Moody’s skeptical on 5G monetization; Heavy Reading: hyperscalers role in MEC and telecom infrastructure

In a recent “Top of Mind” series report, Moody’s said, “The adoption of 5G is gaining momentum. Yet we question how fast companies can roll out 5G and the ability to generate revenue from applications based on 5G technology.”

“We do not expect material revenue increases in the global telecom sector from 5G in the 2022-2025 period. This is because 5G will mainly evolve around enhanced mobile broadband, which will be broadly similar to 4G.”

Wireless network operators have invested heavily in 5G spectrum, network infrastructure upgrades and the credit rating and financial research firm concludes global carriers’ capex will continue to rise through 2025. That’s despite more tepid carrier capex forecasts from Dell’Oro Group and others.

“Global capex growth is expected to moderate from 9 percent in 2021 to 3 percent in 2022, before tapering off in 2023 and 2024,” wrote Stefan Pongratz of Dell’Oro.

Wireless carriers’ capex as a share of revenue leveled off at 16% globally in 2019 and 2020, inched up to 17% in 2021, and is expected to hit 18% for the next four years, according to Moody’s.

Wireless telcos have cumulatively spent $200 billion globally on 5G spectrum to date, according to Moody’s, and GSMA predicts operators will invest about $510 billion on 5G-related infrastructure and services from 2022 to 2025.

…………………………………………………………………………………………………………………..

On the income side of the ledger, wireless carriers have experienced a prolonged period of flat to declining revenue. Rising costs and flat revenue portends a rough four-year stretch for operators, and there’s little to suggest that dynamic will change by 2026. One analyst said the only real revenue generator for wireless telcos in the last few years has been selling their cell towers!

The largely unmet promise of 5G, with no real “killer apps,” follows previous disappointments for carriers in the 3G and 4G time periods. Indeed, they did not make any money of mobile apps, cloud computing/storage, interactive gaming, edge computing or really any value added services.

“This phase carries the greatest uncertainty about companies’ capital spending. As a result, we remain cautious when projecting revenue growth derived from 5G until there is clarity on the business case, especially given the lessons of limited monetization of 4G and 3G,” Moody’s analysts wrote.

Specialized services for enterprises continue to be the most compelling use cases for 5G, and additional IoT applications could drive incremental revenue gains after 2025 but those are unlikely to justify carriers’ significant 5G investments, the financial research firm said.

While ultra low latency might be important (assuming 3GPP release 16 “URLLC in the RAN” spec is completed, performance tested and deployed), the resulting “almost immediate network response time is only relevant in specialized use cases, Indeed, it has become apparent that the most compelling use cases for 5G revolve around businesses rather than residential consumers,” the Moody’s analysts wrote.

“The wide array of potential applications — such as autonomous vehicles, robotics, and smart homes — places different demands on networks in terms of speed and latency, in contrast to previous generations that focused on one major advance, such as broadband mobile video with 4G or web browsing with 3G,” the analysts wrote.

………………………………………………………………………………………………………………..

Moody’s missed a very crucial point related to 5G revenues: that the hyperscalers (Amazon, Microsoft, Google) will get an increasing share of 5G SA core network services and MEC revenues. That’s because of the partnerships wireless carriers have made with the big cloud service providers.

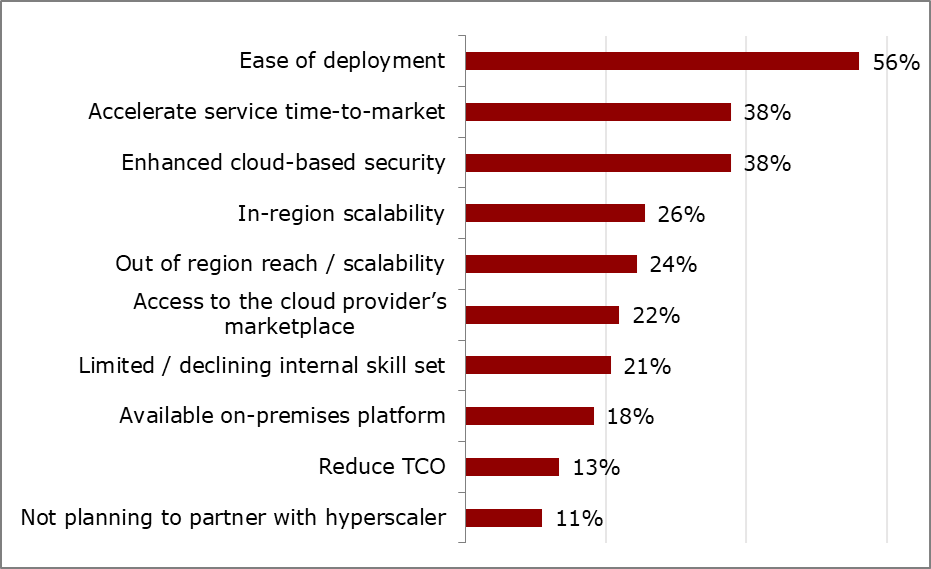

Heavy Reading noted that in a recent blog post. Heavy Reading conducted a survey in collaboration with Accedian, Kontron and Red Hat. The survey questioned 82 communications service providers (CSPs) that have launched edge computing solutions or are planning to do so within 24 months. One of the objectives of the survey was to examine the go-to-market strategies of the CSP and the role the hyperscalers have assumed in those strategies.

Hyperscalers have introduced dedicated edge products and embedded their software stack into operator infrastructure, including Internet of Things (IoT) devices and network gateways. They have introduced products dedicated to the telco market, such as Wavelength from Amazon Web Services (AWS), Azure Edge Zones from Microsoft and Anthos for Telecom from Google Cloud. According to Heavy Reading’s survey results, their efforts have paid off, as CSPs have unquestionably decided to partner with hyperscalers in their multi-access edge computing (MEC) services.

Q: Why do you plan to partner with a hyperscaler to deliver your edge computing? Select up to three. (n=82)

Source: Heavy Reading

…………………………………………………………………………………………………………..

Heavy Reading’s most recent edge computing survey determined that the pivot to improved customer experience is the key goal of edge network deployments and that CSPs must clear new paths to achieve this goal. They must do so by:

- Leaning into automation, particularly in overall lifecycle management.

- Building in comprehensive security protections from the design phase forward.

- Enhancing performance control through automation and AI. CSPs’ growing collaborations with hyperscalers are key to achieving these goals and improving ease of deployment, accelerating time-to-market and enhancing cloud-based security.

Heavy Reading’s survey results show that carriers have committed to edge computing and are progressing rapidly with implementations. The deployment of edge computing brings with it issues of scale and complexity. CSPs are most concerned with overall network performance and security. In fact, those companies that have already deployed the edge have a heightened concern about these issues. They are looking for help from their traditional vendor and integrator partners, from their network monitoring and assurance tools and from the hyperscalers.

References:

One thought on “Moody’s skeptical on 5G monetization; Heavy Reading: hyperscalers role in MEC and telecom infrastructure”

Comments are closed.

Bullish Forecast for Edge Computing:

The global edge computing market size is projected to reach USD 155.90 billion by 2030 and register a CAGR of 38.9% from 2022 to 2030. The integration of artificial intelligence (AI) into the edge environment is expected to propel market expansion. An edge AI system can assist businesses in making quick decisions in real-time.

Key Industry Insights & Findings from the report:

The COVID-19 outbreak has bolstered the use of edge computing and data centers as more and more businesses are prioritizing the development of communications infrastructure.

Based on component, the hardware segment captured a significant revenue share in 2021 due to the increasing number of IIoT and IoT devices. Edge cloud servers must have powerful routers that are flexible and able to handle a volume of incoming traffic while maintaining low latency.

The Industrial Internet of Things (IIoT) applications segment dominated the global edge computing market in 2021 owing to the rampant digitization of services and the emergence of industry 4.0.

Based on industry vertical, the energy and utility segment accounted for a revenue share of over 15% in 2021 as a result of the rising adoption of smart grids that mandates device edge infrastructure.

Smart grids are being installed to aid alternative renewable power generation from sources such as wind and solar. Smart grids enhance operational efficiencies, including incorporation with smart appliances, real-time consumption control, and microgrids to support power generation from dispersed renewable sources.

Geographically, Asia Pacific accounted for a significant market share due to the widespread development of connected device ecosystems in countries such as India and China.

Read 254 page full market research report for more Insights, “Edge Computing Market Size, Share & Trends Analysis Report By Component, By Application, By Industry Vertical, By Region And Segment Forecasts From 2022 To 2030”, published by Million Insights.

Edge Computing Market Growth & Trends

Moreover, the necessity to reduce privacy breaches related to the transmission of massive volumes of data, as well as latency and bandwidth limitations that restrict an organization’s data transmission capabilities, is expected to drive market growth in the forthcoming years.

Precision monitoring and machinery control are a few use cases that employ AI on the edge. A fast-moving production line needs the minimum amount of latency possible, which can be achieved by using edge computing. It can be very beneficial to move data processing close to the manufacturing facility because it can be accomplished with AI. Many different endpoint devices, including sensors, cameras, smartphones, and other Internet of Things (IoT) devices, can make use of artificial intelligence-based edge devices.

Edge computing is currently in its early phases of development. Its operating and deployment models are still in their nascent stages; nonetheless, edge computing is anticipated to present considerable growth opportunities for new entrants in the coming years. As communications infrastructure continues to be developed, demand for edge computing will increase in the years following the COVID-19 pandemic. Working from home is gradually replacing traditional office work and the telecommunications industry is making strides in the development of video conferencing software.

Prominent platforms such as Zoom and Microsoft Teams are creating new solutions to cater to the growing demand. For example, in December 2020, Amazon Web Services and SK Telecom collaborated to launch 5G MEC-based edge cloud services. Energy & utility, healthcare, agriculture, transportation & logistics, retail, telecommunication, and real estate industries are rapidly adopting edge computing as it improves application performance and results, lowers operational costs, and eliminates centralized storage and redundant transmission expenditures.

https://www.prnewswire.com/news-releases/edge-computing-market-to-be-worth-155-90-billion-by-2030-million-insights-301683681.html