Sprint

T-Mobile US CEO talks up Sprint merger & 5G leadership in U.S.

T-Mobile has begun shuttering Sprint’s network in a few locations following its acquisition, but doesn’t expect to really start until 2021-to-2022.

Talking with a fireplace in the background during a UBS Global TMT Virtual Conference on December 8th, T-Mobile CEO Mike Sievert said in response to a question about when Sprint’s network will shut down: “We’ve already done some on an isolated basis.”

T-Mobile has boasted of $6 billion in savings through its Sprint merger which has resulted in a single “master brand.”

We can go into an area, and as we get capacity on the destination T-Mobile network, we can migrate traffic off the Sprint network on to that destination network without having to touch those rate plans or billing relationships at all. We might move the brand relationship from Sprint to T-Mobile in advance of that or we might wait until later.

T-Mobile acquired Sprint for $26 billion earlier this year. Industry observers have been awaiting news on the company’s plans to shutter the old network as the “New T-Mobile” rolls out—which promises 14 times more capacity in six years than standalone T-Mobile has today. Sievert went on to say most of the shutdowns won’t happen until 2022 when at least most of Sprint’s legacy customers should have transitioned over to T-Mobile’s network.

This isn’t T-Mobile’s first acquisition and network shut down. In 2012, T-Mobile acquired MetroPC’s regional network and then dismantled it. It’s a fairly standard practice which Sprint did in 2016. After acquiring Clearwire, Sprint shut down the WiMax network it so highly promoted as the first real 4G.

Author’s Note:

T-Mobile’s 3G network is based on GSM while Sprint uses CDMA. Running two competing 3G networks simultaneously doesn’t help the bottom line. Both telcos support 4G LTE which is the ONLY 4G network since no carrier deployed WiMax Advanced.

…………………………………………………………………………………………………………………

Sievert summed up the Sprint network integration with this statement:

It’s really important that we use our capacity to migrate Sprint mobile customers over, right? So, we’re going to be — while we’re revenue-farming spectrum and building the destination network that’s our priority. So, you’ll see us go at pace for the first couple of years on broadband because the bigger prize for our shareholders is synergy attainment.

…………………………………………………………………………………………………………………….

Sievert said:

“What we’ve got at the dawn of the 5G era is the ability to lead all through this era with a superior product and a superior value simultaneously, something no company has ever been positioned to do. And obviously, they see that and they feel that they need to act. Now, they’ll try and convince you that what they’re doing is economic. By the way, it’s nothing too extraordinary, nor surprising.”

With respect to use of 600MHz for 5G is 2 or 3 times faster than 4G-LTE. Sievert said:

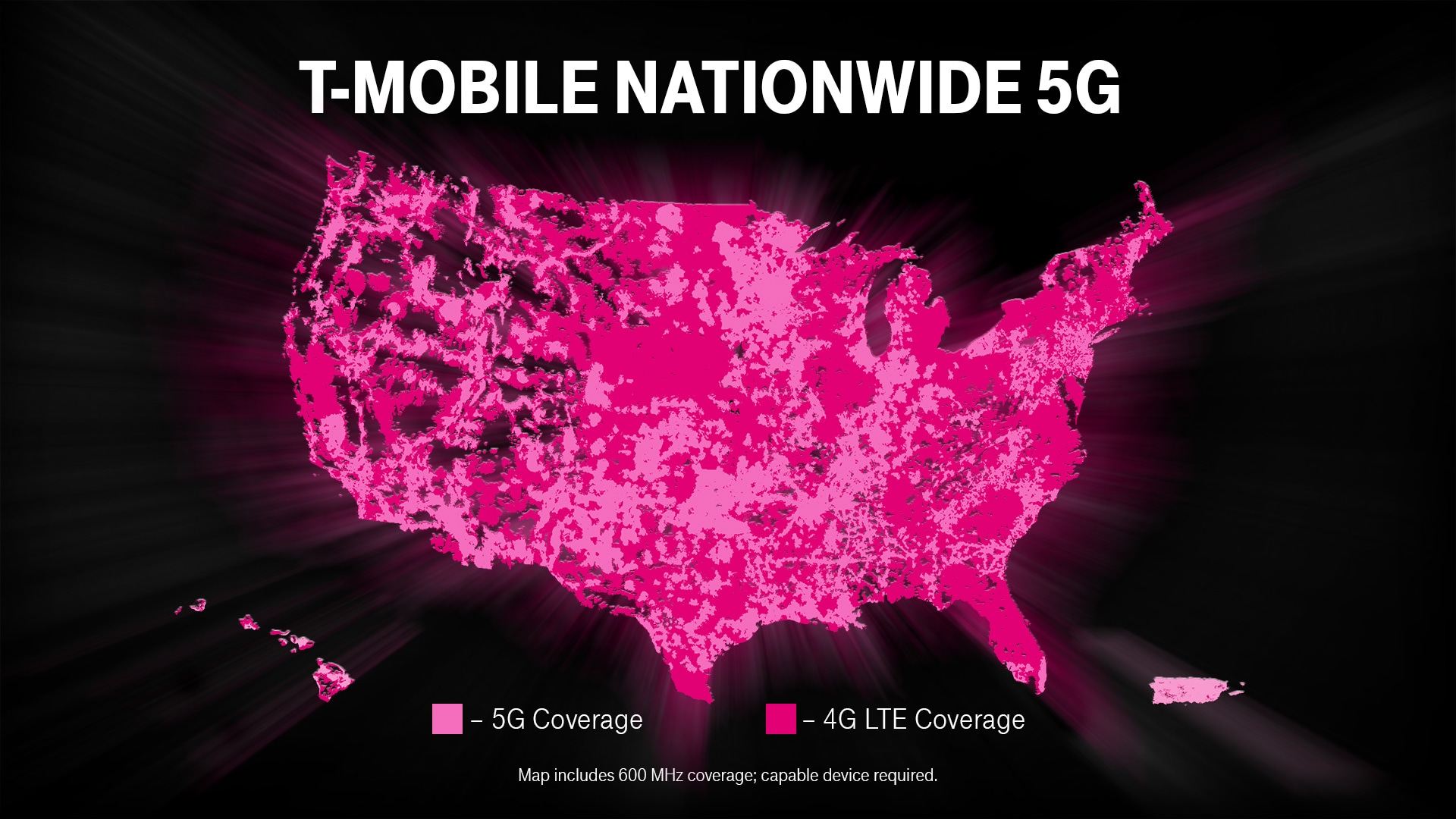

As of the last quarterly announcement, we were reaching about 270 million people with 600 megahertz Extended Range 5G. And that’s 5G even more on 4G LTE. These are dedicated lanes, and to your point, increasing dedicated lanes, because during this farming process and transition process, we’re actually leasing additional 600 megahertz spectrum from a variety of parties.

And what that allows us to do is to open up really wide dedicated Extended Range 5G lanes, so different than what you’re seeing from our competitors with DSS instead. They don’t have those dedicated lanes. And so they’re having to divide up their LTE spectrum into both technologies. It doesn’t get you much.

Our dedicated Extended Range 600 megahertz 5G is two times faster, in some cases, three times faster than LTE. So it’s a really nice pickup and experience for customers, but importantly, also gives us the capacity that we need to move quickly on migration. And that’s obviously the bigger payday for us and for customers. So those are the numbers.

About 1.4 million square miles as of the last quarterly announcement. That’s about three times what Verizon has, about double what AT&T had around that time. And again, we announced that we weren’t stopping there. We’re moving very quickly for the year-end time period. Next time we talk to you shortly after the New Year, we’ll have covered significantly more than those numbers. And so terrific progress there.

Most of the phones are compatible with 600 on the LTE front. Right now, close to 6 million on the 5G front and rapidly growing, because as you know, some of the most popular ones have only very recently been launched. And again this is something — this level of device compatibility is not something we had in prior mergers. And, boy, is it great to see, because we’re able — again, it’s a thing that’s allowing us to move quickly.

The company will add its newly-acquired midband 2.5GHz spectrum to its existing low band 600MHz 5G network. Sievert comments were very strong and “game changing”:

We’re tracking really nicely, to be at 100 million 5G covered people by the end of this year, certainly, by the next time we talk to you. That’s incredible.

The other guys are bumping around, like a Verizon with Ultra Wideband, maybe 2, 3, 4 million. And they’re talking about a lot of new cities, but little parts of cities and towns. You know their strategy. I predict they’re going to have a wholesale change in their strategy over at Verizon. They’re going to discover that they need to have a mid-band-centric 5G approach.

This is the way that you get very-very high ultra capacity 5G experiences to people by the millions and tens of millions. Our signal reaches miles, not meters. And so, that’s really important for the everyday experience. And people are going to see — across these tens of millions of people, they’re going to see an experience that’s not a little bit better than 4G LTE, but a transformation. So 7, 8, 9, 10 times faster, 300, 400 megabits per second, peak speeds over 1 gigabit. And this isn’t just a little smattering of certain street corners and when the leaves aren’t out. This is across vast swaths of the country.

So that’s really game changing. And it’s probably the place where we lead the most. And it’s going to be what millions of people see. It’s going to be FOMO, it’s going to be bragging rights. And everybody is going to be able to see this difference that T-Mobile is able to give you across massive swaths of the country.

100 million as we exit this year into the first part of 2021 and then 200 million as we exit next year. And so, this is game-changing. And it was a huge part of why we worked so hard to get this merger done, because we knew how it would benefit tens of millions of people and by extension, benefit our business.

……………………………………………………………………………………………………………………………

T-Mobile CTO Ray Neville has said is “really going to deliver an incredible 5G experience.”

Neville said in May that T-Mobile’s plan is to grow the company’s ~65,000 towers to 85,000 macro cell sites by building 15,000 new cell towers and decommissioning unnecessary, overlapping Sprint cell sites. T-Mobile says that it’s been adding 2.5GHz transmission radios to its existing towers at the rate of roughly 1,000 per month.

The company claims to be the first wireless telco to deploy a 5G Stand Alone (SA)/ 5G core network.

Sievert’s 5G boasting hit a peak with this statement:

In 5G, that’s our opportunity. We’re starting out way ahead and we intend to lead for the entire era. And not just be the best 5G network in terms of speed and capacity but to be the best network. And this – we’re a pure-play wireless company. And we know that in order to win, we have to have the best and the leading network in this country. And we have to become famous for it, which frankly is even harder because brands are stubborn. Brands are powerful.

That helps us on some fronts because simultaneous to being the best network in this country we’re the best value. And consumers and businesses already give us credit for that. We can’t lose that. We build behind it and lead through the entirety of the 5G era on network.

