Heavy Reading: How network operators will deploy Open RAN and cloud native vRAN

Heavy Reading conducted an operator survey in association with Quanta Cloud Technology (QCT) to explore how and why operators are likely to deploy Open RAN. The data was collected in November 2021 and includes North American, European and Asian operator respondents in roughly equal proportions.

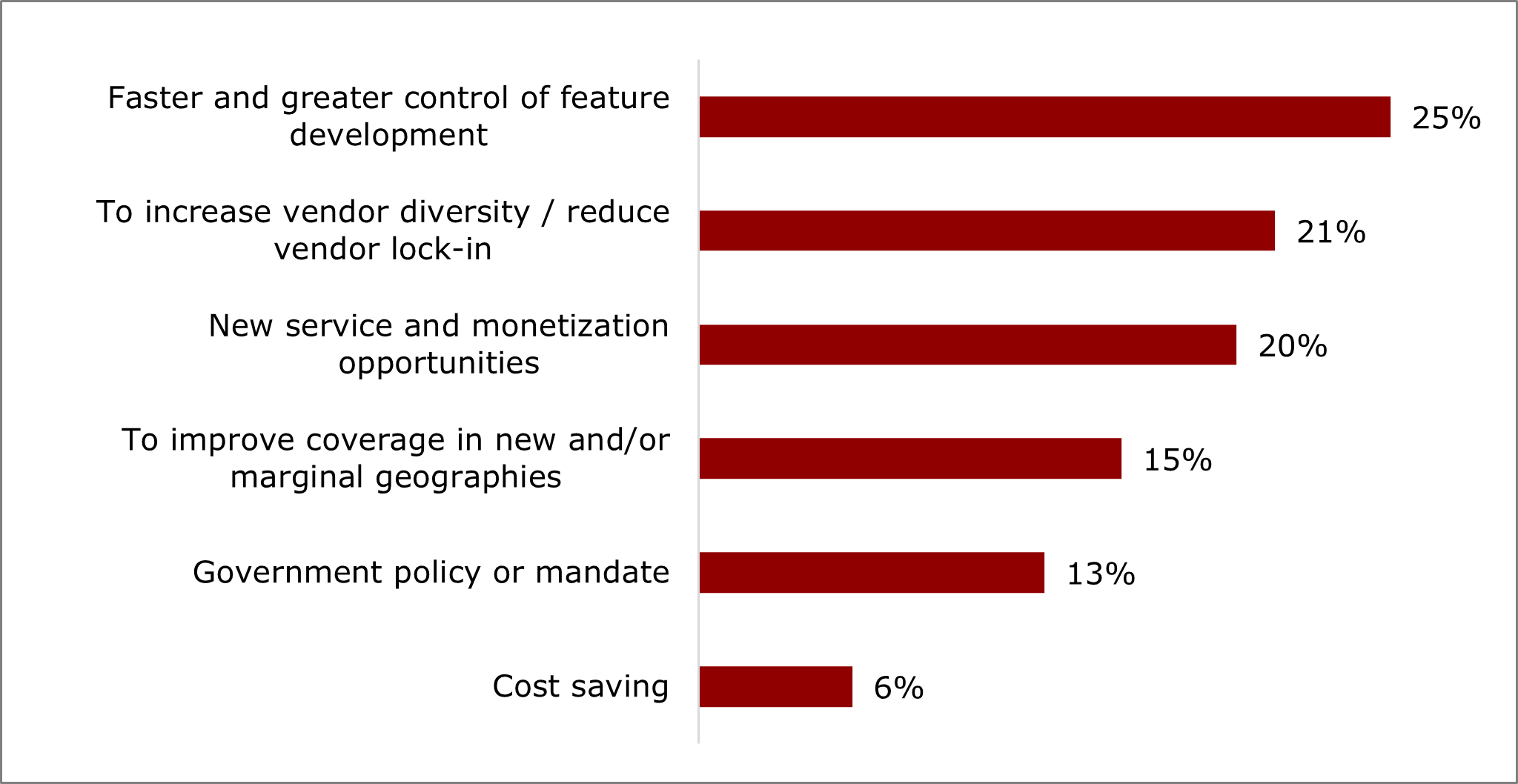

The first question in the survey that asked about the business justification for Open RAN. Here’s the result:

The lead response is for “faster greater control of feature development” with 25%, just ahead of “increase vendor diversity” at 21%, and “new service and monetization opportunities” at 20%.

The absence of an overriding reason to pursue open RAN is consistent with previous Heavy Reading operator surveys. These results indicate the business case will be founded on an accumulation of benefits that will deliver value relative to a classic, single-vendor RAN. They also point to the view that open RAN has not yet found — or at least, has not yet proven — a compelling business justification and that this diversity of views reflects an ongoing search for a business case.

Note that cost savings at 6% of respondents, indicates lower cost is not really a business reason to deploy Open RAN. There are likely two explanations for this:

- Open RAN has a similar bill of materials to classic single-vendor RAN. Ericsson and Nokia say Open RAN is more expensive than integrated, single vendor RAN.

- Operators in leading markets will not compromise on user experience simply to save a small percentage on RAN equipment costs.

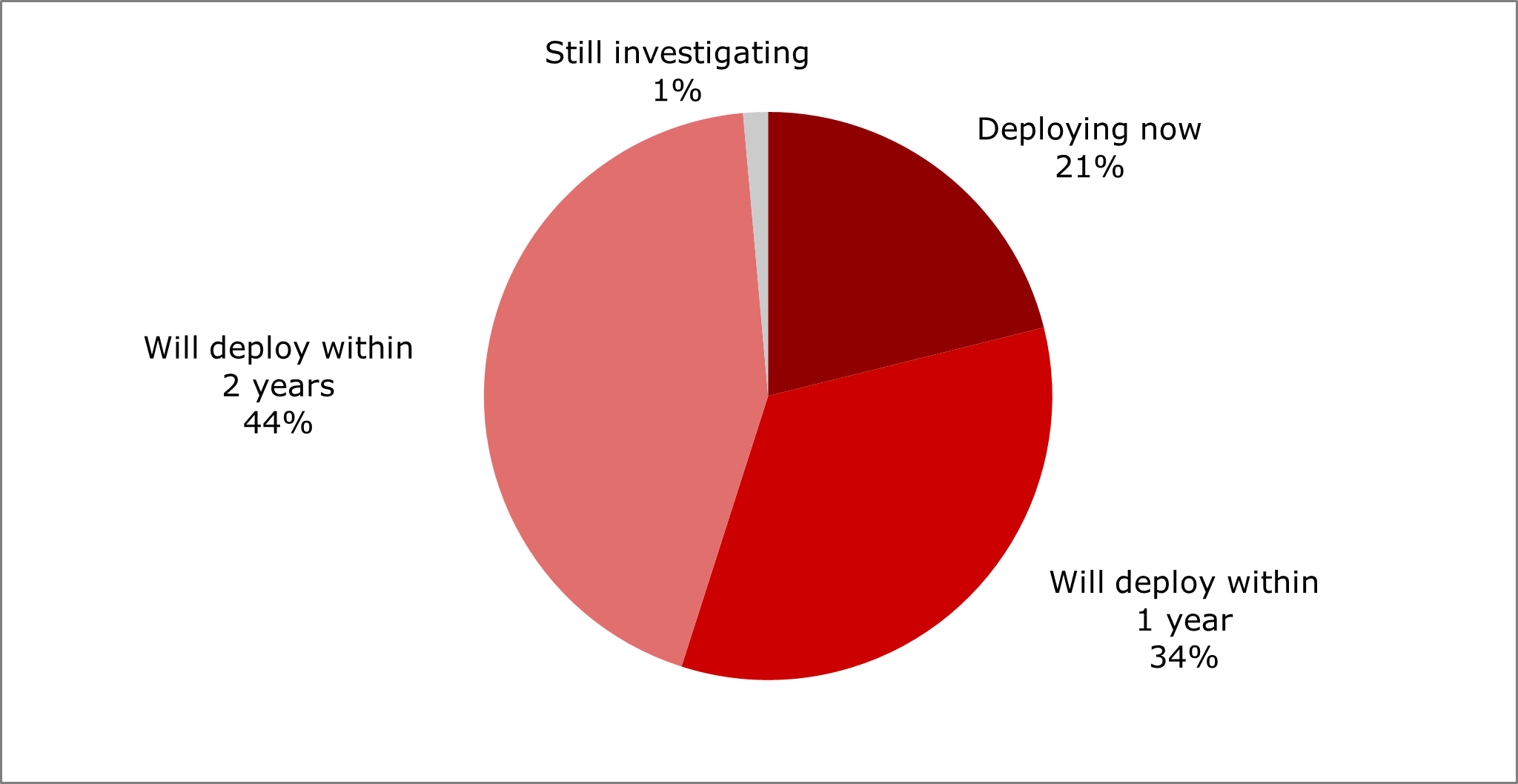

With respect to cloud native vRAN (RAN software that is deployed in containers and centrally orchestrated) the survey asked when operators plan to deploy a containerized Distributed Unit (DU) vRAN application in their commercial network. 21% of respondents said they are “deploying now,” and a further 34% “will deploy within 1 year.”

While this response this looks overly optimistic, containerized DU products are now available and are commercially deployed and operational. Heavy Reading expects deployment of this technology to scale quickly. So even if this data seems too optimistic on the timeline, it is a good indicator of sentiment among operators that are likely to already be positive on vRAN.

