Highlights of Infonetics’ Carrier SDN and NFV Hardware and Software market size and forecast report

Infonetics’ first-ever Carrier SDN and NFV Hardware and Software market size and forecast report, led by Chief Analyst & Infonetics Co-founder Michael Howard. has just been released. Tthe report tracks network functions virtualization (NFV) and software-defined networking (SDN) hardware and software used in service provider networks. It complements a Sept 2014 Infonetics report on SDN for different market segments –Data Center and Enterprise SDN Hardware and Software.

The new 46-page report provides detailed analysis of the SDN and NFV markets and their many facets-from SDN router and switch hardware and software, to the many categories of NFV, particularly the virtualized network functions (VNFs) comprising policy (policy and charging rules function [PCRF] and deep packet inspection [DPI]), the mobile packet core and evolved packet core (EPC), IP multimedia subsystem (IMS), and security. To buy the report, contact Infonetics.

NFV AND SDN MARKET HIGHLIGHTS:

. NFV represents the lion’s share of the combined SDN and NFV market, from 2014 out to 2018

. The value of NFV is in the virtualized network functions software-the applications-rather than the orchestration and control; VNF makes up over 90% of the NFV software segment

. SDN and NFV exemplify the telecom industry’s shift from hardware to software: SDN and NFV software are projected to make up of three-quarters of total SDN/NFV revenue in 2018

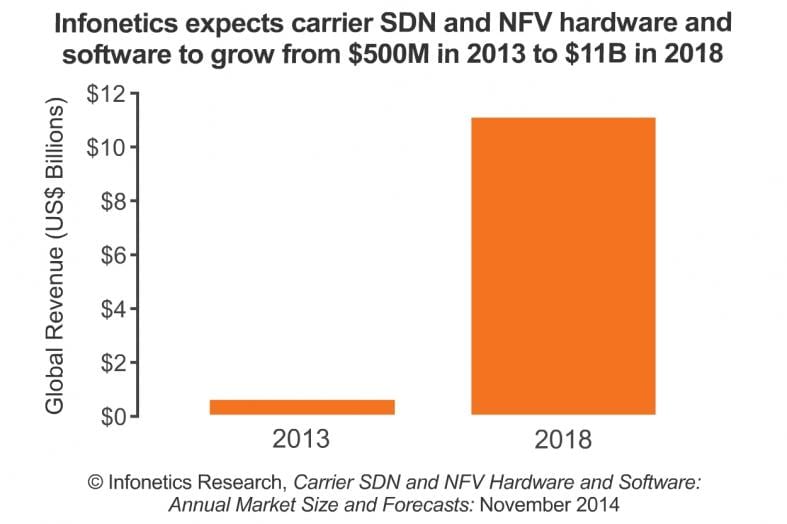

“For three years, the telecom industry has been abuzz over SDN and NFV, with anticipation and hard work developing the vision, goals, architectures, use cases, proof-of-concept projects, field trials, and even some commercial deployments. We’ve been gathering data in this early market for nearly two years and are projecting the global service provider SDN and NFV market to reach $11 billion in 2018,” says Michael Howard, Infonetics Research’s co-founder and principal analyst for carrier networks.

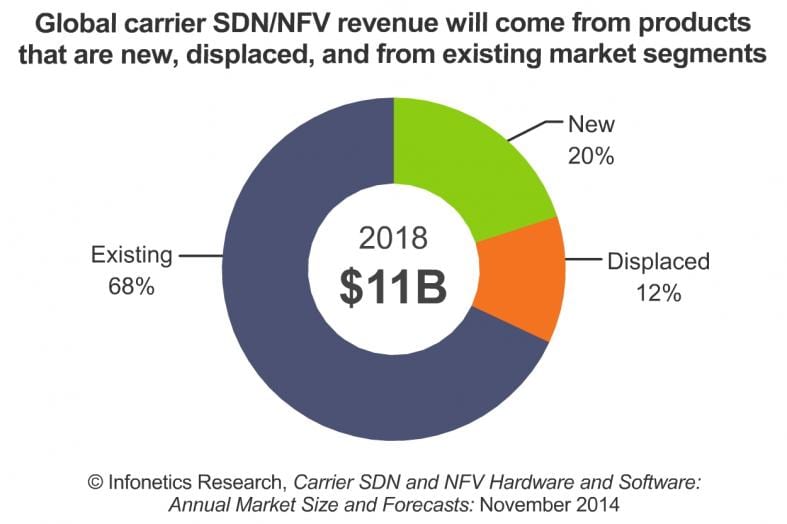

To better understand spending in this emerging market, Infonetics classifies SDN and NFV hardware and software in three distinct categories:

- First, revenue from brand new SDN and NFV software, which we expect to make up 20% of the total SDN and NFV market in 2018.

- Second, revenue that comes from products that companies will buy instead of buying something else-what we refer to as ‘displaced’ revenue, including NFV infrastructure (NFVI) hardware (servers, storage, switches) purchased instead of network hardware (routers, DPI, firewalls, etc.). This segment will make up about 12% of the market in 2018.

- Third, revenue that comes from newly identified segments of existing markets: mostly the virtualized network functions (VNFs), and also ports on routers, switches, and optical gear that have become SDN capable. This last segment makes up the largest slice of the SDN and NFV pie, 68% in 2018.

“This forecast took a ton of work to get to and involved a lot of our analysts. Hopefully it provides useful data for the industry,” said Kim Peinado, Infonetics’ VP of Marketing (and the single best Marketing Communications professional this author has ever worked with in 42 years of tech writing.

REPORT SYNOPSIS:

Infonetics’ new carrier NFV and SDN report provides worldwide and regional market size, forecasts through 2018, in-depth analysis, and trends for the network functions virtualization and software defined networking markets. The report tracks NFV hardware (NFVI servers, storage, switches) and NFV software (NFV MANO, VNF software). It also covers SDN capable service provider telecom hardware (in-use and not in-use routers, switches, and other hardware) and SDN orchestration and controller software and network applications.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

Note: In 2015, Infonetics will publish separate, more in-depth reports for the service provider SDN and NFV markets.

RELATED REPORT EXCERPTS:

. Mobile operators evaluating SDN and NFV for more flexible and cost-effective backhaul

. Strong sequential growth for carrier routers and switches in 2Q14 masks long-term trend

. Operators plan to move security, QoS, VPN and other services to virtual routers

. Carriers name Cisco the top router and switch vendor in Infonetics survey

. Data center and enterprise SDN market grows legs, soars 192% year-over-year

. SDN and NFV to bring about shift in data center security investments