Month: April 2017

AT&T: SD-WAN needed for SMB customers, but VPN not going away

Overview:

AT&T told investment analysts this week that software-defined WAN (SD-WAN) technology would be a key part of its portfolio down the road, especially for small and medium-size businesses. AT&T CEO Randall Stephenson offered insight into AT&T’s SD-WAN strategy on its Q1-2017 earnings call on Wednesday.

Most of the call, especially the prepared remarks, was devoted to AT&T’s wireless operations, 5G availability, DirecTV and DirecTV Now, and the Time Warner acquisition (“moving along as scheduled”). Yet AT&T did talk about strategic business services during the Q & A session of the call. In response to a question from David W. Barden – Bank of America Merrill Lynch about SD-WANs, CEO Stephenson said:

“On the SD-WAN, yeah, it’s real. It tends to be real down-market (SMB), David, and you should assume that we’re developing capability ourselves, because it’s a viable offer down-market. We’re seeing some effect from it. It’s not material yet, but we think it’s a legitimate capability. We need to be there; we need to have it. And so up-market (large enterprise customers), the traditional VPN capability is always, we think, is going to be the enduring capability. But down-market (SMB), we’re going to have to be prepared to compete with this kind of offering.”

Background:

AT&T hasn’t released its own SD-WAN solution yet, but the mega service provider said on October 5, 2016:

“For a customer with similarity across sites and looking to deploy SD-WAN at all locations, the AT&T SD-WAN premises-based, over the top solution (?) may be the best fit. The premises-based, over the top solution will be avaFor a customer with similarity across sites and looking to deploy SD-WAN at all locations, the AT&T SD-WAN premises-based, over the top solution (?) may be the best fit. The premises-based, over the top solution will be available later this year.”

–>It wasn’t and there’s still no definite availability date!

That same day, AT&T revealed it was collaborating with SD-WAN vendor VeloCloud with the aim of releasing a solution sometime in 2017. AT&T’s said its SD-WAN service will let customers manage application performance and bandwidth by allowing them to set parameters for routing data traffic across different access types.

AT&T will continue to market traditional MPLS-based VPN services to its large enterprise customer base. “Up market, the traditional VPN capability is going to be the enduring capability,” as per Stephenson quote above.

A network-based system could build off a customer’s existing MPLS, Carrier Ethernet or wireless connections. Customers could use SD-WAN to manage their various wired and wireless Internet connections from third parties.

“For SD-WAN solutions, AT&T is the first provider in the industry to announce both an over-the-top solution as well as a network-based SD-WAN solution, which couples smart SD-WAN CPE with a smart MPLS network,” wrote a VeloCloud spokesmen to SDxCentral. “A typical SD-WAN solution is deployed in an over-the-top manner, i.e., SD-WAN CPE is deployed at every customer site, and tunnels are established over the network transport links among sites,” he added.

Comment: AT&T hasn’t announced availability of any SD-WAN service so the VeloCloud spokesman is less than honest! AT&T has touted its SD-WAN over the top option (whatever that means), but hasn’t delivered it yet to paying customers. Nonetheless, the VeloCloud website lists AT&T as a “managed service provider partner”:

“AT&T SD-WAN efficiently routes data traffic across a wide area network, choosing the access type for the best network performance. AT&T provides options in the SD-WAN category: a network-based option that enables virtually seamless connectivity across multiple site types, and provides an easy transition for customers with existing AT&T VPN services; an over-the-top premises-based option for businesses that want to deploy SD-WAN at all sites.”

………………………………………………………………………………………

Being able to provide VPN capabilities along with Carrier Ethernet has been a key factor in how AT&T has retained its profile as one of the largest domestic U.S. and international Ethernet providers.

SD-WAN may represent a future capability for AT&T’s business unit, particularly as a next-gen strategic service. That’s despite a challenging environment where businesses are not aggressively spending capital on business services.

Weaker Demand for Business Services:

AT&T CFO John Stephens said on the earnings call that interest in business services was not as strong as the company initially forecast.

“In the business segment, we saw weaker demand than we expected,” Stephens said. “U.S. business investment as percentage of gross domestic product (GDP) continues to be low.” Stephens added that “growth expectations in the economy have been rising, but we have yet to see that translate into economic gains or demand.”

