What’s the real status of Internet access in Cuba?

by Matteo Ceurvels of eMarketer (edited with Notes by Alan J Weissberger)

Few people in Cuba have regular access to the Internet, and those who do encounter slow download speeds, according to an eMarketer study. Although Cuba’s state-run service provider (see details below) has built WiFi hotspots throughout the country, the relatively high rate of $1.50 an hour is too much for most Cubans to pay. [Please see references below for additional information on the WiFi hotspots in Cuba- mostly in Havana]

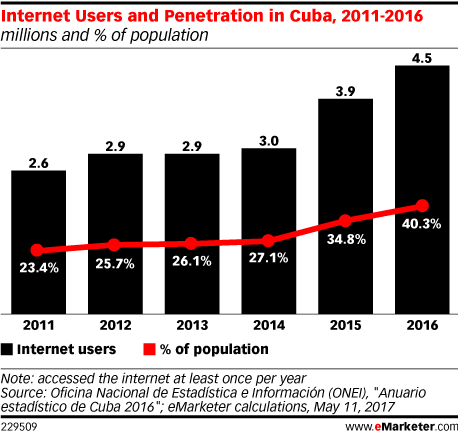

eMarketer estimates that there will be 360.4 million internet users in Latin America in 2017. While the market research firm does not break out specific metrics for Cuba, the latest figures from the government’s National Office of Statistics and Information (ONEI) show that over 4.5 million people, or roughly 40.3% of the total population, accessed the Internet at least once during 2016.

…………………………………………………………………………………………………………..

Editor’s Note: The actual ONEI ICT report (via Google Translate) states that for 2016 there were 403 people that accessed the Internet out of every 1,000 people living on the island. That compares with 348, 271, 261, 257 and 232 people for the years 2015, 2014, 2013, 2012, 2011, respectively.

The same report (which I don’t trust) says the mobile population coverage (not usage) has been 85.3% of the population from 2012-2016, up from 83.7% in 2011.

…………………………………………………………………………………………………..

The number of people with internet access in their homes was significantly lower: The BBC reported in March of last year that the at-home internet penetration rate was roughly 5%.

Web access in the country remains relegated to a few options. State-run telecom Empresa de Telecomunicaciones de Cuba S.A. (ETECSA), which first began offering public Wi-Fi spots in 2015, claims to provide 391 such spots across the country. But at a cost of about $1.50 per hour, access remains too expensive for most Cubans, and internet speeds are reportedly excruciatingly slow.

ETECSA also began a pilot program in December of last year to provide some 2,000 users in Havana, Cuba’s capital, with fixed broadband internet access for a free two-month trial period. In March, ETECSA said 358 participants in the program signed up to pay for the service, which offered data speeds of between 128 kilobits per second (Kbps) and 2 megabits per second (Mbps).

And when residents of the country do manage to get online, they are subject to strict internet censorship overseen by the government. Some websites and services are blocked, and communications can easily be monitored by government figures.

During parliamentary sessions held in July, Vice President Miguel Díaz-Canel acknowledged that Cuba has one of the lowest internet access rates, but rejected the notion that its society was “fully disconnected.”

He added that tech companies that had entered into agreements with the country’s government to provide them with the infrastructure necessary to expand internet access had been met with “fierce financial prosecution.”

Despite these claims, the government has sought out partnerships with some of the world’s leading tech companies. In April, Google brought servers in the country online for the first time, making it the first foreign tech firm to host its own content in Cuba.

At the parliamentary sessions, Díaz-Canel also claimed that the penetration of social media platforms had grown by 346% in 2016. (The government did not respond to eMarketer’s request to verify this figure.)

However, Martín Utreras, vice president of forecasting at eMarketer, noted that the majority of social media users in the country were most likely foreign tourists looking to stay connected while on vacation.

According to data from StatCounter, there are signs that Facebook is a leading social media platform in the country. Facebook was responsible for 83.3% of page views resulting from social network referrals in Cuba in July, more than either Pinterest (8.4%) or Twitter (4.3%). (StatCounter’s figures take into consideration website referral traffic from both locals and visitors in Cuba.)

Despite signs that internet access is increasing in the country, Cuba still has a long way to go before getting online is something residents consider normal. In fact, many in the country rely on “el paquete semanal,” or the weekly package—a hard drive that is loaded with contraband content such as news, music, TV shows and other videos and passed from person to person.

“Cuba’s journey resembles that of similar trends we’ve seen in the case of China or Vietnam,” Utreras said. “Although Cuba is still many years behind in terms of private telecom investment, infrastructure development and overall internet adoption, by comparison, the immediate future will most likely be driven by government interests rather than the market itself.”

……………………………………………………………………………………………..

References:

https://www.emarketer.com/Article/Cuba-on-Slow-Crawl-Toward-Increased-Internet-Access/1016352

http://www.one.cu/aec2016/17%20Tecnologias%20de%20la%20Informacion.pdf

http://www.businessinsider.com/is-there-internet-in-cuba-2017-1

https://insightcuba.com/blog/2017/03/05/havanas-wifi-hotspots-and-getting-online-cuba

Cuba to expand Internet access and lower price of WiFi connections

Verizon passes on G.fast in favor of FTTP for MDUs

Verizon will forgo using copper-based G.fast (DSL) technology in favor of an all-out move to deploy fiber-to-the-premises (FTTP) to/from multiple-dwelling units (MDUs), according to Vincent O’Byrne, director of network planning for Verizon. Mr O’Byrne spoke August 15th at ADTRAN’s Broadband Solutions Summit in Huntsville, AL.

“Our strategy for G.Fast is not to deploy it,” O’Byrne said at the conference.

