Verizon Merger Talk- Anything Goes….or Maybe NOT?

Merger and acquisition speculation has been rampant since the Federal Communications Commission (FCC) ended its quiet period following the completion of the incentive auction for wireless spectrum. Several telecom industry market analysts believe Verizon could end up buying Dish Network LLC to acquire new spectrum assets, but others believe the company may be in the hunt for a cable operator like Comcast Corp or Charter Communications Inc. to earn itself a last-mile network in several markets that could serve as backhaul for new 5G services.

On Tuesday, Verizon CEO Lowell McAdams told Bloomberg that his company would be open to merger talks with Comcast Corp., Walt Disney Co. or CBS Corp. Is that all?

As the company upgrades its infrastructure to provide fifth-generation, or “5G” wireless services, Comcast’s fiber assets in particular could be used for cellular backhaul, which will be necessary due the surge in bandwidth capacity demands.

Mr. McAdam would entertain deal talks with Comcast CEO Brian Roberts to achieve those goals, he said in an interview Tuesday at Bloomberg’s New York headquarters.

“If Brian came knocking on the door, I’d have a discussion with him about it,” McAdam said. “But I’d also tell you there isn’t much that I wouldn’t have a discussion around if somebody came and said ‘Here’s a compelling reason why we ought to put the businesses together.’”

Among cable giants, Comcast has the best fiber assets, in addition to a compelling media business with NBC Universal. McAdam said he would take that same call from Disney’s Bob Iger or CBS’s Les Moonves.

A combination between Verizon and any of the three companies would dramatically reshape the media and telecommunications industry, following AT&T Inc.’s $85.4 billion proposed acquisition of Time Warner Inc. — a deal that would make the telecom carrier one of the biggest producers of TV shows and movies in the world.

A major media deal would also be a departure for New York-based Verizon, whose acquisition strategy has so far contrasted with that of arch-nemesis AT&T. While the Dallas-based phone carrier snapped up satellite provider DirecTV and agreed to buy Time Warner in transactions valued in the tens of billions of dollars, Verizon has spurned old media and kept its purchases below $5 billion.

In the last two years, McAdam’s company has done deals for advertising technology and web traffic, acquiring AOL Inc. and the internet assets of Yahoo! Inc. Those are a far cry from McAdam’s most famous deal, the $130 billion acquisition of Vodafone Group Plc’s 45+% stake in Verizon Wireless in 2014.

Verizon’s most prominent entertainment investment so far has been go90, a YouTube-like video streaming service targeted at teens and preteens. The service hasn’t been a huge hit, so other media platforms that get more viewers could be attractive for Verizon.

“Randall buying into content has made people reevaluate their portfolio,” McAdam said of AT&T CEO Randall Stephenson. “We’re still very excited about Yahoo, bringing them into the fold with AOL. We’re building a lot of millennial-focused content. There are a lot of options out there.”

Verizon has looked to these smaller digital acquisitions to remake itself as the wireless price wars rage on. The carrier, which counts on the mobile-phone business for 75 percent of its sales, has struggled to find a balance between preserving profits and wooing subscribers with promos, freebies and price-cuts. In February, the company started offering unlimited data services for the first time, in part a capitulation to rivals who have stolen away their customers with similar offerings.

Shares of Verizon have fallen 4.9 percent in the past year through Tuesday, while CBS has surged 26 percent, Comcast 20 percent and Disney 13 percent.

Despite more favorable regulatory conditions, there’s no certainty a megadeal will get done. Cable, phone and media companies operate differently, with different management styles, and often have incompatible assets.

“Given what I know about architecture, financial requirement, cultural fit, there’s never a dream deal,” McAdam said.

For now, Verizon is focused on building a fiber-rich 5G network and developing a business that will place the company in direct competition with ad giants Google and Facebook.

“You can always have a wish list, but the practicalities of it limit your wish list,” McAdam said of deals. “My wish list right now? If I can find a company that had the fiber built for this architecture I’d scoop them up in a minute, but they don’t exist.”

…………………………………………………………………………………………

That doesn’t mean Verizon is going to announce a huge merger any time soon. In another interview on CNBC yesterday, McAdam said that Verizon hasn’t found the right fit for a merger from a network architecture standpoint. McAdam said Verizon is installing a lot of fiber to support its wireless network and that no company is matching what Verizon is doing.

McAdam reportedly said in December that a merger with Charter would make “industrial sense.” CNBC’s David Faber asked McAdam about that comment yesterday, and the CEO answered. “As we’ve looked at companies around the US, there is nobody building to the architecture that we’re talking about.”

McAdam then described Verizon’s plans to increase the density of fiber in cities such as Boston, saying, “A cable company would have customers, obviously, would have infrastructure, conduits, pole attachments. But it doesn’t have that kind of fiber.”

McAdam’s various comments about mergers aren’t contradictory. To summarize, he’s open to mergers with just about any company that can pitch a deal that makes sense, whether it’s another network operator or a programmer. But so far, McAdam is not convinced that other big network operators have the architecture to help Verizon’s fiber rollout.

Comcast says it has 145,000 miles of fiber installed across its 39-state territory, in addition to its extensive coaxial cable deployments. Verizon yesterday announced a deal with Corning to purchase up to 37.2 million miles of optical fiber and related hardware over the next three years.

