Dell’Oro: Telecommunication Equipment Market 1Q20 to 3Q20 +China’s New 5G Base Stations

Preliminary estimates by the Dell’Oro Group suggest the overall telecom equipment market advanced 9% Year-Over-Year (Y/Y) during 3Q20 and 5% Y/Y for the 1Q20-3Q20 period. That market includes: Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES).

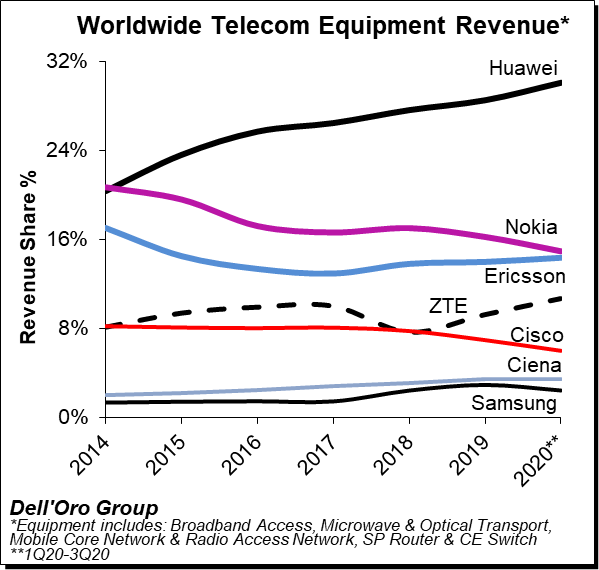

The analysis contained in these reports suggests revenue rankings remained stable between 2019 and 1Q20-3Q20, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for more than 80% of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets.

Huawei and ZTE are both on course to gain two percentage points of market share each this year, at the expense of Nokia, Cisco and Samsung. With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained about 3 percentage points of revenue share,” wrote Dell’Oro Analyst Stefan Pongratz in his blog on the matter, implying they actually grabbed around 1.5 percentage points each.

Dell’ Oro estimates the following revenue shares for 2019 and the 1Q20-3Q20 period for the top seven suppliers:

- Following the 4% Y/Y decline during 1Q20, the positive trends that characterized the second quarter extended into the third quarter, underpinned by strong growth in Optical Transport and multiple wireless segments including 5G RAN, 5G Core, and Microwave Mobile Backhaul. Technology segments that were impacted more materially by COVID-19 and the lockdowns during 1Q20 continued to stabilize in the quarter.

- Preliminary estimates indicate increasing Mobile Infrastructure and Optical Transport revenues offset declining investments in Microwave Transport and SP Routers & CES for the 1Q20-3Q20 period.

- The overall telecom equipment market continued to appear disconnected from the underlying economy. While the on-going transition from 4G to 5G is helping to offset reduced capex in slower-to-adopt mobile broadband markets, we also attribute the disconnect to the growing importance of connectivity and the nature of this recession being different than in other downturns improving the visibility for the operators.

- With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained about 3 percentage points of revenue share between 2019 and 1Q20-3Q20, together comprising more than 40% of the global telecom equipment market.

- The Dell’Oro analyst team has not made any material changes to the overall outlook and projects the total telecom equipment market to advance 5% to 6% in 2020 and 3% to 4% in 2021. Total telecom equipment revenues are projected to approach $90 B to $95 B in 2021.

………………………………………………………………………………………………………………………………………………………………..

Judging from a report by China Daily “China to build 1 million new 5G stations in 2021.” it appears Huawei and ZTE will continue to increase their telecom equipment market share. Reporter Ma Si of China Daily spoke to Wu Hequan, an academician at the Chinese Academy of Engineering, who reckons China will build over a billion 5G base stations next year, taking the grand total to 1.7 million by the end of the year.

China workers working at the construction site of a 5G base station at Chongqing Hi-tech Zone in Chongqing, Southwest China. [Photo/Xinhua]

“As the construction of 5G networks accelerates, the cost of building each 5G base station will go down,” said Wu. “Even if Chinese telecom carriers earmark the same amount of 5G investments in 2022 as they have done this year, they can build far more 5G base stations next year than this year. I believe Chinese telecom carriers will build more than one million 5G base stations next year, though the specific construction targets will have to wait for the telecom carriers’ official announcements.”

