GSM

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

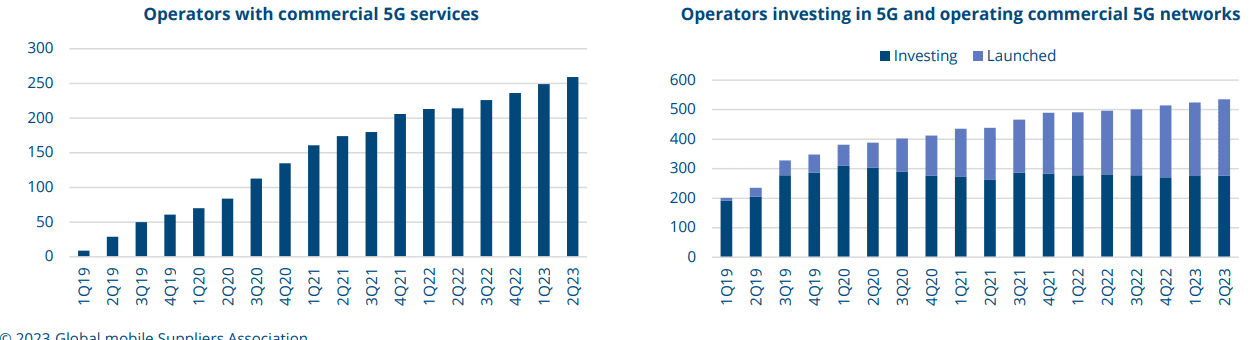

By the end of June 2023, GSA had identified 535 network operators in 162 countries and territories were investing in 5G, including trials, acquisition of licences, planning, network deployment and launches.

This number excludes nearly 200 additional companies awarded priority access licences in the U.S. auction of CBRS spectrum, which could potentially be used for 5G

Of those, a total of 259 operators in 102 countries and territories had launched one or more 3GPP-compliant 5G services 252 operators in 100 countries and territories had launched 5G mobile services 113 operators in 62 countries and territories had launched 3GPP-compliant 5G fixed wireless access services (just over 43% of those with launched 5G services)

13 operators had announced soft launches of their 5G networks that are not counted in the above launch figures 115 operators are identified as investing in 5G standalone (including those evaluating/testing, piloting, planning and deploying, as well as those that have launched 5G standalone networks).

GSA has catalogued 41 operators as having deployed or launched 5G standalone (SA) in public networks.

115 network operators are identified as investing in standalone 5G (including those evaluating, testing, piloting, planning and deploying as well as those that have launched standalone 5G networks).

GSA has catalogued 2,039 announced 5G devices, up by more than 62% from 1,257 at the start of 2022 GSA has identified 1,083 announced 5G phones, up more than 76% from 613 at the start of 2022

There are at least 1,650 commercially available 5G devices, up more than 66% annually from 990

References: