Month: September 2012

OVUM: VCs may renew investments in Network infrastructure companies which have been off their radar screens!

Network Equipment accounted for only 1% of all VC investments for the past four quarters, according to Ovum. They see the sector being ripe for a rebound in VC investments.

“Since the financial crisis, venture capital (VC) firms have been giving much of their tech cash to mobile, social, and OTT start-ups, showing little interest in telecom. VC support for telecom infrastructure start-ups has dropped from US$796m in 2009 to just US$270m in the 3Q11–2Q12 period. In a new report,* though, global analyst firm Ovum finds reason for optimism, concluding that “recent IPO and M&A transactions point to a rebound in VC interest in network infrastructure.”

While VC support for network infrastructure has declined, overall VC investments have recovered, growing from US$20.1bn in 2009 to US$27.8bn in the four quarters ended 2Q12. Some of the beneficiaries of this modest surge include Facebook, Groupon, Twitter, LivingSocial, Square, Lashou, Kabam, WhatsApp, and Spotify.

Matt Walker, Ovum Principal Analyst and author of the report, explains: “A funding disconnect has thereby emerged between network builders and network users. Lots of innovation and venture capital is targeting the network users, such as mobile apps and OTT platforms. However, little of it is directly helping the network builders. With a weak start-up pipeline, the industry relies more on incumbent vendors to generate new ideas and products. Their budgets are bigger, but VCs are often better at funding ‘game changing’ ideas ignored by established vendors.

“Incumbent vendors’ internal R&D budgets are now nearly 90 times larger than VC investments in the sector, up from 30 times two years ago. This narrows options for service providers, who rely on both large and small vendors for innovation. The big vendors also need access to the start-up pipeline, to fill in gaps in their own portfolios through partnership and M&A.”

In response, service providers are getting more actively involved in funding and working with start-ups. Telefonica, Vodafone, Verizon, AT&T, KDDI, China Mobile and many others are now funding start-ups directly, often deploying products in the network or lab ahead of commercial availability. Earlier this month, Deutsche Telekom (DT) was the latest carrier to announce a new push on the venture side, revamping its T-Venture unit to foster purchase of majority stakes and accelerated disbursement of funds.

Walker adds: “Carriers really need help from suppliers, yet what they face is a vendor market in confusion. Most large vendors are now shrinking and reorganizing, even the Chinese suppliers. Several vendors are modifying business plans and selling assets in order to stay solvent. With the recent VC drought in networking, it’s not surprising that big telcos have become more directly involved in funding start-ups.”

Walker points out that, based on data from the PWC/NVCA MoneyTree Report, the “Networking & Equipment” share of total VC investments shrank to just 1.0 percent for the past four quarters (3Q11–2Q12), down from about 10 percent in 2003.

The good news is recent IPO and M&A deals do suggest that VCs are looking favourably on the telecom sector again, when telecom is defined broadly. For instance, VC-funded start-up Nicira Networks was recently acquired by VMware for US$1.26bn. “The tide seems to be shifting. With heightened investor interest and carrier need for solutions in such areas as small cells, network virtualization, and network optimization, telecom network infrastructure VC seems ripe for a rebound,” concludes Walker.”

AJW Comment: With the exception of the largest telcos, the carriers have essentially outsourced R&D to improve/enhance their networks to the huge vendors (Ericsson, Alcatel-Lucent, Huawei, NSN, ZTE, Samsung) they do business with. The smaller vendors (Ciena, Telllabs, Adtran, Motorola Mobility, etc) develop specialized equipment for carriers, but don’t do much research.

One would think that would present a great opportunity for network equipment start-ups. However, without VC or Angel investments, they can’t obtain the funds to develop innovative products. In some cases, the start-ups can make deals with incumbent network vendors, but most of them are in financial difficulty (e.g. NSN, Alcatel-Lucent, and even ZTE) so many not be able to invest. Let’s hope Ovum is correct and VCs start to once again invest in network equipment start- up companies with innovative new technologies!

References:

http://ovum.com/press_releases/ovum-finds-networking-start-ups-overdue-for-vc-rebound/

Also see:

http://viodi.com/2012/08/23/zte-reports-huge-drop-in-profits-telecom-death-spiral-continues/

http://viodi.com/2012/09/24/summary-of-telecom-council-tc3-part-1-service-provider-investment-forum/

New Infonetics Survey Ranks Optical Network Vendors: Alcatel-Lucent, Ciena, Huawei & Infinera get top marks!

Introduction:

Market research firm Infonetics Research released excerpts from its 2012 Optical Equipment Vendor Leadership: Global Service Provider Survey, which explores service providers’ perceptions of optical equipment suppliers and criteria for choosing vendors.

Alcatel-Lucent receives the best overall marks from service providers, particularly for its technology, management, product reliability, and service and support.

OPTICAL VENDOR LEADERSHIP SURVEY HIGHLIGHTS:

- Ciena is cited by service providers as a top vendor nearly as often as Alcatel-Lucent in the areas of 40G/100G+ coherent technology and OTN switching, and ties for optical control plane technology (Ciena ranked highest overall in previous surveys)

- Huawei climbed from 3rd place in 2011 to 1st this year among vendors being evaluated for future optical purchases

- Despite its smaller size, Infinera continues a trend of ranking relatively high in most optical leadership categories and has the best ratio of ‘evaluating’ versus ‘installed.’

SURVEY SYNOPSIS:

For its 21-page Optical Vendor Leadership Survey, Infonetics interviewed 10G/40G/100G optical transmission and switching equipment purchase-decision makers at 20 incumbent, competitive and mobile operators from Europe, the Middle East and Africa (EMEA), North America, Asia Pacific, and the Caribbean and Latin America. Together, the operators represent 28% of global telecom revenue and capex. The survey covers service providers’ familiarity with optical equipment vendors, vendors installed and under evaluation, selection criteria, and their rankings of vendors’ technology, pricing, service and support, product reliability, financial stability, management tools, R&D investment, and total cost of ownership (TCO).

Related Report:

In its 2nd quarter (2Q12) Optical Network Hardware vendor market share report, published August 24, 2012, Infonetics provided these key data points:

- The global optical network equipment market—WDM and SONET/SDH—grew 15% in 2Q12 from the previous quarter, but is down 10% from the year-ago 2nd quarter

- Huawei expanded its lead in the global optical network hardware market in 2Q12; Alcatel-Lucent held onto the #2 spot (optical revenue up 5%); and Ciena posted its strongest quarter on record, easily maintaining 3rd overall and edging into 2nd in the WDM segment

- North American SONET/SDH spending is down 45% year-over-year, negatively impacting vendors with legacy revenue streams; AT&T, in particular, has cut aggressively

- WDM now accounts for 80% of all optical spending in North America

- Optical equipment revenue in Europe, the Middle East, and Africa (EMEA) was up sharply in 2Q12, but still down year-over-year; spending growth on WDM equipment outpaced SDH, a positive indicator for the region

ANALYST NOTES:

“As much as equipment vendors talk about the importance of vendor financial stability, when we talk to optical buyers at network operators around the world, price and total cost of ownership (TCO) come up as the factors they care most about overall,” asserts Andrew Schmitt, principal analyst for optical at Infonetics Research.

“The optical hardware market outlook looks decidedly different depending on which market you sell into,” notes Mr. Schmitt. “While spending on WDM is reasonably healthy, SONET/SDH is sailing off a cliff. Vendors who have good WDM products but large exposure to SONET/SDH are struggling to replace lost revenue fast enough to show growth.”

Schmitt adds: “Asia Pacific notched a big increase in the second quarter, with large seasonal gains by Huawei and ZTE. Despite tepid growth in the first half of 2012, we expect significant growth in optical spending in China, where ZTE continues to take market share from Huawei.”

To purchase this survey or other Infonetics Research reports, contact Infonetics at:

IEEE 802.16 (WiMAX) Session #81 Meeting Report: September 17-20, 2012 in Indian Wells, CA

Overview:

The IEEE 802.16 Working Group’s Session #81 took place on 17-20 September 2012 in Indian Wells, CA, USA in conjunction with the IEEE 802 Wireless Interim meeting.

IEEE Std 802.16-2012, the new revision of the base IEEE 802.16 standard, was pubished on 2012-08-17. IEEE Std 802.16.1-2012, which specifies the IMT-Advanced air interface known as “WirelessMAN-Advanced,” was published on 2012-09-07. Per the current IEEE-SA offer on IEEE 802 standards, both are available for $5 (what a deal!).