And then the third leg of the stool is experiences. Our company believes in delivering the best experiences. We have the highest Net Promoter Scores in the history of this industry. We’ve won five years in a row on J.D. Power for both consumers and businesses. Customers love us because we hire the best people and we have a culture of treating customers with respect and love. And so when you have the best value, the best network and the best experiences, that’s a winning formula. And we intend to lead with that formula through the entire 5G decade.

With respect to the legacy wireless competition, especially AT&T, Sievert said:

I don’t think we’ve caught AT&T on revenues yet. So, we surpassed them on customers. It’s always hard to tell what these comparisons. Our competitors can always provide the same exact transparency that we do.

But we think we’re right behind them on revenues. And so there’s a few differences between our model and the others. One is we have a denser network grid which is going to convey some of that advantage that I talked about that’s so important for growth. So, we intend to be a share taker and a grower through the time period and there’s always some cost to near-term margins to that very small.

We also intend to continue being the best value and there’s a small cost to that on margins. But both of those accrue to terminal value and growth rates and enterprise value-creation potential. And so there are things that are deliberate and we’re proud of and plan to keep.

Beyond that there aren’t that big of differences. And so you’ll see synergy attainment close the gap. And there will be differences as I just said, but between synergies and cost transformation of bringing these companies together, you’ll see that margin gap start to close. And we’ll talk more about it when we lay out more of our plans. But everything we talked about in 2018 when we announced this merger in terms of long-term potential, we still see. And in fact in some cases we see it unfolding better than we had anticipated back in 2018.

On the enterprise (business) market, Sievert said:

One of our biggest growth engines right now is enterprise. And we’re very focused not just on the here and now, but what enterprises want two and three and four years from now. And again, we’ve got this big network capacity, including the spectrum that backs up the network. And ultimately that gives us tools to be able to work with enterprises around the kinds of solutions that they may want in the future for dedicated networks, very low-latency, high-capacity dedicated networks with advanced dedicated spectrum capabilities. And there’s really exciting opportunities there.

Some of them are more two and three years out before they contribute in a very big way. But they’re real. And ultimately we’re so well positioned for that part of the market. Right now what we’re doing is selling our macro capabilities. And enterprises unlike consumers, where we have a bit of a brand deficit, we’ve got to overcome on network, meaning we’re not famous yet, as the best network in the space.

Enterprises don’t care about any of that, because they check out 100 phones and test them for a few weeks and then they come back and pick us. And so that’s a tailwind on our business. You’re seeing it in our present performance. In Q3, we had an all-time record on enterprise sales and you’re going to see it continue. It’s something that we’re really, really focused on a big growth engine for the company. 90-plus percent of the customers out there are with somebody else.

References:

https://event.webcasts.com/viewer/event.jsp?ei=1402861&tp_key=ad09ead741

T-Mobile shutters Sprint’s 5G network; OpenSignal 5G User Experience report highlights

As expected following the April 1st close of T-Mobile’s acquisition, Sprint’s 5G network (which uses 2.5GHz mid-band spectrum) has been deactivated while the “new T-Mobile” works to re-deploy it across its own network.

The integration of the Sprint mid-band spectrum is a key part of T-Mobile’s 5G strategy, which aims to combine low-band 600MHz spectrum for broad, nationwide 5G coverage with faster but lower-range midband (Sprint’s 2.5GHz network) and short-range mmWave networks for a balance of coverage and speed.

T-Mobile has already deployed its new 2.5GHz spectrum in New York, the first market to benefit from the wireless network operator’s spectrum in low-, mid-, and millimeter wave bands. The operator’s 2.5GHz 5G is also live in “parts” of Chicago, Houston, Los Angeles, New York, and Philadelphia.

Most existing Sprint customers won’t be able to use their current devices going forward to access 5G. Newer devices that feature Qualcomm’s X55 modem, like the Galaxy S20 5G lineup, will still be able to access the 2.5GHz 5G when they relaunch as part of the new T-Mobile’s 5G network (along with the rest of T-Mobile’s low-band and mmWave 5G spectrum). T-Mobile is offering credits for affected customers to lease a new 5G device.

“We are working to quickly re-deploy, optimize and test the 2.5 GHz spectrum before lighting it up on the T-Mobile network. In the meantime, legacy Sprint customers with compatible devices can enjoy T-Mobile’s nationwide 5G network,” a T-Mobile spokesperson said.

According to data from a new Opensignal 5G User Experience report, customers using T-Mobile’s mid-band 5G are benefitting from average download speeds of around 330Mbps. The mobile analytics company ranks T-Mobile first for 5G availability; with customers receiving a 5G signal around twice as often as AT&T and 56 times more than Verizon.

T-Mobile’s press release about the Opensignal report said customers are seeing average download speeds of 330 Mbps on its mid-band 2.5 GHz network.

From that OpenSignal report:

T-Mobile wins the 5G Availability award, as its 5G users spend 22.5% of time connected to 5G:

The time connected to a 5G service is extremely important if users are to enjoy all of 5G’s benefits. In the U.S., T-Mobile won the 5G Availability award by a large margin with Sprint and AT&T trailing with scores of 14.1% and 10.3%, respectively. Verizon users saw their extremely fast 5G service 0.4% of the time because of the limited geographical reach of the mmWave wireless technology Verizon currently relies upon for 5G and the early stage of the 5G deployment.