“The strategy we’re using today is fiber all the way to the living unit,” O’Byrne said. “There’s some small percentage that we use fiber to the building (FTTP) and then copper inside the building itself, but because we have two vendors on BPON and on GPON meant in those units we had 8 types of different MDU units.”

O’Byrne cited the sketchy nature of the copper network in some places and a history of VDSL2 inter-operability and speed related problems in MDUs.

“The MDU units started to go end of life and for VDSL2 there wasn’t any interoperability,” O’Byrne said. “Even though we worked on it for a year, it became nuisance so we stopped using those common ONTs and concentrated on getting fiber to the living unit.”

Speed is also an issue. “We ended up in a situation where the 13 units of VDSL2 were going end of life as well as lower speed down the surrounding Fios network, which could get up to 1 Gbps,” O’Byrne said. “With G.fast we see ourselves potentially being in the same situation five years from now where we would have to replace the same thing.”

O’Byrne said that bringing fiber directly to each premises is more of a future proof strategy. “It’s a bit more expensive to put the single family unit fiber connections out there, but we have the same kind of service as the rest of the network,” O’Byrne said. “We also found that the trouble report rate is less on the fiber all the way to the living unit.” That’s in sharp contrast to the hybrid fiber-copper technology used by AT&T in its U-Verse triple play bundle (which this author has had for almost 5 years).

Given the diversity and varying condition of copper plant in Verizon’s wider nationwide network, Verizon has applied its copper replacement strategy for the MDU markets.

In recent years, Verizon has been strategically replacing aging copper plant with fiber at its consumer and business locations. The service provider said that this method enables it to reduce costs by not having to perform multiple customer visits when problems arise.

Verizon has been replacing aging copper plant with fiber at its consumer and business locations. Fios to residential triple play customers was the first step, with fiber to commercial buildings and MDUs now well underway.

“At Verizon we were finding the trouble reports on the copper were two to three times more than when we had fiber to the living unit,” O’Byrne said. “For a long time, the copper plant in the Verizon network was not as good as it was in some locations so if we went to G.fast it would be low volume and we would have the same issues five years down the road.”

“We’re skipping XGS-PON single wavelength,” said O’Byrne. “We’re going for a 10G tunable laser solution.”

O’Byrne said driving costs lower and providing a unified architecture that’s inter-operable across multiple equipment vendors are key goals for their strategy. He also mentioned solutions that can maximize use of Verizon’s extensive and somewhat disparate outside wiring plant environment.

References:

Altice-USA FTTH network to reach 1M homes by 2018

Altice USA (majority owned by Altice NV) is the successor of Cablevision Systems, headquartered in Bethpage, NY. It is one of the largest broadband communications and video service operators in the United States and the provider of Optimum and Suddenlink-branded internet, TV and phone services.

On August 14th, the company said in a press release that design and construction of its fiber to the home (FTTH) network will reach hundred thousand homes in parts of New York, New Jersey, and Connecticut. According to the company, its network is on track to reach one million homes in 2018.

Altice USA says it is the first U.S. cable provider to plan for a large-scale FTTH network deployment. According to the company, the FTTH network will enable a connected home, business, and community that provides an improved customer experience.

“We are incredibly pleased with the progress we are making on our fiber investment and look forward to lighting up this new, advanced network to enable innovative products and services to support our customers’ connectivity needs well into the future,” said Dexter Goei, Altice USA chairman and CEO.

In 2016, Altice revealed plans for its fiber-to-the home (FTTH) network rollout with the ability to deliver speeds of up to 10 Gbps, skipping the DOCSIS 3.1 upgrade protocol.

The company this week indicates it is continuing to deploy enhanced services to customers over its existing hybrid fiber-coaxial (HFC) network.

Altice recently launched gigabit service in seven cities across states including Missouri, Arkansas, and Oklahoma, bringing 1 Gbps broadband service to more than 60 percent of its Suddenlink footprint.

The company’s Optimum footprint now offers speeds of up to 400 Mbps for residential customers and 450 Mbps for business customers.

………………………………………………………………………………………………………………………….

In addition to its fiber investment, Altice USA combined its Lightpath, Optimum Business, and Suddenlink Business brands last month to form the Altice Business unit (see “Altice USA forms Altice Business unit“), becoming a provider of data, voice, video, and managed services for business customers.

Altice USA recently launched gigabit service in seven cities across Missouri, Arkansas, Oklahoma, and other states as part of its efforts to extend 1-Gbps broadband service to more than 60 percent of its Suddenlink footprint, says the company. Altice USA also provides broadband speeds of up to 450 Mbps for business customers and 400 Mbps for residential customers, which is more than triple its Optimum footprint internet speeds.

Altice-USA says it will continue rolling out enhanced services to customers via its existing HFC network, and plans to provide speeds that meet consumers’ future demands.

………………………………………………………………………………………………………….

Altice France and Altice Portugal have both also announced plans to bring fiber to all of their countries.

References:

http://www.alticeusa.com/sites/default/files/pdf/Altice-USA-FTTH-Network-On-Track-to-Reach-1M-Homes-Constructed-2018.pdf

https://www.cedmagazine.com/news/2017/08/altices-ftth-build-out-reach-1m-new-homes-end-2018

KT opens 100,000 free Wi-Fi Access Points in South Korea; WiBro & LTE

KT, the second largest telco in South Korea, has opened up 100,000 Wi-Fi access points (APs) as part of its participation in a government-led program which will improve the public’s access to free Wi-Fi-based connectivity. According to the Korea Times the operator has also pledged to enhance Wi-Fi network equipment in subway trains across the country.