Author Note:

A weak economy is a huge problem for network providers offering business services as spending on same is constrained by lower revenues. Another issue for SD-WAN is that many SMBs are choosing cloud computing and storage, rather than expanding their VPNs or looking for another solution to connect their branch offices and headquarters sites. Such a network topology change augers well for cloud network access solutions (like AT&T Netbond or Equinix Cloud Exchange), but not for SD-WANs.

…………………………………………

References:

http://about.att.com/story/att_unveils_sd_wan_hybrid_networking_strategy.html

http://searchsdn.techtarget.com/news/450400584/ATT-joins-long-list-of-SD-WAN-service-providers

https://www.sdxcentral.com/articles/news/att-chooses-velocloud-deliver-sd-wan/2016/10/

https://www.sdxcentral.com/articles/news/att-brewing-house-sd-wan-velocloud-help/2017/04/

https://opennetworkingusergroup.com/wp-content/uploads/2015/05/ONUG-SD-WAN-WG-Whitepaper_Final1.pdf

https://www.sdxcentral.com/sd-wan/definitions/software-defined-sdn-wan/

https://networkingnerd.net/2017/04/21/the-future-of-sdn-is-up-in-the-air/

2017 Open Networking Summit Best of Show Awards

We covered the 2017 ONS noting that ONAP “stole the show.” Indeed, it was voted “most buzzed about project” as per press release below.

2017 was the first time ONS included Best of Show awards. Finalists for each award were selected by a panel of industry experts and analysts, and conference attendees then voted by email following the event to select the winners.

The recipients of the 2017 ONS Best of Show awards are:

· Most Buzzed About Project – ONAP (57.3% of votes)

o Finalists included: CORD, ONOS and OPNFV

· Best Exhibit Booth – Barefoot Networks (70.2% of votes)

o Finalists included: Dell, Ericsson and Huawei

· Best Announcement/Coverage – Open Network Automation Platform (ONAP) Project Releases Code, Expands Membership and Announces Board Positions (50.4% of votes)

o Finalists included: Alibaba Joins the Microsoft SONiC Community; Espresso Makes Google Cloud Faster, More Available and Cost Effective by Extending SDN to the Public Internet; and OPNFV, the Open Source Project for Integrated Testing of Full, Next-Generation Networking Stack, Issues its Fourth Release

· SDN/NFV Solutions Showcase: Most Innovative Demo – ONAP – Open Network Automation Platform (38% of votes)

o Finalists included: CORD: Rapid Service Enablement with CORD; PNDA: Analytics in an Open Source World; and Service Orchestration Across Cloud Domains & Multi-domain Transport Network

· Most Disruptive Networking Technology (Vendor, Product or Solution) – Barefoot Networks (Programmable Data Plane) (42.2% of votes)

o Finalists included: AT&T & China Mobile (joining forces across entire open networking stack including ONAP); Google (bringing SDN to public internet); Intel (vision and drive for supporting 5G and Software Defined Data Centers); and SnapRoute and its FlexSwitch networking software

“ONS 2017 featured some incredible technology solutions that demonstrate the future for networking truly is open,” said Linux Foundation General Manager, Networking & Orchestration Arpit Joshipura. “There was tremendous competition for the Best of Show awards, and the winners should be proud that ONS attendees recognized their outstanding technologies, projects and announcements.”

ONS 2018 will take place at the InterContinental Los Angeles Downtown. The move from Silicon Valley, ONS’ traditional home, for 2018 reflects the wide reach of open networking. By taking place in a different geographic location, ONS will bring in new verticals and demonstrate different use cases for open networking technologies.

…………………………………………………………………………………………….

About The Linux Foundation:

The Linux Foundation is the organization of choice for the world’s top developers and companies to build ecosystems that accelerate open technology development and commercial adoption. Together with the worldwide open source community, it is solving the hardest technology problems by creating the largest shared technology investment in history. Founded in 2000, The Linux Foundation today provides tools, training and events to scale any open source project, which together deliver an economic impact not achievable by any one company. More information can be found at www.linuxfoundation.org.

For more information: http://www.prnewswire.com/news-releases/open-networking-summit-announces-best-of-show-award-winners-and-2018-dates-and-location-300446161.html

AT&T Fixed Wireless Internet Debuts in Georgia; 17 more states in 2017

On Monday, April 24th, AT&T announced the completion of its first wave rollout of fixed wireless internet in Georgia and said it is working to bring fixed wireless access to 17 more states this year. Those states include Alabama, Arkansas, California, Florida, Illinois, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, North Carolina, Ohio, South Carolina, Tennessee, Texas, and Wisconsin.

AT&T’s Fixed Wireless Internet – offers customer speeds of at least 10 Mbps and 160 GB of internet usage per month via a professionally installed outdoor antenna. Additional data can be purchased in 50 GB increments for $10 each, up to a maximum of $200. WiFi is included in the service, as well as wired Ethernet connections for up to four devices. Fixed Wireless Internet data cannot be added to a Mobile Share plan, and Rollover Data is not included in the Fixed Wireless Internet plan.

“Access to the internet is an important tool for advancing opportunities in communities. It creates economic growth, helps increase community engagement, and makes education accessible,” AT&T’s SVP of Wireless and Wired Product Marketing Eric Boyer commented. “We’re committed to utilizing available technologies to connect hard-to-reach locations,” he added.

AT&T said the rollout is part of its FCC Connect America Fund commitment to serve more than 400,000 locations by the end of this year. The carrier has also pledged to expand that figure to more than 1.1 million locations by 2020. AT&T indicated more than 67,000 locations will be served by fixed wireless in Georgia by 2020.

……………………………………………………………………….

Introducing AT&T Fixed Wireless Internet:

Enjoy a better online experience with faster surfing, streaming, and downloading. Whether you’re off the grid or just outside of town, with AT&T Fixed Wireless Internet you can get fast Internet speeds of at least 10Mbps, so you can download, surf, and stream with confidence.

Here’s how we’ll connect you

Survey

Install

Connect

Samsung & SK Telecom offer Korea’s first LTE-Railway network

In contrast to the Google – India Railways managed WiFi network in India train stations, Samsung has partnered with SK Telecom to offer a LTE-R wireless railway management system, which has started operating in the company’s native South Korea.

The system, which officially deployed on the 41 km-long (25.5 miles) Busan Metro Line 1 between Sinpyeong and Nopo, has been in testing since February. Emerging as a partnership between Samsung, SK Telecom (the country’s largest wireless operator), and the Busan Transportation Corporation, this implementation will allow train operators to better communicate during mission-critical maintenance jobs via the use of “multimedia-based group call/SMS services” to enhance the “one-to-one voice call service between the control center, station employee, and the train engineer.”

In addition to the enhanced communication capabilities, the train operator can, in case of an accident, transmit real-time video between him and the control center, thanks to LTE-R’s low latency.

Jinsoo Jeong, Senior VP and Head of Domestic Business Marketing in Networks Business at Samsung, said:

“Reliability and stability are critical because they are directly tied to public safety. Today’s launch of the Samsung LTE-R solution with BTS and SK Telecom is a huge milestone for the industry. As a leading LTE-R solution provider, we enable fast and reliable communication on high-speed trains capable of speeds as high as 300km/hr, which is expected to be started early next year.”

Samsung has been the supplier of all five LTE-R implementations in the country since 2015. Korean officials stated their intent to extend the area covered by LTE-R to roughly 5,600 km (about 3,500 miles) by 2025.

References:

http://www.railway-technology.com/news/newsfirst-lte-railway-network-starts-official-service-in-korea-5793085

Verizon-Corning $1.05B fiber deal part of larger build-out or buy program

Executive Summary: Verizon has agreed to purchase optical fiber from Corning through 2020 for at least $1.05 billion. Verizon will buy up to 12.4 million miles of fiber each year, much of it for wireless backhaul [1] of its 4G and upcoming “5G” [2] networks.

Note 1. Fiber backhaul promises to be a huge issue for 5G as most cell towers today are not fiber connected. Verizon has announced it would be deploying a pre-standard version of 5G in mid 2017.

Note 2. We’ve pounded, smashed and broken the table by repeatedly stating that ALL “5G” rollouts prior to 2021 will be non-standard as the ITU-R “real 5G” recommendations from IMT 2020 WP5D won’t be completed till the end of 2020. In fact, the Radio Access Network technologies won’t be chosen till mid to late 2018!

…………………………………………………………………………………..

The deal: Corning will sell up to 12.4 million miles of optical fiber to Verizon each year from 2018 through 2020, with a minimum purchase commitment of $1.05 billion, according to the agreement.

In a statement, Verizon said the deal would help it meet its rollout schedule for a fiber-optic network in Boston. Verizon began fiber rollouts in Boston last year under a One Fiber initiative that calls for densifying fiber assets to prepare for “5G” fixed wireless services.

