China to launch 5G mobile networks on Friday with a huge government backed push

China’s three major wireless carriers— China Mobile, China Unicom , and China Telecom —will begin selling 5G services to consumers on Friday, November 1st in 50 major cities, including Beijing and Shanghai, said Chen Zhaoxiong, vice minister of the Ministry of Industry and Information Technology on Thursday October 31st at a Beijing conference. That will allow those with the few available 5G-China compatible smartphones to buy a subscription to access the network. The Chinese telcos will charge by speed rather than data used. See the section on 5G Subscriber Pricing below.

A woman using her cellphone walks past a vehicle covered in a China Unicom 5G advertisement in Beijing on Sept. 17. Chinese phone carriers will begin offering 5G service Friday. (China Stringer Network/Reuters)

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

The Chinese government has made building 5G a national priority, clearing red tape and reducing costs so the three wireless providers introduce the new technology as swiftly as possible. “They’ve made this a national priority. It’s part of the [Communist] Party‘s ability to show that it’s delivering the goods,” said Paul Triolo, head of geo-technology at the Eurasia Group consultancy. “And in the middle of the trade dispute and the actions against Huawei, it’s even more important for China to show that they are continuing to move forward despite all these challenges,” he added.

“This 5G technology is part of an overall, far-reaching revolution, and it will bring brand-new changes to the economic society,” China Telecom President Ke Ruiwen said at the launch Thursday.

China is forecast to spend between $130 billion and $217 billion on 5G between 2020 and 2025, according to a study by the state-run China Academy of Information and Communications Technology.

“The commercialization of 5G technology is a great measure of [President] Xi Jinping’s strategic aim of turning China into a cyber power, as well as an important milestone in China’s information communication industry development,” said Wang Xiaochu, president of China Unicom.

China President Xi has described the world as on the cusp of a fourth industrial revolution, one characterized by advances in information technology and artificial intelligence, analysts at Trivium China, a consultancy, wrote in a research note this week. “Xi wants to make sure that China is at the forefront of this new revolution — getting 5G up and running is a way to get a leg up in that race,” they said.

China’s central government wants 5G coverage extended to cover all of Beijing, Shanghai, Hangzhou and Guangzhou by the end of the year. The country’s largest carrier, China Mobile, which has 900 million cellphone subscribers, says it will be able to offer 5G services in more than 50 cities this year. Chinese technology companies have been touting the industrial applications of 5G, such as managing cement production, typhoon monitoring and surgeries performed by robots.

But there are challenges ahead. For one, relatively few people have 5G-enabled phones or other 5G end points. Huawei has released phones that can support 5G, as have China’s Oppo and South Korea’s Samsung. Apple, which comprises only 6 percent of the Chinese market, is not expected to release a 5G-capable iPhone until next year.

“It’s going to be really hard for Huawei to overcome the supply chain problems,” said Triolo of Eurasia Group. “Basically, the United States has Swiss-cheesed their supply chain, and there are big question marks hanging over Huawei’s ability to plug the holes.”

The technology is at the heart of a bitter dispute between China and the United States. Washington has expressed concern that 5G hardware made by Chinese manufacturers might contain hidden “back doors” that could enable spying.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

5G Base Stations:

Approximately 13,000 5G base stations have been installed in Beijing, the communications administration said this week. About 10,000 are already operating. China already has a total of more than 80,000 5G macro base stations, typically cellular towers with antennas and other hardware that beam wireless signals over wide areas, government officials said. They said China will end the year with about 130,000, while Bernstein Research estimates South Korea will be in second place with 75,000, followed by the U.S. with 10,000. Piper Jaffray estimated that of the 600,000 5G base stations expected to be rolled out worldwide next year, half will be in China.

Indeed, Chinese operators are launching 5G across fully 80,000 macro base stations this week, a figure that will grow to 130,000 by the end of this year, according to Wall Street research firm Bernstein Research. In comparison, the firm expects South Korea to end the year in second place with 75,000 base stations, followed by the US with just 10,000.

This is why most analyst firms expect China to command the largest number of 5G customers in the years to come.

Telecom-industry executives say Chinese wireless carriers now (and in the future will) buy the most of their cellular transmission equipment from Huawei. Analysts say U.S. measures that limit American businesses from selling components to Huawei could make it more difficult for the Chinese company to make telecom equipment. Huawei says it has taken steps to minimize the impact of such restrictions.