“Aiming at reducing people’s telecom (i.e. broadband Internet access) expenses, we have worked on opening 100,000 Wi-Fi APs and improving the quality of Wi-Fi networks inside subway trains,” said Park Hyun-jin, vice president of KT Mobile’s business department. “We will come up with more measures to further cut household telecom expenses and expand benefits for our subscribers.”

With the government’s ‘Public Wi-Fi 2.0’ policy seeking to improve Wi-Fi APs nationwide, KT has said that the bulk of its newly opened hotspots are at busy locations, such as shopping malls, bus stations, subway stations and tourist sites. The hotspots can be accessed by both KT mobile subscribers and those that are not signed up to the cellco’s services, though the latter users are required to provide personal information (such as an email address, phone number, gender and age) in order to take advantage of free Wi-Fi for one hour.

Alongside its expansion of free Wi-Fi APs, KT has begun work on improving network equipment to provide faster and more stable wireless broadband connectivity. To that end, it is reportedly replacing old Wi-Fi network devices, which are based only on WiBro technology (the Korean variant of WiMAX), on subway trains with new hybrid devices that support both WiBro and LTE technologies. KT has said it expects to first complete the replacement for subway trains on lines 1 to 8 in Seoul, before expanding upgrade works nationwide by the end of this month.

KT models show promotion materials for the Giga-WiFi and LTE networks ………………………………………………………………………………………………..

Over one year ago, KT introduced its GiGA WiFi 2.0 that will provide network speeds twice as fast as the previous version. With the world’s first Wi-Fi 2.0 technology, the nation’s second-largest telecom company said it will soon be able to upgrade maximum Wi-Fi speed to 3.4 gigabits per second (Gbps).

The Wi-Fi 2.0 network adopted “multi-user, multiple input and multiple output” technology to provide faster speeds to all users simultaneously connected to a network, KT said. It has also applied the “wireless intrusion prevention system” to block unauthorized access points and devices.

KT also said it has provided more than 200,000 public Wi-Fi access points nationwide of which 100,000 were announced this past Friday.

References:

http://www.koreatimes.co.kr/www/common/vpage-pt.asp?categorycode=133&newsidx=234602

http://www.koreatimes.co.kr/www/tech/2017/07/693_210108.html

KT opens 100,000 free Wi-Fi Access Points in South Korea; WiBro & LTE

KT, the second largest telco in South Korea, has opened up 100,000 Wi-Fi access points (APs) as part of its participation in a government-led program which will improve the public’s access to free Wi-Fi-based connectivity. According to the Korea Times the operator has also pledged to enhance Wi-Fi network equipment in subway trains across the country.

“Aiming at reducing people’s telecom (i.e. broadband Internet access) expenses, we have worked on opening 100,000 Wi-Fi APs and improving the quality of Wi-Fi networks inside subway trains,” said Park Hyun-jin, vice president of KT Mobile’s business department. “We will come up with more measures to further cut household telecom expenses and expand benefits for our subscribers.”

With the government’s ‘Public Wi-Fi 2.0’ policy seeking to improve Wi-Fi APs nationwide, KT has said that the bulk of its newly opened hotspots are at busy locations, such as shopping malls, bus stations, subway stations and tourist sites. The hotspots can be accessed by both KT mobile subscribers and those that are not signed up to the cellco’s services, though the latter users are required to provide personal information (such as an email address, phone number, gender and age) in order to take advantage of free Wi-Fi for one hour.

Alongside its expansion of free Wi-Fi APs, KT has begun work on improving network equipment to provide faster and more stable wireless broadband connectivity. To that end, it is reportedly replacing old Wi-Fi network devices, which are based only on WiBro technology (the Korean variant of WiMAX), on subway trains with new hybrid devices that support both WiBro and LTE technologies. KT has said it expects to first complete the replacement for subway trains on lines 1 to 8 in Seoul, before expanding upgrade works nationwide by the end of this month.

KT models show promotion materials for the Giga-WiFi and LTE networks ………………………………………………………………………………………………..

Over one year ago, KT introduced its GiGA WiFi 2.0 that will provide network speeds twice as fast as the previous version. With the world’s first Wi-Fi 2.0 technology, the nation’s second-largest telecom company said it will soon be able to upgrade maximum Wi-Fi speed to 3.4 gigabits per second (Gbps).

The Wi-Fi 2.0 network adopted “multi-user, multiple input and multiple output” technology to provide faster speeds to all users simultaneously connected to a network, KT said. It has also applied the “wireless intrusion prevention system” to block unauthorized access points and devices.

KT also said it has provided more than 200,000 public Wi-Fi access points nationwide of which 100,000 were announced this past Friday.

References:

http://www.koreatimes.co.kr/www/common/vpage-pt.asp?categorycode=133&newsidx=234602

http://www.koreatimes.co.kr/www/tech/2017/07/693_210108.html

AT&T praises Intel’s role in network virtualization & 5G readiness

“Without some of those advantages [from the new Xeon Scalable processors] and capabilities that have been created in the software space, we wouldn’t be able to do it,” said AT&T’s Chris W. Rice, SVP of AT&T Labs and Domain 2.0 architecture. “It is a key underpinning in our SDN-network virtualization journey. Intel pushed the technology into the ecosystem, the capabilities and the chips, and then we can pull it through the ecosystem.” Rice added.

…………………………………………………………………………………………………………………

Author Notes:

1. AT&T buys Compute Servers which contain Intel Xeon processors:

It’s important to recognize that AT&T does NOT buy processor chips from Intel or any other semiconductor company. It buys compute servers which contain Intel Xeon processors. While the compute server vendor(s) have not been disclosed, it’s likely one or more Chinese or Taiwanese ODMs.

