Verizon

Verizon to buy Frontier Communications

Wall Street Journal reported today that Verizon is on the verge of buying Frontier Communications for as much as $7 billion in a deal that would bolster the company’s fiber network to compete with rivals notably AT&T. With a market value of over $7 billion, Dallas, TX based Frontier provides broadband (mostly fiber optic) connections to about three million locations across 25 states. Frontier is in the midst of upgrading its legacy copper landline network to cutting-edge fiber. Rising interest rates sparked fears among investors, however, that the business would run out of cash and not be able to raise more before completing those upgrades. Frontier has a 25-state footprint and serves largely rural areas. It reported sales of $5.8 billion in 2023, with about 52% of total revenue from activities related to its fiber-optic products and bills itself as “largest pure-play fiber internet company in the US.”

An all-cash deal between the two companies could be announced as soon as Thursday, a person familiar with the negotiations told Bloomberg.

Fiber M&A has heated up as telecom companies and financial firms pour capital into neighborhoods that lack high-speed broadband or offer only one internet provider, usually from a cable-TV company. New fiber-optic construction is expensive and time-consuming, making existing broadband providers attractive takeover targets.

Verizon, with a market valuation of around $175 billion, will be under pressure from shareholders to justify any big purchase after the company paid more than $45 billion to secure C-band 5G wireless spectrum licenses and spent billions more to use them. Executives have said they are focused on trimming the telecom giant’s leverage to put it on a firmer financial footing.

Verizon, the top cellphone carrier by subscribers, has faced increased pressure from competitors and from cable-TV companies that offer discounted wireless service backed by Verizon’s own cellular network. Faced with slowing wireless revenue growth and an expensive dividend, Verizon has invested in expanding its home-internet footprint. It has both 5G fixed wireless access (FWA) and its Fios-branded fiber to the premises network.

T-Mobile is the only major U.S. cellphone carrier that lacks a large landline business. Since its 2020 takeover of rival carrier Sprint, the company has focused on 5G dominance and succeeded in growing its cellphone business faster than rivals. That network has also linked millions of customers to its fixed 5G broadband service, which offers cablelike service over the air. T-Mobile’s strategy has shifted in recent months, however, as the company dabbles in partnerships and wholesale leasing agreements with companies that build fiber lines to homes and businesses. The wireless “un-carrier” in July agreed to spend about $4.9 billion through a joint venture with private-equity giant KKR to buy Metronet, a Midwestern broadband provider.

Photo Credit: Jeenah Moon/Bloomberg News

…………………………………………………………………………………………………………………………………………………………

A deal for Frontier would be a round trip of sorts for some of the network infrastructure that Frontier bought from Verizon in 2016 for $10.54 billion in cash. Frontier later filed for Chapter 11 bankruptcy in April 2020 as it burned through cash and was burdened by a heavy debt load. It emerged as a leaner business in 2021 with about $11 billion less debt and focused on building a next-generation fiber optic network.

Frontier’s biggest investors today include private-equity firms Ares Management and Cerberus Capital Management. The company drew the attention of activist Jana Partners last year, which built a stake in the business. Jana delivered a letter to Frontier’s board late last year asking the company to take steps immediately to help reverse its sinking share price, including a possible outright sale.

…………………………………………………………………………………………………………………………………………………………..

AT&T has focused on expanding its fiber network since spinning off its WarnerMedia assets in 2022 to Warner Brothers Discovery. AT&T has 27.8 million fiber homes/businesses passed, growing at ~2.4 million per year, plus more locations passed via its Gigapower joint venture. AT&T’s fiber internet business is expected to contribute to an increase in consumer broadband and wireline revenue. AT&T expects broadband revenue to increase by at least 7% in 2024, which is more than double the rate of growth for wireless service revenue. In contrast, Verizon only has about 18 million fiber locations, growing at about 500,000 per year.

Other recent deals in the fiber transport market sector include the $3.1 billion acquisition, including debt, of fiber provider Consolidated Communications in late 2023 by Searchlight Capital Partners and British Columbia Investment Management.

………………………………………………………………………………………………………………………………………………………….

It’s All About Convergence (fiber based home internet combined with mobile service):

Speaking at a Bank of America investors conference today, Verizon’s CEO for the Consumer Group Sowmyanarayan Sampath said when Verizon bundles Fios with wireless, it sees a 50% reduction in mobile churn and a 40% reduction in broadband churn. He said they don’t see the same benefits with FWA. Sampath was scheduled to speak at the Mobile Future Forward conference tomorrow, but he canceled at the last minute, which may be a sign that this deal for Frontier is imminent.

The analysts at New Street Research led by Jonathan Chaplin said Verizon’s rationale for the purchase is “convergence baby.” They wrote, wrote, “Verizon seemed complacent. No longer.” Indeed, Verizon CEO Hans Vestberg was challenged on the company’s second quarter 2024 earnings call by analysts who questioned whether Verizon had a big enough fiber footprint to compete in the future. The New Street analysts said Sampath’s comments today “marked a shift in rhetoric from: ‘convergence is important, but we can do it with FWA.”

The analysts at New Street wrote today, “We have been arguing for a couple of years that all the fiber assets would eventually be rolled up into the three big national carriers (AT&T, Verizon, T-Mobile). We always knew that if one carrier started the process, others would have to follow swiftly because there are three wireless carriers and only one fiber asset in every market with a fiber asset.”

Other potential fiber companies that the big three national carriers might be eyeing include Google Fiber, Windstream, Stealth Communications and TDS Telecom.

After its annual summer conference in August in Boulder, Colorado, the analysts at TD Cowen, led by Michael Elias, said there was a lot of conversation about the wireline-wireless “convergence” frenzy. “We believe convergence is a race to the bottom, but if one player is going in with a slight advantage (AT&T), the others must reluctantly follow,” wrote TD Cowen. In the mid-term they speculated that T-Mobile might look at fiber roll-ups with Ziply or Lumen (formerly or other regional players.

