LightCounting: Optical components market to hit $20 billion by 2027+ Ethernet Switch ASIC Market Booms

|

The optical communications industry entered 2020 with very strong momentum. Demand for DWDM, Ethernet, and wireless fronthaul connectivity surged at the end of 2019, and major shifts to work-at-home and school-at-home in 2020 and 2021 due to the COVID-19 pandemic created even stronger demand for faster, more ubiquitous, higher reliability networks.

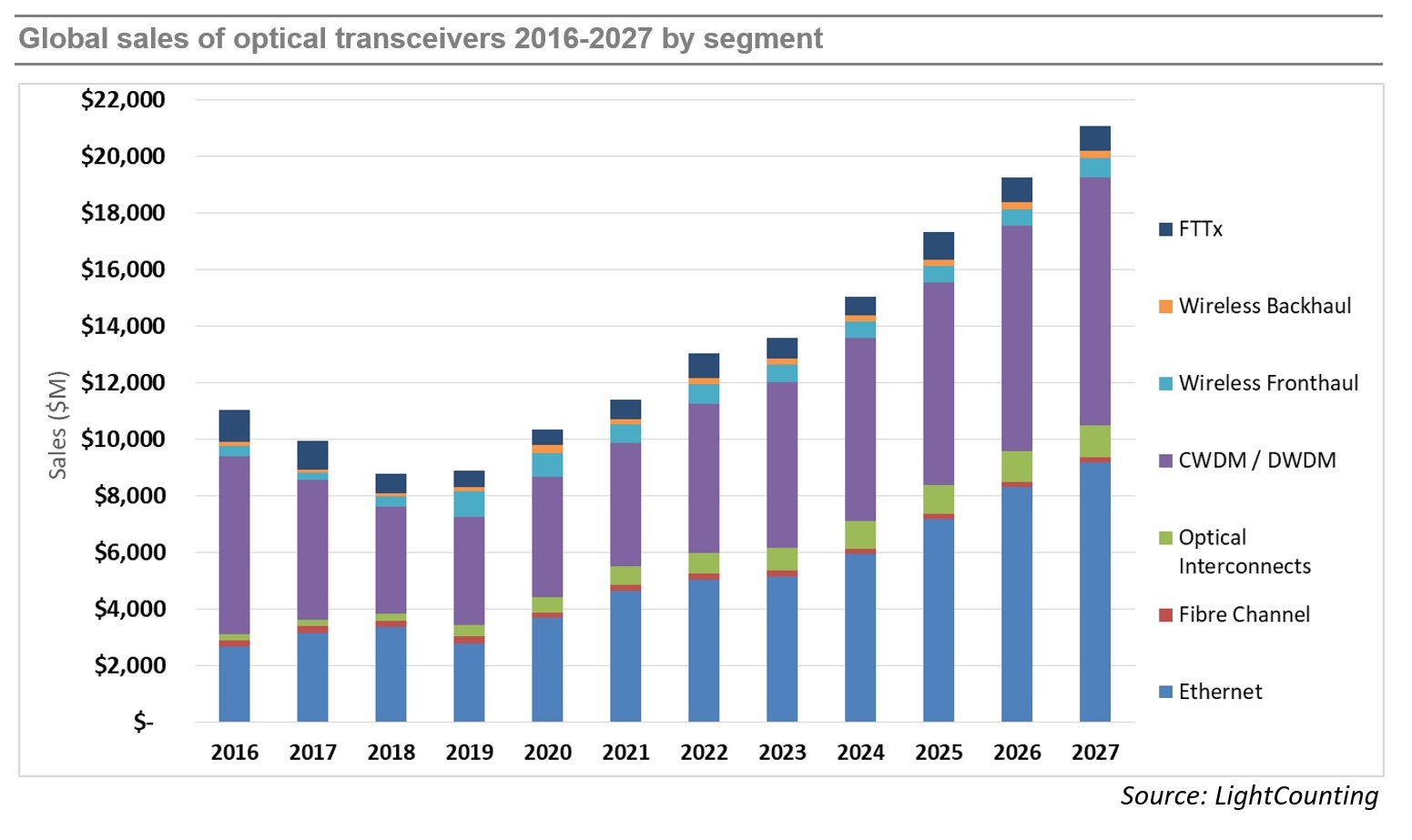

While supply chain disruptions continued, the industry was able to largely overcome them, and the market for optical components and modules saw strong growth in 2020 and 2021, as shown in the figure below. Light Counting believes the transceiver market is on track for another year of strong (14%) revenue growth in 2022, after increasing by 10% in 2021, and 17% in 2020. However, market growth is projected to slow to 4% in 2023, prior to recovering in 2024-2025.