According to IDC, X86 machines dominated the compute server market in 2016. Servers using mostly Xeon processors accounted for $11.2 billion in sales, down 3.1 percent. Server machines using other processor architectures, including Itanium, Power, Sparc, ARM, and a smattering of others, drove $1.3 billion in revenues, but fell 30 percent year on year. Intel X86 compute hardware had a 99.2 percent shipment share and an 89.6 percent revenue share, said IDC in a research report.

An article summarizing IDC and Gartner Group reports on 1Q2017 compute server shipments is here. The rise of ODMs is described in this blog post.

In January 2016, AT&T joined the Open Compute Project which is specifying open source hardware (e.g. compute servers and Ethernet switches) for use in data centers. AT&T has repeatedly stated it wants to make its Central Offices look like cloud resident data centers.

2. AT&T’s Cloud & Virtualization Platforms:

The AT&T Integrated Cloud (AIC) is a data center design that includes top-of-rack switches, storage, servers, and software at the hypervisor. When complete, AIC will encompass more than 1,000 zones distributed around the globe. AIC is based on the open source OpenStack cloud management framework.

AT&T’s Universal CPE (uCPE) is the hardware foundation of its Network Functions on Demand service. It’s an AT&T-branded Intel x86 server (presumably made by a Chinese ODM) that sits at the enterprise premises and can mix and match software-based VNFs, depending on what functions are needed at each location. The uCPE was designed and manufactured to AT&T’s specifications to enable customers to run multiple VNFs on one device.

………………………………………………………………………………………………………………..

According to SDx Central, AT&T has deployed two workloads on Intel’s Xeon Scalable processors and says others are in the queue. The two workloads are AT&T’s virtual Content Distribution Network (vCDN) and its virtual VPN Internet Gateway (vVIG).

vVIG is a virtual machine that acts as an IPSec gateway between unsecure and secure networks, providing data security at the IP packet level. It uses Intel’s Data Plane Development Kit (DPDK) to speed up the cryptographic processing of IPSec data packets.

Using the new Intel processors allows the vVIG to support a larger data throughput for less cost and a smaller footprint. This includes up to 30 percent performance improvement in PPS handling compared to the earlier Intel processor.

AT&T’s vCDN (virtual Content Distribution Network) is a service that allows customers to manage and distribute video and multi-media web content across networks.

“We saw 25 to 30 percent performance improvements from moving it (vCDN) to Purley,” Rice said, referring to the Intel processors’ code-name. “It was a pretty seamless transition, moving it from the older Intel CPUs onto the new one. We are able to do more with fewer processors, and we’re able to get more capabilities out of our CDN and grow it horizontally as well.

“And all of the improvements, whether on the process side or the architecture side, they all have some networking improvement piece as well,” Rice added.

……………………………………………………………………………………………………………………..

Conclusions:

These performance improvements are helping AT&T move closer toward its goal of virtualizing 75 percent of its network by 2020. During its second-quarter earnings call last month, AT&T CFO John Stephens told investors that the company has virtualized more than 40 percent of its network functions. It’s making progress toward its network functions virtualization goal of 55 percent by year-end.

“We want to make sure the whole ecosystem moved with us toward network virtualization,” Rice said. “We didn’t want to have something special just for AT&T. We wanted it to be for the whole industry.”

Additionally, achieving network performance improvements requires automation, Rice said. “You’ll never get to those percentages without automation being a key part, he added.

In an earlier interview with UBB2020, Rice said:

“As we move down an automation path, as we move down a machine-learning path to drive more automation, [having open interfaces on network elements] is really a necessary first step — these open interfaces that cannot be skipped over or overlooked. I don’t know that people understand the significance of that.”

References:

http://www.about.att.com/innovationblog/7_1_milestone

http://about.att.com/innovationblog/author/chrisrice

AT&T praises Intel’s role in network virtualization & 5G readiness

“Without some of those advantages [from the new Xeon Scalable processors] and capabilities that have been created in the software space, we wouldn’t be able to do it,” said AT&T’s Chris W. Rice, SVP of AT&T Labs and Domain 2.0 architecture. “It is a key underpinning in our SDN-network virtualization journey. Intel pushed the technology into the ecosystem, the capabilities and the chips, and then we can pull it through the ecosystem.” Rice added.

…………………………………………………………………………………………………………………

Author Notes:

1. AT&T buys Compute Servers which contain Intel Xeon processors:

It’s important to recognize that AT&T does NOT buy processor chips from Intel or any other semiconductor company. It buys compute servers which contain Intel Xeon processors. While the compute server vendor(s) have not been disclosed, it’s likely one or more Chinese or Taiwanese ODMs.

According to IDC, X86 machines dominated the compute server market in 2016. Servers using mostly Xeon processors accounted for $11.2 billion in sales, down 3.1 percent. Server machines using other processor architectures, including Itanium, Power, Sparc, ARM, and a smattering of others, drove $1.3 billion in revenues, but fell 30 percent year on year. Intel X86 compute hardware had a 99.2 percent shipment share and an 89.6 percent revenue share, said IDC in a research report.

An article summarizing IDC and Gartner Group reports on 1Q2017 compute server shipments is here. The rise of ODMs is described in this blog post.

In January 2016, AT&T joined the Open Compute Project which is specifying open source hardware (e.g. compute servers and Ethernet switches) for use in data centers. AT&T has repeatedly stated it wants to make its Central Offices look like cloud resident data centers.

2. AT&T’s Cloud & Virtualization Platforms:

The AT&T Integrated Cloud (AIC) is a data center design that includes top-of-rack switches, storage, servers, and software at the hypervisor. When complete, AIC will encompass more than 1,000 zones distributed around the globe. AIC is based on the open source OpenStack cloud management framework.