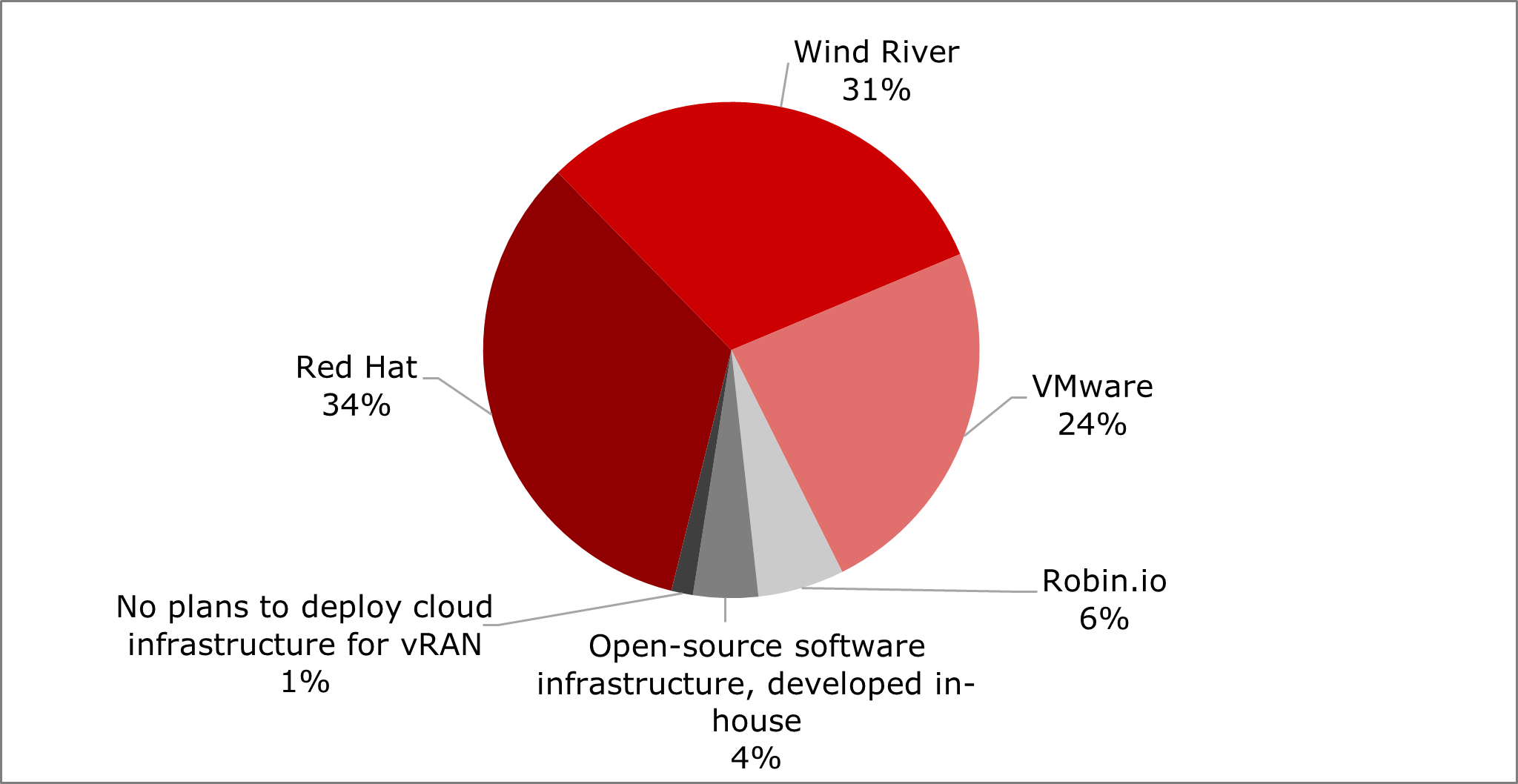

Network operators must deploy RAN software — either in virtual machines, containers or both — on cloud infrastructure. A key question is which software infrastructure platform to use?

The chart below shows three leading operator preferences:

For vRAN software suppliers and DU server vendors that want to help accelerate open vRAN deployments, the three main cloud environments to pre-integrate with appear to be Red Hat, Wind River and VMware.

These are well-known solutions in the telco cloud and core network, and it is logical operators will want to extend their existing telco cloud to the edge to support vRAN. An interesting third option also emerges from this data. Wind River, which offers cloud infrastructure software focused on smaller footprint edge devices that can be optimized for RAN applications, also scores highly at 31%. This is consistent with several Tier 1 operator vRAN deals that reference Wind River publicly.

To learn more about this Heavy Reading operator survey, register for the archived Light Reading webinar on Designing and Deploying Cloud Native Open RAN.

— Gabriel Brown, Principal Analyst, Heavy Reading

……………………………………………………………………………………………………………………………………………………..

A Red Hat survey found that communication service providers (CSPs) now realize the role and benefits of cloud-native network functions (CNFs) and container-based cloud platforms as the means to advance their infrastructures. Benefits include features and efficiency, automation, scalability, and flexibility that will help further lower overall costs. Respondents confirmed their rollout of 5G services would utilize container-based 5G infrastructure, with three-quarters of those respondents indicating the use of container-based platforms in over 25% of their networks by 2022.

In a recent report from Heavy Reading based on a survey of respondents from 77 CSPs, the steady uptick of service providers evolving their RAN has been significant, with the following observations:

-

50% of service providers have deployed a vRAN in over a quarter of their network compared to the fourth quarter of 2019, when only 35% of respondents had achieved the same rollout.

-

vRAN deployment has doubled in service provider 4G-only networks and vRAN in service provider 5G-only networks has increased by 66% since the survey in Q4 of 2019.

-

By the end of 2023 , the above numbers are expected to be flipped, with the majority of service providers deploying vRAN into both their 4G and 5G networks and not 4G alone.

As service providers’ experience with network transformation grows, they are embracing horizontal cloud platforms over vertically integrated solutions. The increased flexibility provided by containers, coupled with automation, can take full advantage of horizontal platforms.

