Telecom Equipment Market

Global telecom infrastructure market outlook after a dismal 2024

Despite the telecom industry’s hopes that 2025 will usher in a turnaround for the global network equipment market, there’s no hint of that happening considering how bad 2024 was.

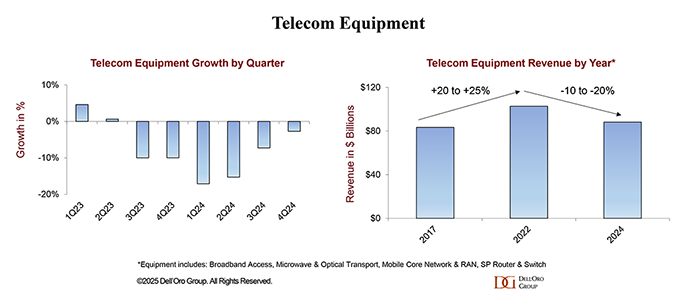

According to Dell’Oro Group, worldwide telecom equipment market revenues in 2024 dropped 11% year-over-year – marking “the steepest annual decline in more than 20 years.”

Dell’Oro VP Stefan Pongratz wrote:

“Preliminary findings suggest that worldwide telecom equipment revenues across the six telecom programs tracked at Dell’Oro Group—Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch—declined 11% year-over-year (YoY) in 2024, recording the steepest annual decline in more than 20 years (decline was >20% in 2002), propelling total equipment revenue to fall by 14% over the past two years. This remarkable output deceleration was broad-based across the telecom segments and driven by multiple factors, including excess inventory, challenging macro environment, and difficult 5G comparisons.

In 4Q24, stabilization was driven by growth in North America and EMEA, which nearly offset constrained demand in Asia Pacific (including China).

The full-year decline was uneven across the six telecom programs. Optical Transport, SP Routers, and RAN saw double-digit contractions, collectively shrinking by 14% in 2024. Microwave Transport and MCN experienced a more moderate combined decline in the low single digits, while Broadband Access revenues were fairly stable.

Similarly, regional developments were mixed in 2024. While the slowdown was felt across the five regions — North America, EMEA, Asia Pacific, China, and CALA — the deceleration was more pronounced in the broader Asia Pacific region, reflecting challenging conditions in China and Asia Pacific outside of China.

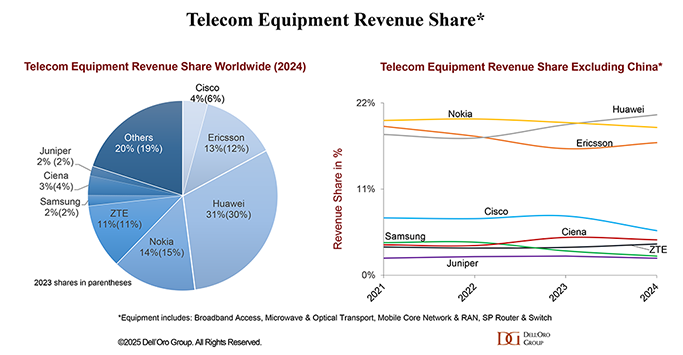

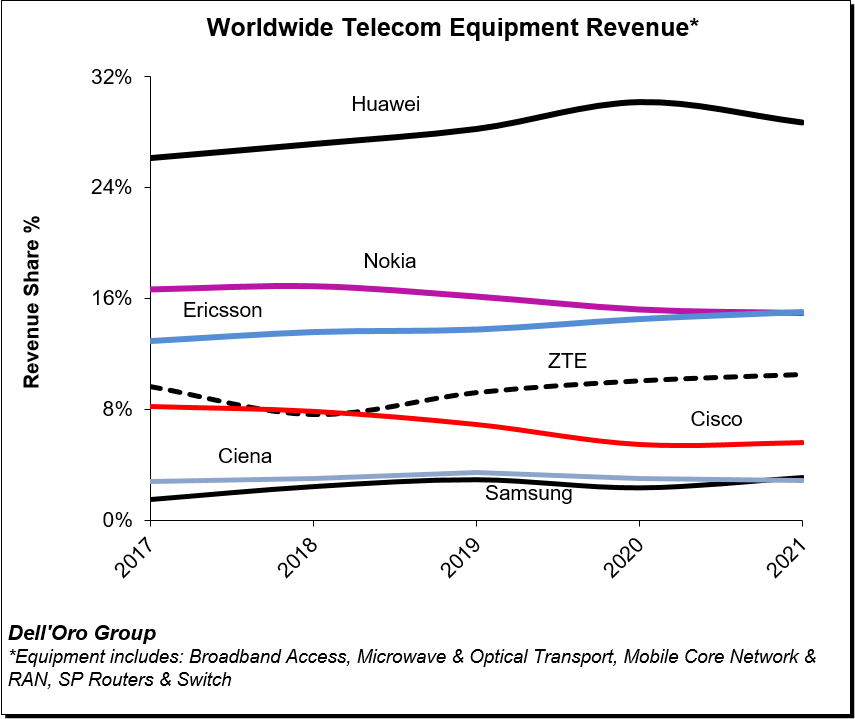

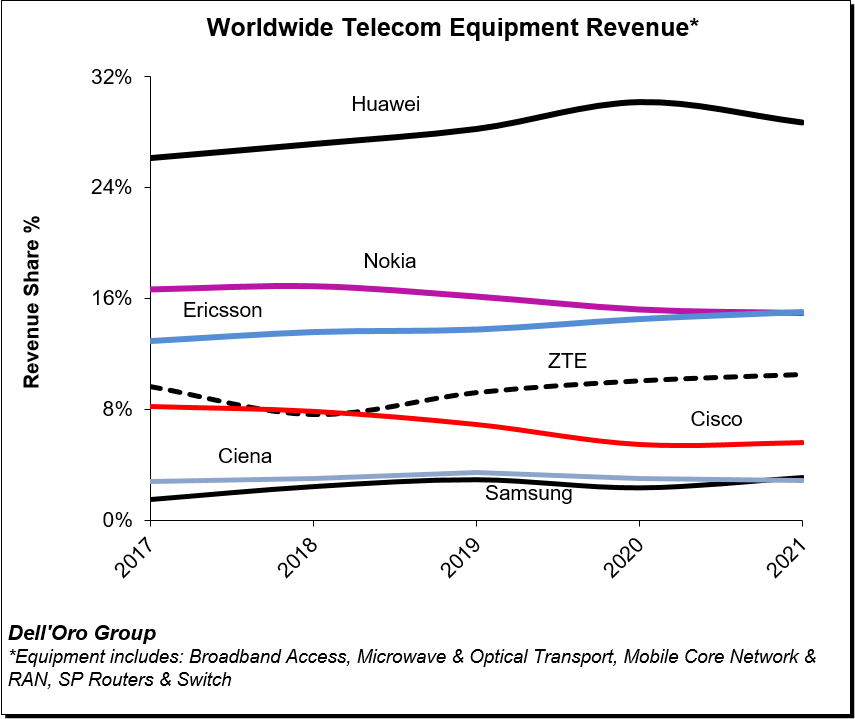

Supplier rankings were mostly unchanged globally, while revenue shares shifted slightly as both Huawei and Ericsson positions improved. Overall market concentration was stable with the 8 suppliers comprising around ~80% of the worldwide market in 2024.

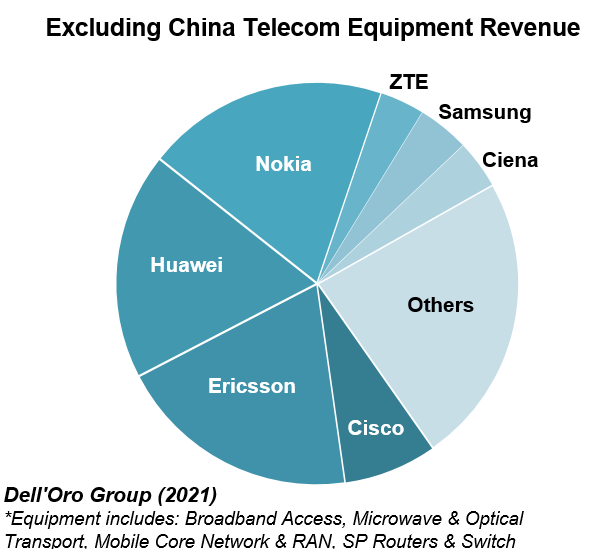

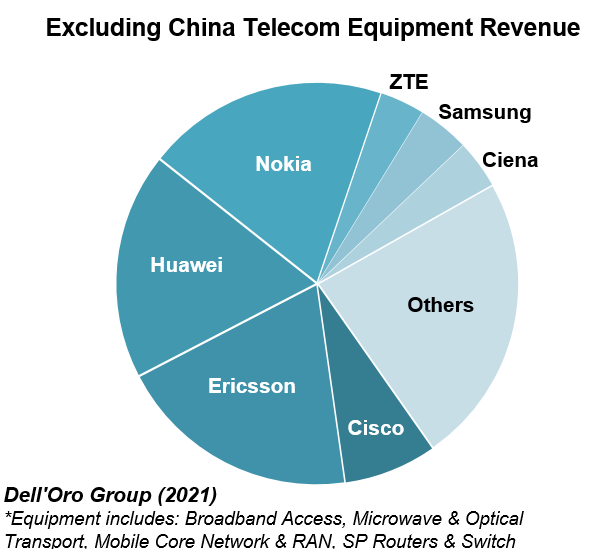

Rankings changed outside of China. Initial estimates suggest Huawei passed Nokia to become the #1 supplier, followed by Nokia and Ericsson. Huawei’s revenue share outside of China was up 2 to 3 percentage points in 2024, relative to 2021, while Ericsson is down roughly two percentage points over the same period/region.

