Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Broadband wireline network operators (telcos and MSOs/cablecos) have cutback on CAPEX with decreased spending for network equipment. In its latest earnings call, Calix warned that broadband operator spending might not increase until 2025, when BEAD subsidies have been allocated. However, fiber vendor Corning and others suggested spending might increase earlier than that.

Calix specializes in providing optical network access equipment to smaller broadband service providers and has seen significant revenue growth in recent years, but near-term growth will be challenged. Calix management’s guidance was that the 2024 fiscal year will be soft for its business. Despite that softness, the company still believes that it has years of growth ahead for itself starting in 2025 due to BEAD regulatory stimulus that should prove beneficial for the enterprise.

The U.S. government’s BEAD program promises to funnel a massive $42 billion in subsidies through US states to telecom companies willing to build networks in rural areas. However, allocation of those funds is taking longer than expected, forcing network operators to stall their deployment plans until they have a better sense of how much funding they might get.

“We have seen a significant broadening in the number of customers interested in competing for BEAD [Broadband Equity Access and Deployment program] funds. Today, nearly all our customers are either assembling a BEAD strategy or actively pursuing funds,” Calix CEO Michael Weening said during the company’s quarterly earnings call, according to Seeking Alpha.

“While they do this, they slow their new [network] builds as BEAD money could be used instead of consuming their own capital, and thus, we’ll slow our appliance shipments until decisions are made and funds are awarded,” Weening said. “At that point, the winners will move ahead and those who decided to skip the BEAD program or did not receive BEAD funding, we’ll begin investing to ensure that the winner does not impinge on their market. This represents a delay but also represents a unique opportunity for Calix.”

……………………………………………………………………………………………………..

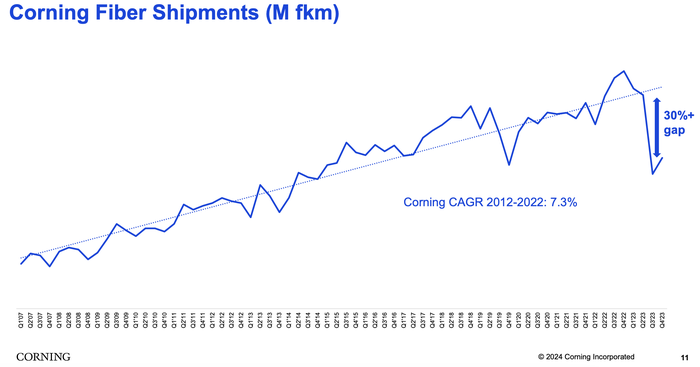

Corning manufactures and sells most of the physical fiber cabling used in U.S. fiber networks. Sales in Corning’s optical business unit – which houses its fiber products – continued to slide in the fourth quarter of 2023.

“We anticipate optical communications sales will spring back because we believe and our carrier customers have confirmed that they purchased excess inventory during the pandemic and that they’ve been utilizing this inventory to continue deploying their networks,” said Corning CEO Wendell Weeks during his company’s quarterly earnings call, according to Seeking Alpha.

“We believe these carriers will soon deplete their inventory and execute on the increased broadband deployment plans they’ve communicated to us over the last several months,” Weeks said. “As a result, we expect them to return to their normal purchasing patterns to service their deployments.”

He also noted that operators are waiting for BEAD funding. “We continue to expect BEAD funding really to start to translate into demand, the beginning of it, sort of late this year. They are progressing with awarding the grants and it will just take a bit for those to turn into real programs,” Weeks said.

Weeks suggested that the company is starting to see the glimmer of an uptick in demand from its broadband operator customers, but nothing definite yet. “We’ll know more in the coming months,” he said in his concluding remarks.

Meanwhile, executives at vendor Harmonic said this week they expect sales in the first half of this year to be relatively soft and then accelerate in the second half of the year as operators start to ramp up network upgrades, including moves to DOCSIS 4.0 technologies.

One thought on “Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?”

Comments are closed.

Viavi Solutions and Clearfield both reported sluggish results last week, and both suggested that network operators continue to hold off on new projects while they make use of exciting equipment supplies while waiting for US government subsidies to hit the market. Viavi sells network testing and measurement equipment, while Clearfield sells fiber equipment and management offerings.

“The reality is, I don’t know what the second half [of 2024] is going to look like from service providers,” Oleg Khaykin, Viavi’s CEO, said during his company’s quarterly conference call, according to Seeking Alpha. “We know the demand will be somewhat stronger in the June quarter. It’s always stronger. Beyond … it’s not getting any worse, it’s getting a little better. But I would still prefer to think of it as flat to slightly recovering … because I think they’re still pretty weak.”

Clearfield CEO Cheri Beranek offered similar commentary. “So, there has been less revenue, less activity than one might expect,” she noted during her company’s quarterly conference call, according to Seeking Alpha. “While the near term industry dynamics remain challenging, we also remain confident that the future growth in fiber is absolute and the value proposition that Clearfield brings to the market is as strong as ever.”

Clearfield CFO Dan Herzog said the company anticipates an “uptick in demand” starting in the second half of this year.

“Telecom demand is at the bottom of the ‘U’ and may begin to slowly recover in the second half of 2024 before a more normal 2025,” wrote the financial analysts at Rosenblatt Securities in a note to investors following the release of Viavi’s latest quarterly results. “Based off of management commentary, our belief from last quarter that this tough spending environment will persist … has been re-affirmed.”

The analysts noted that Viavi, which sells equipment for testing and measuring network performance, ought to be among the first to see any improvement in telecom network operator demand.

“We continue to be on the sidelines until there is stronger evidence of a sustained recovery,” agreed the financial analysts at B. Riley Securities in a research note issued after Viavi’s results.

https://www.lightreading.com/fttx/for-telecom-vendors-the-waiting-continues