Verizon is testing a 5G fixed wireless service with equipment maker Ericsson in 11 U.S. markets and expects a commercial launch as early as 2018.

U.S. Federal Communications Commission (FCC) Chairman Ajit Pai said in a statement that he supported the Verizon-Corning deal and that the agency would “continue to focus on creating a regulatory climate that favors greater investment and competition.”

What’s Next for Verizon Fiber Build-out or Buy?

Verizon and competitor AT&T Inc have been buying assets in preparation for 5G roll-outs. On Friday, sources told Reuters that Verizon is considering making a buyout offer for wireless spectrum license holder Straight Path Communications Inc that would top AT&T‘s $1.25 billion bid for that company.

Verizon has said it would evaluate opportunities to build out or buy fiber on a market-by-market basis. In February, Verizon said it had closed on its acquisition of XO Communications’ fiber-optic network business for about $1.8 billion.

Earlier this year, Verizon released a forecast of its capital expenditures for 2017 as somewhere between $16.8 billion and $17.5 billion. Beyond the Corning deal, how much of Verizon’s CAPEX budget will be used for additional fiber build-outs is unclear.

Verizon has said it would evaluate opportunities to build-out or buy fiber on a market-by-market basis. In February, Verizon said it had closed on its acquisition of XO Communications’ fiber-optic network business for about $1.8 billion.

Verizon has also hinted at an interest in buying cable provider Charter Communications Inc, which would give it access to a fiber and cable network across 49 million homes.

Verizon Chief Executive Lowell McAdam told investors in December that a deal with Charter would make “industrial sense,” igniting takeover speculation.

But in an interview with CNBC on Tuesday, McAdam said the company had not found the right “architectural fit” that would justify doing a big deal.

References:

http://in.reuters.com/article/us-corning-verizon-idINKBN17K201

http://www.lightreading.com/gigabit/fttx/verizons-fiber-spend-wont-end-with-corning/d/d-id/732163

Verizon Merger Talk- Anything Goes….or Maybe NOT?

Merger and acquisition speculation has been rampant since the Federal Communications Commission (FCC) ended its quiet period following the completion of the incentive auction for wireless spectrum. Several telecom industry market analysts believe Verizon could end up buying Dish Network LLC to acquire new spectrum assets, but others believe the company may be in the hunt for a cable operator like Comcast Corp or Charter Communications Inc. to earn itself a last-mile network in several markets that could serve as backhaul for new 5G services.

On Tuesday, Verizon CEO Lowell McAdams told Bloomberg that his company would be open to merger talks with Comcast Corp., Walt Disney Co. or CBS Corp. Is that all?

As the company upgrades its infrastructure to provide fifth-generation, or “5G” wireless services, Comcast’s fiber assets in particular could be used for cellular backhaul, which will be necessary due the surge in bandwidth capacity demands.

Mr. McAdam would entertain deal talks with Comcast CEO Brian Roberts to achieve those goals, he said in an interview Tuesday at Bloomberg’s New York headquarters.

“If Brian came knocking on the door, I’d have a discussion with him about it,” McAdam said. “But I’d also tell you there isn’t much that I wouldn’t have a discussion around if somebody came and said ‘Here’s a compelling reason why we ought to put the businesses together.’”

Among cable giants, Comcast has the best fiber assets, in addition to a compelling media business with NBC Universal. McAdam said he would take that same call from Disney’s Bob Iger or CBS’s Les Moonves.

A combination between Verizon and any of the three companies would dramatically reshape the media and telecommunications industry, following AT&T Inc.’s $85.4 billion proposed acquisition of Time Warner Inc. — a deal that would make the telecom carrier one of the biggest producers of TV shows and movies in the world.

A major media deal would also be a departure for New York-based Verizon, whose acquisition strategy has so far contrasted with that of arch-nemesis AT&T. While the Dallas-based phone carrier snapped up satellite provider DirecTV and agreed to buy Time Warner in transactions valued in the tens of billions of dollars, Verizon has spurned old media and kept its purchases below $5 billion.

In the last two years, McAdam’s company has done deals for advertising technology and web traffic, acquiring AOL Inc. and the internet assets of Yahoo! Inc. Those are a far cry from McAdam’s most famous deal, the $130 billion acquisition of Vodafone Group Plc’s 45+% stake in Verizon Wireless in 2014.