AT&T’s Universal CPE (uCPE) is the hardware foundation of its Network Functions on Demand service. It’s an AT&T-branded Intel x86 server (presumably made by a Chinese ODM) that sits at the enterprise premises and can mix and match software-based VNFs, depending on what functions are needed at each location. The uCPE was designed and manufactured to AT&T’s specifications to enable customers to run multiple VNFs on one device.

………………………………………………………………………………………………………………..

According to SDx Central, AT&T has deployed two workloads on Intel’s Xeon Scalable processors and says others are in the queue. The two workloads are AT&T’s virtual Content Distribution Network (vCDN) and its virtual VPN Internet Gateway (vVIG).

vVIG is a virtual machine that acts as an IPSec gateway between unsecure and secure networks, providing data security at the IP packet level. It uses Intel’s Data Plane Development Kit (DPDK) to speed up the cryptographic processing of IPSec data packets.

Using the new Intel processors allows the vVIG to support a larger data throughput for less cost and a smaller footprint. This includes up to 30 percent performance improvement in PPS handling compared to the earlier Intel processor.

AT&T’s vCDN (virtual Content Distribution Network) is a service that allows customers to manage and distribute video and multi-media web content across networks.

“We saw 25 to 30 percent performance improvements from moving it (vCDN) to Purley,” Rice said, referring to the Intel processors’ code-name. “It was a pretty seamless transition, moving it from the older Intel CPUs onto the new one. We are able to do more with fewer processors, and we’re able to get more capabilities out of our CDN and grow it horizontally as well.

“And all of the improvements, whether on the process side or the architecture side, they all have some networking improvement piece as well,” Rice added.

……………………………………………………………………………………………………………………..

Conclusions:

These performance improvements are helping AT&T move closer toward its goal of virtualizing 75 percent of its network by 2020. During its second-quarter earnings call last month, AT&T CFO John Stephens told investors that the company has virtualized more than 40 percent of its network functions. It’s making progress toward its network functions virtualization goal of 55 percent by year-end.

“We want to make sure the whole ecosystem moved with us toward network virtualization,” Rice said. “We didn’t want to have something special just for AT&T. We wanted it to be for the whole industry.”

Additionally, achieving network performance improvements requires automation, Rice said. “You’ll never get to those percentages without automation being a key part, he added.

In an earlier interview with UBB2020, Rice said:

“As we move down an automation path, as we move down a machine-learning path to drive more automation, [having open interfaces on network elements] is really a necessary first step — these open interfaces that cannot be skipped over or overlooked. I don’t know that people understand the significance of that.”

References:

http://www.about.att.com/innovationblog/7_1_milestone

http://about.att.com/innovationblog/author/chrisrice

IEEE 802.11 considering LiFi as complement to WiFi

Executive Summary:

The Light Fidelity (LiFi) wireless protocol, which works from transmitters in light-emitting diode lamp bulbs, could function as a complement to Wi-Fi connectivity by offering faster internet access for mobile devices. The IEEE 802.11 standards committee is collecting industry feedback on a potential Li-Fi standard as noted in the section below.

Li Fi is an emerging wireless protocol that uses visible light spectrum to provide wireless networking access. A Li-Fi transmitter uses LED lights to modulate light intensity – mostly beyond what our eyes can perceive – and that is read as data by a photosensitive receiver. Because LEDs already use a chip to control their output they can modulate up to millions of times per second, theoretically allowing them to transmit data up to 100 times faster than Wi-Fi.

![fig(i)..Sending of data [2]](https://image.slidesharecdn.com/li-filatest-131027005455-phpapp02/95/li-fi-technology-6-638.jpg?cb=1382835371)

IEEE 802.11 Standards Status of LiFi:

IEEE 802.11 notes on the Topic Interest Group (TIG) page, “The introduction of light emitting diodes (LED) for general purpose lighting has created a growing interest in using the visible light spectrum for wireless communications……It is felt that the IEEE 802.11 is the best forum to drive forward the global standardization efforts for light communications with manufacturers, operators and end customers all present during the standardization process. If the TIG should progress to a Study Group and eventually into a Task Group, then this will not only help users within home, enterprise and industrial environments, but also assist manufacturers and operators to provide common components and services for IEEE 802.11 customers.”

At their July 2017 meeting, the IEEE 802.11 LC TIC unanimously recommended the continuation of the LiFi work via formation of a 802.11 LC Study Group. Hence, the 802.11 standards body is still seeking contributions before LiFi can become an official IEEE 802 standards project.

………………………………………………………………………………………………………..

Light Communications (LC) use cases:

-

Enterprise

-

Data access: where network connections are based on LC for daily work, conference streaming remote desktops along with potential video, etc. Enhanced data security can be achieved for organizations that require high level of confidentiality. The directionality of light propagation can effectively reduce interferences in heavily populated offices. Wireless off-loading to light releases spectrum for connecting other devices.

-

Use cases for RF sensitive facilities: for RF sensitive facilities such as hospital and mining, LC can provide safe data access where RF may not be allowed.

-

-

Home

-

Data access: where mobile devices use LC for high data rate network access. Especially for heavily populated apartments so that reduced interference and enhanced privacy can be achieved.

-

Home theater: Indoor use cases where high definition video and audio equipment connect to a LC AP

-

Virtual reality (VR): use cases where VR goggles are connected to a LC AP

-

-

Retail

-

Currently, delivery of high-bandwidth data at particular points in store requires cabled connection, making these spots immobile. Alteration of retail space to enable new customer experiences is a key part of retailer strategy. High-bandwidth flexible retail space through LC enables cost reductions for retailers when modifying or refitting the space.

-

LC can offer high data density that can enable very-high bandwidth content streaming without fear of interference with other wireless resources.

-

……………………………………………………………………………………………………………………..

