Diamond State Networks to invest more than $1.66 billion in fiber infrastructure in Arkansas

A new consortium in Arkansas is leading the way forward for electric cooperatives in the rural U.S. can increase bandwidth and save costs by collaborating on fiber broadband delivery.

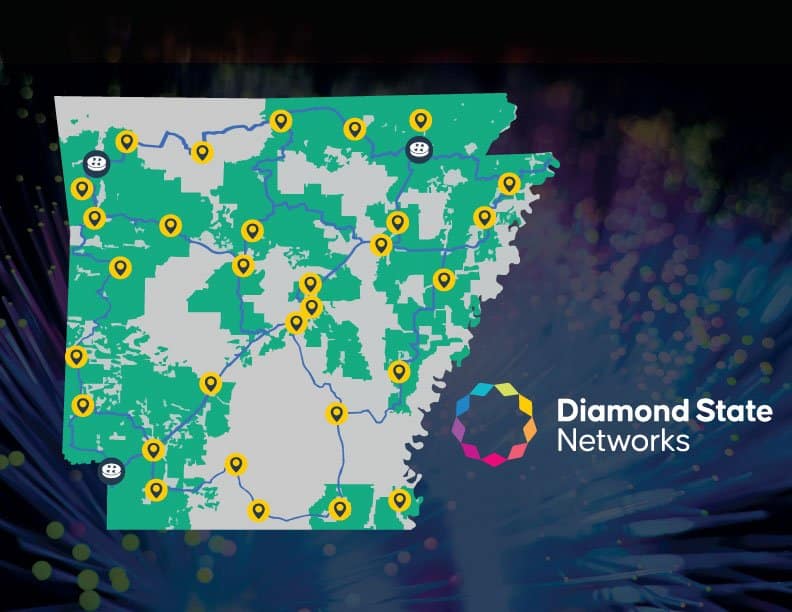

Diamond State Networks (DSN) is a collective of 13 electric co-ops from across the state of Arkansas which are joining forces to deliver wholesale fiber broadband. All in, the cooperative networks’ 50,000 miles of fiber will cover 64% of Arkansas and reach 1.25 million rural Arkansans. The goal for DSN is to serve 600,000 residences and businesses in Arkansas in the next few years, with over 250,000 locations already deployed. Here’s a network coverage map:

The 13 member cooperatives in DSN include: OzarksGo, Clay County Connect, Farmers Electric Cooperative, Petit Jean Fiber, Enlightened by Woodruff Electric, NEXT Powered by NAEC, Wave Rural Connect, Arkansas Fiber Network (AFN), Four States Fiber Internet, empower (delivered by Craighead Electric), MCEC Fiber, South Central Connect and Connect2First.

Doug Maglothin, DSN’s director of operations, says his company expects to add “a couple more cooperatives” to that list. (The state of Arkansas has 17 electric co-ops, served by a central entity called the Arkansas Electric Cooperative Corporation.)

The collective of co-ops that form DSN are at different phases of their service delivery journey. Some, like Farmers Electric, are in the early planning stages. OzarksGo – the subsidiary of Ozarks Electric Cooperative – is furthest along and nearing 40,000 subscribers. Indeed, Maglothin referred to Ozarks Electric CEO Mitchell Johnson as the “visionary” for DSN, who saw the need for the state’s electric co-ops to get involved with broadband delivery in 2015 and 2016.

But as electric co-ops began entering the space in 2017 and 2018, “pretty quickly, you find out how difficult and expensive it can be to buy connectivity to the global Internet,” said Maglothin. It was “from that necessity” that the plan for DSN was born.

While the consolidated electric cooperative model is unique for the broadband space, other states and communities are deploying broadband as collectives or partners. That includes Utopia Fiber’s municipal, open access fiber delivery network in Utah as well as California’s planned open-access statewide middle-mile network. And this week, a group of rural telcos and an electric cooperative in Indiana announced plans to launch HoosierNet, a “multi-year, multi-million-dollar” statewide fiber network.

Maglothin said DSN is collaborating with other states looking for a similar solution and that Diamond State has “kind of become a beacon for cooperative middle mile,” as it offers a model that allows electric co-ops to control their costs.

“The more bandwidth you grow, the more content you collect, the more powerful your voice is in negotiating pricing to get to these big anchor points for your network,” said Maglothin. “So we feel like there’s a potential future for cooperative companies working together like this where we become one of the largest bandwidth aggregators probably in the country.”

The 13 member co-ops are investing more than $1.66 billion in fiber infrastructure for DSN. According to Maglothin, less than 20% of that funding is from federal and state grants. But he expects that DSN will be eligible for Broadband Equity, Access, and Deployment (BEAD) and Middle Mile grant funding, federal programs worth $42.45 billion and $1 billion, respectively.

According to Broadband.Money, a platform connecting local providers and networks with funding opportunities, Arkansas is estimated to receive $1.4 to $1.6 billion for broadband through the Infrastructure Investment and Jobs Act (IIJA). But those numbers are still to be determined by federal broadband mapping data that officials say will be released later this year.

Notably, while existing FCC broadband data is widely understood to undercount the digital divide in the US, a recent presentation by the Broadband Development Group at the Arkansas Rural Connect Broadband Forum revealed that the state’s broadband gap may now be smaller than the FCC’s count shows. While federal data puts Arkansas’ digital divide at 250,000 households or 21% of the population, BDG’s analysis brought that to 209,000 households (17%).

Maglothin attributes this increase in broadband access to the work electric co-ops have done in recent years. “It’s because of the rapid onset of cooperative fiber being pushed out,” he said.

For this reason, and with more funding coming down through the BEAD program, Maglothin thinks that Arkansas can go from being among the lowest-ranked states in the US for connectivity to the highest.

References:

https://www.diamondstatenetworks.com/

https://www.broadbandworldnews.com/document.asp?doc_id=778063&

2 thoughts on “Diamond State Networks to invest more than $1.66 billion in fiber infrastructure in Arkansas”

Comments are closed.

Great summary of what’s going in Arkansas.

Electric cooperatives are getting into the fiber game in a big way. There were several that I spoke to that now have more broadband customers than coop members (one has 3x broadband compared to electric coop members). How is that? They have been asked by communities outside their electric service area to provide broadband.

This has been great for the ratepayers, as it means excess revenue gets returned to the electric cooperative members in the form of capital credits. More on that in a future Viodi interview with one such cooperative.

Indiana is getting another option for statewide fiber connectivity, as a group of 21 electric and telephone cooperatives came together to form the Accord Telecommunications Collaborative.

Today, Accord’s members collectively own 20,000 miles of fiber infrastructure and 40,000 miles of electric lines, serving around 300,000 homes and businesses across the state and about 75% of its land mass. By combining their individual networks, Accord’s members are looking to expand beyond residential services to enterprise offerings, Accord Chairman and SCI REMC CEO James Tanneberger told Fierce.

Tanneberger said discussions about forming a statewide fiber network began around four years ago, when REMC and other co-ops in the state began construction of fiber-to-the-home networks using money from the U.S. Department of Agriculture. At the time, the companies figured if they were spending millions building these networks, it would make sense to drop another few hundred thousand dollars to tie them together.

But only about half of its members’ systems are connected today, meaning there’s plenty of work left for Accord to do. While it’s still sorting out its exact technological needs ahead of an RFP, Accord is planning to build DWDM connections offering at least 100G links and potentially Ethernet over the next year or so. Given the RFP process takes some time, it’ll likely be 2023 before those deployments start.

“The great thing about Accord is that our members for the most part are contiguous in that our electric systems border each other, which means that you have a very short distance to travel to connect our fiber system to our neighbors,” Tanneberger said. “So it’s a very low-cost way to prop up a statewide network when you’re already leveraging over $1 billion in assets that were built and financed for other reasons.”

Given many Accord members already have their own FTTH offerings, Tanneberger said the real opportunity for them in joining Accord is the ability to offer statewide enterprise services and reach businesses they otherwise might not have been able to. That includes organizations with multiple branch locations, such as banks and hospitals, as well as other companies that require high-speed transport.

In terms of how the financials will work, Tanneberger noted Accord will charge a price for transport across the state while member companies will individually reap revenue from traffic that veers off into their local networks. Any surplus revenue generated by members will go back into their businesses to support their core services, he added.

Accord’s members aren’t the first co-ops to tackle such an undertaking, nor even the first group of co-ops in Indiana to do so. Earlier this month, a group of 17 internet service providers and co-ops formed Hoosier Net, aiming to combine their assets and offer middle mile fiber services.

Tanneberger said three of Accord’s members are actually also part of Hoosier Net. However, he said Accord is unique in that it offers a different footprint from Hoosier Net.

“What you have with Hoosier Net and Accord is two physically different networks with the same end goal,” he said. Hinting at the potential for a tie up between the two statewide networks, Tanneberger said “there are lots of conversations happening around the state and Hoosier Net would represent one of those companies that we would like to work with.”

https://www.fiercetelecom.com/telecom/indiana-gets-second-statewide-fiber-network-co-ops-strike-accord