Verizon’s most prominent entertainment investment so far has been go90, a YouTube-like video streaming service targeted at teens and preteens. The service hasn’t been a huge hit, so other media platforms that get more viewers could be attractive for Verizon.

“Randall buying into content has made people reevaluate their portfolio,” McAdam said of AT&T CEO Randall Stephenson. “We’re still very excited about Yahoo, bringing them into the fold with AOL. We’re building a lot of millennial-focused content. There are a lot of options out there.”

Verizon has looked to these smaller digital acquisitions to remake itself as the wireless price wars rage on. The carrier, which counts on the mobile-phone business for 75 percent of its sales, has struggled to find a balance between preserving profits and wooing subscribers with promos, freebies and price-cuts. In February, the company started offering unlimited data services for the first time, in part a capitulation to rivals who have stolen away their customers with similar offerings.

Shares of Verizon have fallen 4.9 percent in the past year through Tuesday, while CBS has surged 26 percent, Comcast 20 percent and Disney 13 percent.

Despite more favorable regulatory conditions, there’s no certainty a megadeal will get done. Cable, phone and media companies operate differently, with different management styles, and often have incompatible assets.

“Given what I know about architecture, financial requirement, cultural fit, there’s never a dream deal,” McAdam said.

For now, Verizon is focused on building a fiber-rich 5G network and developing a business that will place the company in direct competition with ad giants Google and Facebook.

“You can always have a wish list, but the practicalities of it limit your wish list,” McAdam said of deals. “My wish list right now? If I can find a company that had the fiber built for this architecture I’d scoop them up in a minute, but they don’t exist.”

…………………………………………………………………………………………

That doesn’t mean Verizon is going to announce a huge merger any time soon. In another interview on CNBC yesterday, McAdam said that Verizon hasn’t found the right fit for a merger from a network architecture standpoint. McAdam said Verizon is installing a lot of fiber to support its wireless network and that no company is matching what Verizon is doing.

McAdam reportedly said in December that a merger with Charter would make “industrial sense.” CNBC’s David Faber asked McAdam about that comment yesterday, and the CEO answered. “As we’ve looked at companies around the US, there is nobody building to the architecture that we’re talking about.”

McAdam then described Verizon’s plans to increase the density of fiber in cities such as Boston, saying, “A cable company would have customers, obviously, would have infrastructure, conduits, pole attachments. But it doesn’t have that kind of fiber.”

McAdam’s various comments about mergers aren’t contradictory. To summarize, he’s open to mergers with just about any company that can pitch a deal that makes sense, whether it’s another network operator or a programmer. But so far, McAdam is not convinced that other big network operators have the architecture to help Verizon’s fiber rollout.

Comcast says it has 145,000 miles of fiber installed across its 39-state territory, in addition to its extensive coaxial cable deployments. Verizon yesterday announced a deal with Corning to purchase up to 37.2 million miles of optical fiber and related hardware over the next three years.

“I think our shareholders expect us to look at every option, but I would tell you right now we haven’t seen the architectural fit, and we haven’t seen a willing seller and a willing buyer to have a meeting of the minds,” McAdam also said in the CNBC interview. “From a fiber perspective, nobody, whether you’re a fiber company or you’re a cable company, you don’t have the architecture that we’re talking about today.” For now, Verizon is building that architecture itself, he said.

Verizon now seems to be more interested in mobile Internet service (via the nation’s largest wireless network) than wireline home Internet (via FiOS) and has concentrated its landline network in the Northeast US after selling off networks in other states. Even where it still operates wired home Internet service, Verizon has clashed with city officials who say the company has failed to complete fiber-to-the-home rollouts. New York City filed a lawsuit against Verizon last month, seeking a court order to force Verizon to finish installing fiber throughout the city.

But buying a cable network might still be attractive to Verizon because cable dominates the high-speed broadband market, while much of Verizon’s wireline network is stuck on outdated DSL technology. While Verizon has the most mobile subscribers in the country, Comcast is the nation’s largest cable company and home Internet service provider. A merged Verizon and Comcast would have nearly 32 million Internet subscribers (24.7 million from Comcast and 7 million from Verizon), about 9 million more than Charter, the second biggest home Internet provider.

Verizon and Comcast have overlapping territories, so many customers who have two Internet choices today would be left with just one if they merged.

