India to start long delayed spectrum auction on March 1st

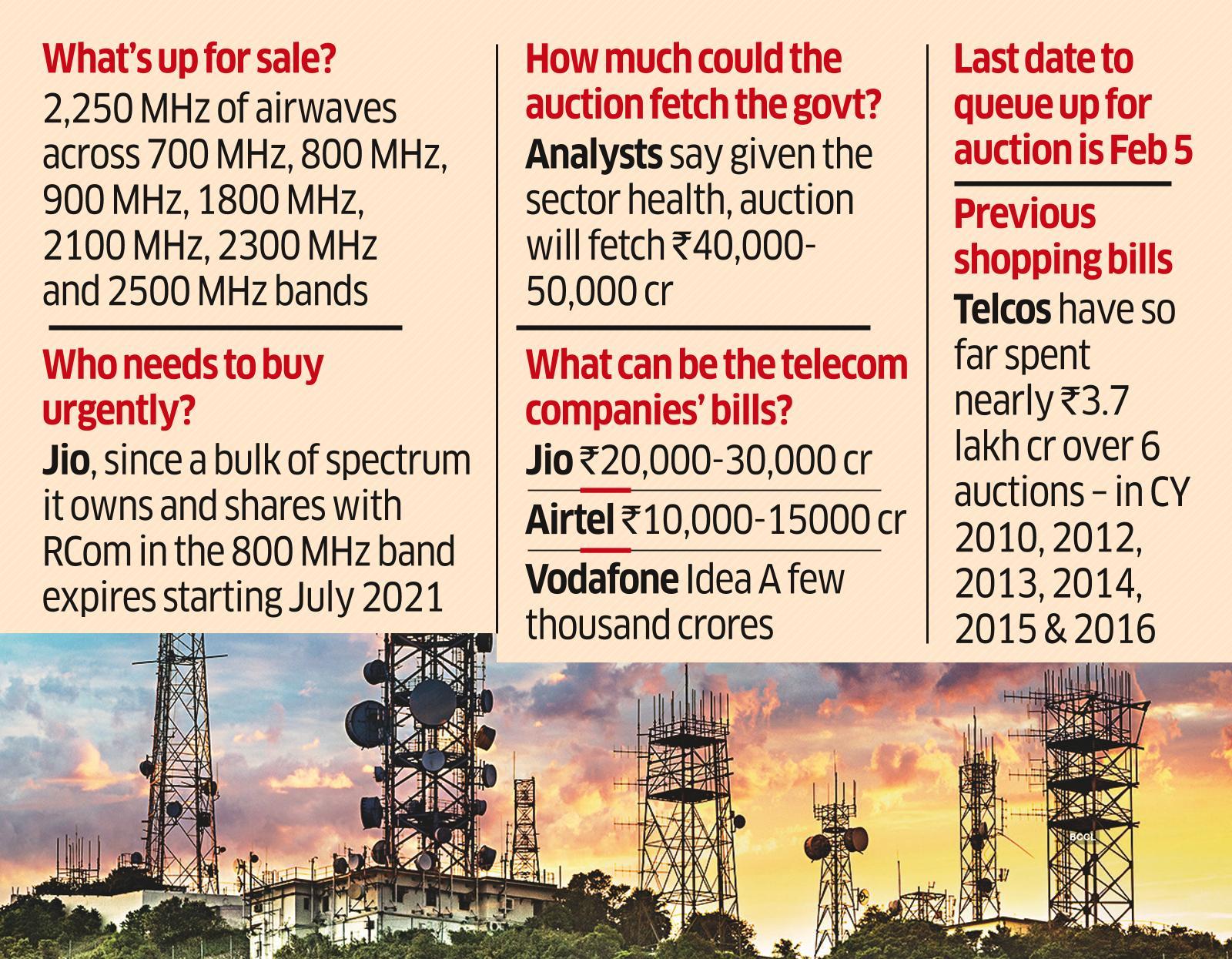

India is FINALLY set to hold its first spectrum auction for four years on March 1st when it offers up 2,250 MHz of spectrum across seven bands ranging from 700 MHz to 2.5 GHz. Reliance Jio, Bharti Airtel and Vodafone Idea (Vi) are expected to bid for airwaves worth Rs 3.92 lakh crore at base price. Industry analysts see a muted response, given the strained condition of the telecom sector, and expect the government to generate only Rs 40,000-50,000 crore from the sale.

