IDC Worldwide Private LTE/5G Wireless Infrastructure Forecast reveals 4G-LTE Dominates

The global private LTE/5G wireless infrastructure market is forecast to reach revenues of $8.3 billion by 2026, an increase compared to revenues of $1.7 billion in 2021, according to new research from International Data Corporation (IDC). IDC said that this market is expected to achieve a five-year compound annual growth rate (CAGR) of 35.7% over the 2022-2026 forecast period.

The report, Worldwide Private LTE/5G Infrastructure Forecast, 2022-2026 (IDC #US48891622), presents IDC’s annual forecast for the private LTE/5G wireless infrastructure market. The forecast includes aggregated spending on RAN, core, and transport infrastructure as well as spending by region; it excludes services or publicly owned and operated networks that carry shared data traffic. The report also provides a market overview, including drivers and challenges for technology suppliers, communication service providers, and cloud providers.

IDC defines private LTE/5G wireless infrastructure as any 3GPP-based cellular network deployed for a specific enterprise/industry vertical customer that provides dedicated access to private resources. (Yet IDC does not state what 3GPP Release(s) or whether necessary 5G capabilities, like specs for URLLC have been completed and performance tested). This could include dedicated spectrum, dedicated hardware and software infrastructure, and which has the ability to support a range of use cases spanning fixed wireless access, traditional and enhanced mobile broadband, IoT endpoints/sensors, and ultra-reliable, low-latency applications.

“Enterprise or industry verticals, such as manufacturing, retail, utilities, transport, and public safety are leading the charge for private LTE, and eventually private 5G networks, driven by a desire to capture productivity gains, enable automation, and improve customer experience. While the demand metrics are relatively understood, the emerging private cellular ecosystem presents several road maps, each with particular advantages and disadvantages. While an enterprise (within any industry vertical) will eventually need to assess its own needs internally, understanding the implications from each road map can provide a starting point,” said Patrick Filkins, IDC senior research analyst, IoT and Mobile Network Infrastructure.

“The private LTE/5G wireless market showcased in 2021 that although its growth is somewhat immune to macro challenges associated with the global pandemic, it still requires a significant amount of market-level solutioning to address the pain points associated with unlocking the full 5G solution. This includes curating and scaling a robust set of 5G device platforms, which still requires more work across the ecosystem, particularly as it relates to vertical-specific solutioning,” Filkins added.

IDC noted that the worldwide market for private LTE/5G wireless infrastructure continued to gain traction throughout 2021. The research firm highlighted that private 4G-LTE remained the predominant private cellular network revenue generator during 2021. However, Private 5G marketing, education, trials, and new private 5G products and services also began to see market availability. IDC also said that most private 5G projects to date remain as either trials or pre-commercial deployments.

“Heightened demand for dedicated or private wireless solutions that can offer enhanced security, performance, and reliability continue to come to the fore as both current and future applications, particularly those in the industrial sector, require more from their network and edge infrastructure. While private LTE/5G infrastructure continues to see more interest, the reality is 5G itself continues to evolve, and will evolve for the next several years. As such, many organizations are expected to invest in private 5G over the coming years as advances are made in 5G standards, general spectrum availability, and device readiness,” Filkins said.

The report forecasts that the market for 5G private networks will reach $47.5 billion in 2030, up from $221 million last year, while the total market for 4G private networks will go from $3.54 billion in 2021 to $66.88 billion in 2030. IDC also noted that the global spending on smart manufacturing will expand from $345 billion in 2021 to more than $950 billion in 2030.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

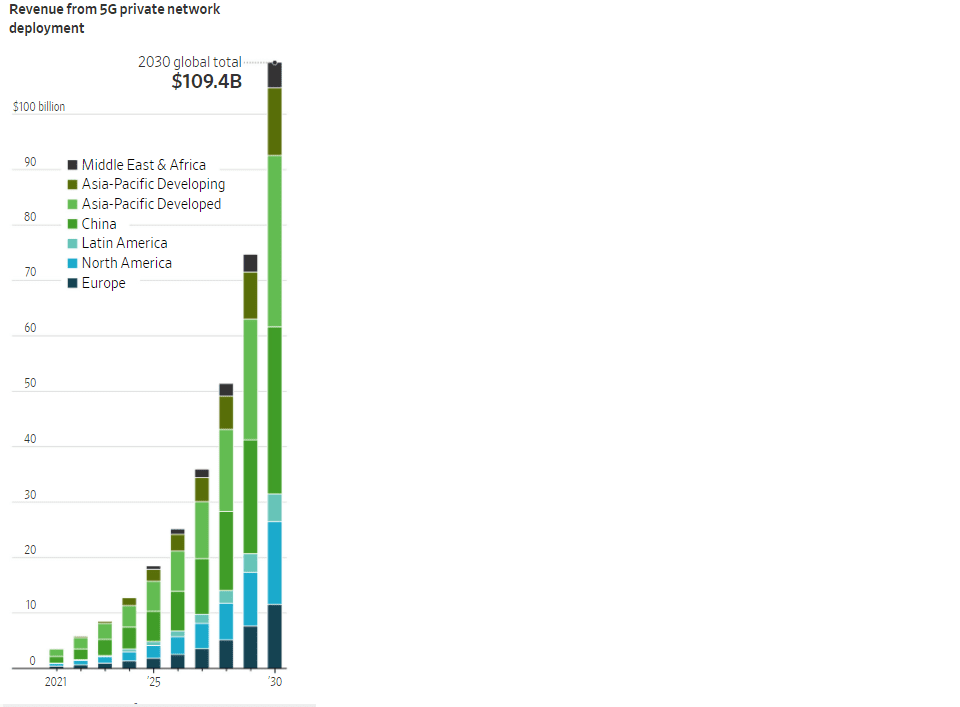

The total addressable market for private networks – including the Radio Access Network, Mobile-access Edge Computing (MEC), core, and professional services – is forecast to increase from $3.7 billion in 2021 to more than $109.4 billion in 2030, according to a recent report by ABI Research. However, a quote in the article introducing that report was dead wrong:

“While the Third Generation Partnership Project (3GPP) has frozen Release 16 (standardizing Ultra-Reliable Low-Latency Communication (URLLC)), Release 16-capable chipsets and devices have not yet emerged in the market. As enterprises require Time-Sensitive Networking (TSN), as well as high availability and reliability of their connection, they are reliant on Release 16 and are, therefore, waiting for compatible chipsets and infrastructure to enter the market. As this is not expected to happen until 2023, enterprise 5G will mature much more slowly than previously anticipate,” ABI Research said.

–>THAT IS BECAUSE EVEN THOUGH 3GPP RELEASE 16 WAS FROZEN IN JUNE 2020, “URLCC IN THE RAN” SPEC WAS NOT COMPLETED AT THAT TIME. Before that spec can be implemented, it must be independently tested to ensure it means the ITU-R M.2410 performance requirements for BOTH ultra high reliability and ultra low latency corresponding to the 5G URLLC use case. As of 16 March 2022 (today), 3GPP Release 16 URLLC in the RAN is only 74% complete!

| 830074 | NR_L1enh_URLLC | Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) | 74% | Rel-16 | RP-191584 |

ABI also noted that the global spending on smart manufacturing will expand from $345 billion in 2021 to more than $950 billion in 2030.

Note: 2022 to 2030 are forecasts. Source: ABI Research

“As manufacturers advance their digital transformation initiatives, they drive up spending on smart manufacturing with investments in factories that adopt Industry 4.0 solutions like Autonomous Mobile Robots (AMRs), asset tracking, simulation, and digital twins,” ABI said. ” While most of the revenue today is attributed to hardware, the greater reliance on analytics, collaborative industrial software, and wireless connectivity (Wi-Fi 6, 4G, 5G) will drive value-added services revenue — connectivity, data and analytic services, and device and application platforms — to more than double over the forecast.”

Meanwhile, Dell’Oro Group VP Stefan Pongratz wrote in an email to this author,” We have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

About IDC:

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,200 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48948422

https://www.idc.com/getdoc.jsp?containerId=US48891622

Global market for private networks to exceed $109 billion in 2030: Study

https://www.3gpp.org/DynaReport/GanttChart-Level-2.htm (Release 16)