There’s more to consider than home and mobile Internet service when it comes to a potential Verizon/Comcast merger. Both companies have expanded into providing video and online content over the networks that they operate. Comcast owns TV programmers such as NBCUniversal and various regional sports networks, while Verizon owns AOL and is buying Yahoo. Verizon wants a piece of the online video streaming market but has struggled with its Go90 offering.

Comcast has reportedly acquired programming rights to offer TV channels nationwide, paving the way for a potential video service that would extend beyond Comcast’s cable territory.

References:

https://arstechnica.com/information-technology/2017/04/verizon-ceo-wed-consider-merger-with-almost-anyone-including-comcast/

ETSI ENI Group elects officers; AI to improve telecom network deployment & operations

Verizon-UK, China Telecom, Huawei and others are taking part in a new “Experiential Networked Intelligence” (ENI) industry specifications group (ISG) at ETSI, or the European Telecommunications Standards Institute, looking at how artificial intelligence (AI) could be used to improve the deployment and operation of telecom networks. The new AI group will cooperate with other industry organizations in advancing this topic area.

Last week, ETSI announced the elections of a chair and vice-chair for this new ENI Industry Specification Group.

“The purpose of the group is to define a Context Aware System using Artificial Intelligence (AI) based on the ‘observe-orient-decide-act’ control model,” ETSI said on its website. “This enables the system to adjust offered services based on changes in user needs, environmental conditions and business goals.”

The group will “improve operators’ experience regarding network deployment and operation, by using AI techniques,” Huawei’s Raymond Forbes said on ETSI’s website. Mr. Forbes is the chairman of the new group. “By introducing technologies such as SDN, NFV or network slicing, the network becomes more flexible and powerful,” added China Telecom’s Haining Wang, the group’s vice-chair. “Nevertheless, the complexity of the future network is not reduced, but transferred from hardware to software, from the network itself to management and operation, from equipment to people. Experiential Networked Intelligence is expected to help operators to solve these problems.”

Here’s the complete list of ISG ENI Members:

- China Academy of Telecommunications Research of MIIT

- China Telecommunications Corporation

- Huawei Technologies Co., Ltd.-China

- Huawei Technologies Co., Ltd. – UK

- Huawei Technologies Sweden

- Interdisciplinary Centre for Security, Reliability and Trust/University of Luxembourg

- PT Portugal SGPS SA

- Samsung R&D Institute – UK

- Verizon UK Ltd. – UK

- WINGS ICT Solutions – GR

- Xilinx Ireland

ETSI (European Telecommunications Standards Institute) creates a variety of standards for fixed, mobile and internet communications. They generally pass their specifications to ITU-T for further work leading to ITU recommendations. In the case of NFV (Network Function Virtualization), the ETSI work was input to OPNFV open source group within the Linux Foundation. The new ETSI ENI group said it would work on the topic with other standards organizations including IETF, MEF, 3GPP and others.

This isn’t the first time artificial intelligence has been discussed in the realm of telecommunications. For example, AT&T’s Brian Daly said last year the carrier is experimenting with AI to make its processes more efficient. And Verizon earlier this year said its “Exponent” initiative will include big data and AI to help carriers monetize troves of data through the application of advanced machine learning techniques and deep analytics.

SoftBank’s Masayoshi Son said earlier this year that the “singularity”—the idea that the invention of artificial superintelligence will trigger massive technological growth and cultural change—will happen in the next handful of years.

References:

IHS-Markit: China’s Mobile Infrastructure Mkt Declines Led by LTE CAPEX -16% Fall

By Stéphane Téral, senior research director and advisor, mobile infrastructure and carrier economics, IHS Markit

Highlights

- In China, the 2G, 3G and LTE (Long Term Evolution) mobile infrastructure market decreased 9 percent in 2016 from 2015, to US$12 billion

- A network sharing deal between China Unicom and China Telecom drove LTE capex down 16 percent year-over-year in 2016

- The Chinese mobile infrastructure macro hardware market is forecast to decline at a -34 percent CAGR (compound annual growth rate) from 2016 to 2021