Sidebar: The Problem with WiFi & How LiFi Complements it

WiFi signals don’t travel far, especially through walls. WiFi routers, operating on the traditional 2.4 GHz band, reach up to 150 feet (46 m) indoors and 300 feet (92 m) outdoors. At 5 GHz, WiFi signals only reach 40 or 50 feet. The higher the frequency, the shorter the wavelength. Hence, there’s less range at the same sensitivity and transmit power for 5 GHz vs 2.4 GHz WiFi.

Also, WiFi is notoriously insecure and easy to spoof by hackers. And even with the bandwidth increases over the years, an access point can be overwhelmed rather easily when too many people try to access it at the same time.

Li-Fi is meant to complement, not replace, Wi-Fi. It will co-exist in devices like smartphones, tablets and laptops, which would require a special receiver and transmitter to send and receive Li-Fi signals. That would also require a special encoder/decoder chip to convert the light signal to data.

………………………………………………………………………………………………………………..

Analyst Opinion:

Will Stofega, program manager for mobile device technology and trends at IDC, says good luck with that.

“Getting any standard approved is tough,” he told Network World. “There is always an ecosystem and political interests to play out. I think overall it needs a lot of work, but it’s the most promising of the alternative connection technologies.”

Wireless Telcos to Spend $9B on C-RAN in 2017; or $1.13B in 2022?

Mobile operators are expected to invest nearly $9 billion in C-RAN (cloud or centralized radio access network) infrastructure roll-outs by the end of 2017, according to a report by SNS Research.

Benefits of C–RAN include improved performance due to the ability to coordinate between cells, and also cost reductions as a result of pooling resources.

The C-RAN market is expected to grow at a CAGR of approximately 24% between 2017 and 2020. These investments will include spending on RRHs (Remote Radio Heads), BBUs (Baseband Units) and front haul transport network equipment.

SNS Research said:

C-RAN is an architectural shift in RAN (Radio Access Network) design, where the bulk of baseband processing is centralized and aggregated for a large number of distributed radio nodes. Initially popularized by Japanese and South Korean mobile operators, C-RAN technology is beginning to gain momentum worldwide with major tier 1 operators – including Verizon Communications, AT&T, Sprint, China Mobile, Vodafone, TIM (Telecom Italia Mobile), Orange and Telefónica – seeking to leverage the benefits of centralized baseband processing.

In comparison to standalone clusters of base stations, C-RAN provides significant performance and economic benefits such as: baseband pooling, enhanced coordination between cells, virtualization, network extensibility, smaller deployment footprint and reduced power consumption.

The “C-RAN (Centralized Radio Access Network) Ecosystem: 2017 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the C-RAN ecosystem including enabling technologies, key trends, market drivers, challenges, standardization, regulatory landscape, deployment models, operator case studies, opportunities, future road map, value chain, ecosystem player profiles and strategies. The report also presents forecasts for C-RAN infrastructure investments from 2017 till 2030. The forecasts cover 3 individual sub-markets and 6 regions.

SNS Research said their report would to be of value to current and future potential investors into the C-RAN ecosystem, as well as enabling technology providers, C-RAN solution providers, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem. For further information concerning the SNS Research report “The C-RAN (Centralized Radio Access Network) Ecosystem: 2017 – 2030 – Opportunities, Challenges, Strategies & Forecasts” please visit: http://www.snstelecom.com/c-ran

For a sample please contact:

Email: [email protected]

…………………………………………………………………………………………..

Separately, in a research report titled: “Cloud Radio Access Network (C-RAN) Market – Global Forecast to 2022,” Research and Markets said that the market for C-RAN is expected to grow from US $681.6 million in 2017 to US $1,132.3 million by 2022, at a CAGR of 10.7%.

………………………………………………………………………………………………………..

Editor’s Note: That $1,132.3M Research and Markets forecast by 2022 is significantly less than the $9B SNS Research says wireless carriers will spend on C-RAN this year! Also note that Research and Markets C-RAN forecast of $681.6M in 2017 is only 7.57% of $9B forecast by SNS Research for this same year. The CAGR is also substantially lower at 10.7% from Research and Markets vs 24% from SNS Research (see above).

The above referenced Research and Markets report is evidently being sold by Markets and Markets (India), and by several other report selling firms. Hence, we have no idea who did the actual C-RAN market research and forecasts. The numbers seem to be very shaky to us and some of the report re-sellers use terrible English grammar.

…………………………………………………………………………………………………

Author’s Note on C-RAN Definitions and Distinctions:

A Cloud-RAN (C-RAN type 1) is a virtualized radio access network that could coordinate multiple radio sites from a data center using NFV and/or SDN techniques. The management of geographically dispersed radio sites is managed by ac compute server in the data center.

A Centralized-RAN (C-RAN type 2) refers to pooling baseband units, in a co-location facility, central office or other carrier owned property. Operators do this to minimize footprint and achieve maximize efficiency when providing broadband wireless services within a stadium, block of Class A commercial buildings or other areas of high network demand. The baseband processing unit (BBU) is the part of the RAN that carriers may move to a central location from which multiple remote radio heads can be served.

According to RCR Wireless – What is C-RAN?:

Centralized RAN and centralized DAS (Distributed Antenna System) both describe architectures in which the mobile operator maintains direct control and ownership of the baseband equipment. Cloud RAN implies this equipment is owned by another service provider, or the baseband processing is handled in software run on a generic “white box” server.

”From a network point of view cloud and centralized RAN are the same in terms of requirements (front haul for instance) and work in the same way,” said analyst Monica Paolini of Senza Fili Consulting. “The difference is in the ownership of equipment.”

Paolini foresees more uptake for centralized RAN than for cloud-based RAN in the months ahead. “I think it is unlikely that operators would want to give control to a third party for the RAN baseband – ownership maybe, but not control,” Paolini added.