“I think our shareholders expect us to look at every option, but I would tell you right now we haven’t seen the architectural fit, and we haven’t seen a willing seller and a willing buyer to have a meeting of the minds,” McAdam also said in the CNBC interview. “From a fiber perspective, nobody, whether you’re a fiber company or you’re a cable company, you don’t have the architecture that we’re talking about today.” For now, Verizon is building that architecture itself, he said.

Verizon now seems to be more interested in mobile Internet service (via the nation’s largest wireless network) than wireline home Internet (via FiOS) and has concentrated its landline network in the Northeast US after selling off networks in other states. Even where it still operates wired home Internet service, Verizon has clashed with city officials who say the company has failed to complete fiber-to-the-home rollouts. New York City filed a lawsuit against Verizon last month, seeking a court order to force Verizon to finish installing fiber throughout the city.

But buying a cable network might still be attractive to Verizon because cable dominates the high-speed broadband market, while much of Verizon’s wireline network is stuck on outdated DSL technology. While Verizon has the most mobile subscribers in the country, Comcast is the nation’s largest cable company and home Internet service provider. A merged Verizon and Comcast would have nearly 32 million Internet subscribers (24.7 million from Comcast and 7 million from Verizon), about 9 million more than Charter, the second biggest home Internet provider.

Verizon and Comcast have overlapping territories, so many customers who have two Internet choices today would be left with just one if they merged.

There’s more to consider than home and mobile Internet service when it comes to a potential Verizon/Comcast merger. Both companies have expanded into providing video and online content over the networks that they operate. Comcast owns TV programmers such as NBCUniversal and various regional sports networks, while Verizon owns AOL and is buying Yahoo. Verizon wants a piece of the online video streaming market but has struggled with its Go90 offering.

Comcast has reportedly acquired programming rights to offer TV channels nationwide, paving the way for a potential video service that would extend beyond Comcast’s cable territory.

References:

https://arstechnica.com/information-technology/2017/04/verizon-ceo-wed-consider-merger-with-almost-anyone-including-comcast/

ETSI ENI Group elects officers; AI to improve telecom network deployment & operations

Verizon-UK, China Telecom, Huawei and others are taking part in a new “Experiential Networked Intelligence” (ENI) industry specifications group (ISG) at ETSI, or the European Telecommunications Standards Institute, looking at how artificial intelligence (AI) could be used to improve the deployment and operation of telecom networks. The new AI group will cooperate with other industry organizations in advancing this topic area.

Last week, ETSI announced the elections of a chair and vice-chair for this new ENI Industry Specification Group.

“The purpose of the group is to define a Context Aware System using Artificial Intelligence (AI) based on the ‘observe-orient-decide-act’ control model,” ETSI said on its website. “This enables the system to adjust offered services based on changes in user needs, environmental conditions and business goals.”

The group will “improve operators’ experience regarding network deployment and operation, by using AI techniques,” Huawei’s Raymond Forbes said on ETSI’s website. Mr. Forbes is the chairman of the new group. “By introducing technologies such as SDN, NFV or network slicing, the network becomes more flexible and powerful,” added China Telecom’s Haining Wang, the group’s vice-chair. “Nevertheless, the complexity of the future network is not reduced, but transferred from hardware to software, from the network itself to management and operation, from equipment to people. Experiential Networked Intelligence is expected to help operators to solve these problems.”

Here’s the complete list of ISG ENI Members:

- China Academy of Telecommunications Research of MIIT

- China Telecommunications Corporation

- Huawei Technologies Co., Ltd.-China

- Huawei Technologies Co., Ltd. – UK

- Huawei Technologies Sweden

- Interdisciplinary Centre for Security, Reliability and Trust/University of Luxembourg

- PT Portugal SGPS SA

- Samsung R&D Institute – UK

- Verizon UK Ltd. – UK

- WINGS ICT Solutions – GR

- Xilinx Ireland

ETSI (European Telecommunications Standards Institute) creates a variety of standards for fixed, mobile and internet communications. They generally pass their specifications to ITU-T for further work leading to ITU recommendations. In the case of NFV (Network Function Virtualization), the ETSI work was input to OPNFV open source group within the Linux Foundation. The new ETSI ENI group said it would work on the topic with other standards organizations including IETF, MEF, 3GPP and others.

This isn’t the first time artificial intelligence has been discussed in the realm of telecommunications. For example, AT&T’s Brian Daly said last year the carrier is experimenting with AI to make its processes more efficient. And Verizon earlier this year said its “Exponent” initiative will include big data and AI to help carriers monetize troves of data through the application of advanced machine learning techniques and deep analytics.

SoftBank’s Masayoshi Son said earlier this year that the “singularity”—the idea that the invention of artificial superintelligence will trigger massive technological growth and cultural change—will happen in the next handful of years.