Sprint’s 5G users’ experience is already changing as new T-Mobile combines its network capabilities:

When we previously looked at the 5G Download Speed of Sprint’s users some time ago we saw average 5G speeds of 114.2 Mbps reflecting the mid-band 5G wireless spectrum Sprint relied upon. But following the completion of T-Mobile’s acquisition of Sprint, the new T-Mobile is starting to provide Sprint 5G users with access to old T-Mobile’s 600MHz spectrum and so average 5G speeds are now 49.5 Mbps but 5G Availability has risen from 10.3% to 14.1% of time. T-Mobile is still in the process of merging its original network with Sprint and we expect the mobile network experience of Sprint users will continue to change for some time.

………………………………………………………………………………………………………………………………………………………………………….

“Building the fastest 5G network is easy if you only cover less than 50 square miles. Opensignal’s report shows that only T-Mobile is doing the hard work to deliver BOTH 5G coverage and speed. And we’re just getting started,” said Neville Ray, President of Technology at T-Mobile.

“With the addition of Sprint, the Un-carrier’s 5G is getting bigger, better and faster every day, moving quickly on our mission to build the world’s best 5G network, one unlike any other, to people all across the country!”

T-Mobile and Sprint were finally cleared to merge on April 1st, following discussions which began in 2013.

To appease regulators, T-Mobile agreed to sell Sprint’s prepaid business, Boost Mobile, and Virgin Mobile to Dish network for $1.4 billion. The deal also included selling Sprint’s entire 800 MHz portfolio of spectrum to Dish. Those deals formally completed yesterday.

Last month, T-Mobile asked California’s Public Utilities Commission (CPUC) to ease other conditions it agreed to in order for the merger to be granted – including job creation promises following the COVID-19 pandemic, average 5G coverage and speed commitments, and to remove a “burdensome” third independent test of its network.

……………………………………………………………………………………………………………………………………………………………………

References:

T-Mobile switches off Sprint’s 5G network following $26.5 billion merger

https://www.opensignal.com/reports/2020/06/usa/mobile-network-experience-5g

New T-Mobile no longer the “uncarrier”: layoffs, network outage, challenge integrating Sprint network

T-Mobile US Inc. is cutting jobs faster than initially planned after its April merger with rival Sprint Corp. created a company with about 80,000 employees. Before regulators signed off on T-Mobile’s $26 billion merger with Sprint, executives like former CEO John Legere said that the merger would create many new jobs from “day one.” With the ink barely dry on the deal, it’s abundantly clear that is NOT happening.

T-Mobile said in a securities filing late Wednesday that it expects to spend about $300 million more than initially projected on merger-related costs, primarily on severance expenses, to accelerate expected cost benefits from the deal. The company now expects merger costs before taxes to total $800 million to $900 million during the June-ended quarter. The “new T-Mo” didn’t detail the number of jobs being cut. T-Mobile ended 2019 with 53,000 workers. Sprint last reported 28,500 employees in early 2019.

T-Mobile Chief Executive Mike Sievert said Tuesday the company seeks to hire workers in 5,000 new positions like retail and engineering over the next 12 months. “As part of this process, some employees who hold similar positions are being asked to consider a career change inside the company, and others will be supported in their efforts to find a new position outside the company,” Mr. Sievert said.

The savings estimates T-Mobile provided investors suggest several thousand jobs are being eliminated, according to Jonathan Chaplin, a telecom analyst for New Street Research. Those cuts don’t include stores run by third-party dealers, some of which will switch to other brands, he added. “They will be cutting redundant positions, but adding other positions as they invest for growth,” Mr. Chaplin said.

T-Mobile last year told lawmakers that the then-proposed merger of the two wireless giants would yield more jobs at the combined company by 2024 than each business would employ on its own.

…………………………………………………………………………………………………………………………………………………

Back Story:

Last month, T-Mobile laid off an estimated 6,000 employees from its Metro prepaid division, layoffs that had everything to do with the merger, and nothing to do with the COVID-19 crisis. And on June 15th, hundreds of Sprint employees were unceremoniously fired as part of a six minute conference call during which nobody was allowed to ask questions:

“In a conference call on Monday lasting under six minutes, T-Mobile vice president James Kirby told hundreds of Sprint employees that their services were no longer needed. He declined to answer his employees’ questions, citing the “personal” nature of employee feedback, and ended the call.”

On June 19th, Tech Dirt’s Karl Bode wrote:

This was all ridiculously predictable. There’s 40 years of documented US telecom history showing that the elimination of a major competitor reduces competition and raises prices (oh hi, Comcast). Global markets (Canada, Ireland) have also made this clear. Such deals almost universally result in thousands of layoffs as redundant retail, support, and management positions are culled. It’s why similar deals of this type (AT&T’s 2011 acquisition of T-Mobile, T-Mobile’s 2014 acquisition of Sprint) were blocked. This isn’t a debate topic. It’s not a murky subject. Telecom consolidation routinely ends badly for employees and customers.

Economists made all of these points to the DOJ and FCC, but they were unceremoniously ignored. First by an FCC that couldn’t bother to even read its own staff analysis before rubber stamping the a merger it helped cook up behind closed doors, then by a DOJ whose “antitrust” boss personally escorted the deal to fruition while ignoring all criticism.