A glimmer of hope is that the Covid instigated inventory correction is over and the supply chain is starting to recover. For example, Ciena recently noted its problems with “inventory digestion” are mostly over. CEO Gary Smith said that customers are again investing in scaling their networks, specifically for the anticipated increase in cloud traffic and new AI workloads, including Managed Optical Fiber Networks opportunities with the cloud providers.

However, that might take time to play out. Vendors may have to take at least 6-12 months to retool their supply chains due to tariffs, AvidThink Principal Roy Chua has said. And given the “will-they, won’t-they” situation going on with the tariffs, their ultimate impact remains to be seen.

…………………………………………………………………………………………………………………………………..

It’s been six years since 5G networks have been commercially deployed. But aside from deploying fixed wireless access (FWA), telcos have struggled to “find large use cases that require 5G speeds and features,” Deloitte said in its latest telecom industry forecast.

“Not only were there seemingly few additional use cases driving 5G adoption and monetization in 2024, but there may not be many more for 2025 or even 2026 either.” The market research/accounting firm continued:

Our outlook focuses on three of those difficult choices, and we have a full chapter on each:

- In 2025, the most discussed source of growth for many industries is generative AI, and telcos are asking how they can share in that excitement. Telcos are using gen AI to reduce costs, become more efficient, and offer new services. Some are building new gen AI data centers to sell training and inference to others. A gen AI gold rush expected over the next five years. Spending estimates range from hundreds of billions to over a trillion dollars on the physical layer required for gen AI: chips, data centers, electricity. Close to another hundred billion US dollars will likely be spent on the software and services layer.

- At the same time, telcos are roughly at the midpoint between the launch of 5G and the expected launch of 6G, and they want to confirm that they can shape 6G to be more profitable than 5G has so far been.

- Finally, after years of divesting noncore assets, telcos are getting primed to deploy M&A strategies in pursuit of growth.

Globally, the telecommunications industry is expected to have revenues of about US$1.53 trillion in 2024, up about 3% over the prior year. Both in 2024 and out to 2028, growth is expected to be higher in Asia Pacific and Europe, Middle East, and Africa, with growth in the Americas being around 1% annually. All three regions are expected to surpass half a trillion dollars in revenue each by 2027. By market cap, the sector is about US$2.6 trillion globally (Figure 1, below).

Stefan summed up: “Market conditions are expected to stabilize in 2025 on an aggregated basis, though it will still be a challenging year. The analyst team is collectively forecasting global telecom equipment revenues across the six programs to stay flat.”

References:

https://www.fierce-network.com/broadband/global-telecom-infra-faced-ultimate-pitfall-2024

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: Global telecom CAPEX declined 10% YoY in 1st half of 2024

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Highlights of Dell’Oro’s 5-year RAN forecast

Strand Consult’s 2024 Telecom Predictions

by John Strand, Founder and CEO of Strand Consult

Introduction:

2024 is poised to be an important year as more than half of the world’s population is poised to vote. Elections create clarity and regime change. They are pivotal because they signal national policy direction for industry and society, not the least being mobile telecom stakeholders. Following are Strand Consult’s hard thoughts on the year ahead. For some holiday mirth and an insightful summary of the challenges facing the telecom industry in 2024, listen to the Telecoms.com podcast featuring telecom legend Denis O’Brien from Digicel in conversation with editors Scott Bicheno (Telecoms.com) and Iain Morris (Light Reading.com).

Geopolitics

2024 is an election year, and more than half of the world’s population are scheduled to vote in 2024. Four critical elections will be held in the Free World: Taiwan on January 23; General elections in India in April-May; the European Parliament on 6 to 9 June; and the US Presidential election on November 5. Separately, a press release notes that a Russian presidential election will be held on 15 to 17 March, and Vladimir Putin will get a fifth term. China canceled free elections again in 2024.

There is limited policymaking in countries during election years, so the policy action is likely to be in the countries in off-election years. However, elections may slow needed action to address conflicts in Ukraine and the Middle East.

Moreover, China continues to partner with dictators, and grow more aggressive. General Secretary Xi Jinping faces limited opposition and critical press. However, many see his reign as a disaster including the mishandling of Covid, the souring economy, and the lost goodwill with other nations, particularly as XI cozies up to Russia’s Putin, North Korea’s Kim Jong Un, and Iran’s Hassan Rouhani.

There still remain mobile telecom operators in the free world which espouse democratic values and yet partner with China’s Huawei and ZTE. The operators reject the claim of security risk and dismiss or downplay the demonstrated control Xi and the party exact on China’s enterprises. The policy secure networks in US and EU has nothing to do with trade, but rather reflects the reality that China has changed fundamentally in the last decade.

2024 will also show the results of the implementation of the EU 5G security toolbox with increased attention on trusted versus non-trusted operators, not just vendors. Nations outside the EU will be inspired by the diplomatic EU approach.

Misguided Regulation

When Strand Consult launched almost 30 years ago, “regulation” had little to no impact on the industry. There were no internet activists trolling telecom regulatory authorities. Today, however, regulation can have a huge impact for both good and ill.

A decade ago Strand Consult published the report The EU’s Broadband and Telecom policy is not working. Europe is falling further behind the US documenting how US operators invested twice as much in infrastructure as their European counterparts over a long period. That trend is ongoing. The US still invests at twice the rate of the EU; the EU is further behind, and the EU gap to close the digital divide has widened from €150 billion to €274 billion.

2024 will be another year in which the EU will publish reports showing that Europe is behind. And yet, European policymakers continue to reject solutions like in-country consolidation which could help firms improve their business case for growth and investment and could ultimately improve the dismal picture for the EU.

Meanwhile the United States, India, and many African nations have completed successful consolidations. The operating results of most telecom firms in these countries are better than those in Europe. EU policymakers accept the status quo of ever-worsening returns and a growing investment deficit.

When it comes to creating better conditions for infrastructure deployment, Europe is also far behind other parts of the world. The only exception in the EU is Denmark, where Strand Consult’s research which started 10 years ago, has made it easier and significantly cheaper to roll out infrastructure in Denmark.

The EU Parliament’s Gigabit Infrastructure Act introduced this year promises faster rollout of gigabit-capable connectivity. It is a solution that helps fixed infrastructure providers. The question remains as to how many years it takes before implementation at the local level. Strand Consult does not expect to see this the effect of this Act in 2024, or even for some years, given rising interest rates. Simply put, the EU bill is too little and about 15 years too late.

The EU’s Digital Markets Act (DMA) proposes to regulate online content and social media platforms. The big question is how to implement it in practice. It will be interesting to see whether Big Tech will censor EU policymakers. There is a similar hubris with the EU’s Artificial Intelligence Act (AI Act) and how it promises “transparency” of algorithms. It’s hard to believe that any European official has the skills to make such an assessment. As AI business models have yet to be proven, the regulation seems premature. No bureaucrat can say whether Google, Microsoft, AWS, ChatGPT, or some other entity has the better AI solution.

Chips, chips, and Chinese chips

All chips matter – whether NVIDIA’s state of the art chips for AI or workhorse memory chips. This has only been heightened by the supply chain shortages driven by Covid-19 and security challenges. Russia, Iran, North Korea and China want advanced chips used for military purposes. Free world nations have imposed restrictions on chips for certain military users; this could only work because firms in the US, Netherlands, Korea, Japan, and Taiwan have the relevant IP.

China is heavily dependent on this advanced chip technology, and indeed firms of all kinds try to work around these rules. Some companies even break them with the expectation that they won’t be caught or fined (See Applied Materials). China has tried for 40 years to get a leadership position in advanced chips with limited success. However, though size and scale, China can impact global chip supply with currency manipulation and by flooding the market with low-end products.

In 2024 China will bombard the media with propaganda saying that if they can’t get an advanced supply of chips, then they will make it themselves. This should be taken with a grain of salt. Strand Consult describes Huawei’s challenges given chip restrictions and its various workarounds and creative messaging. Huawei is diversifying its business and doing an IBM-style transformation, going from a hardware company to a software/service one. It could make Huawei less dependent on its own hardware.