IEEE Std 802.16p-2012 and IEEE Std 802.16.1b-2012 was approved by the IEEE-SA Standards Board on 2012-08-30. These amendments add machine-to-machine specifications to the two newly-published base standards. Publication of the amendments is expected in October 2012.

The IEEE-SA Standards Board authorized initiation of two new 802.16 projects:

- IEEE Project PAR P802.16q, on a Multi-Tier amendment to IEEE Std 802.16, was initiated and temporarily assigned to the HetNet Study Group.

- IEEE Project PAR P802.16.3, to develop a new standalone standard on Mobile Broadband Network Performance Measurements, was initiated and temporarily assigned to the Metrology Study Group.

HetNet Study Group:

The IEEE 802.16 WG Study Group (SG) on the WirelessMAN Radio Interface in Heterogeneous Networks (HetNet Study Group) met for the third time. It addressed three separate topics:

- The SG completed a new Project Authorization Request (PAR) for a project on Small-Cell Backhaul (SCB) Enhancements to WirelessMAN-OFDMA. The WG agreed to submit the draft (PAR P802.16r) to the IEEE 802.16 Executive Committee for action in conjunction with Session #82. A followup Call for Contributions was issued. The WG issued a liaison statement to several external organizations (Metro Ethernet Forum, NGMN Alliance, Small Cell Forum, and WiMAX Forum) requesting views and input regarding technical requirements.

- Work on developing IEEE Project PAR P802.16q began with the consideration of various inputs toward a system requirements document. A followup Call for Contributions was issued toward Session #82.

- The Study Group prepared a presentation on the “OmniRAN” Open Mobile Network Interface concept in relation to cellular offload. The presentation was given to the IEEE 802.11 “Wireless Next Generation” meeting on the evening of 18 September, in a meeting focused on cellular offload.

The Study Group issued a closing report and minutes .

Metrology Study Group:

Following 30 August approval of the new Project P802.16.3, to develop a new standalone standard (independent of air interface technology) on Mobile Broadband Network Performance Measurements, the Applications and Requirements draft was updated and a Call for Contributions was issued. The WG responded to a statement from the Broadband Forum with a reply soliciting views on applications and requirements. The WG also requested comments from the IETF. The WG developed a statement to be delivered to the FCC regarding the FCC’s new program on the measurement of mobile broadband service performance. Per IEEE 802 procedures, the draft statement is under review by the IEEE 802 Executive Committee prior to distribution. The Metrology Study Group issued a closing report and minutes.

GRIDMAN Task Group:

The Working Group’s GRIDMAN Task Group resolved comments received during the IEEE-SA Sponsor Ballot of drafts P802.16n and IEEE P802.16.1a. In each case, Sponsor Ballot recirculation will be conducted, closing prior to Session #82. The TG issued a closing report and minutes.

ITU-R Liaison Group:

The ITU-R Liaison Group drafted two contributions to ITU-R Working Party 5D (WP 5D), one related to sharing studies and another related to Rec. IMT-R M.2039. Once approved within the IEEE-SA process, both documents may be submitted to ITU-R Working Party 5D Meeting #14 in October. The group issued a closing report

Project Planning Committee:

The WG’s Project Planning Committee met for two periods during Session #81. It confirmed the IEEE 802.16 Ballot Schedules. The committee reviewed input contributions on direct mobile communication for proximity-based applications. The Committee issued a closing report.

The draft Working Group Session #81 Minutes are posted, but you need Microsoft Word to open the document and there is no url. Try to download it from http://ieee802.org/16/meetings/mtg81/report.html

Future IEEE 802.16 Sessions:

- Session #82 will take place on 12-15 Nov 2012 in San Antonio, TX, USA in conjunction with the IEEE 802 Plenary Session.

- Session #83 will take place on 14-17 Jan 2013 in Vancouver, BC, Canada in conjunction with the IEEE 802 Wireless Interim.

- Session #84 will take place on 18-21 Mar 2013 in Orlando, FL, USA in conjunction with the IEEE 802 Plenary Session.

