interoperability of sensor and transmission technologies by harmonizing communication protocols.44

4.13 Enhanced multi-media

4.13.1 Augmented reality

Augmented reality is a type of mixed reality where graphical elements are integrated into the real world in order to enhance user experience and enrich information (Ref. Rec. ITU-T J.301 (2014)).

IMT-2020 will support these and other advanced new and emerging audio-visual systems

(Ref. Report ITU-R M.2373). To develop these opportunities a number of initiatives have been created, such as the Virtual Reality Industry Forum (VRIF) and the World Virtual Reality Forum (WVRF).

4.13.2 Gaming

4.13.3 Media and entertainment

SK Telecom Rolls Out “4.5G” Service in South Korea-Plans 1G b/sec in 2018; Negative Outlook from Analysts

Executive Summary:

SK Telecom, the largest wireless telco in South Korea and first global wireless network provider to deploy LTE Advanced (aka LTE-A), has now launched a higher speed “4.5G” [Note 1.] network service in 53 cities across South Korea. The “4.5G” service delivers a speed of 700M b/sec to users that have a compatible handset (for now it’s only the Samsung Galaxy S8). The 4.5G wireless network uses 4 X 4 multiple-input and output (MIMO), which enables downloading a 2G byte movie within just 23 seconds. By using four- or five-channel carrier aggregation in conjunction with 4 x 4 MIMO, as well as other technologies that form part of the LTE-Advanced Pro standard, SK Telecom expects to be able to introduce gigabit-speed connections on its “4.5G” network in the first half of 2018.

The carrier’s “4.5G” network is expecting to reach 50 percent of its population by the end of 2017. In a statement, Choi Seung-won, SVP and head of infrastructure strategy at SK Telecom said it plan to launch 1Gb/s LTE-A pro service in the first half of 2018. See quotes from Mr Choi below.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

NOTE [1]: There really is no standardized “4.5G” service from ITU-R. SK Telecom is simply exploiting features in LTE-A that enable higher speeds. ITU-R originally referred to LTE as a 3G+ technology within IMT 2000. Up till 2012, “4G” was associated with IMT Advanced criteria being met. LTE-A met all the criteria of IMT Advanced.

However, wireless carrier marketeers jumped the gun when LTE was first deployed. LTE (part of ITU-R IMT 2000) was called a “4G” service by many carriers. ITU-R didn’t want to fight the marketing hype and issued this statement: “ITU does not have a definition for 4G and ITU cannot hold a position on whether or not a given technology is labelled with that term for marketing purposes.”

Thereby, faster LTE-A is now called “4.5G”by many wireless carriers to distinguish it from lower speed LTE (or LTE-A). Does that make any sense?

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Key points:

- SK Telecom currently owns 10 MHz in the 800 MHz band, 20 MHz in 1800 MHz, 10 MHz in 2.1 GHz and a total of 30 MHz in the 2.6 GHz range.

- Carrier aggregation, which combines two or more spectrum channels (sometimes from different frequency bands), is used to boost bandwidth to up to 700 Mb/sec.

- The 900 Mbit/s service is based on a mixture of carrier aggregation — with SK Telecom combining either three or four channels — as well as 4×4 MIMO. By using four- or five-channel carrier aggregation in conjunction with 4×4 MIMO, as well as other technologies that form part of the LTE-Advanced Pro standard, SK Telecom expects to be able to introduce gigabit-speed connections on its 4G network in the first half of 2018.

- The higher-speed services will be available only to customers with a Samsung Galaxy S8, which will be able to support the LTE-A Pro technologies following an over-the-air firmware upgrade. However, SK Telecom insists that forthcoming handsets will also be able to handle LTE-A.

……………………………………………………………………………………………………………………………………………………………………………………

Whither 5G?

Some analysts are asking if 5G is really needed once SK Telecom and other carriers roll out 4.5G with speeds up to 1 Gb/sec. There is intense rivalry in South Korea’s mobile Internet market as operators attempt to outperform one another on connection speeds.

Many proponents of 5G have responded to such criticism by drawing attention to the technology’s other attractions, including much lower latency, or network delay, than is found in a 4G system.

With 5G techniques such as network slicing, operators will also be able to provide many different types of network service over the same 5G infrastructure.

SK Telecom is keen to present its latest “4.5G” moves as a kind of stepping stone to the 5G standard, which it has talked about introducing in trial form in time for next year’s Winter Olympics in PyeonChang. (See SKT Airs 28GHz Concerns, Eyes Mid-Band 5G.)

“SK Telecom’s LTE-A Pro services represent an early application of 5G technologies that support Gbit/s-level data speeds and massive network capacity,” said Choi Seung-won, a senior vice president at SK Telecom and head of its infrastructure strategy office, in a company statement. “4.5G can be considered as the very last stage of LTE and will facilitate the spread of immersive multimedia services, including virtual reality, augmented reality and 3D hologram content.” The SK Telecom executive also said he expected the investments in LTE-A Pro to give SK Telecom a “valuable edge in the 5G era.”

http://www.lightreading.com/mobile/lte-a-pro/sk-telecom-moves-closer-to-1gbit-s-4g/d/d-id/733419

……………………………………………………………………………………………………………………………………………………………………………………………

Wireless Network Analyst Opinions:

- According to Bengt Nordström, CEO of consultancy Northstream, telcos are not innovating and the wireless network business will contract over the next few years:

“The trend which we are likely to see over the next couple of years is the deterioration of revenues, because what telcos are bringing to the market is fairly commoditized and very similar to competitors. But there is an upside, the cost structures are too high.

“They can do what they do today and even better, by trimming the organization such as replacing legacy equipment and processes or hiring and retraining new people. They can still maintain margins even though top-line revenues are shrinking.”