Chip policy will stay salient in 2024.

OpenRAN vs. 3GPP 5G RAN

Strand Consult’s predictions about OpenRAN have been spot on, revealing the stories to be the greater part of hype rather than market value. OpenRAN revenue as a share of the mobile infrastructure market is miniscule, but OpenRAN takes an outsized share of press and policymaker attention owing to Washington policy spin and Hollywood storytelling.

The party version of OpenRAN is to break incumbent vendor lock-in, reduce costs, promote innovation, and simplify network deployment and upgrade. This approach has gained attention and support from some telecommunications industry players, standardization bodies, and regulatory authorities to enhance competition and accelerate the development of 5G and beyond. However compelling a storyline, the reality is that OpenRAN does not provide a meaningful technical and commercial alternative to existing RAN players Huawei, Ericsson, Nokia, ZTE and Samsung.

In other words, you can’t put a hodge podge of virtual elements in a 1:1 matchup for existing RAN solutions. There are a few one-off OpenRAN solutions, but these are sideshows. There are proprietary RAN solutions that can connect to different interfaces. OpenRAN has the same function as a USB cable when connecting an iPhone with a Windows PC. With the new OpenRAN specifications launched in Osaka this summer, it is equivalent to going from using a USB-A to a lightning cable to using a USB-C to a USB-C cable.

Of the 200 3GPP/5G networks deployed globally, just three could be classified as OpenRAN. Of the install base of 5G RAN base stations, OpenRAN has about 1 percent market share of the install 5G base.

2024 could see the O-RAN Alliance folded into 3GPP. Or it could be pushed to 2025. 3GPP already works with many open interfaces, and this will drive the O-RAN Alliance to dismantle itself. The key stumbling block to OpenRAN implementation is operators themselves; they don’t want more complexity in networks. There is still value to the one-stop shop, as AT&T just demonstrated with its 5-year, $14 billion deal with Ericsson.

Business models

Over the last 25 years, the mobile telecom industry has moved from selling volume-based traffic to flat rate, all you can eat models. This has been driven for a variety of reasons. However, we predict 2024 will mark a shift with more flexibility at the high and low end of the market, read high value premium service for gamers and packages with bespoke services for the budget market.

Something’s gotta give. Internet adoption has stalled with 2.6 billion people globally offline for lack of access and affordability. Interest rates are rising, and average revenue per user (ARPU) is falling. Alternatively, we could see some nations allow needed in-market consolidation.

Operators have tried and failed to launch new platforms (think Orange World, Vodafone Live, GSMA’s OneAPI). In the year 2000, there was a 3G dream to double ARPU, from €36 to €72 Euro. Today ARPU is at or below €14 in many European countries. OTT solutions like Skype and WhatApp have proven more successful. Hence Strand Consult is not optimistic for GSMA’s Open Gateway in 2024.

For a deep dive on the state the mobile operators today, read Strand Consult’s latest research note Has the iPhone improved the mobile operators’ business case? which revisits Strand Consult’s groundbreaking report.

Operators have four key challenges:

- Regulation which prevents business model innovation and competition with OTTs

- Competition with other operators

- Customer budget constraint

- Operators’ lack of creativity, innovation, product development, strategy etc.

Connectivity may be the most compelling service on this earth. Just turn off the internet to a 9-year-old boy’s iPhone. The problem is that telecommunications providers have not succeeded to monetize sufficiently the value they provide. Ironically connectivity is increasingly valuable, yet its unit price continues to fall, and consumers expect greater value at a ever falling price point.

Broadband cost recovery and fair share

2024 will likely see the reboot of the Free Ride Prevention Act in South Korea, as firms like Google’s Alphabet which devour more than a quarter of the nation’s bandwidth, refuse to come to the table to negotiate. There is also likely to be progress in the USA, India, and Brazil where proceedings are underway, among other countries. Given recent court cases proving that Big Tech pays for placement, the arguments against fair share have been demolished. Moreover, the court cases have documented systematic Big Tech strong-arming, if not abuse of market power. Expect Big Tech to be more open to dealmaking in lieu of being regulated. Check out Strand Consult’s Global Research Project for Broadband Cost Recovery, Affordability, and Fair Share for more information.

Satellite Industry: Musk vs. Bezos

2024 will see more focus on the use of the low earth orbit (LEO) satellites. The fight between Elon Musk (Starlink) and Jeff Bezos (Kuiper) overshadows the big picture. Musk’s Starlink is lightyear’s ahead of Bezos’ Kuiper and already has 5,420 satellites orbiting the Earth; Kuiper has just two satellites. Bezos and Musk share the same dream; the difference is that Musk has already delivered. Bezos has opened his first satellite burger bar. Musk owns the interstellar McDonald’s.

Starlink has first-mover advantage and some lock-in tech dependence. It has access to cheap lifting capacity to get its satellites into space and to operate ground stations. Even with the FCC’s partisan cancelling of $886 million in subsidies (which appears to be a punishment for Musk buying Twitter and not towing the progressive party line), the company is still likely to succeed as it thrives on overcoming adversity and challenge. Satellite is here to stay as a bona fide broadband technology, and 2024 will only make that clearer.

Wrap up

As some 4 billion people go to the polls in 2024, some important policy may be put on hold, and broadband shortfalls will remain. At the same time, voters have a valuable opportunity to signal a change in leadership and direction. However, many governments will promote policy and legislation to improve access to 5G and broadband.

Rising interest rates will have a negative impact on investment. Fiber will be hit harder than mobile, and emerging markets will have a tougher time than the developed world.

While we don’t expect a business model revolution, we expect many operators to increase prices for connectivity. And indeed, many nations will further their broadband cost recovery and fair share policy solutions to improve access and affordability.

We also predict management cleanup. CEOs who have not delivered will be let go. Consider Vodafone which was Europe’s most capitalized company in year 2000 with well over $300 billion; it has shrunk to $24 billion today. Its main success during this period was to divest Verizon in USA. Its multi billion investment in India was a dismal failure and was written off the balance sheet.

Despite the security and reputational risk, Vodafone continues to work closely with Huawei and uses this equipment across many countries. The company appointed a new CEO in early 2023. Strand Consult observed that Vodafone needs a “cleaner” like Harvey Keitel The Wolf in “Pulp Fiction.” Or they need Meryl Streep from the The Iron Lady, not the Meryl Streep in Mama Mia! Margherita Della Valle’s performance at Vodafone is associated with a falling share price.

Strand Consult does not expect to see results for mobile telecom shareholders driven by GSMA or ENTO. However, these organizations will likely continue to pay their top management high salaries. GSMA CEO Mats Granryd gets $2.4 million in annual salary to hold trade shows featuring increasingly Huawei and Meta while serving on the board of Swedish National TV and chairing Vattenfall AB and Coore AB.

Elections and security of national infrastructure will take center stage in 2024. China will wage a proxy war against those countries which don’t adopt its equipment and service platforms. With growing interest rates and inflation, there is little to make telecom shareholders happy in the coming year.

In 2023 Strand Consult published many research notes and reports and featured cool people on its guest blog. Strand Consult’s analysis was quoted in some 1000 news stories globally. Our work took us to all the continents except Antarctica. Our readership continues to grow. For the last 23 years, Strand Consult has made predictions for the coming year. Our archive shows that we get it right.

Thank you for your support and readership.

Feel free to reach me at [email protected]

References:

StrandConsult Analysis: European Commission second 5G Cybersecurity Toolbox report

StrandConsult: 2022 Year in Review & 2023 Outlook for Telecom Industry

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Strand Consult: What NTIA won’t tell the FCC about Open RAN

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Despite being very late to deploy 5G due to tardy licensed spectrum auctions, and with no known indigenous 5G network equipment vendors, India’s Communications Minister Ashwini Vaishnaw believes the country’s indigenous 4G/5G technology stack is “now ready” and the country is poised to emerge as a major telecom technology exporter to the world in the coming three years. Speaking at the Economic Times Global Business Summit 2023, Vaishnaw, who is also the Minister for Railways, categorically said there is no program for the privatization of the national transporter.

The 5G services were launched on October 1, 2022, and within a span of 100 days have been rolled out in 200-plus cities. The sheer speed of rollout has been appreciated by industry leaders globally and is being described in many international forums as the “fastest deployment happening anywhere in the world,” he said. Vaishnaw highlighted the population-scale solutions being tested on India stack, across platforms such as payments, healthcare and identity. Each of these platforms is powerful in itself, but together become a dynamic force that can solve “any major problem in the world.”

The minister said India is set to emerge as a telecom technology exporter to the world in the next three years. “Today there are two Indian companies that are exporting to the world…telecom gear. In the coming three years, we will see India as a major telecom technology exporter in the world,” Vaishnaw said.