References:

IHS-Markit: China’s Mobile Infrastructure Mkt Declines Led by LTE CAPEX -16% Fall

By Stéphane Téral, senior research director and advisor, mobile infrastructure and carrier economics, IHS Markit

Highlights

- In China, the 2G, 3G and LTE (Long Term Evolution) mobile infrastructure market decreased 9 percent in 2016 from 2015, to US$12 billion

- A network sharing deal between China Unicom and China Telecom drove LTE capex down 16 percent year-over-year in 2016

- The Chinese mobile infrastructure macro hardware market is forecast to decline at a -34 percent CAGR (compound annual growth rate) from 2016 to 2021

Our Analysis

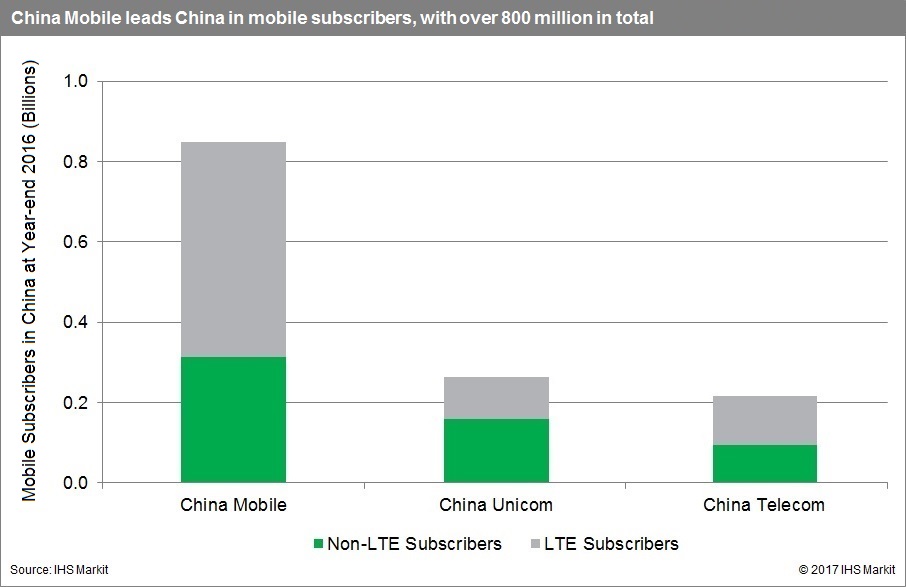

China, the world’s largest mobile subscriber base, had a total of 1.3 billion subscribers in 2016, 64 percent of them on China Mobile’s GSM/TD-SCDMA/LTE network. Fifty-eight percent of China’s mobile subscribers are now on LTE, up from 32 percent in 2015.

In 2016, a network sharing deal between China Unicom and China Telecom drove LTE capex down 16 percent year-over-year. However, the combination of both companies’ addition of FD-LTE (frequency division LTE) eNodeBs and China Mobile’s moderate TD-LTE (time division LTE) rollouts led to a combined total of 1,020,000 eNodeBs deployed—the same number as in 2015.

The overall 2G/3G/LTE mobile infrastructure market came to US$12 billion in 2016, falling 9 percent year-over-year at a time when China Unicom and China Telecom were building their nationwide FD-LTE rollout.

LTE revenue declined to about US$10 billion (-4 percent year-over-year) in 2016, sustained by flat eNodeB rollouts, and leaving combined 2G and 3G revenue at less than US$2 billion.

IHS expects the mobile infrastructure macro hardware market in China to continue to go south, with a double-digit decline anticipated in 2017 due to the end of massive LTE rollouts. In the long run, we forecast the Chinese RAN and packet core infrastructure market to slow down further to US$2 billion in 2021, a -34 percent 2016–2021 CAGR.

Chinese Mobile Report Synopsis

Based on the IHS Markit worldwide Mobile Infrastructure Quarterly Market Tracker, the country-specific Mobile Infrastructure: China Annual Market Tracker focuses on 2G GSM, 3G CDMA2000 (TD-SCDMA, W-CDMA) and 4G LTE (E-UTRAN, EPC) mobile network equipment and subscribers in China. It provides market size, vendor market share, forecasts through 2021, analysis and trends.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

T-Mobile & Dish Networks Dominate $19.8B FCC Auction

T-Mobile US Inc bid $8 billion while Dish Network Corp bid $6.2 billion to win the bulk of broadcast airwaves spectrum for sale in a government auction, the U.S. Federal Communications Commission said on Thursday.

The two carriers accounted for most of the $19.8 billion in winning bids, the FCC said. Comcast Corp agreed to acquire $1.7 billion in spectrum, AT&T Inc. bid $910 million and investment firm Columbia Capital offered $1 billion. It wasn’t immediately clear what Comcast and Dish plan to do with the airwaves. Comcast said earlier this month it would start selling cellphone service to its home internet customers, and the service runs off the back of Verizon’s network. Dish has been amassing a trove of wireless airwaves for years that it has yet to put to use.

The complex FCC reverse auction invited television broadcasters to sell their airwaves with opening prices provided by the government. Those bids fell until the agency got the licenses it needed at the lowest possible price. Then, the FCC sold those airwaves to companies that wanted them for cellular service. The FCC said that 175 broadcast TV stations were selling airwaves (spectrum) to 50 wireless and other telecommunications companies. Companies plan to use the spectrum to build new wireless networks or improve existing coverage.

The spectrum auction’s end is widely expected to kick off a wave of deal-making in the telecom industry. Until now, companies participating in the auction have been restrained by a quiet period, but that will end after April 27, when down payments are due from auction winners.

T-Mobile said its $8 billion winning bid would enable it “to compete in every single corner of he country.” The company, controlled by Deutsche Telekom AG , said the investment will quadruple its low-band holdings.

