Month: July 2018

Analysys Mason: Public WiFi to add $20B to India’s GDP

Public Wi-Fi can play a key role in driving ubiquitous connectivity and digital inclusion in India, as explored in an Analysys Mason report – ‘Accelerating connectivity through public Wi-Fi: Early lessons from the railway Wi-Fi project.’

Despite fast increases in number of people connected (316 million at the end of 2017, compared to 200 million the previous year), mobile broadband penetration in India stood at only 31% at the end of 2017, still significantly behind many of India’s peers. The report, prepared through the lens of Google and Railtel Public Wi-Fi project, support the Government’s ambition under the draft NDCP to reach 5 million access points in 2020 and 10 million in 2022, to provide an all-pervasive coverage and internet connectivity, for 600 million Indians.

David Abecassis, partner at Analysys Mason, said: “In the last few years, India has made significant progress in driving mobile data usage, thanks to improved networks, and low cost data. But to really achieve the connected India vision, India will need to further invest in developing public Wi-Fi as a complement to mobile and fiber broadband.”

According to Abecassis, the Google and RailWire project to deploy high speed Wi-Fi across 400 stations has shown that there was a technical and operational solution to providing high-quality public Wi-Fi to millions of Indians nationwide, on affordable terms.

“The success of this rollout and Reliance Jio’s 80,000 public Wi-Fi access points as of mid-2017 provided valuable insights in further developing public Wi-Fi as a service that can truly achieve the Digital India vision,” he added.

The report further outlines an opportunity to develop a wider connectivity ecosystem with Public Wi-Fi as a key component, which can not only benefit users and wireless ISPs, but also telecom service providers, handset manufacturers and venue owners. ISPs can benefit by monetizing demand for faster mobile broadband and higher data volumes on their networks, as people get used to fast speeds and ubiquitous connectivity.

Analysis Mason found that around 100 million people would be willing to spend an additional USD 2 to 3 billion per year on handsets and cellular mobile broadband services, as a result of experiencing fast broadband on public Wi-Fi. In addition to driving productivity improvements from high speed Wi-Fi for the overall economy, public Wi-Fi can also translate into tangible benefits to GDP, by around USD 20 billion between 2017-19 and at least billion per annum thereafter.

References:

Google’s Internet Access for Emerging Markets – Managed WiFi Network for India Railways

Brookings Institute 5G Game Plan for the U.S. vs Opinion

Can the U.S. catch up with China and South Korea, which are paving the way forward to deploy 5G wireless networks (whatever that means?)

Here’s what the Brookings Institute recommends for the U.S. 5G effort:

U.S. 5G deployment process is slowed by outdated regulatory processes, spectrum scarcity, and local bureaucracy related to building local towers and other infrastructure. The U.S. faces unique challenges associated with the deployment of small cells, which are antennae the size of a pizza box that enable 5G’s signal strength and resiliency. Deployment delays also result from approval times on small cell applications, permitting, and zoning processes at the local level.

While the U.S. has correctly identified 5G leadership as an important goal, a coordinated, comprehensive, and focused approach by Congress, state and local leaders, and the private sector will be needed. Currently, municipalities, states, industry, and other government agencies in the U.S. lack a comprehensive and synchronized strategy, or what I call a “5G game plan,” that harmonizes the goals of public policies, investments, and the public interest.

While having a common goal should be the foundation of any proposed 5G game plan, the framework for this discussion should also prioritize the following three points.

1. The U.S. must rapidly adopt complementary public policies with timelines that address ongoing spectrum shortage concerns.

Higher frequency spectrum will be the lifeblood for advanced wireless networks. Both the House and Senate have recently introduced the bipartisan AIRWAVES Act to expedite the creation of a pipeline of spectrum for 5G by requiring the FCC and the National Telecommunications and Information Administration to make it available across a variety of frequencies, including low-, mid-, and high-bands. While the current legislation has broad bipartisan appeal, it’s important for Congress to act in a timely way. The AIRWAVES Act complements the recent enactment of the RAYBAUM and MOBILE NOW Acts as part of the 2018 omnibus appropriations bill, which paves the way for future auctions and speeds up 5G infrastructure.

Concurrently, the FCC also has the opportunity to bring much-needed mid-band spectrum to market by adopting rules for the 3.5 gigahertz band that will promote 5G deployments. At its July meeting, the FCC launched a proceeding that has the potential to free up hundreds of megahertz of mid-band spectrum in the 3.7 to 4.2 gigahertz band. The agency is also making available high-band spectrum that will, among other things, help free up more millimeter-wave spectrum bands, improve operability requirements within 24 gigahertz bands, and adopt a sharing framework for terrestrial and fixed satellite services.

While all of these actions can address spectrum scarcity concerns, U.S. policymakers and agencies at all levels need to collaborate to hasten the availability of spectrum for commercial wireless use. They also need to work toward short- and long-term coordinated plans that may render even better and faster results.