The minister talked of the rapid strides taken by India in developing its own 4G and 5G technology stack, a feat that caught the attention of the world. “The stack is now ready. It was initially tested for 1 million simultaneous calls, then for 5 million, and now it has been tested for 10 million simultaneous calls,” he said terming it a “phenomenal success.” At least 9-10 countries want to try it out, he added.

The minister gave a presentation outlining key initiatives under his three ministries of telecom, IT and Railways. For Railways, the focus is on transforming passenger experience, he said as he presented slides on how railways is redeveloping stations and terminals (New Delhi, Ahmedabad, Kanpur, Jaipur among others) with modern and futuristic design blueprint, and in the process creating new urban spaces while also preserving rich heritage.

The minister also gave an overview on the Vande Bharat train, the indigenous train protection system Kavach and progress on the bullet train project. To a question on the past talks around private freight rail corridors to boost logistics, the minister said “there is no program for Railway privatization.” “In a country where we have 1.35 billion people, 8 billion people moving every year on Railways, we thought that it is prudent to learn from the experience of others, and keep it within the Government set-up,” Vaishnaw said.

India’s Communications Minister Ashwini Vaishnaw (Photo Credit: PT)

To another query on dedicated freight corridor for food grains, the minister explained that when it comes to transport economics it is important not to divide assets between different applications.

“Today, the thought process has got very refined, and we are adding close to 4500 km of network every year, which amounts to 12 km of new tracks per day. So we have to increase the capacity to such a large extent that there is enough capacity for food grains, enough for coal, small parcels, and every kind of cargo,” he said. While Railways had been consistently losing market share over the last 50-60 years, it has started clawing it back.

“The lowest point was 27 per cent. I am happy to share that from the 27 per cent level, last year Railways increased to 28 per cent, this year we are doing close to 29-29.5 per cent, and in the coming 2-3 years Railways will go towards 35 per cent market share,” he added.

People will choose between transport via road, railways or air based on the distance to be travelled, and “there will be enough for everybody”. “The country will have enough for everybody, is my point. Up to 250 kilometres road is very good, 250 to 1000 kilometres railway is the ideal mode. Beyond 1000 kilometres air will be the ideal mode. So there will be enough for everybody,” the minister said.

References:

MTN Consulting on Telco Network Infrastructure: Cisco, Samsung, and ZTE benefit (but only slightly)

By Matt Walker

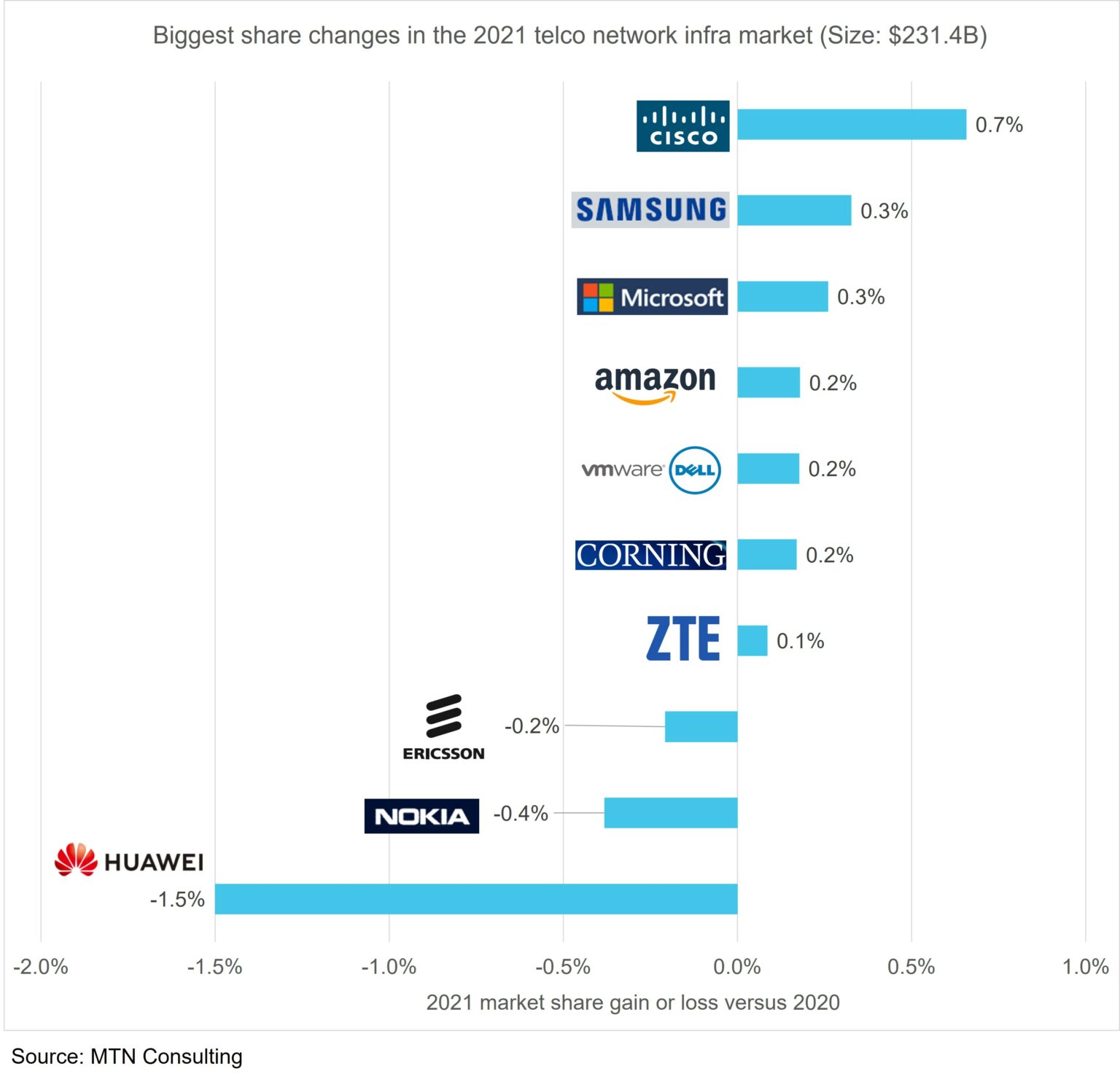

Cisco, Samsung, and ZTE benefit most from Huawei bans in 2021 in the telco Network Infrastructure market. (However, the market share gains were miniscule= <1% for each network equipment vendor).

Introduction:

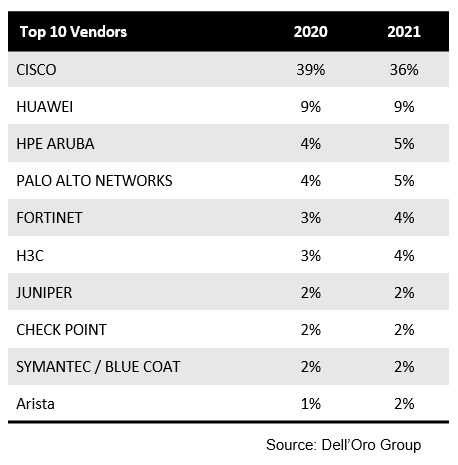

2021 results for the 100+ vendors selling into the telco market are just about finalized. Contrasting 2021 telco network infrastructure (NI) market share with 2020, we note the following NI Equipment Vendor Market Share Changes:

Cisco clearly came out on top, gaining 0.7% share in a market worth $231.4 billion (B). Cisco was helped both by a telco shift in 5G spending towards core networks, and Huawei’s entity list troubles.

Samsung’s share growth of 0.3% was due to a big win with Verizon and a growing telco interest in seeking RAN alternatives beyond Ericsson and Nokia. ZTE, which has escaped the US entity list to date, also picked up some unexpected 5G wins but its growth is more broad-based due to optical, fixed broadband, and emerging market 4G LTE business.

Dell (including VMWare), Microsoft, and Amazon also picked up share as telcos have begun investing in 5G core and cloud technologies. Their growth has little to do with Huawei, and more due to telcos’ ongoing changes to network architecture and service deployment patterns. Corning was an unexpected winner in 2021, gaining 0.2% share on the back of fiber-rich wireless deployments and government support for rural fiber builds.

On the flip side, both Nokia and Ericsson lost share in the overall telco NI market in 2021. Their RAN revenues benefited from Huawei’s troubles in 2020 but telco spending has since shifted towards product areas with more non-Huawei competition. Both vendors are attempting to diversify beyond the telco market, with Nokia so far having more success; its non-telco revenues grew 12% in 2021.

Huawei’s share of telco NI declined to 18.9% in 2021, down from a bit over 20% in both 2019 and 2020. The US Commerce Department’s entity list restrictions were issued in May 2019 but hit the hardest in late 2020 and 2021, after Huawei’s inventory stockpiles began running out.

