CignalAI: Cloud and Colo Optical Hardware Spending Increases by 50% in North America; Century Link’s impressive fiber buildout

by Cignal AI staff

Overview:

Cloud and colocation (colo) operator spending on optical communications hardware continued to spur market growth in the first quarter of 2019, according to the most recent Optical Customer Markets Report from research firm Cignal AI. Cloud and colo spending increased over 50% in North America, offsetting declines in other regions, with Ciena continuing to lead all sales to cloud operators.

In EMEA, traditional telco (incumbent and wholesale network operators) optical spending recovered and will grow by double digits during 2019. Spending growth by these operators is slowing in APAC as total spending reaches record highs. Huawei continues to lead this market in APAC, EMEA, and CALA, while Ciena leads in North America.

“Optical spending in North America continues to shift from traditional telco providers to the cloud and colo operators,” said Scott Wilkinson, Lead Analyst for Optical Hardware at Cignal AI. “Despite traditional telco operators accounting for most spending, the rapid growth in cloud spending combined with traditional operators now adopting cloud architectures has permanently changed supplier R&D priorities.”

The Cignal AI Optical Customer Markets Report is issued quarterly and quantifies optical equipment sales to five key customer markets: Incumbent, Wholesale, Cloud and Colo, Cable/MSO, and Enterprise and Government.

The latest report is now enhanced and includes optical equipment vendor market share for all customer markets as well as updated forecasts through 2023.

Additional findings in the 1Q19 Optical Customer Markets Report include:

- Ciena Waveserver Ai market share continues to increase as cloud & colo spending grows. New compact modular platforms targeted at this market are entering the market in 2Q19 with Cisco, Infinera, and Nokia among those expecting stronger sales in the next quarter.

- North American cable/MSO spending declined in the first quarter. However, moderate growth is still expected in 2019.

- Enterprise and Government spending shows pressure from consolidation and Cloud and Colo encroachment and isn’t expected to recover in the next two years.

About the Optical Customer Markets Report:

The Cignal AI Optical Customer Markets Report tracks optical equipment spending by end customer market type. It provides forecasts based on expected spending trends by regional basis. The report includes revenue-based market size and share for all end customer markets across all regions.

Vendors examined include Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu Networks, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, MRV, NEC, Nokia, Padtec, TE Conn, Tejas Networks, Xtera and ZTE.

………………………………………………………………………………………….

About Cignal AI:

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

To purchase the report contact: [email protected]

……………………………………………………………………………………………

July 25, 2019 Update-CignalAI comments on Cisco-Acacia:

Two weeks ago, Cisco announced it was acquiring Acacia, a move that could transform the company into a market leader in a new era of pluggable coherent optics and disaggregated networks. Cisco was already a growing customer for Acacia and was poised to be one of the leading consumers of Acacia’s AC1200 module that is now reaching the market. Between Cisco’s previous Luxtera acquisition for short-reach optical technology and its current addition of Acacia for long reach coherent, the company will have deep vertical integration.

