Telecom in India

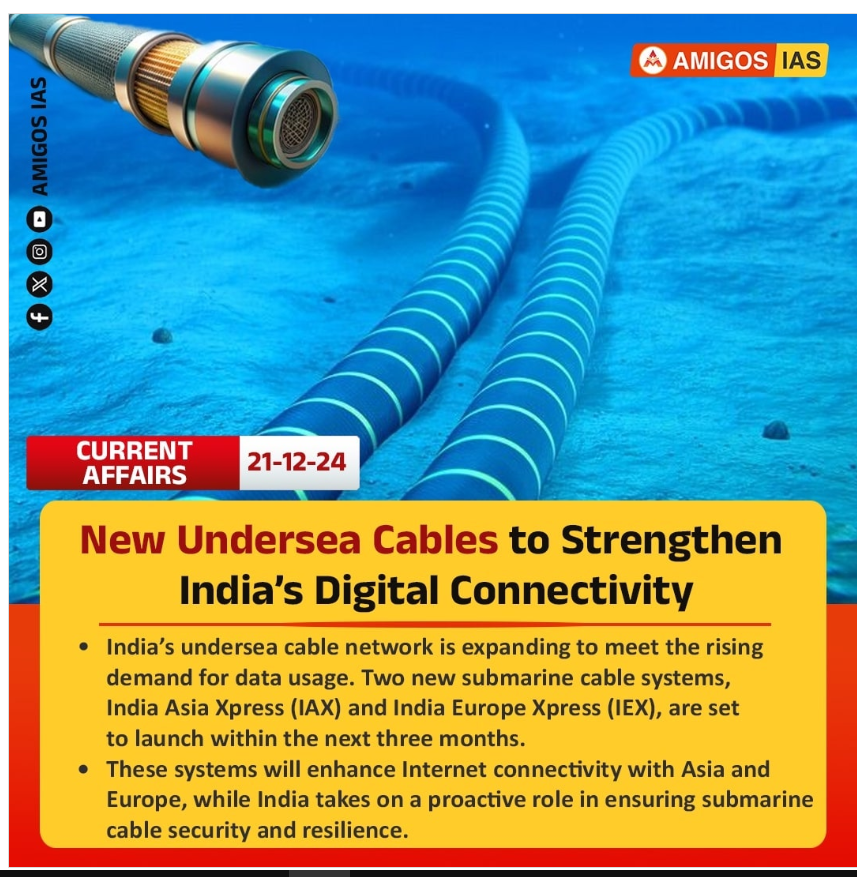

India’s Data Transmission Capacity to Quadruple in 2025 via New Submarine Cables

India’s data transmission capacity is projected to increase fourfold by 2025 with the activation of new submarine cable systems connecting the country to key global markets, said TRAI Chairman Anil Kumar Lahoti at the Digicom Summit. Currently, India hosts 17 international subsea cables across 17 landing stations.

“As of the end of 2023, the total lit capacity and activity and activated capacity of these cables stood at 180 TBPS (terabit per second) and 132 TBPS, respectively. Multiple next-generation systems are due to become operational in 2025, replacing ageing cables. Once the new systems are fully operational, India’s data transmission capacity is projected to quadruple with additional crucial routes,” Lahoti said.

Lahoti highlighted the telecom sector’s role in driving India’s digital economy, which contributes 12% to GDP and is expected to reach 20% by 2026-27. The telecom user base in India has expanded to approximately 1.2 billion users, with 944 million having broadband access.

“Since the current growth rate of the digital economy is 2.8 times the GDP growth rate. Accordingly, the government aims for a USD 1 trillion digital economy by 2027-28. The Indian telecom sector, which is the backbone of a digital economy, has witnessed significant development in recent years, setting the stage for a transformative era given unprecedented data consumption, a vast user base, and a policy-type friendly environment. India continues to foster industry growth and digital connectivity,” Lahoti said.

“One of the hallmarks is achieving over 100 times growth in rural broadband subscriptions in the last decade. In license service areas such as Assam, Bihar, Himachal Pradesh, Odisha and Uttar Pradesh East, the aggregate count of rural broadband connections is significantly higher than the aggregate count of urban broadband connections,” he added.

India’s telecom user base has expanded to 1.2 billion, including 944 million broadband subscribers. Rural broadband subscriptions have surged 100-fold over the past decade, outpacing urban growth in states such as Assam, Bihar, and Uttar Pradesh East.