Huawei’s messaging on its recent fall is muddled. During its annual report webcast yesterday, it cited three factors behind its 2021 revenue decline: supply continuity challenges, a drop in Chinese 5G construction, and COVID. In MTN Consulting’s opinion, supply continuity was the main factor. A related factor were the many government-imposed restrictions on using Huawei gear around the world, especially in Europe where 5G spending was strong in 2021. The other two factors cited by Huawei’s CFO, however, are misleading. Chinese telco network spending, overall, was relatively strong in 2021: total capex for the big three telcos was $52.8B, up 8% from 2020. Without this rise, Huawei’s 2021 results would have been worse. As for COVID, few other vendors cite the pandemic as a factor restraining 2021 telco spend. More vendors cite the opposite: 2021 spending was strong in part because telcos were forced to delay many projects during COVID’s early spread.

To date, Huawei’s troubles have impacted RAN markets the most, but in 2022 and 2023 will begin spreading more clearly to IP infrastructure, optical, microwave, fixed broadband, and other areas. A number of vendors are eager to pursue new opportunities as this happens, including Adtran/ADVA, Ciena, Cisco, CommScope, DZS, and Infinera. The CEO of Infinera, in fact, said on its 4Q21 earnings call that “it was a nice taste, a nice appetizer in 2021, but…we said all along that we would see the design wins and RFPs really scaling and we thought that we’d see revenues from that really beginning to take hold as we got into 2023.”

To date, Huawei has been unable to fully adapt to the supply chain restrictions put in place in 2019. It remains the global #1 in telco NI, however, due to dominance in China and a huge installed base across the globe. The company is investing heavily in carrier services & software, Huawei Cloud and new product areas. One certainty is that it won’t simply fade away, despite the current decline.

……………………………………………………………………………………………….

Editor’s Note:

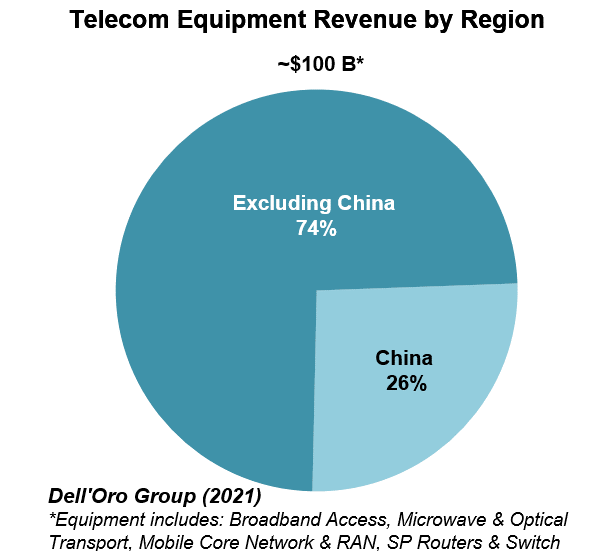

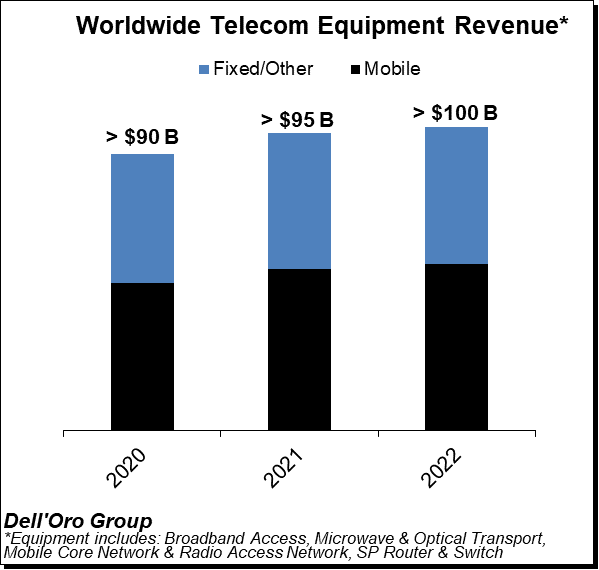

In contrast, Dell’Oro estimates suggest the overall telecom equipment market advanced 7% in 2021, recording a fourth consecutive year of growth, underpinned by surging wireless revenues and healthy demand for wireline-related equipment spurred on by double-digit growth both in RAN and Broadband Access. Total worldwide telecom equipment revenues approached $100 B, up more than 20% since 2017.

Initial readings suggest the playing field is more even outside of China, with Ericsson and Nokia essentially tied at 20% and Huawei accounting for around 18% of the market.

References:

Cisco, Samsung, and ZTE benefit most from Huawei bans in 2021 telco NI market

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

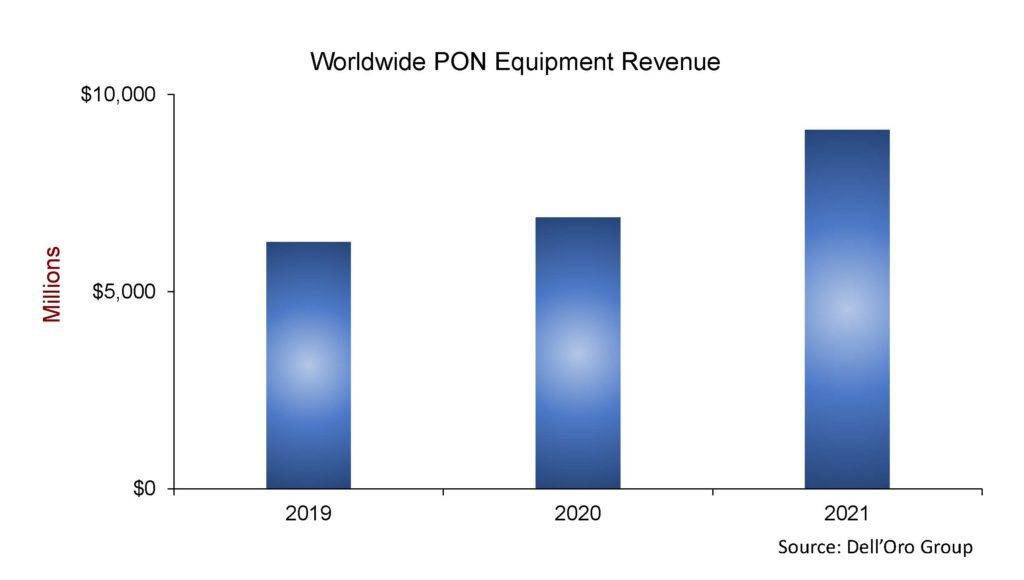

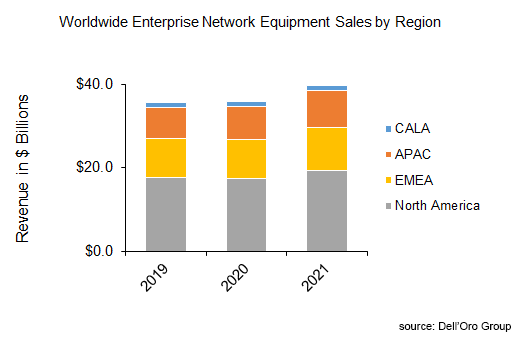

According to a newly published report by Dell’Oro Group, total global revenue for the Broadband Access equipment market increased to $16.3B in 2021, up 12 percent year-over-year (Y/Y). Growth came once again from spending on both PON infrastructure and fixed wireless CPE.

“2021 was a record year for PON (Passive Optical Network) equipment spending, with some of the highest growth coming from the North American market, where expansion projects and fiber overbuilds are picking up considerably,” said Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group. “These fiber expansion projects show no signs of slowing heading into 2022.”

Additional highlights from the 4Q 2021 Broadband Access and Home Networking quarterly report:

- Total cable access concentrator revenue increased 4 percent Y/Y to just over $1B. Steady growth in Distributed Access Architecture (DAA) deployments helps offset declines in traditional CCAP licenses.

- Total PON ONT unit shipments reached a record 140 M units for the year, bucking the supply chain constraints that have dogged the cable CPE market.

………………………………………………………………………………………………………..

Separately, Dell’Oro just completed the 4Q2021 reports for all the Telecom Infrastructure programs covered, including Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch. The data contained in these reports suggests that total year-over-year (Y/Y) revenue growth slowed in the fourth quarter to 2%, however, this was not enough to derail full-year trends.

The market research firm estimates suggest the overall telecom equipment market advanced 7% in 2021, recording a fourth consecutive year of growth, underpinned by surging wireless revenues and healthy demand for wireline-related equipment spurred on by double-digit growth both in RAN and Broadband Access. Total worldwide telecom equipment revenues approached $100 B, up more than 20% since 2017.

In addition to challenging comparisons, we attribute the weaker momentum in the fourth quarter to external factors including COVID-19 restrictions and supply chain disruptions.

