Corning

Fiber Optic Boost: Corning and Meta in multiyear $6 billion deal to accelerate U.S data center buildout

Corning Incorporated and Meta Platforms, Inc. (previously known as Facebook) have entered a multiyear agreement valued at up to $6 billion. This strategic collaboration aims to accelerate the deployment of cutting-edge data center infrastructure within the U.S. to bolster Meta’s advanced applications, technologies, and ambitious artificial intelligence initiatives. The agreement specifies that Corning will furnish Meta with its latest advancements in optical fiber, cable, and comprehensive connectivity solutions. As part of this commitment, Corning plans to significantly scale its manufacturing capabilities across its North Carolina facilities.

A key element of this expansion is a substantial capacity increase at its fiber optic cable manufacturing plant in Hickory NC, for which Meta will serve as the foundational anchor customer. The construction and operation of these data centers — critical infrastructure that supports our technologies and moves us toward personalized superintelligence — necessitate robust server and hardware systems designed to facilitate information transfer and connectivity with minimal latency. Fiber optic cabling is a cornerstone component for enabling this high-speed, near real-time connectivity, powering applications from sophisticated wearable technology like the Ray-Ban Meta AI glasses to the global connectivity services utilized by billions of individuals and enterprises.

“This long-term partnership with Meta reflects Corning’s commitment to develop, innovate, and manufacture the critical technologies that power next-generation data centers here in the U.S.,” said Wendell P. Weeks, Chairman and Chief Executive Officer, Corning Incorporated. “The investment will expand our manufacturing footprint in North Carolina, support an increase in Corning’s employment levels in the state by 15 to 20 percent, and help sustain a highly skilled workforce of more than 5,000 — including the scientists, engineers, and production teams at two of the world’s largest optical fiber and cable manufacturing facilities. Together with Meta, we’re strengthening domestic supply chains and helping ensure that advanced data centers are built using U.S. innovation and advanced manufacturing.”

Meta is expanding its commitment to build industry-leading data centers in the U.S. and to source advanced technology made domestically. Here are two quotes from them:

- “Building the most advanced data centers in the U.S. requires world-class partners and American manufacturing,” said Joel Kaplan, Chief Global Affairs Officer at Meta. “We’re proud to partner with Corning – a company with deep expertise in optical connectivity and commitment to domestic manufacturing – for the high-performance fiber optic cables our AI infrastructure needs. This collaboration will help create good-paying, skilled U.S. jobs, strengthen local economies, and help secure the U.S. lead in the global AI race.”

- “As digital tools and generative AI continue to transform our economy — in fields like healthcare, finance, agriculture, and more — the demand for fiber connectivity will continue to grow. By supporting American companies like Corning and building and operating data centers in America, we’re helping ensure that our nation maintains its competitive edge in the digital economy and the global race for AI leadership.”

Key elements of the agreement:

- Multiyear, up to $6 billion commitment.

- Corning to supply latest generation optical fiber, cable and connectivity products designed to meet the density and scale demands of advanced AI data centers.

- New optical cable manufacturing facility in Hickory, North Carolina, in addition to expanded production capacity across Corning’s North Carolina operations.

- Agreement supports Corning’s projected employment growth in North Carolina by 15 to 20 percent, sustaining a skilled workforce of more than 5,000 employees in the state, including thousands of jobs tied to two of the world’s largest optical fiber and cable manufacturing facilities.

…………………………………………………………………………………………………………………………………………………………….

Comment and Analysis:

Corning’s “up to $6 billion” Meta agreement is essentially a long‑term, anchor‑tenant bet that AI‑era data centers will be fundamentally more fiber‑intensive than legacy cloud resident data centers, with Corning positioning itself as the default U.S. optical plant for Meta’s buildout through ~2030. In practice, this deal is a long‑term take‑or‑pay style capacity lock that de‑risks Corning’s capex while giving Meta priority access to scarce, high‑performance data‑center‑grade fiber and cabling.

AI data centers are becoming the new FTTH in the sense that hyperscale AI buildouts are now the primary structural driver of incremental fiber demand, design innovation, and capex prioritization—but with far higher fiber intensity per site and far tighter performance constraints than residential access ever imposed.

Why “AI Data Centers are the new FTTH” for fiber optic vendors:

For fiber‑optic vendors, AI data centers now play the role that FTTH did in the 2005–2015 cycle: the anchor use case that justifies new glass, cable, and connectivity capacity.

-

AI‑optimized data centers need 2–4× more fiber cabling than traditional hyperscalers, and in some designs more than 10×, driven by massively parallel GPU fabrics and east–west traffic.

-

U.S. hyperscale capacity is expected to triple by 2029, forcing roughly a 2× increase in fiber route miles and a 2.3× increase in total fiber miles, a demand shock comparable to or larger than the early FTTH boom but concentrated in fewer, much larger customers.

-

This is already reshaping product roadmaps toward ultra‑high‑fiber‑count (UHFC) cable, bend‑insensitive fiber, and very‑small‑form‑factor connectors to handle hundreds to thousands of fibers per rack and per duct.

In other words, where FTTH once dictated volume and economies of scale, AI data centers now dictate density, performance, and margin mix.

Carrier‑infrastructure: from access to fabric:

From a carrier perspective, the “new FTTH” analogy is about what drives long‑haul and metro planning: instead of last‑mile penetration, it’s AI fabric connectivity and east–west inter‑DC routes.

-

Each new hyperscale/AI data center is modeled to require on the order of 135 new fiber route miles just to reach three core network interconnection points, plus additional miles for new long‑haul routes and capacity upgrades.

-

An FBA‑commissioned study projects U.S. data centers alone will need on the order of 214 million additional fiber miles by 2029, nearly doubling the installed base from ~160M to ~373M fiber miles; that is the new “build everywhere” narrative operators once used for FTTH.