2. The deployment of small cell technologies must become a priority to accelerate 5G infrastructure.

It is equally important that local, federal, and industry stakeholders work collaboratively on small cell deployment, which is the technical architecture required at the local level. With more than 89,000 local governments in the U.S., policymakers must strike a balance that harmonizes and expedites processes and approvals, and still provides specific localities, especially tribal lands, the ability to provide guidance on safety and aesthetics.

To this end, policymakers should identify and work on laws and regulations at the municipal, state, and federal levels that effectuate a 5G game plan. Jurisdictions without a plan should employ strategies for advancing wireless networks rather than delay the deployment of next-generation mobile networks for their residents, including updates to the guiderails for state and local siting. As of June 1, 2018, 20 states have enacted legislation modernizing regulations to facilitate small cell deployment, and more should follow suit.

Congress is also taking its own steps to expedite 5G readiness. Last month, Senate Commerce Committee Chairman John Thune (R-SD) and Communications Subcommittee Ranking Member Brian Schatz (D-HI) introduced legislation to speed up small cell deployment called the Streamlining the Rapid Evolution and Modernization of Leading-Edge Infrastructure Necessary to Enhance Small Cell Deployment Act (or STREAMLINE Small Cell Deployment Act). The legislation creates a shot clock between 60 and 90 days for state and local governments to decide on industry applications for small cell installation. If the entity misses the deadline, the application would be automatically approved. The legislation also ensures that localities don’t foot the bill for installation of small cells, and requires reasonable cost-based fees for processing applications. Finally, the bill calls for a GAO study on the important issue of identifying barriers to broadband deployment on tribal lands.

While there are legitimate concerns from municipalities about unfair burdens and deadlines, political dogma should not overtake this issue. If passed, the STREAMLINE Small Cell Deployment Act may go a long way toward finding a balance between local entities, the federal government, and the private sector to avoid burdensome application processes, unfair and disparate fee structures between localities, and difficult compliance requirements for municipalities. Moving forward, these issues require a multi-stakeholder approach where policymakers and practitioners can embrace the ultimate benefits of 5G deployment, particularly those that will accrue social and economic value back to constituents.

3. Stakeholders involved in 5G deployment must keep top of mind the economic and social good that these next-generation networks can deliver.

The final leg of the 5G game plan is to ensure that efforts are ultimately promoting economic and social good. For example, 5G networks can enhance healthcare through the integration of electronic and digital devices (e.g., sensors, smartphones), in upward of $650 billion savings by 2025 provided that faster and more reliable networks enable new technologies, according to a report commissioned by Qualcomm. From medical internet of things devices to online consultations, the capture of real-time medical information and data analytics will empower the healthcare sector, patients, and government to find remedies for skyrocketing costs.

In the healthcare industry and other sectors, 5G can reduce costs for the governments that deploy these networks, the consumers who are in need of additional savings (especially for public interest applications and services), and the enterprises that desire a faster access to the global marketplace.

These three points are not meant to be exhaustive, but a starting point for building a sustainable, competitive, and resilient 5G game plan. The game plan should also include proposals on policies that accelerate fiber availability and regulatory permissions that should go to wireline providers that are also critical to 5G deployment.

But what should be evident is that without a plan that addresses both the priorities of multiple stakeholders as well as the technical requisites of this emerging technology, the U.S. will not be 5G-ready, thereby falling behind our global competitors who seek dominance in the ecology driving the next-generation of wireless networks.

Christoph Mergerson contributed research to this blog post.

Alan’s Opinion:

First, we have to define and classify 5G while identifying the critically important use cases. Instead of doing that, wireless carriers have been making noise, promoting nonsense, hype and spin over their proprietary higher speed wireless networks, e.g. fixed BWA, mobile 5G, 5G backhaul from a WiFi hotspot, etc.

Next, carriers MUST respect and not ignore the true 5G standards, from accredited standards bodies such as ITU-R, ITU-T, and IEEE 802.11. The 5G standards (especially IMT 2020 radio and non radio aspects) from those organizations won’t be completed for a couple more years but they will eventually take over from all the proprietary 5G offerings from 2018-to-2020. If that doesn’t happen, 5G won’t scale to serve a large number of users and the technology will be DOA!

IHS Markit: CSPs accelerate high speed Ethernet adapter adoption; Mellanox doubles switch sales

by Vladimir Galabov, senior analyst, IHS Markit

Summary:

High speed Ethernet adapter ports (25GE to 100GE) grew 45% in 1Q18, tripling compared to 1Q17, with cloud service provider (CSP) adoption accelerating the industry transition. 25GE represented a third of adapter ports shipped to CSPs in 1Q18, doubling compared to 4Q17. Telcos follow CSPs in their transition to higher networking speeds and while they are ramping 25GE adapters, they are still using predominantly 10GE adapters, while enterprises continue to opt for 1GE, according to the Data Center Ethernet Adapter Equipment report from IHS Markit.