If you go back and look at some of ex-CEO John Legere’s blog posts from a few months ago (which I’m sure won’t be around much longer), the CEO repeatedly promised that the merger would be “job positive” from “day one”:

“So, let me be really clear on this increasingly important topic. This merger is all about creating new, high-quality, high-paying jobs, and the New T-Mobile will be jobs-positive from Day One and every day thereafter. That’s not just a promise. That’s not just a commitment. It’s a fact. To achieve what we’re setting out to do – become the supercharged Un-carrier that delivers new value, ignites competition and delivers nationwide real 5G for All – the New T-Mobile will provide an amazing and compelling set of services for consumers.”

Legere was so breathlessly offended by statements to the contrary, he tried to insist that union officials were lying — before reminding everybody he testified under oath about the deal’s looming job explosion:

“We also keep seeing the opposition try to use projected layoff numbers from an analyst’s projections that were based on a completely different deal at a completely different point in time to discredit this merger. It’s SO bad that the head of the Communications Workers Association (CWA) was bold enough to refer to those completely unrelated numbers in a CONGRESSIONAL HEARING. I guess if the real numbers don’t tell the story you want, you can just make up new ones? It’s actually offensive. At the hearings, I raised my right hand and swore under oath to tell the TRUTH… and the truth is that the New T-Mobile will CREATE JOBS.”

…………………………………………………………………………………………………………………………………………………

Network Outage:

T-Mobile network suffered a nationwide service failure on Monday. Federal regulators said they would investigate the incident, which led to intermittent voice and data coverage for about 12 hours. Company chief technology officer Neville Ray later said the problems stemmed from a supplier’s fiber optic circuit going down. But what happened to automated failure detection and recovery/restoral?

Cellphone carriers’ network backbones usually have several fallback routes should one path get severed. Mr. Ray said that “redundancy failed us and resulted in an overload situation that was then compounded by other factors.” The company said its Sprint customers weren’t affected and vowed to put new safeguards in place.

………………………………………………………………………………………………………………………………………………

Integrating Sprint’s 3G and 5G networks:

The “new T-Mo” also faces the challenge of integrating Sprint’s 3G CDMA network with its own 3G GSM network. Also the two former carriers were designing different 5G NSA networks, albeit both using 3GPP Release 15 “5G NR” for the data plane.

T-Mobile has had difficulty integrating Sprint’s customers and network assets and building out a faster 5G network throughout the country, The Wall Street Journal reported in May.

Despite pandemic-related challenges, T-Mobile has begun the process of integrating Sprint into the new stand-alone company and tapping into the trove of airwaves it acquired as part of the deal. Many of T-Mobile’s current executives remain in charge, though some Sprint leaders including technology chief John Saw hold key posts in the combined company.

………………………………………………………………………………………………………………………………………………..

Separately, AT&T has outlined plans to cut more than 3,400 jobs in the coming weeks, according to the Communications Workers of America, which represents a large share of the telecom and media giant’s 244,000 employees. Those cuts exclude hundreds of other positions potentially eliminated through store closures.

AT&T said it will make “targeted, but sizable reductions in our workforce across executives, managers and union-represented employees” as it overhauls its employee base. The carrier also is closing more stores to cater to online shoppers, a shift the company said it accelerated in response to the coronavirus crisis.

“Reducing our workforce is a difficult decision that we don’t take lightly,” AT&T said in a statement.

In light of the tens of thousands of AT&T layoffs the last few years, does anyone seriously believe that statement?

…………………………………………………………………………………………………………………………………………….

References:

https://www.wsj.com/articles/t-mobile-and-at-t-are-cutting-thousands-of-jobs-11592501203

https://www.wsj.com/articles/t-mobile-to-feel-coronavirus-pain-through-2020-11588799462

U.S. District Judge approves T-Mobile- Sprint merger; New T-Mo will be #2 wireless carrier in U.S.

A federal judge has ruled in favor of T-Mobile USA’s merger with Sprint, despite evidence presented that showed the deal will likely erode competition, raise U.S. wireless data prices, and result in significant layoffs as redundant jobs are eliminated. U.S. District Judge Victor Marrero concluded the T-Mobile USA merger with Sprint, worth $26 billion when it was struck two years ago, wasn’t likely to substantially lessen competition, and rejected the main arguments by a group of states seeking to block the deal as anti-competitive. The judge praised T-Mobile in his ruling, calling it “a maverick that has spurred the two largest players in its industry to make numerous pro-consumer changes” and describing its business strategy as “undeniably successful.

Judge Marrero wrote:

“While Sprint has made valiant attempts to stay competitive in a rapidly developing and capital-intensive market, the overwhelming view both within Sprint and in the wider industry is that Sprint is falling farther and farther short of the targets it must hit to remain relevant as a significant competitor.”

“Finally, the FCC and DOJ have closely scrutinized this transaction and expended considerable energy and resources to arrange the entry of Dish as a fourth nationwide competitor, based on its successful history in other consumer industries and its vast holdings of spectrum, the most critical resource needed to compete in the RMWTS markets.”

“Dish’s statements at trial persuade the court that the new firm will take advantage of this opportunity, aggressively competing in the RMWTS markets to the benefit of price-conscious consumers and opening for consumer use a broad range of spectrum that had heretofore remained fallow.”

The two companies said they would move forward to finalize their long-delayed merger. The deal’s current terms offer Sprint shareholders new stock equal to 0.10256 of one T-Mobile share.

