Dell’Oro: Mobile Core Network Market 5 Year Forecast

In a revision of its Mobile Core Network 5-Year Forecast report, Dell’Oro Group predicts the Mobile Core Network (MCN) to have an overall revenue compound annual growth rate (CAGR) of 3% from 2020 to 2025. MCN includes 4G Evolved Packet Core (EPC), IP Multimedia Core Network Subsystem (IMS) and the 5G SA Core Network.

The Dell Oro report estimates the 5G portion of the MCN market to have a 33% CAGR. Strong growth in 5G Core network offsets corresponding declines in 4G and IMS core revenue.

Report Highlights:

- The cumulative investment is expected to be over $50B from 2021 to 2025, with regional shares in the range for North America – 18% to 23%; Europe, Middle East, and Africa – 30% to 35%; Asia Pacific – 40% to 45%; and Caribbean and Latin America – 5% to 10%.

- By the year 2025, MCN functions associated with 5G are expected to represent over 70% of the revenue mix between 4G and 5G MCN functions.

- 5G Core builds by the three incumbent service providers for 5G Standalone (5G SA) networks in China are continuing to exceed our expectations. In addition, in 2021, the new Chinese communications service provider, China Broadcasting Network (CBN) will be beginning construction of its 5G SA network.

- Deployments of more 5G SA networks are expected in the latter half of 2021 in Australia, Germany, Japan, South Korea, Switzerland, and the United Kingdom. AT&T and Verizon should begin in earnest in 2022 and 2023 with their 5G SA networks. Geographic coverage is minimal at launch and is expected to grow throughout the forecast period.

“China was all the action in 2020,” Dave Bolan, research director at Dell’Oro Group for MCN, told Light Reading via email. He expects that trend to continue, especially in the first half of the forecast period. Bolan points out that phase one of the 5G SA rollout in China amounted to over $1 billion in 5GC contracts, and the pace of rollout is accelerating with phase two. Phase three is now being readied.

Dell’Oro does not yet provide vendor market share for MEC (Multi-Access Edge Computing formerly known as Mobile Edge Computing), but Bolan said Huawei and ZTE, given the size of China’s market, are currently in the lead.

In an email to this author, Bolan wrote:

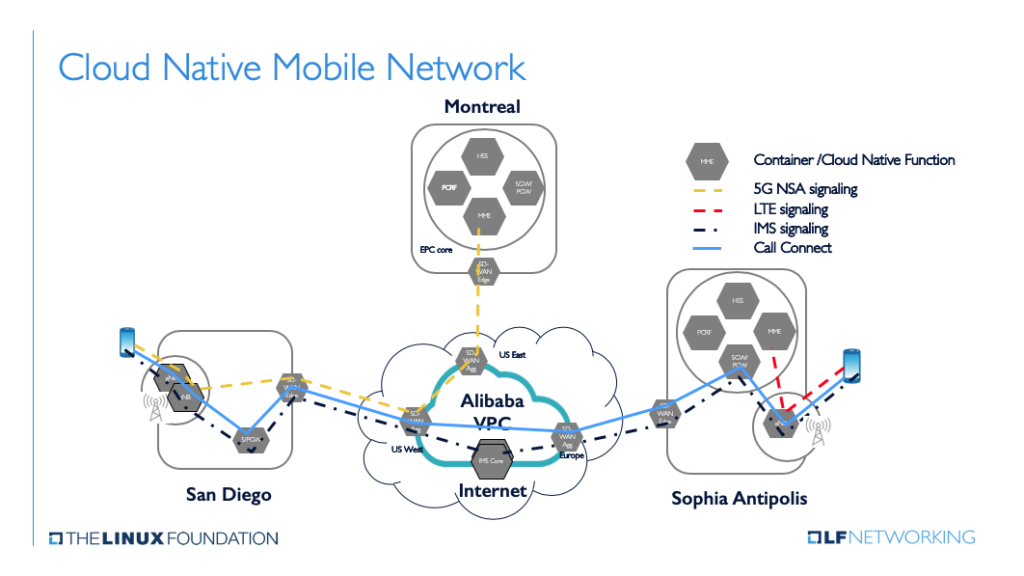

“All of 5G Core network will be Cloud-Native [1.], mostly Container-based. Except there are different cloud-native versions and container versions, not making it truly open. Anyone that wants to put their core on the public cloud will have to customize it for each cloud platform.

Same may be true for the NFVI ((network functions virtualization infrastructure) if it runs on – x86, AMD, ARM, or Nvidia processors – and couple that with the different 5G UPF (user plane function) acceleration techniques, it gets complex very quickly.”

………………………………………………………………………………………………

Note 1. Cloud native, in essence, means the MCN software has been designed for cloud deployment. The software is built up of independent microservices and can run on a container platform, like Kubernetes. In addition to the traditional cloud service providers (AWS, Azure, Google Cloud), many IT vendors have developed 5G cloud native software. The list includes, VMware, Oracle, Cisco, HPE, Mavenir, Samsung, Ericsson, Nokia, Huawei, ZTE, NEC, and Dell Technologies (partnering with either Affirmed Networks or Nokia).

……………………………………………………………………………………………

“The basic network to get the 5G core up and running is the focus today,” Bolan told Light Reading. “NSSF [network slicing service function] and NEF [network exposure function] will come in the second half of the forecast.”

………………………………………………………………………………………………

References:

5-Year Forecast: Mobile Core Network Market Revenues CAGR Projected at 3 Percent from 2020 to 2025

https://www.lightreading.com/the-core/5g-core-spend-is-on-roll-says-delloro/d/d-id/771043?

https://www.opnfv.org/resources/5g-cloud-native-network

6 thoughts on “Dell’Oro: Mobile Core Network Market 5 Year Forecast”

Comments are closed.

ReportsNReports forecasts that the global 5G core market will grow from USD 630 million in 2020 to USD 9,497 million by 2025, at a Compound Annual Growth Rate (CAGR) of 72.0%.

The 5G core market is gaining traction due to its cloud-native and service-based architecture that will improve the modularity of products with greater emphasis on low latency, URLLC, eMBB, and mMTC offerings.

This research study outlines the market potential, market dynamics, and major vendors operating in the 5G core market. Key and innovative vendors in the 5G core market include Nokia (Finland), Ericsson (Sweden), Huawei (China), ZTE (China), Samsung (South Korea), Affirmed Networks(US), Mavenir(US), NEC(Japan), Cisco(US), HPE(US), Oracle(US), Athonet(Italy), Casa SYSTEMS(US), Cumucore(Finland), Druid Software(Ireland), IPLook (China), and Metaswitch(UK).

ReportsNReports says that 5G will soon make it into the list of technologies enterprise will consider, with standalone 5G solutions that will enable various new industrial applications, such as robotics, big data analytics, IIoT and AR/VR in engineering and design, as well as new ways to provide remote support and training.

Asia Pacific (APAC) region to record the highest growth in the 5G core global market. APAC has several growing economies, such as China, India, and Japan, which are expected to register high growth in the 5G Core Market. These countries have always supported and promoted industrial and technological growth. Also, they possess a developed technological infrastructure, which is promoting the adoption of 5G core solutions across all industry verticals. The network market in APAC is driven by the growing acceptance of cloud-based solutions, emerging technologies such as the IoT, and big data analytics and mobility. APAC is one of the biggest markets for connected devices.

https://www.prnewswire.com/news-releases/global-5g-core-market-size-growth-key-players-analysis-network-function-insights-end-user-regional-data-and-forecasts-to-2025–reportsnreports-301320841.html

The Mobile Core Network is in a transitional stage from 4G to 5G and a new type of core network called the 5G Core Service Based Architecture (SBA). The 5G Core SBA is designed to be a universal core that can be the core for mobile and fixed wireless networks, wireline networks, and Wi-Fi networks. This includes the ability to be the core for 2G/3G/4G, so only one core is necessary for the long term. In addition, the IMS Core will migrate into the 5G Core SBA.

The Network Slicing Function, designed into the 5G Core SBA architecture, allows service providers to carve out a portion of the core resources to deliver service level agreement performance to vertical segments. This allows the management of parallel networks within one slice for example: an MVNO, or operating an IoT network, connected cars, industrial robotics, smart cities… the list goes on.

The 5G Core SBA is designed from the start with Control and User Plane Separation, the enabler for multi-access edge computing (MEC). This enables the ability to distribute User Plane compute power closer to the edge to meet latency requirements for certain applications. This also reduces cost by lowering the backhaul cost of moving user data back and forth to the central core.

Coupled together, network slicing and MEC, enables some extreme requirements for factories and enterprise that would basically have their own virtual network.

With Network Function Virtualization (NFV) the 5G Core SBA is best served with Cloud-native Network Functions that disaggregates the hardware from the software and operates in a stateless function with the data separated from the control function among other things.

To take advantage of the opportunities in this market, component manufacturers, equipment vendors, service providers, and financial institutions need to answer critical business questions including:

-How quickly will the Mobile Core Network market grow and what trends will influence its growth?

-What is the future demand for the various types of core products?

-Which vendors lead the equipment market, and why?

-What is the average selling price per license, and how will it change over time?

-How will the emergence of the 5G Core SBA impact the 4G Evolved Packet Core (EPC) and IMS Core market?

-What is the impact on ASPs with NFV implementations?

To answer these and other important questions, Dell’Oro Group delivers both quarterly reports and 5-year forecasts on the Mobile Core Network market.

https://www.delloro.com/market-research/telecommunications-infrastructure/mobile-core-network/

Virgin Media O2 selects Ericsson 5G Core to power Standalone network deployment

*Ericsson is deploying cloud native, container-based dual-mode 5G Standalone Core on Ericsson cloud infrastructure for Virgin Media O2 in the UK

*Virgin Media O2 is harnessing the power of Ericsson 5G Core technology to complete the journey to 5G Standalone and deliver high-performance services to customers and enterprise partners

*New agreement strengthens existing relationship between the two companies and makes Ericsson key end-to-end partner for Virgin Media O2 in the UK

Ericsson has been selected by Virgin Media O2 to deploy cloud native, container-based dual-mode 5G Standalone (SA) Core network on cloud infrastructure in the UK, paving the way for Virgin Media O2 to deliver ultra-fast connectivity to consumers and develop advanced enterprise use cases.

The new agreement, which is already being put into practice, will see Virgin Media O2 bring its 4G, 5G Non-standalone and 5G Standalone services into a single fully integrated Ericsson dual-mode 5G Core hosted on Ericsson cloud infrastructure in Virgin Media O2’s data centres. The solution is incorporating Ericsson network orchestration, automation, enhanced fault and performance management, as well as the Ericsson Traffic Monitoring and Analysis (TMA) solution for real-time troubleshooting and analytics.

The transition to 5G Standalone is an important milestone in the continuing expansion of Virgin Media O2’s 5G infrastructure. 5G Standalone will enable the network of the future for Virgin Media O2 with gigabit connectivity, ultra-low latency, network slicing and huge data-handling ability. New innovative applications and services such as Virtual Reality (VR), Augmented Reality (AR) and other immersive media experiences will all be supported through Ericsson’s 5G Standalone Core. Virgin Media O2 will also be able to harness the full power of Ericsson’s leading 5G technology and container-based microservices architecture to accelerate the digital transformation of its enterprise customers.

Working together the two companies first launched 5G commercial services in 2019 and an extended 5G rollout and network modernization began in 2020, which included an innovation cluster to develop the network migration to 5G Standalone architecture. The 5G Core agreement strengthens the close working relationship between the two companies even further and makes Ericsson a key end-to-end partner for Virgin Media O2 in the UK.

Jorge Ribeiro, Director of Service Platform Strategy & Engineering at Virgin Media O2, said: “This is an exciting time for our award winning network, as we prepare for 5G Standalone. Our teams are already working hard to deliver this infrastructure with Ericsson, who have been a trusted 5G partner since we launched 5GNSA in 2019. The benefits of 5G Standalone are significant as we aim to supercharge the UK’s digital economy, and we look forward to rolling it out for our customers in the near future.”

Katherine Ainley, CEO, Ericsson UK & Ireland, said: “Ericsson’s leading 5G Core technology and strong partnership with Virgin Media O2 means we are ready to build the network of the future together in the UK. Our dual-mode 5G Core will enable the full power of 5G Standalone within Virgin Media O2’s network, unleashing the full potential of 5G for consumers and enabling digital transformation in new industries. 5G Standalone takes the UK’s mobile infrastructure to the next level and will help to boost long-term investment in the country and drive forward our growing digital economy.”

https://www.ericsson.com/en/news/2021/7/ericsson-5g-core-selected-to-power-standalone-network-deployment

Standalone shaping up to be 5G’s next big flop

The only app that performs much better on 5G is a speed test. In the absence of a killer application, the industry is all aflutter about a souped-up version of 5G called standalone. Non-standalone, the variant any Brits with a 5G service are using, needs a 4G crutch to move from A to B. Standalone canters along without props.

This is all thanks to new core technology that UK operators are now introducing, mainly in partnership with Ericsson. The industry loves the 5G core because it comes with a long list of juicy buzzwords and jargon, including “cloud-native,” “microservices,” “latency” and “network slicing,” all of which and more feature in this Ericsson blog.

Tricky sell- But it’s a difficult pitch to the market. The whole idea about network slicing is that it would allow an operator to run many different types of service over the same physical infrastructure. It benefits the provider, not the customer, and no one outside telecom would ask for a network slicing service. Organizations simply want guarantees on bandwidth, reliability – perhaps even latency. If these can be delivered more profitably with network slicing, good for the provider. But don’t expect customers to whoop like an Olympian who just won gold.

As for latency, the premise is that standalone 5G would slash important milliseconds off this signalling delay. Latency sounds more marketable than network slicing, and a sub-10-millisecond service might be needed for robotics and other advanced applications. But fiber and Wi-Fi would suffice for residential gaming, and there is no other service with major appeal crying out for low latency today.

What form might this eventually take? Forget self-driving cars and remote surgery, the hackneyed examples, unless you have suicidal tendencies. Kaan Terzioglu, the CEO of VEON, envisages a Star Trek-style universal translator, allowing monoglots from different countries to chat as if they spoke the same language. It is probably three to five years away, he concedes. Until then, he prefers to focus on 4G rollout in his emerging markets.

Regardless, latency may be hard to “monetize,” in business parlance. Most operators seem to be teaming up with public cloud giants here, which means splitting revenues with those companies or paying them a fee. One risk is that partnerships diminish the telco role. Research conducted by Beyond by BearingPoint and Omdia (a sister company to Light Reading) shows that so-called hyperscalers have “accelerated their push into network activities” during the pandemic, even as that has “exposed some limitations of CSPs [communications service providers] when it comes to capabilities to create new agreements at speed.”

Clearly, there has been no sales boom for operators that have already launched a low-latency service in tandem with a public cloud. Verizon, which joined forces with AWS in late 2019, reported a respectable 3.7% year-on-year increase in revenues at its business unit for the recent second quarter, to about $7.8 billion. At AWS, yet to report second-quarter results, sales shot up nearly a third in the first three months of the year, to $13.5 billion.

No telcos required- Defenders of the 5G faith say the technology must be assessed holistically, not based on its component parts. Building a connected, wireless, robotized and highly automated factory minus the economics and guarantees that come with standalone 5G would be mission impossible, many would argue.

The point is reasonable, but that does not mean standalone will be lucrative for mainstream telcos. Some organizations do not even want telcos involved. Instead, they have bought their own spectrum licenses and plan to build and operate private 5G networks. According to the Beyond by BearingPoint and Omdia research, only 16% of enterprise projects are CSP-led, while a fifth of businesses plan a do-it-yourself approach. Nokia, one of the world’s largest 5G vendors, caters to enterprise customers through telcos as well as directly. On a like-for-like basis, its enterprise sales were up 18% in the first quarter.

Regulators are another potential threat to operators. The European Union has taken a dim view of telcos that prioritize any Internet services, regarding this as an affront to “net neutrality” principles of Internet openness and non-discrimination. A loophole allows telcos to offer “specialized services” if these do not interfere with basic Internet access. But Telenor Magyarorszag, a Hungarian operator, was admonished in late 2020 simply for ditching the usage caps attached to some applications and retaining them for others. Rules might stymie network slicing depending on how they are interpreted.

Want to know more about 5G? Check out our dedicated 5G content channel here on Light Reading.

None of this destroys the business case for investing in standalone technology. In the US, T-Mobile’s 5G service became more widely available after it switched on its standalone service, according to research carried out by OpenSignal. With non-standalone, the operator had to maintain a connection with 4G, which it provides over mid-band spectrum. Standalone meant it could make full use of its low-band frequencies, far better for coverage (if not speed).

Unfortunately, due to a lack of smartphones that support standalone carrier aggregation, T-Mobile has not been able to run 5G services on low- and mid-band spectrum simultaneously. Coverage has been good. Connection speeds have not.

Forthcoming devices will address that problem. But if various network efficiencies and marginal performance improvements turn out to be standalone’s main benefits, it will rank alongside non-standalone as another major telco disappointment. “5G standalone will allow us to launch new services not even contemplated today,” said Howard Watson, the chief technology officer of the UK’s BT, during a recent press conference. The time for contemplation is long overdue.

https://www.lightreading.com/the-core/standalone-shaping-up-to-be-5gs-next-big-flop/a/d-id/771094?

It’s amazing to me how much money is being spent on modernizing global communication networks. Tens of billions of dollars have been invested in bringing 5G to the world, and I’m excited. I wonder what it means to the average person in 2021?

Bret, You wrote: “I wonder what it means to the average person in 2021?”

Answer: NOTHING!