Demand for optics is strong across all market segments, but continuing bottlenecks in the global supply chain negatively impacted sales of 400G DR4 and 100G DR1+ transceivers to Amazon in the first 9 month of 2022. Meta increased its deployments of optics sharply this year, but its latest forecast for 2023 has been reduced substantially. We suspect that Amazon and other cloud companies may moderate their investments in 2023, if the current economic slowdown continues to negatively impact their advertising, streaming, and retail businesses.

|

|

|

LightCounting’s latest forecast projects a 11% CAGR in 2022-2027, not very different from the 13% CAGR in the forecast published in October 2021. Strong sales of DWDM and Ethernet optics accounted for most of the market growth in 2021 and these segments are projected to lead the growth in 2022-2027. Sales of optical interconnects, mostly Active Optical Cables (AOCs), will also increase at double digit rates over the next 5 years. PON sales for FTTx networks will remain steady, as the China market ends its 10G cycle and North America and Europe ramp up 10G PON deployments, driven by government funding programs. 25G and 50G PON provide new growth later in the forecast period. Wireless fronthaul is one area of weakness, since 5G network deployments in China are reaching completion. This segment will return to growth in 2026-2027 with the onset of 6G deployments (which we don’t think will happen till many years later).

…………………………………………………………………………………………………………………………………………………………….

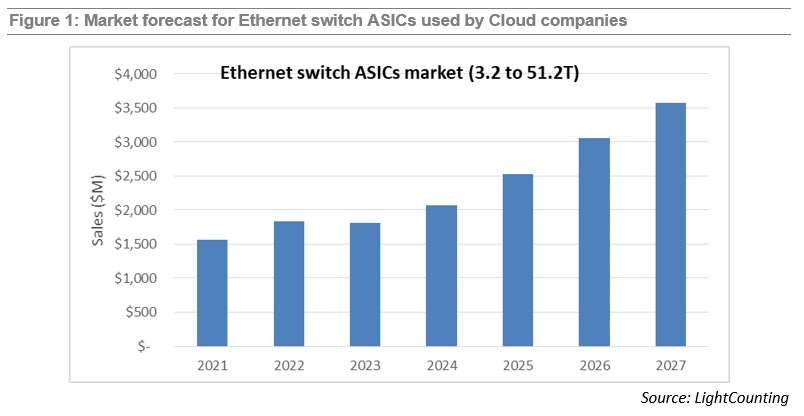

Demand for Ethernet switches from Cloud companies created a new market segment for very high bandwidth switches and switch ASICs. It also transformed the industry supply chain as Cloud companies started using internally designed Ethernet switches and opening these “white box” designs to a broader community. LightCounting’s report on Ethernet switch ASICs was first published in April 2022, and today the first update has been released. The report covers the most interesting segment of the switching ASIC market – high bandwidth (3.2T and above), low latency chips deployed in Cloud datacenters. The report offers brief profiles of the leading suppliers of merchant switch ASIC and system integrators, offering products to Cloud companies, and includes a forecast for sales of 3.2 to 51.2T switch ASICs. The updated report now includes 3.2T/6.4T chips in addition to the higher speed products. This change added close to $1 billion to the total market size compared to our April estimate. The forecast includes chips sold in the merchant market as well as chips used by Cisco in their own equipment (captive market). A lower forecast for 2023 compared to our April 2022 edition reflects reduced guidance by the leading Cloud companies for datacenter upgrades planned for next year. Despite a reduced forecast, the overall market is expected to roughly double in size from $1.8 billion in 2023 to $3.6 billion in 2027.

References:

|