–>Please see Addendum for descriptions of Nokia and Ericsson C-RAN products.

………………………………………………………………………………………………………..

Research and Markets C-RAN Forecast (continued):

Key players were said to be: Nokia, Cisco Systems, Samsung, ZTE Corporation, Altiostar (?), Ericsson, Huawei, NEC, Fujitsu, Intel & Mavenir (?).

4G and 5G accessibility, the reduction of Capital Expenditure (CAPEX) and Operational Expenditure (OPEX) are the major factors driving the growth of the global C-RAN market, according to Research and Markets.

Government and security standards are expected to be the major restraints for the C-RAN market. Regulatory policies differ from nation to nation and from business to business. The structure of these varying regulatory policies, along with changing macroeconomic factors, makes it difficult for vendors to meet the end-users’ requirements.

A conservative base station consists of Base Band Units (BBUs) and Remote Radio Heads (RRHs). Centralized RAN pools BBUs in a centralized location where they are clustered with other BBUs. Virtualized RAN moves the base band processor to a data center. Hence, it can also be termed as cloud RAN.

Virtualization technology is expected to have the largest market size during the forecast period.

North America is expected to witness the highest CAGR and market share during the forecast period. Factors such as continual growth in the mobile network, increasing business complexities, and the unregulated nature of the internet are driving the growth of the C-RAN market in North America.

Network Function Virtualization (NFV) and “5G” were said to be driving forces for C-RAN deployments.

Research and Markets Contact:

Laura Wood, Senior Manager

[email protected]

For E.S.T Office Hours Call 1-917-300-0470

For U.S./CAN Toll Free Call 1-800-526-8630

…………………………………………………………………………………………………

Addendum:

1. From Nokia’s Centralized-RAN product description:

Nokia Centralized RAN software uses clusters of LTE base stations to turn the interference into useful traffic. The base stations use uplink signals from multiple cells’ base stations to cancel the interference and select the best signals from 12 receivers. Network configuration is optimized every millisecond for each mobile device to match actual interference, enhancing LTE upload speeds.

Centralized RAN creates liquid capacity for mass events where the uplink environment is limited, enabling ultra dense cell deployments. It uses the LTE-Advanced capability of Uplink Coordinated Multi-point (UL CoMP) to turn interference into useful traffic. With this, we are able to double average uplink capacity and provide up to ten-fold cell edge throughput gains. It also uses up to 33% less power, for longer device battery life.

Benefits include:

-

Maximizes spectral efficiency and use to give more than 200 percent average uplink throughput gain

-

Eliminates cell edge degradation to give ten-fold increase in cell edge uplink speeds

-

Works with all existing R8 LTE terminals and Nokia equipment, making it easy to deploy

2. From Ericsson’s Cloud-RAN product description:

Mobile broadband is approaching a point where cellular infrastructure is a viable substitute for fixed broadband in many markets. In this new environment, mobile operators are seeking ways to increase network capacity and coverage while reducing time to market for new services and achieving lower total cost of ownership.

To accomplish this, they must cost-effectively combine multiple standards, frequency bands, cell layers and transport network solutions, while at the same time shortening latencies and handling substantially increased data rates.

By introducing Cloud RAN architectures, operators will be able to use Network Functions Virtualization techniques and data center processing capabilities in their networks. This allows for resource pooling, scalability, layer interworking and spectral efficiency.

Cloud RAN can provide further benefits in terms of more separated and decoupled scalability of the different parts of the RAN functionality, as well as a decreased need for dedicated radio hardware and options to mitigate functional and capacity asymmetries introduced by future, much more capable radio access technologies.

Cloud RAN is a frequently used expression today, but is often used with different meanings. When Ericsson talks about Cloud RAN, we want to incorporate as many important aspects of network architecture as possible, with focus on concepts that deals with collaboration. This will give us the flexibility to talk about it in more than one way.

Cloud RAN covers coordination, centralization and virtualization and is a classical optimization problem with more than one boundary condition for successful business. There will not be one solution that fits all scenarios. Solutions will need to coexist and leverage investments made. In the end, the successful operators and vendors will of course be the ones that manage to provide the best user experience at the lowest total cost of ownership.

https://www.telecomasia.net/content/telcos-spend-9b-c-ran-2017

http://www.snstelecom.com/c-ran-centralized-ran-a-9-billion-opportunity-says-sns-research-report

http://www.rcrwireless.com/20151222/featured/what-is-c-ran-tag4

https://networks.nokia.com/products/centralized-ran

https://www.ericsson.com/ourportfolio/networks-solutions/cloud-ran?nav=fgb_101_0851

Analysis of Windstream’s 2nd quarter results; enhanced SD-WAN solution

2Q-2017 Operating Results:

Windstream Holdings Inc. on August 3rd reported a $68 million 2nd quarter loss and said it would end its quarterly dividend to shareholders as part of a new capital allocation strategy.

The Little Rock, AR telecommunications and cloud service provider reported 2nd quarter revenue of $1.49 billion, which was up 10% from the same quarter last year. Operating income was $107 million, down 31% from $155 million in the same period a year ago. Its $68 million net loss, or a loss of 37 cents per share, compared with net income of $1.5 million, or 1 cent per share, a year ago.

“Windstream delivered solid second quarter results, highlighted by sequential growth in Adjusted OIBDAR,” CEO Tony Thomas said in the previously referenced press release.

“Our unique network assets and cloud-based applications have us well positioned to grow market share. Additionally, we continue to improve our cost structure and have significant opportunities to further drive down costs through reductions in network interconnection costs, upcoming synergies from the EarthLink and Broadview transactions (i.e. acquisitions) and initiatives to advance our organizational effectiveness,” Thomas added.

