FCC Auctions

Who will be the big bidders at upcoming FCC C-band and AWS auctions?

Under new chairman Brendan Carr, the U.S. Federal Communications Commission (FCC) plans to open up more C-band (3.98-4.2 GHz) spectrum for 5G, recalling a golden age of spectrum awards that brought in tens of billions of dollars. The first C-band auction, which drew to a close in early 2021, brought in a staggering US$94 billion. Verizon made headlines by shelling out $52.9 billion at the auction, including incentive payments and clearing costs, so naturally there is talk of whether it will look to repeat its performance in the next C-band sale. But until we have more information it’s all just speculation. “In 2020, the FCC conducted the most successful auction in history when it released 280 megahertz of mid-band spectrum in the C-band for 5G,” Carr wrote, in a blog post.

At its upcoming February 25, 2025 Open Commission Meeting, the FCC (among other things) will:

- Enhancing National Security Though the Auctioning of Spectrum Licenses

The Commission will consider a Notice of Proposed Rulemaking that would update 10 year-old AWS-3 service-specific competitive bidding rules to bring those rules in line with current practice as the first step in fulfilling the Commission’s statutory obligation to initiate an auction of licenses for the AWS-3 spectrum in the Commission’s inventory by June 23, 2026, under the Spectrum and Secure Technology and Innovation Act. (GN Docket Nos. 25-70, 25-71, 13-185) - Exploring New Uses for Mid-Band Spectrum in the Upper C-band

The Commission will consider a Notice of Inquiry exploring whether, and if so how, we could free up additional mid-band spectrum for new services in the Upper C-band to meet projected spectrum demand, spur economic growth, and advance American security interests. (GN Docket No. 25-59)

CTIA – the U.S. wireless industry’s primary trade group – quickly cheered the news: “We applaud Chairman Carr for his swift action in exploring how best to make the upper C-band available for 5G wireless commercial use,” CTIA CEO Meredith Attwell Baker said in a statement. However, Carr didn’t specifically say whether that C-band 2.0 auction would be for 5G. “We will vote on a notice of inquiry that asks whether the commission should open up additional portions of the C-band (3.98-4.2 GHz) for more intensive use. We want to hear your views,” Carr wrote.

Elon Musk’s SpaceX and the major U.S. 5G telcos (AT&T, Verizon, T-Mobile) have expressed interest in upper C-band spectrum. SpaceX said in January that the FCC should develop “a modernized sharing framework” for the upper C-band, presumably so that it could be used by both satellite operators (like SpaceX) and terrestrial operators (like AT&T, Verizon and T-Mobile).

“Establishing a modernized sharing framework for the upper C-band that welcomes multiple new entrants is essential to solidify American leadership in 6G, which will interweave terrestrial and satellite networks into a seamless consumer experience,” SpaceX wrote. Politico noted that FCC’s Carr – has been developing ties to Musk.

“While the outcome is far from certain, we give an edge to the wireless interests,” wrote Blair Levin, a policy adviser to New Street Research and a former high-level FCC official, in a recent note to investors. “In this administration it appears that ‘whatever Elon wants, Elon gets.’ So, it is difficult to have conviction on the outcome.” Indeed, there are plenty of ways for the FCC to handle the upper C-band situation. Levin wrote, “There are multiple compromises available, such as allocating some to exclusive and some to satellite sharing or getting back more spectrum from the current users,” he wrote.

Other industry watchers are unsure about SpaceX vs wireless industry C-band spectrum bidding:

- “It’s unclear whether SpaceX could overcome the wireless lobby’s desire for more terrestrial spectrum,” analyst Tim Farrar, with TMF Associates, told Light Reading.

- “The upper C-band is an enormous opportunity to unleash additional spectrum for mobile 5G, for LEO [low-Earth orbit] satellite direct-to-device connectivity, or for a combination of both,” Michael Calabrese told Light Reading. Calabrese is director of the Wireless Future Project, which is part of New America’s Open Technology Institute think tank. Calabrese said that FCC Chairman Brendan Carr “is wise to open a notice of inquiry to explore what form of repurposing or sharing will best promote innovation and the connectivity needs of the future. The one certainty is that the 220 megahertz in C-band that was not repurposed five years ago should be a priority for reallocation to a higher and better use today.”

–>The previous C-band sale may have been the peak of wireless network operator spectrum spending, but we could see the big players pony up a significant amount of cash again in the next year or so at FCC auctions.

……………………………………………………………………………………………………………………………………………………………………………………………………………………

Mr. Carr also talked about an upcoming AWS-3 frequency auction, indicating that it is on track to take place by mid-2026 as required by law. In one of his first official statements as the new chairman of the FCC, Carr said he plans to auction AWS-3 spectrum before the end of next year. He added that the commission would consider holding another auction of C-band spectrum.

“This month, we will vote to kickstart the process for reauctioning a large number of AWS-3 spectrum licenses that have sat in inventory for years. This auction will be a win-win. It brings new spectrum into play for commercial use. And the proceeds from this auction will also cover the costs of the national security initiative known as “rip and replace”—an effort that is removing untrustworthy technology, like Huawei and ZTE gear, from networks. Specifically, our AWS-3 notice of proposed rulemaking will ensure that the Commission is on track to meet its statutory obligation to complete this auction by June 23, 2026.’

Those auctions will help pay for Rip and Replace (mostly Huawei network equipment) from U.S. telco networks. The Rip and Replace program was created in 2020 to remove Chinese components from U.S. wireless communications systems. The Rip and Replace fund needs an additional $3B in order to finish its mission.

AT&T is the most likely to spend big on the AWS-3 spectrum sale, given that it has less mid-band spectrum than its rivals, and CEO John Stankey has already expressed interest in the airwaves.

References:

https://www.telecoms.com/spectrum/new-fcc-chair-looks-to-repeat-c-band-mega-auction

https://broadbandbreakfast.com/fcc-to-vote-on-aws-auction-inquiry-into-upper-c-band-2/

https://www.lightreading.com/5g/could-elon-grab-some-of-5g-s-spectrum-

https://www.lightreading.com/5g/carr-hands-a-spectrum-gift-to-5g-industry

https://www.ctia.org/news/ctia-statement-on-chairman-carrs-announcement-on-upper-c-band

https://www.fcc.gov/February2025

Eric Schmidt: FCC C-Band Auction Dooms U.S. 5G Future

UPDATED: Mid-band Spectrum for 5G: FCC C-Band Auction at $80.9B Shattering Records

FCC Auction 110 for mid-band 5G spectrum gets $21.9B in winning bids

FCC Chairman Pai Reviews 5G FAST plan and importance of the C-Band (3.7 GHz to 4.2 GHz) auction

4 U.S. Mobile Operators offer C-band FCC proposal to address aircraft interference

FCC Auction 108 (2.5 GHz) ends with total proceeds << than expected; T-Mobile expected to be #1 spectrum buyer

FCC launches new 5G mid-band wireless spectrum auction (FCC Auction 108)

Bloomberg: 5G in the U.S. Has Been a $100 Billion Box Office Bomb

FCC Auction 108 (2.5 GHz) ends with total proceeds << than expected; T-Mobile expected to be #1 spectrum buyer

The FCC’s 2.5 GHz auction (FCC Auction 108) ended Monday, after 73 rounds, reaching net proceeds of only $427.8 million (M). The FCC found winning bidders for 7,872 of the 8,017 licenses offered. The FCC holds the remaining 145 licenses. Proceeds were much less than anticipated before the auction. Pre-auction estimates had run as high as $3B, or in the range of $0.10 to $0.20 per MHz-POP. In reality, the end result was just $427.8M in aggregate proceeds, and less than two cents per MHz-POP on average.

