LTE

Nokia’s Bell Labs to use adapted 4G and 5G access technologies for Indian space missions

Nokia’s Bell Labs is receptive to collaborating with the Indian Space Research Organization (ISRO), government agencies, and private players in India’s space sector to support future lunar missions with 4G, 5G and other advanced wireless networking technologies. Thierry Klein, President of Bell Labs Solutions Research, visited India in late June to explore potential partnerships and deepen engagement with the country’s growing space ecosystem. In an interview with Moneycontrol, Klein said India’s space ambitions present a compelling opportunity for collaboration.

“We are in a lot of conversations globally, working with government agencies and private companies to see how we can support their missions from a communications perspective. This is really the reason why I came to India—because it is a great opportunity for me to learn more about the space ecosystem and build relations and explore collaboration opportunities with the Indian space sector,” Klein said. He emphasized that while these space networks make use of existing 3GPP 4G and 5G cellular specifications, they must be drastically reengineered to withstand extreme temperatures, mechanical stress, radiation, and power constraints.

With India opening its space sector to private participation and international collaboration, Nokia’s proposed engagement could bring advanced telecom capabilities to future Indian lunar missions. Klein affirmed the company’s openness to working with both public and private entities in India to advance lunar and deep space communications.

India plans to launch the Chandrayaan-4 mission in 2027, aiming to bring back samples of moon rocks to Earth. Chandrayaan-4 will involve at least two separate launches of the heavy-lift LVM-3 rocket, which will carry five different components of the mission that will be assembled in orbit.

Asked if Nokia Bell Labs is engaging with ISRO, which is the primary agency in India for space exploration and research, Klein said, “Yeah, we definitely want to engage with them [ISRO]. I met people from both the government and private companies. They are very interested in continuing the conversations on both sides, the private sector as well as the public sector. I have had lots of conversations and lots of interest in exploring working together.”

Nokia Bell Labs has been developing cutting-edge communication systems for future lunar missions, with the aim of supporting the growing global interest from governments, such as India, and private space enterprises in establishing a permanent presence on the Moon and, eventually, Mars.

“Unlike the Apollo era, which relied on basic voice and low-resolution imagery, future lunar missions will demand high-definition video, data-rich applications, and low-latency networks to support scientific research, mining, transportation, and habitation on the Moon,” said Klein.

To meet those demands, Bell Labs is adapting commercial-grade 4G and 5G cellular technologies, currently used globally on Earth, for use in space. The first real-world test of this technology was conducted during the Intuitive Machines IM-2 mission, which landed on the moon on March 6, 2024, and successfully demonstrated a functioning 4G LTE network on the lunar surface.

“So that’s been our vision for seven or eight years, and that’s what we’ve really done with the Intuitive Machines 2 mission…We built the first cellular network and wanted to prove that we could do this. It was a technology demonstration to show that we can take something based on the networks we use on Earth, make all the necessary adaptations I mentioned, deploy the network, operate it successfully, and prove that cellular technology is a viable solution for space operations,” Klein said.

Klein said Bell Labs envisions the Moon’s communication infrastructure developing similarly to Earth’s surface networks, supporting permanent lunar bases, while satellites in lunar orbit provide 5G-based backhaul or coverage for remote regions. “We think of 5G as both providing surface capabilities as well as orbit-to-surface capabilities,” he said, likening it to non-terrestrial networks (NTNs) on Earth.

The company initially opted for 4G due to its maturity at the time the project began in 2020. Looking ahead, the migration to 5G is on the horizon, likely coinciding with the shift to 6G on Earth in 2030. “We would expect that we have 5G on the lunar surface by 2030,” Klein said, explaining that staying one generation behind Earth networks allows lunar missions to benefit from economies of scale, mature ecosystems, and deployment experience.

Nokia and Intuitive Machines successfully delivered a 4G LTE network to the Moon. However, a planned wireless call couldn’t be made because the Athena lander tipped over, limiting its ability to recharge. Still, Nokia’s Lunar Surface Communications System (LSCS), including its base station, radio, and core, ran flawlessly during the 25-minute power window.

Klein also revealed that Nokia is working with Axiom Space to integrate 4G LTE into next-generation space suits, which are slated for NASA’s Artemis III mission in 2027. Nokia continues to engage with governments and commercial partners globally. “Everybody realizes there is a need for communication. We are really open to working with anybody that we could support,” Klein said.

References:

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

U.S. military sees great potential in space based 5G (which has yet to be standardized)

China’s answer to Starlink: GalaxySpace planning to launch 1,000 LEO satellites & deliver 5G from space?

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

IDC Worldwide Private LTE/5G Wireless Infrastructure Forecast reveals 4G-LTE Dominates

The global private LTE/5G wireless infrastructure market is forecast to reach revenues of $8.3 billion by 2026, an increase compared to revenues of $1.7 billion in 2021, according to new research from International Data Corporation (IDC). IDC said that this market is expected to achieve a five-year compound annual growth rate (CAGR) of 35.7% over the 2022-2026 forecast period.

The report, Worldwide Private LTE/5G Infrastructure Forecast, 2022-2026 (IDC #US48891622), presents IDC’s annual forecast for the private LTE/5G wireless infrastructure market. The forecast includes aggregated spending on RAN, core, and transport infrastructure as well as spending by region; it excludes services or publicly owned and operated networks that carry shared data traffic. The report also provides a market overview, including drivers and challenges for technology suppliers, communication service providers, and cloud providers.

IDC defines private LTE/5G wireless infrastructure as any 3GPP-based cellular network deployed for a specific enterprise/industry vertical customer that provides dedicated access to private resources. (Yet IDC does not state what 3GPP Release(s) or whether necessary 5G capabilities, like specs for URLLC have been completed and performance tested). This could include dedicated spectrum, dedicated hardware and software infrastructure, and which has the ability to support a range of use cases spanning fixed wireless access, traditional and enhanced mobile broadband, IoT endpoints/sensors, and ultra-reliable, low-latency applications.