“We expect higher speeds (25GE+) to be most prevalent at CSPs out to 2022, driven by high traffic and bandwidth needs in large-scale data centers. By 2022 we expect all Ethernet adapter at CSP data centers to be 25GE and above. Tier 1 CSPs are currently opting for 100GE at ToR with 4x25GE breakout cables for server connectivity,” said Vladimir Galabov, senior analyst, IHS Markit. “Telcos will invest more in higher speeds, including 100GE out to 2022, driven by NFV and increased bandwidth requirements from HD video, social media, AR/VR, and expanded IoT use cases. By 2022 over two thirds of adapters shipped to telcos will be 25GE and above.”

CSP adoption of higher speeds drives data center Ethernet adapter capacity (measured in 1GE port equivalents) shipped to CSPs to hit 60% of total capacity by 2022 (up from 55% in 2017). Telco will reach 23% of adapter capacity shipped by 2022 (up from 15% in 2017) and enterprise will drop to 17% (down from 35% in 2017).

“Prices per 1GE ($/1GE) are lowest for CSPs as higher speed adapters result in better per gig economies. Large DC cloud environments with high compute utilization requirements continually tax their networking infrastructure, requiring CSPs to adopt high speeds at a fast rate,” Galabov said.

Additional data center Ethernet adapter equipment market highlights:

· Offload NIC revenue was up 6% QoQ and up 55% YoY, hitting $160M in 1Q18. Annual offload NIC revenue will grow at a 27% CAGR out to 2022.

· Programmable NIC revenue was down 5% QoQ and up 14% YoY, hitting $26M in 1Q18. Annual programmable NIC revenue will grow at a 58% CAGR out to 2022.

· Open compute Ethernet adapter form factor revenue was up 11% QoQ and up 56% YoY, hitting $54M in 1Q18. By 2022, 21% of all ports shipped will be open compute form factor.

· In 1Q18, Intel was #1 in revenue market share (34%), Mellanox was #2 (23%), and Broadcom was #3 (14%)

Data Center Compute Intelligence Service:

The quarterly IHS Markit “Data Center Compute Intelligence Service” provides analysis and trends for data center servers, including form factors, server profiles, market segments and servers by CPU type and co-processors. The report also includes information about Ethernet network adapters, including analysis by adapter speed, CPU offload, form factors, use cases and market segments. Other information includes analysis and trends of multi-tenant server software by type (e.g., server virtualization and container software), market segments and server attach rates. Vendors tracked in this Intelligence Service include Broadcom, Canonical, Cavium, Cisco, Cray, Dell EMC, Docker, HPE, IBM, Huawei, Inspur, Intel, Lenovo, Mellanox, Microsoft, Red Hat, Supermicro, SuSE, VMware, and White Box OEM (e.g., QCT and WiWynn).

………………………………………………………………………………………………………………………………………….

Mellanox Ethernet Switches for the Data Center:

In the Q1 2018 earnings call, Mellanox reported that its Ethernet switch product line revenue more than doubled year over year. Mellanox Spectrum Ethernet switches are getting strong traction in the data center market. The recent inclusion in the Gartner Magic Quadrant is yet another milestone. There are a few underlying market trends that is driving this strong adoption.

Network Disaggregation has gone mainstream

Mellanox Spectrum switches are based off its highly differentiated homegrown silicon technology. Mellanox disaggregates Ethernet switches by investing heavily in open source technology, software and partnerships. In fact, Mellanox is the only switch vendor that is part of the top-10 contributors to open source Linux. In addition to native Linux, Spectrum switches can run Cumulus Linux or Mellanox Onyx operating systems. Network disaggregation brings transparent pricing and provides customers a choice to build their infrastructure with the best silicon and best fit for purpose software that would meet their specific needs.

25/100GbE is the new 10/40GbE

25/100GbE infrastructure provides better RoI and the market is adopting these newer speeds at record pace. Mellanox Spectrum silicon outperforms other 25GbE switches in the market in terms of every standard switch attribute.

FCC: 5G-High Band Spectrum Auctions Coming this November

FCC Chairman Ajit Pai says the first two 5G-specific high-band spectrum auctions in the U.S. will be in November, with more to follow in 2019. The FCC auctions will sell off the 28GHz millimeter wave (mmWave) band, with the bidding expected to start November 14, and the 24GHz band to be sold off “immediately afterward,” Pai said. He announced the auctions on a blog on Medium. The Federal Communications Commission (FCC) will vote to finalize the rules on the auctions at meeting on August 2.

“With so many wanting so much spectrum for 5G, we’re moving as quickly as possible to make these bands available for commercial use,” the FCC chairman wrote. Pai expects to hold 3 more millimeter wave auctions in the 2nd half of 2019 in the 37GHz, 39GHz, and 47GHz bands. “To help facilitate that auction on this timeline, I’m proposing rules to clean up the 39 GHz band and move incumbents into rationalized license holdings,” Pai writes. He didn’t say exactly how much spectrum will be auctioned yet, but the scale and scope of these planned high-band auctions appear to promise to open up the largest tranche of spectrum for wireless broadband yet seen in the U.S.