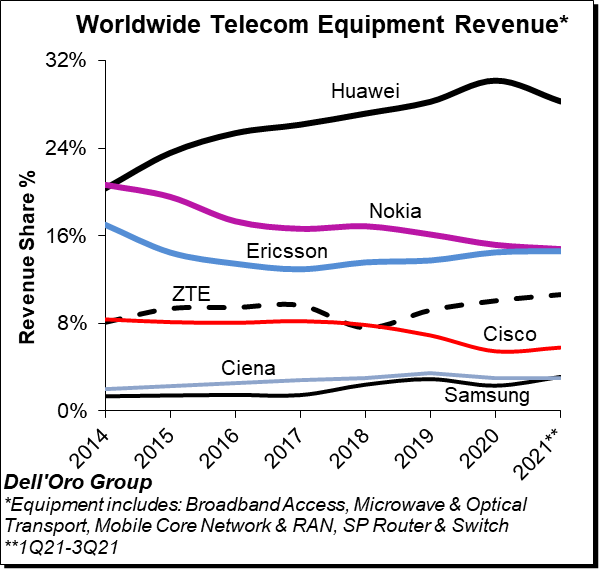

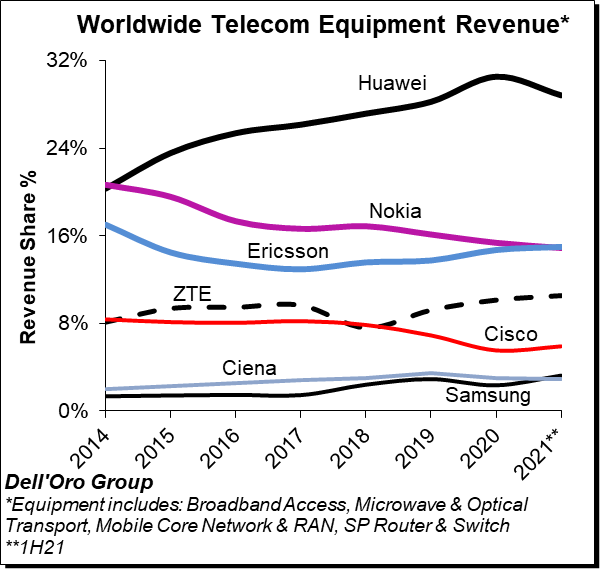

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 2021, with the top seven vendors comprising around 80% of the total market.

Despite U.S. sanctions, Huawei continued to lead the global market, underscoring its grip on the Chinese market, depth of its telecom portfolio, and resiliency with existing footprints. Initial readings suggest the playing field is more even outside of China, with Ericsson and Nokia essentially tied at 20% and Huawei accounting for around 18% of the market.

The relative growth rates have been revised upward for 2022 to reflect new supply chain and capex data. Still, global telecom equipment growth is expected to moderate from 7% in 2021 to 4% in 2022.

Risks are broadly balanced. In addition to the direct and indirect impact of the war in Ukraine and the broader implications across Europe and the world, the industry is still contending with COVID-19 restrictions and supply chain disruptions. At the same time, wireless capex is expected to surge in the U.S. this year.

…………………………………………………………………………………………………..

Top 10 Enterprise Network Equipment Vendors:

References:

Key Takeaways—2021 Total Enterprise Network Equipment Market

ZTE using TSMC’s 7-nm process to build custom chips for its 5G base stations

ZTE is on a roll! China’s #2 telecom firm said in its annual report that it gained market share in China last year for servers, core networks and storage solutions — the three areas where Huawei is a key player. Revenues grew at a double-digit percentage rate last year, rising inside and outside China and across all three business units – carrier (networks), enterprise (business) and consumer (gadgets).

With TSMC’s business booming, Nikkei Asia believes that ZTE is quietly building a technological edge in the base station market for fifth-generation (5G) cellular connectivity. These base stations are used by telecommunications carriers to meet consumer demands, and the publication believes that ZTE has designed its equipment to be based on the 7-nanometer (nm) process node.

The company [ZTE] has been utilizing some of TSMC’s most advanced chip production technology — the so-called 7-nm tech — to build processors for its 5G base stations. Sources said it also uses the Taiwanese chipmaker’s advanced chip packaging technology, which uses stacking technology to arrange chips with different functions into one package.

Nikkei Asia also said that Huawei’s inability to conduct business with TSMC due to American sanctions has left the field wide open for ZTE. The company is targeting double-digit growth for its server and base station segment, and it is also interested in TSMC’s leading-edge chip node, which is the company’s 5nm process.

However, while ZTE might not be sanctioned to procure the latest chip technologies from TSMC, the company still can not sell its 5G base stations to several Western companies. This has resulted in it focusing its efforts mostly on China, as the U.S. will rely on small cell 5G Open RAN platform developed by Qualcomm Incorporated on the 4nm node.

Source: Jordi Boixareu/Alamy Live News

“ZTE has turned quite aggressive in pursuing its chip capability in the past few years. Although the volume is still small, it is showing impressive progress,” said one unnamed source.

TSMC, as well as ZTE, seems to be on a very solid growth track. On the back of another robust set of quarterly financials Q4 FY21 and a strong balance sheet, the world’s #1 chip making firm announced a massive capex budget hike to increase manufacturing capacity in “advanced process technologies,” including 2nm, 3nm, 5nm and 7nm.

TSMC also sells products built on the 4nm, which is a design extension of the company’s 5nm process families. Different process technologies marketed under the 4nm branding are expected to commence production from the second half of this year to the first half of 2023.

References:

https://wccftech.com/tsmc-reveals-36-revenue-growth-as-chinas-zte-reportedly-using-7nm-for-5g/

https://www.lightreading.com/asia/zte-has-designs-on-chips-with-tsmc/d/d-id/775180?

Dell’Oro: 3Q21 Total Telecom Equipment Market up 6% year-over-year & 9% year-to-date

Dell’Oro Group just completed their 3Q21 reporting period for all the Telecommunications Infrastructure programs covered. Those include: Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network (RAN), SP Router & Switch.

The data contained in these reports suggest that the positive trends that characterized the broader telecom equipment market in the first half of 2021 extended into the third quarter, propelling the overall telecom equipment market to a sixth consecutive quarter of year-over-year (Y/Y) growth in revenues.

Preliminary estimates suggest the overall telecom equipment market advanced 6% Y/Y in the quarter and 9% Y/Y year-to-date (YTD). The growth in the quarter was underpinned by healthy demand for both wireless and wireline equipment.

While the majority of the suppliers were able to navigate the supply chain situation fairly well in the first half, supply chain disruptions had a greater impact in the third quarter, though clearly this was not enough to derail the positive momentum that has characterized the market over the past six quarters.

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 1Q21-3Q21, with the top seven vendors comprising around ~80% of the total market.

Ongoing efforts by the US government to curb the rise of Huawei is starting to show in the numbers, especially outside of China. At the same time, Huawei continued to dominate the global market, still nearly as large as Ericsson and Nokia combined.

Overall, we believe ZTE and Samsung are trending upward while Huawei is losing some ground YTD relative to 2020.

Additional key takeaways from the 3Q21 reporting period include:

- Positive market sentiment in the third quarter was driven by strong growth in RAN and Broadband Access, which was more than enough to offset weaker trends in Optical Transport.

- RAN and Broadband Access are also the strongest growth vehicles for the YTD period, fueled by surging demand for 5G, PON, and FWA CPEs.

- With the pandemic resurging and the visibility surrounding the supply chain weakening, the Dell’Oro analyst team is expecting near-term growth to decelerate – the overall telecom equipment market is now projected to advance 2% in 2022, down from 8% in 2021.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Radio Access Network, Optical Transport, and Service Provider (SP) Router & Switch.

MTN Consulting: Network Infrastructure market grew 5.1% YoY; Telco revenues surge 12.2% YoY

Telecom network infrastructure (NI) vendors had a 5.1% year-over-year (YoY) increase in revenue during the second quarter 2021, reflecting a significant pullback from a 10% gain in the previous quarter, according to MTN Consulting.

The market share leaders in the global telco NI market remain Huawei, Ericsson, Nokia, and ZTE, who are also the top providers of 5G infrastructure. After these top four, China Comservice took the fifth spot in 2Q21 due to services sales with domestic telcos. Cisco and Intel followed in the sixth and seventh spots, leveraging strength in the router market, and data centers and virtualization, respectively. CommScope, NEC, and Fiberhome round out the top 10.

- CommScope is a key provider in the connectivity market, both fixed and mobile, and for broadband CPE.

- NEC is becoming an important player in the emerging open RAN market.

- Fiberhome has a significant market share for network equipment in the Chinese telco market, across optical transport and mobile networks.

- Samsung, ranked 11 in 2Q21, is also a notable player in telco NI, as it is rising in the US due to success at Verizon, and has strong potential in Europe.

MTN Consulting’s telco network infrastructure market share study includes a wide range of vendor types and cuts across hardware, software, and services. That’s in contrast to other market research firms that only count telecom equipment vendors.