A common cloud-native application platform deployed across any footprint and any cloud provides a simplified operational model and allows greater choice of CNFs. This is important to fit service providers’ business needs and to deploy and scale where needed, so they can make future additions and changes more easily. A Kuberenetes-based platform offers other direct benefits for RAN workloads, such as reduced latency, higher throughput and precision timing.

In summary, service providers are evolving their RAN to deliver new 5G services that are adaptable, scalable and efficient. Successful vRAN deployments will build upon a telco-grade container platform solution that takes automation and flexibility to the next level. With that, disaggregated vRAN architectures can be optimized to deliver the lowest latency and highest performance. This infrastructure needs to be a consistent cloud-native platform that can support multiple RAN functions and that spans the entire service provider network from edge to core to cloud.

Red Hat OpenShift is an application platform that not only boosts developer productivity but can orchestrate both containers and VMs in production environments. OpenShift helps simplify workflows and reduce overall total cost of ownership (TCO). As an answer to ever-changing marketplace demands, Red Hat’s extensive partner ecosystem provides choices to select software functions and hardware from multiple vendors, while accommodating present needs and anticipating those in the future.

References:

https://www.lightreading.com/open-ran/designing-and-deploying-cloud-native-open-ran/a/d-id/774302?

https://www.redhat.com/en/blog/adoption-evolved-vran-propels-network-enhancements

https://www.redhat.com/en/resources/virtualized-ran-insights-2021-analyst-paper

3 thoughts on “Heavy Reading: How network operators will deploy Open RAN and cloud native vRAN”

Comments are closed.

Neville Ray, the executive in charge of T-Mobile’s five-year, $60 billion 5G network upgrade program, isn’t ready to offload his company’s network operations into a third-party cloud computing provider.

“The phone isn’t going to ring, the data session is not going to happen unless that core service is up and running,” Ray explained this week at an investor event, according to a Seeking Alpha transcript. “I’m not at the point yet where I would put that in the hands of a third party.”

“Still want to put your network core into the public cloud? #suckers,” tweeted Neil McRae, chief architect of the UK’s BT, following one of AWS’ outages.

T-Mobile’s Ray appears to share those feelings.

“We like to own that experience as much as we can ourselves because that’s pretty critical in the nature of the business here,” he said of the operator’s cloud. He said T-Mobile operates its own in-house cloud computing service, and that’s where it runs its 5G standalone core. He said T-Mobile is comfortable offloading its IT operations into a third-party cloud, but that the operator does not feel the same way about its core networking operations.

“But [we’re] very open [to] working with all the cloud providers every day,” Ray added.

Ray’s comments are noteworthy considering both Dish Network and AT&T have widely embraced third-party cloud services. Dish is in the early stages of building its own nationwide 5G network, and has said it plans to run all of its core network operations in the AWS cloud. Dish has argued doing so will provide it with much more flexibility in terms of innovative business services, and that it will cut down dramatically on its network-operation expenses.

AT&T, meanwhile, plans to transition its own 5G core network operations into Microsoft’s cloud over the course of the next three years. One analyst said AT&T risks “losing control” over its network and technology roadmap over the long term due to the move.

Ray argued that T-Mobile is leading in other aspects of 5G. For example, he said T-Mobile plans to deploy its 5G services across 200MHz of midband spectrum by the end of 2023 – up from around 100MHz today. He said that would help T-Mobile reach its goal of increasing its network capacity by a factor of 14 through its purchase of Sprint and Sprint’s 2.5GHz mid-band spectrum.

https://www.lightreading.com/service-provider-cloud/t-mobiles-neville-ray-remains-wary-of-moving-around-in-the-cloud/d/d-id/774124?

Many talk about OpenRAN but few dare to ask the critical questions which concern mobile operators

Many OpenRAN pronouncements sound too good to be true, for example a technology that can reduce mobile operators infrastructure CAPEX and OPEX by 30-40 percent. Investors and other decision makers want objective information about the latest mobile industry hype. Strand Consult’s report “Debunking 25 Myths of OpenRAN” examines the claims made by OpenRAN proponents. Strand Consult, having witnessed the launch of WiMax, OneAPI, and the iPhone among other hyped technologies promised to bring windfall revenues to mobile operators, provides critical questions to evaluate OpenRAN in its latest report.