“5G has the potential to have an enormously positive impact on American consumers,” Pai said in a statement to USA TODAY. “High-speed, high-capacity wireless connectivity will unleash new innovations to improve our quality of life. It’s the building block to a world where everything that can be connected will be connected — where driverless cars talk to smart transportation networks and where wireless sensors can monitor your health and transmit data to your doctor. That’s a snapshot of what the 5G world will look like.”

The FCC is focused on making additional low-, mid-, and high-band spectrum available for 5G services.

- Low-band: Deploying service in 600 MHz bands post incentive auction.

- Mid-band: Exploring a shared service framework in the 3.5 GHz band and developing next steps for terrestrial use in the 3.7 GHz band.

- High-band: Unleashing spectrum at the frontiers of the spectrum chart, including pursuing millimeter wave spectrum for 5G terrestrial use and looking forward to spectrum auctions in 28 and 24 GHz bands.

At its regular monthly meeting Thursday, the FCC will also vote on on a proposal to allow 5G use for mid-band spectrum. This Fall’s upcoming series of high-band spectrum auctions, Pai said, will “make it easier to deploy the physical infrastructure that will be critical to the 5G networks of the future, I believe that the United States is well positioned to lead the world in 5G. … The large amount of spectrum that the FCC will make available for commercial use will enable the private sector to bring the next generation of wireless connectivity to American consumers.”

In July 2016, the FCC said that it planned to open up 3.85GHz of licensed spectrum in the 28GHz, 37GHz, and 39GHz band. The agency later voted to add 700MHz in the 24GHz band, and nearly 1GHz in the 47GHz band.

This would be an embarrassment of radio riches compared to earlier low-band 4G auctions. The 600MHz auction in 2017 offered 108MHz of spectrum nationwide.

High-band millimeter wave spectrum is expected to be a cornerstone of future gigabit-speed 5G network services. AT&T Inc, Verizon Wireless and T-Mobile US Inc. have all tested 28GHz spectrum for fixed or mobile services, sometimes both.

The August FCC meeting should further clarify exactly what will be offered in the forthcoming auctions. One question is whether T-Mobile and Sprint will be allowed to participate in the new auctions, which would likely enable them to build out a 5G pre-standard network in 2019 and in later years.

References:

https://www.lightreading.com/first-5g-specific-us-spectrum-auctions-coming-november/d/d-id/744609?

AT&T acquires AlienVault; says its customers demanded NB-IoT

1. AT&T buys AlienVault:

AT&T has announced plans to acquire cybersecurity company AlienVault. Terms of the deal were not disclosed.

Founded in 2007, AlienVault offers a number of tools for detecting and responding to security threats through its Unified Security Management (USM) platform, while its Open Threat Exchange (OTX) platform serves as an online community where security professionals and researchers can share their latest findings and threat data.

2. AT&T to offer NB-IoT:

AT& already offers cellular LPWAN services (LTE Category 1 and LTE Category M1) for its IoT customers who want to connect devices, assets and equipment to the cloud. Now, AT&T says NB-IoT opens up new use cases for IoT. However, the company did not reveal pricing for its NB-IoT data plan(s).

“We already are using LTE-M, and based on a lot of customer feedback we felt that we needed complementary services for other use cases, such as in a fixed asset tracking environment with very low bandwidth uses,” said Shiraz Hasan, VP, IoT solutions at AT&T. “The motivation is cost savings primarily, and the other thing is the ability to utilize the tech a little better because it penetrates even better than LTE-M.”

Shiraz said AT&T has a lot of customers in the security and alarm industries, and that many of these companies are evaluating IoT technology and learning that NB-IoT may serve their needs best. Alarms and locks are often located deep within buildings, so using cellular connectivity to monitor equipment health requires radio transmissions that can penetrate thick walls.

https://www.fiercewireless.com/wireless/at-t-says-customer-demand-prompted-nb-iot-launch

Nokia & China Mobile collaborate on 5G and AI; Nokia & Tencent on 5G in China

Nokia and China Mobile Collaboration Summary:

Nokia and China Mobile have signed an agreement (MoU) to investigate the potential of artificial intelligence (AI) and machine learning to optimize future wireless networks and enable the delivery of new edge cloud computing and “5G” services.

As part of the collaboration, the two companies will jointly establish a research laboratory in Hangzhou, China to develop a demo system to verify technology use cases using Nokia’s 5G Future X architecture. Meanwhile, China Mobile will lead the research of scenario selections, requirements confirmation, open API specifications and solution definition. Nokia and China Mobile will also conduct technology field trials and demonstrations.

The companies’ will also work together to research applications for AI and machine learning. The objective is to ensure any changes in data traffic demand are predicted and network resources are automatically allocated to meet all service demands with consistent high quality and reliability.

