GSMA

Highlights of GSMA study: Mobile Net Zero 2024, State of the Industry on Climate Action

Reducing carbon emissions has been a top priority for global network operators and equipment vendors for the past few years. Many have published net zero targets and use every opportunity to include their sustainability agenda into their public announcements. In 2019, the mobile industry set a goal to reach net zero by 2050, becoming one of the first sectors in the world to set such an ambitious target.

A new GSMA study titled Mobile Net Zero 2024, State of the Industry on Climate Action, the fourth of its kind, provides a glimpse of how they are progressing.

Over the past year, eight network operators submitted new near-term targets to the Science Based Targets Initiative (SBTi), bringing the total to 70 operators and

representing nearly half of global mobile connections. Fifty-three operators have also

committed to net zero targets.

GSMA found that European telcos are leading the way forward. Operational emissions in Europe fell by half in the 2019-2022 period, with some telcos getting a special mention for exceeding that 50% level; Tele2, Telefónica, Telenor, Telia and Vodafone all achieved deeper reductions.

North America also performed well, with operational emissions falling by around 30% over the period, as did Latin America, where TIM Brasil and Telefonica got a shout-out for driving a 22% reduction. And Turkcell was credited as the main orchestrator of a decline of around a fifth in emissions in the Middle East and North Africa (MENA).

However, emissions from operators in Greater China rose by 3% and those from the Asia-Pacific by 10%. While those numbers are not huge, the relative sizes of those markets mean there is a significant impact on the overall figures.

“While this appears challenging, recent progress shows this is within reach,” the report reads. Yet the target reduction rate for operational emissions was exceeded for the past three years in Europe (21% per year), North America (11%), Latin America (8%) and MENA (8%).

Three-quarters of the mobile industry’s carbon emission come from its value chain (Scope 3), highlighting the importance of engaging supply chains and customers. More than 90% of Scope 3 emissions came from just five Scope 3 categories: 1) Purchased goods and services; 2) Capital goods; 3) Fuel- and energy-related activities; 11) Use of sold products; and 15) Investments.

GSA says there is an urgent need for improved data and further analysis to better understand Scope 3 trends.

“The evidence shows that the mobile industry’s commitment to net zero by 2050 is paying off. Despite surging demand for connectivity and data, the global carbon emissions of operators continued to fall,” said John Giusti, Chief Regulatory Officer at the GSMA.

The number of mobile connections globally rose by 7% between 2019 and 2022, and Internet traffic more than doubled, the GSMA said. As such, the industry’s carbon reductions were mainly driven by energy efficiency and the use of renewable energy.

“Although we see the strongest early lead from Europe in the race to net zero, and encouraging progress in the Americas and MENA, this is a race that everybody needs to win – or else we all lose,” Giusti said, assiduously avoiding naming those trailing markets.

References:

Mobile Net Zero 2024: State of the Industry on Climate Action

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

NGMN Alliance: Green benchmark for mobile networks

Huawei Execs: ICT Industry Initiatives for 5G and Green 5G Networks for a Low-Carbon Future

GSA 5G SA Core Network Update Report

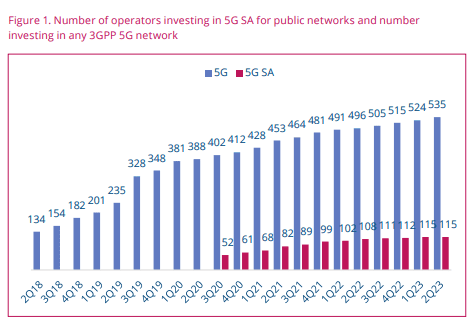

GSA is tracking the emergence of the 5G SA core network, including the availability of chipsets and devices for customers, plus the testing and deployment of 5G SA networks by public mobile network operators as well as private network operators.

5G SA networks can be deployed in a variety of scenarios: as an overlay for a public 5G non-SA network, as a greenfield 5G deployment for a public network operator without a separate LTE network, or as a private network deployment for an enterprise, utility, education, government or other organization requiring its own private campus network.

GSA has identified 115 operators in 52 countries and territories worldwide that have been investing (?) in public 5G SA networks in the form of trials, planned or actual deployments (see Figure 1.). This equates to 21.4% of the 535 operators known to be investing in 5G licenses, trials or deployments of any type.

At least 36 operators in 25 countries and territories are now understood to have launched or deployed public 5G SA networks, two of which have only soft-launched their 5G SA networks.

NOTE: Incredibly, that’s a DECREASE from GSA’s June 5G SA report which stated “GSA has catalogued 41 operators as having deployed or launched 5G standalone (SA) in public networks.”

Also, 19 cellular network operators have been catalogued as deploying or piloting 5G SA for public networks, and 29 as planning to deploy or evaluating, testing or trialing the technology.

Several organizations are testing, piloting or deploying 5G SA technologies for private networks. As of May 2024, 66 (just over 13% of total cellular private networks) organizations are known to be working with 5G SA core networks. These organizations include manufacturers, academic institutions, commercial research institutes, construction, communications and IT services, rail and aviation industries.

The number of 5G SA devices as a percentage of all 5G devices announced has been steadily increasing. They accounted for 35.6% of 5G devices in December 2019, 49.7% in December 2020 and 54.6% in December 2021 and a large increase to 81.8% in December 2022. As of June 2023, they account for 85.8%.

Software upgrades are almost always needed to enable 5G SA capability for existing 5G devices. There is a range of form factors to cater for different users, including modules for equipment manufacturers and vendors; customer-premises equipment (CPE), routers and gateways for enterprise or industrial customers or their systems integrators; CPE for home and business broadband; phones; and battery-operated hot spots for portable services.

Smartphones make up over half (59.0%) of the announced 5G devices with stated 5G SA support (1,034 phones), followed by fixed wireless access CPE (246) and modules (220).

Spectrum Support in 5G SA Devices:

Selected sub-6 GHz frequencies are increasingly well supported in 5G SA devices. The pattern of most-supported bands in sub-6 GHz 5G SA devices largely matches the pattern for most-supported bands across all 5G devices, with C-band, 2.6 GHz, 2 GHz, 1.8 GHz and 700 MHz.

Sub-6 GHz support by band, announced 5G SA devices, most-supported bands by most devices. Support for millimeter wave is not yet common.

Chipsets are being developed to support this capability — GSA has currently only catalogued eight chipsets specifically supporting 5G SA in millimeter-wave spectrum (eight mobile processors and platforms). 320 393 397 421 449 519 739 741 743 817 846 979 1,025 1,115 1,183 1,257 1,309 1,444 1,465 n48 n25 n66 n71 n12 n2 n20 n40 n79 n38 n7 n8 n5 n3 n28 n77 n1 n41 n78 We can expect support for spectrum bands above 6 GHz to increase in the future, as these bands are being promoted as an option for deployment of private 5G networks by regulators in various countries, as well as being promoted as capacity bands for high-traffic locations in public networks.

Summary:

The market is seeing the emergence of a strong 5G SA ecosystem with chipsets, devices of many types and users of public as well as private networks. We can expect to see the market go from strength to strength.

–>This author opines the 5G SA market is going from nowhere to no place!

As it does, GSA will continue to track its evolution and will be looking out for important new trends as they emerge.

Topics likely to become more important in the coming year in this context include 5G carrier aggregation in SA networks, ultrareliable low-latency communications (can’t be accomplished till 3GPP Release 16 URLLC in the RAN spec has been completed and performance tested) capabilities to support machine-to-machine connections in 5G SA systems, increasing support for millimeter-wave connections, network slicing in 5G networks and the introduction of VoNR in 5G SA networks.

……………………………………………………………………………………………………………………..

References:

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

5G SA networks (real 5G) remain conspicuous by their absence

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

GSMA: Closing the digital divide in Central Asia and the South Caucasus

The GSMA has published a report – Closing the digital divide in Central Asia and the South Caucasus – which affirms that mobile technology is fundamental to expanding connectivity across the region, with over 40% of the population living in rural areas where mobile connectivity is the primary, and often only, form of internet access. The report assesses the state of mobile adoption and infrastructure availability in Armenia; Azerbaijan; Georgia; Kazakhstan; Kyrgyzstan; Tajikistan; Turkmenistan; and Uzbekistan.

GSMA Intelligence estimated around 45 million people across the eight countries used mobile internet (as of the date of publication). This represented a significant increase from 14.1 million recorded a decade earlier, though it still leaves around 50 million unconnected. Although lack of coverage was cited as still a challenge in parts of Central Asia, where around 10 per cent of the population in some markets lived in underserved areas, it generally noted the pace of adoption was lagging rollout.

GSMA Intelligence noted collaboration as key to addressing the digital divide in the regions, adding there is a need to “increase digital skills and literacy and improve affordability, in addition to investing in local digital ecosystems and an enabling policy environment that can accelerate growth in local content, services and applications”

The new report was launched to mark the opening of M360 Eurasia 2023, which today welcomed global leaders from the mobile ecosystem and adjacent industries for two days of learning, debate and networking at the Four Seasons Hotel in Baku, Azerbaijan.

“Since the first mobile phone call 50 years ago, our industry has evolved, adapted and advanced the world around us, serving 5.4 billion unique customers. As we enter the era of intelligent connectivity, it feels like anything is possible, but it has also never been more important for us to focus on closing the digital divide. Together we must keep working to build a firm foundation for the next generation of intelligent connectivity and ensure that no one is left behind in our global digital economy,” said Mats Granryd, Director General of the GSMA, on stage for the opening ceremony and keynote.

“I am delighted to welcome the global connectivity community to Baku for M360 Eurasia,” said H.E. Rashad Nabiyev, Minister of Digital Development and Transport for the Republic of Azerbaijan. “As we continue our digital transformation journey in Azerbaijan, we look forward to hearing leaders in mobile and technology explore the latest trends in connectivity and the importance of digital resilience.”

As of April 2023, commercial 5G services were only available in Kazakhstan, Tajikistan and Uzbekistan, though GSMA Intelligence noted activities around the latest generation of mobile technology were ramping more widely.

“Although 5G is on the horizon in several markets in Central Asia and the South Caucasus, the focus for many operators in the medium term is to expand 4G capacity in urban areas and 4G coverage to underserved areas, and accelerate uptake among consumers.”

Closing the Digital Divide in Eurasia:

M360 Eurasia comes to Baku, Azerbaijan as progress to build the digitally powered economy of the future continues in the region, driven by ambitious digital transformation initiatives and a general trend towards greater digitisation.

The new report from the GSMA, which evaluates the connectivity landscape of eight countries1 in Central Asia and the South Caucasus, outlines the digital divide and spotlights ongoing initiatives in the region to close it with recommended action points for stakeholders to accelerate progress.

Other key findings from the report include:

- While 45 million people are now using mobile internet across the eight countries evaluated, a digital divide remains with nearly 50 million unconnected people at risk of missing out on the benefits of mobile internet.

- The adoption of mobile internet services has not kept pace with the expansion of network coverage, resulting in a significant usage gap2. As of 2022, the regional usage gap was widest in Georgia (52%) and Turkmenistan (50%), and lowest in Armenia (33%) and Azerbaijan (31%) versus a global average of 41%.

- While 4G is now the dominant technology in Azerbaijan (59%) and Kazakhstan (62%), 3G still accounts for over 40% of total connections across the region versus a global average of 17%.

- The region’s 5G uptake is still in its infancy with commercial 5G services only available in Kazakhstan, Tajikistan and Uzbekistan as of April 2023. The medium-term focus for operators in the region is to expand 4G capacity in urban areas and 4G coverage to underserved areas.

- While 4G coverage has reached 83% of the population in Central Asia, extending coverage to the last frontier can be costly and complex. This has led to operators increasingly turning to alternate technologies, such as satellite backhaul, and innovative partnerships as a means of closing the digital divide.

- Closing the region’s digital divide will require substantial collaborative actions. To this end, governments and policymakers should implement measures that can attract investment in the deployment of network infrastructure in underserved areas; create innovative digital services to stimulate demand; and address the various non-infrastructure barriers to mobile internet adoption.

M360 Series: Regional focus, global impact:

M360 Eurasia marks this year’s first iteration of the M360 Series. Presented by the GSMA, M360 is a series of global events that unifies the regional mobile ecosystem to discover, develop and deliver innovation that is the foundation to positive business environments and societal change.

The events facilitate inspirational keynotes, engaging panel discussions and insightful case studies across mobile technology and adjacent industry verticals.

To download the report, please click here: Closing the digital divide in Central Asia and the South Caucasus

About GSMA:

The GSMA is a global organisation unifying the mobile ecosystem to discover, develop and deliver innovation foundational to positive business environments and societal change. Our vision is to unlock the full power of connectivity so that people, industry, and society thrive. Representing mobile operators and organisations across the mobile ecosystem and adjacent industries, the GSMA delivers for its members across three broad pillars: Connectivity for Good, Industry Services and Solutions, and Outreach. This activity includes advancing policy, tackling today’s biggest societal challenges, underpinning the technology and interoperability that make mobile work, and providing the world’s largest platform to convene the mobile ecosystem at the MWC and M360 series of events.

References:

GSMA REPORT HIGHLIGHTS PIVOTAL ROLE OF MOBILE TECHNOLOGY IN EXPANDING CONNECTIVITY IN EURASIA REGION

GSMA vision for more mobile spectrum in advance of WRC 23 this November

The GSMA, which represents the worldwide mobile communications industry, says their mission is to ensure mobile operators have timely and affordable access to appropriate spectrum. Without it, mobile operators can’t meet the growing demand for high-speed, mobile broadband services with good coverage in all parts of the world.

Mobile spectrum is a critical national resource for countries worldwide, playing a central role as an enabler of socio-economic development, social mobility, and the fight against climate change. Future allocations of spectrum at national level are guided by decisions made at the International Telecommunication Union (ITU)’s quadrennial WRC conference. At WRC 23 (November 2023) decisions will be made to guide national allocations of spectrum.

However, it should be noted that with respect to 5G frequencies, WRC 19 was a failure: WRC-19 requested ITU-R WP 5D to complete the IMT frequency arrangements (revision 6 of ITU-R M.1036 recommendation) for the new mmW frequencies it authorized for 5G. That has not happened yet! In other words, there is NO STANDARD for IMT frequency arrangements!

Today GSMA released two reports discussing future spectrum allocation and its economic implications. The speed and quality of mobile services are directly linked to spectrum, and decisions taken at WRC-23 have the potential to deliver affordable 5G across the world.

The GSMA’s vision ‘For the Benefit of Billions’ explains how governments and regulators can use WRC-23 to develop thriving and competitive communications markets and help to ensure that no one is left behind in a digital age, concluding that:

- Increasing capacity for mobile at WRC-23 will lead to better services delivered from less costly, more sustainable networks.

- Additional low-band spectrum can deliver broad and affordable connectivity, building bridges towards digital inclusion.

- Mid-band expansion can drive city-wide 5G, transforming industries and delivering mobile services that are an asset to their countries, ensuring their industrial agility in the global marketplace.

Mats Granryd, Director General of the GSMA, said: “WRC-23 is a critical inflection point for every government, every business and every person worldwide that use mobile communications. More than five billion people rely on mobile every day, and the evidence is clear: increasing mobile capacity will deliver the maximum socio-economic benefit for billions worldwide, and provide the biggest boost to national economies. Future growth, future jobs and future innovation all depend on policymakers making choices at WRC-23 that give 5G the room to grow and allow it to play a transformational role across all sectors of our societies and economies.”

The GSMA’s vision paper is accompanied by the association’s latest report: The ‘Socio-Economic Benefits of 5G: The importance of low-band spectrum’. This examines how low-band spectrum is a driver of digital equality, reducing the gap between urban and rural areas and delivering affordable connectivity. It concludes that:

- Low-band 5G is expected to drive around $130 billion in economic value in 2030.

- Half of the impact will come from massive IoT (mIoT). Many existing and future IoT use cases require wide area coverage, in addition to population coverage, which low-band spectrum is best suited to provide.

- MIoT applications are set to play an important role in digital transformation across a range of economic sectors, including manufacturing, transport, smart cities and agriculture.

- The rest of the economic impact will be driven by enhanced mobile broadband (eMBB) and fixed wireless access (FWA), as low bands will play a critical role in delivering high-speed broadband connectivity in areas underserved by fixed networks.

- Without sufficient low-band spectrum, the digital divide is likely to widen, and those living in rural areas will be excluded from the latest digital technologies.

The latest report complements the GSMA’s assessments of the socio-economic benefits of high-band, mid-band and low-band spectrum.

In summary, the GSMA says that freeing up more spectrum will have the duel benefits of letting 5G realize its potential and that there are socio-economic consequences for those not already well connected if this isn’t done.

Note on 5G Deployments:

At the end of 2022, there were already 252 commercial 5G networks in 86 countries around the world, serving more than 1 billion 5G connections. By 2030, more than 5 billion 5G connections are forecast worldwide, driving almost $1 trillion in GDP growth. While 5G is forecast to reach maturity by 2030 in North America, Europe, China and the GCC countries, it will continue to grow in many low- and middle-income countries (LMICs) well into the 2030’s.

References:

https://www.gsma.com/spectrum/wp-content/uploads/2023/03/WRC-23-IMT-AI-Infographic.pdf

https://www.gsma.com/spectrum/

https://telecoms.com/520807/gsma-makes-case-for-more-mobile-spectrum-availability/

GSMA Intelligence: 5G connections to double over the next two years; 30 countries to launch 5G in 2023

GSMA Intelligence forecasts 5G connections are expected to double over the next two years, expedited by technological innovations and new 5G network deployments in more than 30 countries in 2023. Of the new networks to be deployed in 2023, it is expected that 15 will be 5G Standalone (SA) networks. As of January 2023, there were 229 commercial 5G networks globally and over 700 5G smartphone models available to users.

GSMA Intelligence, announced its latest 5G forecast during MWC Barcelona 2023, point to a significant period of growth in terms of mobile subscribers and enterprise adoption. Consumer connections surpassed one billion at the end of 2022 and will increase to around 1.5 billion this year – before reaching two billion by the end 2025.

India will lead the 5G expansion globally in 2023, with the expansion of services from Airtel and Jio in 2023 expected to be pivotal to the region’s ongoing adoption. GSMA Intelligence predicts there will be four 5G networks in India by the end of 2025, accounting for 145 million additional users. With operators such as Jio announcing ambitions to connect as many as 100 million homes across India to its 5G FWA network, the number of FWA users looks likely to grow substantially over the next few years, the report added.

Growth will also come from key markets within APAC and LATAM, such as Brazil and India, which have recently launched 5G networks. India will be especially significant, with the expansion of services from Airtel and Jio in 2023 expected to be pivotal to the region’s ongoing adoption. GSMA Intelligence predicts there will be four 5G networks in India by the end of 2025, accounting for 145 million additional users.

Many of the new 5G markets scheduled to launch networks in 2023 are in developing regions across Africa – including Ethiopia and Ghana – and Asia. Today, 5G adoption in the sub-Saharan region sits below 1% but will reach over 4% by 2025 and 16% in 2030, largely thanks to a concerted effort from industry and government organizations to provide connectivity to citizens.

“Until now, 5G adoption has been driven by relatively mature markets and consumer use cases like enhanced mobile broadband, but that’s changing. We’re now entering a second wave for 5G that will see the technology engage a diverse set of new markets and audiences,” said Peter Jarich, Head of GSMA Intelligence. “The extension to new use cases and markets will challenge the mobile ecosystem to prove that 5G truly is flexible enough to meet these diverse demands in a way that’s both inclusive and innovative.”

The Rise of 5G Fixed Wireless Access (FWA):

As of January 2023, more than 90 FWA broadband service providers (the vast majority of which are mobile operators) had launched commercial 5G-based fixed wireless services across over 48 countries. This means around 40% of 5G commercial mobile launches worldwide currently include an FWA offering.

In the U.S., T-Mobile added over half a million 5G FWA customers in Q4 2021 and Q1 2022 combined. By 2025, it expects to have eight million FWA subscribers, while Verizon is targeting five million FWA subscribers for the same period. The conventional wisdom holds that FWA is primarily useful as a rural service, targeted mostly at the previously unserved or underserved. Verizon says their FWA service is primarily urban and suburban service with target customers that are dissatisfied with terrestrial broadband services. Verizon has increasingly come to view FWA as an integral part of their broadband access offering everywhere that FiOS isn’t available.

Reliance Jio (India) announced ambitions to connect as many as 100 million homes across India to its 5G FWA network, the number of FWA users looks likely to grow substantially over the next few years.

While the majority of current 5G FWA deployments focus on the 3.5–3.8 GHz bands, several operators around the world are already using 5G mmWave spectrum as a capacity and performance booster to complement coverage provided by lower bands.

Only 7% of 5G launches have been in 5G mmWave spectrum so far but this looks set to change given 27% of spectrum allocations and 35% of trials are already using 5G mmWave bands. Furthermore, in 2023 alone, the industry will see ten more countries assigned 5G mmWave spectrum for use – a significant increase from the 22 countries who have been assigned it to date. Spain received the first European 5G mmWave spectrum allocation this year, resulting in Telefónica, Ericsson and Qualcomm launching its first commercial 5G mmWave network at MWC Barcelona 2023.

Enterprise IoT Driving Growth:

The figures from GSMA Intelligence also suggest that, for operators, the enterprise market will be the main driver of 5G revenue growth over the next decade. Revenues from business customers already represent around 30% of total revenues on average for major operators, with further potential as enterprise digitization scales. Edge computing and IoT technology presents further opportunities for 5G, with 12% of operators having already launched private wireless solutions – a figure that will grow with a wider range of expected IoT deployments in 2023.

Another major development for the enterprise will be the commercial availability of 5G Advanced (3GPP Release 18) in 2025. Focusing on uplink technology, 5G Advanced will improve speed, coverage, mobility and power efficiency – and support a new wave of business opportunities. GSMA’s Network Transformation survey showed half of operators expect to support 5G Advanced commercial networks within two years of its launch. While this is likely optimistic, it presents the ecosystem with a clear opportunity to execute on.

Editor’s Note:

GSMA’s 5G forecast is a direct contradiction to Omdia’s which expects weaker 5G growth in the near term. Which forecast do you believe?

………………………………………………………………………………………………………………………………………………………………………..

References:

Omdia forecasts weaker 5G market growth in near term, 4G to remain dominant

GSMA Calls for 2 GHz of Mid-Band Spectrum to meet ITU-R speed requirements (explained)

The mobile industry will need an average of 2 GHz of mid-band spectrum this decade to meet the ITU data speed requirements (ITU-R recommendation not stated, but this author believes it to be M.2410 (11/2017)) [1.]. Achieving this will also minimize environmental impact and lower consumer costs of 5G, according to a global study of 36 cities published by the GSMA but carried out by Coleago Consulting.

The “Vision 2030 Insights for Mid-band Spectrum Needs” study suggests that policymakers should license spectrum to mobile operators in harmonized bands, such as 3.5 GHz, 4.8 GHz and, 6 GHz to meet the ITU’s requirements by 2030. Without the additional spectrum, it will be impossible to realise the full potential of 5G in some cases. In others, the number of antennas and base stations needed will lead to higher carbon emissions and consumer prices. The additional spectrum will lower the carbon footprint of networks by two-to-three times while enhancing the sustainable development of mobile connectivity, according to the study.

This spectrum will also make 5G more affordable. Total costs would be three- to five-times higher over a decade in cities where a deficit of 800-1000 MHz would increase the number of base stations needed and increase deployment costs in each city by $782 million to $5.8 billion.

The actual amount of mid-band spectrum required varies significantly by city, mid-band being roughly 1500 MHz-6 GHz. Population density, spread of base stations, availability of small cells and WiFi offload, and 5G activity levels, amongst other things, will have an impact on how much spectrum any given city needs.

Hong Kong tops the list of 36 cities studied by Coleago Consulting with an upper estimate of 3.7 GHz of mid-band spectrum required, while Tehran ranks at the bottom with a requirement of up to 1.2 GHz. As such, the amount of additional spectrum each city needs is also variable. However, the important message is that all cities need more spectrum than they are set to have, and the additional amount required is “far greater” than that currently planned for release, the GSMA said.

“Without the additional spectrum, it will be impossible to realize the full potential of 5G in some cases. In others, the number of antennas and base stations needed will lead to higher carbon emissions and consumer prices,” GSMA warned.

…………………………………………………………………………………………………………………………………………………………………….

Note 1. ITU-R M.2410 data rate requirements for IMT 2020 (11/2017):

Peak data rate: is the maximum achievable data rate under ideal conditions (in bit/s), which is the received data bits assuming error-free conditions assignable to a single mobile station, when all assignable radio resources for the corresponding link direction are utilized (i.e. excluding radio resources that are used for physical layer synchronization, reference signals or pilots, guard bands and guard times). This requirement is defined for the purpose of evaluation in the eMBB usage scenario. The minimum requirements for peak data rate are:

– Downlink peak data rate is 20 Gbit/s.

– Uplink peak data rate is 10 Gbit/s

Peak spectral efficiency: is the maximum data rate under ideal conditions normalized by channel bandwidth (in bit/s/Hz), where the maximum data rate is the received data bits assuming error-free conditions assignable to a single mobile station, when all assignable radio resources for the corresponding link direction are utilized (i.e. excluding radio resources that are used for physical layer synchronization, reference signals or pilots, guard bands and guard times).

This requirement is defined for the purpose of evaluation in the eMBB usage scenario. The minimum requirements for peak spectral efficiencies are:

– Downlink peak spectral efficiency is 30 bit/s/Hz.

– Uplink peak spectral efficiency is 15 bit/s/Hz.

User experienced data rate: is the 5% point of the cumulative distribution function (CDF) of the user throughput. User throughput (during active time) is defined as the number of correctly received bits, i.e. the number of bits contained in the service data units (SDUs) delivered to Layer 3, over a certain period of time. This requirement is defined for the purpose of evaluation in the related eMBB test environment. The target values for the user experienced data rate in the Dense Urban – eMBB test environment:

– Downlink user experienced data rate is 100 Mbit/s.

– Uplink user experienced data rate is 50 Mbit/s.

…………………………………………………………………………………………………………………………………………………………………………..

Mid-band spectrum availability also will enhance Fixed Wireless Access (FWA). The study shows that with the additional 2 GHz, five-times more households will be covered with each base station, allowing affordable high-speed internet to reach beyond the fiber footprint at a fraction of the cost.

The World Radiocommunication Conference in 2023 is a crucial opportunity to align global policies for mid-band solutions for mobile. This spectrum will ensure mobile operators can deliver the ITU targets of 100 Mbps download speeds and 50 Mbps upload speeds to meet future needs of consumers and businesses.

Therefore, the GSMA asks that regulators:

- Plan to make an average of 2 GHz of mid-band spectrum available in the 2025-2030 time frame to guarantee the IMT-2020 requirements for 5G;

- Carefully consider 5G spectrum demands when 5G usage increases and advanced use cases will carry additional needs;

- Base spectrum decisions on real-world factors including, population density and extent of fibre rollout; and

- Support harmonized mid-band 5G spectrum (e.g., within the 3.5 GHz, 4.8 GHz and 6 GHz ranges) and facilitate technology upgrades in existing bands.

“Coordinated regional decisions will lead to a WRC which enables the future of 5G and supports wider broadband take-up by increasing capacity and reducing costs,” the GSMA said.

…………………………………………………………………………………………………………………………………………………………………

References:

https://www.gsma.com/spectrum/wp-content/uploads/2021/07/5G-Mid-Band-Spectrum-Needs-Vision-2030.pdf

https://telecoms.com/510489/lack-of-mid-band-spectrum-could-cost-operators-billions-of-dollars-gsma/

GMSA vs ITU-R, FCC & U.S. Tech Companies on use of 6GHz band: Licensed 5G or Unlicensed WiFi?

Introduction:

There’s a huge disagreement on the use of the 6 GHz band for wireless communications. GSMA strongly says it’s needed for 5G, ITU-R WRC-23 only has it on their agenda for world region 1, the FCC has opened up that band for unlicensed operation, while a group of big tech companies say 6 GHz unlicensed WiFi is an economic winner and have asked the FCC for additional communications capabilities.

GSMA Position – Licensed 6 GHz for 5G:

In a May 17th GSMA blog post, the GSMA trade group warns that the 6GHz band is urgently needed for licensed (terrestrial) 5G operations, but that governments are diverging [1.] in their plans for same. “The global future of 5G is at risk says GSMA in the first sentence of their post.

“The 6 GHz band is essential not only for mobile network operators to provide enhanced affordable connectivity for greater social inclusion, but also to deliver the data speeds and capacity needed for smart cities, transport, and factories. It is estimated that 5G networks need 2 GHz of mid-band spectrum over the next decade to deliver on its full potential. [reference 1]”

Note 1. Different Approaches for the 6 GHz band

China will use the entire 1200 MHz in the 6 GHz band for 5G. Europe has split the band, with the upper part considered for 5G, but a new 500 MHz tranche available for Wi-Fi. Africa and parts of the Middle East are taking a similar approach.

At the other extreme, the U.S. and much of Latin America have declared that none of this valuable resource will be made avail able for 5G, but rather will be offered to Wi-Fi and other unlicensed band technologies. Also see the section Worldwide Status of Unlicensed 6 GHz below for more on this controversial topic.

……………………………………………………………………………………………………………………………………………

“5G has the potential to boost the world’s GDP by $2.2 trillion,” said John Giusti, Chief Regulatory Officer for the GSMA. “But there is a clear threat to this growth if sufficient 6 GHz spectrum is not made available for 5G. Clarity and certainty are essential to fostering the massive, long-term investments in this critical infrastructure.”

GSMA opines that 5G is accelerating the digital transformation of all industries and sectors, unleashing new waves of innovation that will benefit billions. This technology is crucial for the environment and climate goals as connectivity replaces carbon. In order to reach all users, however, industries will require the extra capacity that the 6 GHz band offers.

The GSMA calls on governments to:

- Make at least 6,425-7,125 MHz available for licensed 5G;

- Ensure backhaul services are protected; and

- Depending on countries’ needs, incumbent use and fiber footprint, the bottom half of the 6 GHz range at 5,925-6,425 MHz could be opened on a license-exempt basis with technology neutral rules.

The GSMA also published a statement with Ericsson, Huawei, Nokia and ZTE that further details the importance of the 6 GHz band for the future of 5G. That document states, “Extending the bandwidth of 5G through the harmonization of 6 GHz spectrum will provide more bandwidth and improve network performance. On top of this, the broad, contiguous channels offered by the 6 GHz range will reduce the need for network densification and make next-generation connectivity more affordable for all.

About GSMA:

The GSMA represents the interests of mobile operators worldwide, uniting more than 750 operators with almost 400 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces the industry-leading MWC events held annually in Barcelona, Los Angeles, and Shanghai, as well as the Thrive Series of regional conferences. The GSMA continues to work with partners that share its commitment to sustainable development and economic growth. Click here to find out more.

For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA.

Media Contact: [email protected]

……………………………………………………………………………………………………………………………………………..

ITU-R (WRC-2023) and FCC Positions:

1. GSMA says the World Radiocommunication Conference in 2023 (WRC-23) will provide the opportunity to harmonize the 6 GHz band across large parts of the world and help develop the ecosystem. That is not entirely correct as their related work item 1.2 only covers 6 GHz IMT for region 1, which comprises Europe, Africa, the former Soviet Union, Mongolia, and the Middle East west of the Persian Gulf, including Iraq.

2. The FCC voted last year to allocate the entire 6 GHz band for unlicensed operations, including Wi-Fi. Commercial Wi-Fi devices working in the 6 GHz band have already begun hitting the market.

The FCC’s vote represented a setback to some players like Ericsson, Verizon and T-Mobile that had urged the Commission to set aside some or all of the 6GHz band for licensed uses, including 5G.

In it’s latest WRC-23 related document, the FCC made no move to reverse their decision on unlicensed 6 GHz. More importantly, they have not requested a broadening of the 6 GHz band for 5G to include the U.S. or any other world region besides region 1. According to that FCC document:

WRC-23 agenda item 1.2 will consider the possibility of identifying IMT in the frequency bands 3 600-3 800 MHz and 3 300-3 400 MHz (Region 2); 3 300-3 400 MHz (amend footnote in Region 1); 7 025-7 125 MHz (globally); 6 425-7 025 MHz (Region 1); 10 000-10 500 MHz (Region 2).

Sharing and compatibility studies will need to be conducted, with a view to ensuring the protection of existing services to which the frequency band is allocated on a primary basis, without imposing additional regulatory or technical constraints on those services, and also, as appropriate, protection of services in adjacent bands.

……………………………………………………………………………………………………………………………………….

Tech Companies Meet with FCC on Unlicensed Use of the 6 GHz band:

Mike Dano, Editorial Director, 5G & Mobile Strategies at Light Reading said that representatives from Apple, Broadcom Facebook, Google, Qualcomm (the #1 supplier of 5G silicon) and two attorney’s from Wiltshire & Grannis LLP met (via video conference) with the legal advisor to FCC Commisioner Carr on May 13th to discuss the “Unlicensed Use of the 6 GHz Band.”

The 5 big tech companies collectively supported the FCC’s 6 GHz decision noting that the FCC unlicensed 6 GHz order adopted carefully considered rules that will protect incumbents while permitting innovation in fixed unlicensed equipment and operations.

The next step is to meet consumers’ expectation for mobility and portability through the pending FCC Public Notice and Further Notice of Proposed Rulemaking (FNPRM) for expanded use of the 6 GHz band in the U.S. They recommend the following additional capabilities:

- Client-to-client communications (which would allow devices to talk directly to each other).

- Very Low Power operations (which would allow low-power communications without Automatic Frequency Coordination technology).

- Mobile operations (which would permit mobile connections using Automatic Frequency Coordination technology for services such as mass transit connectivity).

The companies said that WiFi has been “an economic powerhouse.” In particular:

• Wi-Fi is projected to contribute nearly $1 trillion to the U.S. economy in 2021

• $3.3 trillion contributed globally in 2021

• That contribution will grow to $1.58 trillion by 2025 in the U.S.

• $4.9 trillion global contribution by 2025

• Wi-Fi 6 and 6 GHz devices are significant contributors to this expected growth

Unlicensed bands (NOT 5G) are the workhorses of the wireless economy:

- Unlicensed bands carry half of all internet traffic in the U.S., a figure that is growing each year

- LTE offload to unlicensed will increase with 5G, from 54% of traffic in 2017 to 59% by 2022

- Unlicensed is the on-ramp to broadband for American homes, enterprise wireless, rural

communities, schools, healthcare facilities, and more - Unlicensed spectrum is also the backbone for new IoT networks

- Key economic sectors—manufacturing, logistics, and research—depend on Wi-Fi for business

processes and internal connections - Quotient and Qualcomm studies have demonstrated an enormous unlicensed

spectrum shortfall in the mid-band - The 6 GHz band is central to addressing this pressing need

Worldwide Status of Unlicensed 6 GHz:

Of the top 20 economies in the world, fully half have opened, or are in the process of opening the 6 GHz band to unlicensed use—the U.S., Japan, Germany, UK, France, Canada, South Korea, Brazil, Mexico, and Saudi Arabia. In Europe, the CEPT decision opening 6 GHz is expected to become European law in March 2021 and will shortly be followed by country-specific implementations.

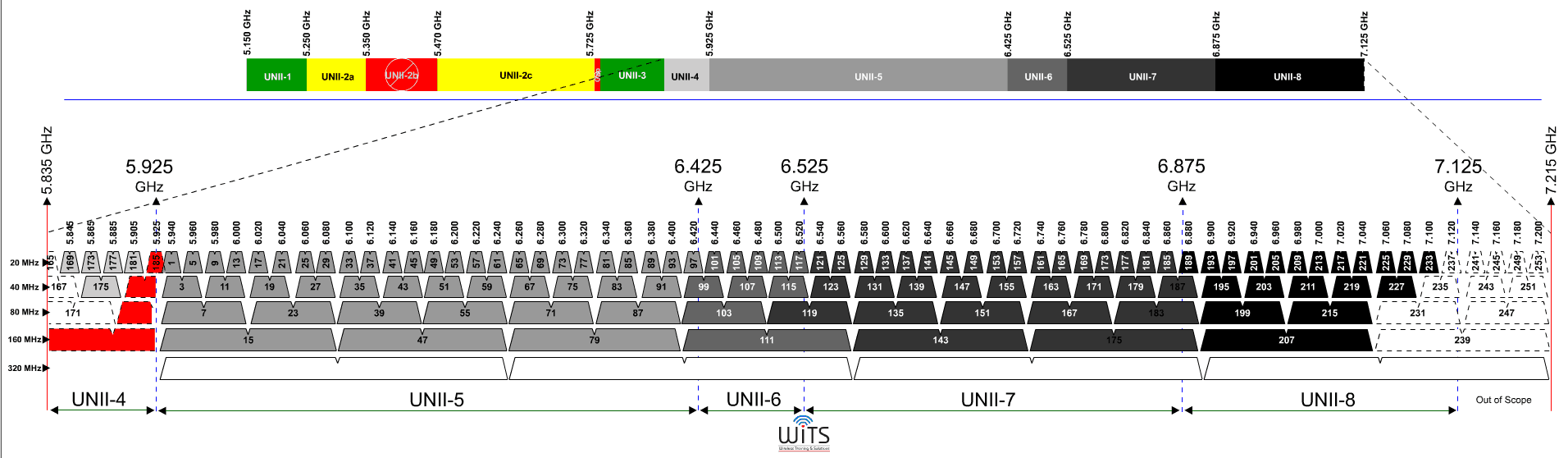

Proposed 6 GHz Channel Map for Unlicensed WiFi:

Image Credit: Wireless Training Solutions

………………………………………………………………………………………………………………………………………

References:

https://www.gsma.com/newsroom/press-release/gsma-calls-on-governments-to-license-6-ghz-to-power-5g/

https://www.gsma.com/spectrum/wp-content/uploads/2021/05/6-GHz-Capacity-to-Power-Innovation.pdf

https://www.lightreading.com/5g/gsma-5g-is-at-risk-if-6ghz-remains-unlicensed/d/d-id/769600?

https://ecfsapi.fcc.gov/file/1051767219870/6%20GHz%20Thumann%20Ex%20Parte%20(May%2013%202021).pdf

https://www.coleago.com/app/uploads/2021/01/Demand-for-IMT-spectrum-Coleago-14-Dec-2020.pdf