Strand Consult is an independent research company with 25 years industry experience in the mobile telecom industry with over 170 mobile operators globally as clients. Strand Consult is known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world.

We at Strand Consult has nothing against OpenRAN. However we want to create the transparency at the O-RAN Alliance, and some of its members have pushed back. Indeed Strand Consult’s transparency concerns are shared by policymakers in the EU and US, notably the House of Representatives Foreign Affairs Committee.

Strand Consult has studied OpenRAN and produced many reports and research notes on the topic. Strand Consult first identified that there are at least 44 Chinese firms participating in the OpenRan Alliance, debunking the assertion that OpenRAN would be free of Chinese influence. Strand Consult has also posited that Huawei is influencing OpenRAN indirectly through its largest customer China Mobile, which is a founding member of the O-RAN Alliance. However inspiring companies like Mavenir, Parallell Wireless, and Altiostar may be to storytellers, they are bit players. Most of the contributions to OpenRAN specifications come from old established technology providers and China Mobile.

Strand Consult’s goal is to create objectivity and transparency about the actors promoting OpenRAN so that mobile operators, investors and others stakeholders can make informed decisions. Strand Consult finds it telling that OpenRAN proponents have not wanted to answer its critical questions addressing financial, economic, technical, and practical points about the technology. This is particularly evident at many OpenRAN webinars over the last 18 months when Strand Consult posts its questions publicly in the chat and the moderator ignores the questions, or Strand Consult’s emailed questions to the event organizer are ignored.

In an effort to lift the level of policy discussion, Strand Consult offers a comprehensive review of the official public documents promoting deployment of 5G Open Radio Access Networks (OpenRAN). These include the set of industrial, think tank, advocacy, and academic papers and reports as well as official proceedings by regulators and authorities in the United States and European Union. Official inquiries on OpenRAN have been undertaken by the Federal Communications Commission (FCC), the National Telecommunications and Information Administration (NTIA), and the DG Connect at European Union.

These inquiries have a variety of goals. One objective of these inquiries is to explore resilience in the network infrastructure market. Another is to promote alternative suppliers to Chinese providers Huawei and ZTE. Yet another is to explore and develop industrial policy and promote domestic companies.

Strand Consult believes that such processes and subsequent reports are important. Telecommunications regulatory authorities are tasked with providing policymakers with objective information for decision making as well as cost benefit and other analyses.

In the report “Debunking 25 Myths of OpenRAN”, Strand Consult investigates the quality of the literature describing OpenRAN. It categorizes the 25 myths into 6 categories: security, competition, innovation, engineering, economics, and public policy. Among the OpenRAN reports, articles, and investigations, there is little information which can be classified as empirical, scientific, or peer-reviewed. Outside of a few exceptions, most materials are marketing/advocacy promoted by OpenRAN proponents or news/press releases/opinion pieces. The key shortcomings of the OpenRAN discussion include

Lack of objectivity and/or empirical support

Preconceived notions, assumptions, and assertions about the economics of infrastructure, competition, and innovation

Little to no discussion of the infrastructure value chain beyond the large infrastructure equipment providers

Ignorance or failure to disclose that OpenRAN is not a technical standard. The O-RAN Alliance develops technical specifications for 4G and 5G RAN internal functions and interface, not for 2G and 3G. The O-RAN Alliance is not a standards development organization (SDOs) like the 3GPP.

Ignorance or failure to disclose that OpenRAN only supports 4G and 5G and therefore it is not a 1:1 commercial alternative for 5G networks. Moreover OpenRAN does not support 2G and 3G, the prevailing network generation in many developing countries, and yet OpenRAN is reported as a solution for developing countries.