“Enterprise or industry verticals, such as manufacturing, retail, utilities, transport, and public safety are leading the charge for private LTE, and eventually private 5G networks, driven by a desire to capture productivity gains, enable automation, and improve customer experience. While the demand metrics are relatively understood, the emerging private cellular ecosystem presents several road maps, each with particular advantages and disadvantages. While an enterprise (within any industry vertical) will eventually need to assess its own needs internally, understanding the implications from each road map can provide a starting point,” said Patrick Filkins, IDC senior research analyst, IoT and Mobile Network Infrastructure.

“The private LTE/5G wireless market showcased in 2021 that although its growth is somewhat immune to macro challenges associated with the global pandemic, it still requires a significant amount of market-level solutioning to address the pain points associated with unlocking the full 5G solution. This includes curating and scaling a robust set of 5G device platforms, which still requires more work across the ecosystem, particularly as it relates to vertical-specific solutioning,” Filkins added.

IDC noted that the worldwide market for private LTE/5G wireless infrastructure continued to gain traction throughout 2021. The research firm highlighted that private 4G-LTE remained the predominant private cellular network revenue generator during 2021. However, Private 5G marketing, education, trials, and new private 5G products and services also began to see market availability. IDC also said that most private 5G projects to date remain as either trials or pre-commercial deployments.

“Heightened demand for dedicated or private wireless solutions that can offer enhanced security, performance, and reliability continue to come to the fore as both current and future applications, particularly those in the industrial sector, require more from their network and edge infrastructure. While private LTE/5G infrastructure continues to see more interest, the reality is 5G itself continues to evolve, and will evolve for the next several years. As such, many organizations are expected to invest in private 5G over the coming years as advances are made in 5G standards, general spectrum availability, and device readiness,” Filkins said.

The report forecasts that the market for 5G private networks will reach $47.5 billion in 2030, up from $221 million last year, while the total market for 4G private networks will go from $3.54 billion in 2021 to $66.88 billion in 2030. IDC also noted that the global spending on smart manufacturing will expand from $345 billion in 2021 to more than $950 billion in 2030.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

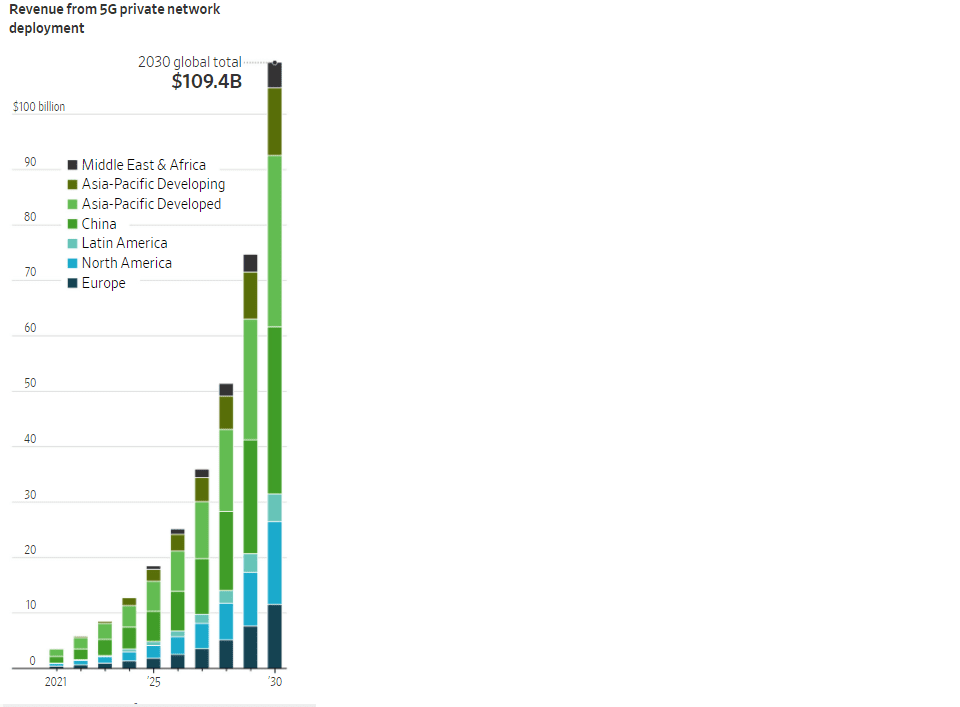

The total addressable market for private networks – including the Radio Access Network, Mobile-access Edge Computing (MEC), core, and professional services – is forecast to increase from $3.7 billion in 2021 to more than $109.4 billion in 2030, according to a recent report by ABI Research. However, a quote in the article introducing that report was dead wrong:

“While the Third Generation Partnership Project (3GPP) has frozen Release 16 (standardizing Ultra-Reliable Low-Latency Communication (URLLC)), Release 16-capable chipsets and devices have not yet emerged in the market. As enterprises require Time-Sensitive Networking (TSN), as well as high availability and reliability of their connection, they are reliant on Release 16 and are, therefore, waiting for compatible chipsets and infrastructure to enter the market. As this is not expected to happen until 2023, enterprise 5G will mature much more slowly than previously anticipate,” ABI Research said.

–>THAT IS BECAUSE EVEN THOUGH 3GPP RELEASE 16 WAS FROZEN IN JUNE 2020, “URLCC IN THE RAN” SPEC WAS NOT COMPLETED AT THAT TIME. Before that spec can be implemented, it must be independently tested to ensure it means the ITU-R M.2410 performance requirements for BOTH ultra high reliability and ultra low latency corresponding to the 5G URLLC use case. As of 16 March 2022 (today), 3GPP Release 16 URLLC in the RAN is only 74% complete!

| 830074 | NR_L1enh_URLLC | Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) | 74% | Rel-16 | RP-191584 |

ABI also noted that the global spending on smart manufacturing will expand from $345 billion in 2021 to more than $950 billion in 2030.

