MoffettNathanson: accelerating rise of Cable Wireless; Business Wireline status; AT&T’s overlooked assets

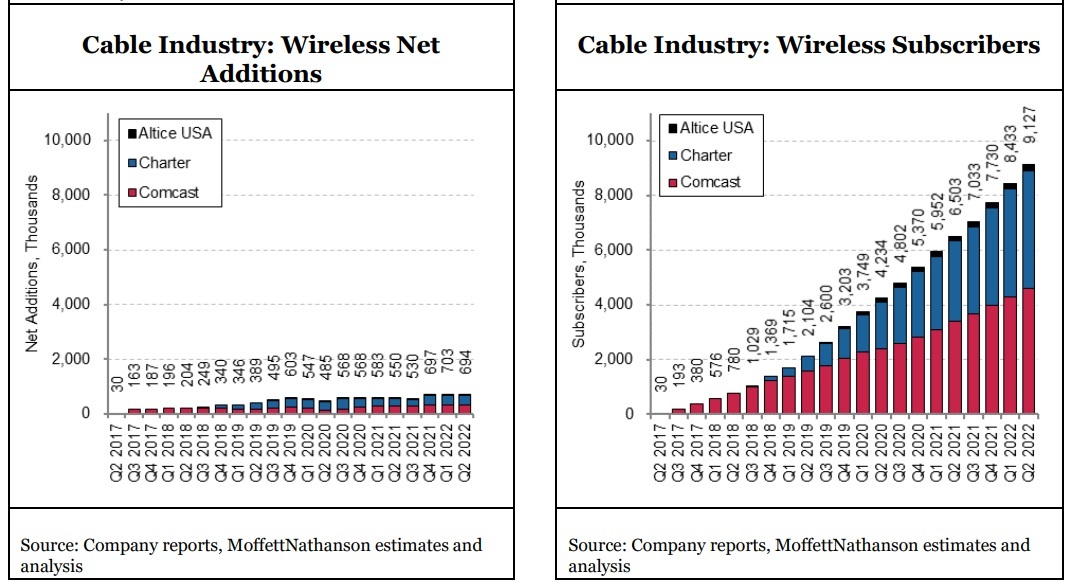

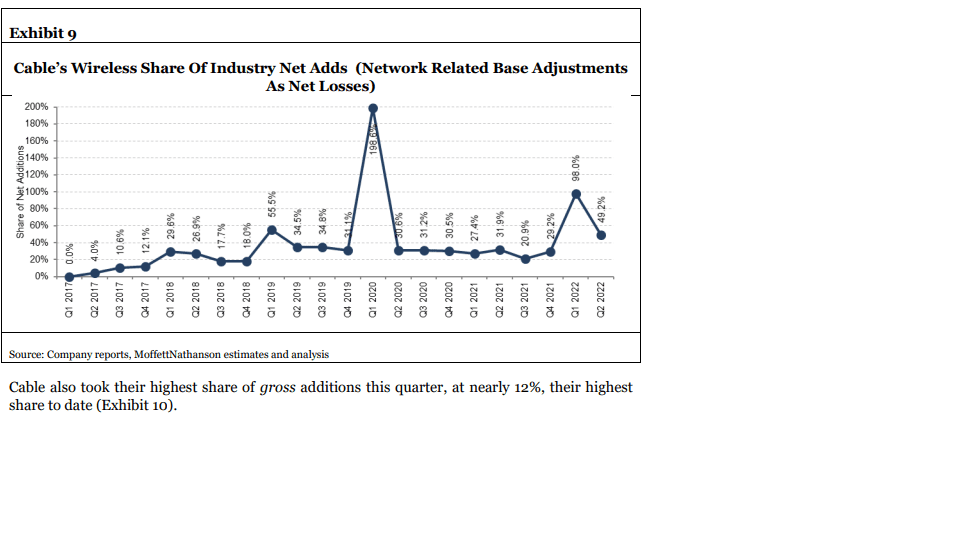

To the surprise of many, the Cable industry (Cablecos/MSOs) has captured an accelerating share of gross and net wireless subscriber additions, forcing incumbent wireless telcos (AT&T, Verizon, T-Mobile) to respond by offering lower priced alternatives. In the second quarter of the year, with cable taking nearly half (49.2%) of industry net additions in the period (after adjusting for 3G network shutdowns), according to MoffettNathanson’s latest report (subscription required) on the mobile sector. Cable’s Q2 2022 take was up from approximately 31.9% in the year-ago period.

MoffettNathanson’s analysis also showed that cable took its highest share of gross mobile subscriber adds in Q2 2022, at 11.9%. That compared to T-Mobile (30.1%), AT&T (29%) and Verizon (27.8%). Comcast, Charter and Altice USA combined to add 694,000 mobile lines in the second quarter, ending the period with 9.12 million.

Comcast, Charter, and Altice collectively added 694K new subscribers in Q2, up more than 100K from the corresponding quarter last year. That takes Cable’s subscriber base beyond 9M, or still just ~3% of the U.S. industry as per the graph below.

- Comcast disclosed that wireless penetration of its residential broadband base has reached 7.9% (or about 2.4M homes), suggesting they’ve reached nearly 2 lines per home, up from ~1.6 lines per account just a year ago.

- Privately held Cox Communications is now in beta testing on its MVNO service, and we expect it will offer pricing similar to Comcast’s and Charter’s. That will only add to the pressure on the wireless telco incumbents.

“Cable Wireless offers have been more successful than anyone had expected when they were first introduced,” MoffettNathanson analyst Craig Moffett wrote. Of note, it appears that Comcast ‘s Xfinity Mobile service has reached nearly two lines per home per mobile sub, up from about 1.6 mobile lines per account just a year ago.

Citing data from Navi, a firm that aggregates data on service plans and promos from major postpaid carriers, original equipment manufacturers and large retailers, Moffett says there’s a “clear and growing interest in Cable Wireless as a potential service provider.”

Citing data from Navi, a firm that aggregates data on service plans and promos from major postpaid carriers, original equipment manufacturers and large retailers, Moffett says there’s a “clear and growing interest in Cable Wireless as a potential service provider.”

“Lower industry growth means a more challenging path forward for all carriers… particularly given the rapid share gains of the cable operators,” Craig wrote. “While Cable wireless collectively took nearly 700K net adds during the quarter, they would presumably have taken even more had the incumbents’ new basic entry plans not been introduced,” he added.

……………………………………………………………………………………………………………………………………………………………………

Business Wireline Status:

“While wireless is inarguably the core business for both Verizon and AT&T, the worsening conditions of the Business Wireline segment, which accounts for some 19% of revenues at AT&T and 11% at Verizon, cannot be ignored. Deterioration in the sector overall is bad enough, particularly in light of high prevailing inflation. Industry revenues are now shrinking by 3.7% per year. Excluding USF and IP sales, AT&T saw Business Wireline revenues fall by 7.6% YoY in Q2, and Verizon saw Business Wireline revenues fall by an estimated 8.2%,” wrote Craig Moffett.

AT&T’s Overlooked Assets:

MoffettNathanson is missing two key growing revenue streams for AT&T:

- Increasing fiber optic network sales to both business and residential customers: AT&T added 316,000 net AT&T Fiber subscribers during the second quarter of 2022, resulting in fiber penetration of nearly 37% with about 6.6 million total fiber subscribers. AT&T has already added nearly 2 million AT&T Fiber (brand name) locations this year. AT&T’s fast-growing fiber revenues now make up nearly half of our consumer wireline broadband revenues.”

- FirstNet network which covers more first responders than any other network. FirstNet now reaches more than 2.81 million square miles across the U.S. That is 50,000+ more square miles than the largest commercial networks (about the size of Alabama) – giving more first responders access to an entire ecosystem of innovative solutions to keep them mission ready.

References:

https://www.fiercetelecom.com/broadband/att-adds-316000-fiber-subs-q2-2022

https://about.att.com/story/2022/fn-covers-more-first-responders-than-any-network.html

5 thoughts on “MoffettNathanson: accelerating rise of Cable Wireless; Business Wireline status; AT&T’s overlooked assets”

Comments are closed.

Indeed, AT&T is growing its fiber footprint faster than any U.S. telco. Only the hyperscalers have bigger fiber optic (private) networks which are exclusively used to connect their own cloud resident data centers.

Chuck Watson wrote in Seeking Alpha:

“A one-time shortfall in FCF that leads to a high payout ratio for a quarter is of little consequence over the long haul.”

While investors in AT&T were set aback by the cut in projected annual FCF, there were a number of positives to be found in the quarterly report. Adjusted for the Warner spinoff, DirecTV transaction, and Latin American asset sale, total revenue increased 2.2% year-over-year.

By front loading capex, AT&T is experiencing a surge in wireless service revenue. The company reported that over the last 8 quarters, it led the industry with 6 million postpaid phone net additions.

AT&T added 813,000 postpaid phone customers during Q2 alone. That’s a year-over-year increase from 798,000, and marks the strongest second quarter in a decade. Average revenue per postpaid phone customer also increased by 1.1%.

It’s important to take note of the strength in AT&T’s wireless Mobility results, as that business generates nearly 70% of post-spinoff revenue.

Mobility EBITDA increased by 2.5% year over year, and management projects improved Mobility-adjusted EBITDA in the second half of the year.

AT&T’s Fiber also gained 316,000 net subscribers during the quarter. This marked the tenth consecutive quarter in which the company recorded more than 200,000 fiber net adds. Over the last 8 quarters, AT&T increased the number of fiber subscribers by 50%.

AT&T also leads the industry over the last 8 quarters with 6 million net postpaid mobile phone additions.

https://seekingalpha.com/article/4526293-at-and-t-block-out-the-noise-focus-on-the-facts

AT&T (T) posted solid telecom results for the second quarter, keeping the firm on pace to meet or exceed management’s 2022 subscriber growth expectations. The continued growth in wireless additions led to an increase in the mobility services revenue growth target to 4%-5% from “at least 3%.” However, management cut its free cash flow target for 2022 by $2 billion to $14 billion due to continued growth investments and the timing of collections. Our fair value estimate, which reflects the Warner spinoff, remains $25 per share. We continue to like AT&T’s strategic position and its network investment plans, which we expect will deliver improving revenue and profit growth over the next several years.

Adjusted for the Warner spinoff, DirecTV transaction, and Latin American asset sale, total revenue (now roughly two thirds wireless, with most of the remainder enterprise and consumer fixed-line services) increased 2.2% year over year to $29.6 billion. Wireless service revenue growth accelerated to 4.8% year over year, ahead of management’s previous 2022 target and in line with the new one, on strong postpaid phone customer growth in recent quarters. AT&T added 813,000 postpaid phone customers during the quarter, up from 798,000 a year ago, the strongest second quarter in a decade. Despite more than two years of blistering industrywide growth, we still believe that postpaid customer additions will eventually have to tick down and match population growth more closely, but AT&T has yet to see any sign of falling demand.

Average revenue per postpaid phone customer was also strong, growing 1.1% versus a year ago as promotional credits, which are amortized against revenue, declined in the quarter and more customers traded up to higher-priced unlimited plans. Management expects average revenue per postpaid phone customer to improve further in the second half. Segment EBITDA expanded by 2.5% year over year, with further expansion projected in the second half of 2022.

https://www.morningstar.com/articles/1103730/att-earnings-show-continued-wireless-momentum-during-q2

Zack’s Research Report:

AT&T has been divesting its non-core assets to increase its liquidity and shed excess baggage to be nimbler. The company inked an agreement in first-quarter 2021 with private equity firm TPG to divest its U.S. video business. AT&T is likely to receive $7.6 billion from this transaction, while retaining stake within the newly formed DIRECTV. The cash resources are likely to be utilized to augment its network infrastructure throughout the country. A paradigm shift to the core telecom operations might also have been triggered by the inherent growth prospects of the sector triggered by the multi-billion infrastructure investment plan by President Biden. The $2 trillion investment plan over an eight-year period includes a $100 billion provision to significantly expand broadband access to Americans, as the administration aims to fortify its technological prowess to thwart the dominance of countries like China. Moreover, a focused entertainment company from by the merger of WarnerMedia and Discovery assets is likely to be better placed to capitalize on the booming direct-to-consumer streaming services market and unlock value from media assets. AT&T remains focused on business transformation efforts to augment operational efficiency and facilitate optimum utilization of resources to enhance value. The company expects this holistic growth policy to add significant customer value and generate healthy ROI across the business.

AT&T is planning a major expansion of its fiber network. The company currently delivers fiber internet to customers in 21 states, most of which are in the South and Midwest.

AT&T fiber is currently unavailable in Arizona, but the company intends to launch service for 100,000 homes in Mesa by next year.

Corning Inc. invented optical fiber in 1970 and is now a major provider of cable across the world.

The Corning-AT&T relationship is mutually essential; The two companies develop products and processes together, and AT&T relies on Corning for cable.

“They supply not 100 percent, but nearly all of our fiber,” Stankey said in an interview. “They provide 100 percent of our fiber for last mile distribution. This is the latest example of cooperation around a new way of assembling fiber units and deploying it into the field that is faster, lower costs, higher reliability, less disruption in the neighborhood.”

Stankey said fiber optic internet is far more reliable than cable internet and it provides better upload bandwidth, which is important for video conferencing or sharing other large files. AT&T’s hope is that deploying residential and consumer fiber will in turn help bolster its business and consumer wireless units as well.

Corning’s optical communications segment is its largest, generating about 30% of the company’s $14 billion in revenue during 2021. CEO Weeks said he only expects the segment to continue growing.

“We’re seeing double-digit growth for as far as we can see going forward,” he said.

https://www.bizjournals.com/phoenix/news/2022/08/31/corning-att-fiber-infastructure-plant.html