Ignorance or failure to disclose that 182 commercial 5G networks have been launched globally. These are classic RAN installations that support 2, 3, 4 and 5G in one base station. There is only 1 commercial OpenRAN installation, Rakuten in Japan.

Ignorance or failure to disclose how small expectations are for the OpenRAN install base by 2025 and 2030 compared to the entire market. This is likely just 1 percent in 2025 and under 3 percent in 2030.

Ignorance or failure to disclose the role of Chinese vendors in OpenRAN ecosystem and their leading role in OpenRAN governance and specification setting

The report “Debunking 25 Myths of OpenRAN” takes a critical view of the claims made about OpenRAN, including the claim that OpenRAN will stimulate the 5G service market. Strand Consult doesn’t believe OpenRAN will stimulate the 5G service market. We understand which services there will be in the core network and which in the cloud. They key problem for OpenRAN community is that they can’t explain which services are based on RAN that require OpenRAN on a cell site to be implemented. And the OpenRAN community cannot tell us who will develop these OpenRAN-based services, who will sell them, what business models underlie these services, whether they will address corporate or consumer market. And they cannot tell us about whether these services only be available on the few mobile sites where the operators have implemented OpenRAN, e.g. outside the big cites.

The report “Debunking 25 Myths of OpenRAN” will provide the objectivity and transparency needed by decision makers. This is the sort of information and analysis which is not available in most mainstream outlets. At the end of the day, mobile operators’ job is to deliver a great network experience to their customers. OpenRAN proponents have not succeeded to communicate, let alone demonstrate, specifically or empirically the difference they will make to mobile operators’ bottom line in a world where 182 commercial 5G networks on classic RAN have been launched.

For more than 25 years, Strand Consult has debunked the many myths of mobile industry hype. With its new and free report “Debunking 25 Myths of OpenRAN”, Strand Consult provides valuable information to mobile operators, investors and other mobile industry stakeholders.

Contact Strand Consult today to get your free copy of the report “Debunking 25 Myths of OpenRAN”

https://strandconsult.dk/debunking-25-myths-of-openran/

Sterlite, Robin.io to provide tech for 5G stack for enterprise -Robin.io will provide the cloud-native platform for deploying applications and network functions on the STL Enterprise Marketplace platform.

Robin.io, a Kubernetes data management platform, will collaborate with Sterlite Technologies (STL) to offer Xaas solution for enterprise applications and 5G services effectively.

“Built on the foundation of cloud-native, zero-touch automation and open architectures, the integrated marketplace solution will enable CSPs to deliver new revenue models and accelerate customer onboarding while keeping service delivery costs in check,” said Partha Seetala, founder and CEO of Robin.io.

There is a growing trend among the Communication Service Providers (CSPs) to become an enterprise platform provider to leverage the massive opportunities it provides.

STL Enterprise Marketplace is a new-age, platform-based model that simplifies collaboration and has the potential to open up multi-sided marketplace opportunities. STL offers end-to-end software solutions for creating new-age digital services, building new business models, and opening new revenue streams.

The Platform brings together service providers, partners and enterprise customers from different verticals on the same Platform. Robin CNP provides storage, network management and scheduling to run complex network workloads from application vendors and partners across a wide spectrum of use cases.

Commenting on the collaboration, Saikat Mitra, COO of STL Network Software, said, “Extreme automation and true cloud-native platforms are key to accelerating digital transformation. In its endeavor to bring innovative XaaS

offerings faster to the market, STL has been supporting a hybrid network ecosystem with its 5G Enterprise Marketplace and 5G monetization initiatives.

In this strategic partnership, we are bringing our Enterprise Marketplace Platform enabling Robin.io to achieve seamless cloud infrastructure management for multi-datacenter, multi-cloud and multi-edge ecosystems and actualize their vision on 5G, IoT and WiFi.”

https://www.dqindia.com/sterlite-robin-io-to-provide-tech-for-5g-stack-for-enterprise/

https://www.stl.tech/