Cable Wireless

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications posted a surprise drop in broadband subscribers in the Q4-2023, the company announced on Friday. Charter’s internet customers decreased by 61,000 (-62,000 residential and +1,000 business) in the 4th quarter, with nearly all of the decline from residential customers. That was much worse than expectations for 17,290 additions, according to Visible Alpha and a year-ago gain of +105,000. The broadband subscriber drop was especially disappointing given Charter’s homes passed growth accelerated to 2.5% year-over-year, Craig Moffett said in a research note.

“Internet growth in our existing footprint has been challenging, driven by admittedly more persistent competition from fixed wireless and similar levels of wireline overbuild activity,” CEO Chris Winfrey said on a post-earnings call, adding that new investments will help drive growth despite the “temporary challenges.” Chief Financial Officer Jessica Fischer had warned in December that the company could lose internet customers in the quarter. At the time, speaking at an analyst conference, she said the company was facing short-term challenges and that results would be in line with the rest of the industry.

Charter was not the only cableco/MSO to report decreased broadband internet subscribers in the 4th quarter. Last week, rival Comcast reported a loss of 34,000 broadband customers, fewer than expectations, but exceeding the 18,000 broadband customers it lost in the previous quarter.

Stiff competition across broadband and wireless mobile and the decline of traditional television have been causes of concern, with Charter trying to expand its reach into rural areas in an effort to boost subscriber and earnings growth. Charter is facing heightened competition from Verizon and T-Mobile’s wireless home internet offerings, and the cable company could soon lose even more subscribers when a key government program runs out of funding in April, JPMorgan analysts say in a research note. In particular, the end of the Affordable Connectivity Program (ACP), which provided up to $30 per month to eligible customers to put toward their internet bills, could hurt Charter more than its peers. If ACP is not refunded, “we’ll work very hard to keep customers connected,” Winfrey said. Charter has more than 5 million ACP recipients, the highest in the industry. The majority of them were Charter broadband subscribers before the program began.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 142,000 broadband subs via its rural subsidy program in Q4, for a total of 420,000, and an overall penetration rate of 33.8% – up from 27.2% in the year-ago quarter. The company posted $74 million in rural revenues, up from $39 million a year earlier. Charter pulled in subsidy revenues of $29 million in Q4. Total capex for the project in Q4 was $426 million, down from $567 million in the year-ago quarter. Charter plans to activate 450,000 new subsidized rural passings in 2024. With all programs rolled up, Charter has committed to build 1.75 million subsidized rural passings.

Charter expects to complete its Rural Digital Opportunity Fund (RDOF) builds by the end of 2026 – two years ahead of schedule. Charter also intends to participate in the much larger $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Completion of Charter’s hybrid fiber/coax (HFC) network upgrade has been delayed to 2026 due in part to a lengthier certification process for distributed access architecture (DAA) technology. Charter’s original plan was to complete its HFC upgrades by the end of 2025. Charter’s HFC evolution plan consists of three steps:

- An upgrade to 15% of its network to 1.2GHz with an upstream-enhancing “high-split” using traditional integrated cable modem termination systems (CMTSs). That enables multi-gigabit downstream speeds and upstream speeds up to 1 Gbit/s.

- An upgrade to 1.2GHz with DAA and a virtual CMTS in 50% of the HFC footprint, enabling downstream speeds up to 5 Gbit/s and upstream speeds up to 1 Gbit/s.

- A full DOCSIS 4.0 upgrade by deploying 1.8GHz with DAA and a vCMTS to 35% of the HFC footprint. That’ll put Charter in position to deliver up to 10 Gbit/s downstream and at least 1 Gbit/s upstream.

Speaking on today’s Q4 2023 earnings call, Charter CEO Chris Winfrey said the operator has launched symmetrical speed tiers in two markets (Reno and Rochester, Minnesota, an official confirmed), with deployments in six additional markets underway that, once completed, will fulfill the phase one plan. Charter expects to start DAA deployments in its phase two markets later this year, Winfrey said.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 546,000 mobile lines in Q4, down from a gain of +615,000 in the year-ago quarter and +594,000 in the prior quarter. Analysts were expecting Charter to add 594,000 mobile lines in the 4th quarter and +2.5 million lines for full 2023, up from 1.7 million in full 2022. The MSO ended 2023 with 7.76 million mobile lines. Charter is also expanding its deployment of CBRS spectrum to help the company offload MVNO costs in high-usage areas. Winfrey said “thousands” of CBRS units have been deployed in one “large” market (believed to be Charlotte, North Carolina). Charter expects to roll CBRS to an additional market later this year, he said.

References:

Charter Communications adds broadband subs and raises CAPEX forecast

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

MoffettNathanson: accelerating rise of Cable Wireless; Business Wireline status; AT&T’s overlooked assets

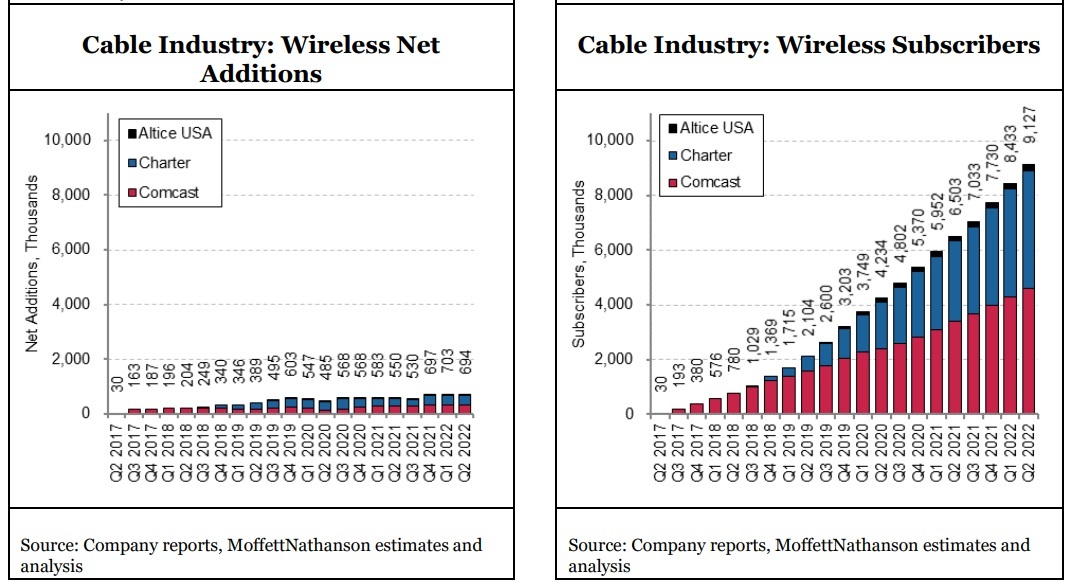

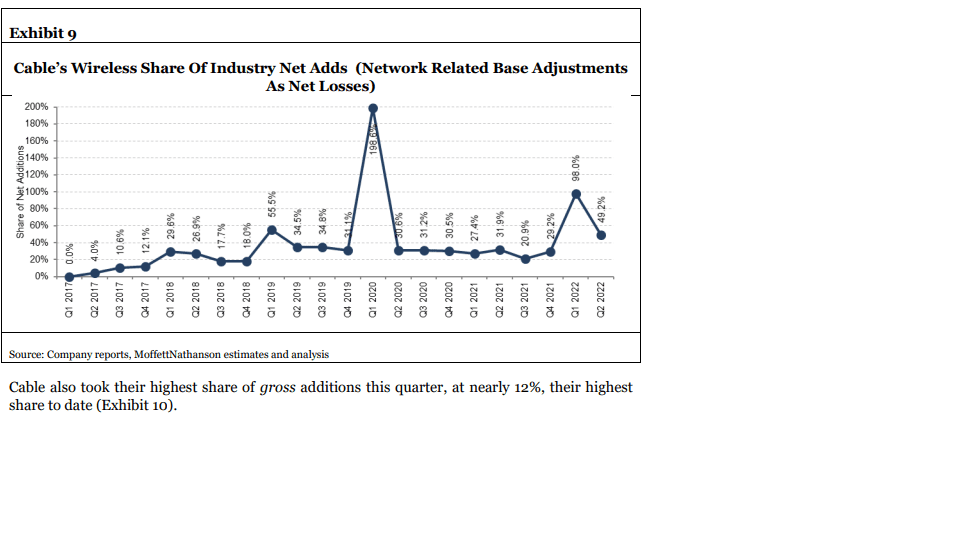

To the surprise of many, the Cable industry (Cablecos/MSOs) has captured an accelerating share of gross and net wireless subscriber additions, forcing incumbent wireless telcos (AT&T, Verizon, T-Mobile) to respond by offering lower priced alternatives. In the second quarter of the year, with cable taking nearly half (49.2%) of industry net additions in the period (after adjusting for 3G network shutdowns), according to MoffettNathanson’s latest report (subscription required) on the mobile sector. Cable’s Q2 2022 take was up from approximately 31.9% in the year-ago period.

MoffettNathanson’s analysis also showed that cable took its highest share of gross mobile subscriber adds in Q2 2022, at 11.9%. That compared to T-Mobile (30.1%), AT&T (29%) and Verizon (27.8%). Comcast, Charter and Altice USA combined to add 694,000 mobile lines in the second quarter, ending the period with 9.12 million.

Comcast, Charter, and Altice collectively added 694K new subscribers in Q2, up more than 100K from the corresponding quarter last year. That takes Cable’s subscriber base beyond 9M, or still just ~3% of the U.S. industry as per the graph below.

- Comcast disclosed that wireless penetration of its residential broadband base has reached 7.9% (or about 2.4M homes), suggesting they’ve reached nearly 2 lines per home, up from ~1.6 lines per account just a year ago.

- Privately held Cox Communications is now in beta testing on its MVNO service, and we expect it will offer pricing similar to Comcast’s and Charter’s. That will only add to the pressure on the wireless telco incumbents.

“Cable Wireless offers have been more successful than anyone had expected when they were first introduced,” MoffettNathanson analyst Craig Moffett wrote. Of note, it appears that Comcast ‘s Xfinity Mobile service has reached nearly two lines per home per mobile sub, up from about 1.6 mobile lines per account just a year ago.

Citing data from Navi, a firm that aggregates data on service plans and promos from major postpaid carriers, original equipment manufacturers and large retailers, Moffett says there’s a “clear and growing interest in Cable Wireless as a potential service provider.”

Citing data from Navi, a firm that aggregates data on service plans and promos from major postpaid carriers, original equipment manufacturers and large retailers, Moffett says there’s a “clear and growing interest in Cable Wireless as a potential service provider.”

“Lower industry growth means a more challenging path forward for all carriers… particularly given the rapid share gains of the cable operators,” Craig wrote. “While Cable wireless collectively took nearly 700K net adds during the quarter, they would presumably have taken even more had the incumbents’ new basic entry plans not been introduced,” he added.

……………………………………………………………………………………………………………………………………………………………………

Business Wireline Status:

“While wireless is inarguably the core business for both Verizon and AT&T, the worsening conditions of the Business Wireline segment, which accounts for some 19% of revenues at AT&T and 11% at Verizon, cannot be ignored. Deterioration in the sector overall is bad enough, particularly in light of high prevailing inflation. Industry revenues are now shrinking by 3.7% per year. Excluding USF and IP sales, AT&T saw Business Wireline revenues fall by 7.6% YoY in Q2, and Verizon saw Business Wireline revenues fall by an estimated 8.2%,” wrote Craig Moffett.

AT&T’s Overlooked Assets:

MoffettNathanson is missing two key growing revenue streams for AT&T:

- Increasing fiber optic network sales to both business and residential customers: AT&T added 316,000 net AT&T Fiber subscribers during the second quarter of 2022, resulting in fiber penetration of nearly 37% with about 6.6 million total fiber subscribers. AT&T has already added nearly 2 million AT&T Fiber (brand name) locations this year. AT&T’s fast-growing fiber revenues now make up nearly half of our consumer wireline broadband revenues.”

- FirstNet network which covers more first responders than any other network. FirstNet now reaches more than 2.81 million square miles across the U.S. That is 50,000+ more square miles than the largest commercial networks (about the size of Alabama) – giving more first responders access to an entire ecosystem of innovative solutions to keep them mission ready.

References:

https://www.fiercetelecom.com/broadband/att-adds-316000-fiber-subs-q2-2022

https://about.att.com/story/2022/fn-covers-more-first-responders-than-any-network.html