If one considers only hardware and software revenues from network equipment providers (NEPs), total revenues were $121.6 billion for the 2Q2021 annualized. The top ten providers for this market are Huawei, Nokia, Ericsson, ZTE, Intel, NEC, Cisco, Fiberhome, Samsung, and Fujitsu. The top four of these suppliers account for 64% of market revenues. This category (NEP hardware & software) most directly maps into what is sometimes reported as the “telecom equipment” market.

Vendors collectively received $110.4 billion in revenue during the first half of 2021, up 7.4% from the first half of 2020. Some of that growth can be attributed to a weak first half of 2020 when the initial spread of COVID-19 clobbered network infrastructure spending plans, Matt Walker, chief analyst at MTN Consulting, explained.

“Labor costs are a big part of telco opex (and rising), and automation is a key area of investment in 2021 for nearly all major telcos,” Walker wrote. “Numerous telcos are reporting that network operations are taking up a larger portion of the opex pie. This is important because vendors are increasingly selling into opex budgets within their telco customers, not just capex budgets. That’s especially true on the services and software sides.”

Total telco capex for the first half of 2021 jumped 9.8% year over year to $151.1 billion, he said, noting that the analyst firm added Airspan, Google Cloud, Amazon Web Services (AWS), and Microsoft Azure to its telco market coverage at the beginning of 2021. Telco capex grew 15% year over year in the second quarter of 2021 while telco opex climbed 14% during the same period.

The biggest YoY Telco NI sales jumps in 1H21 were easily recorded by Ericsson and Nokia, up $1.46 and $1.01B respectively. Cisco, Samsung, and Dell Technologies (VMWare) also saw sizable growth in the telco vertical, as did several vendors riding China’s 5G boom: China Comservice, ZTE, and Fiberhome. On the downside, Huawei’s $1.48B YoY decline in Telco NI sales in 1H2021 was far worse than any other supplier (due to being banned by the U.S. and other countries for political reasons).

Huawei market share decreased the most YoY, when comparing its annualized share in 2Q2021 with that of 2Q2020. As predicted, the company’s share of telco NI has now fallen below 20% (19.01% in 2Q2021, annualized).

For other NI vendors, most changes are due to one of three factors: M&A, telco spending cycles, and technology dislocations.

- Recent M&A deals of note include Capgemini-Altran, CommScope-ARRIS, ECI-Ribbon, Hengtong-Huawei Marine, Casa-Netcomm, and Amdocs-Openet.

- A number of vendors have been impacted by telcos’ 5G infrastructure push, including the recent shift towards core network spending.

- Several large countries are seeing growth in fiber access deployment spending.

- Telcos’ increased adoption of the cloud in a variety of forms cuts across a large number of the changes seen in the below charts. AWS, Azure and GCP have all seen dramatic growth in their telco vertical revenues in the last few quarters, as has Dell Technologies (VMWare) and Arista.

Regarding declines in NI market share, Samsung’s annualized share change reflects a dropoff in Korean 5G spend as it still awaits a pickup in the US, India and/or Europe.

Nokia’s share has stabilized, after falling due to a perception of falling behind in mobile RAN radio technology, as well as its backing away from China. Huawei’s share decline is due to political and supply chain obstacles.

Webscalers/Cloud Service Providers Penetrate Telco Market:

Nearly a decade ago, as cloud services began gaining popularity, many telcos hoped to be direct beneficiaries on the revenue side. The cloud market went a much different direction, though, with large internet-based providers (aka webscalers) proving to have the global scale and deep pockets able to develop the market effectively. From 2011-2020 webscale operators invested over $700 billion in capex, a big portion of it devoted to building out their cloud infrastructure.

The cloud sector has geared its offerings to businesses of all stripes and sizes. Serving telecom operators was not an initial focus for many reasons. Telcos have unique network requirements and stringent reliability criteria, and tend to make purchasing decisions slowly. Many telcos also viewed cloud providers with trepidation, as potential competitors on the enterprise side. Yet the telecom market is also one of the biggest around, viewed as a prize worth fighting for. Nearly $300 billion in annual capex and $1.2 trillion in opex (excluding depreciation) are figures that are hard to ignore. Amazon Web Services (AWS) made the earliest strides in telecom, in 2015 (with Verizon), but Azure and GCP were serious about the market by 2017. Last year, Microsoft bolstered its 5G and cloud-based telecoms offerings with the big-ticket acquisitions of Affirmed Networks and Metaswitch Networks.

This telco-webscale collaboration activity has picked up in the last 12-18 months. Webscale operators help telcos with service and application development, shifting of workloads, and developing, enabling and marketing cloud-based services. Collaborations can involve delivery of a portfolio of 5G edge computing solutions that leverage the telco’s 5G network and the webscale operator’s global cloud coverage, as well as its expertise in areas like Kubernetes, AI/ML, and data analytics. Managing costs is a central purpose of telcos’ willingness to partner with webscale providers. Increasingly, the webscale operators who deliver cloud services are competing alongside traditional telco-facing vendors like Amdocs, Citrix, CSG and Nokia.

For the four quarters ended 2Q2021, MTN Consulting estimates that AWS, Azure and GCP had aggregate revenues to the telco sector of $1.92 billion, up 78% from the 1Q2020 annualized period. These cloud providers will sometimes be valuable partners for telco-focused vendors, but in many cases they will be competitors, and are important to track.

Telco spending outlook for remainder of 2021:

Telco industry capex is likely to come in around $300B for 2021, only slightly up from $295B in 2019. Telco opex budgets are a bit more appealing for vendors. Opex (excluding depreciation & amortization) is roughly 4x capex, and the network operations-related (“netops”) piece of opex is growing for many telcos. For 2021, MTN Consulting projects netops opex of about $297B, from $282B in 2020, and telco outsourcing of netops tasks are widespread and growing. Cloud providers are taking advantage of some of this growth, but a large number of traditional Telco NI vendors sell into telco opex budgets.

…………………………………………………………………………………………………………………………….

In a related report, MTN says that telco revenues surged to 12.2% (for the first time in at least a decade on a YoY basis) coming in at $478.4 billion (B). But this unusually high growth is due to a weak base in 2Q20, when revenues totaled $426.5B, the lowest ever during the 1Q2011-2Q2021 period. Also, as witnessed in 1Q2021, the trend of currency appreciation against the US dollar in several key markets continued to play out in the latest quarter.

Annualized telco revenues also grew for the second straight quarter, posting $1.88 trillion with a YoY growth rate of 5.5% in 2Q21. At the network operator level, five of the top 20 best performing telcos by topline in 2Q21 posted double-digit growth on an annualized basis. These include Deutsche Telekom (30.6% YoY vs. annualized 2Q20), China Telecom (17.6%), China Mobile (17.3%), and China Unicom (14.1%). By the same criteria, the worst telco growth came from Softbank (-13.9%) during the same period. America Movil and Telefonica were only the two other operators among the top 20 to post a decline in revenues. While the big swings at Deutsche Telekom and Softbank are due to the former closing its acquisition of Sprint from Softbank in April 2020, growth witnessed by other operators was mostly an outcome of low base effect. Another factor for some operators is non-service revenues, as these have grown with 5G device sales in many markets.

The biggest capex spender in 2Q21 on a single quarter and annualized basis was China Mobile. This was despite the company’s YoY drops of 6.4% and 15.3% in the single quarter and annualized 2Q21 periods, respectively, enabled by CM’s network partnership with CBN. Nine out of the top 20 operators by annualized capex spend posted double-digit growth rates in the period ended 2Q21. Some of these include: Deutsche Telekom (52.1% YoY vs. annualized 2Q20), Vodafone (24.2%), Orange (17.6%), and BT (25.6%). On an annualized capital intensity basis, Rakuten beats all other telcos handily with a roughly 183% capex/revenue ratio for the quarter; its greenfield network rollout is reaching its peak. Other capital intensity standouts include: Globe Telecom (49.9%), PLDT (43.1%), Oi (41%), Telecom Egypt (34.1%), CK Hutchison (32.7%), True Corp (31.3%), and Digi Communications (31.2%).

To improve operational efficiency, telcos are resorting to several initiatives specifically aimed at digitizing the sales and marketing function. Amid the pandemic last year, telcos were forced to operate with minimal human intervention, and automation efforts have only accelerated since then. As telco execs aim for more automated networks to sustain and grow profitability, automation will be a key selling point for vendor solutions.

Telco industry headcount continues to decline, falling to 4.838 million in 2Q21, down from 4.944 million a year ago. Telco spending on digital transformation, software-defined networks (SDN) and AI tools have facilitated a smaller workforce. MTN Consulting expects headcount reductions to continue via attrition and voluntary retirement schemes, heading towards 4.5 million by 2025. However, we also expect telcos to invest heavily in their workforce: retraining existing employees on digital platforms, and hiring highly skilled software savvy employees. The average telco employee salary will rise as a result, an outlook consistent with 2Q21 results – annualized labor costs per employee increased to $61.5K in 2Q21 from $57.8K in 2Q20.