References:

https://www.wsj.com/business/deals/verizon-nearing-deal-for-frontier-communications-9e402bb4

https://www.fierce-network.com/broadband/verizon-rumored-buy-frontier-its-convergence-game

https://finance.yahoo.com/news/verizon-talks-buy-frontier-communications-180419091.html

https://videos.frontier.com/detail/videos/internet/video/6322692427112/why-fiber

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Verizon Q2-2024: strong wireless service revenue and broadband subscriber growth, but consumer FWA lags

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Verizon Q2-2024: strong wireless service revenue and broadband subscriber growth, but consumer FWA lags

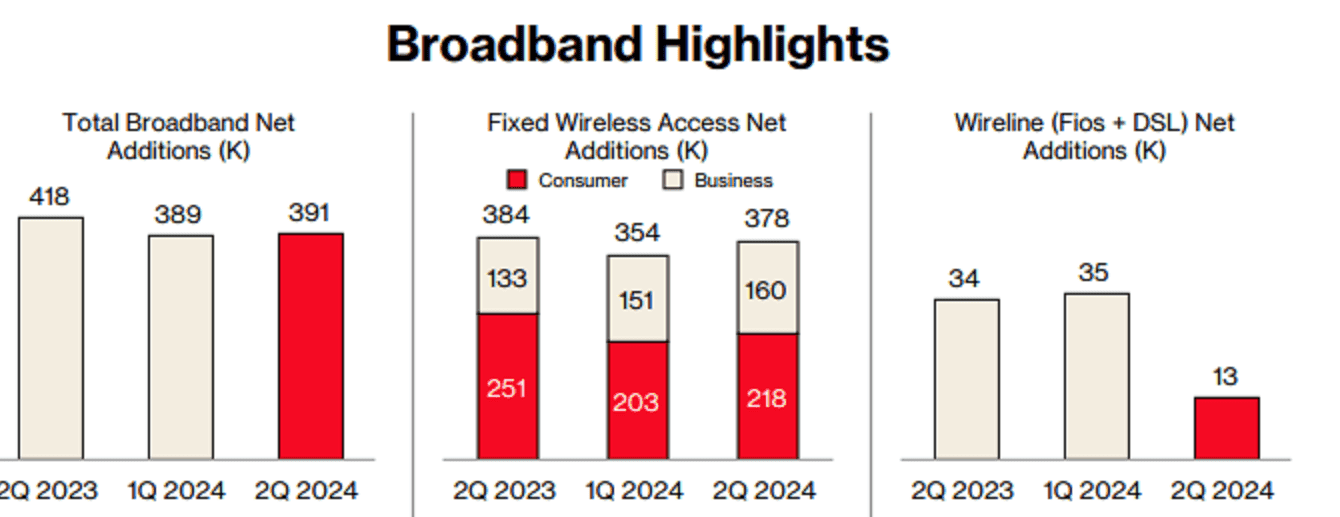

Verizon Communications wireless and wireline subscriber growth expectations in the second quarter beat estimates with 148K postpaid phone net additions vs. 118K expected. There were 391,000 total broadband wireline net additions. The company ended the quarter with 11.5 million broadband subscribers, up 17.2% year over year. However, the telecom company posted lower operating revenue that was below expectations. Earnings mostly matched expectations, but were below the year ago level.

“Demand for the service is strengthening as small businesses and enterprises continue to trust the reliability of the product and the speed and east of deployment,” Verizon CFO Tony Skiadas said on Monday’s earnings call.

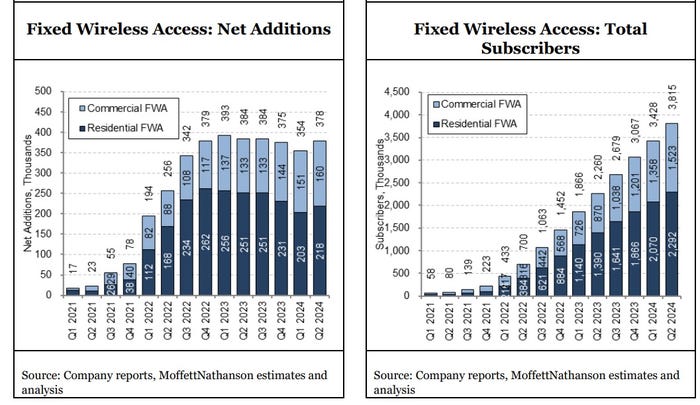

- Verizon added 160,000 business Fixed Wireless Access (FWA) subs in 2Q-2024 – a record quarterly gain in the category that was better than the 138,000 expected by analysts. That quarterly intake was up from a gain of 133,000 in the year-ago quarter and improved from a gain of 151,000 in the prior quarter. Verizon ended Q2 with 1.52 million business FWA subs.

- The company added 218,000 residential FWA subs in Q2 2024, down from a gain of 251,000 in the year-ago quarter, but ahead of the 208,000 residential FWA subs added in the prior quarter. Verizon ended the period with 2.29 million residential FWA subs.

A recent OpenSignal study revealed that Verizon’s 5G customers are rarely connected to the 5G network – in range just 7.7% of the time compared to AT&T (11.8%) and T-Mobile (67.9%). Verizon has not come close to adding as many FWA subs as T-Mobile has each quarter, particularly in the residential market.

New Street Research expects Verizon to cross the 4 million FWA subscriber mark in mid-August. In New Street’s follow-up note, analyst Jonathan Chaplin points to a recent estimate from the firm that data consumption among consumer FWA subs could be four to five time greater than business subscribers. On that basis, an estimate of FWA capacity for 4.1 million Verizon subs would really equate to 6.1 million total customers, he wrote.

2Q 2024 Highlights:

Wireless: Accelerated growth in wireless service revenue

- Total wireless service revenue1 of $19.8 billion, a 3.5 percent increase year over year.

- Retail postpaid phone net additions of 148,000, and retail postpaid net additions of 340,000.

- Retail postpaid phone churn of 0.85 percent, and retail postpaid churn of 1.11 percent.

Broadband: Double-digit broadband subscriber growth

- Total broadband net additions of 391,000. This was the eighth consecutive quarter with more than 375,000 broadband net additions.

- Total fixed wireless net additions of 378,000. At the end of second-quarter 2024, the company had a base of more than 3.8 million fixed wireless subscribers, representing an increase of nearly 69 percent year over year.

- 11.5 million total broadband subscribers as of the end of second-quarter 2024, representing a 17.2 percent increase year over year.

- Fixed wireless revenue for second-quarter 2024 was $514 million, up more than $200 million year over year.

Other results and FY 2024 forecast:

- Verizon reported adjusted earnings of $1.15 a share for the quarter, in line with analyst expectations, but a slowdown from last year’s adjusted earnings of $1.21 a share. This was also the lowest earnings per share for a second quarter since 2017.