Our Analysis

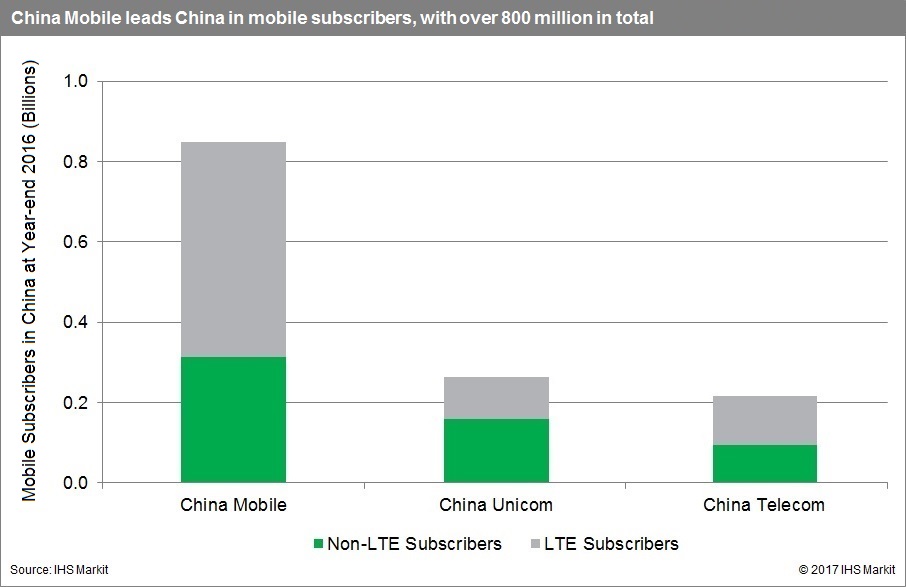

China, the world’s largest mobile subscriber base, had a total of 1.3 billion subscribers in 2016, 64 percent of them on China Mobile’s GSM/TD-SCDMA/LTE network. Fifty-eight percent of China’s mobile subscribers are now on LTE, up from 32 percent in 2015.

In 2016, a network sharing deal between China Unicom and China Telecom drove LTE capex down 16 percent year-over-year. However, the combination of both companies’ addition of FD-LTE (frequency division LTE) eNodeBs and China Mobile’s moderate TD-LTE (time division LTE) rollouts led to a combined total of 1,020,000 eNodeBs deployed—the same number as in 2015.

The overall 2G/3G/LTE mobile infrastructure market came to US$12 billion in 2016, falling 9 percent year-over-year at a time when China Unicom and China Telecom were building their nationwide FD-LTE rollout.

LTE revenue declined to about US$10 billion (-4 percent year-over-year) in 2016, sustained by flat eNodeB rollouts, and leaving combined 2G and 3G revenue at less than US$2 billion.

IHS expects the mobile infrastructure macro hardware market in China to continue to go south, with a double-digit decline anticipated in 2017 due to the end of massive LTE rollouts. In the long run, we forecast the Chinese RAN and packet core infrastructure market to slow down further to US$2 billion in 2021, a -34 percent 2016–2021 CAGR.

Chinese Mobile Report Synopsis

Based on the IHS Markit worldwide Mobile Infrastructure Quarterly Market Tracker, the country-specific Mobile Infrastructure: China Annual Market Tracker focuses on 2G GSM, 3G CDMA2000 (TD-SCDMA, W-CDMA) and 4G LTE (E-UTRAN, EPC) mobile network equipment and subscribers in China. It provides market size, vendor market share, forecasts through 2021, analysis and trends.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

T-Mobile & Dish Networks Dominate $19.8B FCC Auction

T-Mobile US Inc bid $8 billion while Dish Network Corp bid $6.2 billion to win the bulk of broadcast airwaves spectrum for sale in a government auction, the U.S. Federal Communications Commission said on Thursday.

The two carriers accounted for most of the $19.8 billion in winning bids, the FCC said. Comcast Corp agreed to acquire $1.7 billion in spectrum, AT&T Inc. bid $910 million and investment firm Columbia Capital offered $1 billion. It wasn’t immediately clear what Comcast and Dish plan to do with the airwaves. Comcast said earlier this month it would start selling cellphone service to its home internet customers, and the service runs off the back of Verizon’s network. Dish has been amassing a trove of wireless airwaves for years that it has yet to put to use.

The complex FCC reverse auction invited television broadcasters to sell their airwaves with opening prices provided by the government. Those bids fell until the agency got the licenses it needed at the lowest possible price. Then, the FCC sold those airwaves to companies that wanted them for cellular service. The FCC said that 175 broadcast TV stations were selling airwaves (spectrum) to 50 wireless and other telecommunications companies. Companies plan to use the spectrum to build new wireless networks or improve existing coverage.

The spectrum auction’s end is widely expected to kick off a wave of deal-making in the telecom industry. Until now, companies participating in the auction have been restrained by a quiet period, but that will end after April 27, when down payments are due from auction winners.