Verizon Communications Inc. and AT&T Inc., the nation’s largest wireless carriers by subscribers, largely sat out this FCC auction, which began last year. AT&T offered $910 million for the licenses, while Verizon declined to bid.

The FCC sale included one tier that could be bought by anyone and a “reserve” tier of low-band airwaves was set aside for companies that didn’t already own a significant amount of them.

The rule largely prevented AT&T and Verizon from bidding on the reserve tier and also restricts most sales by the winning bidders to AT&T or Verizon. Even though Verizon didn’t buy any spectrum at this FCC reverse auction, the company said it was confident in its network position.

The airwaves are particularly important for T-Mobile, which until recently held almost no low-band frequencies. As a result, its network has suffered in buildings and rural areas.

AT&T and Verizon have more recently spent billions of dollars securing rights to higher-frequency spectrum that they hope will be useful in ultra-fast networks still being developed.

…………………………………………………………………………………

The FCC noted the 600 MHz incentive auction generated nearly $7 billion for the U.S. Treasury for deficit reduction; more than $10 billion of the proceeds will go to broadcasters that chose to relinquish spectrum usage rights; and up to $1.75 billion for other broadcasters that incur costs in changing channels.

Television broadcasters that gave up their spectrum holdings as part of the auction’s reverse bidding process are now on the clock to give up those licenses over the next 39 months. That timing would put full spectrum availability into early 2020, or about the time most expect commercial “5G” services to be coming on air.

Initial 5G deployments are expected to focus on higher band spectrum licenses in the 3.5 GHz band as well as millimeter wave bands higher than the 15 GHz band. These bands are set to include broad swaths of spectrum support in order to meet the expected capacity needs of 5G services.

However, broader coverage will require lower spectrum bands. Many see 5G deployments relying heavily on current LTE deployments using low-band spectrum in order to meet coverage demands, with the 600 MHz spectrum able to bolster the supply.

FCC Chairman Ajit Pai applauded the proceedings, which began under his predecessor Tom Wheeler, but noted hard work remained.

“Today marks a major accomplishment for the commission: the ‘auction’ portion of the world’s first incentive auction is officially over,” Pai said in a statement. “The reverse and forward auctions have concluded and the results have been announced. But this process is far from over. Now, we begin the post-auction transition period. This day has been a long time coming. We congratulate all bidders who were successful in the incentive auction, and we applaud all of those past and present commission staffers who worked so diligently on every aspect of this complex undertaking. We have only reached this point because of their tremendous skill and dedication to this groundbreaking endeavor. Again: While we celebrate reaching the official close of the auction, there is still much work ahead of us. It’s now imperative that we move forward with equal zeal to ensure a successful post-auction transition, including a smooth and efficient repacking process.”

References:

http://ca.reuters.com/article/businessNews/idCAKBN17F2CJ-OCABS

https://www.wsj.com/articles/fccs-tv-airwaves-auction-drew-19-8-billion-led-by-t-mobile-1492110623

Verizon Tests Drones for Disaster Service using Flying LTE Cell Site

Verizon Communications flew drones earlier this month to test their ability to support a “flying cell site” for LTE service over various distances. The company said the test sought to simulate an environment like those that occur when disasters knock out communications services.

Verizon said the test, conducted on April 5 at Woodbine Municipal Airport in Woodbine, N.J. and spotted by DSL Reports, was also designed to “simulate an environment in which commercial power is knocked out indefinitely after a severe weather event or other disaster that interrupts traditional communications services.”

The carrier said the test was done under a Certificate of Waiver or Authorization (COA) issued by the FAA to Cape May County in preparation for a major emergency preparedness exercise in May involving county, state and federal emergency responders.

“This new test builds upon our leadership in conducting the first successful demonstration in the U.S. for providing aerial coverage from a long-endurance medium altitude aircraft with AATI in Cape May last October,” Verizon’s Christopher Desmond said in a statement.

References:

http://www.dslreports.com/shownews/Verizon-Tests-LTE-Wireless-Delivery-Via-Drone-139332

http://www.multichannel.com/news/policy/verizon-trials-lte-drone/412098

Verizon buys Skyward, a drone operations company

AT&T Buys Straight Path Communications in $1.6 Billion Deal

AT&T will purchase embattled spectrum-license holder Straight Path Communications for $1.25 billion in stock plus liabilities to gain access to the millimeter-wave spectrum holder’s cache of 28 GHz and 39 GHz frequencies. The deal objective is to enhance AT&T’s 5G capabilities via Straight Path’s holding of 28 gigahertz and 39 GHz millimeter-wave spectrum — frequencies the U.S. Federal Communications Commission has already approved to power fifth-generation (“5G”) wireless services.

Author’s Note:

The ITU-R WP 5D which has responsibility for standardizing “5G” as IMT2020, has agreed that “terrestrial IMT-2020 systems will incorporate the use of new technologies that benefit from the physical characteristics of the frequencies in the frequency range from 24.25 to 86 GHz and the large bandwidths potentially available which will provide higher data rates and lower latencies.”

………………………………………………………………………………………

The deal marks the second acquisition of high-frequency airwaves by AT&T this year. In January, the Dallas-based telecom behemoth purchased FiberTower Corp., which holds licenses for 24 GHz and 39 GHz bands of airwaves.