China’s 5G Standard-Approved by ITU-R for IMT 2020 RIT:

It should be noted that China has their own 5G standard, which has been presented to and progressed by ITU-R WP5D which is standardizing the radio aspects of IMT 2020. Here’s an excerpt of an IEEE Techblog comment:

On July 17, 2019, the ITU-R WP5D#32 meeting ended in Buzios, Brazil. At this meeting, China completed the complete submission of the IMT-2020 (5G) candidate technical solution, and obtained the official acceptance confirmation letter from the ITU regarding the 5G candidate technology solution.

China’s 5G wireless air interface technology (RIT) solution is based on 3GPP new air interface (NR) and narrowband Internet of Things (NB-IoT) technology. Among them, NR focuses on the technical requirements of enhanced mobile broadband (eMBB), low latency and high reliability (URLLC) scenarios, and NB-IoT meets the technical requirements of large-scale machine connection (mMTC) scenarios. China’s 5G technology program expresses China’s understanding of 5G technology, considers the integrity and advancement of 5G technology, and maintains the global unified standard with 3GPP as the core, reflecting China’s industrial interests.

According to the requirements of the ITU, the complete 5G technology submission materials include technical solution descriptive templates, link budget templates, performance indicator satisfaction templates, and self-assessment reports. China’s 5G technology solutions and technical support materials come from many research results of domestic equipment manufacturers, operators and research units, reflecting the collective efforts and collective wisdom in the domestic communications field. China’s self-assessment research results show that the NR+NB-IoT wireless air interface technology solution can fully meet the technical vision requirements of IMT-2020 and the IMT-2020 technical indicators.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

5G Subscriber Pricing:

Chinese officials said the cheapest 5G subscription would cost 128 yuan (about $18) for 30 gigabytes of data a month. To enjoy the peak speed of 1 Gbps, Unicom customers will pay about $45 a month.

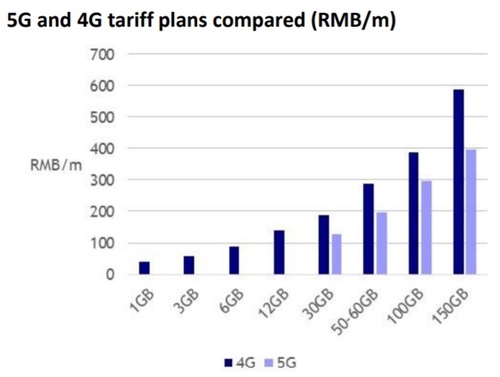

According to the Wall Street research analysts at New Street Research, China Mobile is offering 5G services at a 30% discount to 4G. “A 30GB 4G customer who migrated to 5G on the same plan would see their bill reduced from RMB 188 to RMB 128. Even a 12GB 4G customer migrating to the 30GB 5G plan would save money,” the analysts wrote in a report to investors.

10 million people in China have already registered their intention to purchase 5G subscriptions as we wrote in this IEEE Techblog post.

Mike Dano of Light Reading had this assessment:

A big part of the “race to 5G” discussion centers on spectrum allocation. Operators in China and South Korea are mainly using midband spectrum like 3.5GHz for their 5G buildouts, while operators in the US are using bands ranging from 600MHz to 28GHz because there isn’t much available midband spectrum for 5G in the US. This could change in the months to come as the FCC moves to release midband C-Band spectrum for 5G in the US. Midband spectrum is useful for 5G because it toes the line between providing high-speed connections and covering large geographic areas.

However, in recent months some US policymakers have been working to move the goalposts in the “race to 5G” a bit by pointing out that China’s 5G buildout is mandated by the country’s ruling party while 5G buildouts in the US and elsewhere are driven by the economics of competition and capitalism. As FCC Commissioner Brendan Carr explained earlier this month, that means 5G networks in the US will be more directly aligned with consumer demands than 5G networks in China.

Regardless, China’s official 5G rollout is starting this week — in a country with about four times more potential customers than the US — and it’s undoubtedly going to dwarf the 5G efforts in other countries in terms of most industry metrics.

Huawei vs Apple 5G smartphones in China:

Huawei Technologies has increased its smartphone market share in China to a record 42% in the September quarter, growing shipments by 66% year over year, while Apple’s share fell by two percentage points to 5%, with its shipments falling 28% year over year, according to Canalys.

Huawei has already released 5G-enabled phones—and they’re cheaper than Apple’s high-end non-5G iPhones. More models from other Chinese competitors will likely come out in the next few quarters. Industry analysts don’t expect a 5G-enabled iPhone until late 2020.