China Mobile, China Telecom and China Unicom did not immediately respond to requests for comment from China Daily.

Wu’s remarks are in line with China’s top industry regulators’ predictions the nation will “moderately” push ahead 5G construction in the next few years. The Ministry of Industry and Information Technology said in October as the country is set to enter a lead-in period in the next three years, China will continue to build 5G networks in a rhythm that is moderately ahead of schedule, so the wider coverage of 5G can help promote its use in more industrial and consumer scenarios.

That lead-in period, according to some industry insiders, means new products, new formats and new models of 5G application are constantly emerging and such applications are shifting from single application to large-scale and systemic scenarios.

China seems to be all the more determined to ensure its domestic telecoms industry goes from strength to strength. In response to the threat to the U.S. from China, John Ratcliffe wrote in the Wall Street Journal (on-line subscription required for access): “Beijing is preparing for an open-ended period of confrontation with the U.S. Washington should also be prepared. Leaders must work across partisan divides to understand the threat, speak about it openly, and take action to address it.”

…………………………………………………………………………………………………………………………………………………………..

References:

Key Takeaways—Telecommunication Equipment Market 1Q20 to 3Q20

Chinese telecoms kit vendors gained global market share this year

https://www.chinadaily.com.cn/a/202012/02/WS5fc74e99a31024ad0ba99633.html

7 thoughts on “Dell’Oro: Telecommunication Equipment Market 1Q20 to 3Q20 +China’s New 5G Base Stations”

Comments are closed.

5G equipment vendors may increase revenues when government’s or telcos roll out 5G with a strong deployment policy, even without critical 5G use cases (we have not see any so far).

However, it will be very interesting to see how 5G network operators are able to solve the huge energy consumption of 5G base stations, especially when using millimeter wave spectrum which requires more antennas and many more small cells for adequate coverage. 5G energy expenses are about 3-to-8 times that of 4G! That is a real problem which will not be immediately overcome. It will cost 5G network operators dearly!

Reference: https://www.mtnconsulting.biz/product/operators-facing-power-cost-crunch/

Alan provides an excellent summary of the Telecommunication Equipment Market and China’s 5G Base Stations. For many professionals, the article provides a sufficient overview of Dell’Oro’s publication on the current mainstream telecommunications market, major worldwide OEMs suppliers and their relative niches and market positions.

Separately, Alan covers 5G developments in China. It is quite clear that China is on an aggressive path to deploy 5G base stations. Many underestimate how much Huawei and other Chinese equipment makers (e.g. ZTE) can potentially gain strategically by showcasing a real and leading edge 5G network.

Readers of IEEE Techblog (techblog.comsoc.org) must appreciate Alan’s volunteer efforts and diligence to keep them informed.

Many thanks for your kind words Basant.

While everyone can see my IEEE Techblog posts, no one else knows the hours I spend each day reviewing and editing comments that have been submitted. Many SPAM comments bypass the SPAM filter while several legitimate comments each day are marked as SPAM so I have to check to UNSPAM and edit them (English grammar is usually very bad or made up acronyms are used which I spell out).

That said, I’d like to encourage all readers to comment if they’d like to add on to the content in any blog post and/or if they liked or not liked post(s).

I rеad this article comρⅼetely regarding the 2 topics you addressed. It’s a remarkable article, but would best be spit into 2 separate pieces.

Thanks for the marvelous post on Telecom Equipment Market. I truly enjoyed reading it. You’re a great author. I will make sure to bookmark your blog and will come back down the road.

I want to encourage you to ultimately continue your great writing, have a nice evening!

I think this is a real great blog post on the global telecom equipment market. Thank you!

China says it had built more than 1 million 5G base stations by the end of August, as the nation steps up efforts to build a sound telecom infrastructure for widening the use of 5G in more sectors.

Zhao Zhiguo, spokesman of the Ministry of Industry and Information Technology, said on Monday that China had built a total of 1.037 million 5G base stations by the end of August, covering all prefecture-level cities across the country and with 5G services available in more than 95 percent of counties and urban areas and 35 percent of towns and townships, China Daily reported .

From January to August this year, the shipments of 5G mobile phones in China reached 168 million units, marking a year-on-year increase of 80 percent. In August, 5G mobile phones accounted for 74 percent. —APP