“After some extended bidding in Guam today, Auction 108 finally came to an end,” wrote Sasha Javid, BitPath chief operating officer. “While the end of this auction should not be a surprise for those following activity on Friday, it certainly ended faster than I expected just a week ago.”

With no assignment phase, Javid predicted the FCC will issue a closing public notice in about a week, with details on where each bidder won licenses. T-Mobile was expected to be the dominant bidder as it fills in gaps in the 2.5 GHz coverage it’s using to offer 5G. AT&T, Verizon and Dish Network qualified to bid but weren’t expected to acquire many licenses (see Craig Moffett’s comments below).

New Street analysts significantly downgraded projections for the auction as it unfolded, from $3.4 billion, to less than $452 million in its latest projection. New Street’s Phillip Burnett told investors Sunday Guam Telephone Authority was likely the company making a push for the license there. The authority owns citizens broadband radio service and high-band licenses “but lacks a powerful mid-band license” since “no C-Band or 3.45GHz licenses were offered for Guam,” he said. “We still assume T-Mobile won essentially all the licenses,” Burnett said in a Monday note. The auction translated to just 2 cents/MHz POP, 8 cents excluding the areas where T-Mobile is already operating, he said: “This will make it the cheapest of the 5G upper mid-band auctions at the FCC to date, both in terms of unit and aggregate prices. However, given how odd these licenses were, we wouldn’t expect to see the auction used as a marker for mid-band values going forward.”

Craig Moffett of MoffettNathanson wrote:

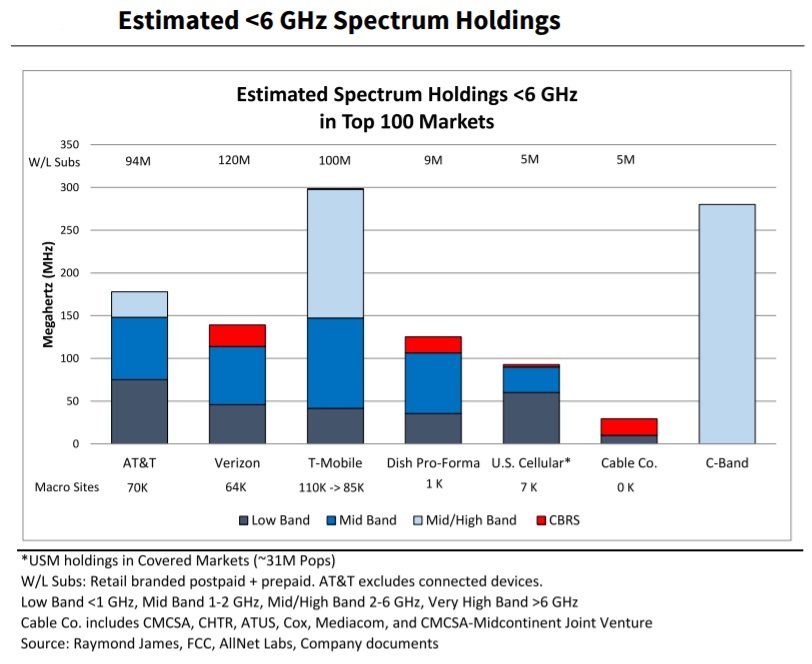

While we won’t know for sure who “won” the licenses in question for another week or so, it is universally assumed that T-Mobile was far and away the auction’s principal buyer. They are the only U.S. company that uses 2.5 GHz spectrum (2.5 GHz is the backbone spectrum band of their 5G network), and the licenses at auction were best seen as the “holes in the Swiss cheese” of T-Mobile’s otherwise national 2.5 GHz footprint. There was a great deal of spectrum here for sale, but it wasn’t geographically contiguous, and thus it would be difficult for anyone other than T-Mobile to use it. Nor should one expect spectrum speculators to have played a large role; after all, if there is but one true exit – i.e., to sell to T-Mobile – then bidding more than T-Mobile was willing to pay would seem an ill-advised strategy. Usually, we refrain from using the term “winner” when discussing auction results.

Winning, after all, depends on price paid. In this case, however, there can be little argument that T-Mobile is the auction’s big winner (assuming, again, that it was indeed T-Mobile that bought almost everything here). They will have significantly expanded their already-large spectrum advantage versus Verizon and AT&T and they will have done so at a much lower price than had been expected. Remember that not only does T-Mobile enjoy a spectrum quantity advantage versus Verizon and AT&T– they already had more mid-band spectrum than either VZ or T, and now they will have significantly augmented their already prodigious holdings – but they also have a spectrum quality advantage, inasmuch as 2.5 GHz spectrum propagates better than the 3.7 GHz C-Band spectrum used for 5G by Verizon and AT&T, and therefore promises better coverage and fewer dead spots with less required capital spending for density/coverage.