- Total operating revenue came in at $32.8 billion, 0.6% higher than a year ago, but below estimates of $33.8 billion.

- Total wireless service revenue was $19.8 billion, up 3.5% year over year, driven primarily by growth in Consumer wireless service revenue.

- FY-2024 Outlook: Verizon reiterated a 2.0% – 3.5% wireless service revenue growth. It maintained an adjusted EPS of $4.50 – $4.70 versus consensus of $4.58.

References:

FWA a bright spot in otherwise gloomy Internet access market

Parks Associates’ newly launched Broadband Market Tracker, states that U.S. Fixed Wireless Access (FWA) adoption from a mobile network operator hit 7.8 million U.S. residential home internet connections in Q1-2024. That’s in comparison to 106.3 million U.S. households that had home internet service at the end of 2023.

Kristen Hanich, director of research at Parks Associates, told Fierce Network FWA and satellite internet are the “fastest growing” segments of the broadband market, “attracting consumers who were previously unserved or underserved by traditional providers.” She noted for the past several years, the FWA base has grown by 700,000 to 900,000 subscribers per quarter while cable connections have declined.

T-Mobile in Q1-2024 passed the 5 million mark for FWA subscribers and Verizon reported a total FWA tally of 3.4 million subscribers. These figures include both residential and business FWA customers.

Key FWA Findings from OpenSignal:

- 5G FWA has reshaped the U.S. broadband market. It has allowed U.S. mobile operators to rapidly expand their broadband footprints for minimal incremental network investment. This has seen 5G FWA absorb all broadband subscriber growth in the market since mid-2022.

- FWA is the secret sauce for 5G monetization. FWA benefits from lower prices compared to wireline competition, access to existing mobile retail channels and subscribers, and the ability to deliver a “good enough” broadband service.

- U.S. mobile networks have proven to be resilient. Despite adding millions of 5G FWA subs since 2021, 5G speeds on T-Mobile and Verizon’s mobile networks have continued to improve. Their success in managing FWA traffic is due to a variety of factors, including plentiful access to mid-band spectrum, localized load management, and differences in peak usage time of day patterns between mobile and FBB usage.

- Elsewhere, there are mixed results. In India, Jio is seeing no discernible impact from FWA on the mobile experience of its users, while in Saudi Arabia Zain is seeing the additional load on its network from FWA having a greater influence on mobile users’ experience, depending on the time of day or the level of FWA penetration.

“Despite adding more than eight million 5G FWA subs using 400+ GB per month of data since Q1 2021, the overall mobile network experience on T-Mobile and Verizon’s mobile networks has not been compromised,” Opensignal analyst Robert Wyrzykowski wrote in the firm’s new assessment of FWA technology.

In its new report, Opensignal found that areas in the U.S. with a larger number of FWA customers actually showed better networking performance than areas with fewer FWA customers. Meaning, Verizon and T-Mobile offered increasingly speedy connections even in geographic locations with higher concentrations of FWA users.

“We would expect low-FWA penetration areas to see better mobile and FWA performance because of less load on the network. However, our data demonstrates the opposite trend,” Wyrzykowski explained.

Other Opensignal findings:

- Around 6% of urban Internet customers subscribe to FWA; in rural areas that figure is 7%.

- Some 74% of FWA customers pay less than $75 per month for their services.

- 35% of FWA customers are between 18-34 years old, whereas that age range is 25% for cable.

Opensignal’s findings provide an important view into the FWA industry in the US as its subscriber growth begins to slow. For example, T-Mobile added 405,000 FWA customers during the first quarter, far less than the 541,000 FWA customers it added during the fourth quarter of 2023.

“5G FWA services have been on a dramatic growth trajectory in the U.S., absorbing all broadband subscriber growth in the market since mid-2022 and amassing more than 600-700 thousand net adds per quarter,” wrote Opensignal’s Wyrzykowski. “This is despite the USA being a mature broadband market with nearly 97% broadband adoption and modest household growth.”

…………………………………………………………………………………………………………….

U.S. cable companies have recorded historic declines in their core Internet businesses amid the growth of FWA in the U.S. Financial analysts at TD Cowen predict the U.S. cable industry will collectively lose more than half a million customers in the second quarter of this year. They attribute that decline to FWA competition as well as other factors including the end of the U.S. government’s Affordable Connectivity Program (ACP).

The situation for cable might get even worse if FWA providers like T-Mobile and Verizon decide to invest further into their fixed wireless businesses.

“The pain for cable may continue for longer than expected as the ability for cable to return to broadband subscriber growth may take longer (if ever),” wrote the TD Cowen analysts in a recent note to investors.

Others agree. For example, the analysts at S&P Global wrote that cable service providers in general have been losing value to wireless network operators despite cable’s efforts to bundle mobile services into cable offerings.

………………………………………………………………………………………………………

Parks’ Hanich said fiber optic access technology is on an upswing and Parks is seeing “excellent growth in the markets where it is available and high customer satisfaction with the customers who have it.”

“But the numbers are not quite as dramatic as what’s been going on with T-Mobile, Verizon and Starlink,” she said, noting the “growing convergence” of satellite and mobile networks is something else to keep an eye on.

Asked whether the demise of the Affordable Connectivity Program has had any impact on Parks’ findings, Hanich said, “we are concerned that the end of the program will result in households and families needing to disconnect from the internet for financial reasons.”

“For a good percentage of Americans, household budgets have been hit by rising inflation and lower-income families especially are having to cut back,” she said. “Thankfully we are seeing ISPs step up, try and transition people onto other plans and initiatives.”

…………………………………………………………………………………………………………….

Separately, Parks found adoption of mobile virtual network operator (MVNO) services reached over 15 million residential customer mobile lines in the quarter. In an MVNO model, broadband operators lease spectrum capacity from a wireless network to stand up their own mobile offering.

NTIA published some findings from its latest Internet Use Survey. Unsurprisingly, internet usage in the U.S. has gone up, with 13 million more people using the internet in 2023 compared to 2021. However, a lot of that usage is coming from lower-income households. Specifically, internet adoption among households making less than $25,000 per year increased from 69% in 2021 to 73% in 2023.

