vRAN

vRAN market disappoints – just like OpenRAN and mobile 5G

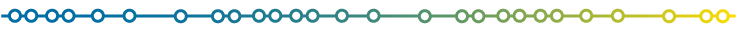

Most wireless network operators are not convinced virtual RAN (vRAN) [1.] is worth the effort to deploy. Omdia, an analyst company owned by Informa, put vRAN’s share of the total market for RAN baseband products at just 10% in 2023. It is growing slowly, with 20% market share forecast by 2028, but it far from being the default RAN architectural choice.

Among the highly touted benefits of virtualization is the ability for RAN developers to exploit the much bigger economies of scale found in the mainstream IT market. “General-purpose technology will eventually have so much investment in it that it will outpace custom silicon,” said Sachin Katti, the general manager of Intel’s network and edge group, during a previous Light Reading interview.

Note 1. The key feature of vRAN is the virtualization of RAN functions, allowing operators to perform baseband operations on standard servers instead of dedicated hardware. The Asia Pacific region is currently leading in vRAN adoption due to rapid 5G deployment in countries like China, South Korea, and Japan. Samsung has established a strong presence as a supplier of vRAN equipment and software.

The whole market for RAN products generated revenues of just $40 billion in 2023. Intel alone made $54.2 billion in sales that same year. Yet Huawei, Ericsson and Nokia, the big players in RAN base station technology, have continued to miniaturize and advance their custom chips. Nokia boasts 5-nanometer chips in its latest products and last year lured Derek Urbaniak, a highly regarded semiconductor expert, from Ericsson in a sign it wants to play an even bigger role in custom chip development.

Ericsson collaborates closely with Intel on virtual RAN, and yet it has repeatedly insisted its application-specific integrated circuits (ASICs) perform better than Intel’s CPUs in 5G. One year ago, Michael Begley, Ericsson’s head of RAN compute, told Light Reading that “purpose-built hardware will continue to be the most energy-efficient and compact hardware for radio site deployments going forward.”

Intel previously suffered delays when moving to smaller designs and there is gloominess about its prospects as note in several IEEE Techblog posts like this one and this one. Intel suffered a $17 billion loss for the quarter ending in September, after reporting a small $300 million profit a year before. Sales fell 6% year-over-year, to $13.3 billion, over this same period.

Unfortunately, for telcos eyeing virtualization, Intel is all they really have. Its dominance of the small market for virtual RAN has not been weakened in the last couple of years, leaving operators with no viable alternatives. This was made apparent in a recent blog post by Ericsson, which listed Intel as the only commercial-grade chip solution for virtual RAN. AMD was at the “active engagement” stage, said Ericsson last November. Processors based on the blueprints of ARM, a UK-based chip designer that licenses its designs, were not even mentioned.

The same economies-of-scale case for virtual RAN is now being made about Nvidia and its graphical processing units (GPUs), which Nvidia boss Jensen Huang seems eager to pitch as a kind of general-purpose AI successor to more humdrum CPUs. If the RAN market is too small, and its developers must ride in the slipstream of a much bigger market, Nvidia and its burgeoning ecosystem may seem a safer bet than Intel. And the GPU maker already has a RAN pitch, including a lineup of Arm-based CPUs to host some of the RAN software.

Semiconductor-related economies of scale, should not be the sole benefit of a virtual RAN. “With a lot of the work that’s been done around orchestration, you can deploy new software to hundreds of sites in a couple of hours in a way that was not feasible before,” said Alok Shah of Samsung Electronics. Architecturally, virtualization should allow an operator to host its RAN on the same cloud-computing infrastructure used for other telco and IT workloads. With a purpose-built RAN, an operator would be using multiple infrastructure platforms.

In telecom markets without much fiber or fronthaul infrastructure there is unlikely to be much centralization of RAN compute. This necessitates the deployment of servers at mast sites, where it is hard to see them being used for anything but the RAN. Even if a company wanted to host other applications at a mobile site, the processing power of Sapphire Rapids, the latest Intel generation, is fully consumed by the functions of the virtual distributed unit (vDU), according to Shah. “I would say the vDU function is kind of swallowing up the whole server,” he said.

Indeed, for all the talk of total cost of ownership (TCO) savings, some deployments of Sapphire Rapids have even had to feature two servers at a site to support a full 5G service, according to Paul Miller, the chief technology officer of Wind River, which provides the cloud-computing platform for Samsung’s virtual RAN in Verizon’s network. Miller expects that to change with Granite Rapids, the forthcoming successor technology to Sapphire Rapids. “It’s going to be a bit of a sea change for the network from a TCO perspective – that you may be able to get things that took two servers previously, like low-band and mid-band 5G, onto a single server,” he said.

Samsung’s Shah is hopeful Granite Rapids will even free up compute capacity for other types of applications. “We’ll have to see how that plays out, but the opportunity is there, I think, in the future, as we get to that next generation of compute.” In the absence of many alternative processor platforms, especially for telcos rejecting the inline virtual RAN approach, Intel will be under pressure to make sure the journey for Granite Rapids is less turbulent than it sounds.

Another challenge is the mobile backhaul, which is expected to limit the growth of the vRAN industry. Backhaul connectivity ia central s widely used in wireless networks to transfer a signal from a remote cell site to the core network (typically the edge of the Internet). The two main methods of mobile backhaul implementations are fiber-based and wireless point-to-point backhaul.

The pace of data delivery suffers in tiny cell networks with poor mobile network connectivity. Data management is becoming more and more important as tiny cells are employed for network connectivity. Increased data traffic across small cells, which raises questions about data security, is mostly to blame for poor data management. vRAN solutions promise improved network resiliency and utilization, faster network routing, and better-optimized network architecture to meet the diverse 5G requirements of enterprise customers.

References:

https://www.lightreading.com/5g/virtual-ran-still-seems-to-be-not-worth-the-effort

https://www.ericsson.com/en/blog/north-america/2024/open-ran-progress-report

https://www.sdxcentral.com/5g/ran/definitions/vran/

LightCounting: Open RAN/vRAN market is pausing and regrouping

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Huawei CTO Says No to Open RAN and Virtualized RAN

Heavy Reading: How network operators will deploy Open RAN and cloud native vRAN

LightCounting: Open RAN/vRAN market is pausing and regrouping

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Private 5G ecosystem is evolving:

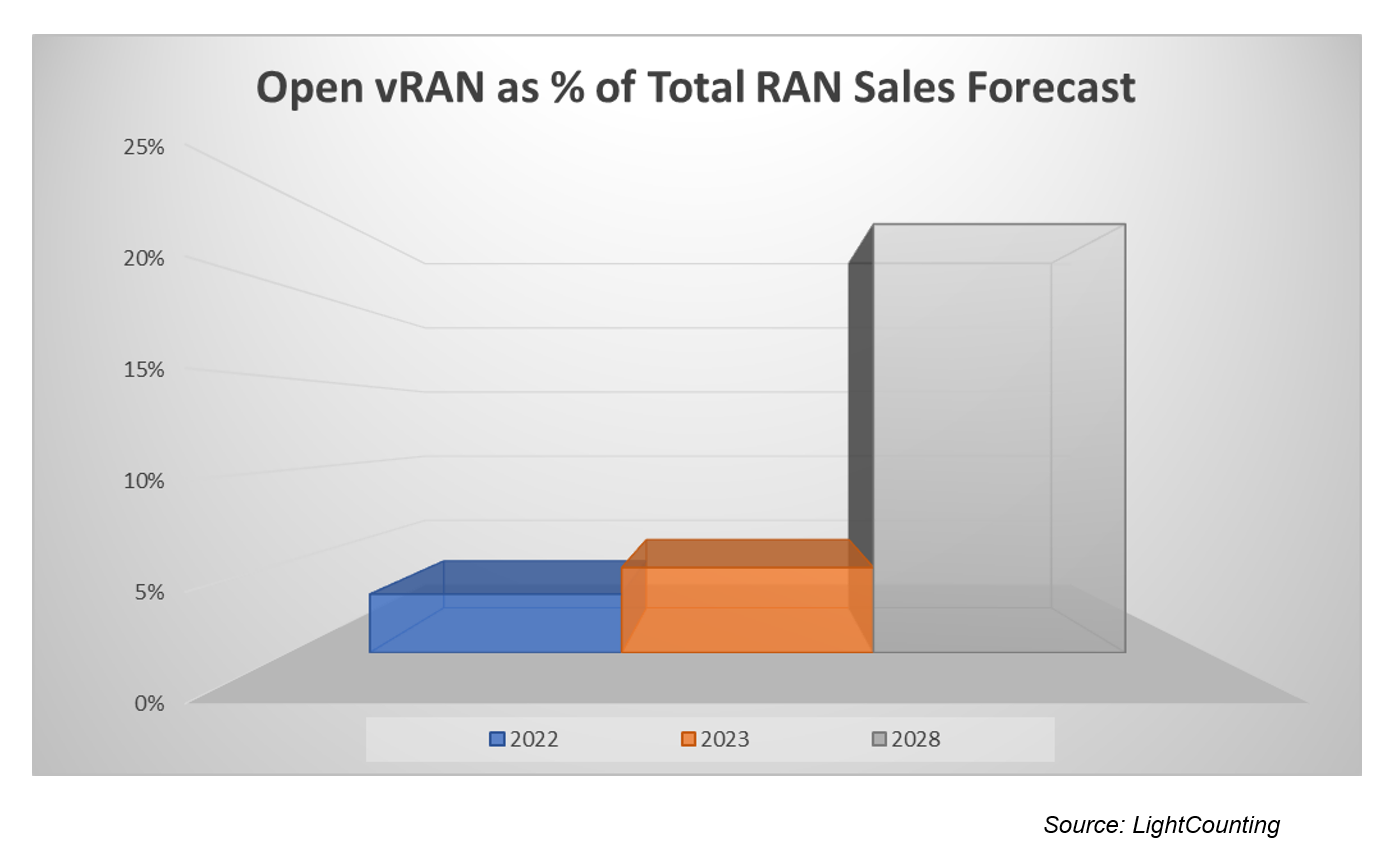

Private 5G is running behind schedule. Dell’Oro’s VP Stefan Pongratz adjusted the firm’s private wireless forecast downward to reflect the current state of the market. Still, the slow uptake is not dampening the enthusiasm for private wireless. If anything, the interest is growing and the ecosystem is evolving as suppliers with different backgrounds (RAN, core, Wi-Fi, hyperscaler, in-building, SI) are trying to solve the enterprise puzzle.

According to Dell’Oro’s data, the total private wireless small cell market outside of China exceeds $100 million. But Pongratz indicated that’s not very much. “Commercial private wireless revenues are still so small. We estimate private wireless small cells is still less than 1% of the overall public-plus-private RAN market in 2022.”

He did concede that the private wireless small cell market outside of China is growing at double digits. “It’s heading in the right direction,” said Pongratz. “A lot of suppliers see good things for 2023.”

According to Stefan, the top three private wireless vendors in the world are Nokia, Huawei and Ericsson. Celona has said that its goal is to overtake Nokia in private wireless. Celona CEO Rajeev Shah said that based on Nokia’s public earnings reports, the company seems to be garnering about 30-35 private wireless customers a quarter and has about 515 of these customers in total. Shah said these numbers aren’t huge, and the industry has a long way to go.

Below is a summary of the private RAN, core, and SI/services providers that Stefan is currently monitoring.

Pongratz said the private wireless market can also be segmented by macro versus small cell. He said private wireless has been around for quite some time — since 2G. But traditionally, it was used as a wide area network (WAN), using the 3GPP definition for non-public networks. Often these networks deployed macros for very large organizations such as utility companies.

“The shiny new object is really the local campus deployments; that’s really small cells,” said Pongratz. “There will be a component of the new shiny that is also WAN, like a car manufacturer that could use both macros and small cells.”

But regardless, whether the private wireless market is segmented by macro or small cell, Dell’Oro still finds the top three suppliers are Huawei, Ericsson and Nokia.

………………………………………………………………………………………………………………………………………………………………………..

Virtualized RAN is gaining momentum:

As we now know, vRAN started out slow but picked up some speed in 2022 in conjunction with the progress in the US. The challenge from a forecasting perspective is that the visibility beyond the greenfields and the early brownfield adopters is limited, primarily because purpose-built RAN still delivers the best performance and TCO. As a result, there is some skepticism across the industry about the broader vRAN growth prospects.

During MWC, Steffan learned four things: 1) Near-term vRAN visibility is improving – operators in South Korea, Japan, US, and Europe are planning to deploy vRAN in the next year or two. 2) vRAN performance is firming up. According to Qualcomm, Vodafone (and Qualcomm) believes the energy efficiency and performance gap between the traditional and new Open vRAN players is shrinking (Vodafone publicly also praised Mavenir’s OpenBeam Massive MIMO AAU). Samsung also confirmed (again) that Verizon is not giving up any performance with Samsung’s vRAN relative to its purpose-built RAN. 3) vRAN ecosystem is expanding. In addition to existing vRAN suppliers such as Samsung, Ericsson, Mavenir, Rakuten Symphony, and Nokia announcing improvements to their existing vRAN/Cloud RAN portfolios, more RAN players are jumping on the vRAN train (both NEC and Fujitsu are expecting vRAN revs to ramp in 2023). And perhaps more interestingly, a large non-RAN telecom vendor informed us they plan to enter the vRAN market over the next year. 4) The RAN players are also moving beyond their home turf. During the show, Nokia announced it is entering the RAN accelerator card segment with its Nokia Cloud RAN SmartNIC (this is part of Nokia’s broader anyRAN strategy).

Skepticism is on the rise

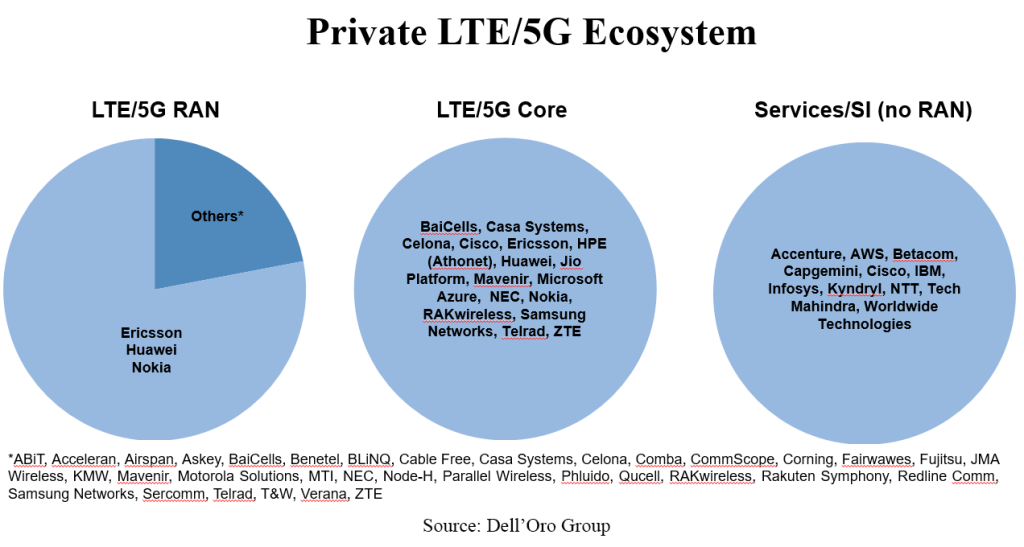

Not surprisingly, disconnects between vision and reality are common when new technologies are introduced. Even if this is expected, we are sensing more frustration across the board this time around, in part because RAN growth is slowing and 5G still has mostly only delivered on one out of the three usage scenarios outlined in the original 5G use case triangle. With 5G-Advanced/5.5G and 6G starting to absorb more oxygen, people are asking if mMTC+/mMTC++ and URLLC+/URLLC++ are really needed given the status of basic mMTC and URLLC. Taking into consideration the vastly different technology life cycles for humans and machines, there are more questions now about this logic of assuming they are the same and will move in tandem. If it is indeed preferred to under-promise and over-deliver, there might be some room to calibrate the expectations with 5G-Advanced/5.5G and 6G.

References:

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

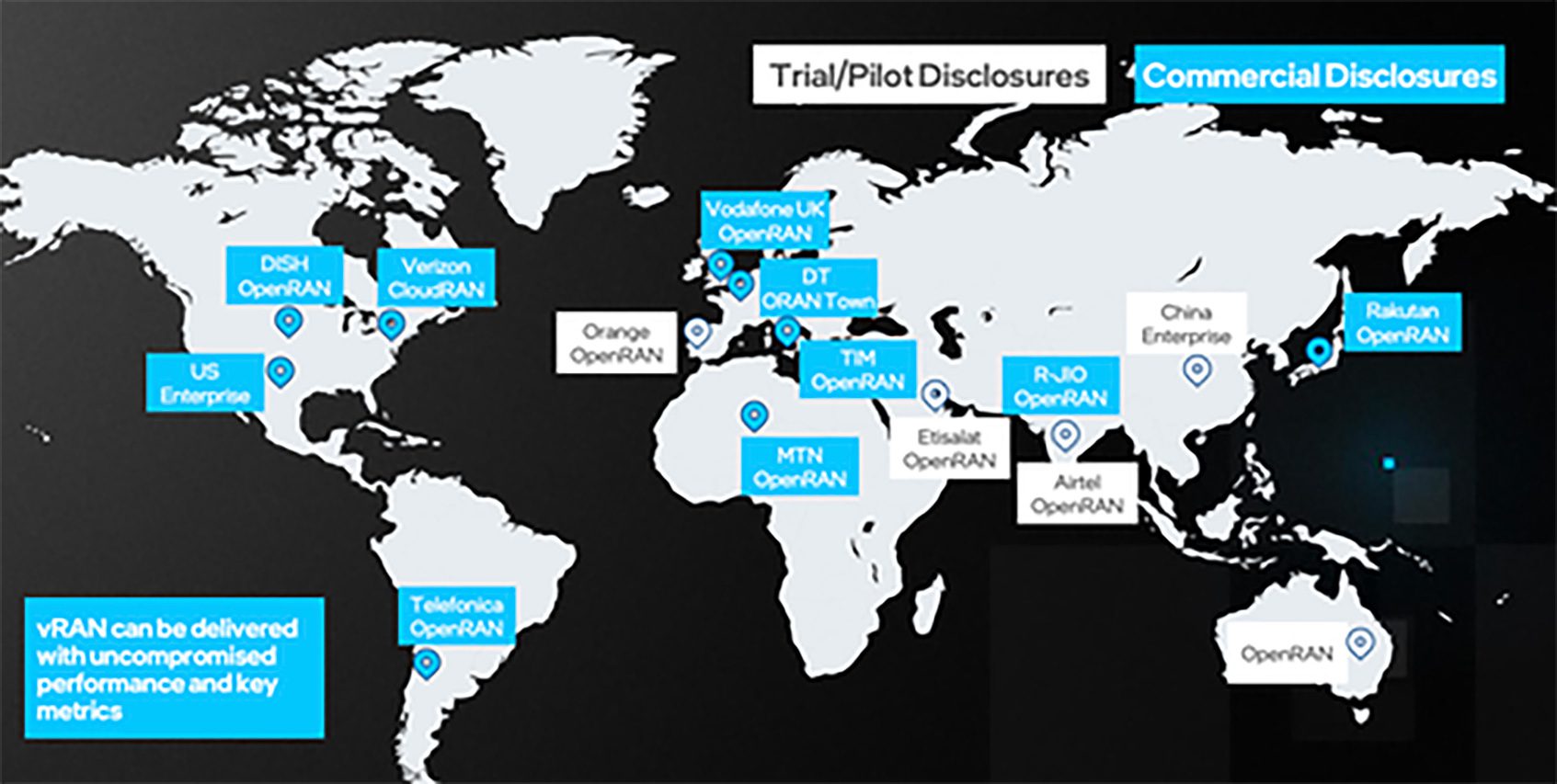

Dell’Oro Group estimates the RAN market is currently generating between $40 billion and $45 billion in annual revenues. The market research firm forecasts that Open RAN will account for 15% of sales in 2026. Research & Markets is more optimistic. They say the Open RAN Market will hit $32 billion in revenues by 2030 with a growth rate of 42% for the forecast period between 2022 and 2030.

As the undisputed leader of microprocessors for compute servers, it’s no surprise that most of the new Open RAN and virtual RAN (vRAN) deployments use Intel Xeon processors and FlexRAN™ software stack inside the baseband processing modules. FlexRAN™ is a vRAN reference architecture for virtualized cloud-enabled radio access networks.

The hardware for FlexRAN™ includes: Intel® Xeon® CPUs 3rd generation Intel® Xeon® Scalable processor (formerly code named Ice Lake scalable processor), Intel® Forward Error Correction Device (Intel® FEC Device), Mount Bryce (FEC accelerator), Network Interface Cards – Intel® Ethernet Controller E810 (code name Columbiaville). Intel says there are now over 100 FlexRAN™ licensees worldwide as per these charts:

Source: Intel

A short video on the FlexRAN™ reference architecture is here.

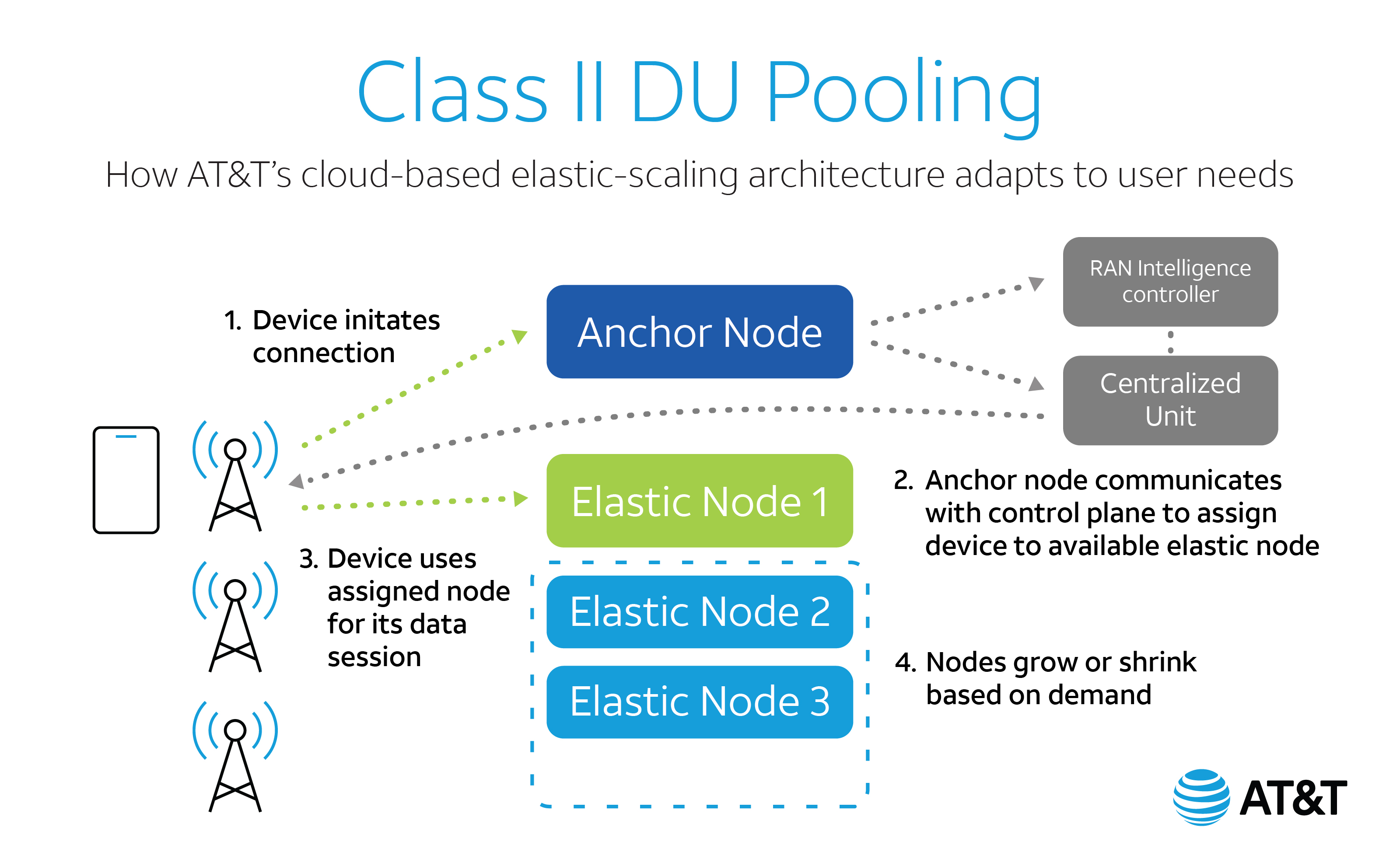

FlexRAN™ got a big boost this week from AT&T. In a February 24, 2022 blog post titled “Cloudifying 5G with an Elastic RAN,” Gordon Mansfield, AT&T VP Mobility Access & Architecture said that “AT&T and Intel had co-developed an industry-leading advanced RAN pooling technology freeing 5G radios from the limitations of dedicated base stations, while enabling more efficient, resilient, and green 5G networks. DU-pooling will eventually be usable by the entire 5G operator community to drive the telecom industry’s goals of green and efficient wireless networks forward.”

DU pooling technology was made possible by combining AT&T’s deep knowledge of Open RAN technologies as one of the co-founders of the O-RAN Alliance with Intel’s expertise in general purpose processors and software-based RAN through its FlexRAN™ software stack running on Intel 3rd generation Intel® Xeon® Scalable processors. The open standards for communications between radios and DUs that were published by O-RAN enabled its development, and the result is a technology demonstrator implemented on FlexRAN™ software.

………………………………………………………………………………………………………………………………………………………………………………..

Intel is now facing new Open RAN competition from several semiconductor companies.

Marvell has just unveiled a new accelerator card that will slot into a Dell compute server (which uses x86 processors). Based on a system called “inline” acceleration, it is designed to do baseband PHY layer processing and do it more efficiently than x86 processors. A Marvell representative claims it will boost open RAN performance and support a move “away from Intel.” Heavy Reading’s Simon Stanley (see below) was impressed. “This is a significant investment by Dell in open RAN and vRAN and a great boost for Marvell and the inline approach,” he said.

Qualcomm, which licenses RISC processors designed by UK-based ARM, has teamed up with Hewlett Packard Enterprise (HPE) on the X100 5G RAN accelerator card. Like Marvel’s offering, it also uses inline acceleration and works – by “offloading server CPUs [central processing units] from compute-intensive 5G baseband processing.”