Editors Note:

One rupee crore, as of 2014, is approximately equivalent to $163,720, using the exchange rate of 61.07 rupees per U.S. dollar. In the south Asian numbering system, a crore is equivalent to 10 million.

A lakh is a unit in the Indian numbering system equal to one hundred thousand (

………………………………………………………………………………………………………………………………………………………………………………………………

The sale will help Reliance Jio renew a chunk of expiring spectrum permits and offer Bharti Airtel and Vi a chance to add to their bandwidth holdings as data usage rises. Experts expect Jio, the only profit-making carrier, to be the main buyer and spend close to Rs 20,000-30,000 crore, followed by Airtel at Rs 10,000-15,000 crore, and Vi pitching in with a few thousand crores by bidding for only some airwaves. The spending will add to the telcos’ debt, making tariff hikes more likely.

SOURCE: Economic Times of India

…………………………………………………………………………………………………………………………………………………………………………………………..

The main objectives of the auction were to obtain a “market-determined price for the spectrum on offer, ensure efficient use of spectrum and avoid hoarding,” stimulate competition in the sector and maximize revenue proceeds, the Department of Telecommunications (DoT) said in the NIA.

The government is putting on sale 660 MHz in the 700 MHz band, 230 MHz in 800 MHz band, 81.4 MHz in 900 MHz band, 313.6 MHz in 1800 MHz band, 175 MHz in 2100 MHz band, 560 MHz in 2300 MHz band and 230 MHz in 2500 MHz band. Indian telcos have spent nearly Rs 3.7 lakh crore over six spectrum auctions since 2010. But this is the first time there are likely to be only three bidders.

COAI, the industry body that represents the telcos, said the government had addressed the requirement for availability of more spectrum. But lower reserve prices would have provided additional resources for network expansion for the telcos. “High reserve prices (in the past) have resulted in large amounts of spectrum remaining unsold,” said COAI in a statement.

COAI said the auction will enable the industry to cater to the exponential increase in data usage which will facilitate in supporting the Digital India vision. “While the government has addressed the requirement for the availability of more spectrum, lowering the reserve prices would have provided additional resources for network expansion to the telcos. High reserve prices in past auctions have resulted in large amounts of spectrum remaining unsold. We hope the Govt. will take additional measures to boost the financial health of the industry, which is the backbone of a digitally connected India,” COAI DG SP Kochhar said.

In the premium 4G spectrum (700 MHz), Trai had reduced the reserve price by 43% compared to 2016 auctions, at Rs 6,568 crore per MHz, for a pan-India 5 MHz block, still, operators would have to shell out Rs 32,840 crore, which is seen as quite high. In the 2016 auctions, the government had mopped a total amount of Rs 65,789 crore, 4% over the reserve price, from the country’s six operators who participated in the bidding. However, this was a lukewarm response as only 965 MHz spectra got sold against a total of 2,353 MHz put up on sale, meaning that only 40% got sold.

According to analysts, Reliance Jio may be the only buyer of some airwaves in the premium 700 MHz band, with its rivals likely giving it a miss, despite a 43% cut in the base price from the 2016 sale, when they went unsold. This band alone is valued at Rs 2.3 lakh crore, with the rest of the bands worth Rs 1.62 lakh crore, at base price, according to brokerage Motilal Oswal.

While the NIA has clauses to factor in new entrants, including foreign players, industry experts say it’s unlikely that any new player will join the fray, given the dire state of the industry with debt of over Rs 8 lakh crore, weak pricing power and only one profit-making telco.

“Jio will focus on 800 MHz for renewal and adding capacity as its market share increases. Vi may look at optimization of spectrum since it has surplus airwaves in the 1800 MHz while Airtel will look at 1800 MHz as well,” said Rajiv Sharma, a telecom expert. “…this auction will further add to the operators’ debt, which in turn gets them closer to tariff hikes.”