References:

https://www.fierce-network.com/broadband/fixed-wireless-continues-its-climb-among-us-homes-parks

https://www.lightreading.com/fixed-wireless-access/fwa-in-the-usa-getting-ready-for-phase-2

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Verizon’s 2023 broadband net additions led by FWA at 375K

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

UScellular has added NetCloud Private Networks from Cradlepoint (part of Ericsson) to expand its portfolio of private cellular solutions. The company now offers Ericsson Private 5G and Ericsson’s Mission Critical Networks to its customers. By building on these capabilities, UScellular is able to support even more customers across varying areas of business.

Some existing private cellular network ecosystems are pulled together piece by piece from different providers, which requires additional training and agreements. This makes it difficult for enterprise IT teams to have seamless visibility across the entire network. NetCloud Private Networks is an end-to-end private cellular network solution that removes these complexities to simplify building and operating 5G private networks.

“With the addition of NetCloud Private Networks to our portfolio, we can better address business challenges for customers of all sizes to connect business, industry and mission critical applications,” said Kim Kerr, senior vice president, enterprise sales and operations for UScellular. “The agility, flexibility and scalability of NetCloud Private Networks helps improve coverage, security, mobility, and reliability for applications where Wi-Fi may not be enough.”

NetCloud Private Networks supports enterprises who need more scalable, reliable and secure connectivity than they are getting today with traditional Wi-Fi solutions. There is significant opportunity in warehouses, logistics facilities, outdoor storage yards, manufacturing and retail operations environments to provide more connectivity. This will alleviate manual work, improve safety, and provide increased visibility.

“UScellular is a leader in this space by showing how a public carrier enhances the value of private network solutions,” said Manish Tiwari, head of private cellular networks, Cradlepoint and Ericsson Enterprise Wireless Networks.

“By adding NetCloud Private Networks to their portfolio of Ericsson private networks solutions, UScellular unlocks new opportunities for organizations to have local network coverage and address their reliability and security challenges. With solutions available to cater to both OT and IT in industrial and business environments, their customers have a choice in adopting the right private network solution for their use-cases with secure, policy-based wireless connectivity at scale.”

………………………………………………………………………………………………………………………..

Separately, The Wall Street Journal reported Thursday that T-Mobile is seeking to buy $2 billion worth of UScellular and take over some operations and wireless spectrum licenses. A deal could be announced this month, according to people familiar with the matter.

Meanwhile, Verizon is considering a deal for some of the rest of the company which is 80% owned by Telephone & Data Systems (TDS). Last year, TDS put the wireless company’s operations up for sale, as it struggled with competition from national wireless telco rivals and cable-broadband providers.

Verizon is the biggest U.S. cellphone carrier by subscribers, while T-Mobile became the second largest soon after it bought rival Sprint. T-Mobile gained more customers this month after it completed its purchase of Mint Mobile, an upstart brand.

The rising value of wireless licenses is a driving force behind the deal. U.S. Cellular’s spectrum portfolio touches 30 states and covers about 51 million people, according to regulatory filings.

U.S. companies have spent more than $100 billion in recent years to secure airwaves to carry high-speed fifth-generation, or 5G, signals and are hunting for more. But the Federal Communications Commission has lacked the legal authority to auction new spectrum for more than a year. The drought has driven up the price of spectrum licenses at companies that already hold them.

The U.S. wireless business has also matured: Carriers have sold a smartphone subscription to most adults and many children, which leaves less room for expansion as the country’s population growth slows. AT&T and Verizon have meanwhile retreated from expensive bets on the media business to focus on their core cellphone and home-internet customers.

A once-crowded field of small, midsize and nationwide cellphone carriers in the U.S. is now split among Verizon, T-Mobile and AT&T, leaving few players left to take over. As one of the last pieces left on the board, U.S. Cellular has long been an attractive takeover target. For many years, the home of the Chicago White Sox has been UScellular field.

………………………………………………………………………………………………………………………..

About UScellular:

UScellular offers wireless service to more than four million mostly rural customers across 21 states from Oregon to North Carolina. It also owns more than 4,000 cellular towers that weren’t part of the latest sale talks. The company has a market value of about $3 billion.

UScellular provides a range of solutions from public/private hybrid networks, MVNO models, localized data (aka CUPS) and custom VPN approaches. Private 5G offers unparalleled reliability, security and speed, enabling seamless communication and automation. For more information:

https://business.uscellular.com/products/private-cellular-networks/

References:

https://www.wsj.com/business/telecom/t-mobile-verizon-in-talks-to-carve-up-u-s-cellular-46d1e5e6

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

Verizon’s 2023 broadband net additions led by FWA at 375K

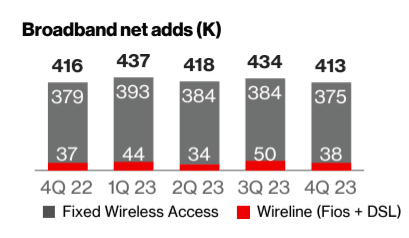

At the end of 2023, Verizon’s total broadband base was 10.7 million, with fixed wireless access (FWA) customers making up the bulk of quarterly net additions. For all of 2023, Verizon posted 375,000 net FWA additions, bringing its total fixed wireless subscriber base to over 3 million.

Total broadband net additions were 413,000, compared to 416,000 in Q4 2022. Although Verizon doesn’t post metrics for its DSL customers, overall wireline net adds were 38,000, implying the company lost 17,000 DSL subscribers in the quarter.

In the 4th quarter of 2023, Verizon added 55,000 Fios Internet customers, marking a year-on-year decline of 4,000. Consumer Fios revenue of $2.9 billion increased 1% from Q4 2022, but for the full year was relatively flat at $11.6 billion. Business Fios revenue for the quarter increased 2.6% to $312 million, while jumping 2.8% to $1.2 million for full-year 2023.

CEO Hans Vestberg noted on the earnings call broadband net adds for full-year 2023 totaled more than 1.7 million, “with more than one and a half million from fixed wireless access.” Fios net additions for the year came to 248,000.

Total Broadband:

- Total broadband net additions of 413,000, represented the fifth consecutive quarter that Verizon reported more than 400,000 broadband net additions. Total broadband net additions included 375,000 fixed wireless net additions, bringing the subscriber base to over 3 million. In fourth-quarter 2023, more than 80 percent of Consumer fixed wireless gross additions were in Verizon’s first 76 C-Band markets. Verizon is ahead of schedule to achieve its goal of 4 to 5 million subscribers by the end of 2025.

- 55,000 Fios Internet net additions, down 4,000 from the fourth-quarter 2022.

