T-Mobile US CEO talks up Sprint merger & 5G leadership in U.S.

T-Mobile has begun shuttering Sprint’s network in a few locations following its acquisition, but doesn’t expect to really start until 2021-to-2022.

Talking with a fireplace in the background during a UBS Global TMT Virtual Conference on December 8th, T-Mobile CEO Mike Sievert said in response to a question about when Sprint’s network will shut down: “We’ve already done some on an isolated basis.”

T-Mobile has boasted of $6 billion in savings through its Sprint merger which has resulted in a single “master brand.”

We can go into an area, and as we get capacity on the destination T-Mobile network, we can migrate traffic off the Sprint network on to that destination network without having to touch those rate plans or billing relationships at all. We might move the brand relationship from Sprint to T-Mobile in advance of that or we might wait until later.

T-Mobile acquired Sprint for $26 billion earlier this year. Industry observers have been awaiting news on the company’s plans to shutter the old network as the “New T-Mobile” rolls out—which promises 14 times more capacity in six years than standalone T-Mobile has today. Sievert went on to say most of the shutdowns won’t happen until 2022 when at least most of Sprint’s legacy customers should have transitioned over to T-Mobile’s network.

This isn’t T-Mobile’s first acquisition and network shut down. In 2012, T-Mobile acquired MetroPC’s regional network and then dismantled it. It’s a fairly standard practice which Sprint did in 2016. After acquiring Clearwire, Sprint shut down the WiMax network it so highly promoted as the first real 4G.

Author’s Note:

T-Mobile’s 3G network is based on GSM while Sprint uses CDMA. Running two competing 3G networks simultaneously doesn’t help the bottom line. Both telcos support 4G LTE which is the ONLY 4G network since no carrier deployed WiMax Advanced.

…………………………………………………………………………………………………………………

Sievert summed up the Sprint network integration with this statement:

It’s really important that we use our capacity to migrate Sprint mobile customers over, right? So, we’re going to be — while we’re revenue-farming spectrum and building the destination network that’s our priority. So, you’ll see us go at pace for the first couple of years on broadband because the bigger prize for our shareholders is synergy attainment.

…………………………………………………………………………………………………………………….

Sievert said:

“What we’ve got at the dawn of the 5G era is the ability to lead all through this era with a superior product and a superior value simultaneously, something no company has ever been positioned to do. And obviously, they see that and they feel that they need to act. Now, they’ll try and convince you that what they’re doing is economic. By the way, it’s nothing too extraordinary, nor surprising.”

With respect to use of 600MHz for 5G is 2 or 3 times faster than 4G-LTE. Sievert said:

