FCC Auction 108 (2.5 GHz) ends with total proceeds << than expected; T-Mobile expected to be #1 spectrum buyer

The FCC’s 2.5 GHz auction (FCC Auction 108) ended Monday, after 73 rounds, reaching net proceeds of only $427.8 million (M). The FCC found winning bidders for 7,872 of the 8,017 licenses offered. The FCC holds the remaining 145 licenses. Proceeds were much less than anticipated before the auction. Pre-auction estimates had run as high as $3B, or in the range of $0.10 to $0.20 per MHz-POP. In reality, the end result was just $427.8M in aggregate proceeds, and less than two cents per MHz-POP on average.

“After some extended bidding in Guam today, Auction 108 finally came to an end,” wrote Sasha Javid, BitPath chief operating officer. “While the end of this auction should not be a surprise for those following activity on Friday, it certainly ended faster than I expected just a week ago.”

With no assignment phase, Javid predicted the FCC will issue a closing public notice in about a week, with details on where each bidder won licenses. T-Mobile was expected to be the dominant bidder as it fills in gaps in the 2.5 GHz coverage it’s using to offer 5G. AT&T, Verizon and Dish Network qualified to bid but weren’t expected to acquire many licenses (see Craig Moffett’s comments below).

New Street analysts significantly downgraded projections for the auction as it unfolded, from $3.4 billion, to less than $452 million in its latest projection. New Street’s Phillip Burnett told investors Sunday Guam Telephone Authority was likely the company making a push for the license there. The authority owns citizens broadband radio service and high-band licenses “but lacks a powerful mid-band license” since “no C-Band or 3.45GHz licenses were offered for Guam,” he said. “We still assume T-Mobile won essentially all the licenses,” Burnett said in a Monday note. The auction translated to just 2 cents/MHz POP, 8 cents excluding the areas where T-Mobile is already operating, he said: “This will make it the cheapest of the 5G upper mid-band auctions at the FCC to date, both in terms of unit and aggregate prices. However, given how odd these licenses were, we wouldn’t expect to see the auction used as a marker for mid-band values going forward.”

Craig Moffett of MoffettNathanson wrote:

While we won’t know for sure who “won” the licenses in question for another week or so, it is universally assumed that T-Mobile was far and away the auction’s principal buyer. They are the only U.S. company that uses 2.5 GHz spectrum (2.5 GHz is the backbone spectrum band of their 5G network), and the licenses at auction were best seen as the “holes in the Swiss cheese” of T-Mobile’s otherwise national 2.5 GHz footprint. There was a great deal of spectrum here for sale, but it wasn’t geographically contiguous, and thus it would be difficult for anyone other than T-Mobile to use it. Nor should one expect spectrum speculators to have played a large role; after all, if there is but one true exit – i.e., to sell to T-Mobile – then bidding more than T-Mobile was willing to pay would seem an ill-advised strategy. Usually, we refrain from using the term “winner” when discussing auction results.

Winning, after all, depends on price paid. In this case, however, there can be little argument that T-Mobile is the auction’s big winner (assuming, again, that it was indeed T-Mobile that bought almost everything here). They will have significantly expanded their already-large spectrum advantage versus Verizon and AT&T and they will have done so at a much lower price than had been expected. Remember that not only does T-Mobile enjoy a spectrum quantity advantage versus Verizon and AT&T– they already had more mid-band spectrum than either VZ or T, and now they will have significantly augmented their already prodigious holdings – but they also have a spectrum quality advantage, inasmuch as 2.5 GHz spectrum propagates better than the 3.7 GHz C-Band spectrum used for 5G by Verizon and AT&T, and therefore promises better coverage and fewer dead spots with less required capital spending for density/coverage.

T-Mobile just a few weeks ago invested about $3.5B in low frequency spectrum, allocating about the same amount of capital many had expected them to spend on Auction 108. But their low (600 MHz) frequency spectrum purchase – done at what we assume is $2.53 per MHz-POP in a two-part acquisition from private equity owners – is for spectrum they were already leasing, so it represents a direct substitution of capital for opex without changing the amount of spectrum employed in their network. Margins should be higher, as what was previously leased is now owned. And, happily, they got the deal done just before the Inflation Reduction Act eliminated the cash tax shield from spectrum purchases as it relates to the 15% minimum corporate tax rate on future spectrum purchases.

