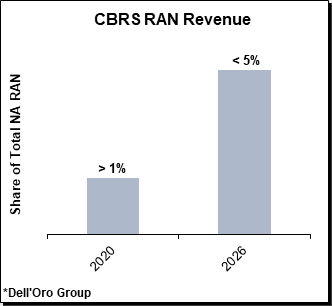

Dell’Oro: CBRS RAN is Behind Schedule: <5% of NA RAN by 2026

With all the air coming out of the next gen cellular hype balloon, Dell’Oro’s report that CBRS RAN is not living up to expectations comes as no surprise. Think about the failed promise of 5G since there is no standard or spec for URLLC in the RAN. Or all the terrific 5G functions and features (including network slicing and security) which are ONLY made possible with a 5G SA core network (very few have been deployed). Or that there is no standard (revision of M.1036) for the mmWave frequencies to be used for 5G.

Dell’Oro says that CBRS adoption continues to increase, but it is significantly below expectations. That’s driven primarily by diverging trends between fixed wireless access (FWA) and non-FWA including public and private LTE/5G NR.

“Adoption gaps across the various CBRS segment remained significant in 2021,” said Stefan Pongratz, Vice President and analyst with Dell’Oro Group. “We have again revised the CBRS RAN projections downward to reflect the lower baseline and slower-than-expected uptake with non-FWA segments. This adjustment does not change the long-term vision—we continue to believe that there is an opportunity to improve spectrum utilization while at the same time stimulating innovation for both public and private networks across various industry segments. So we see this downward revision more as a calibration to reflect the current state of the market and the fact that there is still a significant gap between registered SAS APs and LTE/5G NR base stations,” continued Pongratz.

Source: Counterpoint Research

Other highlights from the CBRS RAN Advanced Research Report:

- LTE is projected to drive the lion share of the investments over the near term while 5G NR based CBRS capex will dominate by 2026.

- CBRS RAN revenues are expected to account for less than 5 percent of North America RAN by 2026.

- Fixed Wireless Access and capacity augmentation for Mobile Broadband (MBB) applications are dominating the CBRS RAN capex mix initially while the enterprise share is expected to improve in the outer part of the forecast period.

Pongratz’s comments were echoed by Norman Fekrat of CBRS vendor Imagine Wireless. In a recent YouTube presentation, Fekrat said that sales of CBRS-based private wireless networking equipment and services to enterprises have been sluggish.

He attributed that in part on the complexities around the technology to use CBRS spectrum. He said the telecom industry in general needs to smooth the sales process for enterprises looking to build their own private wireless networks using CBRS spectrum.

According to Pongratz, there’s a wide range of vendors selling CBRS-capable hardware and software. He said companies like Baicells, BliNQ Networks, Airspan Networks, Telrad Networks and Cambium Networks sell equipment into the FWA market, while companies like Ericsson, Nokia and Samsung have been supplying CBRS equipment into the market for mobile networks.

Verizon was the biggest spender during the FCC’s 3.5GHz CBRS spectrum auction (#105) in 2020, paying almost $1.9 billion for 557 licenses in markets across the U.S. We reported that they planned to test carrier aggregation in the CBRS band, but don’t know if that ever happened. Instead, Verizon’s attention has since shifted following the massive $53 billion it spent in the FCC’s C-band spectrum auction last year. Verizon recently lit up C-band services that covers ~ 95 million people.

Dish Network was another major CBRS spectrum buyer, but they too have not started a major buildout of its CBRS spectrum holdings.

Among the cablecos/MSOs, Comcast, Charter Communications, Cox Communications and others spent millions of dollars on licenses in the auction. However, Charter is the only cable company that has discussed any major efforts to construct a network in the spectrum. Charter may provide additional details on its CBRS efforts during its fourth quarter earnings conference call scheduled for Friday (January 28th).

Financial analysts at New Street Research believe that’s a mistake. “Deployed spectrum has strong long-term strategic benefits. Developing expertise in wireless networking will take years,” they wrote in a note to investors this week. “We think Comcast should be making hard investments in wireless infrastructure now.”

Dell’Oro Group’s Advanced Research: Citizen Broadband Radio Service (CBRS) Report offers an overview of the CBRS LTE and 5G NR potential with a 5-year forecast for the CBRS RAN market by technology, location, and market. For more information about the report, please contact us at [email protected].

References:

https://www.lightreading.com/5g/cbrs-isnt-living-up-to-expectations—delloro-group/d/d-id/774899?

FCC CBRS Auction for 5G mid-band spectrum in the 3.5GHz band

FCC permits Verizon to test 5G and carrier aggregation in CBRS spectrum band