MEC

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

Following their first partnership one year ago, Nokia and Kyndryl have extended it for three years after acquiring more than 100 customers for automating factories using 4G/5G private wireless networks as well as multi-access edge computing (MEC) technologies. Nokia is one of the few companies that have been able to get any traction in the private 4G/5G business which is expected to grow by billions of dollars every year. The size of the global private 5G network market is expected to reach $41.02 billion by 2030 from 1.38 billion in 2021, according to a study by Grand View Research.

The companies said some customers were now coming back to put private networks into more of their factories after the initial one. “We grew the business significantly last year with the number of customers and number of networks,” Chris Johnson, head of Nokia’s enterprise business, told Reuters.

According to the companies, 90% of those engagements—which span “from advisory or testing, to piloting, to full implementation”—are with manufacturing firms. In Dow Chemical’s Freeport, Texas, manufacturing facility which is leveraging a private LTE network using CBRS frequencies to cover 40 production plants over 50-square-kilometers. The private wireless network increased worker safety, enabled remote audio and video collaboration, personnel tracking, and vehicle telematics, the companies said. Dow Chemical is now planning to expand the same coverage to dozens of its factories, said Paul Savill, Kyndryl’s [1.] global practice leader. “Our pipeline has been growing fundamentally faster than it has been in the last 12 months,” he said. “We now have over 100 customers that we’re working with in the private wireless space … in around 24 different countries.”

Note 1. After getting spun off from IBM in 2021, Kyndryl has focused on building its wireless network business and has signed several agreements with cloud providers.

The current active engagements are across more than 24 countries, including markets like the U.S. where regulators have set aside spectrum assets for direct use by enterprises; this means it’s increasingly possible for buyers to access spectrum without the involvement of mobile network operators.

“As enterprises seek to accelerate and deliver on their journeys towards Industry 4.0 and digitalization, the effective integration and deployment of advanced LTE and 5G private wireless networking technologies becomes instrumental to integrate all enterprise operations in a seamless, reliable, efficient and built in a secure manner,” said Alejandro Cadenas, Associate Vice President of Telco and Mobility Research at IDC. “This expanding, powerful, relationship between Nokia and Kyndryl is a unique combination of vertical and horizontal capabilities, and offers IT, OT and business leaders access to the innovation, tools, and expert resources they need to digitally transform their operations. The partnership offers a compelling shared vision and execution that will enable customers across all industries and geographies to access the ingredients they need to deliver against the promise of digital acceleration, powered by network and edge computing.”

The expanded effort will be enhanced with Kyndryl’s achievement of Nokia Digital Automation Cloud (DAC) Advanced accreditation status, which helps ensure that enterprise customers benefit from an expanded lineup of expert resources and skilled practitioners who have extensive training and deep understanding of Nokia products and solutions. In addition, customers will gain access to Kyndryl’s accelerated network deployment capabilities and support of Nokia cellular radio expertise in selected markets.

In response to a question about how direct enterprise access to spectrum has informed market-by-market activity, Kyndryl Global Practice Leader of Network and Edge Paul Savill told RCR Wireless News in a statement, “Spectrum availability is rapidly becoming less of a barrier, with governments allocating licensed spectrum for industrial use and the emergence of unlicensed wireless networking options (such as CBRS in the US, and MulteFire).”

The companies have also developed automated industrial drones that can monitor a site with different kinds of sensors such as identifying chemicals and video recognition as part of surveillance. While drones have not yet been deployed commercially yet, customers are showing interest in rugged, industrialized non-stop automated drone surveillance, Johnson said.

References:

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

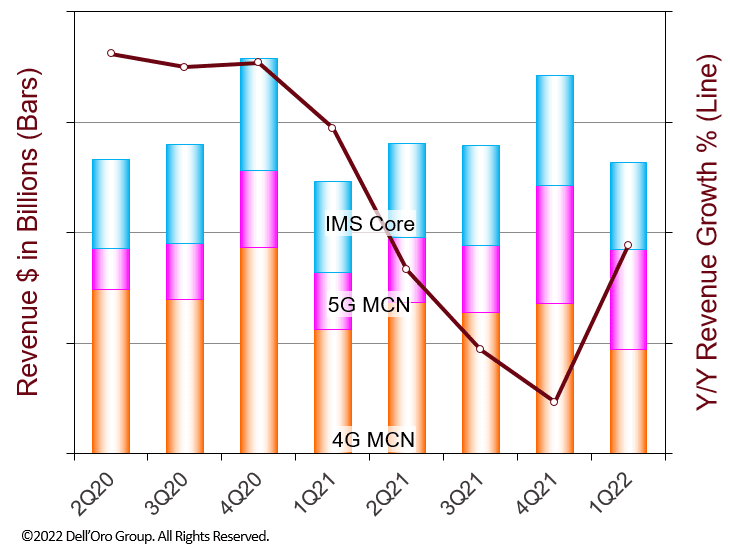

According to a recently published report from Dell’Oro Group, the Mobile Core Networks (MCN) [1.] and Multi-access Edge Computing (MEC) market revenues are expected to reach over $50 billion by 2027.