The deal comes after the U.S. government sanctioned Straight Path in and ordered it to sell its spectrum holdings or face an $85 million fine as part of a settlement related to fraud allegations brought against the company.

Straight Path’s spectrum licenses will allow AT&T to better compete with Verizon Communications Inc. and T-Mobile US Inc. as 5G networks roll out over the next several years.

Straight Path Communications has billed itself as a leader in providing high-frequency airwaves for carrying traffic that will grow as “5G” and the Internet of Things gain market traction. The company is the third-largest owner of spectrum licenses for airwaves that have been approved by the FCC for flexible use with an eye toward 5G.

Verizon still has a wide lead against rivals in coverage with 28 GHz spectrum. Wireless carriers use a measurement called megahertz-POP — the amount of bandwidth multiplied by the potential number of people covered by the airwaves. Verizon owns almost 200 billion Mhz-POP of 28 GHz spectrum, more than 600 MHz on average nationally. T-Mobile controls 97.4 billion and Straight Path has 39.7 billion, according to a Bloomberg Intelligence analysis.

……………………………………………………………………………………………..

“The merger of AT&T and Straight Path Communications marks a vital point for us,” Straight Path CEO Davidi Jonas commented. “Importantly, this merger provides Straight Path shareholders with a compelling return since Straight Path’s spin-off to become an independent public company in 2013, with an initial price per share of $6.40 on July 31, 2013.”

The companies indicated the merger is expected to close within 12 months, subject to FCC review.

………………………………………………………..

Wells Fargo Senior Analyst Jennifer Fritzsche in an April 10, 2017 note to clients opined that:

“This ultra-high band spectrum has fairly limited propagation characteristics, which likely means the spectrum needs to be within several hundred feet of a fiber-fed base station. We have long thought AT&T was in the early innings of its fiber deployment, and this announcement gives us more conviction in this view. It is worth noting this fiber build or leasing could even occur outside of its incumbent footprint to realize the full benefits of this spectrum.”

Wireless Week noted that “AT&T also seems to be moving down a fixed wireless path as part of its 5G roadmap.”

In a successful trial with Nokia earlier this year, DirecTV Now (Internet TV) content was streamed via a fixed wireless 5G connection in the 39 GHz band.

AT&T will be conducting a 5G video trial in Austin in the first half of this year that lets customers stream DirecTV Now over a fixed wireless 5G connection and also announced plans to conduct additional fixed and mobile 5G trials in the second half of 2017 in the 28 GHz and 39 GHz bands.

………………………………………………………………………………………

References:

https://www.wirelessweek.com/news/2017/04/t-scoops-straight-path-16b

FCC Chair Pai Plans for Rollback of Open Internet Rules

Federal Communications Commission (FCC) Chairman Ajit Pai met with with trade groups this week to outline plans for rolling back open internet rules, according to informed sources.

Mr. Pai has reportedly requested that Internet Service Provider’s (ISP’s) voluntarily commit in writing to not impeding consumer access to the Internet as part of their terms of service. It is unclear if regulators could legally compel internet providers to adopt open internet principles without existing net neutrality rules. As part of that move, the Federal Trade Commission (FTC) would assume oversight of ensuring compliance.

Three sources said Pai plans to unveil his proposal to overturn the rules as early as late April and it could face an initial vote in May or June of this year.

………………………………………………………………………………………………….

FCC Chairman Ajit Pai, shown above on March 8, 2017 aims to preserve the basic principles of net neutrality but shift enforcement to the Federal Trade Commission.

PHOTO: ANDREW HARRER of BLOOMBERG NEWS

………………………………………………………………………………………………….

The FCC declined to comment, but Pai previously said he is committed to ensuring an open internet but feels net neutrality was a mistake. In December 2016, he predicted that net neutrality’s days were numbered. The new FCC Commissioner told Reuters this February he believes “in a free and open Internet and the only question is what regulatory framework best secures that.”

Pai and congressional Republicans have moved quickly to dismantle Obama-era telecommunications rules.

Trump on Monday signed a repeal of Obama-era broadband privacy rules a victory for internet service providers (ISPs) and a blow to privacy advocates.

Until recently, the Federal Trade Commission was the government agency responsible for policing internet service providers. But last year a federal court ruled that the FTC had no jurisdiction over telecommunications providers since they were considered common carriers — a tag placed on industries that allows them to be regulated like a public utility.

When the bill to repeal the privacy rules was signed on Monday, Pai said that he would work to put the FTC back in charge of internet service providers, something that would require at least a partial repeal of the net neutrality rules.

……………………………………………………………………………………………….

It remains unclear when the FCC could move forward with the planned rollback, which is sure to spark an outcry from consumer groups and some congressional Democrats. They—along with some internet firms—view strong net neutrality rules as crucial to maintaining competition on the internet. They are skeptical of any effort to roll back the rules.

Mr. Pai’s plans could begin to be adopted as soon as the FCC’s monthly meeting in May, although the June meeting remains possibility, according to one person familiar with the matter. The FCC currently comprises Mr. Pai, Republican Michael O’Rielly and Democrat Mignon Clyburn. Two seats on the five-person panel are vacant, waiting for President Donald Trump to nominate new commissioners.

The multi-step plan that is emerging appears aimed at eventually shifting oversight for net neutrality to the FTC, which has long overseen most internet-related business, according to people familiar with the discussions.