……………………………………………………………………………………………

Recent Acquisitions:

1. Windstream completed its purchase of EarthLink Holdings Corp. of Atlanta, GA in February. The company has said the $1.1 billion all-stock deal will expand Windstream’s U.S. nationwide fiber footprint and lead to enhanced products and services.

2. Windstream closed on its $225 million purchase of Broadview Networks Holdings Inc. of Rye Brook, New York last month. The private, cloud-based unified communications services provider to small and medium-sized businesses offers a suite of services under the OfficeSuite UC brand which will now be sold by Windstream’s sales force.

…………………………………………………………………………………………..

Comment & Analysis:

Windstream is a leading rural local exchange carrier in the U.S. The company offers broadband Internet, private line, telephony and digital TV services to consumers primarily in rural areas. Windstream also provides advanced network communications such as cloud computing and managed services to enterprise (medium & large business) customers. The company also has business units for: ILEC consumer & small business, CLEC consumer & small business, and wholesale. They have recently entered the SD-WAN market via VeloCloud’s solution (see below).

From Windstream’s most recent SEC 10-K report filing:

Our vision is to provide a best-in-class customer experience through a world-class network. Our “network first” strategy entails leveraging our existing infrastructure and investing in the latest technologies to create significant value for both our customers and our shareholders.

Following the completion of the Merger with EarthLink, our business unit organizational structure will be focused on the following four core customer groups: ILEC Consumer and Small Business, Wholesale, Enterprise, and CLEC Consumer and Small Business, as further defined below. During the third quarter of 2016, we changed the name of our Carrier segment to Wholesale to better reflect our customer base and the products and services we are selling in the marketplace. Historically, we were solely focused on serving telecom companies based in the United States, but over the past year, we have expanded our focus to sell our products and services to nontraditional telecom companies, including content providers, data center operators and international carriers requiring voice and data transport services in the United States. This organizational structure aligns all aspects of the customer relationship (sales, service delivery, and customer service) to improve accountability to the customer and sharpen our operational focus.

Windstream’s local exchange business competitors include: wireless communications providers, cable television companies/MSOs, resellers of local exchange services, inter-exchange carriers, satellite transmission service providers, electric utilities, competitive access service providers.

Windstream has been losing access lines due to pricing pressure and fierce competition. The company is also under pressure with losses in the wholesale business. Being a local exchange carrier (both an ILEC and CLEC), Windstream remains exposed to stringent regulatory measures by the Federal Communications Commission (FCC) as well as state regulatory bodies and local public utility commissions.

……………………………………………………………………………………………

SD-WAN Offering:

In an earlier press release this month, Windstream touted its previously promoted SD WAN solution which now includes additional broadband flexibility, improved self-service monitoring and control options, and a new SD-WAN Concierge™ managed service that automatically optimizes application performance, lowers costs and simplifies network management. Windstream customers can also combine SD-WAN with Diverse Connect to achieve a 100 percent availability service level agreement (SLA).

“We introduced our SD-WAN service in January, and we have seen tremendous adoption in the first six months as customers find they benefit from a more tailored, flexible and controllable WAN experience,” said Joseph Harding, executive vice president and enterprise chief marketing officer at Windstream. “Following our merger with EarthLink, we are enhancing our SD-WAN solution as we work to integrate our offerings. The result is a powerful new solution that gives customers even greater network agility, scalability and performance, all while also reducing costs and virtually eliminating downtime.”

Windstream’s SD-WAN solution was said to utilize “cutting edge technology” (see Editor’s Note below) coupled with the customer’s application prioritization to dynamically route traffic over a combination of private and public networks to reach multiple locations. Customers maintain control over their network from a convenient centralized location rather than manage various individual routers and firewalls.

Windstream’s enhanced SD-WAN solution is available immediately to businesses in Windstream’s nationwide service area. Over the past six months, Windstream has partnered with customers in the retail, banking, professional services, healthcare, manufacturing and financial services industries, and the company expects demand to remain high for its industry leading solution.

In addition to SD-WAN, Windstream offers a full suite of advanced network communications and technology solutions like UCaaS and Diverse Connect along with voice and data services such as VoIP access, SIP trunking, MPLS, Wavelength, Ethernet and dedicated high-speed Internet. Windstream also offers managed services, cloud services and network security services designed to help businesses increase productivity and improve operational costs. For more information, visit windstreambusiness.com.

……………………………………………………………………………………………………

Editor’s Note:

As we’ve repeatedly stated in these techblog posts (and elsewhere), there are no standards for SD-WANs which implies each network provider goes with a single vendor solution which won’t inter-operate with any other SD-WANs from other network providers. Earlier this year, Windstream selected VeloCloud’s SD WAN as the product powering their SD-WAN service.

Earlier this summer, Windstream joined the ONAP open source project (under Linux Foundation). The ONAP Project is focused on creating a harmonized and comprehensive framework for real-time, policy-driven software automation of virtual network functions. ONAP’s primary objective is to enable software, network, IT, and cloud providers and developers to rapidly create new services which can be monetized.

References:

http://abea-43pvyw.client.shareholder.com/investors/releasedetail.cfm?ReleaseID=1035855

http://investor.windstream.com/investors/releasedetail.cfm?ReleaseID=1035354

https://www.windstreambusiness.com/solutions/networking-solutions/sd-wan

https://www.windstreambusiness.com/resources/brochures/sd-wan-solutions

http://files.shareholder.com/downloads/ABEA-43PVYW/4941624088x0xS1282266-17-13/1585644/filing.pdf

https://techblog.comsoc.org/2017/07/01/windstream-joins-onap-open-source-telco-movement/