The collaboration is intended to foster an open RAN and 5G ecosystem as Nokia and China Mobile work with third parties to leverage AI and machine learning. A goal is to optimize next generation wireless networks for the delivery of high bandwidth, low latency services such as cloud virtual reality based gaming. The companies’ research will leverage Nokia AirScale Cloud RAN, AirFrame OpenRack, open edge server and ReefShark chipsets, as well as Nokia-developed AI middleware to access embedded intelligence.

China Mobile Research Institute (CMRI) deputy general manager Yuhong Huang said the wireless telco giant has been paying attention to the application of artificial intelligence for a long time, and is working to build an open and collaborative 5G+AI ecosystem.

“With the signing of this MoU, we are pleased to initiate the collaboration on the research of big data and machine learning technologies applying to 5G RAN network. [We will also] make joint effort in the O-RAN alliance which was kicked off recently to enhance the intelligence of 5G networks, reduce the complexity, and explore the new capabilities of the network,” Huang said.

“The use of AI and machine learning will enable myriad new services opportunities and we are pleased to leverage the capabilities of our 5G Future X architecture to support China Mobile’s AI research to optimize future networks and the delivery of many innovative new services,” said Marc Rouanne, Nokia’s President of Mobile Networks.

Teaming with Tencent to explore 5G initiatives in China

In a separate announcement, Nokia said it has struck a partnership with Chinese internet giant Tencent to jointly conduct R&D work to explore the potential of 5G that “will benefits billions of internet users in China.”

The two companies will establish a joint lab in Shenzhen that provides an end-to-end 5G test environment leveraging 5G technologies, products and solutions, including centralized and decentralized split architecture using Nokia Airscale Radio Access Network, 5G Core, MEC framework and third party devices.

Nokia and Tencent will conduct verification on service key performance indicators and develop new 5G and IoT use cases. Those two companies will also leverage the AI and automation management capabilities to promote international standards (which one’s were not specified), and to foster an open-source ecosystem that will expand the development of new services.

The pair will also be conducting 5G applications research by making use of technologies like edge computing, which will be of great advantage for a number of vertical markets, including transportation, finance, energy, intelligent manufacturing and entertainment.

This will potentially open up the widespread introduction of applications such as cellular vehicle-to-everything (C-V2X) communications and enhance the delivery of services such as cloud-based gaming and entertainment, the companies said.

References:

https://telecomtimes.com.au/2018/07/07/nokia-china-mobile-join-forces-in-ai-5g-research-push/

https://techblog.comsoc.org/2018/07/05/nokia-tencent-working-together-on-5g-applications/

IHS Markit: On-premises Enterprise Data Center (DC) is alive and flourishing!

by Cliff Grossner, PhD, IHS Markit

Editor’s Note: Cliff and his IHS Markit team interviewed IT decision-makers in 151 North American organizations that operate data centers (DCs) and have at least 101 employees.

………………………………………………………………………………………………………………………………………………….

Summary:

While enterprise have been adopting cloud services for a number of years now, they are also continuing to make significant investments in their on-premises data center infrastructure. We are seeing a continuation of the enterprise DC growth phase signaled by last year’s respondents and confirmed by respondents to this study. Enterprises are transforming their on-premises DC to a cloud architecture, making the enterprise DC a first-class citizen as enterprises build their multi-clouds.

The on-premises DC is evolving with server diversity set to increase, the DC network moving to higher speeds, and increased software defined storage with solid state drive (SSD) adoption, according to the Data Center Strategies and Leadership North American Enterprise Survey

“Application architectures are evolving with the increased adoption of software containers and micro-services coupled with a Dev/Ops culture of rapid and frequent software builds. In addition, we see new technologies such as artificial intelligence (AI) and machine learning (ML) incorporated into applications. These applications consume network bandwidth in a very dynamic and unpredictable manner and make new demands on servers for increased parallel computation,” said Cliff Grossner Ph.D., senior research director and advisor for cloud and data center at IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

“New software technologies are driving more diverse compute architectures. An example is the development of multi-tenant servers (VMs and software containers), which is requiring new features in CPU silicon to support these technologies. AI and ML have given rise to a market for specialized processors capable of high degrees of parallelism (such as GPGPUs and the Tensor Processing Unit from Google). We can only expect this trend to continue and new compute architectures emerging in response,” said Grossner.

More Data Center Strategies Highlights

· Respondents expect a greater than 2x increase in the average number of physical servers in their DCs by 2019.

· Top DC investment drivers are security and application performance (75% of respondents) and scalability (71%).

· 9% of servers are expected to be 1-socket by 2019, up from 3% now.

· 73% of servers are expected to be running hypervisors or containers by 2019, up from 70% now.

· Top DC fabric features are high speed (68% of respondents), automated VM movement (62%), and support for network virtualization protocols (62%).

· 53% of respondents intend to increase investment in software defined storage, 52% in NAS, and 42% in SSD.

· 30% of respondents indicated they are running general purpose IT applications, 22% are running productivity applications such as Microsoft Office, and 18% are running collaboration tools such as email, SharePoint, and unified communications in their data centers.