Under federal law, the FTC lost much of its oversight of broadband providers when the FCC adopted its net neutrality policy, because the FCC rules reclassified broadband providers as common carriers subject to the agency’s oversight.

Mr. Pai’s plans likely would reverse that reclassification eventually, so the FTC again would have jurisdiction over the telecommunications carriers. To preserve the basic tenets of net neutrality, the plans would require broadband providers to pledge to abide by net neutrality principles such as no blocking or paid prioritization of internet traffic. That would allow the FTC to go after violators for deceptive or unfair trade practices.

Some details of the meeting were first reported by Politico Pro.

Mr. Pai also is believed to be considering provisions to restore FTC oversight of broadband providers’ consumer privacy protections. GOP lawmakers, with the backing of Mr. Pai, recently passed a measure repealing an Obama-era FCC privacy rule that broadband providers criticized as unfairly restrictive.

……………………………………………………………………………………

ISP’s like AT&T Inc, Verizon Communications Inc and Comcast Corp have argued net neutrality rules would make it harder to manage internet traffic and investment in additional capacity less likely. Websites worry that without the rules they might lose access to customers.

AT&T and major trade groups sued the FCC in 2015 over the net neutrality rules.

Democrats and privacy advocates say net neutrality is crucial to keeping the internet open. This author*strongly agrees!

References:

http://www.reuters.com/article/us-usa-internet-idUSKBN1790AP

http://thehill.com/policy/technology/327771-fcc-chair-outlines-plan-to-undo-net-neutrality-reports

* End NOTE:

Author finds there is NO REGULATION of Internet Service in CA or anywhere in the U.S.!

In 2015, this author had several complaints about his “broadband” Internet service and ISP (AT&T municipal contacts for CA and NV) which was submitted to one regulatory agency after another, including the FCC, FTC, California Public Utilities Commission, City of Santa Clara Telecom Policy Coordinator, CA Dept of Consumer Affairs, CA Dept of Justice, etc. These regulatory agencies either said they have no jurisdiction over Internet service or (in the case of the FCC and City of Santa Clara) they passed on the complaint to AT&T without taking any action or enforcement.

The FCC complaints website says: “We encourage you to contact your provider to resolve your issue prior to filing a complaint…..By filing a consumer complaint and telling your story, you contribute to federal enforcement and consumer protection efforts on a national scale and help us identify trends and track the issues that matter most.”

It turns out there is NO U.S. AGENCY THAT REGULATES OR ENFORCES INTERNET SERVICE OR PRACTICES. I was told that ONLY VoIP is regulated- not Internet data services.

https://consumercomplaints.fcc.gov/hc/en-us

Open Network Summit: ONAP Steals the Show with Broad Support

During a Tuesday morning “disruptive collaboration” keynote at the Open Network Summit (ONS), John Donovan, Chief Strategy Officer at AT&T, revealed that the company had “software defined” 34% of its network by the end of 2016, which exceeded its goal of 30%. This year’s goal of 55% network virtualization (via an overlay network*) will be a major milestone.

“When you get to 55% there’s no turning back,” said Donovan. “You’re more software-defined than you are not software-defined. When you hit that tipping point you start to say, OK, now what? Now what do we do when we have a software-defined network and how do we capitalize on it?”

* Note: Network virtualization via an overlay network is to be contrasted with pure SDN which requires an entire new network infrastructure consisting of a centralized SDN controller for path computations and L3 packet/L2 frame forwarding engines.

The next step for AT&T is “Network 3.0 Indigo” which makes heavy use of ECOMP [1] – the orchestration platform AT&T created to power their version of software-defined network. [See Andre Fuetsch’s comments below on current uses for ECOMP].

Donovan reminded the audience that in February 2017, AT&T announced it was moving its ECOMP platform code to the Linux Foundation where it was then merged with the Open Orchestrator (ON-O) initiative [one of two major Linux Foundation open source MANO (management and organization) projects] and is now called Open Network Automation Platform (ONAP) [2].

Andre Fuetsch, president of AT&T Labs and CTO, said during this same keynote, “We have over seven global operators representing nearly two billion mobile subscribers participating in the ONAP project.” Fuetsch also said there were significantly more operators planning to join the ONAP initiative in coming months, representing another one-third of global operators.

“ONAP is about many things, but what is most important is about working together as a common aligned community to innovate and deploy faster,” Andre said. “It’s about working together to build new things and not the same things twice,” he added.

Fuetch also said that, “ECOMP is a model driven operating system for SDN automation. It’s been in production for 2 1/2 years and supports over 100 different Virtual Network Functions (VNFs).” He added that VoLTE calls were partly handled by ECOMP which also supports AT&T’s Mobile Packet Core (MPC) and manages wavelengths on the telco’s optical transport network.

………………………………………………………………………………………………….

Note 1. ECOMP = Enhanced Control, Orchestration, Management and Policy. It provides the necessary software automation platform that enabled AT&T to achieve aggressive network virtualization goals across enterprise, infrastructure, mobility and consumer use cases.

Note 2. The Open Network Automation Platform (ONAP) Project brings together top global carriers and vendors with the goal of allowing end users to automate, design, orchestrate and manage services and virtual functions. ONAP unites two major open networking and orchestration projects, open source ECOMP and the Open Orchestrator Project (OPEN-O), with the mission of creating a unified architecture and implementation and supporting collaboration across the open source community. The ONAP Project is a Linux Foundation project. For more information on ONAP, please visit https://www.onap.org.