“Today was a huge victory for this merger… and now we are FINALLY able to focus on the last steps to get this merger done!” cheered T-Mobile CEO John Legere (pictured below) in a press release.

The states might decide to appeal the ruling and another U.S. district judge in Washington must approve the existing Justice Department arrangement. Letitia James, New York’s attorney general, said the states disagreed with the decision and would review their options. “There is no doubt that reducing the mobile market from four to three will be bad for consumers, bad for workers and bad for innovation,” Ms. James said.

The two companies also need clearance from California’s Public Utilities Commission and face a private antitrust suit challenging the merger. A judge in the Northern District of California ruled in January 2020 that the case could proceed if the carriers overcame the state-led challenge.

T-Mobile and Sprint hope to close the merger by April 1st. The two telcos have spent more than seven years pursuing a combination in some form. They abandoned previous attempts in 2013 and 2017 before their boards struck an agreement in early 2018 that would allow T-Mobile to take over its smaller rival, creating a company closer in size to Verizon and AT&T.

The new T-Mobile would be a formidable rival to Verizon and AT&T, the two largest wireless carriers in the country. In fact, the total number of “New T-Mobile” wireless subscribers will be more than AT&T currently has.

The “New T-Mobile” will be strengthened by a massive stockpile of wireless radio licenses held by Sprint. Those spectrum holdings allow the new company to serve more customers with high-speed internet service on the go, putting pressure on AT&T and Verizon to match them as carriers upgrade to faster 5G mobile networks.

The court victory also benefits T-Mobile parent Deutsche Telekom AG and Japan’s SoftBank Group Corp., Sprint’s majority owner. SoftBank Chairman Masayoshi Son, a billionaire investor who upended the telecom business in Japan, had been seeking a way to rescue an investment that proved less successful in the U.S.

Tuesday’s court verdict will test the idea that three big players will compete as effectively as four did. Dish enters the market with fewer customers than Sprint, making it a distant No. 4 in the consumer-cellular business.

Dish Chairman Charlie Ergen testified during the trial that his Englewood, Colo., company was better equipped to compete than Sprint. His new wireless service will ride over T-Mobile’s network at first, though customers will eventually use a new cellphone system Dish is required to build over seven years.

Quotes from opponents of the deal:

“We are profoundly disappointed that the judge approved a merger that will harm communities of color and low-income communities across California,” said Greenlining Institute Technology Equity Director Paul Goodman, in a statement.

“While the court may think it unlikely for a newly entrenched trio of enormous wireless carriers to collude rather than compete, the history of broken and abandoned merger promises from these companies – to say nothing of the mountains of evidence and expert analysis in this trial – say otherwise,” said Free Press Vice President of Policy and General Counsel Matt Wood, in a statement.

“The Rural Wireless Association disagrees with Judge Marrero’s decision to approve this deal, which has been consistently and drastically altered from what was originally proposed in early 2018, and now includes Dish, a company that has zero experience operating as a facilities-based mobile wireless carrier network as the savior for wireless competition,” the association said in a statement.

Quotes from supporters of the deal:

“I’m pleased with the district court’s decision. The T-Mobile-Sprint merger will help close the digital divide and secure United States leadership in 5G,” said FCC Chairman Ajit Pai in a statement.

“We appreciate Judge Marrero’s thorough evaluation of this merger. The ruling, in addition to the DOJ and FCC approvals, accelerates our ability to deploy the nation’s first virtualized, standalone 5G network and bring 5G to America,” said Dish Network’s Charlie Ergen in a statement. “We are eager to begin serving Boost customers while aggressively growing the business as a new competitor, bringing lower prices, greater choice and more innovation to consumers. We look forward to the Boost employees and dealers joining the Dish family.

Analyst Opinions:

“This is clearly a big win for T-Mobile, which will now how [sic] a superior spectrum position which it can use to launch 5G and handle even higher growth,” wrote the Wall Street research analysts at Lightshed in a post. “We also see this as a big win for Dish based on what we have learned about its MVNO terms. It’s not great news for Verizon, given that it removes Sprint and Dish’s spectrum as an alternative, created a new competitor in Dish and has empowered T-Mobile with the tools to deliver a superior network experience to consumers.”

“We view a deal as initially negative to AT&T/Verizon despite our view that consolidation should help to further rationalize the competitive/pricing environment long term considering T-Mobile is likely to be aggressive at least early on to help validate the premise of the deal which is it will result in more favorable pricing for consumers,” wrote the Wall Street analysts at Cowen in a note to investors.

“Dish will need to execute on a myriad of levels including building a cloud-native nationwide network followed by the operational challenges that come with competing against three very well entrenched wireless players,” the Cowen analysts added.

“The wireless industry is going to get tougher. Cable would have had a much easier time sucking subscribers out of Verizon and AT&T in a four-carrier market with a capacity constrained T-Mobile. Now they are going to have to fight T-Mobile for every one of those subs, and industry pricing is likely headed lower,” wrote the Wall Street analysts at New Street Research in a note to investors.

However, the New Street analysts pointed out that cable companies may also see some silver lining in the merger of Sprint and T-Mobile, if it is ultimately approved. “Cable will have one more company competing for its MVNO business. We have been surprised the companies haven’t announced new MVNO terms with Verizon or AT&T; negotiations were in full force in October / November last year. Perhaps they have been waiting to see what T-Mobile might offer them if the deal went through. Altice will be the most immediate winner; their MVNO with Sprint now moves to a much better network.”