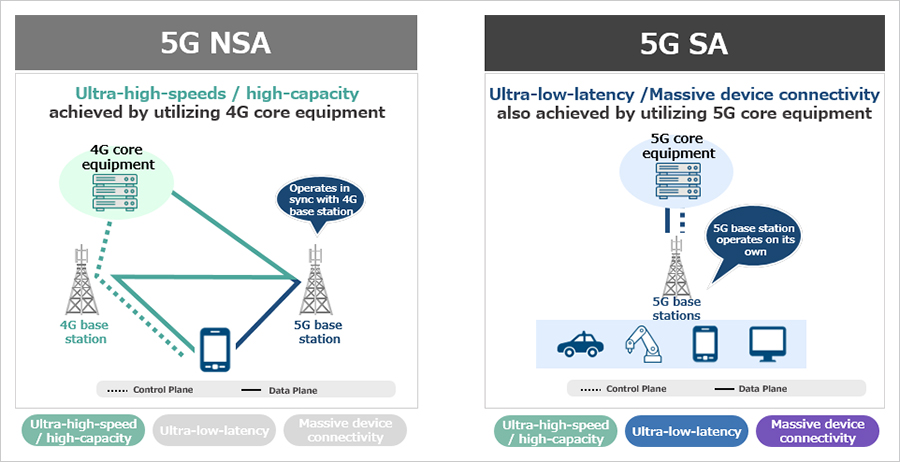

Note 1. The Mobile Core Network is in a transitional stage from 4G to 5G and a new type of core network called the 5G Core Service Based Architecture (SBA). The 5G Core SBA is designed to be a universal core that can be the core for mobile and fixed wireless networks, wireline networks, and Wi-Fi networks. This includes the ability to be the core for 2G/3G/4G, so only one core is necessary for the long term. In addition, the IMS Core will migrate into the 5G Core SBA.

…………………………………………………………………………………………………………………………………………………………………

“The MNC and MEC market revenues are expected to grow at a 2 percent CAGR (2022-2027). We expect the MCN market for the China region to reach maturity first—due to its early start on 5G SA deployments—and is projected to have -4 percent CAGR throughout the forecast period,” stated Dave Bolan, Research Director at Dell’Oro Group.

“The worldwide market, excluding China, is projected to have a 3 percent CAGR. The Asia Pacific (APAC) and the Europe, Middle, East, and Africa (EMEA) region are expected to have the highest CAGRs throughout the forecast period as MNOs accelerate the deployments of 5G SA networks and expand their respective coverage footprints.

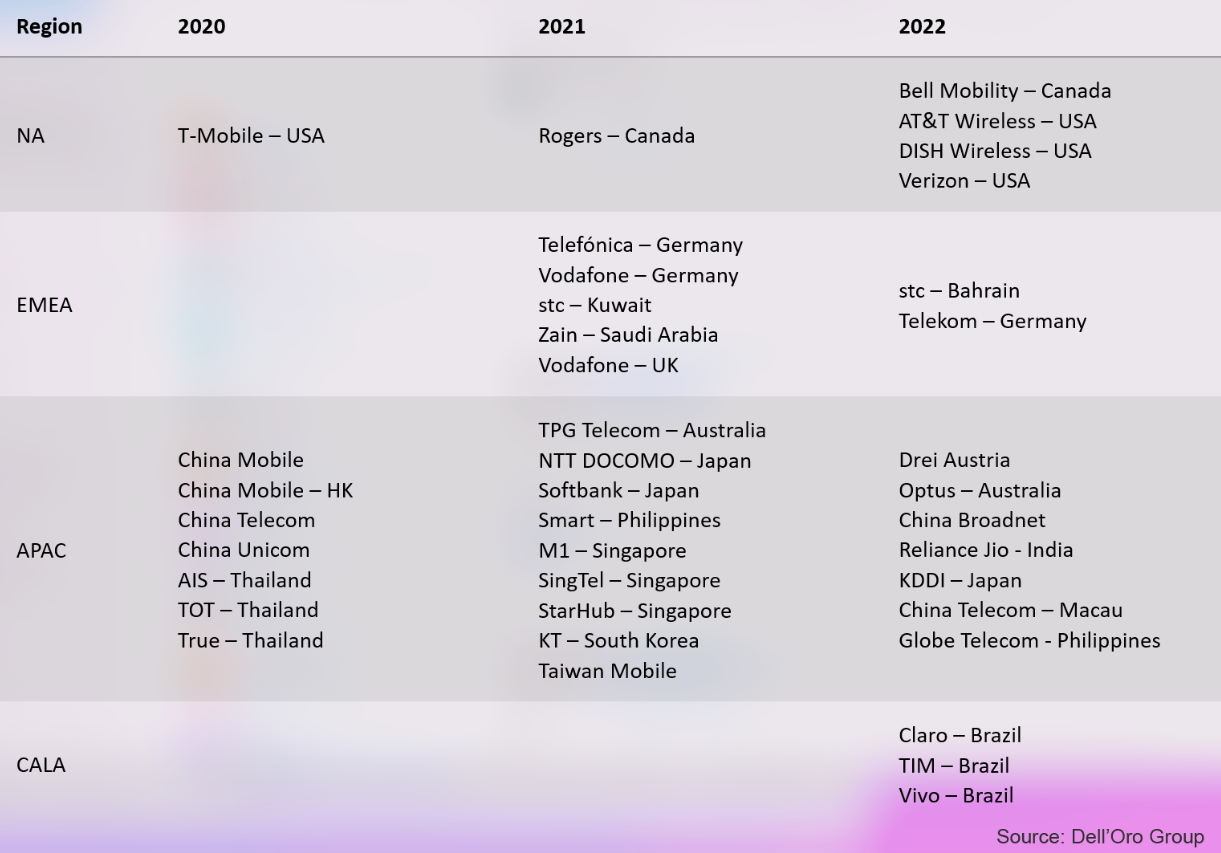

“There were hopes early in the year that many more [SA networks] would be launched in 2022, but the hopes were lowered as the year progressed,” Bolan explained. At the close of 2022, Dell’Oro identified 39 MNOs (Mobile Network Operators) that have commercially launched 5G SA eMMB networks.

“Reliance Jio, China Telecom-Macau, and Globe Telecom were new MNOs added to the list of 39 MNOs launching 5G SA eMMB networks in the fourth quarter of 2022. Reliance Jio has announced a very aggressive deployment schedule to cover most of India by the end of 2023. In addition, AT&T and Verizon plan large expansions to their 5G SA coverage in 2023, raising the projected Y/Y growth rate for the total MCN and MEC market for 2023 higher than 2022,” added Bolan.