- 10.7 million total broadband subscribers as of the end of fourth-quarter 2023.

Total Wireless:

- Total wireless postpaid net additions for full-year 2023 increased 26 percent compared to 2022.

- Total wireless service revenue of $19.4 billion, a 3.2 percent increase year over year.

- Retail postpaid phone net additions of 449,000, and retail postpaid net additions of 1,460,000.

- Retail postpaid churn of 1.18 percent, and retail postpaid phone churn of 0.93 percent.

“After delivering continuous improvement throughout 2023, we ended the year strong and continue to pursue the right balance of growth and profitability,” CEO Hans Vestberg said in the 4th quarter earnings statement.

References:

https://www.verizon.com/about/investors/quarterly-reports/4q-2023-earnings-conference-call-webcast

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

Verizon once again delays 5G Standalone (SA) commercial service

Verizon once again delays 5G Standalone (SA) commercial service

Like AT&T, Verizon has promised 5G standalone (SA) core network for a very long time. The mostly wireless U.S. carrier initially said it would launch standalone 5G in 2020. Some in the industry thought it did so in 2022. But the company said the technology ‘is in testing now’ and is still not available commercially.

“We have it in trials only at this point. We don’t have it commercially available for our customers,” Verizon’s chief networking executive, Joe Russo, said on a podcast last month hosted by Recon Analytics. “So more to come in the next several months as Verizon will be entering the standalone core game.”

“It is absolutely a capability that we think will be another enabler to new use cases. But … the reliability and performance of Verizon’s network is what we stand for, and I don’t put technology out into the network that is a step back. It has to be a step forward. And all of the data that I see – both internal testing and with external testing that happens out there in the market – tells me that SA [standalone] needs a little bit more time.”

“We’re doing significant developing and testing to make sure that both the data session and the voice sessions in a standalone world are as good or better than what you would expect in our 4G network today. So we see that in the next several months we’re going to get there, but it was not my goal to be first in deploying standalone. It’s my goal to be best in deploying standalone.”

……………………………………………………………………………………………………………………………..

Verizon spokesperson Kevin King clarified that “we have commercial traffic running on our 5G non standalone core. That is what we announced earlier in the year. Joe was referring to our 5G standalone core which is in testing now.”

That cop-out was contradicted by a statement made during a webinar for analysts on September 29th, which was obtained by Light Reading. “People talk about the standalone core. Just terminology-wise, that’s the 5G core essentially. If you guys have read the stuff we’ve said publicly, certainly we serve some customers on portions of our 5G core,” said Mike Haberman, Verizon’s SVP of strategy and transformation, And then we have some internal stuff going on with other functionality on the core. We’re in the process of rolling out (5G SA) in a very smart fashion.”

“Here’s the deal: When you go to the standalone core, you can’t aggregate your LTE carriers. With the non standalone core I’m aggregating together both 5G and 4G. So when you go standalone you start to bifurcate the spectrum. So that’s the impact to the RAN [radio access network]. So you better be sure that your mobile [customer] distribution, where they are geography, makes sense. Or what will happen is those customers will experience a lower service level. No good. We want to be careful of that. So that’s why, when you do the standalone core, you have to pay very close attention to your radio access network because they are directly attached.”

On April 27th Verizon issued a press release describing the benefits of 5G standalone (SA) technology and how it’s “what sets Verizon apart.” However, the release doesn’t specifically say that Verizon launched the technology. That despite Verizon last year announced it had begun moving traffic onto its new 5G core, which supports both the non standalone (NSA) and standalone (SA) versions of the technology.

Last year, Mobile World Live reported that Verizon was migrating “commercial traffic onto SA 5G core.” The article cited an unnamed Verizon representative. Mobile World Live also reported that Ericsson, Casa Systems, Oracle and Nokia supply Verizon’s 5G core.

Dell’Oro Group, in January 2023, listed Verizon among the few North American wireless providers that had commercially launched the technology.

“This is a moving target,” Recon Analytics analyst Roger Entner told Light Reading. But Entner said Verizon’s position on the standalone version of 5G makes sense. “The benefits you can get today from standalone are limited.”

–>This author totally disagrees with Mr. Entner, because TRUE 5G=5G SA. IN OTHER WORDS, ALL OF THE 3GPP DEFINED 5G FEATURES REQUIRE 5G SA! That includes 5G security and network slicing.

…………………………………………………………………………………………………………………………………

Light Reading’s Mike Dano wrote:

Verizon now appears to be roughly three years behind its initial standalone 5G rollout plans. In the summer of 2020, Verizon said it would begin moving traffic onto its standalone 5G core “in the second half of 2020 with full commercialization in 2021.”

Then, in early 2022, Verizon CTO Kyle Malady suggested that the operator would begin moving some of its fixed wireless access (FWA) traffic onto its standalone 5G core by June of that year. He also said at the time that Verizon would start putting smartphone traffic onto that core in 2023.

………………………………………………………………………………………………………….

T-Mobile US and Dish Wireless are the only two 5G carriers that have launched commercial 5G SA. AT&T has made a lot of noise about it’s 5G SA plans but has yet to launch.

AT&T’s chief networking executive, Chris Sambar, wrote in a September 29th blog post that AT&T was moving some customers to standalone 5G. “Many of the newest mobile devices are ready for 5G standalone, and we continue to move thousands of customers every day. We also recently launched AT&T Internet Air home fixed wireless service, and from the start, this product rides on standalone 5G.”

https://www.lightreading.com/5g/verizon-surprises-with-ongoing-delays-in-5g-standalone-rollout

https://www.verizon.com/about/news/5g-standalone-why-it-matters

https://about.att.com/blogs/2023/network-ready.html

AT&T touts 5G advances; will deploy Standalone 5G when “the ecosystem is ready”- when will that be?

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

GSA 5G SA Core Network Update Report

5G subscription prices rise in U.S. without killer applications or 5G features (which require a 5G SA core network)

Verizon, T-Mobile and AT&T brag about C-band 5G coverage and FWA

Verizon says it has approximtely 222 million people covered with its mid-band C-band network, [1.] a figure the company hopes to increase to 250 million by the end of next year. “C-band is a game change for our business,” CEO Hans Vestberg said on the telco’s 3rd quarter earnings call. “Our network is winning.”