The base rate of airwaves in the efficient 800 MHz band was pegged at Rs 4,745 crore a unit, which is around 20% less than the previously recommended minimum of Rs 5,819 crore a unit for 2016. The starting price for 1800 MHz spectrum though was set higher at Rs 3,291 crore a unit, compared with Rs 2,873 crore a unit previously.

A substantial portion of Jio’s own airwaves and those it shares with Reliance Communications in the 800 MHz band expires in 12 and 14 circles, respectively, starting July 2021. Without these airwaves, Jio’s services in these circles will be impacted, making it imperative that the telco bid for them, analysts said. Jio, with over 406 million subscribers, also needs additional airwaves to cater to surging data demand and a rapidly growing user base that it expects to touch 500 million.

Airtel and Vi – with about 294 and 272 million users, respectively – own less expensive spectrum, mostly in the 1800 MHz band, set to expire across eight circles each from July. Both of those telcos have backup airwaves in most service areas. Airtel CEO Gopal Vittal has previously said that the company will look mainly for for sub-1 GHz spectrum.

For spectrum which isn’t immediately available and which will be assigned beyond one month of the close of this auction, the component of the upfront payment payable will be 10% of the bid amount for sub-1 GHz bands, and 20% of the bid amount for other bands. “…and the balance component of upfront payment (total of which is 25% for sub-1 GHz and 50% for other bands) shall be made one month prior to the ‘effective date’,” the DoT said.

References:

https://www.financialexpress.com/industry/government-to-hold-spectrum-auction-on-march-1/2165852/4

India ramps up supply chain for 5G service launch in 2021 pending spectrum auction

6 thoughts on “India to start long delayed spectrum auction on March 1st”

Comments are closed.

Spectrum auction: Telcos attend pre-bid conference; DoT asks cos to submit queries by Jan 15

Telecom firms like Reliance Jio, Bharti Airtel and Vodafone Idea on Tuesday participated in pre-bid conference for spectrum auctions, as the telecom department asked

Telecom firms like Reliance Jio, Bharti Airtel and Vodafone Idea on Tuesday participated in pre-bid conference for spectrum auctions, as the telecom department asked telcos to submit written queries regarding the rules and processes by January 15, according to sources. During the pre-bid conference, operators raised queries on aspects such as earnest money deposit and roll-out obligations in the bid document, an industry source said.

The Department of Telecom (DoT) sources said telcos, including Jio, Airtel and Vodafone Idea, attended the pre-bid conference on Tuesday. The department has now asked the operators to send their written queries on the issues raised at the pre-bid conference by January 15.

The DoT has already released a notice inviting applications for the spectrum auctions in seven bands — 700, 800, 900, 1800, 2100, 2300 and 2500MHz bands, and the bidding is scheduled to begin on March 1.

https://telecom.economictimes.indiatimes.com/news/spectrum-auction-telcos-attend-pre-bid-conference-dot-asks-cos-to-submit-queries-by-jan-15/80231926

India should make 5G spectrum available at affordable rates to ensure the sector remains competitive, the Competition Commission of India (CCI) has advised.

Costly rates would allow service providers with better financial resources to launch 5G ahead of others, it fears.

“The current financial health of the sector as a whole could result in an uneven speed of adoption of 5G by operators, the more profitable ones are likely to be faster off the block,” said the CCI in a study. “In case this scenario unfolds, it will have implications for the level of competition in the long run.”

Reliance Jio is currently the only profitable service provider in India. While it plans to launch 5G later this year, rivals Bharti Airtel and Vodafone Idea have said they do not think the market is ready for 5G services.

https://www.lightreading.com/asia/indias-govt-advised-to-make-5g-spectrum-more-affordable/d/d-id/766994?