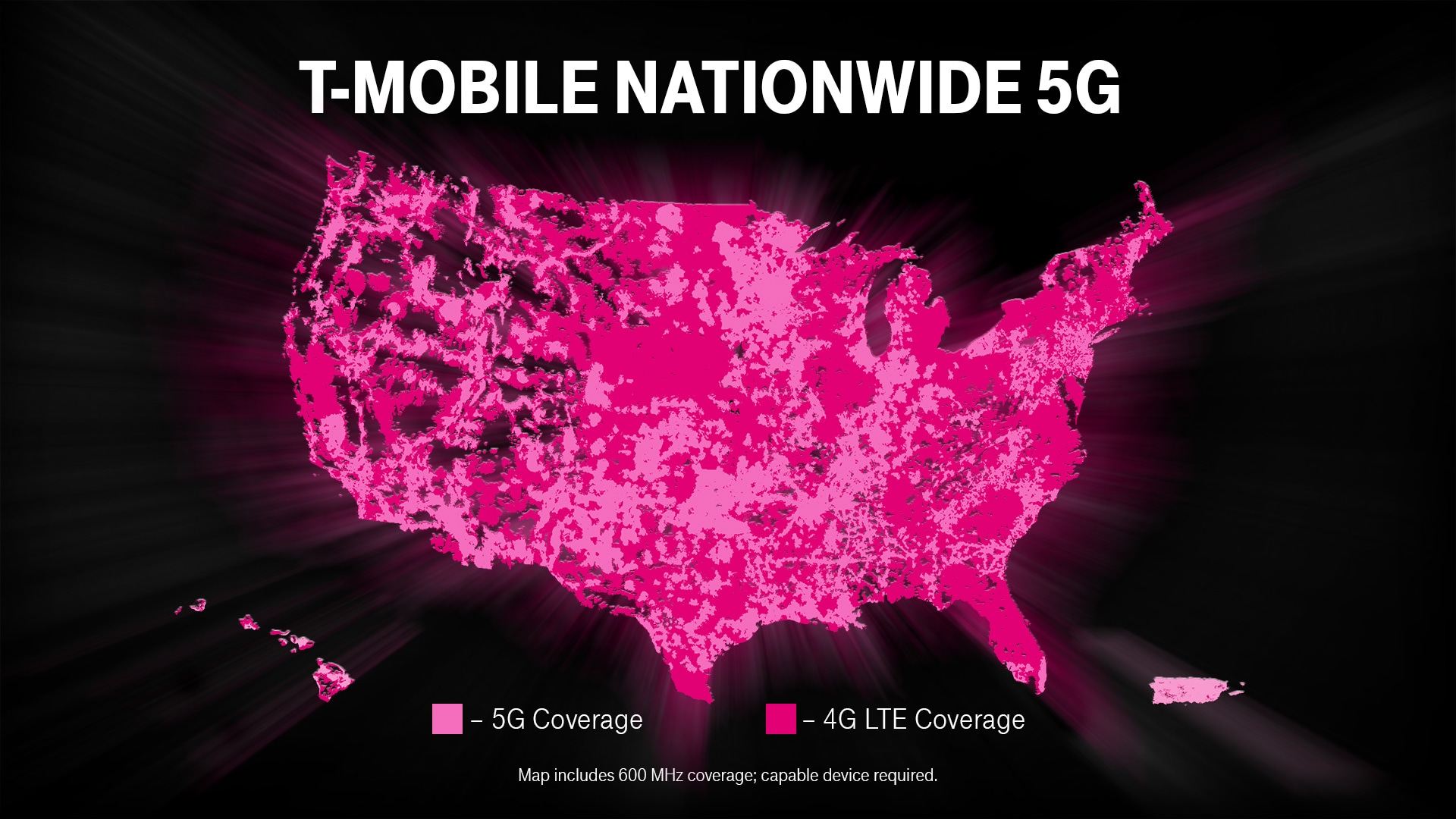

As of the last quarterly announcement, we were reaching about 270 million people with 600 megahertz Extended Range 5G. And that’s 5G even more on 4G LTE. These are dedicated lanes, and to your point, increasing dedicated lanes, because during this farming process and transition process, we’re actually leasing additional 600 megahertz spectrum from a variety of parties.

And what that allows us to do is to open up really wide dedicated Extended Range 5G lanes, so different than what you’re seeing from our competitors with DSS instead. They don’t have those dedicated lanes. And so they’re having to divide up their LTE spectrum into both technologies. It doesn’t get you much.

Our dedicated Extended Range 600 megahertz 5G is two times faster, in some cases, three times faster than LTE. So it’s a really nice pickup and experience for customers, but importantly, also gives us the capacity that we need to move quickly on migration. And that’s obviously the bigger payday for us and for customers. So those are the numbers.

About 1.4 million square miles as of the last quarterly announcement. That’s about three times what Verizon has, about double what AT&T had around that time. And again, we announced that we weren’t stopping there. We’re moving very quickly for the year-end time period. Next time we talk to you shortly after the New Year, we’ll have covered significantly more than those numbers. And so terrific progress there.

Most of the phones are compatible with 600 on the LTE front. Right now, close to 6 million on the 5G front and rapidly growing, because as you know, some of the most popular ones have only very recently been launched. And again this is something — this level of device compatibility is not something we had in prior mergers. And, boy, is it great to see, because we’re able — again, it’s a thing that’s allowing us to move quickly.

The company will add its newly-acquired midband 2.5GHz spectrum to its existing low band 600MHz 5G network. Sievert comments were very strong and “game changing”:

We’re tracking really nicely, to be at 100 million 5G covered people by the end of this year, certainly, by the next time we talk to you. That’s incredible.

The other guys are bumping around, like a Verizon with Ultra Wideband, maybe 2, 3, 4 million. And they’re talking about a lot of new cities, but little parts of cities and towns. You know their strategy. I predict they’re going to have a wholesale change in their strategy over at Verizon. They’re going to discover that they need to have a mid-band-centric 5G approach.

This is the way that you get very-very high ultra capacity 5G experiences to people by the millions and tens of millions. Our signal reaches miles, not meters. And so, that’s really important for the everyday experience. And people are going to see — across these tens of millions of people, they’re going to see an experience that’s not a little bit better than 4G LTE, but a transformation. So 7, 8, 9, 10 times faster, 300, 400 megabits per second, peak speeds over 1 gigabit. And this isn’t just a little smattering of certain street corners and when the leaves aren’t out. This is across vast swaths of the country.

So that’s really game changing. And it’s probably the place where we lead the most. And it’s going to be what millions of people see. It’s going to be FOMO, it’s going to be bragging rights. And everybody is going to be able to see this difference that T-Mobile is able to give you across massive swaths of the country.

100 million as we exit this year into the first part of 2021 and then 200 million as we exit next year. And so, this is game-changing. And it was a huge part of why we worked so hard to get this merger done, because we knew how it would benefit tens of millions of people and by extension, benefit our business.

……………………………………………………………………………………………………………………………

T-Mobile CTO Ray Neville has said is “really going to deliver an incredible 5G experience.”

Neville said in May that T-Mobile’s plan is to grow the company’s ~65,000 towers to 85,000 macro cell sites by building 15,000 new cell towers and decommissioning unnecessary, overlapping Sprint cell sites. T-Mobile says that it’s been adding 2.5GHz transmission radios to its existing towers at the rate of roughly 1,000 per month.

The company claims to be the first wireless telco to deploy a 5G Stand Alone (SA)/ 5G core network.

Sievert’s 5G boasting hit a peak with this statement:

In 5G, that’s our opportunity. We’re starting out way ahead and we intend to lead for the entire era. And not just be the best 5G network in terms of speed and capacity but to be the best network. And this – we’re a pure-play wireless company. And we know that in order to win, we have to have the best and the leading network in this country. And we have to become famous for it, which frankly is even harder because brands are stubborn. Brands are powerful.

That helps us on some fronts because simultaneous to being the best network in this country we’re the best value. And consumers and businesses already give us credit for that. We can’t lose that. We build behind it and lead through the entirety of the 5G era on network.

And then the third leg of the stool is experiences. Our company believes in delivering the best experiences. We have the highest Net Promoter Scores in the history of this industry. We’ve won five years in a row on J.D. Power for both consumers and businesses. Customers love us because we hire the best people and we have a culture of treating customers with respect and love. And so when you have the best value, the best network and the best experiences, that’s a winning formula. And we intend to lead with that formula through the entire 5G decade.

With respect to the legacy wireless competition, especially AT&T, Sievert said:

I don’t think we’ve caught AT&T on revenues yet. So, we surpassed them on customers. It’s always hard to tell what these comparisons. Our competitors can always provide the same exact transparency that we do.

But we think we’re right behind them on revenues. And so there’s a few differences between our model and the others. One is we have a denser network grid which is going to convey some of that advantage that I talked about that’s so important for growth. So, we intend to be a share taker and a grower through the time period and there’s always some cost to near-term margins to that very small.

We also intend to continue being the best value and there’s a small cost to that on margins. But both of those accrue to terminal value and growth rates and enterprise value-creation potential. And so there are things that are deliberate and we’re proud of and plan to keep.

Beyond that there aren’t that big of differences. And so you’ll see synergy attainment close the gap. And there will be differences as I just said, but between synergies and cost transformation of bringing these companies together, you’ll see that margin gap start to close. And we’ll talk more about it when we lay out more of our plans. But everything we talked about in 2018 when we announced this merger in terms of long-term potential, we still see. And in fact in some cases we see it unfolding better than we had anticipated back in 2018.

On the enterprise (business) market, Sievert said:

One of our biggest growth engines right now is enterprise. And we’re very focused not just on the here and now, but what enterprises want two and three and four years from now. And again, we’ve got this big network capacity, including the spectrum that backs up the network. And ultimately that gives us tools to be able to work with enterprises around the kinds of solutions that they may want in the future for dedicated networks, very low-latency, high-capacity dedicated networks with advanced dedicated spectrum capabilities. And there’s really exciting opportunities there.

Some of them are more two and three years out before they contribute in a very big way. But they’re real. And ultimately we’re so well positioned for that part of the market. Right now what we’re doing is selling our macro capabilities. And enterprises unlike consumers, where we have a bit of a brand deficit, we’ve got to overcome on network, meaning we’re not famous yet, as the best network in the space.

Enterprises don’t care about any of that, because they check out 100 phones and test them for a few weeks and then they come back and pick us. And so that’s a tailwind on our business. You’re seeing it in our present performance. In Q3, we had an all-time record on enterprise sales and you’re going to see it continue. It’s something that we’re really, really focused on a big growth engine for the company. 90-plus percent of the customers out there are with somebody else.

References:

https://event.webcasts.com/viewer/event.jsp?ei=1402861&tp_key=ad09ead741

8 thoughts on “T-Mobile US CEO talks up Sprint merger & 5G leadership in U.S.”

Comments are closed.

I like this wonderful post on T-Mobile being the U.S. leader in 5G.

At the Oppenheimer 5G Summit 15 Dec 2020, T-Mobile’s president of technology Neville Ray said the operator has some high-tech goals for next year, including adding carrier aggregation and voice-over-5G functions to its network.

Ray said that he’s already making significant progress in the operator’s five-year, $60 billion network upgrade program, having launched 5G on T-Mobile’s lowband 600MHz spectrum across most of the nation. Ray said T-Mobile is seeing average speeds on that network reaching up to 100 Mbit/s, roughly double the speeds available on T-Mobile’s 4G LTE network.

T-Mobile’s deployment of 5G in Sprint’s 2.5GHz spectrum will result in dramatic improvements to the operator’s offerings. He said the company expects to reach 100 million people with 5G in 2.5GHz spectrum by the end of this year, with average speeds of around 300 Mbit/s.

Ray explained that the addition of carrier aggregation technology next year to T-Mobile’s network should boost those speeds even further. Carrier aggregation technology is common throughout global 4G LTE networks, though it has not been applied widely to 5G networks. The technology essentially glues together transmissions in different spectrum bands, thereby boosting users’ overall speeds.

However, Ray said the deployment of carrier aggregation technology on T-Mobile’s network in 2021 will be contingent on the phones T-Mobile obtains from its suppliers. Ray said that some T-Mobile phones could support carrier aggregation as early as the first quarter of 2021, but that the rollout of the technology across all of T-Mobile’s phones “is going to be a little staggered.”

Finally, Ray also said T-Mobile is working to quickly move its customers’ voice traffic onto its 5G network. Dubbed “VoNR” (and pronounced “voner”) for “Voice over 5G New Radio,” the technology would represent an upgrade to the Voice over LTE (VoLTE) technology that T-Mobile has deployed on its 4G network.

The goal of VoNR would be to push all of T-Mobile’s traffic onto its most advanced network. Ray explained that T-Mobile hopes to deploy VoNR next year if possible, though the effort would depend on support from the operator’s vendors.

https://www.lightreading.com/ossbss/t-mobiles-2021-5g-goals-improved-speeds-upgraded-voice/d/d-id/766160?

I think the admin of this site is really working hard for the IEEE Techblog website. All the posts are based on quality information.

I am not sure the place you are getting your info, but it’s a great topic. Thanks for wonderful info I used to be looking for this information for my mission.|

The content on T-Mobile’s 5G leadership is great. Thanks – I will definitely share it.

T-Mobile previously disclosed it will shutter Sprint’s 3G CDMA network on January 1, 2022. That has caused some controversy following Dish Network’s request that T-Mobile maintain the network through a portion of next year – a request that T-Mobile has denied. An unspecified portion of Dish’s Boost Mobile customers still rely on Sprint’s CDMA network.

The overall Sprint network shutdown efforts are part of T-Mobile’s plan to assimilate Sprint following its blockbuster $26 billion purchase of the operator in a transaction that closed last year. T-Mobile is in the process of building a 5G network using Sprint’s spectrum and tower assets and is working to shift Sprint’s legacy customers off the Sprint network as a result.

Already, T-Mobile said it has managed to move about 33% of its Sprint customers onto its T-Mobile network.

“Moving customers who are on old networks onto modern, advanced high-speed networks means they will need to have phones and devices that can tap into the latest technologies and don’t rely on older ones. We’ll ensure that we support our customers and partners through the transition. We began sending notifications late last year, and everyone who needs to act will be given advanced notice and hear directly from T-Mobile,” the operator wrote on its website.

Interestingly, T-Mobile has no plans to turn off its own 2G network. “We’ve also shared that we plan to retire T-Mobile’s older GSM 2G and UMTS 3G networks as well, but no date has been set. We will update this page with any additional information in the future,” the operator wrote.