Rosenblatt Securities analyst Jun Zhang predicts many low- to mid-end iPhone users in China could switch to a cheaper 5G Android phone in 2020. “We believe Apple still has yet to face its biggest challenge in China, which is the upcoming launch of 5G service in November as well as the coverage for 5G service expanding to 100 cities by the middle of 2020,” Zhang wrote in a Thursday research note. “We continue to expect Apple’s smartphone market share will decline once 5G service starts in more cities,” he wrote in a note to clients.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

6 thoughts on “China to launch 5G mobile networks on Friday with a huge government backed push”

Comments are closed.

China just launched the world’s largest 5G network

The country’s three state-run telecom operators launched services for the next generation wireless technology on Friday.

China Mobile (CHL), China Telecom (CHA) and China Unicom (CHU) are all offering 5G plans that start at 128 yuan ($18) for 30 GB of data per month, giving Chinese internet users access to the ultra fast service.

5G commercial services are now available in 50 cities, including Beijing, Shanghai, Guangzhou and Shenzhen, according to Chinese state news agency Xinhua. In Shanghai, nearly 12,000 5G base stations have been activated to support 5G coverage across the city’s key outdoor areas.

https://www.cnn.com/2019/11/01/tech/5g-china/index.html

5G pricing similar to current 4G; slow 5G rollout in China in 2020 despite the hype; China 5G standard (IMT 2020 RIT) based on 3GPP Release 15 “5G NR” but has slight differences

Chinese telcos released 5G service packages on Oct 31 and officially launched the 5G commercial service on Nov 1, 2019, in 50 cities. There was really no major surprise in telcos’ 5G data pricing, which is a little cheaper than current 4G pricing. I don’t expect current 5G service packages to become a significant ARPU growth driver in China. Also, there’s a huge barrier to enter the China telecom market, especially since China has their own 5G standard as reported in the above blog post.

China 5G subscriber ramp-up could be slower than 4G, without meaningful handset subsidies and killer apps to spur smartphone user migration. Immature standalone 5G supply chain could delay China’s 5G network rollout in 2020. We expect capex savings from China Unicom/China Telecom network sharing could beat current market expectations.

Price competition for 5G could be less than 4G: Entry-level monthly fees of the initial 5G packages were Rmb128-129, similar to the entry-level monthly fees of China Mobile’s 4G packages at the initial 4G commercial service period in early 2014. Chinese telcos currently have similar 5G data pricing, indicating likely less price competition for 5G than in the current 4G market. The unit data pricing of current 5G packages is a little lower than current 4G unit data pricing.

Chinese telcos have launched twelve 5G smartphone models with prices ranging from Rmb3,649 to Rmb7,999.

5G smartphone vendors include Samsung, Huawei, Vivo, Xiaomi and ZTE. Chinese telcos do not offer handset subsidies for the current 5G commercial services. We expect the 5G subs penetration increase will be slower than 4G, partly due to few handset subsidies from telcos and partly to a lack of killer apps to drive 5G migration.

China kicks off 6G telecom service R&D amid aggressive 5G push-Chinese Ministry of Science and Technology on Wednesday announced the establishment of two offices to develop 6G

China has officially commenced the research and development of the 6G telecom service, days after launching 5G cellular services in the country in a bid to advance its ambitious goal to emerge as a global leader in the next generation telecom technology, surpassing the US and the western countries.

The Chinese Ministry of Science and Technology on Wednesday announced the establishment of two offices to develop 6G, setting off the competition for the next-generation cellular data service that comes after the super-fast 5G.

The Ministry said one of the offices will house the government agencies responsible for the relevant policy making.

The other is comprised of 37 experts from colleges, research academies and enterprises, who are expected to advise policymakers, it said.

China’s Vice-Minister for Science and Technology Wang Xi said that worldwide knowledge about the telecom technology is still in an exploratory stage, without consensus over its definitions and applications.

The ministry will work with relevant departments to roll out a plan for 6G development, and work towards breakthroughs regarding its basic theories, key technologies and standards, state-run China Daily quoted him as saying on Thursday.

https://www.business-standard.com/article/pti-stories/china-kicks-off-6g-r-d-amid-aggressive-5g-push-119110701546_1.html

By already launching research into sixth-generation (6G) technology, China can be expected to extend the country’s healthy lead over the US in global 5G into a future world that is increasingly reliant on technology, Chinese experts said on Thursday.

The announcement by the Ministry of Science and Technology (MOST) Wednesday that China was kicking off research into 6G came a few days after the rollout of 5G commercial services in China, the world’s largest internet market.

Chinese net users responded to the ministry announcement by expressing marvel at the nation’s capability and resolve to set its eyes on next-generation technology.

The ministry, together with several government departments, the Chinese Academy of Sciences and the National Natural Science Foundation of China, held a meeting in Beijing on Sunday to start research on 6G technology, according to a statement posted on its website.