About IEEE 802.16:

The IEEE 802.16 Working Group on Broadband Wireless Access Standards has developed and is enhancing the WirelessMAN® Standards for wireless metropolitan area networks. IEEE 802.16 is a unit of the IEEE 802 LAN/MAN Standards Committee, the premier transnational forum for wired and wireless networking standardization. A list of IEEE 802.16 standards and drafts is available on-line, as is an archive of previous Session Reports. The IEEE 802.16 Interactive Calendar includes sessions and deadlines.

Infonetics: SAN market hits $1.5 billion on increased FCoE and 16G Fibre Channel switch sales

Market research firm Infonetics Research released excerpts from its 2nd quarter 2012 (2Q12) SAN Equipment market size, market share, and forecast report, which tracks storage area network (SAN) switches and adapters.

The global SAN equipment market, including switches and adapters, grew 15% sequentially in 2Q12

SAN EQUIPMENT MARKET HIGHLIGHTS:

- SAN adapter revenue fell 2% in 2Q12, due to weakness in the FCoE converged network adapter (CNA) segment, a bright spot just a quarter ago

- Cisco leads the overall SAN equipment market for the 5th consecutive quarter after posting a 31% increase in SAN revenue in 2Q12

- Brocade essentially owns the 16G Fibre Channel segment, with an astounding 99% of global revenue market share

- While sales of FCoE-capable switches are strong overall, adoption lags for FCoE for storage transport.

Author’s Note on FCoE:

FCoE is a transmission method used to connect storage servers in a data center. The Fibre Channel frame is encapsulated into an Ethernet MAC frame at the server before sending them over the 10 Gigabit Ethernet LAN and de-encapsulates them when FCoE frames are received. The Ethernet MAC frame is removed at the Ethernet edge switch to access the Fibre Channel frame, which is then transported to the SAN. Fibre Channel encapsulation requires use of 10 Gigabit Ethernet transmission electronics as well as provides for increased server to SAN connectivity.

FCoE encapsulation standards activity took place in the Fibre Channel T11.3 committee (not in IEEE 802.3).

“Skyrocketing shipments of Fibre Channel over Ethernet (FCoE)–capable switches and 16G Fibre Channel products pushed the storage networking equipment market to new heights in the 2nd quarter, passing $1.5 billion,” notes Sam Barnett, directing analyst for data center and cloud at Infonetics Research. “And there’s no end in sight. Thanks to the popularity of social networking and video sharing, as well as advances in cloud computing and the data center, we expect a cumulative $41.7 billion to be spent on SAN switches and adapters in the 5 years from 2012 to 2016.”

REPORT SYNOPSIS:

Infonetics’ quarterly SAN Equipment report provides worldwide and regional market size, vendor market share, forecasts, trends and analysis for Fibre Channel host bus adapters (HBAs), iSCSI HBAs, FCoE CNAs, and chassis and fixed Fibre Channel and all FCoE-capable switches that are purpose-built for the data center (10G FCoE, FC 2G, FC 4G, FC 8G, FC 16G, iSCSI). Companies tracked include Brocade, Chelsio, Cisco, Dell, Emulex, IBM (BNT), Juniper, Mellanox, QLogic, others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp.

Telecom Council Recognizes Top Start-Ups via SPIFFY Award Winners at Annual TC3 Conference

The Service Provider members of the Telecom Council of Silicon Valley recognized 8 young telecom companies with SPIFFY awards on September 12, 2012 at the annual TC3: Telecom Council Carrier Connections in Sunnyvale, CA. 2012 SPIFFY nominees attended the ceremony, sponsored by Tata Consultancy Services, and were joined by over 400 telecom professionals, including 20 senior executive carrier speakers from the TC3 summit.

Criteria used for these awards included the candidate companies innovation, execution, management, and technologies. All startups that have been invited to present at a Telecom Council meeting have been identified as a promising telecom company. From among these, some young companies stand out for their innovation, market opportunity or quantifiable interest among the Council’s 25 global Service Providers including AT&T, British Telecom, DoCoMo, France Telecom/Orange, Swisscom, Verizon, Vodafone and many other fixed and wireless carriers from Europe, Asia, and North and South America listed on the Telecom Council website: http://telecomcouncil.com/memberlist.php

Members of the Service Provider Forum (SPIF) reviewed over 200 start-ups at Telecom Council meetings over the past year. Competition for these awards is stiff because all startups are screened by Telecom Council Steering Committees before they are selected to present to the SPIF or other Telecom Council meetings. Startups who present have been identified as having ideas, relevance, and traction that most appeal to our carriers from around the globe.