Lahoti also reportedly acknowledged the effort of telecom operators in providing 4G coverage across 97% of the villages and 5G connectivity in over 99 per cent of districts in the country. The upgraded submarine cable network is expected to further strengthen India’s global connectivity and drive the next phase of its digital transformation.

References:

India’s Data Transmission Capacity to Quadruple in 2025 with New Submarine Cables: Report

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India Mobile Congress 2024 dominated by AI with over 750 use cases

Reliance Jio vs Starlink: administrative process or auction for satellite broadband services in India?

India Mobile Congress 2024 dominated by AI with over 750 use cases

As expected, Artificial Intelligence (AI) took center stage at India Mobile Congress 2024 (IMC 2024), as a diverse spectrum of tech and telecom companies, including startups and educational institutions, showcased over 900 technology use case scenarios, including 750 AI-based use cases during the 4-day conference in New Delhi, India. IMC 2024 hosted over 400 exhibitors, about 900 startups and participation from over 120 countries.

The focus of the AI-enabled use cases was on conservation, convenience, efficiency, safety, automating hazardous tasks, assisting humans and others. AI-based virtual agents were taking over the workloads at contact centers while addressing the shortage of doctors in remote areas. Some key use cases included solutions for railway safety, including AI-based systems that can detect and send alerts on unusual activity on tracks. In particular:

- Reliance Jio offered attendees a glimpse of PhoneCall AI, a highly anticipated feature for transcribing and summarizing phone calls, which is currently in alpha testing phase. Jio also presented a 5G intelligent village concept powered by AI. Farmers can now use their mobile phones to take pictures of crops, allowing AI to detect diseases and recommend solutions, improving crop health and yield. Jio facilitates the delivery of these solutions to homes or nearby retail stores, empowering farmers by enabling higher revenue and better employment opportunities. Jio also showcased its JioKrishi Agri IoT device for agriculture. The IoT device with multiple sensors takes farming into the digital age, providing real-time data on crop health and enabling optimal irrigation and fertilization. Connected to the AI-enabled JioKrishi app, farmers can receive recommendations for fertilizers or pesticides, including the quantities to use, and order farm supplies—ensuring end-to-end farm solutions.

- Bharti Airtel launched India’s first AI-powered spam detection solution to combat spam calls and messages. This network-based tool provides real-time alerts, helping users reduce spam effectively. Ericsson showcased a 5G-powered robotic dog, Rocky, who can assist authorities with efficient emergency response by sending alerts in time that can help authorities deal with emergencies like fire outbreaks.

- Vodafone Idea demonstrated the transmission of real-time diagnostic reports over its high-speed network, enabling doctors to conduct video consultations remotely. The solution offers over 30 medical tests, including vitals and blood screenings, at a cost of under ₹250, making healthcare more accessible in rural areas.

- C3iHub, a Technology Innovation Hub established at IIT Kanpur and funded by Department of Science & Technology (DST), addressed cybersecurity of cyber-physical systems, with a key focus on critical infrastructure, automotive, and drones.

- Indian Council of Agriculture Research (ICAR) showcased over a dozen AI-based solutions for smart agriculture and even aquarium management, with AI-enabled feed for fish. The AI system detects the right time for feeding and releases food accordingly while also monitoring water quality and sending alerts to owners. Mahindra University students displayed AI-based solutions to bolster shrimp farming (raising shrimp in controlled environments). The tool constantly monitors and ensures conditions are ideal for shrimp farming. India Mobile Congress, Asia’s largest digital technology forum, has become a well-known platform across the globe for showcasing innovative solutions, services and state-of-the-art use cases for industry, government, academics, startups and other key stakeholders in the technology and telecom ecosystem.

- Nokia showcased technologies spanning 5G, 6G, AI/ML and network infrastructure, aimed at driving innovation and promoting a sustainable future.

- Prime Minister Narendra Modi interacted with pioneering startups including Signalchip, Wisig Networks, and female led startups like Astrome and Easiofy Solutions, showcasing India’s leadership in cutting-edge technology innovations.

IMC 2024 showcased groundbreaking ideas and innovations from prestigious academic institutions like IITs and IIMs. Through LLMs such as BharatGen, IMC highlighted the cutting-edge research and technological advancements emerging from these institutions, demonstrating their role in shaping the future of telecom and technology in India.

References:

https://telecomtalk.info/jio-showcases-ai-tools-industry5-5g-imc2024/983400/

India’s Success in 5G Standards; IIT Hyderabad & WiSig Networks Initiatives

At long last: India enters 5G era as carriers spend $ billions but don’t support 5Gi

India Mobile Congress 2018: Telecom Equipment Vendors to Invest over Rs 4,000 crore in India; Samsung in Spotlight

Reliance Jio vs Starlink: administrative process or auction for satellite broadband services in India?

Reliance Jio has argued that India’s telecom regulator incorrectly concluded that home satellite broadband spectrum should be allocated and not auctioned, according to a letter seen by Reuters. That intensifies Jio’s face-off with Elon Musk’s Starlink.

Starlink is expected to launch broadband satellite service in India soon after receiving a Global Mobile Personal Communication by Satellite (GMPCS) license. The Telecom Ministry has granted in-principle approval, and the Home Ministry is expected to finalize the vetting process. Starlink’s initial strategy was to provide satellite broadband directly to consumers, but the company may now only offer business services in India

India’s telecom regulator, TRAI, is holding a public consultation, but Reliance in a private Oct. 10 letter seen by Reuters asked for the process to be started afresh as the watchdog has “pre-emptively interpreted” that allocation is the way forward. “TRAI seems to have concluded, without any basis, that spectrum assignment should be administrative,” Reliance’s senior regulatory affairs official Kapoor Singh Guliani wrote in the letter to India’s telecoms minister Jyotiraditya Scindia.

References:

https://www.reuters.com/business/media-telecom/ambanis-reliance-lobbies-india-minister-satellite-spectrum-new-face-off-with-2024-10-13/

India’s TRAI releases Recommendations on use of Tera Hertz Spectrum for 6G

FCC: More competition for Starlink; freeing up spectrum for satellite broadband service

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India’s Trai: Coexistence essential for efficient use of mmWave band spectrum

OneWeb, Jio Space Tech and Starlink have applied for licenses to launch satellite-based broadband internet in India

Starlink to explore collaboration with Indian telcos for broadband internet services

India’s TRAI releases Recommendations on use of Tera Hertz Spectrum for 6G

Telecom Regulatory Authority of India (TRAI) is urging the government and wireless network operators to explore the use of terahertz spectrum for new 6G technologies and services. “The government should introduce a new experimental authorization for the spectrum in the 95 GHz to 3 THz range termed as ‘Tera Hertz Experimental Authorization’ [THEA],” said a press release issued by TRAI.

THEA’s primary objective would be to promote “research and development (R&D), indoor and outdoor testing, technology trial, experimentation and demonstration in the 95 GHz to 3 TZ range,” said TRAI. Any Indian entity, including academic institutes, R&D labs, telecom service providers, central or state government bodies and original equipment makers, will be eligible for an authorization covering a maximum of five years. The scope of THEA should be to conduct R&D, indoor and outdoor testing, technology trial, experimentation, and demonstration in the 95 GHz to 3 THz range; and to market experimental devices designed to operate in the 95 GHz to 3 THz range via direct sale.

TRAI believes the terahertz frequency band is likely to play a crucial role in upcoming 6G technology. “The high-speed point-to-point wireless data link is an emerging usage of Terahertz radiation,” said TRAI in its recommendations. “For this reason, communications in the Terahertz band are expected to play a pivotal role in the upcoming 6th generation (6G) of wireless mobile communications, enabling ultra-high bandwidth communication paradigms.”

“The large Terahertz bandwidths and massive antenna arrays, combined with the inherent densification caused by machine-type communications, will result in an enhanced communication system performance,” added TRAI.

“TRAI is laying the groundwork for India to become a global powerhouse in testing as well as in research and development so that we are fully geared to produce cutting-edge technologies and services in the near future,” said TV Ramachandran, the president of the Broadband India Forum (BIF), in his response to the announcement.

The recommendations are a further sign of India’s interest in shaping the 6G standard, likely to appear around 2030. Vocal about its ambitions, India has already set up the Bharat 6G Alliance to actively contribute to 6G activities. It has also collaborated with several organizations, including the US-based Next G Alliance, Europe’s 6G Smart Networks and Services Industry Association (6G IA) and the 6G Flagship of Oulu University as it tries to position itself as a “global leader” in digital infrastructure and innovation.

The terahertz band has been attracting attention as an option for 6G deployment, with the European Telecommunications Standards Institute (ETSI) recently releasing two reports on the band and the use cases it could support.