All four major geographical regions experienced double-digit growth in revenues from 2Q2020. But in capex terms, Europe was a standout as it managed to grow by 29.9% on a YoY basis in 2Q2021. The region also recorded not just an uptick but also the highest annualized capital intensity of 18.4% in 2Q2021, while all other regions witnessed a fall when compared to the same period last year. Europe’s capex growth story is courtesy of a late start to 5G spending due to delayed spectrum auctions, coupled with increased efforts in FTTH deployments and government-supported rural rollouts.

References:

https://www.mtnconsulting.biz/product/telecoms-biggest-vendors-2q21-edition/

https://www.mtnconsulting.biz/product/telecommunications-network-operators-2q21-market-review/

Dell’Oro: Worldwide Telecom Equipment Revenue +10% Year over Year

Reports and Data: Telecom Cloud Market to grow at CAGR of 19.7% through 2026

Dell’Oro: Worldwide Telecom Equipment Revenue +10% Year over Year

Dell’Oro Group has completed its 1H2021 reports on “Telecommunications Infrastructure programs” including Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network (RAN), Service Provider Router & Switch markets. The data contained in these reports suggest that the positive trends that characterized the broader telecom equipment market extended into the second quarter, even if the pace of the growth slowed somewhat between the first and the second quarter.

Preliminary estimates suggest the overall telecom equipment market advanced 10% year-over-year (Y/Y) during 1H21 and 5% Y/Y in the quarter, down from 16% Y/Y in the first quarter. The growth in the first half was primarily driven by strong demand for both wireless and wireline equipment, lighter comparisons, and the weaker US Dollar (USD). Helping to explain the Y/Y growth deceleration between 1Q and 2Q is slower growth in China.

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 1H21, with the top seven vendors comprising around ~81% of the total market.

Huawei is still the overall market leader by some margin, despite its sales and marketing challenges in many other parts of the world. Huawei’s market share slid below 30%, though that still almost double the share of its nearest rivals Ericsson and Nokia. Within the mix, Dell-Oro estimates Huawei and Nokia lost some ground between 2020 and 1H21 while Cisco, Ericson, Samsung, and ZTE recorded minor share gains over the same period.

Additional key takeaways from the 1H2021 reporting period include:

- Following the Y/Y decline in 1Q20, our analysis suggests the overall telecom equipment market recorded a fifth consecutive quarter of growth in the second quarter.

- The improved market sentiment in the first half was relatively broad-based, underpinned by single-digit growth in SP Routers and double-digit advancements in Broadband Access, Microwave Transport, Mobile Core Networks, and RAN.

- Aggregate 2Q21 revenues were in line with expectations, however, within the programs both Broadband Access and Microwave Transport were surprised on the upside while Optical Transport and SP Routers came in below expectations.

- From a regional perspective, China underperformed in the quarter, impacting the demand for both wireless and wireline-related infrastructure.

- Ongoing efforts by the US government to curb the rise of Huawei are starting to show in the numbers outside of China, not just for RAN but in other areas as well.

- Though Huawei is not able to procure custom ASICs for its telecom products, the supplier is assuring the analyst community its current inventory levels is not a concern over the near term for its infrastructure business.

- The majority of the vendors have through proactive measures been able to navigate the ongoing supply chain shortages and minimize the infrastructure impact. At the same time, the supply constraints appear more pronounced with higher volume residential and enterprise products including CPE and WLAN endpoints.

- Even with the unusual uncertainty surrounding the economy, the supply chains, and the pandemic, the Dell’Oro analyst team remains optimistic about the second half – the overall telecom equipment market is projected to advance 5% to 10% for the full-year 2021, unchanged from last quarter.

Two of the key telecom revenue drivers will be the RAN and Broadband Access markets, both of which have been growing at a strong pace this year so far: The RAN market is set to grow at between 10% and 15% this year, which means it could be worth as much as $40 billion, while the increasing number and size of investments in fibre broadband access networks around the world is driving growth in the Broadband Access market, which Dell’Oro reports was worth $3.6 billion during the second quarter alone.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Switch.

Gartner: Worldwide 5G Network Infrastructure Revenues to Grow 39% in 2021

Worldwide 5G network infrastructure revenue is on pace to grow 39% to total $19.1 billion in 2021, up from $13.7 billion in 2020, according to the latest forecast by Gartner, Inc.

Communications service providers (CSPs) in mature markets accelerated 5G development in 2020 and 2021 with 5G representing 39% of total wireless infrastructure revenue this year.

“The COVID-19 pandemic spiked demand for optimized and ultrafast broadband connectivity to support work-from-home and bandwidth-hungry applications, such as streaming video, online gaming and social media applications,” said Michael Porowski, senior principal research analyst at Gartner.

5G is the fastest growing segment in the wireless network infrastructure market (see Table 1). Of the segments that comprise wireless infrastructure in this forecast, the only significant opportunity for investment growth is in 5G. Investment in legacy wireless generations is rapidly deteriorating across all regions and spending on non-5G small cells is poised to decline as CSPs move to 5G small cells.

Table 1: Wireless Network Infrastructure Revenue Forecast, Worldwide (Millions of U.S. Dollars)

| Segment | 2020 Revenue | 2021 Revenue | 2022 Revenue |

| 5G | 13,768.0 | 19,128.9 | 23,254.6 |

| LTE and 4G | 17,127.8 | 14,569.1 | 12,114.0 |

| 3G and 2G | 3,159.6 | 1,948.2 | 1,095.2 |

| Small Cells Non-5G | 6,588.5 | 7,117.9 | 7,113.9 |

| Mobile Core | 5,714.6 | 6,056.2 | 6,273.3 |

| Total | 46,358.5 | 48,820.2 | 49,851.0 |

Source: Gartner (August 2021)

Regionally, CSPs in North America are set to grow 5G revenue from $2.9 billion in 2020 to $4.3 billion in 2021, due, in part, to increased adoption of dynamic spectrum sharing and millimeter wave base stations. In Western Europe, CSPs will prioritize on licensing spectrum, modernizing mobile core infrastructure and navigating regulatory processes with 5G revenue expected to increase from $794 million in 2020 to $1.6 billion in 2021.

Greater China is expected to maintain the No.1 global position in global 5G revenue reaching $9.1 billion in 2021, up from $7.4 billion in 2020. With China’s government funding 5G development for the three state owned carriers, that’s no surprise.

The big beneficiaries of China’s 5G infrastructure spending will be its domestic equipment makers, Huawei, ZTE, and (state owned) Datang Telecom. Despite clamoring for Sweden to permit Huawei 5G equipment to be deployed, Ericsson only received 3% of a joint 5G radio contracts from China Telecom, China Unicom and 2% from China Mobile, according to Reuters. Nokia, which was expected to take away Ericsson’s market share in China, did not receive any share, according to a tender document published by the Chinese companies.

In a way that’s a win for the Swedish vendor – and a brief share price hike backs up that statement – which won just 2% of an earlier deal from China Mobile. But if they want to secure their share of the multiple billions of dollars of global 5G infrastructure revenues forecast by Gartner, the likes of Ericsson and Nokia will need to keep winning contracts in their home markets.

5G Coverage in Tier-1 Cities Will Reach 60% in 2024:

While 10% of CSPs in 2020 provided commercialized 5G services, which could achieve multiregional availability, Gartner predicts that this number will increase to 60% by 2024, which is a similar rate of adoption for 4G- LTE in the past.

“Business and customer demand is an influencing factor in this growth. As consumers return to the office, they will continue to upgrade or switch to gigabit fiber to the home (FTTH) service as connectivity has become an essential remote work service,” said Porowski. “Users will also increasingly scrutinize CSPs for both office and remote work needs.”

This rapid shift in customer behavior is driving growth in the global passive optical network (PON) market as a preferred technology. The 10-Gigabit-capable symmetric-PON (XGS-PON) is not a new technology and with the price difference with other technologies narrowing, CSPs are willing to invest in XGS-PON to differentiate themselves in customer experience and network quality. Gartner estimates that by 2025, 60% of Tier-1 CSPs will adopt XGS-PON technology at large-scale to deliver ultrafast broadband services to residential and business users, up from less than 30% in 2020.

Gartner clients can learn more in the reports “Forecast Analysis: Communications Service Provider Operational Technology, Worldwide” and “Forecast: Communications Service Provider Operational Technology, Worldwide, 2019-2025, 2Q21 Update.”

…………………………………………………………………………………………

Small Cells?

While Gartner did not split out small cells’ contribution to the overall 5G infrastructure segment, evidence thus far suggests the market is progressing more slowly than many had once believed.

Last month, Crown Castle increased its guidance for the second time this year due to a strong cell towers market, but halved the number of small cells it expects to deploy in 2021 to 5,000. The company noted that wireless network operators have focused on tower-based 5G rollouts at the expense of small cells.

References:

5G network kit revenues to near $20 billion this year — report