Counterpoint Research: Mediatek is world’s #1 smartphone chipset vendor

Christmas day surprise! Taiwanese fabless chipmaker Mediatek has overtaken Qualcomm and is now the #1 smartphone chipset vendor with a 31% market share in Q3 2020. Mediatek was helped by its growth in regions like India and China, and a strong performance in the $150-200 price smartphone category, according to estimates from market research firm Counterpoint Technology Market Research.

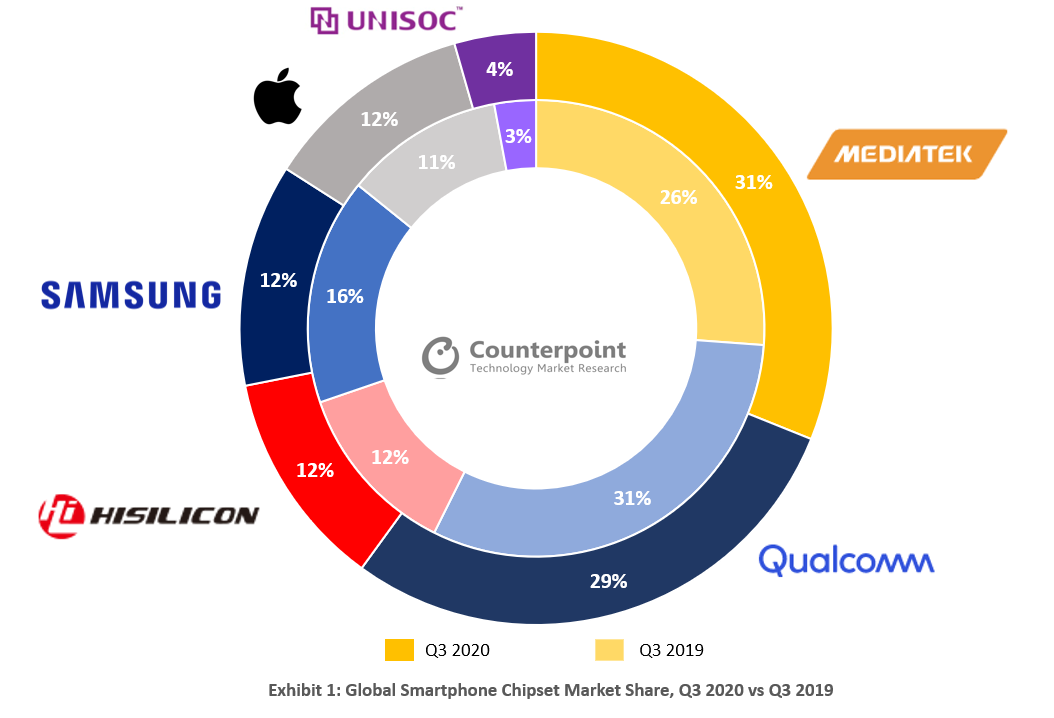

In terms of market share, MediaTek led the chipset market at the first position, followed by Qualcomm (29%), HiSilicon (12%), Samsung (12%), Apple (12%), and UNISOC (4%) respectively.

Qualcomm was the biggest 5G chipset vendor in Q3 2020. Its silicon powered 39% of the 5G phones sold worldwide. The demand for 5G smartphones doubled in Q3 2020 – 17% of all smartphones sold in Q3 2020 were 5G. This impressive growth trajectory is going to continue, more so with Apple launching its 5G line-up. One-third of all smartphones shipped in Q4 2020 are expected to be 5G enabled. There is still a chance Qualcomm will regain the top position in Q4 2020.

Source: Counterpoint Research

………………………………………………………………………………………………………………………………………………………………………………………………………

MediaTek’s Research Director Dale Gai said:

“MediaTek’s strong market share gain in Q3 2020 happened due to three reasons – strong performance in the mid-end smartphone price segment ($100-$250) and emerging markets like LATAM and MEA, the U.S. ban on Huawei and finally wins in leading OEMs like Samsung, Xiaomi and Honor. The share of MediaTek chipsets in Xiaomi smartphones has increased by more than three times since the same period last year.’

“MediaTek was also able to leverage the gap created due to the U.S. ban on Huawei. Affordable MediaTek chips fabricated by TSMC became the first option for many OEMs to quickly fill the gap left by Huawei’s absence. Huawei had also previously purchased a significant amount of chipsets ahead of the ban.”

“On the other hand, Qualcomm also posted strong share gains (from a year ago) in the high-end segment in Q3 2020, again thanks to HiSilicon’s supply issues. However, Qualcomm faced competition from MediaTek in the mid-end segment. We believe both will continue to compete intensively through aggressive pricing, and mainstream 5G SoC products into 2021.”

Counterpoint Research Analyst Ankit Malhotra said:

“Qualcomm and MediaTek have both reshuffled their portfolios, and consumer focus has played a key role here. Last year, MediaTek launched a new gaming-based G-series, while Dimensity chipsets have helped in bringing 5G to affordable categories. The world’s cheapest 5G device, the realme V3, is powered by MediaTek.”

Commenting on the outlook for chipset vendors, Malhotra added, “The immediate focus of chipset vendors will be to bring 5G to the masses, which will then unlock the potential of consumer 5G use cases like cloud gaming, which in turn will lead to higher demand for higher clocked GPUs and more powerful processors. Qualcomm and MediaTek will continue to contend for the top position.”

