GlobalData: 5G to drive mobile services market in China through 2026

The total mobile service revenues in China are poised to grow at a compounded annual growth rate (CAGR) of 3.1% from US$131.3bn in 2021 to US$152.7bn in 2026, mainly supported by growing 5G subscriptions, according to GlobalData, a leading data and analytics company.

According to GlobalData’s China Mobile Broadband Forecast Pack, mobile voice revenues will decline at a CAGR of 5.2% between 2021 and 2026, due to falling voice average revenue per user (ARPU) levels. Mobile data revenues, on the other hand, will increase at a CAGR of 6.8%, driven by rising adoption of 5G services and the subsequent rise in data ARPU.

The three leading (state owned) network operators in China greatly increased their 5G CAPEX. China Mobile’s 2020 5G CAPEX totaled US$15.7bn (RMB 102.5bn), 57% of all CAPEX up from US$3.7bn (RMB 24.0bn) (14% of total CAPEX) in 2019.

Meanwhile, the combined 5G CAPEX of China Telecom and China Mobile, who are sharing 5G infrastructure, totaled US$11.3bn (RMB 73bn) in 2020, 48% of total combined CAPEX, up from US$2.7 (17.2 bn) in 2019 (13% of total combined CAPEX).

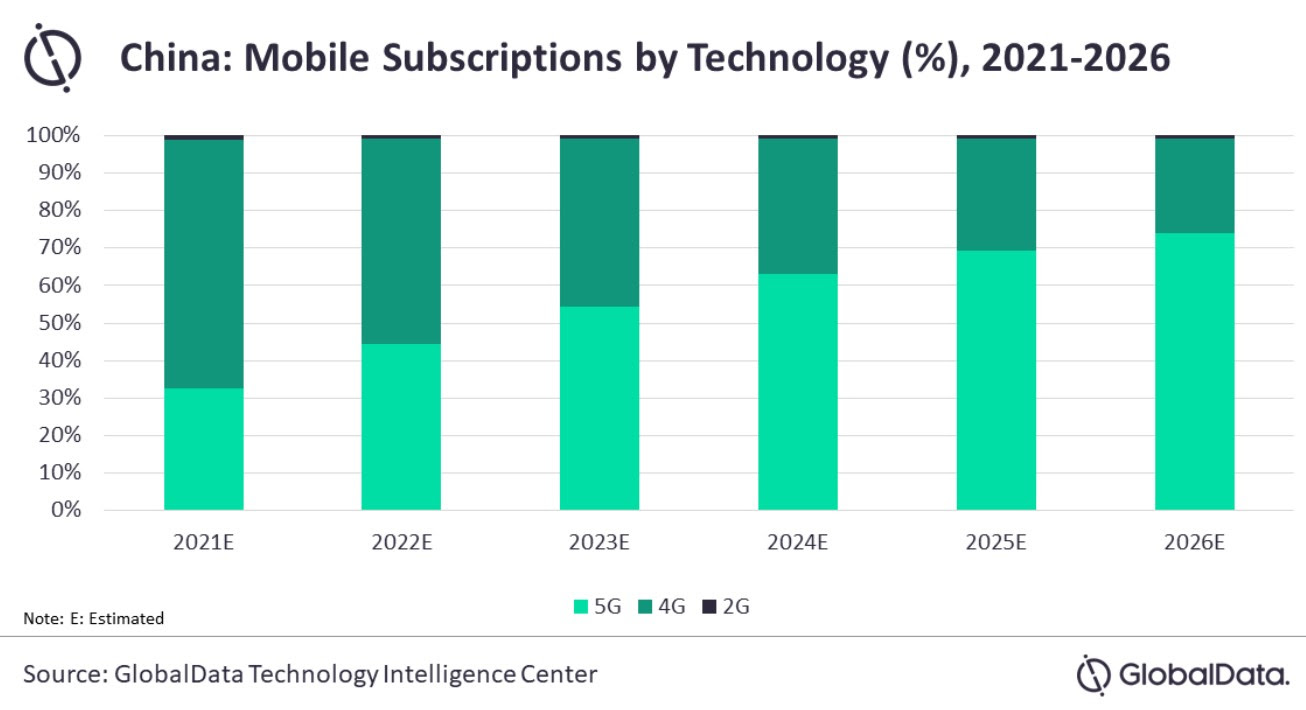

Harika Damidi, Telecoms Analyst at GlobalData, says: “5G subscriptions will surpass 4G subscriptions in 2023 and go on to account for 73.8% of the total mobile subscriptions share in 2026, driven by the ongoing 5G network expansion by operators and increase in the availability of 5G-enabled smartphones. Moreover, increasing penetration of IoT and M2M services are also expected to drive market growth during the forecast period.”

The average monthly mobile data usage is forecasted to increase from 9.9GB per month in 2021 to around 32.6GB per month in 2026, driven by the growing consumption of high-bandwidth online entertainment and social media content over smartphones.

Ms Damidi concludes: “China Mobile led the Chinese telecom market in terms of mobile subscriptions in 2020, followed by China Telecom. Moreover, China Mobile is the leading provider of 5G services which are poised to dominate the Chinese market in the future. In addition, the operator is making strategic investments in 5G base stations, data centers, industrial Internet, and IoT to ensure its leadership.”

…………………………………………………………………………………………….

According to GlobalData’s mobile broadband forecasts, by end of 2020 China and South Korea outpaced the world in adoption with 26% and 24% 5G subscription penetration of the population respectively compared to the Global penetration of 5% at the end of the same period. This rapid adoption is beginning to help operators in these markets grow revenue from mobile services and drive ARPU uplift in China and South Korea with overall 2021 mobile service ARPU expected to rise.

5G in China and South Korea are supporting both consumers and enterprise and even contributing to social welfare. On the consumer side new value and revenue streams for consumer 5G is being driven by next gen content like AR/VR experiences, the ability to stream 8K anywhere, providing multi-camera views for live events, offering dedicated gaming networks and new consumer IoT applications.

Enterprise networks are being deployed as an enabler for enterprise services alongside technologies like multi-access edge computing (MEC) and IoT platforms and industrial applications to support use cases like (industrial automation, AI video applications, drones, smart city). Often these enterprise solutions are supported by a combination of 5G, IoT and multi-access edge computing (MEC). China Mobile alone has entered contracts to construct dedicated 5G networks for private industry with 470 enterprise customers, in 2020. The company claims these projects support 15 different industry segments and represent over US$620m (RMB 4bn) in revenues.

Beyond typical consumer and enterprise services, 5G has supported the pandemic response in both countries, with hospitals in Wuhan being rapidly connected with 5G networks and telehealth for the elderly being delivered in South Korea.

References:

5G to drive mobile services market in China through 2026, forecasts GlobalData

Optimistic 5G Market forecasts by GlobalData and Research&Markets

3 thoughts on “GlobalData: 5G to drive mobile services market in China through 2026”

Comments are closed.

Previous Global Data forecast: 5G investments to boost China’s mobile services market over 2020-2025- 5G connections across China will reach an estimated 1.5 billion by 2025, growing at a CAGR of 31.9% between 2020 and 2025, as 5G infrastructure investment gains momentum in the country.

Anshika Gandotra, Telecom Analyst at GlobalData, says: “Although 4G will remain the leading mobile technology by subscription share in 2020, 5G will surpass 4G subscriptions in 2023 in line with increasing demand for high-speed services. With all the major telcos accelerating their roll-out of 5G network services, GlobalData expects 5G subscriptions to account for 62.5% share of the total mobile subscription by 2025.

To drive revenue growth following the lean period, Chinese telecom operators, along with their joint infrastructure venture China Tower, have invested about CNY197.3bn (US$27.8bn) on 5G technology in 2020.

Moreover, to accelerate the deployment of 5G services nationwide in the forthcoming years, the Chinese telecom regulator issued 5G test license to state-owned cable TV operator China Broadcasting Network (CBN). The entry of fourth operator in the mobile services market will further boost competition in China’s mobile services market.

Ms Gandotra concludes: “The top three mobile operators, China Mobile, China Unicom and China Telecom, will account for 91.5% share of overall mobile subscriptions in 2020. China Mobile will lead the mobile services market in terms of mobile subscriptions in 2020, followed by China Telecom. China Mobile will retain its leading position through 2025, given its widespread 4G reach and 5G development efforts to compete with its competitors.”

https://www.globaldata.com/5g-investments-boost-chinas-mobile-services-market-2020-2025-reveals-globaldata/

China says it had built more than 1 million 5G base stations by the end of August, as the nation steps up efforts to build a sound telecom infrastructure for widening the use of 5G in more sectors.

Zhao Zhiguo, spokesman of the Ministry of Industry and Information Technology, said on Monday that China had built a total of 1.037 million 5G base stations by the end of August, covering all prefecture-level cities across the country and with 5G services available in more than 95 percent of counties and urban areas and 35 percent of towns and townships, China Daily reported .

From January to August this year, the shipments of 5G mobile phones in China reached 168 million units, marking a year-on-year increase of 80 percent. In August, 5G mobile phones accounted for 74 percent. —APP

Enterprise, not 5G, powers China Mobile, Unicom earnings growth

China Mobile now claims 331 million “5G package” customers – that is, customers that have signed up for a 5G plan. Of these, just 160 million are using the new network with a 5G device. That’s still an enormous number itself and includes the 33 million added in Q3 alone – more than South Korea’s entire 5G customer base.

But while China Mobile might be sweating the LTE network by selling bigger data bundles to 4G users, it is carrying 171 million ‘5G’ customers on its 4G legacy network, which means it is missing out on the efficiency and capacity gains of 5G. That is especially concerning when mobile ARPU is down. Mobile’s ARPU slipped 4.0% from Q2 to Q3 – not where you want to go when you’re piling on 5G subs and when mobile data usage per handset has climbed by a third.

Rather than 5G, enterprise was the biggest source of growth for both China Mobile and China Unicom.

China Mobile’s Q3 cloud and industrial internet revenue soared 46% to 49 billion yuan, or nearly a quarter of total revenue. The company said it had “seized the development opportunities” provided by accelerated digital transformation.

China Unicom’s Q3 industry internet revenue increased 29% to 12 billion yuan – around 15% of its total sales.

Looking ahead, China Unicom said it hoped to “fully unlock” the potential of digital transformation and its the mixed-ownership reform.

https://www.lightreading.com/asia/enterprise-not-5g-powers-china-mobile-unicom-earnings-growth/d/d-id/772976?