· Cisco, Dell, HPE, Juniper, and Huawei were identified as the top 5 DC Ethernet switch vendors by respondents ranking the top 3 vendors in each of 8 selection criteria.

Data Center Network Research Synopsis:

The IHS Markit Data Center Networks Intelligence Service provides quarterly worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends for (1) data center Ethernet switches by category [purpose-built, bare metal, blade, and general purpose], port speed [1/10/25/40/50/100/200/400GE] and market segment [enterprise, telco and cloud service provider], (2) application delivery controllers by category [hardware-based appliance, virtual appliance], and (3) software-defined WAN (SD-WAN) [appliances and control and management software], (4) FC SAN switches by type [chassis, fixed], and (5) FC SAN HBAs.

Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, CradlePoint, Dell, F5, FatPipe, HPE, Huawei, Hughes, InfoVista, Juniper, KEMP, Nokia (Nuage), Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, ZTE and others.

Busting a Myth: 3GPP Roadmap to true 5G (IMT 2020) vs AT&T “standards-based 5G” in Austin, TX

TRUTH about 3rd Generation Partnership Project (3GPP) and the path to 5G Standards:

3GPP is a very honest, focused and effective engineering organization that develops technical specifications – not standards. Not once has 3GPP contributed to the hype and spin embedded in “5G” propaganda and fake news. It is the 3GPP member companies, service providers, and the press that’s guilty of that disinformation campaign.

From the 3GPP website under the heading Official Publications:

The 3GPP Technical Specifications and Technical Reports have, in themselves, no legal standing. They only become “official” when transposed into corresponding publications of the Partner Organizations (or the national / regional standards body acting as publisher for the Partner). At this point, the specifications are referred to as UMTS within ETSI and FOMA within ARIB/TTC.

Some TRs (mainly those with numbers of the form xx.8xx) are not intended for publication, but are retained as internal working documents of 3GPP. Once a Release is frozen (see definition in 3GPP TR 21.900), its specifications are published by the Partners.

All of the above and more were explained in this blog post, but apparently no one paid any attention as the claims of being compliant with “3GPP standards” abound. Here are two from AT&T:

1. After the 3GPP New Radio (NR) description/specification was completed in 3GPP Release 15:

“We’re proud to see the completion of this set of standards. Reaching this milestone enables the next phase of equipment availability and movement to interoperability testing and early 5G availability,” said Hank Kafka, VP Access Architecture and Analytics at AT&T. “It showcases the dedication and leadership of the industry participants in 3GPP to follow through on accelerating standards to allow for faster technology deployments,” he added.

2. In AT&Ts recent FCC application for an experimental radio license in Austin, TX, which is in this FCC filing:

“3GPP has developed 5G standards that became available in 2018.”

That statement was echoed in a Light Reading blog post titled: AT&T to Show Off Standards-Based 5G in Austin.

My rebuttal in an email to AT&T executives included this paragraph:

