AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

The city of Amarillo, TX has selected AT&T to install fiber-to-the-premises (FTTP) networks, covering more than 22,000 customer locations. The project will cost about $24 million (with $2 million coming from the city). The network, which will be built out over three years, still requires final approval by Amarillo and a final contract between AT&T and the city.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build-out.

[Amarillo residents and businesses also served by Altice USA’s Suddenlink Communications.]

AT&T is taking the public/private partnership route here. The telco inked a similar $39.6 million agreement (with about $10 million coming from public funds) last year with Vanderburgh County, Indiana, to build fiber to about 20,000 locations in the rural, southern tip of the state. AT&T also has a $33 million fiber project underway to connect about 20,000 locations in Oldham County, Kentucky.

As noted in an earlier IEEE Techblog post, AT&T’s FTTP buildout/upgrade plan is targeting 30 million locations by 2025. AT&T added 289,000 FTTP subs in Q1 2022, ending the period with a grand total of 6.28 million, and enough to offset a quarterly loss of 284,000 non-fiber subs (including U-verse Internet customers).

“What we’re doing here in Amarillo that’s different is that this is an urban core,” said Jeff Luong, president, broadband access and adoption initiatives for AT&T. “The city of Amarillo identified a specific area that they believe is challenging from a connectivity perspective in their urban core,” he added.

“The area that the city wanted to address is actually the city core. It’s actually an area they feel is underserved,” he said. “We are expanding access, we are providing a very affordable free solution when partnered with ACP [Affordable Connectivity Program] and then we’ll be actively engaging in adoption, digital literacy and other type of activities to ensure that people have access, they can afford it and that they understand how to use the service.”

“We’re working with the public sector to identify areas that are more challenging to build on our own from a private sector perspective and creating these type of public/private partnerships where we, AT&T, will invest our own capital. But the public sector would also contribute a share of the cost to expand fiber connectivity to these locations,” Luong said.

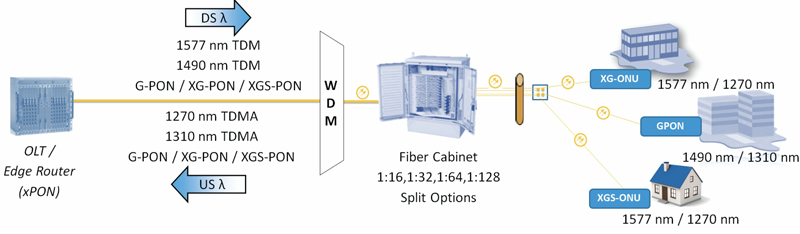

AT&T today delivers services in the area via other technologies, including legacy copper networks. The new fiber overlay, based on XGS-PON, will be capable of delivering symmetrical speeds of 5 Gbit/s, replicating a new mix of multi-gigabit services that AT&T has launched in its other FTTP markets.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build.

About AT&T in Texas:

AT&T customers and FirstNet® subscribers in Texas got a big boost in wireless connectivity and fiber access last year. In 2021, AT&T completed nearly 1,000 wireless network enhancements in Texas, including adding nearly 200 new macro sites. AT&T also made fiber available in more than 300,00 new locations in Texas in 2021. These network improvements will enhance the state’s broadband coverage and help give residents, businesses and first responders faster, more reliable service.

From 2018 to 2020, we expanded coverage and improved connectivity in more communities by investing more than $7.7 billion in our wireless and wireline networks in Texas. This investment boosts reliability, coverage, speed and overall performance for residents and their businesses.

And in Amarillo, we expanded coverage and improved connectivity by investing more than $60 million in our wireless and wireline networks from 2018-2020.

References:

https://www.att.com/local/fiber/texas/amarillo

https://about.att.com/story/2022/amarillo-broadband-access.html

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

“Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022

One thought on “AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX”

Comments are closed.

AT&T (T) posted solid telecom results for the second quarter, keeping the firm on pace to meet or exceed management’s 2022 subscriber growth expectations. The continued growth in wireless additions led to an increase in the mobility services revenue growth target to 4%-5% from “at least 3%.” However, management cut its free cash flow target for 2022 by $2 billion to $14 billion due to continued growth investments and the timing of collections. Our fair value estimate, which reflects the Warner spinoff, remains $25 per share. We continue to like AT&T’s strategic position and its network investment plans, which we expect will deliver improving revenue and profit growth over the next several years.

Adjusted for the Warner spinoff, DirecTV transaction, and Latin American asset sale, total revenue (now roughly two thirds wireless, with most of the remainder enterprise and consumer fixed-line services) increased 2.2% year over year to $29.6 billion. Wireless service revenue growth accelerated to 4.8% year over year, ahead of management’s previous 2022 target and in line with the new one, on strong postpaid phone customer growth in recent quarters. AT&T added 813,000 postpaid phone customers during the quarter, up from 798,000 a year ago, the strongest second quarter in a decade. Despite more than two years of blistering industrywide growth, we still believe that postpaid customer additions will eventually have to tick down and match population growth more closely, but AT&T has yet to see any sign of falling demand.

Average revenue per postpaid phone customer was also strong, growing 1.1% versus a year ago as promotional credits, which are amortized against revenue, declined in the quarter and more customers traded up to higher-priced unlimited plans. Management expects average revenue per postpaid phone customer to improve further in the second half. Segment EBITDA expanded by 2.5% year over year, with further expansion projected in the second half of 2022.

https://www.morningstar.com/articles/1103730/att-earnings-show-continued-wireless-momentum-during-q2