…………………………………………………………………………………………..

This new ONAP project seems to be led by AT&T and China Mobile, but has gotten huge support from other telco’s and network equipment vendors. At ONS this week, it was announced that group’s 27 members now include about 33% of global network operators, which deliver wireless services to 38% of the world’s mobile subscribers. China Mobile is the world’s largest mobile operator with 800 million subscribers. New ONAP member (see below for complete list of new members) Reliance Jio claims to be the largest 4G network operator in India with 100 million total subscribers.

Six new members announced at ONS are: platinum member Reliance Jio; silver members Ciena, Microsoft, H3C Technologies, and Wind River; and associate member Open Networking Foundation.

“We’re excited to see how developers and others in the industry contribute to the ONAP code,” said Chris Rice, ONAP Chair and Senior Vice President, AT&T Labs. “Today is an important day for ONAP and open networking. Collaboration is key in open source projects and we’re looking forward to the community’s efforts to harden the production-ready code.”

The ONAP code base was said to be production-ready and in use. Open source software developers are invited to access it at https://git.onap.org/.

……………………………………………………………………………………..

Harmonization of Open Source Projects:

ONAP represents a significant example of what the Linux Foundation calls “harmonization” – the coordinated collaboration and sometimes combination of what has become a plethora of open source networking groups, often with competing or overlapping objectives and functionality. Therefore, it will be important to observe if the combination of the two approaches to network orchestration actually produces something stronger than the individual efforts, without losing momentum in the process.

Mazin Gilbert, VP of advanced technologies and architecture at AT&T, will head the ONAP Technical Steering Committee. He said that ONAP will issue its first software release in the fourth quarter of 2017. Gilbert noted the modular approach each project has taken will make it easier to merge them.

“You have to realize with ECOMP you have about 8.5 million lines of code,” said Gilbert. “Open-O is the same caliber. By definition, it’s complicated. We have spent a lot of time working with the Linux Foundation. We agree on the principles. Now we go into the details. As a community we, by the last quarter of this year, will make a release, and it will be a joint release.”

Yachen Wang, deputy director of network technology at China Mobile Research Institute said, “On behalf of ONAP members, I would like to welcome the new members to the team. We anticipate close collaboration that will further the automation of SDN and NFV networks, and will enable all the community to take advantage of the best architectural components and implementation from ONAP.” Yang also said that developing a target architecture that considers OSSs as well as NFV/SDN and service delivery is another major issue.

Margaret Chiosi (x-AT&T lifer, NFV pioneer and now with Huawei) said during her Wednesday morning keynote:

“You have all these open source pieces — they are great initial pieces, but you can’t just clean it up and run it, because it’s not complete,” Chiosi said, in an interview following her keynote presentation here. “The challenge for the industry is how do we get from here to production — there are a lot of gaps.”

There are two open source projects devoted to SDN controllers — OpenDaylight and ONOS — and Huawei participates in both, but has created its own controller, taking what it sees as the best of breed from both projects.

During a Thursday morning ONS panel session on Harmonizing Open Source Networking, Linux Foundation Networking General Manager (long time friend of IEEE and this author) Arpit Joshipura noted that AT&Ts ECOMP framework consisted of eight modules, while the work done by Open-O resulted in code that’s been consolidated into three additional modules. Both ECOMP and Open-O had orchestrators – ECOMP had a master service orchestrator while Open-O had a global service orchestrator. The way to blend them is to combine all the orchestration ECOMP provides with Yang models and all orchestration from Open-O with its Tosca data model. Arpit believes these two orchestration methods are complementary.

Moving forward, in terms of who wins when there are disputes about code, Joshipura said, “Linux has set governance. It’s always meritocracy. The right answer wins.” We couldn’t agree more!

……………………………………………………………………………………..

Finally, the ONAP Governing Board members this week elected the following individuals to serve as officers:

- Chair: Chris Rice, SVPYachen Wang of AT&T Labs

- President: Yachen Wang, deputy director of the Network Technology Department at China Mobile Research Institute

- Treasurer: Vincent Danno, director of Wireline Standards of the Innovation Technical & Marketing at Orange

In closing, Arpit said: “We congratulate the Governing Board officers on their election to serve. They will be responsible for working with other members to support the ecosystem growing around the project, while technical governance remains separate in the hands of the developer community.”

References:

http://about.att.com/innovationblog/onap

http://about.att.com/story/indigo_redefining_connectivity.html

Comcast to Offer Xfinity Mobile Service using Verizon network

Comcast has outlined details for the Xfinity Mobile cellular service it plans to introduce for current subscribers, with unlimited data plans ranging from $45 to $65 per month. As the new Xfinity Mobile service will use Verizon’s cellular network, Comcast will become a MVNO. Comcast will sell handsets made by Apple, Samsung and LG.

Many subscribers will save money, especially if they don’t use a lot of data. The catch: Only Comcast cable Internet customers can sign up for the Xfinity Mobile service.

Comcast, which has nearly 25 million high-speed internet customers, said its wireless service is aimed at holding onto its customers. Comcast’s key competitors — AT&T’s DirecTV and Verizon’s FiOS — are part of companies with wireless offerings.