Source: Counterpoint Research

……………………………………………………………………………………………………………………………………………………………………………………………………..

About Counterpoint Research:

Counterpoint Technology Market Research is a global research firm specializing in Technology products in the TMT industry. It services major technology firms and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of 13 years in the high-tech industry.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Separately, MediaTek 5G silicon will be used in future notebook PCs with Intel inside.

MediaTek’s T700 5G modem, which will be used to bring 5G connectivity to Intel-powered PCs, completed 5G standalone (SA) calls in real world test scenarios. Additionally, Intel has progressed on system integration, validation and developing platform optimizations for a superior user experience and is readying co-engineering support for its OEM partners. MediaTek and Intel are both committed to delivering a superior user experience.

“Our partnership with Intel is a natural extension of our growing 5G mobile business, and is an incredible market opportunity for MediaTek to move into the PC market,” said MediaTek President Joe Chen. “With Intel’s deep expertise in the PC space and our groundbreaking 5G modem technology, we will redefine the laptop experience and bring consumers the best 5G experiences.”

“A successful partnership is measured by execution, and we’re excited to see the rapid progress we are making with MediaTek on our 5G modem solution with customer sampling starting later this quarter. Building on our 4G/LTE leadership in PCs, 5G is poised to further transform the way we connect, compute and communicate. Intel is committed to enhancing those capabilities on the world’s best PCs,” said Chris Walker, Intel corporate vice president and general manager of Mobile Client Platforms.

References:

MediaTek Becomes Biggest Smartphone Chipset Vendor for First Time in Q3 2020

2 thoughts on “Counterpoint Research: Mediatek is world’s #1 smartphone chipset vendor”

Comments are closed.

Samsung Electronics Co. is expected to remain the world’s top smartphone producer this year, according to a report by according to market researcher TrendForce. However, the company’s market share is likely to decrease as other brands will ramp up production with the recovery of mobile demand.

The top six smartphone brands ranked by production volume for 2020, in order, are Samsung, Apple, Huawei, Xiaomi, OPPO, and Vivo. The most glaring change from the previous year is Huawei’s market share.

Global smartphone production was projected to increase 9 percent on-year to 1.36 billion units in 2021. Trendforce predicted that device replacement demand and growth in emerging markets will lead to gradual recovery of the smartphone market.

http://www.trendforce.com/presscenter/news/20210105-10630.html

Taiwan Semiconductor Manufacturing Company (TSMC), the dominant maker of the world’s most advanced chips, is in bullish mood.

On the back of another robust set of quarterly financials (Q4 FY21) and a strong balance sheet, TSMC is upping once again its capex budget. By doing so, it hopes to be better placed to exploit future market growth.

“We are witnessing a structural increase in underlying semiconductor demand underpinned by the industry megatrends of 5G-related and HPC [high-performance computing] applications,” explained TSMC CTO Wendell Huang, speaking on the company’s Q4 earnings conference call.

The CFO said the capital budget for 2022 was slated at between $40 billion and $44 billion, well up on the $30 billion splashed out in 2021. TSMC’s capex in 2019, by way of comparison, was $14.9 billion.

Huang said between 70% and 80% of the 2022 budget will be allocated to “advanced process technologies” including 2-nanometer (nm), 3nm, 5nm and 7nm. “About 10% will be spent for advanced packaging and mask making,” he added, “and 10% to 20% will be spent for specialty technologies.”

TSMC should have no trouble in funding its largesse on advanced chips (7mn and below). “With $38 billion in cash and $40 billion in operating cash flow before capex, TSMC can afford to take some risk,” said Richard Windsor at analyst firm Radio Free Mobile. “The sheer size of its investments in 2022 demonstrates that TSMC is intent on leaving its rivals in the dust come what may.”

Windsor argued, however, that the cyclical semiconductor industry had most likely reached a peak. “The return on these investments will be felt over a period of years, meaning that TSMC thinks that the industry is in a period of secular expansion with no real dip in sight,” he said. “This is precisely the view that when uttered by semiconductor companies is most often an indicator of a peak in the semiconductor cycle.”

Thin wafers, fat margins

Shipments of 5nm during Q4 accounted for 23% of TSMC’s total wafer revenue, while the 7nm share was 27%. It meant that advanced technologies (7nm and below) accounted for 50% of total wafer revenue, up from 41% in 2020.

Moreover, TSMC continues to post very respectable margins. Gross margin for Q4 was 52.7%, operating margin was 41.7%, and net profit margin came in at 37.9%. Revenue for the quarter, at $15.74 billion, was a 24.1% jump year-over-year (and up 5.8% compared with the previous quarter).

“Moving into first quarter 2022, we expect our business to be supported by HPC-related demand, continued recovery in the automotive segment, and a milder smartphone seasonality than in recent years,” said Wuang in prepared remarks.

TSMC is guiding for Q1 FY22 revenue of between US$16.6 billion and US$17.2 billion. Based on the exchange rate assumption of 1 US dollar to 27.6 NT dollars, gross profit margin is expected to be between 53% and 55%, while operating profit margin is guided at between 42% and 44%.

https://www.lightreading.com/5g/tsmc-massively-ups-capex-on-advanced-chips/d/d-id/774601?