Over 25 carrier members voted on over 200 startup companies and the winners of the 2012 SPIFFY Awards are:

- The Edison Award for Most Innovative Start-Up goes to Plex.T.

- The Ground Breaker Award for Engineering Excellence goes to Expertmaker.

- The Graham Bell Award for Best Communication Solutions goes to Blue Jeans Network.

- The San Andreas Award for Most Disruptive Technology goes to Bridgewave Communications.

- The Core Award for Best Fixed Telecom Opportunity goes to Cloudscaling.

- The Zephyr Award for Best Mobile Opportunity goes to Devicescape.

- The Prodigy Award for the Most Successful SPiF Alumni is Ruckus Wireless.

- The Fred & Ginger Award for Most Supportive Carrier goes to Bouygues Telecom for the active role of their Silicon Valley-based team in supporting telecom entrepreneurs.

Of the above mentioned companies, only Ruckus Wireless and Bridgewave make telecom gear for carriers.

http://bridgewave.com/company/pressreleases_20120921.cfm

Ruckus Wireless participated in a panel on WiFi Offload 2.0, while Bridgewave had a demo table in the back of the room to promote its products.

“It’s a tremendous honor to be recognized by the telecommunications industry here in the Valley as the most successful SPIF alumni organization,” said Rob Mustarde, vice president of marketing for Ruckus Wireless. “Our carrier-class Wi-Fi products are delivering unique business and technology benefits to mobile operators in almost every corner of the globe. And with the newest iPhone 5 now hitting the market, the growth in subscribers’ data usage will continue at an exponential pace for the foreseeable future, which will put our solutions in even greater demand. It’s an exciting time for the entire mobile industry.”

“This award win further solidifies the support, recognition and accolades BridgeWave has received since bringing our high capacity wireless solutions to market,” said Amir Makleff, chief executive officer for BridgeWave. “BridgeWave’s continued commitment to innovation, as seen with our FlexPort and PicoHaul products, will help customers tackle 4G challenges with minimal investments, resulting in more profitable mobile data services.”

Liz Kerton, President of Telecom Council, said proudly of the 25 SPIF carriers and this year’s crop of startups, “The past year has been a great for innovation in telecom; we all applaud these winners for their contributions to the future of our industry.'”

The Telecom Council looks forward to presenting many more telecom startups to the industry in 2012 and beyond.

The 2012 SPIFFY AWARD Nominees were:

Graham Bell Award for Best Communication Solution

Telecom is really about helping people communicate, historically that has meant connecting one with another, but now can mean connecting many with many, or connecting people to machines. This award recognizes the company that advanced the noble cause of improving telecommunications.

- Blue Jeans Network

- IOVOX

- Mavenir Systems

- Pie Digital

- QualiSystems

Edison Award for Most Innovative Startup

Some ideas are so unusual they surprise you, but it’s a small minority of these that are also likely to succeed. With this award, we recognize the startup that brings the most innovative ideas, but also the ability to successfully bring that idea to market.

- Crowd Factory

- Plex

- TuneWiki

- Vantrix

San Andreas Award for Most Disruptive Technology

This award is for the most game-changing startup to present to the Telecom Council. It is offered to the company whose progress is most likely to disrupt markets and change the way people do things.

- Accumulate

- Bridgewave

- iKnowWare

- Spectrum Bridge

- Zoove

Core Award for Best Fixed Telecom Opportunity

This award recognizes the best investment opportunity within the fixed telecom sector that we’ve seen at the SPIF Meeting in the past two years.

- AnyFi Networks

- Cloudscaling

- Edgewater Networks

- Guavus

- Private Planet

Zephyr Award for Best Mobile Opportunity

This award recognizes the best investment opportunity within the mobile telecom sector that we’ve seen at the SPIF Meeting in the past two years.

- Acudora

- Blinq

- Devicescape

- FeedHenry

- Skyfire

Ground Breaker Award for Engineering Excellence

This award is offered to the company that has produced the most impressive technological advancements. These are the firms who have invested in R&D, and have turned the gears of progress through sweat, tenacity, and a Costco account for Jolt and Mountain Dew.