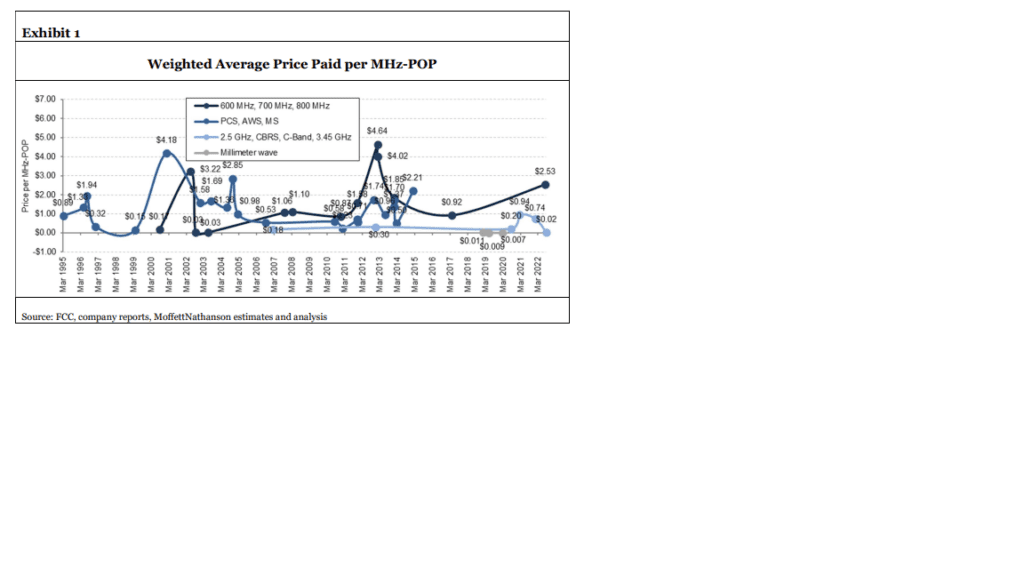

T-Mobile just a few weeks ago invested about $3.5B in low frequency spectrum, allocating about the same amount of capital many had expected them to spend on Auction 108. But their low (600 MHz) frequency spectrum purchase – done at what we assume is $2.53 per MHz-POP in a two-part acquisition from private equity owners – is for spectrum they were already leasing, so it represents a direct substitution of capital for opex without changing the amount of spectrum employed in their network. Margins should be higher, as what was previously leased is now owned. And, happily, they got the deal done just before the Inflation Reduction Act eliminated the cash tax shield from spectrum purchases as it relates to the 15% minimum corporate tax rate on future spectrum purchases.

If there is one additional takeaway here, it is the reminder that spectrum is NOT a commodity, where prices inherently reflect some immutable “intrinsic value.” Instead, they are highly volatile, reflecting much more the dynamics of supply and demand for each individual spectrum band at any given moment, factoring in not just how much different carriers might want the spectrum, but also what their balance sheets will bear.

Our long-term tracking of spectrum transactions, sorted into low-band, mid-band, upper mid-band, and millimeter wave cohorts, now updated to include both Auction 108 and T-Mobile’s private market transactions for 600 MHz spectrum, tells the tale:

References:

https://www.fcc.gov/document/auction-108-25-ghz-band-qualified-bidders

FCC launches new 5G mid-band wireless spectrum auction (FCC Auction 108)

The U.S. Federal Communications Commission (FCC) said Friday it had opened bidding in its latest mid-band spectrum auction (FCC Auction 108) to boost next generation 5G wireless services. The new round will auction about 8,000 county-based licenses in the 2.5 GHz spectrum band in mostly rural parts of the U.S. FCC Chairwoman Jessica Rosenworcel said Friday, “We all know there are gaps in 5G coverage, especially in rural America, and this auction is a unique opportunity to fill them in.”

Auction 108, which started at 10am ET on Friday, July 29, utilizes a “clock-1” auction format. This format is similar to the clock phase of past FCC auctions, but rather than offering multiple generic spectrum blocks in a category in a geographic area, it will offer only a single frequency-specific license in a category in a county.

The U.S. Congress last year approved $42.5 billion for Commerce Department grants to expand physical broadband deployment in places like rural areas without access to high-speed service. The FCC has been auctioning spectrum in recent years to help address the rising demand for wireless connectivity as the number of internet-connected devices rises sharply.

In January, AT&T Inc led bidders in the 3.45 GHz mid-band spectrum auction, winning $9.1 billion, while T-Mobile won $2.9 billion and Dish Network spent $7.3 billion. In 2021, the three largest U.S. wireless companies won $78 billion in bids in an FCC C-Band spectrum auction. Verizon Communications ultimately paid $52 billion for 3,511 licenses and to quickly clear its use, while AT&T won $23.4 billion in licenses and T-Mobile won $9.3 billion.

FCC Commissioner Brendan Carr in March said the FCC should move to expand spectrum use and consider auctioning other spectrum including looking at the “Lower 3 GHz band and several additional spectrum bands.”

In February, the FCC and National Telecommunications and Information Administration (NTIA) vowed to improve coordination on spectrum management after a 5G aviation dispute threatened flights earlier this year. The agencies said they will work cooperatively to resolve spectrum policy issues and are holding formal, regular meetings to conduct joint spectrum planning.

Addendum:

Here are the (disappointing) results of FCC Auction 108:

References:

https://www.fcc.gov/document/fcc-announces-next-5g-mid-band-spectrum-auction-start-july-29

https://www.reuters.com/technology/us-launches-new-5g-mid-band-wireless-spectrum-auction-2022-07-29/

https://www.tvtechnology.com/news/fcc-starts-5g-mid-band-spectrum-auction

FCC Auction 110 rakes in $22.5 billion in gross proceeds for 3.45 GHz Service

The results of the FCC’s 3.45 GHz auction were announced today. On January 4, 2022, bidding in Auction 110—the auction of new flexible-use licenses in the 3.45–3.55 GHz band—concluded following the close of bidding in the assignment phase.1 Auction 110 raised a total of $22,418,284,236 in net bids and $22,513,601,811 in gross bids, with 23 bidders winning a total of 4,041 licenses.

With $22.5 billion in gross proceeds, Auction 110 was the third highest grossing auction in the FCC’s history.

The 3.45 GHz action makes available 100 megahertz of mid-band spectrum for commercial use across the contiguous United States. Licensees can use it for fixed or mobile uses.

Here are the big winners:

- AT&T: $9.1B

- Dish: $7.3B

- T-Mobile: $2.9B

AT&T won 1,624 licenses in the 3.45 GHz auction, and Dish, bidding under the name Weminuche LLC, won 1,232 licenses. US Cellular acquired 380 licenses, followed by Cherry Wireless LCC with 319. T-Mobile acquired 199 licenses. Meanwhile, Verizon bid =ZERO.

