Verizon broadband – a combination of FWA and Fios (but not so much pay TV)

Verizon today announced its earnings for the third quarter of 2021, with the company posting net income of $6.6 billion, operating revenue of $32.9 billion, and $1.55 in earnings per share. Verizon now expects total wireless service revenue growth of around 4%, an increase to prior guidance of 3.5% to 4%. It’s earnings guidance was also revised upwards. Verizon adjusted earnings per share of $5.35 to $5.40 is now forecast for the current quarter – an increase from its prior guidance of $5.25 to $5.35.

“We had a strong third quarter, delivering on our strategy and growing in multiple areas,” Verizon Chairman and CEO Hans Vestberg said in the earnings release. “Our disciplined strategy execution demonstrated growth in 5G adoption, broadband subscribers and business applications. We are increasing our 2021 guidance, and we continue to expand our 4G LTE and 5G network leadership. We fully expect to have a strong finish to the year as we accelerate deployment of 5G to our customers across the country,” he added.

“Verizon reported another quarter of strong financial and operating performance,” Verizon Chief Financial Officer Matt Ellis said in the press release. “We are seeing strong demand for connectivity across our Consumer and Business segments as our Mix and Match and Business Unlimited value propositions, network quality and unique partnerships are resonating with both new and existing customers. We grew revenue in the quarter, achieved solid cash flow, completed the sale of Verizon Media and increased the dividend for a 15th consecutive year.”

The #1 wireless telco in the U.S. lost 68,000 net video subscribers from its Fios (FTTH/FTTP) service in the third quarter. “The telecom giant has been shifting its video focus away from Fios TV to partnerships with third-party streaming services as it positions itself as a key distribution platform for them. For example, Verizon has a deal with The Walt Disney Co. for the Disney bundle, which gives customers with select Verizon wireless unlimited plans access to Disney streaming services Disney+, Hulu and ESPN+,” said the Hollywood Reporter.

During the quarter, Verizon sold off its Verizon Media unit, which consisted of formerly dominant tech brands like AOL and Yahoo. The unit was acquired by Apollo Global Management, although Verizon continues to hold a 10 percent stake.

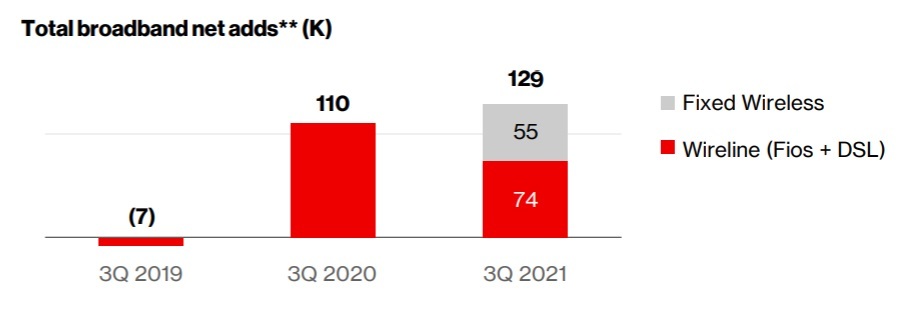

Verizon reported 129,000 broadband net additions in the third quarter, comprised of Fios, DSL and FWA subscribers, during the quarter. Of those, there were 55,000 Fixed Wireless Access (FWA) subscriber adds , which was about 42% of the 129,000 total broadband net adds generated in the quarter. Verizon FWA has a total of ~150,000 subscribers.

Source: Verizon Infographic from 3Q 2021 Earnings Report

Verizon CEO Hans Vestberg said during the earnings call, “We’re on track to meet our fixed wireless access household coverage targets with an expected 15 million homes passed by the end of the year between 4G and 5G. To date, 5G Home is in 57 markets and 4G LTE Home is in over 200 markets across all 50 states.”