- Amimon

- E-Blink

- Expertmaker

- Matrixx Software

- Newfield Wireless

Prodigy Award for the Most Successful SPIF Alumni

This award is given to the pre-2011 SPIF presenting company that went on to achieve the most notable growth, market success or exit.

- Ruckus Wireless

- Exalt Communications

- Zong

- BelAir Networks

- LifeSize Communications

The Fred & Ginger Award for Most Supportive Carrier

This award allows the SPIF startup companies to choose which SPIF carrier was overall the most responsive and supportive to the Silicon Valley entrepreneur community.

- AT&T

- BT

- Bouygues Telecom

- Docomo

- Vodafone

About the Telecom Council:

The Telecom Council of Silicon Valley is Where Telecom Meets Innovation. We connect the companies who are building communication networks, with the people and ideas that are creating it – by putting those companies, research, ideas, capital, and human expertise from across the globe together in the same room. Last year, The Telecom Council connected over 2,000 executives from 750 telecom companies and 25 fixed and wireless carriers across 40 meeting topics.

———————————————————————————————————————

Author’s Note- Forthoming TC3 Summary article:

The TC3 summary article will focus on WiFi Offload 2.0, which was the only session related to network infrastructure. The concept is to offload mobile data/video traffic from a carrier’s 3G/4G cellular network to a large WiFi hot spot network maintained by that carrier or a trusted partner. The term “WiFi integration” was preferred to offload, as the data traffic would be automatically switched between the 3G/4G cellular newtork and carrier controlled WiFi network. The user would have to “opt-in” to enable automatic switching from one network to another. QoS, especially latency, might be an issue when switching from an LTE network to WiFi (which is a best effort wireless network with no bounds on latency or jitter).

Please email the author if you have any other topics you’d like covered in the TC3 Summary article:

VOIP – THE NEW REALITY OF BUSINESS TELECOMMUNICATIONS

Telecommunication has become an ever more critical part of the business environment. The evolution of voice solutions for the enterprise has evolved to include IP- the predominant protocol for all data and video communications. Many of the configurations and applications of Voice over IP (VoIP) are explored in this article, as well as the benefits behind using Metro Ethernet to strengthen you VoIP deployment strategy.

The article referenced below is intended for IT professionals who are considering a VoIP deployment for their business.

Article Link:

http://www.nicktornetta.com/VoIP_the_New_Reality-Nick_Tornetta-(REV_IEEE).pdf

Editors Note: Comcast Business is a VoIP and Metro Ethernet service provider selling to small and medium business(SMB). Here’s another useful article link:

http://customer.comcast.com/help-and-support/internet/voice-over-internet-protocol/

Mr Tornetta presented an excellent overview of Comcast Business’ Metro Ethernet and related data services for SMBs and other enterprise customers at the March 2011 IEEE ComSocSCV Town Hall Meeting, chaired by yours truly.

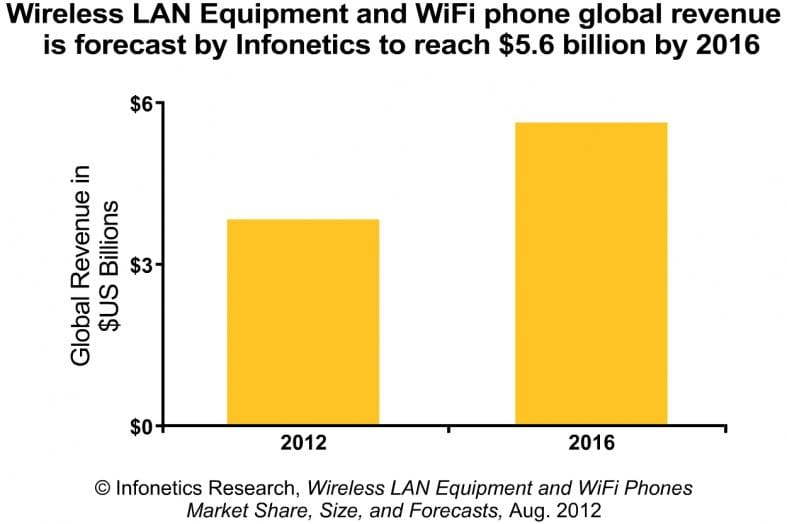

Strong Growth in WiFi LAN equipment and WiFi phone sales as total market nears $1B!