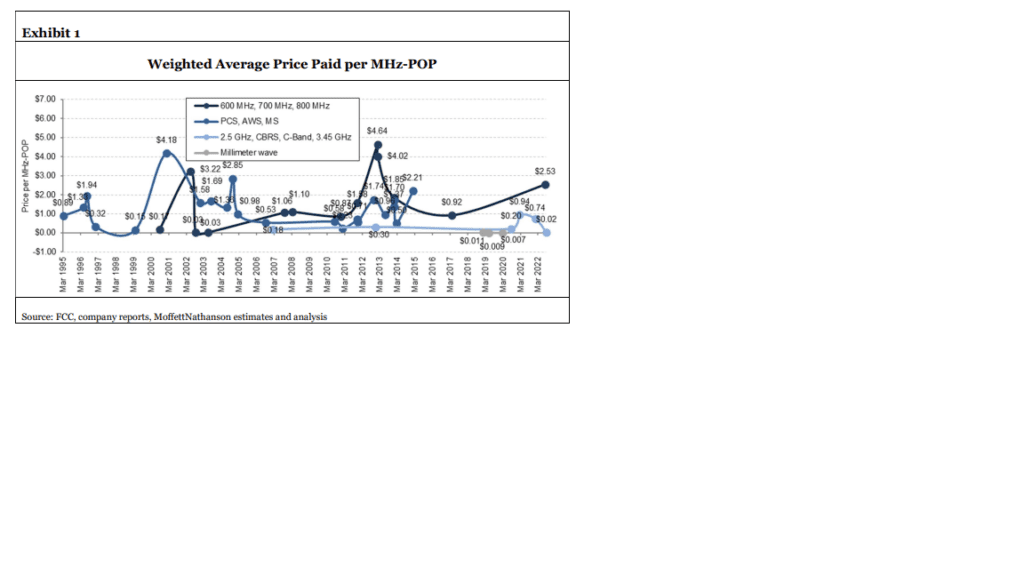

If there is one additional takeaway here, it is the reminder that spectrum is NOT a commodity, where prices inherently reflect some immutable “intrinsic value.” Instead, they are highly volatile, reflecting much more the dynamics of supply and demand for each individual spectrum band at any given moment, factoring in not just how much different carriers might want the spectrum, but also what their balance sheets will bear.

Our long-term tracking of spectrum transactions, sorted into low-band, mid-band, upper mid-band, and millimeter wave cohorts, now updated to include both Auction 108 and T-Mobile’s private market transactions for 600 MHz spectrum, tells the tale:

References:

https://www.fcc.gov/document/auction-108-25-ghz-band-qualified-bidders

4 thoughts on “FCC Auction 108 (2.5 GHz) ends with total proceeds << than expected; T-Mobile expected to be #1 spectrum buyer”

Comments are closed.

What a coup for T-Mobile. As a T-Mobile customer, hopefully, it will mean better coverage.

To put it in a physical world metaphor, the spectrum they picked up sounds like a piece of land that might be landlocked or too small to build on. It would be valuable only for the landowner whose land surrounds or is next to that otherwise worthless piece of land.

T-Mobile spent $304 million in FCC auction 108, and it won 90% of all the licenses sold or 7,156 of the 7,872 total licenses that received winning bids. The auction offered up a total of 8,017 licenses in mostly rural locations around the country, but not all of those licenses received winning bids.

“With most of the available spectrum in the 2.5GHz band located in rural areas, this auction provides vital spectrum resources to support wireless services in rural communities,” according to the FCC.

T-Mobile was widely expected to bid heavily in the auction, considering it is the only big wireless network operator that uses the 2.5GHz spectrum band. Moreover, other operators like Verizon, AT&T and Dish Network have spent heavily in other FCC spectrum auctions, leaving them with little financial firepower to chase 2.5GHz spectrum.

However, the FCC’s 2.5GHz auction generated far less interest among bidders than most analysts had expected. Before the auction started in late July, estimates ranged from $1 billion to $5 billion in total bids. But when the auction ended earlier this week, it generated just $428 million in total bids. Thus, T-Mobile accounted for roughly 71% of all spending in the auction.

Other big spenders in the auction include PTI Pacifica ($18 million); TeleGuam Holding ($17 million); and Evergy Kansas Central ($13 million).

T-Mobile will undoubtedly use its auction winnings to expand the rural growth strategy it laid out in recent years.

This is just the latest batch of spectrum licenses T-Mobile has purchased in recent years for its 5G network. Aside from the vast 2.5GHz holdings it acquired via its $26 billion purchase of Sprint in 2020, T-Mobile also spent around $10 billion in the FCC’s recent C-band auction, $3 billion in the FCC’s 3.45GHz auction earlier this year and $3.5 billion for 600MHz spectrum licenses from Columbia Capital in a deal announced last month.

https://www.lightreading.com/5g/the-results-are-in-t-mobile-dominates-fccs-25ghz-auction/d/d-id/780119?

From Mike Dano of Light Reading:

Verizon purchased a handful of 2.5GHz spectrum licenses scattered around the US for a total of $1.5 million in the FCC’s recent auction. Analysts are calling it an accident.

“This 2.5GHz spectrum will be useless to Verizon; the company actually tried to dump all of their bids, but got stuck as the final bidder for the licenses they won,” wrote the financial analysts at New Street Research in a note to investors. Verizon currently does not widely use 2.5GHz spectrum in its wireless network.

The New Street analysts noted that Verizon paid a $20 million deposit to participate in the 2.5GHz auction, which was far more than the $1,000 that AT&T paid and the $25,000 that Dish paid (neither AT&T nor Dish won any licenses). T-Mobile, for its part, made a $65 million deposit and ended up walking away with the vast majority of the spectrum licenses in the auction. The 2.5GHz band sits at the core of T-Mobile’s 5G network.

So what was Verizon doing in the 2.5GHz auction? “They were clearly trying to drive the price up for T-Mobile,” the New Street analysts wrote.

Others agree.

“Verizon ended up with just 12 licenses across 9 counties where it probably could not get out of,” wrote Sasha Javid, chief operating officer for BitPath, on LinkedIn. Javid has closely tracked previous FCC auctions, and maintains a detailed website for the agency’s Auction 108 of 2.5GHz spectrum. “Maybe one day, someone will explain what Verizon’s strategy was in this auction. My suspicion is that they realized early that they could be stuck with unwanted licenses so their goal of driving up prices for T-Mobile was too risky.”

According to Javid’s website, Verizon’s 2.5GHz winnings are seemingly scattered across the country at random in locations in Arizona, Oklahoma, Kentucky and elsewhere.

https://www.lightreading.com/5g/it-looks-like-verizon-accidentally-bought-$15m-worth-of-25ghz-spectrum/d/d-id/780140?

The 2.5 GHz auction was “an undisputed win” for T-Mobile, Sasha Javid, BitPath chief operating officer, said in an analysis posted Friday.

“T-Mobile spent $304 million to acquire 7,156 licenses covering by my estimates over 93% of the available POPs in this auction and over 67% of the nationwide POPs (including territories). T-Mobile won licenses with an average depth over 100 MHz in each county. It also picked up most licenses in the 25 largest counties. … Better yet, T-Mobile paid only $0.014 per MHz-POP, or roughly $0.06 when you only consider the unencumbered MHz-POPs.”

Javid said Verizon, not Dish Network as some speculated at the time was the bidder that shed demand in round six. “Verizon had over $56 million in processed demand in Round 5 before dropping substantially to just $1.5 million in Round 6,” he said: “Maybe one day, someone will explain what Verizon’s strategy was in this auction. My suspicion is that they realized early that they could be stuck with unwanted licenses so their goal of driving up prices for T-Mobile was too risky.”

AT&T not bidding wasn’t a surprise, Javid said, noting he thought Dish would “dabble” since prices were so low. “I guess even [Chairman] Charlie Ergen is feeling the pressure of those build out deadlines for DISH’s existing spectrum assets,” he said.

https://communicationsdaily.com/article/view?search_id=587175&id=1353328&BC=bc_6316c74181711