The remainder went to a relatively familiar list of private equity investors, including Grain Capital, Columbia Capital, and Charlie Townsend’s Bluewater Wireless. Here’s the complete list of bidders:

| Bidder | Bidding entity | Winning bids | Licenses won |

| AT&T | AT&T Auction Holdings, LLC | $9 billion | 1,624 |

| Dish Network | Weminuche L.L.C. | $7.3 billion | 1,232 |

| T-Mobile | T-Mobile License LLC | $2.9 billion | 199 |

| Columbia Capital | Three Forty-Five Spectrum, LLC | $1.4 billion | 18 |

| Uscellular | United States Cellular Corporation | $580 million | 380 |

| Whitewater Wireless II, L.P. | $428 million | 14 | |

| Grain Management | NewLevel III, L.P. 0 | $376 million | 8 |

| Moise Advisory | Cherry Wireless, LLC | $211 million | 319 |

| N Squared Wireless, LLC | $101.8 million | 55 | |

| Skylake Wireless II, LLC | $39 million | 57 | |

| Blue Ridge Wireless LLC | $8.9 million | 39 | |

| Agri-Valley Communications | Agri-Valley Communications | $8 million | 7 |

| LICT | LICT Wireless Broadband Company, LLC | $7.7 million | 24 |

| Viaero | NE Colorado Cellular, Inc. | $6.7 million | 18 |

| Nsight | Nsight Spectrum, LLC | $4.7 million | 6 |

| East Kentucky Network | East Kentucky Network, LLC | $4.4 million | 2 |

| Carolina West Wireless | Carolina West Wireless, Inc. | $3.8 million | 11 |

| PVT | PVT Networks, Inc. | $2 million | 6 |

| Chat Mobility | RSA 1 Limited Partnership | $1.7 million | 1 |

| Raptor Wireless LLC | $845,700 | 6 | |

| Horry Telephone | Horry Telephone | $88,060 | 12 |

| PocketiNet | PocketiNet Communications | $59,501 | 1 |

| Jones, Anthony L | $1,575 | 2 | |

| Bidder identity included where available. Source: FCC | |||

The results were pretty much as expected- Dish spent more than expected, and AT&T a bit less, but in rank order and in magnitude, the numbers were relatively close to expectations.

Credit: Getty Images

The “mid-band spectrum” that was auctioned off is considered crucial for mobile operators’ deployment of next generation of wireless service such as 5G, which promises to deliver much faster wireless service and a more responsive network. Mid-band spectrum provides more-balanced coverage and capacity due to its ability to cover a several-mile radius with 5G, despite needing more cell sites than lower-tiered spectrum bands. Its ability to connect more devices and offer real-time feedback is expected to spark a sea change in how we live and work, ushering in new advances like self-driving cars and advanced augmented reality experiences.

“Today’s 3.45 GHz auction results demonstrate that the Commission’s pivot to mid-band spectrum for 5G was the right move,” said FCC Chairwoman Jessica Rosenworcel. “I am pleased to see that this auction also is creating opportunities for a wider variety of competitors, including small businesses and rural service providers. This is a direct result of the Commission’s efforts to structure this auction with diversity and competition front of mind.”

Craig Moffett wrote in a note to clients shortly after the auction results were announced by the FCC:

“After the almost $100B spent on the C-Band auction [1.], these numbers might sound almost quaint. Still, AT&T’s $9B translates to nearly a quarter turn of additional leverage. And for Dish Network, it is roughly two years of EBITDA, or two full turns. As always, spending money on spectrum is only the beginning. Now starts the spending on putting the new spectrum to work. The carriers did not pay up for this spectrum to allow it to languish in a fallow state, and the Towers will be natural beneficiaries of the deployment process over the coming years. Carrier plans for the C-Band suggest that spectrum will ultimately be deployed in a fairly broad-based manner, rather than just in more densely populated areas of the country, and a similar result seems likely for this spectrum, given its broadly similar propagation attributes.”

Note 1. The C-band auction broke records with its $81.2 billion in gross proceeds.

Analysts at New Street Research thought T-Mobile was going to win more spectrum than it did. They were predicting T-Mobile to spend in the range of $6.6 billion and Dish to spend about $5 billion. The FCC is planning for even more auctions in the future.

References:

https://www.fcc.gov/document/fcc-announces-winning-bidders-345-ghz-service-auction

https://www.fcc.gov/auction/110

FCC Auction 110 for mid-band 5G spectrum gets $21.9B in winning bids

https://www.cnet.com/tech/mobile/at-t-and-dish-big-winners-in-latest-5g-auction/

https://www.fiercewireless.com/wireless/att-dish-top-list-fccs-345-ghz-auction-winners

Big U.S. Wireless Carriers to bid at FCC mid-band auction; cablecos missing in action

The FCC will conduct another 5G spectrum auction on October 5th. FCC Auction 110 will be for 100MHz in the 3.45GHz to 3.55GHz band for flexible use of wireless services.

Full Title: Auction of Flexible-Use Service Licenses in the 3.45-3.55 GHz Band for Next-Generation Wireless Services; Status of Short-Form Applications to Participate in Auction 110

Auction 110 will offer approximately 4,060 new flexible‐use licenses of 100Mhz within the 3.45–3.55 GHz band (3.45 GHz Service) throughout the contiguous United States. Bidding in Auction 110 is scheduled to begin on October 5, 2021.

…………………………………………………………………………………………….

Analysis:

AT&T, T-Mobile, US Cellular and Dish Network are among the 42 different entities that registered interested in participating in Auction 110, based on the roster contained in FCC filings related to the auction (attachments A & B in References below). Verizon’s application is listed as incomplete.

We’ve never heard of most of the other companies bidding, but note that the big cablecos/MSOs (Comcast, Charter Communications, Altice USA and Cox Communications) are not listed.

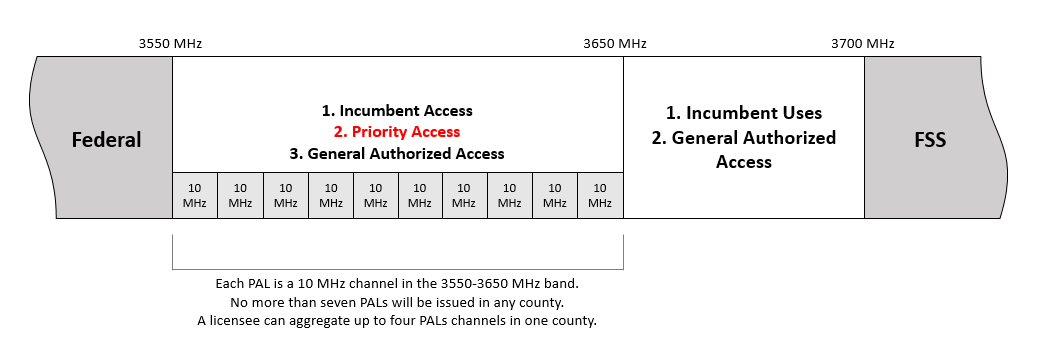

3.45 GHz spectrum up for auction is in the mid-band range seen as key for 5G by offering a mix of coverage and capacity, and sits nearby the 3.7 GHz C-band and the shared 3.5 GHz Citizen Broadband Radio Service (CBRS) band.

Financial analysts at New Street Research say that Auction 110 will increase the total overall amount of spectrum in circulation in the US from 1023MHz to 1123MHz. They believe that AT&T and T-Mobile to be the big winners with Dish Network an also ran.