Verizon first began offering 4G LTE Home in July 2020 and has really accelerated its rollout. The company has also rolled out 5G Home. Verizon executives on today’s earnings call noted that the FWA subscriber base is a mix of customers getting service from its 4G/LTE network and via Verizon’s 5G millimeter wave (mmWave) network. The company’s FWA base currently is a mix of residential and business customers, but did not break out that ratio. But they did note that there’s about a rough 50/50 split between FWA customers that are coming from Verizon’s existing base and from other service providers. CFO Matt Ellis said Verizon’s FWA customers aren’t solely focused on rural areas, as Verizon is also seeing “good traction” with the product in urban and suburban areas.

Verizon now seems to favor FWA over Fios, probably because of significantly lower installation costs for the former. Yet the company is not giving up on Fios. “In addition to fixed wireless access, we’re pleased with the great performance of Fios and continue to grow the open-for-sale volumes within our footprint.”

Indeed, Fios Internet net adds were 104,000 in the quarter. The telco is increasing its Fios footprint, adding over 400,000 open-for-sale locations this year. One analyst noted that Verizon hasn’t talked about increasing its Fios brand within its ILEC for quite some time.

Chief Financial Officer Matt Ellis said, “On the Fios expansion, we see great opportunity. We have been investing in that for a number of years; maybe haven’t spoken about it quite as much. But it continues to be a very good growth driver for the business.”

The company reported that Fios revenue of $3.2 billion in the quarter was up 4.7% year over year, driven by continued growth in customers as well as Verizon’s effort to increase the value of each customer by encouraging them to step up in speed tiers.

“We remain focused on bringing in high-quality net adds,” said Elllis. “The mix and match pricing structure for both wireless and Fios provides opportunity to migrate customers to higher value tiers and bring in customers on higher value plans. Our strategy is focused on increasing the value we receive from every connection.”

Vestberg said, “Our strategy is becoming a national broadband provider with the best access to the tech for our customers, including Fios, fixed wireless access on 5G, on 4G, mmWave and C-band.”

In a research note to clients, analyst Craig Moffett discussed Verizon’s broadband business:

Verizon’s FiOS service continues to show strength, a product of both more aggressive pricing and a lessening drag from video as the video base shrinks. Notably, Verizon is also beginning to see some contribution from fixed wireless access.

- FiOS internet subscriber gains of 104K were almost spot on with consensus. DSL losses

remained relatively steady (-30K) despite the fact that the base of legacy DSL has been

gradually depleted. Overall broadband net additions came in at 129K, which includes

55K fixed wireless connections. The company reported that it had 150K fixed wireless

broadband customers at the end of Q3. Wireline broadband net additions were strong,

at 74K, but were still weaker than expected. Notably, the company has guided to an

addition of 400K FiOS homes open for sale, the first meaningful expansion of homes

available for sale in some time (note that “open for sale” does not necessarily equate to

new build – particularly in New York, there has long been a large gap between homes

already passed and homes open for sale – but it is likely that there is at least some new

build here. - Like peers, Verizon is losing video subscribers (down 68K, a little worse than the 54K

loss we had expected, and worse than the 62K loss a year ago despite a smaller

denominator). Their decline rate of 7.2% is broadly in line with the rate of decline for the

industry overall.

With respect to Verizon’s 5G strategy and competition (e.g. T-Mobile), Craig wrote:

As we creep up to the 5G epoch, we’re on the brink of a very different industry. Despite a relatively healthy third quarter report – albeit against relatively easy year ago comps – there are reasons for disquiet. A post-COVID service revenue growth recovery has already begun to slow, and incremental revenue streams from 5G are still uncertain. Industry structure, which once appeared to be getting better – we went from four to three with the merger of Sprint and T-Mobile – is now arguably getting worse, as we now arguably go from three to five with the emergence of hybrid MVNO/MNO networks from Cable and Dish. Verizon is on the brink of a very different competitive position.

T-Mobile’s 5G network is increasingly viewed as better than Verizon’s for coverage, speed, and reliability. Verizon’s one-time bid for sustained superiority – millimeter wave “ultra-wideband” service – currently accounts for just one half of one percent of the time 5G users are connected.

Craig notes that Verizon’s initial gambit to retain network superiority in 5G was built on millimeter wave spectrum. The very limited propagation of millimeter wave spectrum, however, demands an incredibly dense wired backhaul network, at enormous cost, lest customers are simply out of range much of the time. Verizon is, anecdotally at least, well ahead of peers in network densification. Still, recent data (once again, from OpenSignal) suggests that, while 5G customers of Verizon’s 5G service are connected to mmWave spectrum much more often than are 5G customers of AT&T or T-Mobile, that is still too trivial a percentage of the time (one half of one percent). That’s hardly the basis of an advantaged network.

T-Mobile has an advantage in both spectrum propagation (coverage) and spectrum depth (speed). And Verizon still charges a premium. Retention and growth will be harder in a world where their network superiority has been ceded to a lower priced service.

In conclusion, Craig states that Verizon enjoyed years as the best network, but it will be harder to maintain that claim in the 5G era, where T-Mobile has a coverage and spectrum depth (speed) advantage. And where TMobile and the company’s Cable MVNO partners charge meaningfully lower prices than Verizon does for the same or better service.

Verizon’s Year End 2021 Priorities:

• Expand 5G leadership (?) and drive adoption; mmWave deployment and C-Band launch

• Customer differentiation and scaling premium experiences

• Transform the business; Tracfone acquisition and Verizon Media Group sale

• Accelerate and amplify 5 vectors of growth; Network-as-a-Service strategy

References:

https://www.lightreading.com/5g/verizon-has-150000-fixed-wireless-access-subs-/d/d-id/772925?

https://www.slashgear.com/verizon-5g-home-internet-expands-to-cover-more-cable-cutters-07694326/

One thought on “Verizon broadband – a combination of FWA and Fios (but not so much pay TV)”

Comments are closed.

Verizon’s next step involves a massive, nationwide undertaking to deploy 5G on its recently acquired C-band spectrum. CEO Hans Vestberg today said the operator is on track to meet its 5G infrastructure deployment goals this year, including the deployment of more than 14,000 mmWave sites and up to 8,000 mid-band sites.

“All the major equipment, radios, etcetera, that stuff’s already secured. It is in our warehouse,” he said during Verizon’s third-quarter 2021 earnings call. “With the opening of the C-band, we see great new opportunities” that will allow Verizon to “accelerate and amplify our business case on 5G.”

Verizon’s early and all-in bet on mmWave spectrum remains a point of contention and concern. The high-band spectrum, which features higher speeds but a low coverage radius that requires radio densification, hasn’t helped Verizon maintain its domestically superior position on coverage, speed, and reliability, according to analysts at MoffettNathanson.

Verizon’s 5G Ultra Wideband service “currently accounts for just one half of 1% of the time 5G users are connected,” the analysts wrote.

Vestberg maintains that Verizon’s continued expansion of 5G mmWave will allow it to carry at least 5% of its urban area traffic on mmWave by the end of this year. During the third quarter, in markets where Verizon has an established 5G mmWave footprint, at least 20% of customer traffic traveled over mmWave, according to Vestberg.

Verizon continues to point to fixed wireless access and mobile edge computing as the most obvious and initial business opportunities for 5G insofar that both represent new revenue streams for the operator.

The carrier ended Q3 with 11.6 million homes covered by fixed wireless access, and executives said it’s on pace to surpass 15 million households by year end. 5G deployments on mid-band spectrum, mmWave, and 4G LTE all contribute to Verizon’s fixed wireless access footprint, depending on the location.

Vestberg also highlighted Verizon’s early start on mobile edge computing, which currently includes a public variant on Amazon Web Services, and a private, on-premises service with Microsoft Azure.

Public mobile edge compute, private mobile edge compute, and private 5G networks comprise the three use cases identified by Verizon thus far, and all three are in the execution phase today, Vestberg said.

“Of course it takes some time because we are actually creating a totally new market, and we’re actually alone in this market,” he said. “Nobody else in the world has launched mobile edge compute at this moment.”

Verizon previously said it doesn’t expect to generate meaningful revenue from its edge service until 2022, but it’s identified a total addressable market of $1 billion for private edge compute by the end of 2022 and expects that to grow up to $10 billion by 2025.

https://www.sdxcentral.com/articles/news/verizons-5g-story-rides-on-mid-band-upshot/2021/10/