-

Carriers now plan backbone routes, ILAs, and regional rings around dense clusters of AI campuses, treating them as primary traffic gravity wells rather than as just a handful of peering sites at the edge of a consumer broadband network.

The strategic shift: FTTH made the access network fiber‑rich; AI makes the entire cloud and transport fabric fiber‑hungry.

Strategic implications:

-

AI is now the dominant incremental fiber use case: residential fiber adds subscribers; AI adds orders of magnitude more fibers per site and per route.

-

Network economics are moving from passing more homes to feeding more GPUs: route miles, fiber counts, and connector density are being dimensioned to training clusters and inference fabrics, not household penetration curves.

-

Policy and investment narratives should treat AI inter‑DC and campus fiber as “national infrastructure” on par with last‑mile FTTH, given the scale of projected doubling in route miles and more than doubling in fiber miles by 2029.

In summary, the next decade of fiber innovation and capex will be written less in curb‑side PON and more in ultra‑dense, AI‑centric data centers with internal fiber optical fabrics and interconnects.

……………………………………………………………………………………………………………………………………………………………………………………………….

References:

Meta Announces Up to $6 Billion Agreement With Corning to Support US Manufacturing

Big tech spending on AI data centers and infrastructure vs the fiber optic buildout during the dot-com boom (& bust)

Analysis: Cisco, HPE/Juniper, and Nvidia network equipment for AI data centers

Networking chips and modules for AI data centers: Infiniband, Ultra Ethernet, Optical Connections

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Superclusters of Nvidia GPU/AI chips combined with end-to-end network platforms to create next generation data centers

Lumen Technologies to connect Prometheus Hyperscale’s energy efficient AI data centers

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

Hyper Scale Mega Data Centers: Time is NOW for Fiber Optics to the Compute Server

Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Broadband wireline network operators (telcos and MSOs/cablecos) have cutback on CAPEX with decreased spending for network equipment. In its latest earnings call, Calix warned that broadband operator spending might not increase until 2025, when BEAD subsidies have been allocated. However, fiber vendor Corning and others suggested spending might increase earlier than that.

Calix specializes in providing optical network access equipment to smaller broadband service providers and has seen significant revenue growth in recent years, but near-term growth will be challenged. Calix management’s guidance was that the 2024 fiscal year will be soft for its business. Despite that softness, the company still believes that it has years of growth ahead for itself starting in 2025 due to BEAD regulatory stimulus that should prove beneficial for the enterprise.

The U.S. government’s BEAD program promises to funnel a massive $42 billion in subsidies through US states to telecom companies willing to build networks in rural areas. However, allocation of those funds is taking longer than expected, forcing network operators to stall their deployment plans until they have a better sense of how much funding they might get.

“We have seen a significant broadening in the number of customers interested in competing for BEAD [Broadband Equity Access and Deployment program] funds. Today, nearly all our customers are either assembling a BEAD strategy or actively pursuing funds,” Calix CEO Michael Weening said during the company’s quarterly earnings call, according to Seeking Alpha.

“While they do this, they slow their new [network] builds as BEAD money could be used instead of consuming their own capital, and thus, we’ll slow our appliance shipments until decisions are made and funds are awarded,” Weening said. “At that point, the winners will move ahead and those who decided to skip the BEAD program or did not receive BEAD funding, we’ll begin investing to ensure that the winner does not impinge on their market. This represents a delay but also represents a unique opportunity for Calix.”

……………………………………………………………………………………………………..

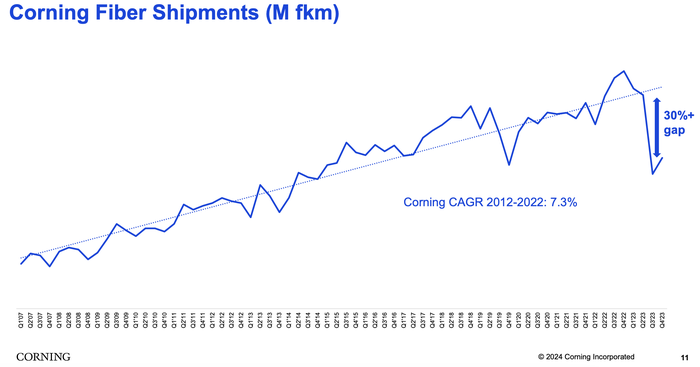

Corning manufactures and sells most of the physical fiber cabling used in U.S. fiber networks. Sales in Corning’s optical business unit – which houses its fiber products – continued to slide in the fourth quarter of 2023.

“We anticipate optical communications sales will spring back because we believe and our carrier customers have confirmed that they purchased excess inventory during the pandemic and that they’ve been utilizing this inventory to continue deploying their networks,” said Corning CEO Wendell Weeks during his company’s quarterly earnings call, according to Seeking Alpha.

“We believe these carriers will soon deplete their inventory and execute on the increased broadband deployment plans they’ve communicated to us over the last several months,” Weeks said. “As a result, we expect them to return to their normal purchasing patterns to service their deployments.”

He also noted that operators are waiting for BEAD funding. “We continue to expect BEAD funding really to start to translate into demand, the beginning of it, sort of late this year. They are progressing with awarding the grants and it will just take a bit for those to turn into real programs,” Weeks said.

Weeks suggested that the company is starting to see the glimmer of an uptick in demand from its broadband operator customers, but nothing definite yet. “We’ll know more in the coming months,” he said in his concluding remarks.

Meanwhile, executives at vendor Harmonic said this week they expect sales in the first half of this year to be relatively soft and then accelerate in the second half of the year as operators start to ramp up network upgrades, including moves to DOCSIS 4.0 technologies.