“We think that AT&T, T-Mobile and Dish each want 40MHz in the 3.45GHz auction (the limit any one company can buy), but there is only 100MHz to go around,” the analysts wrote in a note to investors in July. “Based on visible resources, AT&T and T-Mobile are best positioned to end up with 40MHz each, leaving 20MHz for Dish (and other participants).”

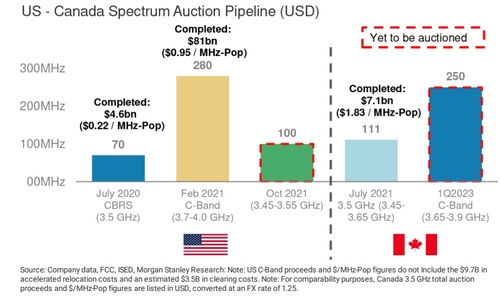

Analysts at Morgan Stanley offered a their perspective at how the upcoming 3.45GHz-3.55GHz FCC auction compares with recently completed spectrum auctions in the U.S. and Canada.

Source: Morgan Stanley

“AT&T will be keen to get the maximum 40MHz allowable on a quasi-nationwide basis, while T-Mobile has said they will be opportunistic, although they and Verizon already have some 200MHz of midband spectrum. Dish is another wild card, although it lacks the financial resources of the larger wireless players,” wrote the financial analysts at Morgan Stanley in a note to investors this week.

…………………………………………………………………………………………….

Recent FCC auctions have included the 37GHz, 39GHz and 47GHz spectrum bands in Auction 103, Auction 101 of 28GHz spectrum and Auction 102 of 28GHz spectrum, Auction 105 for 3.5GHz CBRS spectrum licenses, and Auction 107 -the C-band auction (which ended earlier this year and generated an astounding $81 billion in winning bids).

“We think Auction 110 looks much more similar to the smaller, cheaper CBRS auction that had $4.5 billion in net bids for 70MHz of spectrum ($0.215 per MHz POP), than the larger, more expensive C-band auction that ended with $81 billion in net bids for 280MHz of spectrum ($0.945 per MHz POP),” wrote the financial analysts with Raymond James in a note to investors this week. (The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors.) The Raymond James analysts cited Andromeda’s 40MHz ownership cap and military sharing zones as reasons for their conclusions.

“Still, midband spectrum remains crucial in densifying 5G networks, and while we do not expect anywhere close to C-band-like prices, this is a good opportunity for price-conscious bidders (e.g. Dish) to augment spectrum holdings,” the Raymond James analyst team concluded.

………………………………………………………………………………..

Terms & Conditions for Auction 110:

Upfront payments for Auction 110 are due in the proper account at the U.S. Treasury by 6:00 p.m. Eastern Time (ET) on Thursday, September 2, 2021. In order to meet the Commission’s upfront payment deadline, an applicant’s payment must be credited to the Commission’s account by the deadline.

Due Diligence: The FCC reminds each potential bidder that it is solely responsible for investigating and evaluating all legal, technical, and marketplace factors and risks associated with the licenses that it is seeking in Auction 110; evaluating the degree to which those factors and risks may have a bearing on the value of the licenses being offered and/or affect the bidder’s ability to bid on, otherwise acquire, or make use of such licenses; and conducting any technical analyses necessary to assure itself that, if it wins any license(s), it will be able to build and operate facilities in accordance with the Commission’s rules.

Non Disclosure Rules: Bidding applicants must take care not to communicate non-public information to the public, financial analysts, or the press.45 Examples of communications raising concern, given the limited information procedures in effect for Auction 110, would include an applicant’s statement to the press or other public statement (for example, a statement on social media) about its upfront payment or bidding eligibility, an applicant’s statement to the press or other public statement that it is or is not interested in bidding in the auction, or an applicant’s statement to the press or other public statement prior to the down payment deadline that it is the winning bidder in any particular geographic areas.

References:

https://www.fcc.gov/auction/110

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status/attachment-a

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status/attachment-b

https://www.fcc.gov/document/facilitating-5g-345-355-ghz-band

https://www.lightreading.com/5g/what-to-expect-from-upcoming-345ghz-auction-for-5g/d/d-id/771612?

https://www.lightreading.com/5g/cable-may-miss-americas-next-big-5g-spectrum-auction/d/d-id/771578?

https://www.benton.org/headlines/big-wireless-carriers-apply-fccs-mid-band-spectrum-auction

FCC Votes to Move Forward on 3.45-3.55GHz Spectrum Auction

The Federal Communications Commission (FCC) said today that it will make mid-band spectrum in the 3.45-3.55 GHz band available for auction to facilitate 5G deployment across the U.S. The FCC consulted last year on allowing flexible use of the 3.45-3.55 GHz band. The latest action means the FCC is on track for a 5G mid-band auction this year. Bidding in FCC Auction 110 is expected to begin in early October 2021.

Auction 110 will offer up to 100 megahertz of spectrum divided into ten 10-megahertz blocks licensed by geographic areas known as Partial Economic Areas (PEAs), for a total of 4,060 flexible-use licenses across the contiguous United States. The proposed auction procedures would include a clock phase for bidding on generic blocks in each geographic area followed by an assignment phase for bidding on frequency-specific license assignments. The Public Notice proposes bidding credit caps and specific upfront payment and minimum opening bid amounts. Flexible-use licenses made available through this auction are subject to cooperative sharing requirements to protect federal incumbents, so the Public Notice proposes a reserve price of over $14.7 billion in order to meet the requirement that auction proceeds cover the expected sharing and relocation costs for federal users in the band.

Today’s Public Notice works in concert with new rules for the 3.45 GHz band that were also adopted today, establishing a framework for coordination of non-federal and federal use and establishing a band plan. In legislation passed last year, Congress required the Commission to commence a system of competitive bidding for licenses in the 3.45 GHz band by the end of 2021. Today’s actions position the Commission to fulfill that mandate.

Last year’s Consolidated Appropriations Act required the commission to start an auction for licenses in the 3.45-3.55 GHz band by the end of 2021. The rules now adopted will reallocate 100 MHz of spectrum in the 3.45 GHz band for flexible use wireless services.

The FCC also established a framework for the 3.45 GHz band which will enable commercial use by different cellular network providers, while also ensuring that federal incumbents are protected from interference. Together, the 3.45 GHz band and the neighboring 3.5 GHz and 3.7 GHz bands represent 530 MHz of contiguous mid-band spectrum for 5G.

The FCC is now inviting comments on procedures for the auction of 100 MHZ of mid-band spectrum in the 3.45–3.55 GHz. Bidding in Auction 110 is expected to start in early October.

………………………………………………………………………………………………………………………………….

Forward Reference:

Separately, the FCC Seeks Comment on Open Radio Access Networks, which we cover in a companion post.

UPDATED: Mid-band Spectrum for 5G: FCC C-Band Auction at $80.9B Shattering Records

The FCC’s latest auction has raised more than $69.8 billion after three weeks of bidding, a record sum that could alter cellphone carriers’ prospects for 5G and the next decade. The C-band auction, offering 280-megahertz of spectrum, started on December 8th. Just within two weeks, it’s by far the biggest U.S. spectrum auction ever. The auction will now pause for the Christmas holidays until Jan. 4th , when total bids could move even higher.

The radio frequencies being offered range between 3.7 GHz and 4 GHz, a middle-of-the-road range considered well-suited for 5G service. New 5G smartphones can already connect to those frequencies in other countries that have licensed equivalent mid-band spectrum. The U.S. is also selling big chunks of spectrum all at once, enhancing its value.

The high offers benefit the U.S. Treasury, which will collect a windfall after the winners pay for their licenses. The victors will also need to spend at least $13 billion more to help modify equipment for a group of satellite companies that already use the frequencies. The satellite operators agreed to an FCC plan that shifts their TV transmissions to a narrower portion of the radio spectrum.

The current auction proceeds have already topped the $44.9 billion in provisional bids in a 2015 FCC sale of mid-band spectrum licenses, which U.S. cellphone carriers used at the time to enhance their 4G LTE service. Those telcos are now investing billions of dollars in 5G coverage. Some higher-end estimates for the auction had ranged from $35.2 to $51 billion.

After 45 rounds, the average nationwide price per MHz PoP price for licenses was of $0.81. That rises to $0.96 across categories when factoring in accelerated clearing payments and relocation costs to move satellite operators out of the band band, estimated at $9.7 billion and $3.3 billion respectively.

Editors Notes: The B block consists of 100 megahertz (five 20-megahertz sub-blocks) from 3.8-3.9 GHz) and the C block makes up the final 80 megahertz with four 20-megahertz sub-blocks; there are 406 available Partial Economic Areas (PEAs) across the United States. 406 available Partial Economic Areas across the United States.

…………………………………………………………………………………………………………………………….

Analysts had estimated C-band licenses would be between $0.20-$0.50 per MHz PoP (Point of Presence). The nationwide price for A block licenses per MHz Pop was $1.21 as of Wednesday, while BC prices were $1.11 per MHz PoP according to tracking by BitPath COO Sasha Javid.

Demand for most of the category A blocks (which includes the first 100-megahertz tranche of spectrum in 46 of the top 50 markets that has a clearing schedule of December 2021) has evened out. In the top 20 PEAs at the end of round 43 there were still 12 markets that had competition, mostly for BC blocks, but also a few category A, including PEAs of Miami, Phoenix, and Minneapolis-St.Paul.

PHOTO: ADREES LATIF/REUTERS

……………………………………………………………………………………………………………………………………………………

The recent bids have blown past Wall Street’s highest forecasts, suggesting that several companies are fighting over the most valuable wireless rights.

There are 57 participants in the clock phase of this auction, but each bid is cloaked in secrecy until the auction process ends. Industry analysts expect mega telcos like AT&T and Verizon Communications to obtain a large share of the licenses to match the trove of 2.5 GHz assets that rival T-Mobile US acquired from Sprint.

Wall Street analyst firms like Wells Fargo, believe Verizon will spend the most, previously estimating around $22 billion in gross proceeds to acquire 120 MHz of mid-band spectrum. AT&T could spend anywhere from $4.3 billion to $20 billion for the C-band.

All three major U.S. wireless carriers have rolled out nationwide 5G either using low-band spectrum or dynamic spectrum sharing (DSS) technology, but performance hasn’t proved better than 4G LTE. Verizon has deployed 5G with high-band millimeter wave in parts of 60 cities, and AT&T has a few mmWave markets, but mid-band is seen as the sweet spot in delivering both capacity and coverage.

Meanwhile, T-Mobile says its 2.5 GHz can deliver 300 Mbps and peak speeds up to 1 Gbps.

……………………………………………………………………………………………………………………………………………………………………………………………………..

“Mid-band spectrum will be where 5G lives,” said Walt Piecyk, a telecom analyst for research firm LightShed Partners. He added that T-Mobile’s merger with Sprint “clearly put pressure on Verizon and AT&T” to match their rival’s war chest. “When the numbers get this big, you have to assume that everybody’s getting more aggressive,” Mr. Piecyk said.

“Gross proceeds have been driven by surprisingly robust and persistent demand,” wrote Javid in an analysis Tuesday morning. “In Round 36, I suspect that a large bidder pulled back significantly in the largest markets given that all the top 10 markets experienced a drop in demand.”

Mobile service providers are also bidding against investment firms and new market entrants. Satellite provider Dish Network Corp. won many of the licenses sold in the 2015 auction. The company this month raised more cash through a $2 billion convertible-note offering to help fund more network investments. Dish is building its own 5G network after buying spectrum assets and about 8 million customers from Sprint.

Cable internet providers (MSOs) could also influence the auction’s outcome after years of experimentation with wireless services. Comcast Corp. and Charter Communications Inc. teamed up to bid in the current auction after they spent nearly $1 billion on a smaller license sale earlier this year.

…………………………………………………………………………………………………………………………………

Cellphone carriers can afford to commit to big payments given their low borrowing costs and relatively stable service revenue (AT&T is an exception due to its high debt), said Raymond James analyst Frank Louthan. “Investors see these companies as some of the most secure around,” Mr. Louthan said. “I don’t think a slight change in a debt ratio would make much of a difference. Time to market matters. We generally see prices get high when you can deploy spectrum quickly.”

The FCC won’t reveal the auction’s winners for several days after the auction ends, meaning the broader telecom industry could remain in suspense until February. Federal rules against coordinated bidding also limit what the auction participants can say about the process, restricting their ability to raise capital or discuss major deals involving spectrum.

The auction is a first step in a multiyear process. Wireless customers might not see the full band cleared for cellphone service until late 2023, though there is an early tranche slated to move by late 2021. Auction winners with no time to spare could also pay the incumbent satellite users larger fees to quicken their relocation. That would allow some companies to repurpose spectrum in base stations and related cell-tower equipment that is already transmitting data on other frequencies–just not the bands in question. The change could result in faster and more reliable 5G service.

………………………………………………………………………………………………………………………………………….

This author is astonished there has been no concern expressed regarding C-Band Auction’s Threat to Aviation. Viodi View principal Ken Pyle wrote:

The RTCA is recommending that the mobile wireless and aviation industries work with their respective regulators to take appropriate steps to mitigate the risk associated with the deployment of 5G in the C-Band. The question is what impact will this interference risk have on the rollout of 5G in the C-band?

It will be interesting to see how the potential interference risks raised by RTCA impact the rollout of 5G in the C-Band.

On December 7th, Reuters reported that House Committee on Transportation and Infrastructure Chair Peter DeFazio urged a delay in the FCC auction of C-Band spectrum over concerns it could jeopardize aviation safety. He cited a six-month review of 5G network emissions with safety-critical radio altimeter performance by the Radio Technical Commission for Aeronautics (RTCA) that found serious risks of harmful interference on all types of aircraft.

Caveat Emptor!

References:

https://www.wsj.com/articles/5g-auction-shatters-record-as-bidding-tops-66-billion-11608731335 (on-line subscription required)

https://www.fiercewireless.com/5g/c-band-nears-70b-rockets-above-prior-us-spectrum-auctions

https://www.rcrwireless.com/20201223/spectrum/fccs-auction-holiday-haul-closing-in-on-70-billion

https://viodi.com/2020/11/30/c-band-5gs-threat-to-aviation/

https://www.wsj.com/articles/everything-you-need-to-know-about-5g-11605024717

……………………………………………………………………………………………………………………………………

January 18, 2021 Update:

The Federal Communications Commission has completed the first round of the auction of the 3.7-3.98 GHz band, raising the most ever in a spectrum auction in the US. All 5,684 blocks on offer were acquired, with total bids of USD 80.9 billion, nearly twice the previous record for a FCC auction.

FCC Chairman Pai Reviews 5G FAST plan and importance of the C-Band (3.7 GHz to 4.2 GHz) auction

Speaking at the Americas Spectrum Management Conference on October 12th, FCC Chairman Ajit Pai assessed the Commission’s 5G Fast Plan and highlighted the importance of this December’s C-Band auction for 5G spectrum.

Pai said the 5G Fast Plan, introduced in 2018, had three central planks: freeing up spectrum, promoting wireless infrastructure, and modernizing our regulations to encourage more fiber deployment. Pai said the FCC has been freeing up high-, mid-, and low-band spectrum for 5G:

High-band spectrum enables ultra-high-speed, gigabit-plus wireless connectivity. Last year, the FCC successfully concluded our nation’s first two auctions of millimeter-wave spectrum for 5G services, in the 28 GHz and 24 GHz bands, respectively. Earlier this year, we concluded bidding in an auction of the upper 37 GHz, 39 GHz, and 47 GHz spectrum bands. This was the largest auction in American history, releasing 3,400 megahertz of spectrum into the commercial marketplace.

All told, we’ve made available almost five gigahertz of high-band spectrum for commercial use though these auctions. To put that in perspective, that was more spectrum than was used before for terrestrial mobile broadband by all wireless service providers in the United States combined.

With respect to low-band spectrum, we’ve finished repurposing spectrum in the 600 MHz band, which was long used for broadcast television, for mobile broadband. To clear the 600 MHz band spectrum for wireless use, roughly half of our nation’s broadcast TV stations—nearly 1,000 total—had to change their transmission frequencies. This summer, we completed this enormous undertaking—known as the “repack.” Now, all of the valuable low-band airwaves sold in the ground-breaking broadcast incentive auction are available for wireless broadband service, and this spectrum is already being used to provide 5G service to areas where over 200 million Americans live.

Pai said the FCC has made the most headway on mid-band spectrum. Mid-band spectrum is appealing for 5G largely because of physics: it combines good geographic coverage with good capacity. The FCC chairman claims the commission has systematically identified mid-band airwaves that were being underused and set plans to put these airwaves to work for the American people.

The FCC also targeted rule changes to bring the 3.5 GHz band into commercial use. The rules for this band had not been optimized to encourage 5G deployment. But with the leadership of FCC Commissioner O’Rielly, new rules were promulgate to promote investment in the band. This August, the Commission successfully completed an auction of 70 megahertz of licensed spectrum in the 3.5 GHz band—the first-ever auction of mid-band spectrum for 5G. And we’ve completed the necessary technical work so that the band’s entire 150 megahertz is now available for commercial use.

Pai said the biggest move to free up mid-band spectrum for 5G is in the swath of spectrum from 3.7 GHz to 4.2 GHz—what is referred to as the C-band. This spectrum is mostly used by fixed-satellite companies to beam content to video and audio broadcasters, cable systems, and other content distributors. However, with advances in technology, these companies can now provide the same services using alternative technologies or considerably less spectrum.

This past February, the FCC voted to clear the lower 300 megahertz of the C-band and make 280 megahertz of this spectrum available for 5G through a public auction. All eligible space station operators currently using this spectrum have committed to an accelerated relocation to the upper 200 megahertz of the C-band—meaning that the lower 280 megahertz will become available for 5G two to four years earlier than otherwise would have been the case. The FCC will begin the auction of the lower 280 megahertz of the C-band on December 8th.

And just a couple weeks ago, at our September meeting, the Commission proposed to make the 3.45-3.55 GHz band available for innovative commercial operations while accommodating limited remaining operations by federal incumbents. This action follows through on the White House and the Defense Department’s August announcement that this 100 megahertz of contiguous mid-band spectrum should be made available for 5G as quickly as possible. I am optimistic that we will be able to auction the 3.45 GHz band next year.

The bottom line of all these mid-band efforts is this: With the aforementioned auctions of the C-band, the 3.5 GHz band, and a 2021 auction of the 3.45 GHz band, the FCC is on a path to have a contiguous 530-megahertz swath—from 3.45 to 3.98 GHz—of mid-band spectrum available for 5G.

GSA: “Global regulators have sought to open up access to the C-band, which has become (initially at least) the most important spectrum band for 5G.”

……………………………………………………………………………………………………………………………………………………………………………………………………..

Pai asserts that he has presided over the most aggressive FCC in history when it comes to spectrum. He claims that the FCC has been similarly productive on the other two planks of 5G FAST PLAN: promoting wireless infrastructure and modernizing our regulations to encourage more fiber deployment.

For example, the number of new cell sites in the United States has skyrocketed. We added fewer than 7,000 cell sites from 2013 to 2016, but added over 87,000 from 2016 to 2019, with an increase of over 46,000 in 2019 alone. He said that the FCC is focused on the integrity of the communications supply chain—the process by which products and services are manufactured, distributed, sold, and ultimately integrated into our communications networks.

………………………………………………………………………………………………………………………………………………………………………………………………..

Comment and Analysis on the C-band auction:

Analysts at Morgan Stanley Research raised their C-band mid-point auction forecasts from $23.5 billion in proceeds to about $26 billion, with their high-end estimates at $35.2 billion. The firm cited a relatively low turnout in the Citizens Broadband Radio Service (CBRS) 3.5 GHz auction as a catalyst, as well as improved macro environment and supportive credit markets. The lower-than-expected turnout by big carriers in the CBRS auction indicates they’re likely saving their gun powder for the big C-band auction, which offers more unencumbered mid-band spectrum for 5G.

Former FCC Chairman Tom Wheeler said, “One of the challenges the FCC faces is that the allocation of spectrum was first made from analog assumptions that have been rewritten as a result of digital technology.” Consider the transition from analog to digital TV, where an analog TV signal took up 6MHz of spectrum and required guard bands on either side to avoid interference, four or five digital signals can fit into that one channel.

“I went through it with the [Department of Defense], with the satellite companies, and the fact of the matter is that one of the big regulatory challenges is that nobody wants to give up the nice secure position that they have based on analog assumptions,” said Wheeler. “I think you also have to pay serious consideration, but I found that claims of interference were the first refuge of people who didn’t like the threat of competition or anything else.”

“As we look at C-Band, it brings forward some use cases that could increase the size of the 5G opportunity for us,” Verizon CFO Matt Ellis said during a recent investor event. While Verizon has purchased billions of dollars worth of unused millimeter wave (mmWave) spectrum for 5G, such spectrum isn’t suitable for covering large geographic areas because transmissions in such bands can only travel a few thousand feet in the best of conditions and requires line of sight communications (no trees, walls, buildings between cell site and mmWave end point subscriber),

Indeed, analyst Craig Moffett forecasts that Verizon will need to spend as much as $20B on spectrum in order to keep pace with T-Mobile, which currently enjoys a huge spectrum advantage by virtue of their 2.5 GHz spectrum. He says that even if Verizon acquires C-Band spectrum, its propagation shortcomings relative to T-Mobile’s 2.5 GHz spectrum suggest that Verizon will still be disadvantaged in either coverage or cost.

Craig believes that AT&T won’t be able to keep pace with Verizon’s bidding at the C-band auction. The New York Post reported that a sale of all of DirecTV (owned by AT&T) might yield less than what Verizon is expected to spend in the upcoming C-Band auction alone. Without a large block of mid-band spectrum to compete with T-Mobile and Verizon, AT&T’s Mobility segment could fall behind for a generation. Satellite-TV provider Dish Network, which is building out a 5G network, isn’t participating in the auction, according to several sources.

…………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.fcc.gov/document/fcc-establishes-bidding-procedures-december-c-band-auction-0

https://www.fcc.gov/news-events/blog/2020/07/15/need-speed

https://nypost.com/2020/10/06/att-pushes-ahead-with-auction-of-directv-despite-lowball-bids/

https://www.tvtechnology.com/news/fcc-issues-c-band-auctions-draft-procedures

https://www.rcrwireless.com/20200106/spectrum/gsa-c-band-is-most-important-spectrum-band-for-5g

Cablecos join telcos in winning FCC auction 105 bids in 3550-3650 MHz band; Buildout

Cable companies (aka MSOs) joined Verizon and Dish Network among the top bidders in the Federal Communications Commission’s (FCC’s) latest auction of cellular spectrum licenses, according to FCC data released Wednesday. The FCC auction, which began on July 23 and wrapped up on August 25, offered 70 megahertz of Priority Access Licenses (PALs) in the 3550-3650 MHz band. In total, the FCC auction 105 generated $4,585,663,345 from 228 bidders who won a total of 20,625 licenses.

Verizon, the country’s largest cellphone carrier, topped the list with $1.89 billion in winning bids for licenses in the 3.55 gigahertz band, according to the commission.

- Dish unit Wetterhorn Wireless LLC bid about $913 million.

- Wireless units of Charter Communications Inc., Comcast Corp. and Cox Communications Inc. followed with winning bids of $464 million, $459 million and $213 million, respectively.

- Cellphone carrier T-Mobile US bid less than $6 million in the auction.

- AT&T did not bid.

The FCC said winning bidders have until September 17 to submit a down payment totaling 20 percent of their winning bid(s). Full payment is due by October 1, 2020.

The licenses were considered highly valuable (3.5GHz spectrum) but complicated by a sharing arrangement that allowed some companies to use nearby frequencies without an exclusive license. The military also uses the spectrum band, though radio engineers consider the likelihood of interference from naval radar low in most of the U.S.

Image Credit: FCC

………………………………………………………………………………………………………………………………………………………..

A frequency coordinator called a Spectrum Access System (SAS) will assign the specific channel(s) for a particular licensee on a dynamic basis. Although a Priority Access Licensee may request a particular channel or frequency range from an SAS following the auction, they are not guaranteed a particular assignment, and an SAS may dynamically reassign a PAL to a different channel as needed to accommodate a higher priority Incumbent Access user. To the extent feasible, an SAS will “assign geographically contiguous PALs held by the same Priority Access Licensee to the same channels in each geographic area” and “assign multiple channels held by the same Priority Access Licensee to contiguous frequencies within the same License Area.” An SAS may, however, temporarily reassign individual PALs to non-contiguous channels to the extent necessary to protect incumbent users from harmful interference or if necessary, to perform its required functions.

Technicians installing a cellular base station. Photo credit: GEORGE FREY/REUTERS

……………………………………………………………………………………………………………………………………………………………………………………………………

Wireless-industry analysts expected Verizon and Dish to be active participants in the most recent auction, which offered 70 megahertz of “priority access” licenses in a band considered useful for ultrafast fifth-generation, or 5G, transmissions. Rival T-Mobile’s purchase of Sprint Corp. this year gave it a treasure trove of wireless licenses that led Verizon to play catch-up in the race to supply customers with more mobile internet data. Satellite-TV operator Dish has spent the past decade amassing its own spectrum licenses for a brand-new wireless network, though the system hasn’t been built.

The entry of regional cable operators suggests that residential broadband providers are eager to offer more service over the air. Charter and Comcast have added hundreds of thousands of smartphone customers over the past year, but their mobile service runs on Verizon’s network outside the home, limiting the cable companies’ profitability. Charter also has tested fixed home broadband service over 3.5 GHz frequencies to lower the cost of stringing wires to far-flung households.

The cable companies’ wireless bets pale next to their regular investments in landline infrastructure, and the latest bids are no guarantee their strategies will shift. Cable companies have made similar wagers on wireless service before withdrawing and selling their holdings back to established cellphone carriers.

The auction results also set the stage for a more expensive auction of C-Band spectrum, another swath of frequencies useful for 5G service. The commission is expected to kick off an auction for those spectrum bands in December.

References:

https://www.fcc.gov/document/fcc-announces-winning-bidders-35-ghz-band-auction

https://docs.fcc.gov/public/attachments/DOC-366624A1.pdf

https://www.fcc.gov/auction/105/factsheet

https://www.wsj.com/articles/cable-satellite-operators-place-new-bets-on-5g-airwaves-11599063412

https://www.techspot.com/news/86623-fcc-generates-more-than-45-billion-latest-wireless.html