“We’re not getting into the mobile business to be the number one carrier,” said Sam Schwartz, chief business development officer with Comcast Cable. “It’s to benefit our existing core business. We’re not going to make billions of dollars in profit.”

The service Comcast is selling will be essentially the same as a Verizon plan, though Comcast will reduce speeds on unlimited plans after 20 gigabytes. Verizon’s threshold is higher, at 22 gigabytes, and reduced speeds apply only when there is network congestion.

Comcast will initially require customers to buy phones through the company. It’s offering iPhones, Samsung Galaxy phones and one budget model from LG. Customers can pay in full up front or in monthly installments, just as they would through a traditional carrier.

Comcast’s pay-per-gigabyte approach is similar to what Google is doing with its wireless service, Google Fi. Customers don’t need to guess ahead of time how much data they plan to use; both plans charge them only for what they use. With traditional carriers, unused data might get carried over to the following month; even if not, the customer still pays for the unused amount.

But Google Fi hasn’t caught on, in part because it works with only a few Google-branded phones and uses networks from T-Mobile, Sprint and U.S. Cellular, which aren’t as robust as Verizon’s. Comcast says it can also take advantage of vast array of marketing channels for internet and voice services.

Read entire AP story here.

AT&T Building Nationwide Broadband Cellular Network for 1st Responders

AT&T has been selected by the U.S. Commerce Dept. to build the first nationwide wireless broadband network dedicated to America’s first responders. This record-breaking public-private partnership is a significant investment in the communications infrastructure that public safety desperately needs for day-to-day operations, disaster response and recovery, and securing of large events. It will also make 20 MHz of prime broadband spectrum available for private-sector development.

“Today is a landmark day for public safety across the Nation and shows the incredible progress we can make through public-private partnerships,” said U.S. Department of Commerce Secretary Wilbur Ross. “FirstNet is a critical infrastructure project that will give our first responders the communications tools they need to keep America safe and secure. This public-private partnership will also spur innovation and create over ten thousand new jobs in this cutting-edge sector.”

The broad terms of this 25-year agreement between FirstNet and AT&T are:

- FirstNet will provide 20 MHz of high-value, telecommunications spectrum and success-based payments of $6.5 billion over the next five years to support the Network buildout – FirstNet’s funding was raised from previous FCC spectrum auctions;

- AT&T will spend about $40 billion over the life of the contract to build, deploy, operate and maintain the network, with a focus on ensuring robust coverage for public safety;

- Additionally, AT&T will connect FirstNet users to the company’s telecommunications network assets, valued at more than $180 billion.

The FirstNet network will be designed to give priority to first responders, said FirstNet President T.J. Kennedy. Through special SIM cards inserted in their phones, police, fire and medical officers will be better able to communicate with one another. Much like current technology, the new network will allow them to send and receive video, data and voice calls before they reach a crisis area. But that information will arrive uninterrupted and in real time.

“They will always be prioritized. They’re always at the front of the line,” Kennedy said. “This happens inside the network at the millisecond level.”

FirstNet is administered by the U.S. Commerce Department and was proposed in the years after Sept. 11, 2001, when emergency workers responding to the day’s terrorist attacks struggled to communicate across clogged channels and incompatible technologies.

Under the contract, AT&T will spend $40 billion of its own money deploying FirstNet. It will also receive $6.5 billion from the federal government at the end of five years if it successfully meets a number of milestones designed to fast-track the project. The government is awarding the company with as much as 20 megahertz of new wireless airwaves that AT&T intends to integrate into the service. That “spectrum,” will expand the network’s capacity and help ensure that communications do not fail.

The ability to communicate seamlessly across jurisdictions is critical for law enforcement, fire, and emergency medical services (EMS) when securing large events or responding to emergencies and disasters. In those instances, networks can become overloaded and inaccessible, limiting responders’ use of vital communication technologies, such as smartphones and applications dedicated to public safety services.

That will change with a high-speed network built specifically for the millions of public safety users in all 50 states, 5 U.S. territories and the District of Columbia, including those serving rural communities and tribal lands. The Network will modernize first responders’ communications and deliver specialized features that are not available to them on wireless networks today.

“This public-private partnership is a major step forward for the public safety community as we begin building the broadband network they fought for and deserve,” said FirstNet Chair Sue Swenson. “FirstNet and AT&T will deliver high-speed connectivity to help millions of first responders operate faster, safer, and more effectively when lives are on the line.”

“It’s not going to be a build-from-scratch type of thing,” said FirstNet chief executive Mike Poth. “So it’s a win for us and public safety because it’s going to accelerate the time to market.”

To take advantage of the network’s capabilities, public safety departments will need to buy a subscription to FirstNet. Automatically included is the preemption feature, which is among the most-requested by first responders, said Chris Sambar, AT&T’s senior vice president for FirstNet. Mr. Sambar declined to say how expensive the rate plans will be but said that they would be priced “below market [rates].”

Designing a system such as FirstNet has taken years because of the sheer number of public safety departments in the United States who expect to use the network, according to an industry official who spoke on the condition of anonymity because details of the project remain private.

“It’s been a long hard slog, because it’s complicated technically to think about building a network like this,” the official said. “We’ll see how it goes, but obviously AT&T’s serious about it and it has the potential to be a big win for public safety.”

References: