GMSA vs ITU-R, FCC & U.S. Tech Companies on use of 6GHz band: Licensed 5G or Unlicensed WiFi?

Introduction:

There’s a huge disagreement on the use of the 6 GHz band for wireless communications. GSMA strongly says it’s needed for 5G, ITU-R WRC-23 only has it on their agenda for world region 1, the FCC has opened up that band for unlicensed operation, while a group of big tech companies say 6 GHz unlicensed WiFi is an economic winner and have asked the FCC for additional communications capabilities.

GSMA Position – Licensed 6 GHz for 5G:

In a May 17th GSMA blog post, the GSMA trade group warns that the 6GHz band is urgently needed for licensed (terrestrial) 5G operations, but that governments are diverging [1.] in their plans for same. “The global future of 5G is at risk says GSMA in the first sentence of their post.

“The 6 GHz band is essential not only for mobile network operators to provide enhanced affordable connectivity for greater social inclusion, but also to deliver the data speeds and capacity needed for smart cities, transport, and factories. It is estimated that 5G networks need 2 GHz of mid-band spectrum over the next decade to deliver on its full potential. [reference 1]”

Note 1. Different Approaches for the 6 GHz band

China will use the entire 1200 MHz in the 6 GHz band for 5G. Europe has split the band, with the upper part considered for 5G, but a new 500 MHz tranche available for Wi-Fi. Africa and parts of the Middle East are taking a similar approach.

At the other extreme, the U.S. and much of Latin America have declared that none of this valuable resource will be made avail able for 5G, but rather will be offered to Wi-Fi and other unlicensed band technologies. Also see the section Worldwide Status of Unlicensed 6 GHz below for more on this controversial topic.

……………………………………………………………………………………………………………………………………………

“5G has the potential to boost the world’s GDP by $2.2 trillion,” said John Giusti, Chief Regulatory Officer for the GSMA. “But there is a clear threat to this growth if sufficient 6 GHz spectrum is not made available for 5G. Clarity and certainty are essential to fostering the massive, long-term investments in this critical infrastructure.”

GSMA opines that 5G is accelerating the digital transformation of all industries and sectors, unleashing new waves of innovation that will benefit billions. This technology is crucial for the environment and climate goals as connectivity replaces carbon. In order to reach all users, however, industries will require the extra capacity that the 6 GHz band offers.

The GSMA calls on governments to:

- Make at least 6,425-7,125 MHz available for licensed 5G;

- Ensure backhaul services are protected; and

- Depending on countries’ needs, incumbent use and fiber footprint, the bottom half of the 6 GHz range at 5,925-6,425 MHz could be opened on a license-exempt basis with technology neutral rules.

The GSMA also published a statement with Ericsson, Huawei, Nokia and ZTE that further details the importance of the 6 GHz band for the future of 5G. That document states, “Extending the bandwidth of 5G through the harmonization of 6 GHz spectrum will provide more bandwidth and improve network performance. On top of this, the broad, contiguous channels offered by the 6 GHz range will reduce the need for network densification and make next-generation connectivity more affordable for all.

About GSMA:

The GSMA represents the interests of mobile operators worldwide, uniting more than 750 operators with almost 400 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces the industry-leading MWC events held annually in Barcelona, Los Angeles, and Shanghai, as well as the Thrive Series of regional conferences. The GSMA continues to work with partners that share its commitment to sustainable development and economic growth. Click here to find out more.

For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA.

Media Contact: [email protected]

……………………………………………………………………………………………………………………………………………..

ITU-R (WRC-2023) and FCC Positions:

1. GSMA says the World Radiocommunication Conference in 2023 (WRC-23) will provide the opportunity to harmonize the 6 GHz band across large parts of the world and help develop the ecosystem. That is not entirely correct as their related work item 1.2 only covers 6 GHz IMT for region 1, which comprises Europe, Africa, the former Soviet Union, Mongolia, and the Middle East west of the Persian Gulf, including Iraq.

2. The FCC voted last year to allocate the entire 6 GHz band for unlicensed operations, including Wi-Fi. Commercial Wi-Fi devices working in the 6 GHz band have already begun hitting the market.

The FCC’s vote represented a setback to some players like Ericsson, Verizon and T-Mobile that had urged the Commission to set aside some or all of the 6GHz band for licensed uses, including 5G.

In it’s latest WRC-23 related document, the FCC made no move to reverse their decision on unlicensed 6 GHz. More importantly, they have not requested a broadening of the 6 GHz band for 5G to include the U.S. or any other world region besides region 1. According to that FCC document:

WRC-23 agenda item 1.2 will consider the possibility of identifying IMT in the frequency bands 3 600-3 800 MHz and 3 300-3 400 MHz (Region 2); 3 300-3 400 MHz (amend footnote in Region 1); 7 025-7 125 MHz (globally); 6 425-7 025 MHz (Region 1); 10 000-10 500 MHz (Region 2).

Sharing and compatibility studies will need to be conducted, with a view to ensuring the protection of existing services to which the frequency band is allocated on a primary basis, without imposing additional regulatory or technical constraints on those services, and also, as appropriate, protection of services in adjacent bands.

……………………………………………………………………………………………………………………………………….

Tech Companies Meet with FCC on Unlicensed Use of the 6 GHz band:

Mike Dano, Editorial Director, 5G & Mobile Strategies at Light Reading said that representatives from Apple, Broadcom Facebook, Google, Qualcomm (the #1 supplier of 5G silicon) and two attorney’s from Wiltshire & Grannis LLP met (via video conference) with the legal advisor to FCC Commisioner Carr on May 13th to discuss the “Unlicensed Use of the 6 GHz Band.”

The 5 big tech companies collectively supported the FCC’s 6 GHz decision noting that the FCC unlicensed 6 GHz order adopted carefully considered rules that will protect incumbents while permitting innovation in fixed unlicensed equipment and operations.

The next step is to meet consumers’ expectation for mobility and portability through the pending FCC Public Notice and Further Notice of Proposed Rulemaking (FNPRM) for expanded use of the 6 GHz band in the U.S. They recommend the following additional capabilities:

- Client-to-client communications (which would allow devices to talk directly to each other).

- Very Low Power operations (which would allow low-power communications without Automatic Frequency Coordination technology).

- Mobile operations (which would permit mobile connections using Automatic Frequency Coordination technology for services such as mass transit connectivity).

The companies said that WiFi has been “an economic powerhouse.” In particular:

• Wi-Fi is projected to contribute nearly $1 trillion to the U.S. economy in 2021

• $3.3 trillion contributed globally in 2021

• That contribution will grow to $1.58 trillion by 2025 in the U.S.

• $4.9 trillion global contribution by 2025

• Wi-Fi 6 and 6 GHz devices are significant contributors to this expected growth

Unlicensed bands (NOT 5G) are the workhorses of the wireless economy:

- Unlicensed bands carry half of all internet traffic in the U.S., a figure that is growing each year

- LTE offload to unlicensed will increase with 5G, from 54% of traffic in 2017 to 59% by 2022

- Unlicensed is the on-ramp to broadband for American homes, enterprise wireless, rural

communities, schools, healthcare facilities, and more - Unlicensed spectrum is also the backbone for new IoT networks

- Key economic sectors—manufacturing, logistics, and research—depend on Wi-Fi for business

processes and internal connections - Quotient and Qualcomm studies have demonstrated an enormous unlicensed

spectrum shortfall in the mid-band - The 6 GHz band is central to addressing this pressing need

Worldwide Status of Unlicensed 6 GHz:

Of the top 20 economies in the world, fully half have opened, or are in the process of opening the 6 GHz band to unlicensed use—the U.S., Japan, Germany, UK, France, Canada, South Korea, Brazil, Mexico, and Saudi Arabia. In Europe, the CEPT decision opening 6 GHz is expected to become European law in March 2021 and will shortly be followed by country-specific implementations.

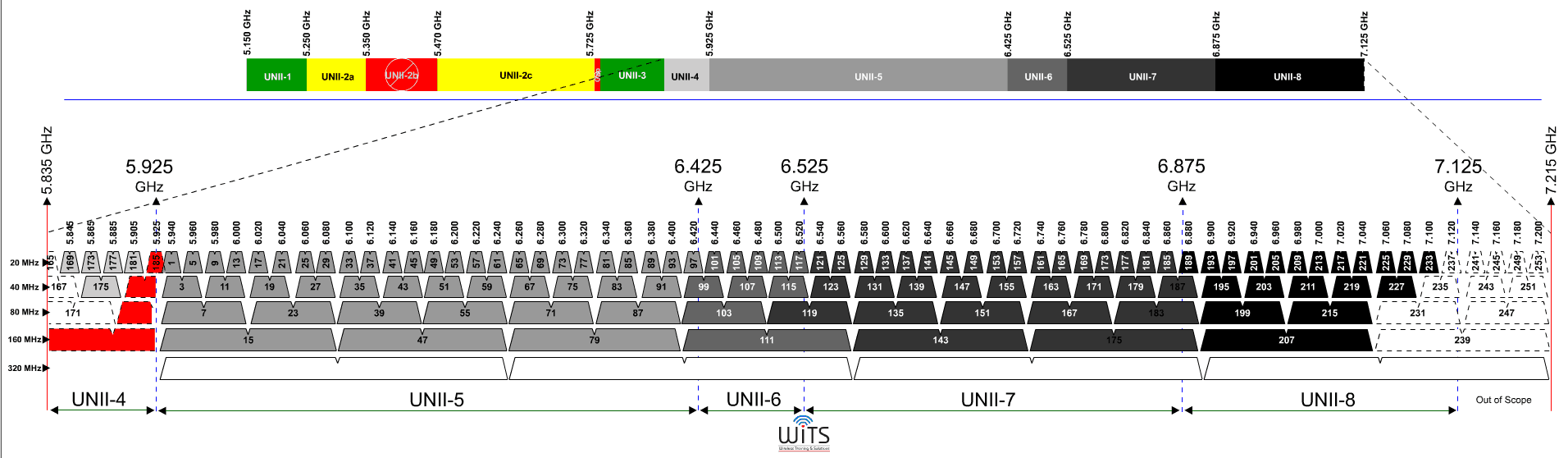

Proposed 6 GHz Channel Map for Unlicensed WiFi:

Image Credit: Wireless Training Solutions

………………………………………………………………………………………………………………………………………

References:

https://www.gsma.com/newsroom/press-release/gsma-calls-on-governments-to-license-6-ghz-to-power-5g/

https://www.gsma.com/spectrum/wp-content/uploads/2021/05/6-GHz-Capacity-to-Power-Innovation.pdf

https://www.lightreading.com/5g/gsma-5g-is-at-risk-if-6ghz-remains-unlicensed/d/d-id/769600?

https://ecfsapi.fcc.gov/file/1051767219870/6%20GHz%20Thumann%20Ex%20Parte%20(May%2013%202021).pdf

https://www.coleago.com/app/uploads/2021/01/Demand-for-IMT-spectrum-Coleago-14-Dec-2020.pdf

3 thoughts on “GMSA vs ITU-R, FCC & U.S. Tech Companies on use of 6GHz band: Licensed 5G or Unlicensed WiFi?”

Comments are closed.

Thanks for providing a global perspective on a technology that promises to continue the advance of low-cost bandwidth and connectivity. It seems like WiFi-6e has the market momentum and devices in the market. It seems like the 5G operators want to protect their huge investments in spectrum, while their suppliers want to protect their oligopoly positions.

The real revolution with WiFi-6e is the continuation of both the unlicensed and Licensed by Rule approach to managing spectrum. This results in faster innovation than spectrum auctions or “spectrum homesteading” (what the FCC did to encourage the build-out of broadcast television in the 50s, where the broadcasters would get the spectrum for free in exchange for fulfilling public obligations).

It will also be interesting to see how this develops. Will WiFi-6e become a last 300′ type solution and part of a larger network that service providers stitch together? Will it become a literal cable replacement, replacing unsightly HDMI cables to monitors? All the above?

Terrific comment Ken! However, the key point is that the world seems to be split on how the 6 GHz band will be used. It’s interesting that Qualcomm is in the Unlicensed WiFi camp, since it is the primary supplier of 5G silicon.

The 6 GHz band continues to be one of the most sought-after frequency ranges for a number of key stakeholders. It is currently used around the world by satellite and microwave (fixed links for backhaul) systems. As for the future, the band has attracted great attention for use by IMT: 5G and its evolution (based on licensed access to spectrum), as well as for RLAN: Wi-Fi 6E and its evolution (based on licence exempt – a.k.a unlicensed – use of spectrum). In particular, the future of the upper portion of the band (6425-7125 MHz) is being hotly contested. ITU-R has started its preparatory work within WRC-23 Agenda Item 1.2 (AI 1.2) assessing the feasibility of identifying the band for IMT. The ITU-R will finalize technical parameters and channel models by the end of July. Based on these, the initial results of studies on coexistence between IMT and the incumbent systems will become available in the following months.

A decision has been taken in Europe to open up the lower portion of the 6 GHz band (5925-6425 MHz) for licence-exempt Wi-Fi use, to meet the needs of radio local area networks (RLAN). But what about the 6 GHz spectrum and the needs of the mobile networks? Many attendees in this conference believed that the evolution of mobile networks will need access to more mid-band spectrum, in particular the Upper 6 GHz band, to meet the demands of the mobile users.

Massimiliano Simoni, Chairman of the Spectrum Strategy Management Group at GSMA, highlighted the importance of mid-bands and said that “A recent report we published with Coleago states that an additional 1 to 2 GHz of spectrum will be required in Europe before the end of the decade. This new spectrum in mid-bands will be needed to address new consumer take up and usage.” Simoni also emphasised that “Licensed spectrum remains essential to guarantee the long term heavy network investment needed for 5G and to deliver high quality of service”, noting that “Right now we have some concerns especially on the mid-bands, where we see a risk of ending up without any new spectrum identified for IMT, and this would create a hole in the infrastructure that we plan and we foresee to put in place.”

Erika Tejedor, Director of Government and Industry Relations, Ericsson, agreed with the 1-2 GHz mid-band needs of IMT in the 2025-2030 timeframe, to provide services for IMT-2020 citywide “speed coverage”, smart cities, fixed wireless access and Industry 4.0. Tejedor noted that “3.8-4.2 GHz and 6425-7125 MHz are required to enable all these objectives in an economical manner. As we hear from the European Commission, the 3.8-4.2 GHz is going to be considered for local verticals usage. That means that the Upper 6 GHz band becomes even more important for Europe.”

Nadia Katsanou, Co-chair of RSPG Subgroup on WRC-23, also thinks “more mid-bands spectrum will be required in 2025-2030 to meet the connectivity needs of European citizens and industries, to meet European targets set in the latest EU communication on the digital compass. 6 GHz band may respond to additional spectrum demand since it has similar technical characteristics as the 3.5 GHz band and complementing it, as it seems that it [3.5 GHz] won’t be sufficient for the long term.”

Glyn Carter, Senior Spectrum Advisor at GSMA highlighted the importance of the Upper 6 GHz band for IMT, and said, “the Upper 6 GHz band can provide city-wide capacity for 5G expansion, and identification of 6425-7125 MHz is important for the future of 5G in terms of improved harmonisation and affordable mobile broadband and other services.”

Päivi Ruuska, Spectrum Management, Telia Company raised the issue of interference from license exempt RLAN (Wi-Fi) equipment to the existing fixed links in the Lower 6 GHz band used by mobile operators. Ruuska said, “The equipment RLAN use is unlicensed, so there is no professional installation and it’s very difficult to ensure that their use is as it is supposed to be. That’s why we require that the Upper 6 GHz band would be retained for licensed use. In addition to fixed link demands, we have demands for IMT in future, especially in the mid-bands which are very good capacity bands. We support licensed use in the Upper 6 GHz, and we believe that sharing is possible between licensed use and fixed links, because the conditions can be included in the licenses.”

Ecosystem is one key factor for the development of any industry, which was also discussed during the conference.

“We’ve got an ecosystem that’s being developed for Wi-Fi. So one of the options I’m currently looking at and currently considering is whether actually we make this spectrum available for a local licensed use to enable people to use the chipsets and the devices that are currently emerging to enable this band, the Upper 6 GHz band, to be used for that purpose”, said Philip Marnick, Spectrum Group Director from Ofcom.

On the other hand, the ecosystem of Upper 6 GHz band for mobile industry is also being developed now. At a showcase session, Huawei presented its prototypes of 6 GHz 5G NR base stations which have been deployed and verified in field tests. According to these tests, 6 GHz can provide similar coverage performance as C-band in urban and suburban areas by using innovative technologies such as active antenna systems. These technologies can close the propagation gap between these two bands, and Huawei thinks that 6 GHz spectrum is a good option for future IMT macro cellular deployment. In the same showcase, Huawei described how the deterministic radio protocols of 5G NR can deliver huge spectral efficiencies and low latencies for industrial IoT use cases, which cannot be achieved with the stochastic radio protocols of Wi-Fi or 5G NR-U. “This spectrum would also address the demands of smart cities and increase capacity required along major transport routes in Europe. 6 GHz is a key band for 5G NR macro-cellular deployment. Advanced technology enhancements will allow similar performance at 6 GHz as in 3.5 GHz band, reusing the same sites”, said Reza Karimi, Vice President, Corporate Strategy, Huawei.

So where does the balance lie between licensed and license-exempt use of 6 GHz spectrum, and should decisions in the lower portion of the band affect the way that the upper portion is handled?

Nadia Katsanou said, “Europe is waiting for the outcomes of co-existence studies to make its decisions. Europe also needs to find a balance between licensed (i.e., IMT and better protection of the incumbent services e.g. FS, FSS) and licence exempted (i.e. RLAN/Wi-Fi) spectrum use. So, it seems to me that we should consider it as opportunity to find a balanced approach between RLAN (Wi-Fi) and IMT and not as a ‘battleground’ as far as it concerns service allocation or licensing schemes.”

Reza Karimi also believes that 6 GHz is not a ‘battleground’ but an opportunity for balance. “IMT and RLAN both have important roles to play: Mid-bands are key to 5G-NR and Wi-Fi 6/6E and sufficient spectrum need to be ensured for the development of both uses. A balanced approach is needed for both uses across mid-bands. Deployment of RLAN in lower 6 GHz band should not result in undue restrictions to the deployment of IMT 5G NR in Upper 6 GHz band; i.e., RLAN receiver characteristics at the 6425 MHz boundary should account for this.”

What work is being done by CEPT and the Commission to develop a harmonized EU approach in the band?

Tuck Poon, Co-ordinator for AI 1.2 at CEPT said that it is “Still at a very early stage in deciding the approach to the Upper 6 GHz, and studies need to be conducted to understand the coexistence situation. I would expect a lot of work and initial sharing and compatibility studies to be conducted in the next couple of months for discussions in PT1 and 5D towards September and October when we see the first results of these initial results. We need to actually wait for the studies to be complete to make an assessment.”

Alexandre Kholod, chairman CEPT CPG said, “Results of sharing studies will be decisive for IMT and incumbents in 6425-7025 MHz (in region 1) and 7025-7125 MHz (globally), CEPT position is yet to be developed.”

So it seems reasonable for regulators to not decide the use of Upper 6 GHz before WRC-23, until the relevant studies have been fully conducted at the ITU-R. And while the proponents of Wi-Fi would like to see the entire 6 GHz to be made available for Wi-Fi in Europe, the counter message from the mobile industry was loud and clear: 6 GHz band is uniquely essential for the needs of IMT (5G and its evolution) in the 2025-2030 timeframe, and for the delivery of high capacity wider area coverage.