Note: 2022 to 2030 are forecasts. Source: ABI Research

“As manufacturers advance their digital transformation initiatives, they drive up spending on smart manufacturing with investments in factories that adopt Industry 4.0 solutions like Autonomous Mobile Robots (AMRs), asset tracking, simulation, and digital twins,” ABI said. ” While most of the revenue today is attributed to hardware, the greater reliance on analytics, collaborative industrial software, and wireless connectivity (Wi-Fi 6, 4G, 5G) will drive value-added services revenue — connectivity, data and analytic services, and device and application platforms — to more than double over the forecast.”

Meanwhile, Dell’Oro Group VP Stefan Pongratz wrote in an email to this author,” We have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

About IDC:

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,200 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48948422

https://www.idc.com/getdoc.jsp?containerId=US48891622

Global market for private networks to exceed $109 billion in 2030: Study

https://www.3gpp.org/DynaReport/GanttChart-Level-2.htm (Release 16)

Orange and Nokia deploy 4G LTE private network for Butachimie in Alsace, France

Orange Business Services and Nokia are deploying a redundant and secure 4G-LTE private mobile network that can be upgraded to 5G network at Butachimie’s Chalampé plant in Alsace, France. The network uses the 2.6 GHz spectrum, which French regulator Arcep has designated for mobile networks built to meet businesses’ specific needs. It also uses TDD (Time Division Duplexing) to separate wireless transmit and receive channels.

Butachimie will connect factory equipment and assets to the network, which is expected to allow technicians to geolocate assets with pinpoint accuracy. Nokia will supply a dedicated core network as well as RAN equipment, so that all network data stays onsite. The companies said both the factory equipment and the data it generates will be visible on the network at all times, enabling the manufacturer to prevent failures and ensure continuous production.

This private 4G network allows Butachimie teams to gain controlled and effective access to information system applications; they can also take advantage of new services via wirelessly connected devices (geolocation, intercom, camera, real-time sharing of videos and images, etc.). In addition, the equipment and the data collected ensure a high level of network availability of more than 99.99%, which makes it possible to forecast incipient network failures and guarantee continuous production within the plant.

Stéphane Cazabonne, project manager at Butachimie, said: “Our digital transformation and modernization plan has to meet very stringent challenges in terms of security and availability. Therefore, it is essential for us to be able to rely on reliable partners who can provide us with technological robustness, personalized support, and our business knowledge and related uses. Thanks to Orange Business Services and Nokia, we are taking a new step towards developing the Factory of the Future by offering our operators new tools to increase our performance and competitiveness in our industry. With this scalable network, we can finally benefit from the performance and benefits of the technology, such as 5G, which is already predicted.”

Butachimie’s Chalampé Plant. Photo credit: Butachimie

Butachimie’s Chalampé Plant. Photo credit: Butachimie

Orange Business Services provides advice and technical support on full network management and the use cases around it. Industry 4.0 [1.] current or future. In the design phase, Orange Business Services considered the scalability of the private mobile network, in particular by designing an architecture adapted to the principles of Mobile Edge Computing.

Note 1. Towards Factory 4.0:

Since 2010 Butachimie has been involved in the MIRe project. All the electronics on the site will be completely reviewed and modified by 2022 in order to optimize production. Digitalizing our processes and incorporating digital tools will allow us to improve both performance and competitiveness. It will also speed up process development while following the fundamental rules of safety and sustainability.

…………………………………………………………………………………………………………………………………………………

Denis de Drouâs, director of the private radio networks program at Orange Business Services, said that Butachimie chose a private network that is “totally independent from the public network.” However, other manufacturers may select different solutions.

For example, Schneider Electric is using a hybrid network model that combines private and public 4G and 5G infrastructure. The network uses Orange’s commercial 5G frequencies in the 3.4-3.5GHz bands, but Schneider’s critical data is kept on its campus and can be used for low-latency, edge-based applications.

Orange says it “slices its public network” for enterprise customers, according to de Drouâs. However, that is not the same as “network slicing” (?) which requires a 5G SA core network. Commercial frequencies are used, and the “private slice” guarantees the customer a specific quality of service.

This 4G Private Mobile Network is the backbone for all future applications currently under development as part of the Butachimie digital transformation project.

References:

ABI Research and Mobile Experts: Fixed Wireless Access CAGR >=70%

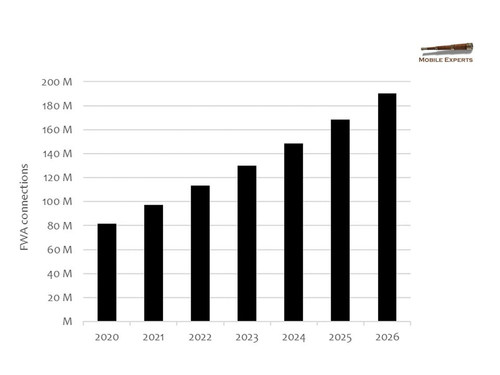

ABI Research and Mobile Experts forecast that 5G FWA connections will increase at a compound annual growth rate of 71% and “over 70%,” respectively.

Fixed Wireless Access (FWA) will be among the most valuable use cases for LTE and 5G network operators, according to two new reports that predict compound annual growth rates in excess of 70%.

- ABI Research expects global 5G fixed wireless access to exceed 58 million residential subscribers by 2026.

- Mobile Experts predicts 5G fixed wireless access to serve 66.5 million customers by 2026.

FWA is a decades-old technology (that’s how WiMAX was deployed), but its prominence and rate of growth grew substantially during the last year amid the ongoing COVID-19 pandemic, which has forced billions of people worldwide to stay home (“shelter in place”).

Image Credit: Upward Broadband

…………………………………………………………………………………..

ABI Research:

Remote working, online learning, e-commerce, and virtual healthcare drove high-speed broadband demand throughout 2020. The significant increase in the use of internet-based home entertainment such as video streaming and online gaming also pushed existing broadband users to upgrade their broadband service to a higher-tier package, while households without broadband access signed up for new subscriptions.

“Increasing adoption of internet-connected devices, smart TVs, and smart home devices, as well as consumers’ media consumption through internet applications, will continue to drive high-speed broadband adoption in the years to come. In addition, many businesses are allowing remote working for some of their employees after the pandemic, which will boost the need for home broadband services even further,” explains Khin Sandi Lynn, Industry Analyst at ABI Research.

FWA will be the fastest-growing residential broadband segment, forecast to increase at a CAGR of 71%, exceeding 58 million subscribers in 2026.

As residential broadband penetration saturates mature markets, competition among broadband operators is likely to create challenges to maintain market shares. “In addition to network upgrades, broadband operators need to invest in cutting-edge software and hardware to optimize network performance and support better user experiences. Providing advanced home networking devices, internet security, and home network self-diagnosis tools can help service providers reduce churn and improve average revenue per user,” Lynn concluded.

……………………………………………………………………………….

Mobile Experts:

Mobile Experts forecasts the number of global fixed wireless access connections will more than double to 190 million by 2026. FWA services grew almost 20% yearly to over 80 million in 2020—Mobile Experts sees that number rocketing to almost 200 million by 2026. Around 8-11% of FWA connections over the next five years will be served via proprietary technology primarily deployed by small operators.

FWA equipment sales, including IEEE 802.11 based proprietary, LTE, and 5G CPE revenue, are projected to grow from $4.0 billion this year to over $5.5 billion in 2026. Meanwhile, the proprietary equipment market, including both access point and CPE sales, is expected to stay elevated around $880–$940 million per annum over the next five years.

“Large mobile operators will leverage LTE and 5G for FWA services, and we expect the 5G mm-wave will become a key aspect of their long-term FWA plans—especially in ‘fiber-rich’ markets in the APAC region. That said, large and small operators will benefit from government funding to help build out hybrid fiber plus FWA networks for the next 5-10 years,” said Principal Analyst Kyung Mun.

This report includes 41 charts and diagrams, including a five-year forecast illustrating the growth of the market for infrastructure and customer premise equipment and fixed wireless access connections by technology. Key details such as technical breakdowns, equipment revenue, and market shares are included.

………………………………………………………………………………………..

References:

https://www.mobileexperts.org/reports/p/virtual-mobile-networks-pt3na-zrw9g

https://www.sdxcentral.com/articles/news/5g-fixed-wireless-rides-pandemic-related-shift/2021/08/

Global Data: Huawei #1 amongst 5 major LTE RAN vendors

Executive Summary:

GlobalData, a leading market data and analytics company, has rated Huawei’s LTE RAN portfolio to be a leader in the market. In competitive analyses of five major RAN vendors, GlobalData evaluated 4G LTE base station portfolios according to four key areas important to mobile operators: baseband unit (BBU) capacity, radio unit portfolio breadth, ease of deployment and technological evolution. GlobalData found Huawei to be a Leader in all four categories and a Leader overall among its peers.

Editor’s Note/ Disclaimer:

We don’t know whether Huawei paid Global Data (?) to evaluate 4G LTE vendor portfolios or if that was done indepedently on Global Data’s own initiative. It’s disturbing that we could not find a related report or media press release on the company’s website after doing multiple searches.

…………………………………………………………………………………………………………………………………………………………………………………………..

LTE RAN Basics: In the RAN, radio sites provide radio access and coordinate the management of resources across the radio sites. User Equipment (e.g. wireless network endpoints) are connected to Nodes (base stations or small cells) using LTE. Radio Network Controllers are wirelessly connected to the core network which for LTE is called the Evolved Packet Core (EPC). This is depicted in the illustration below:

Source: Research Gate

……………………………………………………………………………………………………………………………………………………………………………………

Huawei has introduced new advances in its LTE RAN portfolio to enhance the coverage and capacity of mobile networks. It also offers solutions to aid the coordination of 4G and 5G networks and to enable new services for operators. The Chinese IT behemoth has the highest BBU cell capacity – in terms of both LTE carriers and Narrowband IoT – of any major RAN vendor. It also offers more radio units and more Massive MIMO options than other vendors and supports a wide array of 4G spectrum bands. To make deployment easier, Huawei offers multiple novel solutions, including its Super Blade Site and Bracelet Kit offerings. And to help operators evolve their networks technologically, Huawei has been proactive in commercializing spectrum-sharing capabilities such as its CloudAIR solution, which allows various access technologies (2G/3G/4G/5G) to use the same spectrum, and its SuperBAND solution, which can improve user experience under multi-frequency networks.

This portfolio is well-suited to meet the diverse needs of the world’s mobile operators, and Huawei continues to expand its RAN portfolio to help operators prepare for the future and maximize the value of their LTE networks.

Coverage:

Adequate network coverage is an essential characteristic for ensuring quality mobile services. It becomes especially important in LTE networks as 5G is deployed in high-frequency bands whose coverage footprint areas are more limited. LTE must cover the areas that 5G does not.

To enhance the coverage of 4G/5G networks, Huawei has introduced the Blade Pro solution. The Blade Pro Ultra-Wideband Remote Radio Unit (RRU) is a pole-mountable RU that supports three low or medium Frequency-Division Duplex (FDD) bands simultaneously: it currently supports 700 MHz, 800 MHz and 900 MHz; and in late 2021, it will support 1.8 GHz, 2.1 GHz and 2.6 GHz.

By supporting three frequency bands in a single 25-kilogram unit, the Blade Pro eliminates the need for two boxes, reducing the load on poles, easing the burden on installers and making deployment faster, smoother and less expensive. Making installation easier means operators are better able to increase coverage by expanding or densifying their networks.

Capacity:

Operators face the eternal challenge of keeping up with ever-increasing user demand for data at faster speeds in the space of finite spectrum. One way to add network capacity without finding additional spectrum is to deploy greater antenna arrays, upgrading radios with two transceivers to those with four or eight, for example, or adding Massive MIMO antennas bearing 32 or 64 arrays.

Huawei’s LTE RAN portfolio now includes a radio unit with eight transceivers and receivers for enhanced capacity, useful for urban hotspot areas. The “Smart 8T8R” solution also gives operators flexibility in their migration to 5G. The FDD 8T8R RRU is hardware-ready for 5G NR, and the antenna array is software-defined, meaning its configuration can be adjusted – without changing the hardware – for example, to six sectors for LTE and three sectors for 5G. The solution also dynamically adjusts the power supply allocated to sectors according to how users are distributed. This flexibility can be helpful in allowing operators to serve specific needs on a site-by-site basis and to adapt in real time to changes in user behavior. On TDD side, meanwhile, Huawei leverages its considerable research in TDD-LTE to offer an 8T8R IMB (Intelligent Multi-Beam) solution, which is also based on a software-defined antenna and promises to deliver 1.8-2.2x capacity gains compared with more common products.

For even higher capacity needs, Huawei has introduced the “Smart Massive MIMO” solution, a dual-band 5G-ready 4G radio with 32 transceivers and receivers promising three to five times the download speeds compared with more common products. Like the Smart 8T8R solution, Smart Massive MIMO automatically adjusts the power allocated to individual beams based on user traffic patterns. This lends efficiency in two ways, since Massive MIMO beamforming is itself a more efficient use of mobile spectrum than traditional antenna arrays, and the Smart Massive MIMO solution uses its power supply more efficiently than typical Massive MIMO gear.

4G/5G Coordination:

In addition to the ways Huawei’s aforementioned gear balances and coordinates 4G and 5G networks, its portfolio also includes other solutions to further optimize the relationship between the two.

Its SuperBAND solution uses artificial intelligence (AI) to aggregate network scheduling – the coordinated allocation of radio resources to mobile signals – among multiple frequency carriers, essentially boosting network capacity beyond the divisions and fragmentation of various spectrum bands. In 4G/5G networks, SuperBAND can perform this aggregation across both 4G and 5G, maximizing spectral efficiency and, ultimately, optimizing the quality of the user experience.

Meanwhile, Huawei also offers Dynamic Spectrum Sharing (DSS) as part of its CloudAIR solution. DSS allows 4G and 5G traffic to share the same spectrum bands, increasing spectral usage efficiency; it also allows 4G and 5G traffic to dynamically switch from one band to another, regardless of radio access technology, in response to congestion on specific bands, ensuring the best use of spectrum even as user behavior changes. CloudAIR goes even further, applying a similar spectrum-sharing function to 2G and 3G traffic as well for a more comprehensive capability that is especially relevant to markets where legacy networks remain.

New Service Enablement:

Enhancing and optimizing the network are important aims, but from a commercial perspective, one of the most important imperatives operators face is the need to deliver new revenue-generating services. Huawei’s LTE RAN portfolio addresses this requirement in multiple ways.

Huawei’s Voice-over-LTE solution, VoLTE Plus, helps operators migrate voice traffic from legacy technologies like 2G and 3G to LTE, not only achieving higher quality voice service but also allowing operators to sunset their legacy networks and repurpose their VoLTE investments for the future. In addition, Huawei’s latest VoLTE solution, goes further, adding four new capabilities that help protect the quality of voice service in 4G/5G networks:

- 5G-to-LTE EPS fallback

- LTE-to-5G fast return

- New Enhanced Voice Services capabilities

- Dedicated services that allow for optimization on LTE

Beyond voice, Huawei’s LTE portfolio also supports Narrowband IoT, to capture opportunities in the Internet-of-Things space. The vendor’s roadmap also targets support for 5G NB-IoT in particular, which will allow operators with existing IoT services to migrate those services to their 4G/5G network and replace disparate or ad-hoc legacy networks with a unified network that yields multiple revenue streams from a common infrastructure investment.

Huawei’s portfolio also enables new services via fixed wireless access (FWA) products. Amid the global pandemic, the increase in telecommuting and home-based learning based on video connections has increased the demand for residential broadband networks. Where fiber isn’t available, FWA is vital in building these residential networks. Huawei’s LTE-based FWA solutions have achieved enviable momentum in the market. The vendor has also added 4G/5G customer premises equipment to its portfolio, giving these networks a future-proof migration path to continued service enablement.

Conclusion

Huawei’s LTE RAN portfolio continues to evolve in order to help operators maximize the value of their networks as they prepare for the future. New solutions in the portfolio enhance the coverage and capacity of LTE networks as well as maximize network efficiency by coordinating 4G and 5G operations. Meanwhile, Huawei offers multiple solutions aimed at enabling the delivery of additional services that can help operators grow revenue in a variety of ways, including VoLTE, the Internet of Things and FWA.