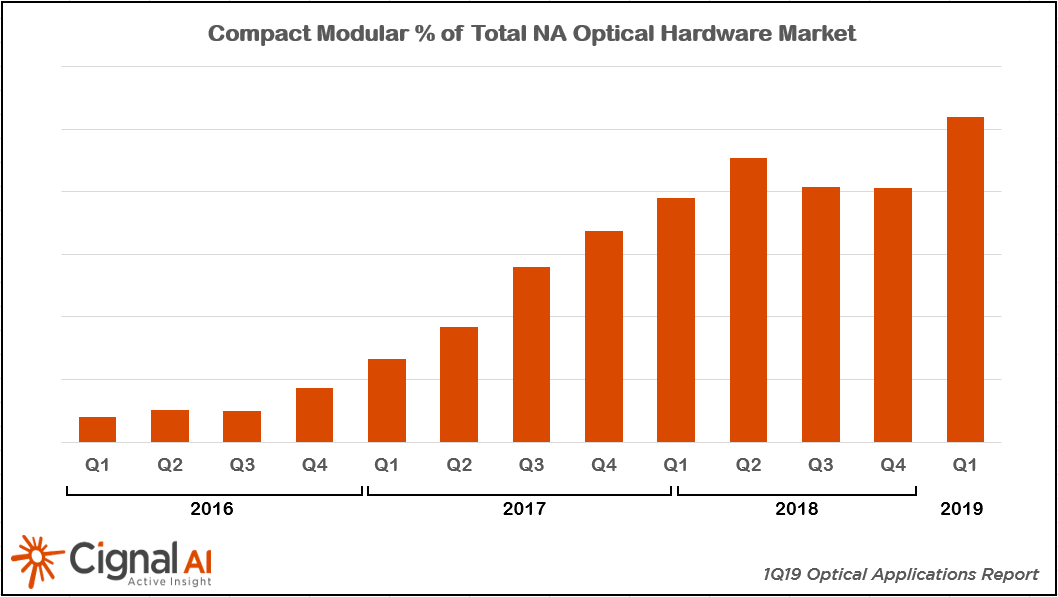

| Compact modular optical hardware is being used in more network applications than ever before, driving up sales during the first quarter of 2019 as reported in the latest Optical Applications Report. Worldwide, compact modular hardware sales are tracking to exceed $1 billion in revenue this year. |

………………………………………………………………………………………………………..

Separately, CenturyLink says it has completed the first of a two-phase build out that will see its fiber-optic networks in the U.S. and Europe grow by 4.7 million fiber miles. The new fiber infrastructure leverages ultra-low-loss fiber from Corning (NYSE: GLW) and will support businesses, government agencies, and other service providers who want access to fiber.

The first phase, completed in June, addressed CenturyLink’s U.S. requirements and connected more than 50 cities via 3.5 million new fiber miles. The European work, slated to finish in the first part of 2021, will see 1.2 million fiber miles installed. Both deployments leverage CenturyLink’s multi-conduit infrastructure, which the company says enables quick and economical fiber deploy and capacity expansion.

CenturyLink’s expanded fiber network connects more than 50 locations in the U.S. Image courtesy of Century Link

……………………………………………………………………………………………………

“Our newly built intercity fiber network, created with the latest optical technology, is another example of how our diverse fiber assets differentiate us from other network providers,” said Andrew Dugan, CenturyLink chief technology officer. “Our multi-conduit infrastructure has a significant amount of capacity for supporting the growing demand for fiber and will allow us to quickly and cost effectively deploy new fiber technology now and in the future. This uniquely positions CenturyLink to meet the needs of companies seeking highly reliable, low-latency network infrastructure designed to move massive amounts of data.”

CenturyLink was able to quickly and cost effectively complete the first phase of the project using multi-conduit infrastructure already in place. The company is currently selling routes to large enterprise companies and content providers in the U.S. and will work with customers to add additional routes as needed.

Key Facts:

- CenturyLink is creating an extensive 4.7-million fiber mile intercity fiber network across the U.S. and parts of Europe.

- The first phase, comprising 3.5 million fiber miles, was completed in June. An additional 1.2 million fiber miles will be added by early 2021.

- CenturyLink is currently selling fiber routes to large enterprise companies and content providers in the U.S.

- Multi-conduit infrastructure allows CenturyLink to quickly and economically deploy new fiber technology or add network capacity as needed.

- The investments in the first phase of the fiber upgrade are included in CenturyLink’s full year 2019 capital expenditure outlook.

- The expanded fiber network utilizes Corning’s SMF-28® ULL fiber and SMF-28® Ultra fiber, creating the largest ultra-low-loss fiber network in North America.

References:

http://news.centurylink.com/2019-07-23-CenturyLink-Expands-Fiber-Network-Across-U-S-and-Europe