T-Mobile said its $8 billion winning bid would enable it “to compete in every single corner of he country.” The company, controlled by Deutsche Telekom AG , said the investment will quadruple its low-band holdings.

Verizon Communications Inc. and AT&T Inc., the nation’s largest wireless carriers by subscribers, largely sat out this FCC auction, which began last year. AT&T offered $910 million for the licenses, while Verizon declined to bid.

The FCC sale included one tier that could be bought by anyone and a “reserve” tier of low-band airwaves was set aside for companies that didn’t already own a significant amount of them.

The rule largely prevented AT&T and Verizon from bidding on the reserve tier and also restricts most sales by the winning bidders to AT&T or Verizon. Even though Verizon didn’t buy any spectrum at this FCC reverse auction, the company said it was confident in its network position.

The airwaves are particularly important for T-Mobile, which until recently held almost no low-band frequencies. As a result, its network has suffered in buildings and rural areas.

AT&T and Verizon have more recently spent billions of dollars securing rights to higher-frequency spectrum that they hope will be useful in ultra-fast networks still being developed.

…………………………………………………………………………………

The FCC noted the 600 MHz incentive auction generated nearly $7 billion for the U.S. Treasury for deficit reduction; more than $10 billion of the proceeds will go to broadcasters that chose to relinquish spectrum usage rights; and up to $1.75 billion for other broadcasters that incur costs in changing channels.

Television broadcasters that gave up their spectrum holdings as part of the auction’s reverse bidding process are now on the clock to give up those licenses over the next 39 months. That timing would put full spectrum availability into early 2020, or about the time most expect commercial “5G” services to be coming on air.

Initial 5G deployments are expected to focus on higher band spectrum licenses in the 3.5 GHz band as well as millimeter wave bands higher than the 15 GHz band. These bands are set to include broad swaths of spectrum support in order to meet the expected capacity needs of 5G services.

However, broader coverage will require lower spectrum bands. Many see 5G deployments relying heavily on current LTE deployments using low-band spectrum in order to meet coverage demands, with the 600 MHz spectrum able to bolster the supply.

FCC Chairman Ajit Pai applauded the proceedings, which began under his predecessor Tom Wheeler, but noted hard work remained.

“Today marks a major accomplishment for the commission: the ‘auction’ portion of the world’s first incentive auction is officially over,” Pai said in a statement. “The reverse and forward auctions have concluded and the results have been announced. But this process is far from over. Now, we begin the post-auction transition period. This day has been a long time coming. We congratulate all bidders who were successful in the incentive auction, and we applaud all of those past and present commission staffers who worked so diligently on every aspect of this complex undertaking. We have only reached this point because of their tremendous skill and dedication to this groundbreaking endeavor. Again: While we celebrate reaching the official close of the auction, there is still much work ahead of us. It’s now imperative that we move forward with equal zeal to ensure a successful post-auction transition, including a smooth and efficient repacking process.”

References:

http://ca.reuters.com/article/businessNews/idCAKBN17F2CJ-OCABS

https://www.wsj.com/articles/fccs-tv-airwaves-auction-drew-19-8-billion-led-by-t-mobile-1492110623

Verizon Tests Drones for Disaster Service using Flying LTE Cell Site

Verizon Communications flew drones earlier this month to test their ability to support a “flying cell site” for LTE service over various distances. The company said the test sought to simulate an environment like those that occur when disasters knock out communications services.

Verizon said the test, conducted on April 5 at Woodbine Municipal Airport in Woodbine, N.J. and spotted by DSL Reports, was also designed to “simulate an environment in which commercial power is knocked out indefinitely after a severe weather event or other disaster that interrupts traditional communications services.”

The carrier said the test was done under a Certificate of Waiver or Authorization (COA) issued by the FAA to Cape May County in preparation for a major emergency preparedness exercise in May involving county, state and federal emergency responders.

“This new test builds upon our leadership in conducting the first successful demonstration in the U.S. for providing aerial coverage from a long-endurance medium altitude aircraft with AATI in Cape May last October,” Verizon’s Christopher Desmond said in a statement.

References:

http://www.dslreports.com/shownews/Verizon-Tests-LTE-Wireless-Delivery-Via-Drone-139332

http://www.multichannel.com/news/policy/verizon-trials-lte-drone/412098

Verizon buys Skyward, a drone operations company