Note 1. C-band sits between the two Wi-Fi bands, which are at 2.4GHz and 5GHz. It’s slightly above and very similar to the 2.6GHz band that Clearwire and then Sprint used for 4G starting in 2007, and which T-Mobile currently uses for mid-band 5G. And it adjoins CBRS, a band from 3.55 to 3.7GHz that’s currently being deployed for 4G. ITU-R divided C-band into three chunks, referred to as band n77, band n78, and band n79.

……………………………………………………………………………………………………………………………

Verizon officials said the company is using the capacity in its mid-band 5G network to pursue opportunities like fixed wireless access (FWA) and private wireless networks. “We see demand for the product continuing to grow,” Vestberg said of Verizon’s private wireless network offerings. He added that Verizon is working to transition its private wireless customers from pilots to commercial deployments. He also said the company is growing its ecosystem of suppliers for that business.

…………………………………………………………………………………………………………………………

T-Mobile announced Tuesday it now covers 300 million people with its 2.5GHz mid-band network, reaching that goal three months earlier than the company had planned. T-Mobile’s overall 5G footprint has expanded as well, now covering more than 330 million people or 98% of the population.

“We have been leaders in the 5G era from the start, deploying the largest, fastest, most awarded and most advanced 5G network in the country faster than anyone else,” said Ulf Ewaldsson, President of Technology at T-Mobile. “While the other guys are playing catch-up, finally beginning to build out their mid-band 5G networks, we are maintaining our lead and will continue offering customers the best network – paired with the best value – for years to come.”

“T-Mobile’s turnaround story is incredible, going from network underdog a decade ago to the undeniable network leader today,” said Anshel Sag, Principal Analyst at Moor Insights and Strategy. “T-Mobile has not only built out a robust 5G network with unmatched coverage and capacity, but the Un-carrier is also leading the way in rolling out new capabilities that will unlock the true promise of 5G.”

………………………………………………………………………………………………………………………..

Last week, AT&T said it ended the third quarter covering 190 million subscribers for its mid-band 5G network, and said it remains on track to cover 200 million by the end of the year. On the telco’s 3-2023 earnings call, CEO John Stankey said, “we continue to enhance the largest wireless network in North America and expand the nation’s most reliable 5G network. It’s no surprise that when you combine our high-value customer growth and rising revenues per user, we continue to grow profits in our wireless business.”

Regarding FWA, Stankey touted the company’s Internet Air offering. “We have no issues selling Internet Air into the business segment. It’s a really attractive thing for us to do. It’s a really helpful product on a number of different fronts. It meets a particular need.

……………………………………………………………………………………………………..

References:

https://www.lightreading.com/private-networks/verizon-jumps-too-as-mobility-biz-surprises-in-q3

https://www.pcmag.com/news/what-is-c-band

https://www.fool.com/earnings/call-transcripts/2023/10/19/att-t-q3-2023-earnings-call-transcript/

https://www.att.com/internet/internet-air/

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

We noted in a recent IEEE Techblog post that the 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Well, it’s worse than that! The previously referenced negative comments from the CEO of Crown Castle, were corroborated by American Tower last week:

“The recent pullback was more abrupt than our initial expectations,” said Rod Smith, the CFO for cell tower firm American Tower, during his company’s quarterly conference call last week, according to Seeking Alpha. Smith was discussing the reduction in US operator spending on 5G, a situation that is now cutting $40 million out of American Tower’s margin expectations. “The initial burst of 5G activity has slowed down,” agreed the financial analysts at Raymond James in a note to investors following the release of American Tower’s earnings.

Cell tower giant SBA Communications said it too is seeing the broad pullback in spending that has affected its cell tower competitors (i.e. American Tower and Crown Castle). But the company’s management sought to reassure investors with promises of continued growth over the long term. During their earnings call, SBA executives said they expect activity to increase next year as T-Mobile looks to add 3.45GHz and C-band spectrum to its network, and as Dish Network restarts its network buildout.

The two largest 5G network equipment vendors that sell gear in the U.S. are seeing similar CAPEX cutbacks. “We see some recovery in the second half of the year but it will be slower than previously expected,” Nokia CEO Pekka Lundmark said earlier this month during his company’s quarterly conference call, in response to a question about the company’s sales in North America. His comments were transcribed by Seeking Alpha. Ericsson’s CEO, Borje Ekholm, is experiencing similar trends: “We see the buildout pace being moderated,” he said of the North American market, according to a Seeking Alpha transcript

AT&T’s CFO Pascal Desroches confirmed the #1 U.S. network operator is slowing its network spending. “We expect to move past peak capital investment levels as we exit the year,” he said during AT&T’s quarterly conference call, as per a Seeking Alpha transcript. AT&T’s overall CAPEX would be $1 billion lower in the second half of 2023 when compared with the first half of this year due to greatly reduced 5G network build-outs.

“This implies full year capex of ~$23.7 billion, which management believes is consistent with their prior full year 2023 capex guidance of ‘~$24 billion, near consistent with 2022 levels’ and includes vendor financing payments,” wrote the financial analysts at Raymond James in their assessment of AT&T’s second quarter results, citing prior AT&T guidance.

“Although management declined to guide its 2024 outlook, it has suggested that it expects capital investments to come down as it progresses past the peak of its 5G investment and deployments. We believe the trends present largely known CY23 [calendar year 2023] headwinds for direct 5G plays CommScope, Ericsson and Nokia. Opportunities from FWA [fixed wireless access] might provide modest offsets and validate Cambium’s business. AT&T’s focus on meeting its FCF [free cash flow] targets challenge all of its exposed suppliers, which also include Ciena, Infinera and Juniper,” the financial services firm added.

Verizon CEO Hans Vestberg told a Citi investor conference in January that CAPEX would drop to about $17bn in 2024, down from $22bn in 2022″ “We continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. Our peak capital spend is behind us, and we are now at a business-as-usual run rate for capex, which we expect will continue into 2024,” explained Verizon CFO Tony Skiadas during his company’s quarterly conference call last week, according to Seeking Alpha.

“After years of underperformance, perhaps the best argument for Verizon equity is that expectations are very low. They are coming into a phase where capex will fall now that they’ve largely completed their 5G network augmentation. Higher free cash flow will flatter valuations, but it will also, more importantly, lead to de-levering first, and potentially even to share repurchases down the road,” speculated the analysts at MoffettNathanson in a research note to investors following the release of Verizon’s earnings.