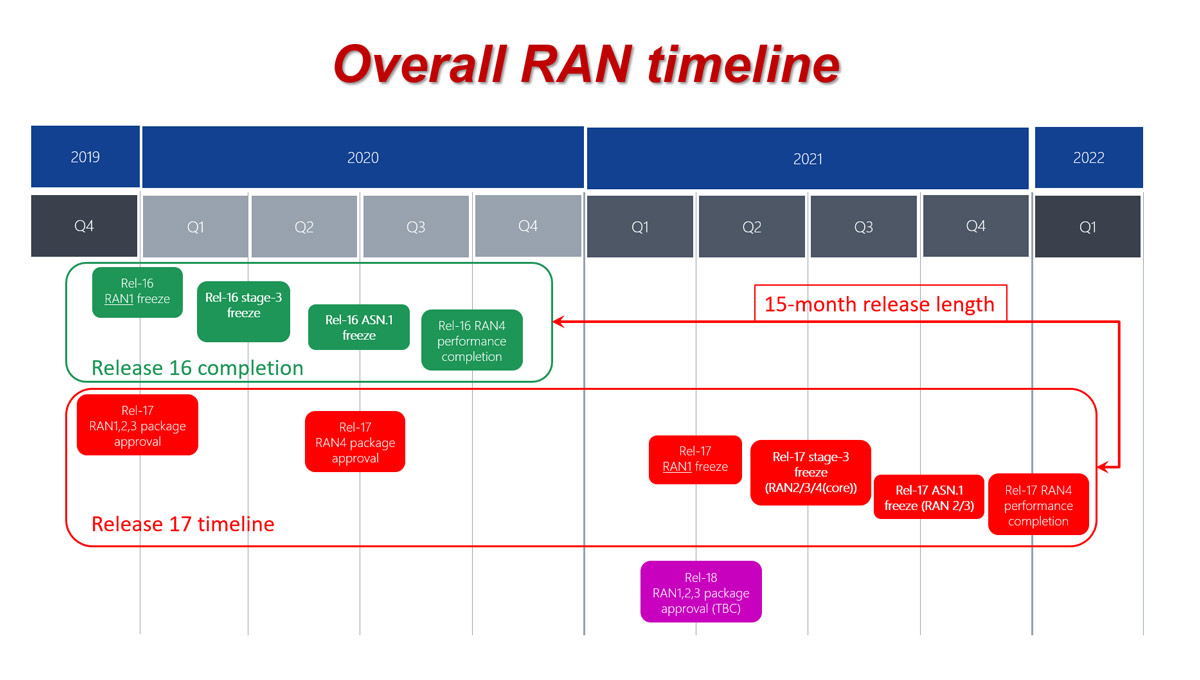

As you should be very well aware, 3GPP specifications have no official status and are not standards (as per their website). More importantly, 3GPPs “final 5G” spec will be in release 16 which won’t be completed till July 2019. Release 16 and parts of Release 15 will then be submitted for consideration as an IMT 2020 Radio Interface Technology (RIT) at the July 2019 ITU-R WP5D meeting- the first meeting which will evaluate IMT 2020 RIT/SRITs. All this info and much more is available at the 3GPP website with no log in required for access!…………………………………………………………………………………………………………………………………………………………………………

Here’s the actual status of 3GPP specs directed at 5G standards (IMT 2020) from 3GPP’s Submission of initial 5G description for IMT-2020:

This document December 2017 version of 3GPP Release 15) is the first of three planned steps spanning two releases from 3GPP, following the decision to submit preliminary descriptions of the solution only when milestones of high relevance are achieved:

- Release 15 December 2017 version;

- Release 15 June 2018 version and

- Release 16 (scheduled for July 2019)

The final and fully comprehensive 3GPP IMT-2020 submission (encompassing both Release 15 and Release 16) for IMT 2020 is planned for July 2019.

To help the ITU-R Evaluation Groups in their work, 3GPP is currently planning a workshop to present the 5G solutions to interested external bodies – specifically the Evaluation Groups – to allow a better understanding of the 3GPP technologies for 5G.

Here’s a free 3GPP webinar where you can get more information:

http://www.3gpp.org/news-events/3gpp-news/1966-webinar2_ran

……………………………………………………………………………………………………………………………………………………………………..

Comment from Kevin Flynn of 3GPP, which was inadvertently deleted when this website was move to a new compute server in early May 2019:

Hi Alan,

I have now updated the 3GPP page on Official Publications (http://www.3gpp.org/specifications/63-official-publications), referenced above. I hope that this does not undermine your excellent article in any way. I have updated the Partners & their web sites and modified the text to bring it up-to-date.

Thanks & best regards,

Kevin Flynn

3GPP Marketing Officer

……………………………………………………………………………………………………………………………………………………………………..

Debunking the 5G carrier and vendor claims:

As we’ve repeatedly stated, ITU-R WP 5D is the official standards organization for IMT 2020 (5G mobile). They will evaluate RIT/SRIT submissions at their July 2019 meeting. To date, 3GPP, South Korea, China, ETSI/DECT Forum, and TDSI have all indicated their intent to submit detailed RIT/SRIT proposals at the July 2019 ITU-R WP 5D meeting. There are significant differences amongst these proposed RITs which WP 5D must sort out and approve before the IMT 2020 standard is completed at the end of 2020.

Note also that there is NO IMT 2020 USE CASE FOR 5G FIXED WIRELESS ACCESS (FWA), so all claims about standards compliant 5G FWA (based on 3GPP release 15 “5G NR – Non Stand Alone” are bogus/fake.

“Non Stand Alone” (NSA) 5G NR means that a 4G-LTE network anchors the 5G NR access (see comments below this post). That LTE network is used for control plane signaling and for the Evolved Packet Core (EPC). In 5G NR NSA access, the LTE base station (eNB) and the 5G NR base station are interconnected with dual connectivity. The IMT 2020 standard will include a 5G packet core without any LTE components.

In addition to the IMT 2020 specified (by ITU-R) packet core there is the transport network for 5G, which is described in this ITU-T Technical Report (TR). There are fronthaul, midhaul and backhaul components described in that TR. It is a work in progress.

…………………………………………………………………………………………………………………………………………………………………………

AT&T to test “standards based 5G” at the Austin, TX Convention Center:

The FCC has just granted AT&T an experimental radio license to test what the mega carrier calls “standards-based 5G” in the convention center in Austin, Texas. The test will begin at the end of July. AT&T will run “up to 3” 28GHz fixed base stations in the convention center with connections to “up to 6” compatible user devices at up to 100 meters. AT&T promises demonstrations of 4K TV, volumetric video and eSports, as well mobile gaming, over the air, and more.

Indeed, Austin has been a hotbed for AT&T’s 5G developments. In February, the company announced plans to open a new 5G lab there. One of the first in-house projects built at the lab is the Advanced 5G NR Testbed System (ANTS), which AT&T describes as a first-of-its kind 5G testbed system that is proprietary to AT&T.