SOURCE: GlobalData

Reference:

https://www.prnewswire.com/news-releases/globaldata-lte-ran-innovation-and-competitiveness-insight-301202706.html

IDC: 5G and LTE Router/Gateway Market to Reach $3.0 Billion in 2024; Other forecasts

Driven by increasing demand from branch, mobile, and Internet of Things (IoT) customers, International Data Corporation (IDC) expects LTE routers to experience double-digit growth in 2020. 5G wireless routers will add to this year’s forecast, supported by initial commercial deployments in select regions in the second half of 2020.

“Even with some downward pressure on enterprise network infrastructure spending from COVID-19, 2020 will be another year of growth for most LTE router and gateway vendors. The inclusion of 5G products will also contribute, but will not materially affect the total market until 2021,’ said Patrick Filkins, senior research analyst for IoT and Mobile Network Infrastructure at IDC.

“Wireless WAN solutions continued to see broader uptake in 2019 and will see sustained growth over the next few years as both LTE and 5G performance gains enable suppliers to compete head-on with traditional, wireline edge solutions. In areas such as mobility and IoT, cellular solutions are proving themselves, especially as a solution to connect hard-to-reach areas and/or to securely and reliably support global operations,” Filkins added.

Worldwide, IDC expects the total 5G and LTE router/gateway market to grow from approximately $979.3 million in 2019 to just under $3.0 billion in 2024 at a compound annual growth rate (CAGR) of 21.2%.

Regionally, North America will remain the largest consumer of LTE routers/gateways, but Asia/Pacific (including Japan) (APJ) will grow the fastest over the forecast period supported by continued expansion and/or densification of macro LTE networks in the region. Both the United States and certain countries in APJ, such as Australia, will be key proving grounds for 5G products.

The report, Worldwide 5G and 4G/LTE Router/Gateway Forecast, 2020–2024: Stronger Focus on Cellular Solutions at the Enterprise Edge (IDC #US46208020), presents IDC’s annual forecast for the 5G and LTE router/gateway market. Revenue is forecast for both routers and gateways. The report also provides a market overview, including drivers and challenges for technology suppliers.

About IDC:

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading tech media, data and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights: http://bit.ly/IDCBlog_Subscribe.

https://www.idc.com/getdoc.jsp?containerId=prUS46300620

……………………………………………………………………………………………………………………………………………………….Other Forecasts:

Earlier this year, Statista forecast that the LTE router/gateway market is forecast to be 1.9 billion U.S. dollars in 2022.

Separately, Insight Partners said the global cellular router market is US$ 565.1 Million in 2017 and estimated to grow at a CAGR of 14.4% during the forecast period 2018 – 2025 and account US$ 1,639.4 Mn by the year 2025. The business era prevailing today is transforming rapidly and therefore is entirely unprecedented. New innovation in technology has created a business landscape of “Disrupt or be disrupted”. With the advancement in technology in today’s world and the existing network, infrastructures prove to be incapable of handling the predicted surge in the number of connected devices as well as the data explosion over the network. As a result, a huge demand for a more robust and reliable communication network infrastructure capable of handling the huge influx of data over the network is on the rise.

Therefore, market players are adopting different strategies such as agility, low cost, rapid deployment, and other expansion strategies. Network security and data breaches are two major concerns for the industry. Cellular M2M (Machine-to-Machine) provides the ability to connect diverse devices and applications by enabling fixed assets, such as electric meters, or mobile assets, such as fleet vehicles. The cellular M2M product segment is composed of different communications products and development services, including cellular routers and gateways. The cellular routers provide connectivity for devices over a cellular data network. They can be used as a cost-effective alternative to a fixed phone line for primary or backup connectivity for inaccessible sites and devices. These products are certified by some of the major wireless network providers including, AT&T, Sprint, Verizon Wireless, Bell Mobility, Rogers and Vodafone, etc. These products act as a cellular gateway when combined with other network product and provide cellular network access to devices where there is no existing network or where access to other network is barred.

……………………………………………………………………………………………………………………………………………..

GSA Report: Evolution of LTE to 5G also includes NB-IoT and LTE-M

Pre-standard “5G” roll outs continue and the latest Evolution of LTE to 5G report from GSA identifies 884 operators actively investing in LTE, with 769 operational LTE networks in 225 countries, 194 VoLTE capable networks and 296 operators in 100 countries investing in 5G with 39 – 3GPP Release 15 (5G NR NSA) compliant 5G networks launched – some with limited service.

High end devices are also growing in popularity with more CAT-12 and above devices coming to market and 100 5G devices now announced. GSA expects 5G to be deployed much faster than 4G which took 7 years to reach 100 million subscriptions. We expect 5G to reach 100 million subscriptions in less than 5 years.

GSA Market Research Findings:

• 884 operators actively investing in LTE, including those evaluating/ testing and trialling LTE and those paying for suitable spectrum licences (excludes those using technology neutral licences exclusively for 2G or 3G services).

• 769 operators running LTE networks providing mobile and/or FWA services in 225 countries worldwide.

• 194 commercial VoLTE networks in 91 countries and a total of 262 operators investing in VoLTE in 120 countries.

• 304 launched or launched (limited availability) LTE-Advanced networks in 134 countries. Overall, 335 operators are investing in LTE-Advanced technology in 141 countries.

• Ten launched networks that support user equipment (UE) at Cat-18 DL speeds within limited geographic areas, and one supporting Cat-19 (in a limited area).

• 228 operators with TDD licences and at least 164 operators with launched LTE-TDD networks.

• 151 operators investing in NB-IoT in 72 countries; of these, 98 NB-IoT networks are deployed/launched in 53 countries. 62 operators are investing in LTE-M/Cat-M1 in 36 countries; of these, 38 LTE-M/Cat-M1 networks are deployed/commercially launched in 26 countries. • 296 operators in 100 countries have launched with limited availability, deployed, demonstrated, are testing or trialling, or have been licensed to conduct field trials of mobile 5G or FWA 5G.

• 56 operators in 32 countries have announced the deployment of 5G within their live network.

• 39 operators have announced 3GPP 5G service launches (or limited service launches).

LTE deployments:

The drivers of LTE, LTE-Advanced, LTE-Advanced Pro and increasingly 5G, for operators are more capacity, enhanced performance and improved efficiencies to lower delivery cost. Compared with 3G, LTE offered a big step up in the user experience, enhancing demanding apps such as interactive TV, video blogging, advanced gaming and professional services. Deployment of LTE-Advanced technologies – and particularly carrier aggregation – takes performance to a new level and is a major current focus of the industry. Interest in LTE-Advanced Pro is high too, bringing with it new, globally standardised LPWA solutions – LTE Cat-M1 (LTE-M, eMTC) and Cat-NB1 (NB-IoT) – and new business opportunities. And while LTE-Advanced and LTE-Advanced Pro solutions have yet to be deployed by the majority of operators, vendors and network operators are already looking towards 5G and its potential to meet future capacity, connectivity and service requirements.

Spectrum for LTE deployments:

Pressure for spectrum is high and operators need to deploy the most efficient technologies available. LTE, LTE-Advanced and LTE-Advanced Pro services can be deployed in dozens of spectrum bands starting at 450 MHz and rising to nearly 6 GHz. The most-used bands in commercial LTE networks are 1800 MHz (Band 3), which is a mainstream choice for LTE in most regions; 800 MHz (Band 20 and regional variations) for extending coverage and improving in-building services; 2.6 GHz (FDD Band 7) as a major capacity band; and 700 MHz (with variations in spectrum allocated around the world) again for coverage improvement. The now-completed LTE standards enable the possibility to extend the benefits of LTE-Advanced to unlicensed and shared spectrum.

There are several options for deploying LTE in unlicensed spectrum. The GSA report LTE in Unlicensed and Shared Spectrum: Trials, Deployments and Devices gives details of market progress in the use of LAA, eLAA, LTE-U, LWA and activity in the CBRS band.

Many recent allocations/auctions of spectrum have focused on licensing unused spectrum – including pockets of spectrum in the 2 to 4 GHz range, but also at lower frequencies – for LTE and future 5G services. This spectrum is sometimes dedicated to LTE, sometimes to 5G and sometimes allocated on a technology-neutral basis.

VoLTE global status:

In total GSA has identified 262 operators investing in VoLTE in 120 countries, including 194 operators that have launched VoLTE voice services in 91 countries. There have been recent launches in India, Hungary, Iran, Maldives, Kenya, Mexico, Tuvalu, Ireland, New Zealand and Nieu.

GSA is aware of at least 30 operators deploying VoLTE and nearly 40 other operators planning VoLTE or are testing/trialling the technology. The GSA report VoLTE and ViLTE: Global Market Update, published in August 2019, gives more detail.

LTE-Advanced global status:

Investment in LTE-Advanced networks continues to grow. By July 2019, there were 304 commercially launched LTE-Advanced networks in 134 countries. Overall, 335 operators are investing in LTE-Advanced (in the form of tests, trials, deployments or commercial service provision) in 141 countries.

Many operators with LTE-Advanced networks are looking to extend their capabilities by adding 3GPP Release 13 or Release 14 LTE-Advanced Pro features, e.g. those making use of carrier aggregation of large numbers of channels, or carriers across TDD and FDD modes, LAA, massive MIMO, Mission-Critical Push-to-Talk, LTE Cat-NB1/NB-IoT or LTE-M/Cat-M1.

The GSA report LTE in Unlicensed and Shared Spectrum: Trials, Deployments and Devices tracks the progress of LAA/eLAA, LWA and LTE-U. By July 2019, there were 37 operators investing in LAA (including eight deployed/launched networks), 11 operators investing in LTE-U (including three launched/deployed networks) and three investing in LWA (including one launched network). One operator had undertaken trials of eLAA.

Carrier aggregation has been the dominant feature of LTE-Advanced networks. Varying numbers of carriers and varying amounts of total bandwidth have been aggregated in trials and demos, but in commercial networks, the greatest number of carriers aggregated (where we have data) is five. Some trials and demos have also aggregated up to ten carriers, for instance SK Telecom’s trial in South Korea.

Pre-standard 5G global status:

GSA has identified 296 operators in 100 countries that have launched (limited availability or non-3GPP networks), demonstrated, are testing or trialling, or have been licensed to conduct field trials of 5G-enabling and candidate technologies (up from 235 operators in May 2019).

Detailed analysis of speeds and spectrum used for 5G trials to date is available in the report Global Progress to 5G – Trials, Deployments and Launches on the GSA website. Operators continue to provide clarity about their intentions in terms of launch timetables for 5G or pre-standards 5G. GSA has identified 56 operators in 32 countries that have stated that they have activated one or more 5G sites within their live commercial network (excludes those that have only deployed test sites).

The number that have announced the launch of commercial services remains much lower however, as operators have had to await the availability of 5G devices. These have now started to appear, removing the market blockage.

GSA has identified 100 announced devices (excluding regional variants and prototypes) and a handful of these are now available for customers to buy and use. See GSA’s report 5G Device Ecosystem, published monthly, for more details.

GSA knows of 39 operators who have (as of 6 August 2019) announced 3GPP compatible 5G service launches (either mobile or FWA, some with limited availability): we understand there are ten operators with FWA-only services, 15 with mobile-only services, and 14 with both mobile and FWA services. All services are initially restricted in terms of either geographic availability, devices availability, or the types and numbers of customers being provided with services.

Among recent service launches (or limited service launches) are those by three operators in Kuwait (Viva, Zain and Ooredoo), Batelco in Bahrain, T-Mobile and Vodafone in Germany, Vodafone in the UK, Digi Mobile in Romania, Monaco Telecom and Dhiraagu in the Maldives.

Cellular LPWANs for IoT:

The start of 2019 has continued to see strong growth in the number of cellular IoT networks based on NB-IoT and LTE-M. By July 2019, there were 151 operators investing in NB IoT in 72 countries, up from 148 operators in 71 countries in May 2019. The number of deployed/launched NB-IoT networks was 98 in 53 countries, up from 78 operators in 45 countries in January 2019. There are 62 operators investing in LTE-M networks in 36 countries, up from 57 operators in 34 countries in January 2019. Thirty-eight operators have deployed/launched LTE-M networks in 26 countries, up from 30 operators in January 2019. Orange Spain launched its LTE-M network in June 2019.

Altogether 55 countries now have at least either a launched NB-IoT network or a launched LTE-M network and 24 of those countries have both network types.

…………………………………………………………………………………………………….

GSA will continue tracking the progress of 5G deployments worldwide. GSA reports are compiled from data stored in the GSA Analyser for Mobile Broadband Devices/Data (GAMBoD) database, which is a GSA Member and Associate benefit.

Much of the GSA activity is working on spectrum and the upcoming WRC-19 conference in October/November. If you would like to meet up with GSA in Sharm el-Sheikh, Egypt at the conference, please email [email protected]

GSA May Update: Gigabit LTE – Global Status

Editor’s Note:

Gigabit LTE will be the backbone of support for (3GPP Release 15) 5G NR-NSA as it’s used for signaling, evolved packet core (EPC), and network management. 5G with low latency, signaling and a 5G mobile packet core won’t be deployed in mass till IMT 2020 standard has been completed.

INVESTMENT IN GIGABIT LTE NETWORK TECHNOLOGIES WORLDWIDE:

- At the end of February 2019, GSA has identified 101 operators in 60 countries or territories investing in all the three core LTE-Advanced features for Gigabit LTE (defined as Carrier Aggregation, 4×4 MIMO or higher, and 256 QAM modulation in the downlink)

- 53 operators have deployed all three of these technologies and / or launched commercial services based on them

- 313 operators in 133 countries are investing in at least one of the key technologies

DISTRIBUTION OF GIGABIT LTE NETWORKS AND DOWNLINK SPEEDS OF THE FASTEST NETWORKS:

Gigabit LTE does not always equal Gigabit speed. Some networks capable of delivering 1 Gbps downstream do so without using all three key LTE-Advanced (AKA IMT Advanced in ITU-R) features; some networks using all three features do not achieve 1 Gbps

The fastest networks in the GSA database are:

- KDDI, SK Telecom, Swisscom, Telus, Turkcell: 1.2 Gbps

- KT: 1.167 Gbps(achieved using MPTCP to combine LTE with 3CA and WiFi)

- China Unicom: 1.156 Gbps

- Bell Mobility: 1.15 Gbps

- 3 Hong Kong, Singtel: 1.1 Gbps

- Optus: 1.03 Gbps

- Vodafone Italy: 1.023 Gbps

- AT&T Mobility, China Mobile Hong Kong, CYTA, Dialog Axiata, DNA, Elisa, HKT, Inwi(Wana), O2 Czech Republic, Ooredoo Qatar, Smartone, Sprint, StarHub, Telenor Denmark, TeliaSonera Denmark, Telstra, Vodafone Germany, Vodafone Ziggo: 1 Gbps

This data is taken from Gigabit LTE Networks: Analysis of Deployments Worldwide (May 2019) published by GSA and available from www.gsacom.com.

……………………………………………………………………………………………………………………………………………………………………..

LTE FAST FACTS: LTE IN UNLICENSED SPECTRUM (DATA AS OF END-APRIL 2019):

- 8 LAA (License Assisted Spectrum) [1] deployments/launches:

- AT&T (US), T-Mobile (US), AIS (Thailand), MTS (Russia), Smartone(Hong Kong), TIM (Italy), Turkcell, Vodafone Turkey (deployed)

- 28 LAA trials and deployments in progress in 18 countries

- The latest include MOTIV and Vimpelcomin Russia, and 3 Indonesia

- 1 eLAAtrial (SK Telecom)

- 3 LTE-U network deployments/launches

- T-Mobile (US) – though it is now switching focus to LAA, AIS (Thailand), Vodacom (South Africa)

- 8 LTE-U trials or pilots in progress

- 1 LWA launch …

- Chunghwa Taiwan and 2 others are trialing the technology (in Singapore and South Korea)

- 1 commercial launch of a private LTE network using CBRS

- 16 operators investing in CBRS trials in the US

- The latest are Altice, CDE Lightband, CoxCommnications, Extenet, Mobilitieand Windstream

- 21 commercially available modem/platform chipsets supporting unlicensed access

- 133 devices announced supporting LTE in unlicensed spectrum or shared spectrum using CBRS (including regional variants)

Note 1. A variant of LTE-Unlicensed is Licensed Assisted Access (LAA) and has been standardized by the 3GPP in Rel-13. LAA adheres to the requirements of the LBT protocol, which is mandated in Europe and Japan. It promises to provide a unified global framework that complies with the regulatory requirements in the different regions of the world.

- 3GPP Rel-13 defines LAA only for the downlink (DL).

- 3GPP Rel-14 defines enhanced-Licensed Assisted Access (eLAA), which includes uplink (UL) operation in the unlicensed channel.

- 3GPP Rel-15 The technology continued to be developed in 3GPP’s release 15 under the title Further Enhanced LAA (feLAA).

LTE Fast Facts are taken from the GSA report “LTE in Unlicensed Spectrum: Trials, Deployments and Devices April 2019”available from www.gsacom.com.

GSA reports are compiled from data stored in the GSA Analyser for Mobile Broadband Devices/Data (GAMBoD) database.