…………………………………………………………………………………………

Addendum from Robin Hood Snacks:

|

Here’s the history of this complex courtship:

Sprint has been lagging rivals for a while… so the judge doesn’t think this deal will substantially hurt competition. Plus, regulators will make sure that Dish Network enters the game as a viable new service provider. Sprint will have to sell Dish 9M customers, but that’ll still be a distant competitor to the Big 3. |

|

THE TAKEAWAY

|

|

We have a three-opoly on our hands… Here’s the pecking order now: Verizon #1, New T-Mobile #2, and AT&T #3. And a three-opoly could affect your bill:

|

Justice Dept approves the “New T-Mobile” via Sprint merger; Dish Network becomes 4th U.S. wireless carrier with focus on 5G

The Justice Department approved T-Mobile US Inc. ’s merger with Sprint Corp. after the companies agreed to create a new wireless carrier by selling assets to satellite-TV provider Dish Network Corp. The federal approval for T-Mobile and Sprint caps a more than yearlong review of a combination that fell apart twice in the past five years over terms of the deal or fears that the Justice Department would object.

The landmark antitrust agreement seeks to address concerns that the combination of T-Mobile, the nation’s No. 3 carrier by subscribers, and No. 4 Sprint will drive up prices for consumers. It would leave more than 95% of American cellphone customers with the top three U.S. operators.

A deal brokered by the Justice Department will require Dish, which has been sitting on valuable airwaves, to build a 5G network for cellphone customers. To help it get started, T-Mobile will sell Sprint’s prepaid brands to Dish and give access to its network for seven years.

“The remedies set up Dish as a disruptive force in wireless” with the pieces needed for the company to have a cellphone service that is ready to go, Makan Delrahim, the Justice Department’s antitrust chief, said in a news conference.

Critics of the arrangement include a group of state attorneys general that broke with the Justice Department and have filed an antitrust lawsuit seeking to block the more than $26 billion merger. Five states that weren’t part of the lawsuit joined the federal government in the settlement announced Friday.

“Why scramble so much to create a fourth competitor when you already have one?” said Samuel Weinstein, an assistant law professor at the Cardozo School of Law at Yeshiva University who worked previously in the Justice Department’s antitrust unit.

The deal gives Dish Network, a satellite-TV provider, about nine million Sprint prepaid cellphone customers and additional wireless spectrum. Those subscribers, which mostly come from its Boost Mobile business, represent about one-fifth of Sprint’s customer base. Dish’s service, which could keep the Boost brand or take on a new name, would also be able to move from pay-as-you-go plans to postpaid service, which tends to be more profitable.

T-Mobile and Sprint must also give Dish access to at least 20,000 cell sites and hundreds of retail locations. The new T-Mobile must provide “robust access” to its network, the Justice Department said. Please see comments on Dish in the box below this article.

The union of T-Mobile and Sprint, years in the making, would create a wireless company surpassing 90 million U.S. customers, closing the gap with Verizon Communications Inc. and AT&T Inc., which each have roughly 100 million wireless customers. It also would fulfill a long-held goal of Japan’s SoftBank Group Corp., which owns most of Sprint, and Deutsche Telekom AG, which controls T-Mobile.

T-Mobile and Sprint currently use separate frequencies, often requiring different cell towers:

Under the merger:

- Dish rents capacity from the new T-Mobile, creating a new carrier to serve Boost Mobile customers and giving it time to build its own network.

- After seven years, Dish runs its own network using spectrum from its past acquisitions and its own equipment installed on fewer towers.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Federal Communications Commission Chairman Ajit Pai, who had previously backed the deal, said Friday the Justice Department settlement, coupled with T-Mobile and Sprint’s earlier commitments to deploy a nationwide 5G network, will preserve competition and advance U.S. leadership in rolling out next-generation networks.

In its agreement with the government, T-Mobile promised not to raise prices for three years and cover 97% of the U.S. population with 5G service in three years. T-Mobile has been adding millions of customers at the expense of its rivals, pushing unlimited data plans and lower prices than the incumbents. Sprint, despite owning valuable airwaves, has been shedding millions of subscribers and has struggled to be profitable.

T-Mobile surpassed Sprint to become the number three wireless carrier by subscribers and argued the acquisition of the smaller carrier’s airwaves would help speed its deployment of a 5G network so that it could better compete with Verizon and AT&T. U.S. carriers have been battling for customers in the $180 billion wireless voice-and-data market, where growth has slowed now that the companies have rolled out unlimited data plans and most Americans have upgraded to smartphones.

Letitia James, the New York attorney general, said the proposed merger would cause harm to consumers nationwide. “To be clear: The free market should be picking winners and losers, not the government, and not regulators,” she said during a call with reporters. Ms. James said Dish lacks the experience to operate a nationwide mobile network.

Mr. Delrahim said his office will share its settlement with the federal judge overseeing the states’ lawsuit. “Sometimes independent sovereigns do make independent determinations,” he said. A trial is expected later this year. On Friday, T-Mobile and Sprint extended the deadline to close their deal, from July 29 to Nov. 1.

The Justice Department stopped sharing information with the Democratic attorneys general after they decided to file their lawsuit in June without notifying their federal counterparts, Mr. Delrahim said. “That was their choice, not ours,” he said.

…………………………………………………………………………………………..