AT&T said in January 2018 that it plans to launch 3GPP release 15 based mobile 5G in up to 12 markets by the end of the year. The mega carrier (and now via Time Warner acquisition an entertainment content company) has been using special events around the country to showcase its 5G technology.

In early June, AT&T staged its Shape conference at Time Warner’s Warner Bros. Studios in Burbank, California, where it showed presentations on edge technologies, artificial intelligence and immersive entertainment, as well as a 5G demonstration with Ericsson and Intel.

At the Electronic Entertainment Expo (E3) in Los Angeles, AT&T conducted a 28 GHz demo to give gamers an up-close look at how a 5G connection can give them a live gaming experience virtually anywhere there’s network coverage. That demo also involved Ericsson, Intel and ESL.

Also in June, there was the 2018 5G demo at the U.S. Open, which took place at the Shinnecock Hills Golf Club in Tuckahoe, New York. Ericsson, Intel and Fox Sports were also participated in that demo.

………………………………………………………………………………………………………………………

4G Speeds Increase in the U.S. and Asia: Seoul, Korea and Singapore fastest 4G cities

4G (LTE and LTE Advanced) speeds have increased all over the world in the last year. In the U.S., PC Mag wrote:

Peak speeds have jumped from the 200Mbps range to the 300Mbps range, average download speeds have bumped up by 10Mbps or more, and latency has dropped by 10ms. That’s an impressive change in one year, and it continues the trend of improvement that we’ve seen over the past several years of testing.

As we get to a world where we can assume 20Mbps or higher download speeds on 4G in most cities, other questions arise: Where are those speeds most consistent? Where is the network most responsive, especially when you’re downloading pages made of many small files?

Our tests cover data speeds and reliability; we don’t make voice calls. But our awards for data service apply more and more to voice, too. All of the carriers other than Sprint now use voice-over-LTE, piping their voice calls through their data networks. So the reliability of those LTE data networks translates into the reliability of your HD voice calls, as well.

………………………………………………………………………………………………………………………………………………………………..

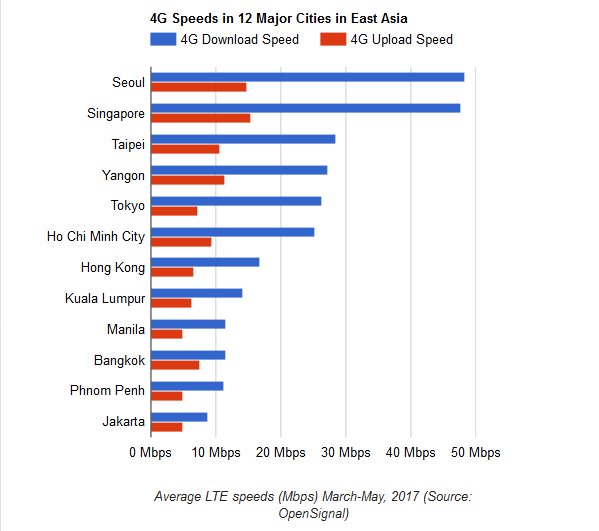

In Southeast Asia (including Japan, but not China except for Hong Kong), Seoul and Singapore are the fastest 4G cities, according to a regional ranking of major cities from OpenSignal. An analysis of 12 cities in the region shows that Seoul recorded an average 4G speed of nearly 50Mbps, with Singapore close behind.

Four cities demonstrated 4G speeds of over 25Mbps – Taipei, Tokyo, Yangon and Ho Chi Minh. The latter cities have benefited from having launched 4G just two years ago, which OpenSignal said suggests that they have not yet filled their networks to the extent that speeds have started to decline.

The final six cities examined all had speeds at or below the global average of 16.9Mbps. Hong Kong was highest among this grouping, followed by Kuala Lumpur, Manila, Bangkok, Phnom Penh and Jakarta.

OpenSignal noted that Southeast Asian operators are focusing on improving coverage over speed. Singapore topped the list for average 4G upload speed at 15.4Mbps, followed by Seoul and Yangon. But the gap between the fastest and slowest upload speed was only around 10Mbps, with even the slowest cities in the region, Phnom Penh and Jakarta, averaging 4G upload speeds of 4.9 Mbps.

As 4G connections are far superior to 3G connections, Southeast Asia’s wireless network operators seem intent on making LTE services accessible to the vast majority of their customers before they turn their attention to raw speed.

Nokia, Tencent working together on 5G applications

Nokia and Tencent will collaborate on 5G applications, testing and rolling out offerings to WeChat and QQ users, the companies announced. Under the partnership, the two will focus on products for the transportation, finance, energy, intelligent manufacturing and entertainment sectors, including edge computing, “Cellular Vehicle-to-Everything” and cloud-based entertainment.

Nokia to build and test 5G apps in China with Tencent, leveraging 1B+ WeChat and QQ users