Additional highlights from the January 2023 MCN and MEC 5-Year forecast report:

- The MEC segment of the MCN market will have the highest CAGR, followed by the 5G MCN market and the IMS Core market.

- As networks migrate to 5G SA, the 4G MCN market is expected to decline at a double-digit percentage CAGR.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

………………………………………………………………………………………………………………………………………………………………

From Deloitte:

“The coming migration to 5G standalone core networks is expected to allow for increased device density, reliability, and latency, opening the door to advanced enterprise applications,” according to several analysts from Deloitte’s Technology, Media & Telecommunications industry group.

“5G SA’s big attraction for MNOs are the new service and revenue opportunities it creates, Along with near-zero latency and massive device density, 5G SA enables MNOs to provide customers – specifically enterprise customers – access at scale to fiber-like speeds, mission-critical reliability, precise location services, and tailored network slices with guaranteed service levels.”

Deloitte expects the number of mobile network operators investing in 5G SA networks – with trials, planned deployments, or rollouts – to double from more than 100 operators in 2022 to at least 200 by the end of 2023.

References:

Mobile Core Network Market to Reach over $50 billion by 2027, According to Dell’Oro Group

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

AWS enabling edge computing, supports mobile & IoT devices, 5G core network and new services

In an AWS re-Invent Leadership session titled “AWS Wherever You Need It,” [1.] Wayne Duso, vice president of engineering and product at AWS, expressed similar goals. “Today, customers want to use AWS services in a growing range of applications, operating wherever they want, whenever they require. And they’re striving to do so to deliver the best possible customer experience they can, regardless of where their customers or users happen to be located. One way AWS helps customers accomplish this is by bringing the AWS value to our regions, to metro areas, to on-premises, and to the furthest and evolving edge.”

Note 1. You can watch the 1 hour “AWS Wherever You Need It” session here (top right).

“We’re helping customers by providing the same experience from cloud to on-prem to the evolving edge, regardless of where your application may need to reside,” Duso explained. “AWS is enabling customers to use the same infrastructure, services and tools to accomplish that. And we do that by providing a continuum of consistent cloud-scale services that allow you to operate seamlessly across this range of environments.”

Duso explained how AWS is enabling edge computing by adding capabilities for mobile and IoT devices. “There are more than 14 billion smart devices in the world today. And it’s often in things we think about, like wristwatches, cameras, cellphones and speakers,” he said.

“But more often, it’s the stuff that you don’t see every day powering industries of all types and for all types of customers.” Duso cited the example of Hilcorp, a leading energy producer, which is using smart devices to monitor the health of its wells, optimize production and proactively predict failures so it can minimize capital expenditures.

With IoT devices becoming common among energy providers, edge computing is on the rise to handle the volume of data these devices generate. “Now, AWS IoT provides a deep and broad set of services and partner solutions to make it really simple to build secure, managed and scalable IoT applications,” Duso added.

Duso pointed to Couchbase as a use case for flexible AWS services: “Couchbase is a non-SQL database company that uses AWS hybrid edge services such as Local Zones, Wavelength, Outposts and the Snow Family to deploy its applications and highly scalable, reliable and performant environments to reduce latency by over 18 percent for its customers.” Each of these AWS managed services enables Couchbase to move data from the edge to the cloud or manage and process it where it’s generated.

“What we built on these AWS compute environments was a highly distributed, managed or self-managed database,” Duso explained. “For the cloud, an internet gateway for accessing that data securely over the web and synchronizing that data down to the edge. And that works across cloud, edge and on the offline, first-compute environments.”

“Our goal is I want to make AWS the best place to run 5G networks. That is the overarching objective. How can I make AWS, whether we are running it in the region, in a Local Zone, on an Outposts, on a Snow device, how do we make it the best place to run a 5G network, and then provide that infrastructure.”

AWS’ 5G network efforts include a cloud architecture that can support an operator’s 5G SA core network and applications, similar to what AWS is doing with greenfield U.S. wireless network operator Dish Network. Sidd Chenumolu, VP of technology development and network services at Dish Network, recently explained that the wireless carrier’s 5G core network was using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the Local Zones, but most were deployed with Nokia applications across AWS around the country.”

AWS is also working with Verizon to support a part of that carrier’s public MEC system. This includes use of AWS’ Outposts and Wavelengths, the latter of which AWS recently expanded in the United Kingdom with Vodafone.

Hofmeyr continued, “I think you have a spectrum (of different wireless carrier networks), from the total greenfields like what we did with Dish to the large tier-ones. The one thing that’s common across the board is the desire to modernize and become more cloud-like. That is common. Everyone wants that. Each one has a very unique job. There’s not one way that they all are executing in the same way. They’re taking this one workload and then building, so all of them are focusing on different workloads in the network and put it in the cloud.”

In conclusion Hofmeyr said, “I think all over the edge we find these use cases for which purpose-built systems were designed to handle that. And our goal is how do you make that available in the cloud.”

References:

https://reinvent.awsevents.com/leadership-sessions/

https://reinvent.awsevents.com/on-demand/?trk=www.google.com#leadership-sessions

https://www.sdxcentral.com/articles/analysis/aws-wants-to-be-the-best-place-for-5g-edge/2022/12/

https://biztechmagazine.com/article/2022/12/aws-reinvent-2022-harvesting-data-cloud-edge

Vodafone UK opens Edge Innovation Lab; partners with AWS for distributed MEC zone in Manchester

Vodafone-UK has opened a new Edge Innovation Lab in MediaCity, Salford – the first of its kind in the UK. The lab will support the development of Manchester, and the surrounding region, into a Northern digital powerhouse, according to the company. The lab will give enterprises in the region an opportunity to trial new use cases that rely on real-time connectivity.

In addition to equipping the lab with dedicated MEC servers, Vodafone has also partnered with Amazon Web Services (AWS) to deploy a distributed MEC zone in Manchester, which will presumably give enterprises a taste of what ‘real-world’ performance might look like. Voda has also roped in IBM’s IT spin-off Kyndryl to offer customers professional and managed MEC and cloud services.

Spending on edge-related hardware, software and services is expected to reach $176 billion worldwide this year, according to IDC, rising to $274 billion by 2025. With figures like this doing the rounds, it’s little wonder that Vodafone is keen to get enterprise customers to buy into the concept.

“The lab offers innovators the opportunity to experiment with next-generation technologies and bring to life ideas that could revolutionise the way we do business and deliver public services,” said Nick Gliddon, UK business director at Vodafone, in a statement. “It will place Manchester and the surrounding region at the centre of the next stage of digital revolution.”

MEC technology enables real time data processing at the network edge, allowing for the creation of low latency services that would not be possible on today’s traditional network infrastructure. This offers innovators in the Greater Manchester area an opportunity to be at the forefront of next generation digital services.

By installing specialist servers either in Vodafone or customer facilities, applications are able to respond to command significantly faster. This time applications take to respond, known as latency, is a barrier for next generation innovations that require almost instantaneous reactions, or are powered by artificial intelligence. When combined with 5G, latency could be reduced to speeds faster than the human brain processes information.

Use cases enabled by MEC include autonomous vehicles, autonomous operations in factories, immersive augmented and virtual reality, remote medicine, cloud gaming and drone transport.

Vodafone has deployed Dedicated MEC servers at the Edge Innovation Lab and has launched a Distributed MEC zone in the Manchester area in partnership with Amazon Web Services (AWS), as part of their AWS Wavelength Zone infrastructure. Vodafone will also showcase Mixed Reality and Visual Inspection services at the lab. Vodafone has partnered with Kyndryl to offer customers professional and managed services for dedicated MEC and wider cloud-managed services to Vodafone customers.

Tosca Colangeli, president, Kyndryl UK&I, said: “We are excited, as part of our strategic partnership with Vodafone, to be supporting the Edge Innovation Lab in Salford and to use the facility as inspiration and co-creation for our joint customer engagements.

“We expect edge technologies to increasingly become an enabler of business outcomes, allowing end users – and machines – and industries including manufacturing, energy and retail, to reap the benefits of traditional cloud computing while gaining advantages such as reduced data latency, better data autonomy and enhanced security.”

This builds on Vodafone’s four-year partnership with HOST in MediaCity, where the lab will be located.

…………………………………………………………………………………………………………………………………………………………….

Opinion —Nick Wood of telecoms.com wrote:

Barely a day goes by at the moment without someone opening a lab somewhere.

- Monday saw Nokia cut the ribbon on a 5G and 6G research facility at its campus in Amadora, Portugal. Its focus is software, specifically embedded and real-time software. It wants to employ 100 staff over the next two years.

- Last Tuesday, Ericsson revealed plans to spend tens of millions of pounds over the course of the next decade on a UK-based 6G research programme. A team of researchers, academics, PhD students and CSP and industry partners will look at aspects like network resilience and security, AI, cognitive networks and energy efficiency.

- A day later, UK-based Colt strengthened its partnership with IBM by opening an Industry 4.0 lab, also in the UK. It will offer enterprises in the manufacturing sector hands-on experience with various applications enabled by their respective cloud and edge networking solutions in an effort to lower barriers to adoption and generate a bit of business for Colt and IBM along the way.

- A couple of weeks ago, Orange Belgium opened its second 5G lab. The first is based in Antwerp, but this new one is in Liège, and will focus on standalone (SA) 5G use cases.

The growing number of labs showcasing what can be done with 5G and related tech like MEC and slicing only goes to show just how desperate the industry is to evolve beyond enhanced mobile broadband (eMBB) and into new service categories that will hopefully generate more revenue. Meanwhile, Nokia and Ericsson researching 6G is just prudent planning on their part – they need to have something expensive to sell to operators in 10 years time.

Whatever the motivation, it seems to be a good time to be in the lab-building business.

References:

Analysys Mason: few private networks include edge computing, despite the synergies between the two technologies

In a report on Private LTE/5G network deployments, Analysys Mason said that “Only 58 of the 363 private network announcements in our tracker explicitly mention that the private network is working with edge computing.” That’s no surprise as per our recent IEEE Techblog post that edge computing has not lived up to its promise and potential.

The number of announced private networks increased from 256 during the third quarter of last year, to 363 announced deployments during Q3 of this year. Most of that growth is coming from more advanced countries and China “where the IoT markets are mature and are driving demand for private networks.” Private networks using 4G LTE technology continue to dominate the overall market “because it is able to meet the connectivity requirements of most private network applications.” However, 5G is gaining ground with more than 70% of new networks announced this year stating the use of 5G technology.

Private networks and edge computing are complementary as each adds value to the other. When combined, the technologies can support applications that have requirements for low latency and high bandwidth or that need to be located on site for security purposes.

The adoption of edge computing with private networks has been limited thus far due to several factors, such as the relative immaturity of edge technology. The drivers of private network adoption are also different to those of edge computing adoption.

Private LTE/5G networks are often introduced to replace existing Wi-Fi or fibre access networks, and no other changes are made. Nevertheless, the share of private network announcements that mention edge is growing, and more than 20% of the private networks that have been publicly announced in 2022 so far include edge. We expect that more private networks will include edge computing in the next 18–24 months. Some vendors are promoting edge as part of a packaged private network solution (such as Nokia with its NDAC solution).

A few operators, such as Verizon, Vodafone and the Chinese MNOs, are promoting the combination, and many other service providers have trials that combine the technologies.