T-Mobile said it expects to close its Sprint purchase in the second half of this year despite the states’ lawsuit. Under the deal, Dish will pay $1.4 billion for the Sprint customer accounts, most of which come from its Boost prepaid brand, and $3.6 billion three years later to buy Sprint spectrum licenses in the 800-megahertz range, which can travel long distances and cover rural areas.

The new T-Mobile will have the option to lease back part of that spectrum for an additional two years after the airwaves sale closes. The companies have also agreed to negotiate for T-Mobile to lease Dish spectrum in the 600-megahertz range.

Dish is set to start its wireless life with a base of Sprint’s pay-as-you-go customers, though carriers often struggle to keep those so-called prepaid subscribers. More than 4% of Sprint’s prepaid customers choose to drop their service or are disconnected for nonpayment each month, according to company filings.

The deal creates a fake competitor, said Andrew Jay Schwartzman, a lecturer at Georgetown Law, adding that even if Dish builds out its own network it will take years. During that time, the three large carriers will be able to introduce 5G and lock in their subscriber bases, he said.

“Rather than having Sprint as a weak fourth competitor, the combined companies will now face an extremely weak fourth competitor,” Mr. Schwartzman said.

Sprint ended March with nearly $33 billion of net debt on its balance sheet. Even though it had more than 40 million customers, Sprint said during deal negotiations that it was in poor health and wouldn’t be able to launch nationwide 5G service without the merger.

Dish has argued it can build a better network by starting from scratch. Even before he pursued a deal with the Justice Department, Dish Chairman Charlie Ergen said his business could invest capital more efficiently without the burden of old equipment and software holding back its ambitions. Dish hasn’t made public the prices or structure of the wireless plans it will sell.

“These developments are the fulfillment of more than two decades’ worth of work and more than $21 billion in spectrum investments intended to transform Dish into a connectivity company,” Dish CEO Ergen said in a press release. “Taken together, these opportunities will set the stage for our entry as the nation’s fourth facilities-based wireless competitor and accelerate our work to launch the country’s first standalone 5G broadband network.”

Dish says:

The 800 MHz nationwide spectrum adds to Dish’s existing 600 MHz and 700 MHz low-band holdings. The low-band portfolio, well suited for wide geographic coverage and in-building penetration, complements Dish’s AWS-4 and AWS H Block mid-band offerings, which promise high data capacity potential with narrower operating range.

Dish has committed to new buildout schedules associated with the company’s 600 MHz, AWS-4, 700 MHz E Block and AWS H Block licenses. In addition, DISH has committed to deploy 5G Broadband Service utilizing those licenses.

Senior FCC officials said on a call with reporters that they are confident the new carrier under Dish will be viable because the wholesale deal it has struck with the new T-Mobile is more aggressive than any other such arrangement the carrier and Sprint currently have. Its terms give Dish the financial ability to compete in the prepaid market against T-Mobile’s Metro brand, they said. The settlement also included provisions designed to make sure Dish actually builds the promised infrastructure. Among other penalties, Dish agreed to pay the government up to $2.2 billion if it fails to meet its network expansion requirements.

Following the closing of T-Mobile’s merger with Sprint and subsequent integration into the New T-Mobile, DISH will have the option to take on leases for certain cell sites and retail locations that are decommissioned by the New T-Mobile for five years following the closing of the divestiture transaction, subject to any assignment restrictions. The companies have also committed to engage in good faith negotiations regarding the leasing of some or all of DISH’s 600 MHz spectrum to T-Mobile.

The completion of the T-Mobile and Sprint combination remains subject to remaining regulatory approvals and certain other customary closing conditions. T-Mobile and Sprint expect to receive final federal regulatory approval in Q3 2019 and currently anticipate that the merger will be permitted to close in the second half of 2019. Additional information can be found at www.NewTMobile.com.

………………………………………………………………………………………………………………………………………………………………………

Addendum from WSJ Editorial Board July 27, 2019 print edition:

The Justice Dept has rescued Dish Chairman Charlie Ergen from his bet of buying wireless spectrum but keeping it idle. Mr. Ergen loudly opposed the merger, and his reward was the chance to buy Sprint’s pre-paid customers at a bargain price and have access to 20,000 T-Mobile-Sprint cell sites and hundreds of retail locations. But Dish has no experience running a wireless network, and it will take years to build one even as the Big Three invest to gain an edge in 5G wireless…………………………………………………..

A strong third competitor will be good for consumers and 5G deployment in the U.S. The combined company should force Verizon and AT&T to focus on 5G rather than dabbling in content acquisitions like Time Warner. Three strong competitors are better than two.

………………………………………………………………………………….

FCC Comments:

“That’s a real significant win for U.S. leadership in 5G. It’s been my top priority. It’s been a big priority for the Trump administration. And by accelerating 5G build-out through this deal, 99% of Americans are going to see 5G faster,” FCC Commissioner Carr said.

In addition to the Justice Department, FCC Chairman Ajit Pai announced support for the more than $26 billion merger in May. The deal still faces a lawsuit from 13 state attorneys general and the District of Columbia that seeks to block it.

…………………………………………………………………………………..

References:

https://www.t-mobile.com/news/t-mobile-sprint-merger-doj-clearance

https://www.cnbc.com/2019/07/26/dish-network-finally-has-a-plan-for-a-new-wireless-network.html

https://techblog.comsoc.org/2018/08/03/dish-network-on-track-for-5g-build-out-phase1-is-nb-iot/