4G

AT&T Deploys LTE Licensed Assisted Access (LTE-LAA) Technology; Plans 5G Evolution

AT&T has introduced a high speed “4G” service in the form of LTE-Licensed Assisted Access (LAA) in Indianapolis, IN. LTE-LAA uses unlicensed spectrum. According to AT&T it will provide theoretical gigabit speeds to some areas of the city. LTE-LAA has reached a peak of 979 Mbps in a San Francisco, CA trial.

“Demand continues to grow at a rapid pace on our network,” the Bill Soards, President AT&T Indiana in a press release. That’s why offering customers the latest technologies and increased wireless capacity by combining licensed and unlicensed spectrum is an important milestone.”

The U.S. mega telco recently announced plans to roll out its 5G Evolution program in Minneapolis. That initiative – which aims to provide networks with the capability to support 5G when it is ready – already is in use in parts of Indianapolis and in Austin, TX. It features LTE Advanced features such as 256 QAM, 4×4 MIMO and 3-way Carrier Aggregation.

AT&T says that it invested $350 million in its wired and wireless network infrastructure in Indianapolis between 2014 and 2016.

References:

http://about.att.com/story/commercial_lte_licensed_assisted_access_indianapolis.html

Ericsson Survey: Network Operators Focus on New Markets for 5G Revenue

Survey Highlights:

Most network operators say they’re ready for “5G” even if they don’t know what it will actually deliver (the RAN and other key functions haven’t even been discussed by ITU-R WP5D for IMT 2020, let alone agreed upon), Ericsson found in a survey of wireless network operators around the world (see References and hyper-links below). Many expect the enterprise market and Internet of Things (IoT) applications to drive revenue growth from 5G technology.

More than three-quarters of the respondents said they were in the midst of 5G trials. That corresponds with research from the Global Mobile Suppliers Association research which found 81 5G trials underway in 42 countries.

23% of survey respondents plan to migrate 4G subscribers to 5G with enhanced services and revenues (but when?). Yet nearly two thirds (64%) of operators said they can’t pay for 5G by simply raising rates on consumers, because consumers are “tapped out.” Eighteen percent of respondents said they expect to monetize 5G by “expanding to new markets—enterprise/ industry segments.”

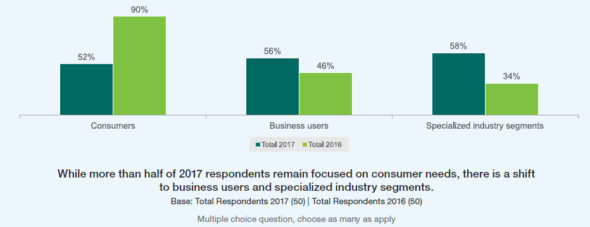

“In 2016, 90% pointed to consumers as the central segment in their planning and only 34% focused on specialized industries,” the Ericsson researchers wrote in this year’s report. An increased emphasis on the enterprise market is a key shift since a previous Ericsson 5G operator survey was conducted in 2016.

“This year, operators are seeing that the consumer market is saturated, so planning for 5G is more evenly split across specialized industry segments (58%), business users (56%) and consumers (52%),” the Ericsson researchers added.

Specific industry segments on which operators expect to focus 5G monetization efforts include media/entertainment (cited by 69% of respondents), automotive (59%), public transport (31%), healthcare (29%) and energy/ utilities (29%).

Providing industry-specific services to these industry segments will be important in 5G monetization, according to 68% of respondents. The single most important use case in the media/entertainment segment is high-quality streaming, respondents said. Other top use cases by segment included:

- Automotive: autonomous vehicle control

- Public transport: Smart GPS

- Healthcare: Remote robotic surgery

- Energy & utilities: Control of edge-of-grid generation

More than three quarters (77%) of respondents said third-party collaboration is an essential element in 5G monetization and 68% said they need to find new revenue-sharing models.

Chart courtesy of Ericsson’s 5G Readiness Survey

……………………………………………………………………………………………..

Survey Questions and Methodology:

Some of the questions asked in the survey:

-Exactly how have preparations for 5G evolved over the past year?

-Where do telcos stand now in their 5G activities and developments?

-What actions are service providers taking now in anticipation of 5G?

-What priorities drive their initiative?

-How ready are they to take leadership positions in the 5G future?

The survey’s objective was to obtain a snapshot of the state of the industry in relation to next-generation mobile technology. Last year, we struggled to find 50 executives globally who were far enough along in 5G to answer the survey questions.

This year, Ericsson says they “easily identified 50 executives, both business and technical leaders, from 37 operators around the world. As leaders of their organizations’ 5G efforts, they are at the center of the 5G evolution. That increase clearly signifies the growing recognition among industry leaders of 5G’s importance.”s

References:

https://www.ericsson.com/assets/local/narratives/networks/documents/5g-readiness-survey-2017.pdf

5G Monetization Survey: Operators Look to IoT for Revenue Growth