Of course, T-Mobile isn’t the only wireless provider working to shutter older networks in order to devote more resources to newer and more capable networking technologies. For example, AT&T plans to shut down its 3G network early next year, while Verizon now plans to shutter its 3G network at the beginning of 2023.

https://www.lightreading.com/5g/t-mobile-to-shutter-sprints-lte-network-on-june-30-2022/d/d-id/771269?

T-Mobile notches 4.95 Gbps on 5G standalone network

T-Mobile is claiming a new first for standalone 5G. The operator used a combo of 2.5 GHz and mmWave spectrum to reach nearly 5 Gbps on its commercial SA 5G network.

T-Mobile said it’s the world’s first New Radio Dual Connectivity (NR DC) data call on a commercial standalone 5G network, which resulted in download speeds of 4.95 Gbps. The data session took place in the September-October timeframe on a single site in Southern California, utilizing 100 MHz of 2.5 GHz spectrum and 800 MHz of mmWave, according to a T-Mobile spokesperson. Ericsson provided the network gear, and the call was conducted on a test device, the spokesperson said.

The mmWave portion used spectrum in the 39 GHz band. T-Mobile has long touted a layer cake strategy for 5G but put far less emphasis on mmWave than competitors like Verizon in early days – instead focusing on low-band 600 MHz for coverage and now 2.5 GHz since it later amassed a trove of mid-band spectrum from Sprint that provides a mix of coverage and capacity.

At the FCC’s third millimeter wave auction T-Mobile spent around $931 million to buy licenses in the 47 GHz and 39 GHz bands. Limited deployments, for example to boost capacity before big events like the Super Bowl LV in Tampa earlier this year or in the major market of Las Vegas, have used 39 GHz. Other locations like New York and Los Angeles have used 28 GHz.

While T-Mobile holds the bragging rights of first operator to deploy a nationwide 5G SA network at scale (and still the only U.S. carrier to do so) it hasn’t made much noise about impacts since the rollout.

RELATED: How’s 5G standalone doing in the U.S.?

During third quarter earnings results this week, T-Mobile CEO Mike Sievert made a short mention of 5G SA efforts and called out enterprise interest in advanced capabilities.

“We’ve already seen an increase in our win share for traditional postpaid services and we’re well positioned to capture advanced 5G services with the most widely built out 5G network and the only stand-alone 5G core, which is exactly why many large enterprises are in active trials with T-Mobile for advanced capabilities like mobile edge compute and private networks,” Sievert said. “And let me remind you that these advanced 5G services represent upside to our plan.”

The recent test focused on throughput although advanced capabilities like network slicing or ultra-low latency tend to be a focus of standalone 5G benefits, rather than straight speed gains. For 5G speeds, like in T-Mobile’s recent data call, spectrum resources and technologies like carrier aggregation or dual connectivity seem to get more attention. That was illustrated in recent Opensignal testing that showed T-Mobile’s 5G service using additional 2.5 GHz spectrum boosted user speeds significantly – but standalone 5G wasn’t the main driver.

T-Mobile until this point has largely focused on 600 MHz for users connected to the SA 5G network, who actually saw slower speeds than those on non-standalone (NSA) 5G which also incorporate 4G LTE mid-band frequencies to support 5G, according to Opensignal.

T-Mobile and U.S. carriers AT&T and Verizon all started initial 5G deployments in NSA mode, which helps get 5G up and running faster by having the option to still lean on 4G.

“Now, we can see that the 2.5 GHz band is predominantly used with NSA and so SA is not the key reason for the improvement in 5G speeds (although it likely does continue to have other benefits),” wrote Opensignal in an October 27 analysis.

Still, 5G experience improved as latencies dropped with help from the SA core and network reach expanded with the rollout, according to an earlier report.

“T-Mobile appears to have initially targeted its use of SA 5G to boost the reach of its 5G network, and therefore used its 600 MHz band for SA 5G — a low band that generally propagates further compared to higher bands like its 2.5 GHz band, but doesn’t allow for the same speeds,” Opensignal concluded in a February report on the operator’s 5G SA performance.

However, as T-Mobile’s most recent test shows, a mix of 2.5 GHz and mmWave with SA 5G dual connectivity can deliver ultra-fast results.

https://www.fiercewireless.com/5g/t-mobile-notches-4-95-gbps-5g-standalone-network

Everyone loves incisive analysis of telecom companies. Thanks for sharing your thoughts on T-Mobile. Great blog, stick with it!