T-Mobile USA had previously said its expansive 5G build-out had achieved a high degree of scale and it would reduce its capex sharply starting in 2023.”We expect capex to taper in Q3 and then further in Q4,” said T-Mobile USA’s CFO Peter Osvaldik during his company’s quarterly conference call last week, according to Seeking Alpha. He said T-Mobile’s capex for 2023 would total just under $10 billion. T-Mobile hopes to cover around 300 million people with its 2.5GHz midband network by the end of this year. Afterward, it plans to invest in its network only in locations where such investments are necessary.

Similarly, Verizon and AT&T are completing deployments of their midband C-band 5G networks, and will slow spending after doing so. That’s even though neither telco has deployed a 5G SA core network which involves major expenses to build, operate and maintain.

Dish Network managed to meet a federal deadline to cover 70% of the U.S. population with it’s 5G OpenRAN in June. As a result, the company said it would pause its spending until next year at the earliest.

American Tower was a bit more hopeful that CAPEX would pick up in the future:

- “Moderation in carrier spend following the recent historic levels of activity we’ve seen in the industry isn’t unexpected and is consistent with past network generation investment cycles,” explained CFO Rod Smith.

- “The cycles typically progress as there’s a coverage cycle. It’s what we’ve seen in past cycles, including 3G and 4G. It’s an initial multiyear period of elevated coverage capex, and it’s tied to new G spectrum aimed at upgrading the existing infrastructure,” said American Tower’s CEO Tom Bartlett. “And then later in the cycle, it will fill back into a capacity stage where we’ll start to see more densification going on. So I’m hopeful that our investor base doesn’t get spooked by the fact that this is a pullback. It’s very consistent. The cadence is really spot on with what we’ve seen with other technologies.”

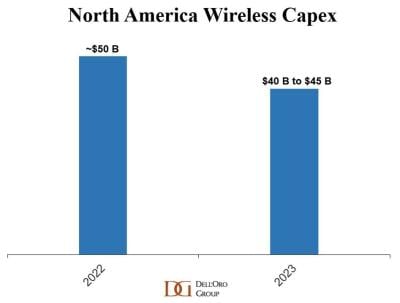

In April, Dell’Oro Group analyst Stefan Pongratz forecast global telecom capex is projected to decline at a 2% to 3% CAGR over the next 3 years, as positive growth in India will not be enough to offset sharp capex cuts in North America. He also predicted that wireless CAPEX in the North America (NA) region would decline 10% to 20% in 2023 as per this chart:

Now, that NA CAPEX decline seems more like 30% this year!

……………………………………………………………………………………………………………………………………………

References:

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

USA’s 5G capex bubble will burst this year as three main operators cut back

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

Worldwide Telecom Capex to Decline in 2023, According to Dell’Oro Group

https://www.fiercewireless.com/wireless/wireless-capex-north-america-expected-decline-10-20-2023

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

Verizon Point-To-Multipoint network architecture using mmWave Spectrum

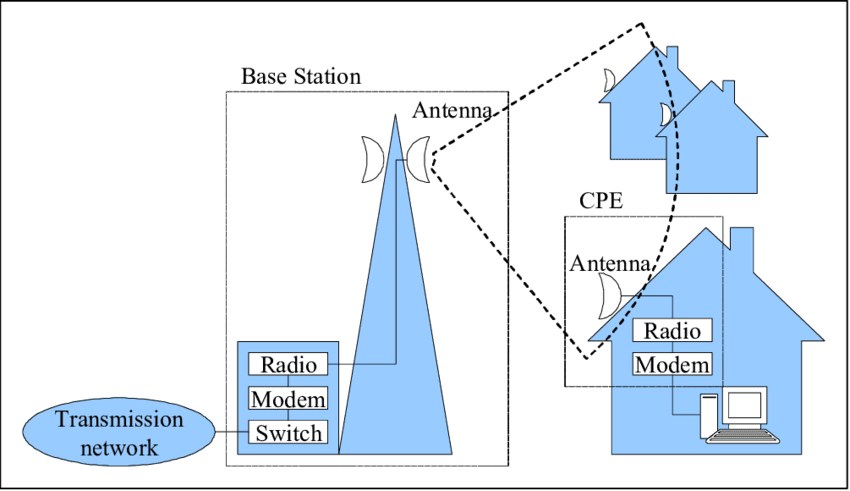

Verizon has unveiled a point-to-multipoint solution to expand high-speed internet access across various locations. According to the press release, a successful proof of concept in Texas showcased the company’s approach, leveraging its extensive mmWave spectrum holdings and fiber infrastructure.

Verizon stated that its point-to-multipoint architecture is designed to cater to multi-dwelling units (MDUs) such as apartment buildings and townhomes, as well as distributed enterprise campuses and high rises. Intending to serve multiple end-user connections from a single origination location, Verizon said this solution promises reliable, secure, and efficient connectivity.

The company claims this network architecture is less expensive to build, quicker to deploy, and addresses the unique complexities of distributed end users in a single facility or small area such as a residential unit with a large population.

In this proof of concept, an airlink over licensed mmWave spectrum was established between a centralized, rooftop radio site and a radio atop a simulated multi end-point building. The signal was then transmitted via coaxial cable throughout the building to a data processing unit along with a corresponding modem. From there, the building’s existing wiring transported the signal to end user routers that provided broadband coverage throughout simulated distributed end points. Instead of transmitting the data through Verizon’s 4G and 5G wireless cores, this unique architecture uses a simplified Broadband Network Gateway to direct the traffic to and from the internet over Verizon’s public IP network. This means that data traffic will not add load on Verizon’s current wireless cores while at the same time providing excellent capacity and latency.

Source: Research Gate Point-to-multipoint FWA network architecture

………………………………………………………………………………………………………………………………….

“Verizon has been building the infrastructure and assets for years to make this new design possible,” said Adam Koeppe, Senior Vice President of Technology Planning for Verizon. “Leveraging our significant fiber footprint in over 70 major markets nationwide and large amounts of ready-to-use mmWave spectrum, this new architecture means we will be able to provide point-to-multipoint architecture in a cost effective and efficient way.”

Leveraging Verizon’s current mmWave spectrum and fiber assets means this point-to-multipoint technology could reduce the cost of providing broadband to many locations. Depending on the various designs of buildings, office complexes and campuses, running fiber connections to individual buildings and individual units within buildings requires complex licensing, significant capital investments, long lead times and can be disruptive, making air links and established indoor cabling appealing alternatives for delivering services. Applications for this type of point to multipoint mmWave based technology could include distributed enterprise campuses, commerce areas, home broadband for multi dwelling units or other areas where air links could easily connect donor sites in the Radio Access Network to facilities with their own internal infrastructure.