India telecom market leader Reliance Jio, second ranked Bharti Airtel and financially stressed Vodafone Idea (Vi) have filed applications for participation in the upcoming 4G spectrum auctions, due to start on March 1. The auction for over 2300 MHz of airwaves—valued at Rs 3.92 lakh crore at base price—though is likely to see limited bidding intensity for spectrum worth less than Rs 48,000 crore, with Jio and Airtel expected to be the main players. Industry executives have confirmed to ET that the three telcos have filed in their applications although Airtel, Jio and Vi did not respond to ET’s queries.

https://telecom.economictimes.indiatimes.com/news/jio-airtel-vodafone-idea-apply-to-bid-in-spectrum-auctions/80769608

I read this piece about India’s long delayed 5G spectrum auction which is likely to be delayed yet again. It’s amazing that India is so far behind in 5G, while other countries a fraction of its size (e.g. Saudi Arabia) have widely deployed 5G.

India’s much delayed 5G trials could hit a fresh snag, with Bharti Airtel, Reliance Jio and Vodafone Idea (Vi) saying they don’t have any clarity on whether the coveted millimetre wave bands (26 GHz and 28 GHz) – allotted for trials – will be auctioned in the next spectrum sale.

The telecom operators said they cannot spend time, effort and money to developing 5G use cases around these mmWave bands, unless the government commits to their commercial allotment at affordable rates as well. They called upon the Department of Telecommunications (DoT) to revise the National Frequency Allocation Plan (NFAP-2021) to include these vital mmWave band airwaves, which will give the carriers clarity before they start trials.

SP Kochhar, director general of the Cellular Operators Association of India (COAI), told ET that “a reminder has just been sent to DoT that the revised NFAP has still not been finalised by its Wireless Planning & Coordination wing even after various meetings of the working groups were held and inputs provided by all stakeholders”.

The COAI represents Jio, Bharti Airtel, Vi and global network vendors such as Ericsson and Nokia.

Bharti Airtel, Jio and Vi did not respond to ET’s queries till press time.

Though DoT earlier this month allowed telcos to conduct 5G trials on multiple spectrum bands, including mmWaves, the latter does not find a place in the current NFAP.

If mmWave bands do not figure in the revised NFAP-2021, industry executives said 5G deployment costs would jump manifold and make the ultra-fast wireless broadband service unaffordable to consumers in India. They said mmWave bands such as 26 GHz and 28 GHz offer lightning fast data rates above 2 Gbps and huge capacity, which are critical for running 5G use cases cost-effectively, and also since the bulk of the global 5G devices ecosystem is evolving around these bands.

Telcos are being given experimental airwaves in mid-band (3.2-3.67 GHz), sub-GHz (700/800 MHz) and mmWave bands (26-28 GHz) to run 5G trials for six months. So far, only mid-band spectrum in the 3.3-3.6 GHz bands has been earmarked by the government for 5G services.

Read also

Government OKs 13 applications for 5G trials; Chinese vendors kept out

India’s decision allowing 5G trials without Chinese companies a sovereign one: US

“Only after mmWaves are included in the revised NFAP, can DoT give a reference to Trai (Telecom Regulatory Authority of India) to examine and start fresh consultations on all bands identified for 5G, relook at their pricing and make fresh recommendations for the next auction,” said a senior industry executive, who did not wish to be identified.

Unless this happens soon, the next auction could get pushed back by another 12-18 months, said the executive, and telcos will not see any business case in investing heavily in 5G network trials and developing India-relevant use cases, especially if there is no certainty around the commercial availability of crucial mmWave 5G spectrum.

The revised NFAP-2021 will outline available airwave bands and services for which they can be used, including mobile broadband communications, defence, satellite operations under the Department of Space and also to meet the needs of the aviation, information and broadcasting, railways and home ministries.

“It’s essential the revised NFAP document is finalised and issued at the earliest by DoT as it will earmark spectrum for various usages in the country,” said Kochhar.

https://telecom.economictimes.indiatimes.com/news/telcos-uncertain-if-band-allotted-for-5g-trials-will-be-auctioned/82698104

DoT favors price cut for 5G, 700MHz bands

The DoT is also likely to shortly seek a fresh base price for the 3300 MHz-3600 MHz band earmarked for 5G, the 700 MHz band, and other new bands which can be used for the next-gen technology. Following this, Trai will need to start a fresh consultation process for arriving at the prices. The regulator usually cuts prices of unsold spectrum.

https://telecom.economictimes.indiatimes.com/news/dot-favours-price-cut-for-5g-700mhz-bands/82898428