Two teams were announced: one consisting of relevant government bodies and the other made up of 37 experts from universities, scientific research institutes and companies.

The announcement invited a global spotlight on China’s technological achievements, although 6G is already on the agenda of major economies including the US and a slew of technology firms including Chinese tech giant Huawei.

Ready for a head start

“6G will certainly be a major upgrade in terms of functions and performances including mobile broadband, latency, reliability, intelligence, power consumption and coverage, although 6G is still a concept so far without specific definition and standards,” said Tang Xiongyan, chief scientist of the network technology research institute at China Unicom, one of the country’s three telecom carriers.

Technologies and frameworks should be adopted to boost research and exploration, Tang told the Global Times on Thursday.

The system of networks carried by electromagnetic waves is nearing its technical limits, leaving the industry to contemplate what format will enable the next generation of mobile network technology.

Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, predicted that researchers may explore the potential of terahertz waves or integrate space, sea and ground functions into an intelligent network.

China’s 6G drive, albeit not targeting the US, will inevitably add a new layer of anxiety for a country already haunted by China’s rising technological prowess, Chinese industry insiders said.

Europe, the US, Japan and South Korea are probably all about to kick off 6G research, Tang noted.

“When one generation of telecommunication technology is put into commercial use, it is time to carry out research on technologies and standards for the next generation,” he said, “This is routine.”

In a fresh move in late October, Sony, NTT and Intel announced they were forming a 6G partnership.

South Korea’s LG Electronics announced as early as January that it was embarking on a research and development plan for 6G telecommunications, and in June Samsung Electronics and SK Telecom decided to work together to develop 6G, according to South Korean media reports.

European countries have also started 6G research, with the University of Oulu in Finland establishing a 6G center early this year and publishing what it claimed was the world’s first 6G white paper in September, outlining the key drivers, research requirements and challenges.

Global cooperation

Like 5G, 6G research will hinge on open innovation and international cooperation, Tang believed.

But Chinese market watchers say the US fancies itself a pioneer in global protectionism, meaning any such global push would not be so easy and would most likely have to be spearheaded by China.

Tang predicted the US would reinforce its technological advantage in microelectronics and software, and hope to change the traditional rules of the telecom industry and gain a new edge through subversive technology, ecosystem and business innovation.

The US will surely be alert to Chinese 6G, said Xiang, the consumption alliance director-general.

“The Trump administration is likely to impose more severe sanctions on Chinese tech companies, including Huawei and ZTE, and meanwhile, ban more technology communication or transfer with Chinese companies in an attempt to contain China’s 6G technology development,” Xiang said.

However, US sanctions and technology blocks will not deter China and will help Chinese technology develop more rapidly, he said, citing China’s 5G technology as a precursor.

Chinese analysts all agreed that China was likely to overtake the US in 6G development.

They pointed out the US approach is driven by companies and so cannot attract the best manpower and equipment from all sectors.

Meanwhile technology push is based on the comprehensive research of companies, research institutions and other related departments under government guidance “which is surely more competitive,” Xiang said.

As 6G blurs international borders, the US technological approach of splendid isolation will soon lag behind, experts said.

China and the EU with their more open attitudes toward markets and technology will have broader cooperation opportunities, Fu Liang, a Beijing-based telecom industry expert, told the Global Times.

Chinese companies such as Huawei have been cooperating with the EU to deepen 5G development, with broader market access for both sides, he noted.

Zhou Zheng contributed to this story

Global Times

Obviously, China is a large potential market for 5G. The increased transmission speeds will change the way the world works. HYC Co., Ltd has 19 years experience in R&D, manufacture of fiber optical products, which are in will be widely deployed for 4G/5G backhaul.

March 15, 2020:

Beijing has put 26,000 5G base stations into operation, with 5G users reaching about 800,000, according to the Beijing Municipal Communications Administration.

Beijing municipal government rolled out policies in the past year to support the telecom industry by slashing the expenses in carrying out 5G infrastructure construction, said the administration in a statement.

According to a report compiled by the China Academy of Information and Communications Technology, the 5G commercialization in China is expected to generate a direct gross output of 10.6 trillion yuan (about 1.51 trillion U.S. dollars) from 2020 to 2025, plus an indirect gross output of about 24.8 trillion yuan.

Given the complexity of the current epidemic control and the economic development, it is an important and pressing task to expedite the development of 5G technology, said Chen Zhaoxiong, vice minister of Industry and Information Technology, recently.

http://www.xinhuanet.com/english/2020-03/15/c_138880135.htm