Verizon is completing RFPs for the specialized radio access equipment for the licensed 37-39 GHz spectrum and expects to continue developing this technology throughout the year.

References:

https://www.verizon.com/about/news/verizon-develops-new-point-multi-point-use-case-mmwave-spectrum

https://www.verizon.com/about/our-company/5g/what-millimeter-wave-technology

Verizon deploys Private 5G at Wichita Smart Factory; 5G Radio’s an Issue?

Executive Summary:

Verizon Business announced that its private 5G wireless network is live at The Smart Factory at Wichita, a new immersive, industry experience centre convened by Deloitte. Verizon collaborates with Deloitte and other companies in the Smart Factory ecosystem to advance smart manufacturing deployment and allow manufacturers to quickly adopt cutting-edge Industry 4.0 solutions and technologies that support new business models that improve quality, productivity, and sustainability.

Verizon, as a builder-level collaborator in The Smart Factory at Wichita ecosystem of 20 leading global companies, intends to use this network of companies to help customers from various industries to innovate their approach to better connectivity and use of data to improve real-time coordination between people and assets. Verizon’s private 5G wireless network provides features that will help drive select use cases at The Smart Factory in Wichita, which include:

Select Use Cases at The Smart Factory:

- Improved shop floor visibility: Using predictive maintenance analytics on assets can improve uptime and productivity by addressing up to approximately 50% of the root causes of downtime.

- Improved quality assurance and reduced defects: Detection of potential defects in manufactured products or services before they reach customers, thereby improving the customer experience and reducing waste.

- Material handling automation: Orchestration and management of AGV and AMR fleets can improve the reliability, consistency, safety, and accuracy of moving material across the plant.

- Workplace safety: Reduces human error and manual workloads to minimize injury and productivity loss.

Commenting on the Private 5G Network Deployment, Jennifer Artley, SVP, 5G Acceleration, Verizon Business, said: “The Smart Factory at Wichita is a microcosm of industry 4.0 itself, with a wide range of enterprise partners, suppliers, researchers, and complementary technologies coming together in one ecosystem to make a supercharged impact. 5G brings massive bandwidth and incredibly fast data speeds to the equation to help make these impacts replicable in a plethora of business applications at virtually any scale — customers have the flexibility to dream big and start small.”

“5G is the backbone of Industry 4.0, and we’re so excited to bring it to Deloitte’s The Smart Factory at Wichita to help catalyze scalable, collaborative innovation,” added Jennifer Artley.

The Smart Factory in Wichita:

The Smart Factory at Wichita assists firms through their most difficult manufacturing challenges by showcasing modern manufacturing techniques in a variety of applications on a shop floor. The Factory, located on the Innovation Campus at Wichita State University, includes a fully operational production line and experiential labs for creating and researching smart manufacturing technology and strategy.

Visitors to the facility can explore smart manufacturing concepts that combine the Internet of Things (IoT), cloud, artificial intelligence (AI), computer vision, and more to create interconnected systems that use data to drive real-time, intelligent decision-making.

Verizon Private 5G:

By utilizing Verizon 5G and edge computing to create applications and solutions that drive both the manufacturing and retail industries, this work with Deloitte at The Smart Factory at Wichita strengthens the commitment between the two businesses to co-innovate.

Verizon Business announced that its private 5G wireless network is live at The Smart Factory at Wichita, a new immersive, industry experience centre convened by Deloitte. Verizon collaborates with Deloitte and other companies in the Smart Factory ecosystem to advance smart manufacturing deployment and allow manufacturers to quickly adopt cutting-edge Industry 4.0 solutions and technologies that support new business models that improve quality, productivity, and sustainability.

Commenting on the Private 5G Network Deployment, Jennifer Artley, SVP, 5G Acceleration, Verizon Business, said: “The Smart Factory at Wichita is a microcosm of industry 4.0 itself, with a wide range of enterprise partners, suppliers, researchers, and complementary technologies coming together in one ecosystem to make a supercharged impact. 5G brings massive bandwidth and incredibly fast data speeds to the equation to help make these impacts replicable in a plethora of business applications at virtually any scale — customers have the flexibility to dream big and start small.”

“5G is the backbone of Industry 4.0, and we’re so excited to bring it to Deloitte’s The Smart Factory at Wichita to help catalyze scalable, collaborative innovation,” added Jennifer Artley.

Could 5G Radios be a Problem for Private 5G?

CEO Hans Vestberg told a Citi investor conference this week:

“We need certain radio base stations for private networks, different price ranges. We need modems for certain things. You need more than the handset and the macro sites that is now in there,” Vestberg said at Citi’s 2023 Communications, Media, and Entertainment Conference. “We would now have offerings for cheaper private 5G networks with certain suppliers and more high level, high quality. We didn’t have this optionality, and that’s why we’re now sort of seeing that we’re actually meeting the customer demands of building private 5G networks.”

Vestberg added that the carrier now has “the ecosystem for radios so we are fully committed. We strongly believe in private 5G networks, and that’s a revenue stream we don’t have today because we’re not into Wi-Fi networks and optimization of a manufacturing site. We’re not into that today.”

Verizon Business CEO Sowmyanarayan Sampath during an investor conference in November said it had dozens of private networks already deployed, with accelerating momentum.

“On the private networks, we are very bullish on that opportunity and I think things have gotten a little faster in the last 90 days than they’ve gotten in the last year or so,” Sampath said, adding most of Verizon’s initial private network deals have resulted in incremental spending by customers.

“For example, if we are providing wireline network services – I’ll call it more broadly network services – to 10,000 stores, and if the realtor wants 100 sites or 200 sites of private network, they’re going to come to us because we are already integrated into their service stack, we are integrated into their day-two operating model, we are integrated into their operating system, so when a ticket happens they know what to do and vice versa,” Sampath said. “It’s a very logical extension to our business when you’re managing large portions of the infrastructure to manage their private network piece to it.”

References:

https://www.fiercewireless.com/private-wireless/verizons-arvin-singh-discusses-private-5g

https://www.verizon.com/about/news/verizon-private-5g-network-aircraft-hangar