There is also EdgeQ which is sampling a “Base Station on a Chip” which is targeted at Open RAN and private 5G markets. Three years in the making, EdgeQ has been collaborating with market-leading wireless infrastructure customers to architect a highly optimized 5G baseband, networking, compute and AI inference system-on-a-chip. By coupling a highly integrated silicon with a production-ready 5G PHY software, EdgeQ uniquely enables a frictionless operating model where customers can deploy all key functionalities and critical algorithms of the radio access network such as beamforming, channel estimation, massive MIMO and interference cancellation out of the box.

For customers looking to engineer value-adds into their 5G RAN designs, the EdgeQ PHY layer is completely programmable and extensible. Customers can leverage an extendable nFAPI interface to add their custom extensions for 5G services to target the broad variety of 5G applications spanning Industry 4.0 to campus networks and fixed wireless to telco-grade macro cells. As an industry first, the EdgeQ 5G platform holistically addresses the pain point of deploying 5G PHY and MAC software layers, but with an open framework that enables a rich ecosystem of L2/L3 software partners.

The anticipated product launches will be welcomed by network operators backing Open RAN. Several of them have held off making investments in the technology, partly out of concern about energy efficiency and performance in busy urban areas. Scott Petty, Vodafone’s chief digital officer, has complained that Open RAN vendors will not look competitive equipped with only x86 processors. “Now they need to deliver, but it will require some dedicated silicon. It won’t be Intel chips,” he told Light Reading in late 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Inline vs Lookaside Acceleration:

While Marvell and Qualcomm are promoting the “inline” acceleration concept, Intel is using an alternative form of acceleration called “lookaside,” which continues to rely heavily on the x86 processor, offloading some but not all PHY layer functions. This week, Intel announced its own product refresh based on Sapphire Rapids, the codename for its next-generation server processors.

Simon Stanley, an analyst at large for Heavy Reading (owned by Informa), said there are two key innovations. The first involves making signal-processing tweaks to the Sapphire Rapids core to speed up the performance of FlexRAN™, Intel’s baseband software stack. Speaking on a video call with reporters, Dan Rodriguez, the general manager of Intel’s network platforms group, claimed a two-fold capacity gain from the changes. “In the virtual RAN and open RAN world, the control, packet and signal processing are all done on Xeon and that is what FlexRAN enables,” he said.

The other innovation is the promise of integrated acceleration in future Sapphire Rapids processors. Sachin Katti, who works as chief technology officer for Intel’s network and edge group, said this would combine the benefits of inline acceleration with the flexibility of x86. That is preferable, he insisted, to any solution “that shoves an entire PHY layer into an inflexible hardware accelerator,” a clear knock at inline rivals such as Marvell and Qualcomm. Despite Katti’s reference to inline acceleration, Stanley does not think it is Intel’s focus. “None of this rules out an inline acceleration solution, but it does not seem to be part of the core approach,” he told Light Reading. “The key strategy is to add maximum value to Xeon Scalable processors and enable external acceleration where needed to achieve performance goals.”

Both inline and lookaside involve trade-offs. Inline’s backers have promised PHY layer software alternatives, but Intel has a major head start with FlexRAN™, which it began developing in 2010. That means lookaside may be a lot more straightforward. “The processor is in control of everything that goes on,” said Stanley during a previous conversation with Light Reading. “It is essentially the same software and makes life very easy.”

Larger network operators seemed more enthusiastic about inline during a Heavy Reading survey last year. By cutting out the processor, it would reduce latency, a measure of the delay that occurs when signals are sent over the network. That could also weaken Intel, reducing power needs and allowing companies to use less costly CPUs. “If you use inline, you probably need a less powerful processor and less expensive server platform, which is not necessarily something Intel wants to promote,” Stanley said last year.

References:

https://www.intel.com/content/www/us/en/communications/virtualizing-radio-access-network.html

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

Heavy Reading: How network operators will deploy Open RAN and cloud native vRAN

Heavy Reading conducted an operator survey in association with Quanta Cloud Technology (QCT) to explore how and why operators are likely to deploy Open RAN. The data was collected in November 2021 and includes North American, European and Asian operator respondents in roughly equal proportions.

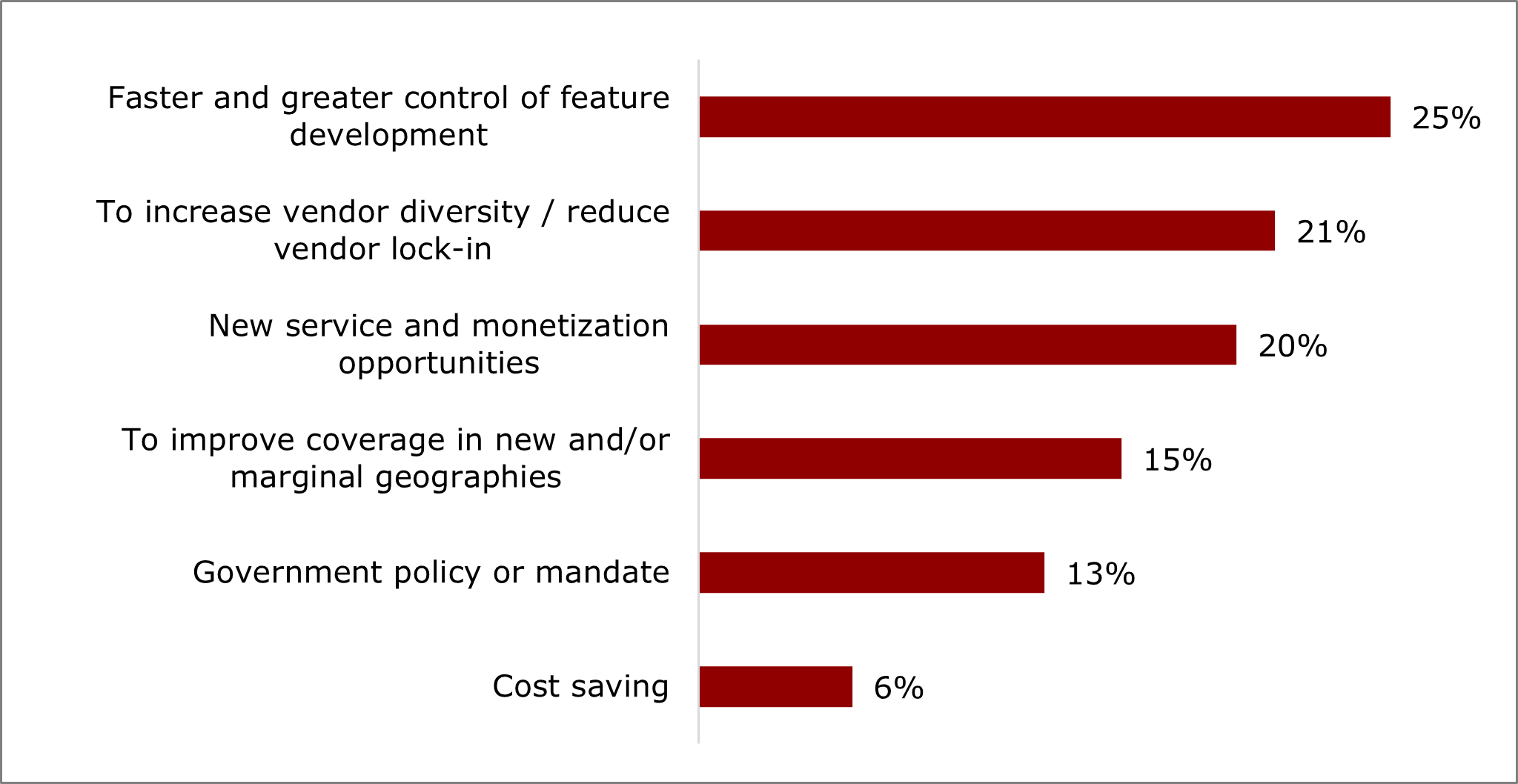

The first question in the survey that asked about the business justification for Open RAN. Here’s the result:

The lead response is for “faster greater control of feature development” with 25%, just ahead of “increase vendor diversity” at 21%, and “new service and monetization opportunities” at 20%.

The absence of an overriding reason to pursue open RAN is consistent with previous Heavy Reading operator surveys. These results indicate the business case will be founded on an accumulation of benefits that will deliver value relative to a classic, single-vendor RAN. They also point to the view that open RAN has not yet found — or at least, has not yet proven — a compelling business justification and that this diversity of views reflects an ongoing search for a business case.

Note that cost savings at 6% of respondents, indicates lower cost is not really a business reason to deploy Open RAN. There are likely two explanations for this:

- Open RAN has a similar bill of materials to classic single-vendor RAN. Ericsson and Nokia say Open RAN is more expensive than integrated, single vendor RAN.

- Operators in leading markets will not compromise on user experience simply to save a small percentage on RAN equipment costs.

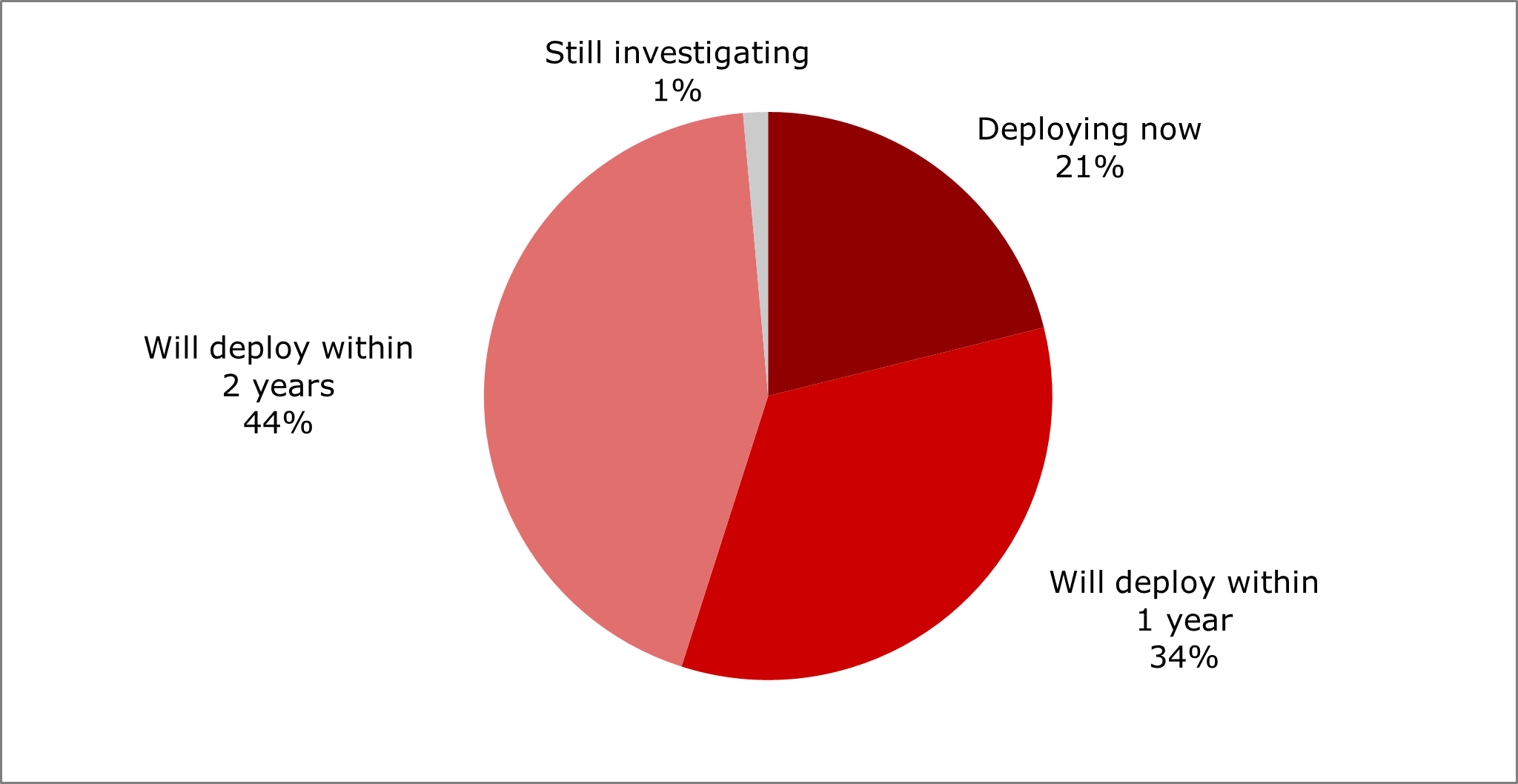

With respect to cloud native vRAN (RAN software that is deployed in containers and centrally orchestrated) the survey asked when operators plan to deploy a containerized Distributed Unit (DU) vRAN application in their commercial network. 21% of respondents said they are “deploying now,” and a further 34% “will deploy within 1 year.”

While this response this looks overly optimistic, containerized DU products are now available and are commercially deployed and operational. Heavy Reading expects deployment of this technology to scale quickly. So even if this data seems too optimistic on the timeline, it is a good indicator of sentiment among operators that are likely to already be positive on vRAN.

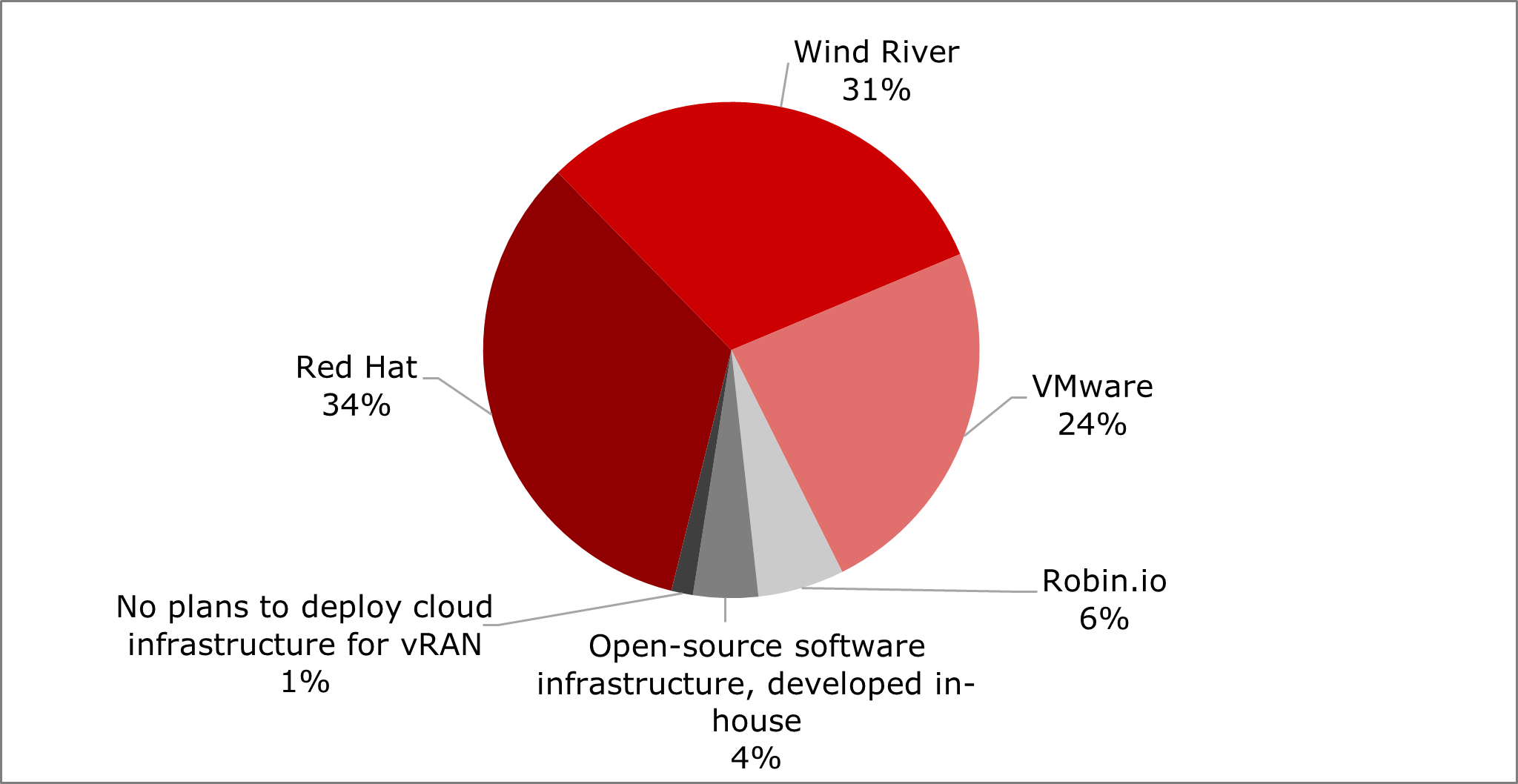

Network operators must deploy RAN software — either in virtual machines, containers or both — on cloud infrastructure. A key question is which software infrastructure platform to use?

The chart below shows three leading operator preferences:

For vRAN software suppliers and DU server vendors that want to help accelerate open vRAN deployments, the three main cloud environments to pre-integrate with appear to be Red Hat, Wind River and VMware.

These are well-known solutions in the telco cloud and core network, and it is logical operators will want to extend their existing telco cloud to the edge to support vRAN. An interesting third option also emerges from this data. Wind River, which offers cloud infrastructure software focused on smaller footprint edge devices that can be optimized for RAN applications, also scores highly at 31%. This is consistent with several Tier 1 operator vRAN deals that reference Wind River publicly.

To learn more about this Heavy Reading operator survey, register for the archived Light Reading webinar on Designing and Deploying Cloud Native Open RAN.

— Gabriel Brown, Principal Analyst, Heavy Reading

……………………………………………………………………………………………………………………………………………………..

A Red Hat survey found that communication service providers (CSPs) now realize the role and benefits of cloud-native network functions (CNFs) and container-based cloud platforms as the means to advance their infrastructures. Benefits include features and efficiency, automation, scalability, and flexibility that will help further lower overall costs. Respondents confirmed their rollout of 5G services would utilize container-based 5G infrastructure, with three-quarters of those respondents indicating the use of container-based platforms in over 25% of their networks by 2022.

In a recent report from Heavy Reading based on a survey of respondents from 77 CSPs, the steady uptick of service providers evolving their RAN has been significant, with the following observations:

-

50% of service providers have deployed a vRAN in over a quarter of their network compared to the fourth quarter of 2019, when only 35% of respondents had achieved the same rollout.

-

vRAN deployment has doubled in service provider 4G-only networks and vRAN in service provider 5G-only networks has increased by 66% since the survey in Q4 of 2019.

-

By the end of 2023 , the above numbers are expected to be flipped, with the majority of service providers deploying vRAN into both their 4G and 5G networks and not 4G alone.

As service providers’ experience with network transformation grows, they are embracing horizontal cloud platforms over vertically integrated solutions. The increased flexibility provided by containers, coupled with automation, can take full advantage of horizontal platforms.

A common cloud-native application platform deployed across any footprint and any cloud provides a simplified operational model and allows greater choice of CNFs. This is important to fit service providers’ business needs and to deploy and scale where needed, so they can make future additions and changes more easily. A Kuberenetes-based platform offers other direct benefits for RAN workloads, such as reduced latency, higher throughput and precision timing.

In summary, service providers are evolving their RAN to deliver new 5G services that are adaptable, scalable and efficient. Successful vRAN deployments will build upon a telco-grade container platform solution that takes automation and flexibility to the next level. With that, disaggregated vRAN architectures can be optimized to deliver the lowest latency and highest performance. This infrastructure needs to be a consistent cloud-native platform that can support multiple RAN functions and that spans the entire service provider network from edge to core to cloud.

Red Hat OpenShift is an application platform that not only boosts developer productivity but can orchestrate both containers and VMs in production environments. OpenShift helps simplify workflows and reduce overall total cost of ownership (TCO). As an answer to ever-changing marketplace demands, Red Hat’s extensive partner ecosystem provides choices to select software functions and hardware from multiple vendors, while accommodating present needs and anticipating those in the future.

References:

https://www.lightreading.com/open-ran/designing-and-deploying-cloud-native-open-ran/a/d-id/774302?

https://www.redhat.com/en/blog/adoption-evolved-vran-propels-network-enhancements

https://www.redhat.com/en/resources/virtualized-ran-insights-2021-analyst-paper

Samsung partners with Orange to deliver 5G vRAN and O-RAN compliant base stations

Samsung Electronics has announced that it is collaborating with the France headquartered telecom operator Orange, to disaggregate the software and hardware elements of traditional RAN. The South Korea based tech giant will provide its virtualized RAN (vRAN), “which has been proven in the field through commercial deployments with global Tier one operators including the U.S.”

As one of the world’s leading telecommunications operators, Orange provides mobile services to 222 million users in 26 countries along with Europe, Africa, and the Middle East. Through this partnership, Samsung and Orange aim to deploy O-RAN Alliance-compliant base stations beginning with rural and indoor configurations and then, expanding to new deployments in the future.

“Open RAN is a major evolution of radio access that requires deeper cooperation within the industry. With our European peers, we want to accelerate the development of Open RAN solutions that meet our needs. After the publication of common specifications, Orange’s Open RAN Integration Center will support the development and tuning of solutions from a broad variety of actors,” said Arnaud Vamparys, Senior Vice President of Radio Access Networks and Microwaves at Orange.

Samsung’s vRAN solutions can help ensure more network flexibility, greater scalability and resource efficiency for network operation by replacing dedicated baseband hardware with software elements. Additionally, Samsung’s vRAN supports both low and mid-band spectrums, as well as indoor and outdoor solutions. Samsung is the only major network vendor that has conducted vRAN commercial deployments with Tier one operators in North America, Europe and Asia.

“We are pleased to participate in Orange’s innovative laboratory,” said Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics. “Through this collaboration, we look forward to taking networks to new heights in the European market, enabling operators to offer more immersive mobile services to their users.”

By opening its Open RAN Integration Center in Châtillon, near Paris, Orange will enable the testing and deployment of networks capable of operating with innovative technologies, which will serve as the backbone of the operator’s future networks. At the center, Samsung and Orange will conduct trials to verify capabilities and performance of Samsung’s vRAN, radio and Massive MIMO radio.

With a vRAN approach, carriers are able to rapidly shift capacity to address customer needs. For business customers, vRAN can drive more efficient access to private 5G networks through easy deployment of baseband software in Multi-access Edge Computing (MEC) facilities.

“We are committed to providing reliable, secure, and flexible network solutions that deliver the power of 5G around the world,” said Magnus Ojert, Vice President, Networks Division, Samsung Electronics America. “We believe vRAN’s next phase of innovation will accelerate what’s possible for society and look forward to collaborating with an industry-leader like Verizon to make 5G a reality for millions in 2021.”

Samsung says they have “pioneered the successful delivery of 5G end-to-end infrastructure solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.”

References:

https://news.samsung.com/global/samsung-and-orange-collaborate-to-advance-5g-networks-to-a-new-level

https://www.samsung.com/global/business/networks/products/radio-access/virtualized-ran/

Samsung’s 5G vRAN adoption could be a key turning point for the industry

Samsung vRAN to power KDDI 5G network in Japan

Samsung will deploy its cloud-native, fully virtualized Radio Access Network (vRAN) in KDDI’s 5G network, following the successful completion of a 5G Standalone (SA) call using Samsung’s vRAN and another vendor’s 5G Massive MIMO radios. Among other capabilities, virtualized networks will enable 5G network slicing. Samsung and KDDI will begin trials in Q1 of 2022, and start commercial deployment in the second half of 2022.

“We are delighted to extend our collaboration with Samsung and to become the first operator in Japan to use their 5G vRAN solutions, which are currently delivering superior performance in commercial networks,” said Kazuyuki Yoshimura, Chief Technology Officer of KDDI. “We believe in the power of virtualization, and this collaboration serves as a meaningful catalyst for driving the next phase of 5G innovation, and advancing our networks to offer best-in-class 5G services.”

With its latest 5G vRAN technology, Samsung brings a range of improvements to KDDI’s network. By replacing dedicated baseband hardware with software elements, vRAN offers more deployment flexibility, greater scalability and improved resource efficiency in network operation. With its cloud-native, container-based architecture, Samsung’s vRAN also simplifies end-to-end network management through automation, allowing operators to quickly introduce new services with minimal impact on deployment.

“With commercially-proven performance and reliability, our vRAN is an attractive technology option for operators — from both the deployment and operational perspectives,” said Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics.

“We are excited to mark another milestone with KDDI, following previous network collaborations that include the commercialization of 5G in 2020, and the rollout of 700MHz 5G in 2021. We look forward to our ongoing work with KDDI to bring new 5G innovations to their customers.”

Virtualized networks will play a key role in supporting KDDI’s pursuit of new 5G use cases and next-generation capabilities. Last year, Samsung and KDDI demonstrated how 5G end-to-end network slicing could play a key role for mobile operators by enabling the creation of multiple virtual networks within a single physical network infrastructure.

Samsung has been at the forefront of vRAN leadership around the world, unveiling its fully virtualized 5G RAN in 2020, followed by successful commercialization with a Tier 1 operator in the U.S. In June 2021, the company was selected by a major European operator to bring vRAN to the U.K.

Samsung recently demonstrated its vRAN capability to support Massive MIMO radios on mid-band, reaching multi-gigabit speeds. The company also teamed with a Tier 1 U.S. operator to complete an end-to-end 5G vRAN trial over C-Band in a live network environment, demonstrating vRAN performance equal to that of traditional hardware-based equipment.

References:

https://news.samsung.com/global/samsung-and-kddi-to-bring-5g-vran-to-japan

Huawei CTO Says No to Open RAN and Virtualized RAN

Paul Scanlan, CTO of Huawei Carrier Business Group made clear what everyone already knew- that the Chinese tech giant doesn’t support Open RAN or Virtualized RAN (vRAN). On a media call today, Scanlan noted that Open RAN has a lot of problems: It isn’t standardized, it can’t be easily integrated with existing network infrastructure, and it’s not ready for the most intense period of 5G deployments coming up with 5G SA core networks.

“It’s not that it’s not going to happen, and I believe it will in different guises but I’m not sure whether … from a commercial perspective, is it too late practically? The challenge is it’s not standardized. It’s an association. Because things are not standardized, no standards, you don’t get cooperation, you don’t get competition, you don’t get innovation to drive this,” Scanlan said, describing groups such as the O-RAN Alliance as “just a bunch of friends.”

Absent standardization, technologies like open RAN become fragmented and lack interoperability — two outcomes that most network operators are unwilling to accept, according to Scanlan.

The IEEE Techblog has noted from day one that neither the O-RAN Alliance or TIP Open RAN project are standards development organizations (SDOs). Worse, is they don’t even have liaisons with ITU-R, ETSI, or 3GPP which are (although 3GPP specs must be transposed by SDOs like ETSI or submitted to ITU-R WP 5D to become binding standards).

In June, Scanlan told Asia Times that Huawei has already built enterprise networks for 2,000 manufacturing companies and plans to build 16,000 next year. The Chinese tech giant has also built 5,300 private networks for mining companies, Scanlan stated. Today, he said that the real cost for network operators is opex, rather than capex.

“The telecom operator’s problem is not capex, it’s actually opex,” he said, adding that opex eats up about 65% of the average cost per site for site rental, backhaul, and energy. RAN comprises about 12% of opex costs per site on average, he said. The implication is that Open RAN opex will be higher than that of conventional RANs with purpose built network equipment from legacy base station vendors.

Another challenge for open RAN involves security and point of responsibility. That’s because of many more exposed interfaces between different vendor equipment. In a typical open RAN deployment “you’ve got three or four vendors all providing components (modules) that are going to be patched together. Scanlan asked, “Who’s responsible for making sure that it’s going to be secure or it’s going to deliver” on performance and fall in line with guaranteed operating costs?”

“Everybody says from a cybersecurity perspective it’ll be more secure. Well, I don’t agree with that. I mean, who’s going to be responsible?”

Critics of O-RAN argue that the much-touted alternative to Huawei will be costly, cumbersome and ineffective. Henry Kressel wrote in Asia Times on December 29, 2020:

O-RAN proposes to open up only part of the proprietary wireless network, namely the part that goes from the antenna to the delivery of transportable data packets to the extended interconnection network that routs the packets to their ultimate destination. These functions are currently performed using equipment and software proprietary to each equipment vendor.

This is a big ,multiyear project that requires the collaborative efforts of industry and governments. These technologies are complex and require extremely high levels of reliability – hence, extensive and costly testing.

The O-RAN Coalition has recommended that US federal sources put $1 billion into the project. But even if government money is forthcoming, it will be only the beginning of a costly development project. One estimate from a reliable industry expert states that at least five years might be needed before competitive products meeting the new standards could reach the market.

“So many people just throw out (?) virtualization or throw out (?) vRAN, or open RAN, and all the rest for different types of reasons,” he said. “If you’ve not been either developing the technology or you’re not at the operator’s point to understand the challenges and the pain points of each of them, then often a lot of the reasons why we want to do something is perhaps for political reasons [1.] and just haven’t been very well thought out.”

Note 1. Many believe the motivation and impetus for Open RAN is to permit new base station vendors, particularly skilled in virtualization software, to enter the 4G/5G market. Two particular politically inspired vendor targets are Huawei and ZTE who are not permitted to join either O-RAN or TIP projects.

Of course there are also performance issues with the commoditized chips that will be used for Open RAN. Several years ago, Huawei explored the use of commoditized silicon in its 5G network equipment, but “the problem was that the jitter at the substrate level was too high. It would not achieve the targets that we wanted in terms of latency, so we had to develop the chip ourselves,” Scanlan said.

“For virtualized RAN, what do you want to do with virtualization, what’s the target objective? When we put things in a cloud the first thing we’re really trying to do is create flexibility and resource scaling. And because it’s software driven, we’re able to change those things and downstream everything can operate from it,” Scanlon explained.

“Within the next two or three years, there are no commercial opportunities for open RAN because of technological maturity,” Victor Zhang, Huawei’s vice president, told Light Reading when asked what Huawei was doing to support the concept. “There is still a long way to go with open RAN.”

One problem is that the general-purpose processors used in open RAN baseband equipment are less power-efficient than customized gear. Huawei summed this up in 2019. “There is a specific R&D team doing research on using white boxes with Intel CPUs [central processing units] in 4G basestations and the power consumption is ten times more,” said Peter Zhou, the chief marketing officer of Huawei’s wireless products line, at a London event. “5G is [even] more complicated and an Intel CPU gives you a problem with jitter. In terms of existing CPU technology, we haven’t seen the possibility of using that with 5G basestations.”

John Strand, the CEO of Strand Consult, thinks it inconceivable that Huawei is not privy to the O-RAN Alliance’s activities. Smaller Chinese vendors could even be representing Huawei, he has suggested. It seems highly likely that links between China Mobile and Huawei are much stronger than connections between a European operator and its main supplier.

References:

https://www.sdxcentral.com/articles/news/huawei-cto-disses-virtualized-open-ran/2021/09/

Dell’Oro Group increases Open RAN radio and baseband revenue forecast

Assessment: Nokia and Samsung tout new equipment for Open RAN and Virtual RAN

For years, Huawei, Ericsson, Nokia, Samsung and ZTE supplied most of the wireless network infrastructure equipment (base stations, small cells, core network, etc) for building cellular networks and mobile operators can only pick one for each part of their network. That may change with the movement of legacy telecom equipment companies like Nokia and Samsung announcing Open RAN products.

Nokia today became the first major telecom equipment maker to commit to adding open interfaces in its products that will allow mobile operators to build networks that are not tied to a vendor. It’s Open Radio Access Network (Open RAN), aims to reduce reliance on any one vendor by making every part of a wireless 3G/4G/5G base station modular and interoperable which permits network operators to choose different suppliers for different components. The company bolded stated in its press release:

“Nokia Open RAN (O-RAN) solutions will deliver world-class performance and security to the O-RAN ecosystem.”

As part of its implementation plan, Nokia plans to deploy Open RAN interfaces in its baseband and radio units, a spokesman said. An initial set of Open RAN functionalities will become available this year, while the full suite of interfaces is expected to be available in 2021, the company said.

Nokia, unlike other Ericsson, Huawei, and other base station vendors, has participated in the development of open RAN technology and have joined the O-RAN Alliance and TIP Open RAN project.

The Finnish telecom giant (which includes what’s left of Alcatel-Lucent) promised an initial set of O-RAN functionalities this year and a “full suite” of O-RAN-defined interfaces in 2021. Nokia’s press release, made no mention of external partners/customers.

“Several operators have now committed to Open RAN, due to the enhanced flexibility that O-RAN can bring. New operators are fully committing to Open RAN and alternative hardware vendors throughout their networks, and legacy operators are using O-RAN to create opportunities for innovative new products to fit into their complex networks. This overall trend strengthens the ecosystem and allows for specialty radios to address the infinite variety of real-world applications. Nokia is the only major vendor that has fully committed to actively developing the O-RAN interfaces, ensuring that its 5G RAN solutions will support the future open ecosystem the operators are seeking,” said Joe Madden, a principal analyst at Mobile Experts.

Tommi Uitto, President of Mobile Networks at Nokia, said: “Nokia is committed to leading the open mobile future by investing in Open RAN and Cloud RAN solutions with the aim of enabling a robust telecom ecosystem with strong network performance and security. Nokia’s Cloud RAN solution leads the market and is continuing to evolve to a cloud-native architecture. We have the scale and capabilities to address the increased customer demand for this technology, underpinned by the world-class network performance and security that only Nokia can deliver.”

………………………………………………………………………………………………………………………………………..

Samsung followed Nokia’s announcement today, announcing RAN products that are fully “virtualized” baseband and radio units. The South Korean conglomerate said in its press release that it’s fully-virtualized 5G Radio Access Network (vRAN) solution will be commercially available this quarter.

“The solution provides a new option for mobile operators seeking improved efficiencies, cost savings, and management benefits from deploying a software-based 5G radio infrastructure,” according to that press release.

Samsung’s 5G vRAN consists of a virtualized Central Unit (vCU), a virtualized Distributed Unit (vDU), and a wide range of radio units to enable a smooth migration to 5G. By replacing the dedicated baseband hardware used in a traditional RAN architecture with software elements on a general-purpose computing platform, mobile operators can scale 5G capacity and performance more easily, add new features quickly, and have flexibility to support multiple architectures. Samsung’s vRAN solution operates on x86-based COTS servers, either with or without hardware accelerators depending on factors such as total bandwidth. The company said:

“When combined with Samsung’s virtualized 4G/5G Core (network), the operator will be able to implement an end-to-end software-based radio and core network running on COTS x86 servers.”

Samsung already commercialized its virtualized Central Unit (vCU) in April 2019, which operates in live networks in Japan, South Korea, and the U.S. The new 5G vRAN solution has expanded to include a virtualized baseband or Distributed Unit (vDU).

“Samsung’s 5G vRAN validates a software-based alternative to vendor-specific hardware, while offering high performance, flexibility, and stability,” said Jaeho Jeon, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “Once the solution becomes commercially available this quarter, we look forward to providing carriers with additional architectural options for building innovative and open 5G networks.”

“Samsung is a big believer in open systems,” explained Alok Shah, Samsung’s VP of strategy, marketing and business development. “It’s what our customers are asking for.”

“Now, more than ever, mobile operators recognize the need for quality-driven, flexible, scalable, and cost-efficient network architectures while planning for 5G network success,” said Peter Jarich, Head of GSMA Intelligence. “RAN virtualization will be an important tool in helping to deliver on those demands and Samsung’s continuing vRAN innovation positions it well to deliver.”

Derek Johnston, Samsung’s head of marketing and 5G business development for the Networks unit, said the company completed a final validation test performed for customers this past April. The press release said: “Samsung demonstrated its vRAN capabilities to customers in April 2020, proving the feasibility of full virtualization by operating 5G New Radio (NR) baseband functions in software running on an x86-based COTS server.”

…………………………………………………………………………………………………………………………………………………

Samsung is a RAN equipment supplier to cellular networks in Korea, U.S., and most recently Japan, where the majority of worldwide 5G subscribers are currently located. In addition, Samsung is further expanding its global footprint rapidly to new markets from Europe to Canada and New Zealand. It has recently closed contracts with Videotron and Telus in Canada, KDDI in Japan and Spark in New Zealand.

In the U.S., it is one of the suppliers for AT&T and Verizon’s 5G networks. Earlier this year the South Korean vendor received a 5G RAN contract with U.S. Cellular. Field trials of the vRAN kit will happen with North American customers in the second half of 2020, according to Johnston.

………………………………………………………………………………………………………………………………………………

Assessment, Comment and Analysis:

1. Samsung is a smaller player in the RAN market, so likely is going after greenfield or brown field carriers with its Open RAN offerings. Perhaps, U.S. rural wireless carriers will be fertile ground for the Korean giant, as many have been forced to “rip and replace” Huawei gear.

Samsung named several technology partners, including Qualcomm, HPE, Marvell and Xilinx for its base station products. Samsung, for example, has a deal with HPE to work on 5G core software and edge computing offerings, according to Mike Dano of Light Reading. For many years, we have been very skeptical about vRANs for many reasons. While it would greatly reduce the cost and OPEX of dedicated, purpose built RAN infrastructure equipment, it represents a single point of failure, an exponentially enlarged malware attack target, and lower performance, especially latency and jitter (delay variation) requirements for critical real time applications.

2. Nokia made no reference to other firms (partners or customers) in its O-RAN announcement today. In May, the company said it had joined the Open RAN Policy Coalition to help enable a comprehensive and secure approach to 5G and future network generations.

One has to wonder if Nokia is using their O-RAN/Open RAN Policy Coalition announcements as an optional check-off item for wireless carriers that will buy purpose built RAN equipment today, but want the option of going Open RAN in the future, when the smoke clears?

Much more significant is potential multi-vendor interoperability problems with Open RAN. There are two independent consortiums generating open source hardware/software specs for it (the O-RAN Alliance and TIP Open RAN project), which have some sort of undescribed relationship.

In an earlier Techblog post, we noted that two vendors from the O-RAN Alliance had to generate their own spec for an O-RAN radio and its interface to the baseband module.

I always thought that an open hardware project (e.g. O-RAN Alliance) would completely specify all hardware modules (like OCP does). In this case, radios used in 4G/5G cellular networks within an Open RAN environment. Evidently, I was wrong!

The Open RAN interoperability problem is highlighted by these two quotes in that article:

“Very few companies are participating in the current (OpenRAN) supply chain and mostly offering proprietary radio solutions lacking open interfaces that are not interoperable with other network elements. In addition, the requirement to procure products from trusted vendors in the US market is also causing operators to reconsider supplier options. OpenRAN radios provide new possibilities for operators to implement a secure, cost effective and best of breed solution as networks move to 5G and beyond.”

Parallel Wireless CEO Steve Papa commented to Light Reading that Open RAN (aka O-RAN) “will only be as good as the radios that are available,” he said. “If Ericsson and Nokia are struggling to be competitive with Huawei’s radios, we should not expect O-RAN to magically solve this problem by using the same semiconductors available to Ericsson and Nokia at present.”

Until it can demonstrate full interoperability between its own products and those made by other O-RAN suppliers, Nokia (along with every other Open RAN supplier) will find it quite difficult to sell O-RAN products.

References:

https://www.fiercewireless.com/tech/samsung-unveils-commercial-5g-vran

NEC and Mavenir collaborate to deliver 5G Open vRAN platform

NEC Corp. and Mavenir entered a collaboration agreement to deliver a 5G Open virtualized RAN (vRAN) platform to the Japanese enterprise market. This move will open up Local/Private 5G Network opportunities for enterprises, regional authorities and other organizations, according to the companies.

Under this collaboration, NEC and Mavenir said they will jointly work on 5G Open vRAN and Local 5G business developments and create a simple and cost-efficient ecosystem in the market. The collaboration will bring together NEC’s expertise in IT, network and system integration and Mavenir’s cloud-native network technology.

Editor’s Note:

Moving to a virtual RAN (vRAN) may offer operators important benefits, including a reduced capital expenditure (CAPEX) and operational expenditure (OPEX) over time. Additionally, RAN transformation can be boosted by network functions virtualization (NFV) technology, which changes the typical network architecture from hardware-based to software-defined infrastructure and decouples the baseband functions from the underlying hardware. In turn, the architecture is more flexible, agile, and easier to maintain, allowing operators to launch new services to market faster than ever before.

Cisco created and announced Open vRAN at Mobile World Congress 2018. Conversations with key network operator customers, as well as our partners, made it apparent that something needed to change and they thought we could help. Since then, it’s been a whirlwind ride – working with customers to better define this future and the key elements, building solutions with our partners, innovating in the market to explore new service designs, and contributing to the process of defining industry specifications.

On that last topic, sometimes there is a little confusion between Open vRAN and O-RAN due to the similar names and similar principles. The naming similarity was coincidental, but not surprising, given both are fairly descriptive of the opportunity. O-RAN (Open RAN Alliance) describes themselves well on their website: “The O-RAN Alliance was founded by operators to clearly define requirements and help build a supply chain eco-system to realize its objectives.” They have extensive details available on their website and in their whitepaper.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Mavenir delivers an Open vRAN platform that provides strategic differentiation by enabling multi-source Remote Radio Units (RRUs) to interwork with the virtualized, containerized, Cloud Base Band software over Ethernet Fronthaul (FH), using the O-RAN open interface, overcoming the traditional constraints of the proprietary walled garden specifications used by the other traditional equipment vendors.

“We are excited to collaborate with NEC, as we move together toward open, virtualized networks,” said Pardeep Kohli, Mavenir’s President and CEO. “Mavenir’s vRAN and NEC’s radio naturally come together to quickly and easily bring new and innovative solutions to the Japanese Enterprise Market.”

NEC actively promotes an open, virtualized infrastructure model in support of the 5G era, using IT, orchestration and network expertise. Moreover, the NEC ecosystem contributes to vRAN via inter-operability testing between multiple vendors’ equipment that is compliant with O-RAN fronthaul specifications.

“The combination of advanced assets and expertise from Mavenir and NEC will enable us to offer end-to-end one-stop 5G Open vRAN and Local/Private 5G solutions, including an advanced 5G network solution for the ecosystem, and vertical solutions that meet the needs of a great variety of Enterprise customers.” said Nozomu Watanabe, senior vice president at NEC.

This joint collaboration will continue to provide value-added products for customers worldwide. An overview of this collaboration will be introduced during MWC Barcelona 2020 (assuming the event is not cancelled as is rumored now) at the NEC booth, Hall 3, 3M30.

……………………………………………………………………………………………………………………………………………………….

About Mavenir:

Mavenir is the industry’s only end-to-end, cloud-native Network Software Provider focused on accelerating software network transformation and redefining network economics for Communications Service Providers (CSPs) by offering a comprehensive end-to-end product portfolio across every layer of the network infrastructure stack. From 5G application/service layers to packet core and RAN, Mavenir leads the way in evolved, cloud-native networking solutions enabling innovative and secure experiences for end users. Leveraging industry-leading firsts in VoLTE, VoWiFi, Advanced Messaging (RCS), Multi-ID, vEPC and OpenRAN vRAN, Mavenir accelerates network transformation for more than 250+ CSP customers in over 140 countries, which serve over 50% of the world’s subscribers.

We embrace disruptive, innovative technology architectures and business models that drive service agility, flexibility, and velocity. With solutions that propel NFV evolution to achieve webscale economics, Mavenir offers solutions to help CSPs with revenue generation, cost reduction, and revenue protection. Learn more at www.mavenir.com

References:

https://mavenir.com/press-releases/nec-and-mavenir-deliver-5g-open-vran-solution/

https://www.telecompaper.com/news/nec-mavenir-collaborate-to-deliver-5g-open-vran-platform–1326379

https://blogs.cisco.com/sp/the-open-vran-wave-is-building