Verizon Business CEO Sowmyanarayan Sampath who during a recent NSR & BCG Innovation Conference explained that private 5G network momentum was outpacing demand for the carrier’s mobile edge computing (MEC) services.

“On the MEC, what we are finding is demand is taking a little longer to go,” Sampath said. “And part of that is we are having to work back and integrate deeper into their operating system. So it’s going to be much stickier when it does happen [but] it’s going to take a little longer. We’ve got loads of proof of concepts and early commercial deployments, but we shouldn’t see revenue till the back half of next year and into 2024.”

References:

https://www.sdxcentral.com/edge/definitions/what-multi-access-edge-computing-mec/

Has Edge Computing Lived Up to Its Potential? Barriers to Deployment

Casa Systems and Google Cloud strengthen partnership to progress cloud-native 5G SA core, MEC, and mobile private networks

Andover, MA based Casa Systems [1.] today announced a strategic technology and distribution partnership with Google Cloud to further advance and differentiate Casa Systems and Google Cloud’s integrated cloud native software and service offerings. The partnership provides for formalized and coordinated global sales, marketing, and support engagement, whereby Casa Systems and Google Cloud will offer Communication Service Providers (CSPs) and major enterprises integrated Google Cloud-Casa Systems solutions for cloud-native 5G core, 5G SA multi-access edge computing (MEC), and enterprise mobile private network use cases. It’s yet another partnership between a telecom company and a cloud service provider (e.g. AWS, Azure are the other two) to produce cloud native services and software.

This new partnership enables Google Cloud and Casa Systems’ technical teams to engage deeply with one another to enable the seamless integration of Casa Systems’ cloud-native software solutions and network functions with Google Cloud, for best-in-class solution offerings with optimized ease-of-use and support for telecom and enterprise customers. Furthermore, Casa Systems and Google Cloud will also collaborate on the development of unique, new features and capabilities to provide competitive differentiation for the combined Google Cloud – Casa Systems solution offering. Additionally, this partnership provides the companies with a foundation on which to build more tightly coordinated and integrated sales efforts between Casa Systems and Google Cloud sales teams globally.

“We are delighted to formalize our partnership with Google Cloud and more quickly drive the adoption of our cloud-native 5G Core and 5G SA MEC solutions, as well as our other software solutions,” said Jerry Guo, Chief Executive Officer at Casa Systems. “This partnership provides the foundation for Casa Systems and Google Cloud’s continued collaboration, ensuring we remain at the cutting edge with our cloud-native, differentiated software solutions, and that the products and services we offer our customers are best-in-class and can be efficiently brought to market globally. We look forward to working with Google Cloud to develop and deliver the solutions customers need to succeed in the cloud, and to a long and mutually beneficial partnership.”

“We are pleased to formalize our relationship with Casa Systems with the announcement of this multifaceted strategic partnership,” said Amol Phadke, managing director and general manager, Global Telecom Industry, Google Cloud. “We have been working with Casa Systems for over two years and believe that they have a great cloud-native 5G software technology platform and team, and that they are a new leader in the cloud-native 5G market segment. The partnership will enable a much wider availability of premium solutions and services for our mutual telecommunications and enterprise customers and prospects.”

Casa also partnered with Google Cloud last year to integrate its 5G SA core with a hyperscaler public cloud, in order to deliver ultra-low latency applications.

Note 1. Casa Systems, Inc. delivers the core-to-customer building blocks to speed 5G transformation with future-proof solutions and cutting-edge bandwidth for all access types. In today’s increasingly personalized world, Casa Systems creates disruptive architectures built specifically to meet the needs of service provider networks. Our suite of open, cloud-native network solutions unlocks new ways for service providers to build networks without boundaries and maximizes revenue-generating capabilities. Commercially deployed in more than 70 countries, Casa Systems serves over 475 Tier 1 and regional service providers worldwide. For more information, please visit http://www.casa-systems.com.

Image Courtesy of Casa Systems

…………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.fiercetelecom.com/cloud/casa-systems-google-cloud-tout-combined-cloud-native-offering

SK Telecom launches 2nd 5G edge zone in Seoul using AWS Wavelength

SK Telecom has deployed its second 5G edge zone in Seoul, which enables 5G-connected cloud services with ultra-low latency using multi-access edge computing (MEC) [1.], the South Korean telecom company said on Tuesday. SKT’s 5G edge zone is based on Amazon Web Services (AWS) Wavelength [2,]. This 5G edge zone in Seoul is the second launched by SK Telecom, following the one in Daejeon established in December, 2020.

Note 1. MEC refers to technologies that bring computation capabilities and data storage closer to user endpoint devices. It is of critical importance in reducing end to end 5G latency.

Note 2. Amazon’s Wavelength embeds AWS compute and storage services at the edge of communications service providers’ 5G networks while providing seamless access to cloud services running in an AWS Region. By doing so, AWS Wavelength minimizes the latency and network hops required to connect from a 5G device to an application hosted on AWS. With AWS Wavelength and SK Telecom 5G, application developers can now build the ultra-low latency applications needed for use cases like smart factories, interactive live streaming, autonomous vehicles, connected hospitals, and augmented and virtual reality-enhanced experiences.

In 2019, Verizon, Vodafone, SKT and KDDI were among the first operators to partner with AWS to develop commercial edge computing services running on 5G networks.

SK Telecom said that its second edge zone will enhance the efficiency of 5G cloud services, as edge computing workloads will be shared out between the Seoul zone and the Daejeon zone.

The Seoul zone will cover network traffic coming from the top half of the country including the greater Seoul area while the Daejeon zone will cover the rest. Before the Seoul edge zone was set up, the Daejeon edge zone had covered all network traffics across the country.

SK Telecom said that its “SK Edge Discovery” system will automatically allocate the edge zone based on users’ current location.

SKT recently unveiled an enterprise 5G MEC solution called ‘Petasus‘ in collaboration with Dell Technologies. The Petasus 5G MEC solution combines SKT’s 5G MEC solution and Dell PowerEdge servers. It provides network virtualization features specialized for MEC and operational tools. Going forward, the solution will support integration with MEC solutions of other telcos and provide an app store-like feature for MEC services applications.

As a solution that reflects SKT’s extensive experience in 5G MEC commercialization and operation, the platform can be provided in a customized manner. Going forward, it will enable enterprises to deploy MEC in a prompt and stable manner by supporting interworking with public clouds.

SKT and Dell plan to provide the Petasus solution not only to global telcos, but also to businesses and public institutions throughout the globe that plan to adopt private 5G networks. In particular, they will strengthen their cooperation in 5G end-to-end business, which includes consulting, infrastructure deployment and maintenance services.

References:

https://aws.amazon.com/about-aws/whats-new/2022/05/aws-wavelength-zone-seoul/

https://www.sktelecom.com/en/press/press_detail.do?page.page=1&idx=1534&page.type=all&page.keyword=

SK Telecom and AWS launch 5G edge cloud service and collaborate on other projects

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

According to a recently published report from Dell’Oro Group, the total Mobile Core Network (MCN) and Multi-access Edge Computing (MEC) market revenues for 1Q 2022 rebounded to a positive year-over-year (Y/Y) growth rate after the decrease in 4Q 2021 which was the first decrease since 4Q 2017.

The MCN market growth was driven by an extremely high double-digit percentage Y/Y revenue growth rate in the 5G MCN market overcoming the Y/Y revenue declines in the 4G MCN and IMS Core markets. For the MCN market regionally, the China region had a high growth rate while the MCN market excluding China had a negative growth rate for the quarter.

“With the continued aggressive build-out of 5G Standalone (SA) networks in China, the China region in 1Q 2022 substantially increased its share of the 5G MCN market over last quarter,’ stated Dave Bolan, Research Director at Dell’Oro Group. “At the end of 1Q 2022, we have identified 25 Mobile Network Operators (MNOs) that have commercially launched 5G SA Mobile Broadband networks (MBB) with services available to consumers. The 5G Core vendors (in alphabetical order) include Cisco, Ericsson, Huawei, NEC, Nokia, Samsung, and ZTE. We have identified 150 MNOs with 5G Core contracts with the above vendors plus Mavenir. There are still more 5G Core contracts that vendors have acknowledged without revealing the associated MNOs.

“We see fewer 5G Core network launches slated for 2022 as compared to 2021 when 16 networks were launched. However, many are being readied for 2023 launches and we project mid-single-digit percentage Y/Y growth rates for the balance of 2022. One of the most anticipated and publicized 5G Core launches is Dish Wireless – the first to run 5G Core on the Public Cloud. The company is preparing to launch in many cities by mid-June 2022 to meet regulatory coverage requirements. In early May 2022, Dish had a soft launch in its first city, Las Vegas. Nokia is the primary 5G Core vendor.

“Multi-access Edge Computing deployed by MNOs has barely scratched the surface in spite of all the hype, except for the China region, which has deployed thousands of MEC nodes throughout their MNO networks, with a mix of Public MEC and Private MEC sites,” continued Bolan.

Additional highlights from the 1Q 2022 Mobile Core Network and Multi-Access Edge Computing Report:

- The top two vendors for the MCN, 4G MCN, and IMS Core markets were Huawei and Ericsson.

- The top two vendors for the 5G MCN market were Huawei and ZTE.

- Nokia and Ericsson had the highest Y/Y growth rates for the 5G MCN market coming from a low small base. However, Huawei had the highest dollar revenue gain, with a lower Y/Y growth rate coming from a larger base.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

Softbank launches 5G MEC in Japan using its 5G SA core network

SoftBank announced that it has deployed a 5G Multi-access Edge Computing (MEC) site in the Kanto region of Japan. The multi-national conglomerate said it has started the nationwide deployment of MEC servers in Japan this month (May 2022). SoftBank claims its 5G MEC delivers a low-latency and secure service experience by using its 5G SA core network with compute servers at the network’s edge. The 5G MEC offering now makes it possible for customers to experience high-speed services through the deployment of applications close to user devices within the 5G SA network, which significantly reduces server access times.

SoftBank’s 5G MEC platform provides a Kubernetes-based container environment [1.] which is a de facto platform for application development. From physical infrastructure set-up to application deployment and distribution, 5G MEC sites are automated. Such features make applications on the 5G MEC platform more fault-tolerant, and they also enable faster service rollout with reduced complexity, improving a variety of industry services such as emergency notifications, in-building IoT-based network deployments, factory automation, multi-user network gaming and automated driving, among others.

Note 1. Kubernetes is a portable, extensible, open source platform for managing containerized workloads and services, that facilitates both declarative configuration and automation.

“This deployment of 5G MEC is a major milestone for SoftBank. Its compatibility with SRv6 MUP and network slicing, along with its automation of operation features, make it unique across the industry. With our partners, we’ll develop a multi-industry ecosystem to become a complete digital platform provider by harnessing the capabilities of our 5G MEC solution,” said Keiichi Makizono, SoftBank Corp. Senior Vice President and Chief Information Officer (CIO).

Source: GSMA

Source: Softbank

……………………………………………………………………………………………………………………………………………………………………………………………

Comments from partners supporting Softbank’s 5G MEC are as follows:

“SoftBank is committed to enabling the digital transformation of companies and organizations across all sectors, and we are honored to have been selected as a cloud partner in this aim. We share with SoftBank a vision where modern applications must integrate seamlessly with cloud operations to create exceptional end user experiences. We look forward to further enabling SoftBank to execute on this vision, for their cloud native customers’ use cases in and beyond 5G,” said Ankur Singla, SVP, Security & Distributed Cloud Product Group, F5. [F5 is a strategic partner for SoftBank that has worked jointly on strategic initiatives including SRv6 and 5G MEC, commented on 5G MEC].

“Corezero is excited to join SoftBank’s 5G MEC initiative. Corezero enables Logging-as-a-Service. Our flagship product FFWD is a real-time observability system built using cutting edge software to achieve true Ingest-Query-Separation, and Compute-Storage-Separation: an architecture type that best serves the modern high-volume log flows and query profiles in highly distributed cloud environments. We are looking forward to working with SoftBank to provide Logging-as-a-Service (LaaS) starting from their 5G MEC enhanced with low-cost programmability,” said Yee Soon, CEO, Corezero.

“Niantic has been working with SoftBank on promotions for our AR/location-based game titles, as well as network optimization at our live events, etc. We believe that SoftBank’s nationwide deployment of 5G MEC will open up new possibilities not only for our game titles but also for developers and creators who use Niantic Lightship ARDK, which will lead to the creation of an innovative AR experience from Japan to the world in the future,” said Setsuto Murai, President, Niantic Japan.

“Vantiq is excited to be part of SoftBank’s 5G MEC program, which is bringing significant value to the communications industry. The combination of SoftBank’s Digital Platform, which provides the necessary edge-computing infrastructure, and Vantiq’s real-time distributed processing capabilities, will help drive market innovation and disruption through the creation of mission-critical, ultra low-latency business applications,” said Marty Sprinzen, CEO, Vantiq.

“We are very excited about the Kubernetes (k8) container technology-based SoftBank 5G MEC roll out. MIXI is actively utilizing the k8-based container platform for future microservice based application development. By utilizing 5G MEC distributed all over Japan with a high affinity with mobile networking, we aim for further innovation in the sports entertainment area along with other futuristic applications,” said Junpei Yoshino, Chief General Manager, Development Operations, mixi, Inc.

“Yahoo! JAPAN is proactively trying to adopt new technologies to provide safe, secure, and comfortable services to a wide range of customers. Therefore, we are paying close attention to the expansion of SoftBank 5G MEC, which will enhance the possibility of our services by providing CSP infrastructure closer to our customers’ mobile devices with higher network reliability, significantly reduced processing speed, and ease of deployment through container infrastructure. We also expect MEC sites distributed around the world to be a powerful advantage when we, the content service providers, expand our business all over the world. We have high expectations for SoftBank to lead this important platform,” said Masahiko Kokubo, Director, EVP, Managing Corporate Officer, CTO, Yahoo Japan Corporation.

“The JCV face recognition platform is widely adopted at thousands of retail shops and entertainment venues. To provide customers with highly accurate AR experiences using spatial image recognition at commercial facilities and stadiums Real-time computing processing using SoftBank’s upcoming 5G MEC will enable us to provide our customers with increased accuracy and ultra-low latency. We are confident that, with SoftBank 5G MEC, this will fuel the creation of a metaverse platform linking online and offline,” said Andrew Schwabecher, CEO of Japan Computer Vision Corp.

“We are very much excited about SoftBank’s 5G MEC deployment which will play a vital role in realizing distributed computing necessary for advanced digital society. Using SRv6 for networking will make SoftBank’s 5G MEC even more optimal and easy to deploy at remote locations. By utilizing our regional Internet eXchanges (IX), BBIX with its valued partners will deliver the optimal network platform for the Digital Twin [2.] era,” said Hidetoshi Ikeda, Representative Director, President & CEO, BBIX, Inc.

- Note 2. Digital twin is a technology that collects information in real space via IoT, etc. and reproduces real space in cyber space based on the transmitted data.

- ……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

- Other Notes:

- In October 2021, SoftBank announced that it had started to offer 5G Standalone (SA) network services. With this new launch, SoftBank claimed to be the first carrier in Japan to offer 5G SA commercial services. At that time, the company said that the most important features of 5G SA networks are their ability to deliver network slicing and Private 5G networks, which are customized networks tailored to individual enterprise needs, and other connectivity features based on advanced technologies.

- Softbank had initially launched commercial 5G services in Japan through NSA architecture in March 2020.

- In April 2021, Softbank launched Japan’s first 5G global roaming service.

- According to Statistica, Softbank had a 20.8% share (# 3) of Japan’s mobile subscribers in 2021. NTT DoComo led with a 37% market share, while KDDI was in second place with a 27.2% market share.

- Softbank’s history is here.

References:

https://www.softbank.jp/en/corp/news/press/sbkk/2022/20220526_01/

https://www.softbank.jp/en/corp/news/press/sbkk/2021/20211019_01/

Bell Canada deploys the first AWS Wavelength Zone at the edge of its 5G network

In yet another tie-up between telcos and cloud computing giants, Bell Canada is the first Canadian network operator to launch multi-access edge computing (MEC) services using Amazon Web Services’ (AWS) Wavelength platform.

Building on Bell’s agreement with AWS, announced last year, together the two companies are deploying AWS Wavelength Zones throughout the country at the edge of Bell’s 5G network starting in Toronto.

The Bell Canada Public MEC service embeds AWS compute and software defined storage capabilities at the edge of Bell’s 5G network.

The Wavelength technology is then tied into AWS cloud regions that host the applications. This moves access closer to the end user or device to lower latency and increase performance for services such as real-time visual data processing, augmented/virtual reality (AR/VR), artificial intelligence and machine learning (AI/ML), and advanced robotics.

Source: Bell Canada

……………………………………………………………………………………………………………………………………………………………………………….

“Because that link between the application and the edge device is a completely controllable link – it doesn’t involve the internet, doesn’t involve these multiple hops of the traffic to reach the application – it allows us to have a very particular controlled link that can give you different quality of service,” explained George Elissaios, director and GM for EC2 Core Product Management at AWS, during a briefing call with analysts.

Network infrastructure is the backbone for Canadian businesses today as they innovate and advance in the digital age. Organizations across retail, transportation, manufacturing, media & entertainment and more can unlock new growth opportunities with 5G and MEC to be more agile, drive efficiency, and transform customer experiences.

Optimized for MEC applications, AWS Wavelength deployed on service providers’ 5G networks provides seamless access to cloud services running in AWS Regions. By doing so, AWS Wavelength minimizes the latency and network hops required to connect from a 5G device to an application hosted on AWS. AWS Wavelength is now available in Canada, the United States, the United Kingdom, Germany, South Korea, and Japan in partnership with global communications service providers.

Creating an immersive shopping experience with Bell Canada 5G:

Increasingly, retailers want to offer omni-channel shopping experiences so that consumers can access products, offers, and support services on the channels, platforms, and devices they prefer. For instance, there’s a growing appetite for online shopping to replicate the in store experience – particularly for apparel retailers. These kinds of experiences require seamless connectivity so that customers can easily and immediately pick up on a channel after they leave another channel to continue the experience. These experiences also must be optimized for high-quality viewing and interactivity.

Rudsak worked with Bell and AWS to deploy Summit Tech’s immersive shopping platform, Odience, to offer its customers an immersive and seamless virtual shopping experience with live sales associates and the ability to see merchandise up close. With 360-degree cameras at its pop-up locations and launch events, Rudsak customers can browse the racks and view a new product line via their smartphones or VR headsets from either the comfort of their own home or while on the go. To find out more, please click here.

Bell Canada Public MEC with AWS Wavelength is now available in the Toronto area, with additional Wavelength Zones to be deployed in the future. To find out more, please visit: Bell.ca/publicmec

AWS currently has Wavelength customers (see References below) in the United States, the United Kingdom, Germany, South Korea, Japan, and now Canada. It also has deals with Verizon, Vodafone, SK Telecom, and Dish Network.

Bell Canada explained that the service is targeted at enterprise customers. It will initially offer services to enterprises in Toronto, with expansion planned into other major Canadian markets.

“We’re excited to partner with AWS to bring together Bell’s 5G network leadership with the world’s leading cloud and AWS’ robust portfolio of compute and storage services. With general availability of AWS Wavelength Zones on Canada’s fastest network, it becomes possible for businesses to tap into all-new capabilities, reaching new markets and serving customers in exciting new ways. With our help, customers are thinking bigger, innovating faster and pushing boundaries like never before. Our team of experts are with customers every step of the way on their digital transformation journey. With our ongoing investments in supporting emerging MEC use cases, coupled with our end-to-end security built into our 5G network, we are able to give Canadian businesses a platform to innovate, harness the power of 5G and drive competitiveness for their businesses.”

– Jeremy Wubs, Senior Vice President of Product, Marketing and Professional Services, Bell Business Markets

“AWS Wavelength brings the power of the world’s leading cloud to the edge of 5G networks so that customers like Rudsak, Tiny Mile and Drone Delivery Canada can build highly performant applications that transform consumers’ experiences. We are particularly excited about our deep collaboration with Bell as it accelerates innovation across Canada, by offering access to 5G edge technology to the whole AWS ecosystem of partners and customers. This enables any enterprise or developer with an AWS account to power new kinds of mobile applications that require ultra-low latencies, massive bandwidth, and high speeds.”

– George Elissaios, Director and General Manager, EC2 Core Product Management, AWS

“With Bell’s Public MEC and AWS Wavelength we are able to offer new, fully immersive shopping experiences to our customers. Shoppers can virtually explore our new arrivals and interact in real-time with our staff and industry experts during interactive events and pop-ups. Thanks to the hard work, support and expertise of Bell, AWS and Summit Tech, we were able to successfully deliver our first immersive/interactive shopping event with the quality, innovation and excellence that our brand is known for.”

– Evik Asatoorian, President and Founder, Rudsak

“Canadian organizations across all industries are transforming their workflows by harnessing the power of new technologies to launch new products and services. In fact, 85% of Canadian businesses are already using the Internet of Things (IoT). In order to maximize the benefits of cloud computing, intelligent endpoints and AI, while adding emerging technologies like 5G, we need to modernize our digital infrastructure to embrace multi-access edge computing (MEC). Modernized edge computing interconnects core, cloud and diverse edge sites, enabling CIOs and business leaders to optimize their architectures to resolve technical challenges around latency, bandwidth and compute power, financial concerns about cloud ingress/egress and compute costs as well as governance issues such as regulatory compliance without losing advanced features like machine learning, AI and analytics. MEC offers the possibility of deploying modernized, cloud-like resources everywhere to support the ability to extract value from data.”

– Nigel Wallis, Research VP, Canadian Industries and IoT, IDC Canada

- Bell is the first Canadian telecommunications company to offer AWS-powered public MEC to business customers

- First AWS Wavelength Zone to launch in the Toronto region, with additional locations in Canada to follow

- Apparel retailer Rudsak among the first to leverage Bell Public MEC with AWS Wavelength to deliver an immersive virtual shopping experience

Bell is Canada’s largest communications company, providing advanced broadband wireless, TV, Internet, media and business communication services throughout the country. Founded in Montréal in 1880, Bell is wholly owned by BCE Inc. To learn more, please visit Bell.ca or BCE.ca.

References:

AWS looks to dominate 5G edge with telco partners that include Verizon, Vodafone, KDDI, SK Telecom

Verizon, AWS and Bloomberg media work on 4K video streaming over 5G with MEC

AWS deployed in Digital Realty Data Centers at 100Gbps & for Bell Canada’s 5G Edge Computing

Amazon AWS and Verizon Business Expand 5G Collaboration with Private MEC Solution