Infonetics Research released excerpts from its 2nd quarter 2012 (2Q12) Wireless LAN Equipment and WiFi Phones vendor market share and forecast report, which tracks 802.11 a/b/g, 802.11n, and 802.11ac access points (APs), wireless LAN (WLAN) controllers, and WiFi phones for the enterprise. That total market approached $1B in 2Q2012!

WIRELESS LAN MARKET HIGHLIGHTS:

•Global wireless LAN equipment and WiFi phone sales grew 16% sequentially in 2Q12, to $993 million, driven by strong demand in North America and the education and retail verticals

•WLAN equipment revenue in EMEA (Europe, the Middle East, and Africa) is up by more than 1/3 year-over-year

•Revenue for outdoor access points rose 45% from the year-ago 2nd quarter due to increasing deployments of WiFi by service providers

•Cisco, the perennial leader in the wireless LAN equipment market, gained about 4 market share points year-over-year in 2Q12; Aruba again took the #2 spot; HP leapfrogged Motorola to take 3rd

•Vocera widened its lead over Polycom and Cisco in the race for enterprise WiFi phone market share in 2Q12

ANALYST NOTE:

“Wireless LAN has had a very good run over the last couple of years, even outperforming wired LAN, and the WLAN market is now approaching the $1-billion-per-quarter mark,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research. “The world is going wireless, and users expect fast, always-on connectivity no matter where they are. Enterprises need to keep pace with ever-increasing bandwidth demands, and next-gen WLAN gear based on fast 802.11n and soon 802.11ac technologies gives them a reason to upgrade.”

REPORT SYNOPSIS:

Infonetics’ quarterly Wireless LAN Equipment and WiFi Phones report provides worldwide and regional market size, vendor market share, forecasts, and analysis for interactive, independent, and outdoor access points (802.11 a/b/g, 802.11n, and 802.11ac), wireless LAN controllers, and enterprise single-mode WiFi phones. Companies tracked include Alcatel-Lucent, Aruba, Brocade, Cisco, D-Link, Enterasys, Extreme, Juniper, LG Ericsson, Meru, Motorola, NETGEAR, Polycom, HP, Ruckus, SMC, Vocera, Xirrus, and others.

TO BUY INFONETICS REPORTS, CONTACT SALES:

- N. America (West), Asia, Latin America: Larry Howard, [email protected], +1-408-583-3335

- N. America (East), Texas, Midwest: Scott Coyne, [email protected], +1-408-583-3395

- Europe, Middle East, Africa: George Stojsavljevic, [email protected], +44-755-488-1623

- Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

Dell’Oro Group, another market research firm specializing in networking and telecommunications industries reports that Wireless LAN (WLAN) revenue grew 16% year-over-year in 2Q2012, driven in part by a 26% year-over-year increase in the Enterprise WLAN segment. Dell’Oro states that nine WLAN vendors had record revenue quarters, marking it a very strong quarter for the industry. Cisco Systems maintained the majority revenue market share in the Enterprise WLAN market, followed by Aruba Networks and Hewlett Packard. In the SOHO market, Netgear retained the number one revenue rank, followed by Cisco Systems. In the Service Provider WiFi market, Hewlett Packard, Ruckus

Wireless and Cisco Systems were within 0.2 percent revenue share points of each other in a near dead heat for top vendor ranking, according to Dell’Oro.

The Dell’Oro Group Wireless LAN Quarterly Report provides complete, in-depth coverage of the Service Provider, Enterprise, and SOHO markets with tables containing manufacturers’ revenue, average selling prices, and unit shipments by the following wireless standards: 802.11g, 802.11a/g, 802.11n and 802.11ac.

“There are many exciting changes underway in the Wireless LAN industry now. We have a new generation of technology shipping, 802.11ac; a new customer group emerging, Service Providers; and new architectures being brought to market, cloud services and virtualized software,” stated Chris DePuy, Analyst of Wireless LAN research at Dell’Oro Group. “In addition, enterprises now consider Wireless LAN infrastructure systems to be just as important as their wired Ethernet systems, which is driving a need for combined management systems for wired and wireless access at the edge of the enterprise,” continued DePuy.

http://finance.yahoo.com/news/wireless-lan-market-sales-16-130000763.html