“Due to their shorter wavelengths, Terahertz communication systems can support higher link directionality, are less susceptible to free-space diffraction and inter-antenna interference, can be realized in much smaller footprints, and possess a higher resilience to eavesdropping,” said the TRAI report. Even so, there are several challenges that would need to be addressed before terahertz could be feasible for widespread usage. Above all, signal propagation is generally weak in higher frequency bands and power limitations can also result in poor coverage, said TRAI.

The Recommendations have been placed on the TRAI’s website (www.trai.gov.in). For any clarification! information Shri Akhilesh Kumar Trivedi, Advisor (Networks, Spectrum and Licensing), TRAI may be contacted at Telephone Number +91-11-20907758.

References:

https://www.lightreading.com/6g/india-gets-behind-terahertz-push-for-6g

https://www.trai.gov.in/sites/default/files/PR_No.56of2024.pdf

www.trai.gov.in

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

Ericsson and the Indian Institute of Technology (IIT) Kharagpur have announced a partnership for a long-term cooperation for joint research in the area of radio, computing and AI (artificial intelligence). Both organisations have signed two milestone agreements. As part of the agreements, researchers from IIT Kharagpur and Ericsson will collaborate to develop novel AI and distributed compute tech for 6G. Leaders from IIT Kharagpur and Ericsson participated in discussing the developments and advancements for the future of networks and communications at the GS Sanyal School Telecommunications (GSSST).

Ericsson members from left: Rupa Deshmukh, Mikael Prtz, Kaushik Dey, Mikael Hook, Bo Hagerman,Magnus Frodigh, Director – Prof V. k Tewari, Deputy Director – Prof Amit Patra, Anil R Nair

……………………………………………………………………………………………………….

Two key initiatives finalized by Ericsson and IIT were:

a) Compute offload and Resource Optimisation at edge compute: The project aims to explore resource optimization, dynamic observability and sustainable distributed and Edge computing technologies.

b) RL-based Beamforming for JCAS: Safe, Causal, and Verifiable: The project aims to explore causal AI methods for joint communication and sensing (JCAS).

…………………………………………………………………………………………………………….

AI and Compute Research is instrumental to Ericsson’s 6G networks as the compute offload needs to be managed dynamically at edge and the policies would primarily be driven by AI. These themes of research are well aligned with IIT Kharagpur and both organizations view this partnership as a way to push the boundaries of fundamental and applied research in the Radio domain.

Editor’s Note:

Ericsson laid off 8,500 employees last year as part of its cost-cutting initiatives and reduced total costs by 12 billion Swedish crowns ($1.15 billion) in 2023.

Telecoms equipment suppliers are expecting a challenging 2024 as 5G equipment sales – a key source of revenue – are slowing in North America, while India, a growth market, may also see a slowdown. Ericsson’s fourth-quarter net sales fell 16% to 71.9 billion Swedish crowns ($6.89 billion), missing estimates of 76.64 billion.

……………………………………………………………………………………………………………..

Magnus Frodigh, Head of Ericsson Research, says: “This collaboration strengthens our R&D commitments in India and is pivotal to Radio, Compute and AI research. We are excited to partner with IIT Kharagpur and look forward to collaborative research in fundamental areas as well as translational research for our Future Network Platforms”. Dr Frodigh also presented Ericsson’s vision on 6G which aims to blend the physical and digital worlds enabling us to improve the quality of life by incorporating widespread Sensor-based communications between humans and machines through digital twins.

Nitin Bansal, Managing Director of Ericsson India said, “Ericsson is well poised to lead 6G innovation and we are making significant R&D investments in India in line with our commitment to the country. Given our 5G and technology leadership, our research initiatives are geared to provide affordable network platforms for ubiquitous connectivity all across the country.”

Virendra Kumar, Director at IIT Kharagpur, said, “In the commitment towards Digital India and making India the hub of technological innovation, this collaboration with Ericsson will be effective for next-generation technology significantly. 6G networks integrated with artificial intelligence will enable AI-powered applications to run faster and more efficiently. In the 6G era, IIT Kharagpur aims to contribute to Radio Access Technology and Network, Core Network, RF & Device Technologies, VLSI Design, Neuromorphic Signal Processing, Services and Applications.”

About Ericsson;

Ericsson enables communications service providers to capture the full value of connectivity. The company’s portfolio spans Networks, Digital Services, Managed Services, and Emerging Business and is designed to help our customers go digital, increase efficiency and find new revenue streams. Ericsson’s investments in innovation have delivered the benefits of telephony and mobile broadband to billions of people around the world. The Ericsson stock is listed on Nasdaq Stockholm and on Nasdaq New York. www.ericsson.com

About IIT Kharagpur:

Indian Institute of Technology Kharagpur (IIT KGP) is a higher educational and academic institute, known globally for nurturing industry ready professionals for the world and is a pioneer institution to provide Excellence in Education, producing affordable technology innovations. Set up in 1951 in a detention camp as an Institute of National Importance, the Institute ranks among the top five institutes in India and is awarded, “The Institute of Eminence”, by the Govt. of India in 2019. The Institute is engaged in several international and national mission projects and ranks significantly in research output with about 20 academic departments, 12 schools, 18 centers (including 10 Centre of Excellence) and 2 academies with vast tree-laden campus, spreading over 2100 acres having 16,000+ students. Currently, it has about 750+ faculty, 850+ employees and 1240+ projects.

To know more visit: [http://www.iitkgp.ac.in/]

Ericsson, IIT Kharagpur Partner to Joint Research in AI and 6G

Ericsson’s India 6G Research Program at its Chennai R&D Center

India unveils Bharat 6G vision document, launches 6G research and development testbed

India creates 6G Technology Innovation Group without resolving crucial telecom issues

https://www.cnbc.com/2024/01/23/ericsson-warns-of-2024-market-decline-despite-q4-earnings-beat.html

LightCounting & TÉRAL RESEARCH: India RAN market is buoyant with 5G rolling out at a fast pace

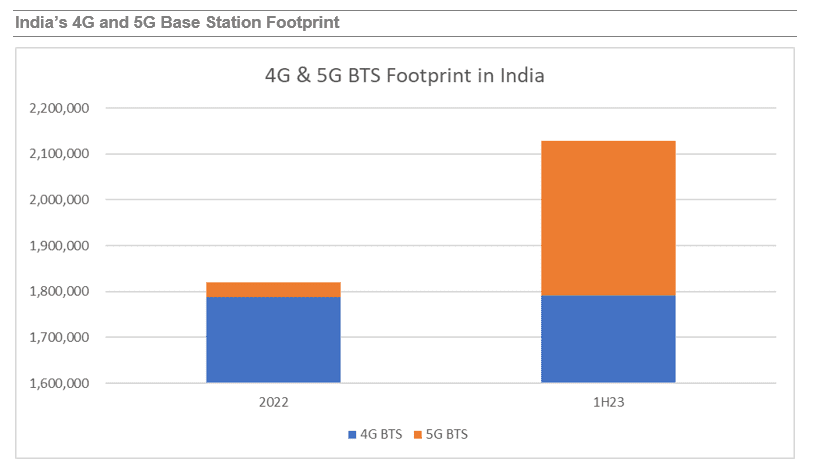

The India Wireless Infrastructure Report provides an update on the 5G radio access (RAN) developments in India, including geopolitics trends and technology. The report says that The RAN market in India is buoyant with a swelling local ecosystem that boasts big international ambitions.

Reliance Jio is rolling out 5G at a fast pace, followed by Bharti Airtel. As a result,1H23 RAN sales surged 300% YoY, and kept Ericsson in the driver’s seat, followed by Nokia and Samsung. Although the rollout pace has slowed down, 2023 is looking up, looks like the peak year, and we expect RAN equipment sales to more than double compared to last year, still driven by Jio and Airtel while BSNL will contribute with its 4G deployment.

“It’s a two-horse race, the near Jio / Airtel duopoly is quickly blanketing the country with 5G while the rest are struggling and catching up with 4G.” said Stéphane Téral, Chief Analyst at LightCounting Market Research and Founder of TÉRAL RESEARCH.

Source: LightCounting

………………………………………………………………………………………………………………………….

- 2024 is shaping up as a shift year from 5G network buildout to how to foster utilization and some midband FWA experiments.

- Due to the looming formation of a CSP duopoly, the looming merger of MTNL into BSNL, and Vodafone Idea’s unsustainable indebtment, our long-term forecast points to a lumpy RAN market. There is no surprise that India is a tough cellular market characterized by flat subscriber growth, ultralow ARPUs and low equipment average sales pricing.

- Open RAN is the brightest spot with a penetration of the total RAN market that will surpass 50% by 2028.

- At the same time, a mushrooming energetic local ecosystem is rising with great international ambitions enabled by strong ties between the U.S. and India.

…………………………………………………………………………………………………………..

References:

https://www.lightcounting.com/report/september-2023-india-wireless-infrastructure-217

https://www.lightcounting.com/report/september-2023-open-vran-market-213

Reliance Jio in talks with Tesla to deploy private 5G network for the latter’s manufacturing plant in India

OTT players in India struggle in telco partnerships

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India to set up 100 labs for developing 5G apps, business models and use-cases

Adani Group to launch private 5G network services in India this year

Vodafone Idea (Vi) is worth ZERO; needs additional liquidity support from lenders

While announcing its FY23 earnings, UK telecom company, Vodafone Plc said the Group’s carrying value of investment in Indian listed firm Vodafone Idea (Vi) is Zero. Also, that the Group is recording no further losses related to Vi. The troubled-laden Vi is still in need of additional liquidity and plans to raise funds going forward. In its FY23 report, Vodafone Plc said, “VIL remains in need of additional liquidity support from its lenders and intends to raise additional funding.”

Vodafone seems to be backing away from Vi. The business needs more money, that Vodafone is certainly not willing to provide, and that zero valuation indicates that it will put no more effort into saving it. There are significant uncertainties in relation to Vi’s ability to make payments in relation to any remaining liabilities covered by the mechanism and no further cash payments are considered probable from the Group as at 31 March 2023, it added.

“VIL [Vodafone Idea Ltd] remains in need of additional liquidity support from its lenders and intends to raise additional funding. There are significant uncertainties in relation to VIL’s ability to make payments in relation to any remaining liabilities covered by the mechanism and no further cash payments are considered probable from the Group as at 31 March 2023,” Vodafone said, in the notes to its consolidated financial statements for the 2023 financial year.

Furthermore, Vodafone said, “the carrying value of the Group’s investment in VIL is nil and the Group is recording no further share of losses in respect of VIL.”

It should be noted that Vi is the only Indian telco that has NOT yet deployed 5G services. Since the launch of 5G last October, Reliance Jio’s 5G services have become available in more than 400 cities and towns, while Airtel’s 5G services can be accessed in more than 500. Jio plans to provide all-India 5G coverage by December, with Airtel aiming for blanket availability by March next year.

Recently, Vodafone Idea complained to the Telecom Regulatory Authority of India (TRAI), accusing its rivals of predatory 5G pricing. Although it has been shedding customers for years, there can be little doubt that losses have accelerated since the launch of 5G. Vodafone Idea had lost about 7 million in the four months leading up to 5G’s launch in October last year. In the four months following the introduction of 5G services by Airtel and Jio, its losses soared to about 10 million.

Vodafone Idea is known to have a significant percentage of high-spending customers who have remained loyal to it. These customers typically show limited interest in lower tariffs, but many will have been drawn to 5G services available only from other telcos, with Vodafone Idea’s 5G plan nowhere close to fruition. Airtel and Jio, accordingly, are racing to build 5G networks and attract as many Vodafone Idea subscribers as possible.

………………………………………………………………………………………………………………………………………………………………………………..

When Vodafone and Idea Cellular entered into an merger agreement in 2017, the parties had agreed to a mechanism for payments between the Group and Vodafone Idea, pursuant to the difference between the crystallisation of certain identified contingent liabilitiesin relation to legal, regulatory, tax and other matters, and refunds relating to Vodafone India and Idea Cellular. Cash payments s or cash receipts relating to these matters must have been made or received by Vi before any amount becomes due from or owed to the Group.

Hence, any future future payments by the Group to VIL as a result of this agreement would only be made after satisfaction of this and other contractual conditions. Thereby, the UK-based telco said, “Vodafone Group’s potential exposure to liabilities within VIL is capped by the mechanism described above; consequently, contingent liabilities arising from litigation in India concerning operations of Vodafone India are not reported.”

Vodafone Plc’s potential exposure under this mechanism is capped at ₹64 billion n (€719 million) following payments made under this mechanism from Vodafone to VIL, in the year ended 31 March 2021, totalling ₹19 billion (€235 million).

In FY23, Vodafone Plc’s revenue increased by 0.3% to €45.7 billion driven by growth in Africa and higher equipment sales, offset by lower European service revenue and adverse exchange rate movements. While adjusted EBITDAal declined by 1.3% to €14.7 billion due to higher energy costs, and commercial underperformance in Germany.

References:

https://telecoms.com/521728/vodafone-sees-no-remaining-value-in-indian-operation/

OTT players in India struggle in telco partnerships

Telecom partnerships, which generate 50-70% of overall revenues of OTT platforms [1.] in India, have failed to live up to expectations amid subscription pressure. As a result, many OTT services have adopted revenue sharing models, particularly for smaller platforms that struggle to attract viewership. Payments are currently based on the number of views a specific content receives. In a competitive scenario with high customer acquisition costs, OTT platforms have to offer significant discounts to be available on telco aggregators, limiting their revenues. Telcos are increasingly becoming resellers instead of using OTT bundles as acquisition tools.

Note 1. An over-the-top (OTT) application is any application or service that provides a product over the Internet and bypasses traditional distribution. •Services that come over the top are most typically related to media and communication and are generally, if not always, lower in cost than the traditional method of delivery

“In case of a fixed upfront fee, irrespective of the number of subscriber additions annually, a certain amount is paid to the OTT, providing more stable monetization. With a revenue sharing arrangement, the amount keeps fluctuating depending on customer churn,” said Sourjya Mohanty, chief operating officer at IN10 Media Network’s OTT service, EPIC ON. He said the company takes a fixed fee for all its deals that helps in sizeable monetization and has stayed away from revenue sharing arrangements that aren’t stable. Eyeballs for OTT content may also depend on whether the aggregator is investing enough in marketing, he added.

Amit Dhanuka, EVP at Hollywood streaming service Lionsgate, noted that telcos and OTT complement each other and form a competitive offer for the consumer when combined with data. “Telcos want to monetize data and increase data consumption, where OTT plays an important role. For an OTT platform, an offer coupled with data forms a competitive offering for the consumer and helps drive subscriptions,” Dhanuka said. However, several media industry experts believe that the revenue figures generated from telco partnerships don’t justify the costs of customer acquisition. “65-70% of the customer base of a telco like Jio is on cheap, pre-paid plans that do not really offer compelling OTT bundles. Technically, tying up with a telco brings in reach and data on user behaviour at a time that costs of customer acquisition are very high but revenue figures are not that great,” said an anonymous senior media analyst.

Revenue sharing models have arisen as telcos seek to reduce minimum guarantee payments and restructure partnerships with smaller platforms that don’t generate significant viewership. “A SonyLIV would be making far more revenue than say, an aha with the same telco. Also, OTTs have to offer steep discounts as part of these deals, which could range between 50-70% of their Arpus (average revenue per user). They don’t have a choice at the moment; India is a price-sensitive market and the only alternative to high spends on customer acquisition is telco deals,” said a senior executive at a streaming platform.

Nonetheless, for OTTs, telcos remain an essential distribution medium, especially for those platforms without a strong standalone proposition, said Neeraj Sharma, MD, communications, media, and technology at Accenture India. Increasingly, telcos are becoming resellers instead of using OTT bundles as acquisition tools, Sharma said. However, a key challenge is the limited scope for differentiation as similar content is available across telcos.

References:

https://www.itu.int/en/ITU-D/Regional-Presence/AsiaPacific/Documents/Events/2016/Jul-RR-ITP/OTT_Rony_Mamur_Bishry.pdf

India’s COAI joins 4 European telcos in demanding OTT players pay to use their networks

India unveils Bharat 6G vision document, launches 6G research and development testbed

Despite being very late in rolling out 5G [1.], without TSDSI’s 5Gi ITU-R standard, India is ONCE AGAIN talking up 6G. Prime Minister Narendra Modi opened the new United Nations’ ITU area office and Innovation Centre on Wednesday and revealed the Bharat 6G Vision document and launched the 6G R&D Test Bed.

Note 1. Indian telecom service providers started to deploy 5G services in October 2022.

The Indian government’s Bharat 6G vision document was prepared by the Technology Innovation Group on 6G (TIG-6G), which was formed in November 2021 to build a roadmap and action plans for 6G in India, according to an official statement. Officials from Ministries/Departments, experts from research and development institutions, academia, standardisation bodies, telecom service providers, and business are among the members.

The 6G Test Bed will provide a platform for academic institutions, industry, start-ups, MSMEs, and industry, among others, to test and verify evolving ICT technologies.

The Bharat 6G Vision Document and 6G Test Bed, according to Centre, will create an enabling environment for innovation, capacity building, and faster technology adoption in India.

India PM Modi unveiling Bharat 6G vision document (Photo – PM Modi/YouTube)

………………………………………………………………………………………………………………………………………………….

“Today India is the fastest 5G rollout country in the world. In just 120 days, 5G has been rolled out in more than 125 cities. Today 5G services have reached about 350 districts of the country. Moreover, today we are talking about 6G only after six months of 5G rollout and this shows India’s confidence,” Modi said, according to a transcript of his address at the inauguration of a new ITU Area Office & Innovation Center in New Delhi. “Today we have also presented our vision document. This will become a major basis for 6G rollout in the next few years,” Modi added.

The Bharat 6G vision document foresees 6G services launched in India by the second or third quarter of 2024. That would enable India to move ahead from 5G services in just 2 short years. According to government sources, India’s 6G mission will be completed in two phases- 1] from 2023 to 2025 and 2] from 2026 to 2030.

………………………………………………………………………………………………………………………………………………….

References:

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Despite being very late to deploy 5G due to tardy licensed spectrum auctions, and with no known indigenous 5G network equipment vendors, India’s Communications Minister Ashwini Vaishnaw believes the country’s indigenous 4G/5G technology stack is “now ready” and the country is poised to emerge as a major telecom technology exporter to the world in the coming three years. Speaking at the Economic Times Global Business Summit 2023, Vaishnaw, who is also the Minister for Railways, categorically said there is no program for the privatization of the national transporter.

The 5G services were launched on October 1, 2022, and within a span of 100 days have been rolled out in 200-plus cities. The sheer speed of rollout has been appreciated by industry leaders globally and is being described in many international forums as the “fastest deployment happening anywhere in the world,” he said. Vaishnaw highlighted the population-scale solutions being tested on India stack, across platforms such as payments, healthcare and identity. Each of these platforms is powerful in itself, but together become a dynamic force that can solve “any major problem in the world.”

The minister said India is set to emerge as a telecom technology exporter to the world in the next three years. “Today there are two Indian companies that are exporting to the world…telecom gear. In the coming three years, we will see India as a major telecom technology exporter in the world,” Vaishnaw said.

The minister talked of the rapid strides taken by India in developing its own 4G and 5G technology stack, a feat that caught the attention of the world. “The stack is now ready. It was initially tested for 1 million simultaneous calls, then for 5 million, and now it has been tested for 10 million simultaneous calls,” he said terming it a “phenomenal success.” At least 9-10 countries want to try it out, he added.

The minister gave a presentation outlining key initiatives under his three ministries of telecom, IT and Railways. For Railways, the focus is on transforming passenger experience, he said as he presented slides on how railways is redeveloping stations and terminals (New Delhi, Ahmedabad, Kanpur, Jaipur among others) with modern and futuristic design blueprint, and in the process creating new urban spaces while also preserving rich heritage.

The minister also gave an overview on the Vande Bharat train, the indigenous train protection system Kavach and progress on the bullet train project. To a question on the past talks around private freight rail corridors to boost logistics, the minister said “there is no program for Railway privatization.” “In a country where we have 1.35 billion people, 8 billion people moving every year on Railways, we thought that it is prudent to learn from the experience of others, and keep it within the Government set-up,” Vaishnaw said.

India’s Communications Minister Ashwini Vaishnaw (Photo Credit: PT)

To another query on dedicated freight corridor for food grains, the minister explained that when it comes to transport economics it is important not to divide assets between different applications.

“Today, the thought process has got very refined, and we are adding close to 4500 km of network every year, which amounts to 12 km of new tracks per day. So we have to increase the capacity to such a large extent that there is enough capacity for food grains, enough for coal, small parcels, and every kind of cargo,” he said. While Railways had been consistently losing market share over the last 50-60 years, it has started clawing it back.

“The lowest point was 27 per cent. I am happy to share that from the 27 per cent level, last year Railways increased to 28 per cent, this year we are doing close to 29-29.5 per cent, and in the coming 2-3 years Railways will go towards 35 per cent market share,” he added.

People will choose between transport via road, railways or air based on the distance to be travelled, and “there will be enough for everybody”. “The country will have enough for everybody, is my point. Up to 250 kilometres road is very good, 250 to 1000 kilometres railway is the ideal mode. Beyond 1000 kilometres air will be the ideal mode. So there will be enough for everybody,” the minister said.

References: