AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

AT&T is expanding its network of fiber-optic cables to deliver fast internet speeds for customers, including those in places where it doesn’t already provide broadband. The plan will cost billions of dollars over the next several years, a price tag that the company—whose debt load outstrips its annual revenue—will not carry alone. AT&T formed a joint venture with BlackRock to fund the project and also wants to access government funding to accelerate the build-out. AT&T and BlackRock have collectively invested $1.5 billion in the venture—named Gigapower—to date, the company said.

Gigapower plans to provide a state-of-the-art fiber network to internet service providers and other businesses in parts of select metro areas throughout the country using a commercial wholesale open access platform. Both companies believe now is the time to create the United States’ largest commercial wholesale open access fiber network to bring high-speed connectivity to more Americans.

AT&T will serve as the anchor tenant of the Gigapower network, but other companies could also provide internet service over the network. That so-called open-access model has become common throughout Europe, but has yet to be widely embraced in the U.S. Gigapower recently introduced plans to build out fiber in Las Vegas, northeastern Pennsylvania and parts of Arizona, Alabama and Florida.

Doubling down on fiber optics sets AT&T on a different path than its rivals Verizon and T-Mobile US, which are relying on improved technology that beams broadband internet service from the same cellular towers that link their millions of mobile smartphone customers. AT&T is testing a similar fixed wireless access service but on a smaller scale, but executives say fiber remains the long-term focus.

AT&T updated shareholders on its vision for fiber internet and 5G cellular networks at its annual meeting, but the documentation/replay was not available at press time. AT&T spent about $24 billion on its fiber and 5G networks last year, and it forecast a similar level of spending this year. The company is confident it will get a very good return on investment (ROI).

The Dallas-based company and its peers face heightened competition in the cellphone business—their core profit engine. After the Covid-19 pandemic brought a surge in new accounts, the cellphone business has cooled, pushing companies to seek alternate paths for growth. AT&T, which has nearly 14 million consumer broadband customers, has provided internet service for years, and executives say that keeping customers plugged in requires faster connections as more data is used.

“We should be putting more fiber out faster, quicker and in more places than anybody else,” AT&T Chief Executive John Stankey said in a recent interview. “If we do that, that means our network is always going to be ahead of anybody else’s.”

Fiber-optic cables, wired directly to or near Americans’ homes, contain easy-to-upgrade glass strands that can carry much more data than radio waves. That higher capacity is crucial for video calls, streaming, videogames and other services, which use more internet data than most smartphone apps. As of last year, fiber was available at some 63 million homes, or more than half of primary residences, according to the Fiber Broadband Association.

AT&T wants its fiber network to cover more than 30 million homes and businesses within its current service area by the end of 2025. In many cases, fiber will replace internet connections over copper wirelines.

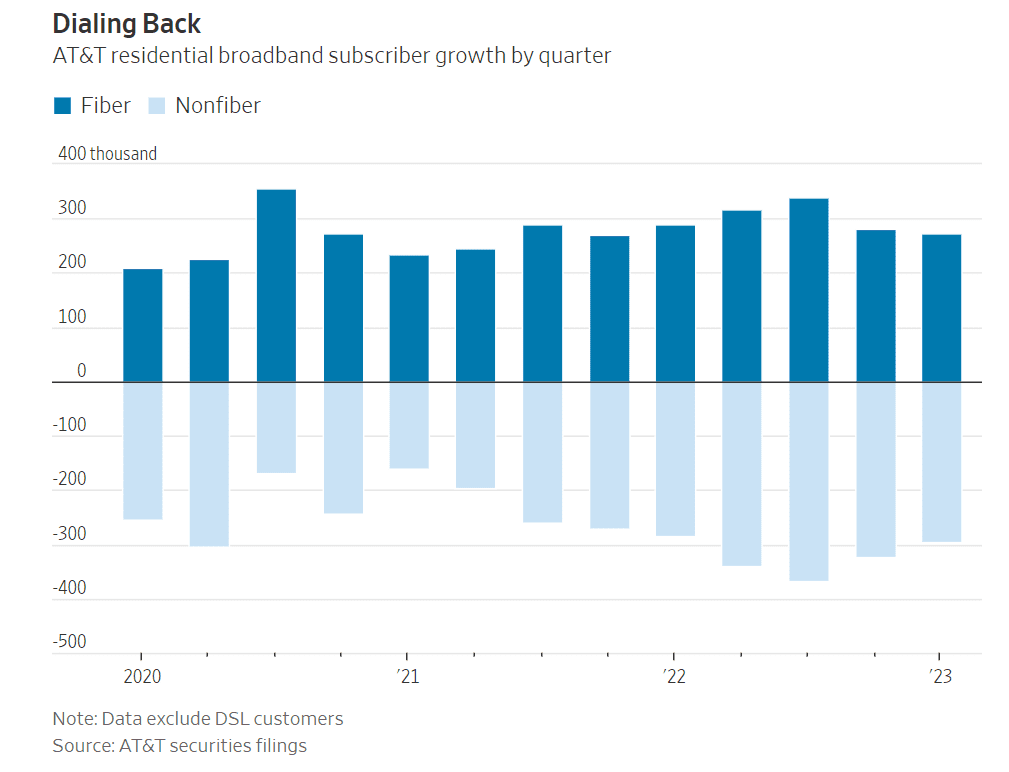

Laying the fiber is one thing, but progress in getting customer sign-ups has been slower than some analysts expected. In the first three months of the year, AT&T signed up 272,000 home fiber subscribers, a deceleration from the December quarter and the same period last year.

The results also marked the fourth straight quarter during which residential fiber sign-ups failed to offset declines in broadband customers overall. Stankey said he isn’t expecting the trend to reverse this year.

AT&T offers its fiber service at various speed tiers, starting at $55 a month for downloads up to 300 megabits a second. Prices run as high as $180 a month for 5-gigabit speeds.

In the March quarter, the average AT&T fiber internet customer paid about $66 a month. That total was up 9% from last year but still slightly less than the sums paid by customers of cable rivals Charter Communications and Comcast, according to Roger Entner, the founder of Recon Analytics.

While AT&T’s fiber build-out continues, it hopes its Internet Air service—which uses cell towers to beam broadband to homes—can stem customer defections in the short term. The service, which costs $55 a month, isn’t yet widely available, said Stankey, who took over as CEO in 2020 and unwound AT&T’s bet on entertainment.

5 thoughts on “AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth”

Comments are closed.

Gigapower is getting a lot of interest from ISP, cablecos, and large enterprise users, according to Bill Hogg on the Light Reading podcast. GigaPower may target more than 1.5M locations. Their open access model is critical to making this joint venture succeed with excellent ROI.

Gigapower is NOT a commodity product! Don’t confuse wholesale enterprise fiber with fiber to the home. When a company is the first fiber provider to the home there’s a mote there as the up-front capital to be the second fiber provider to the home is substantial. There are lots of wholesale fiber providers but not all the way to the home. There’s real money there and far from a commodity.

AT&T is investing in growing its network, as it hopes to reach over 30 million fiber locations by the end of 2025 — that’s up from around 18.5 million locations last year. Overall, the company is doing a good job of balancing dividends and growth, while trying to reduce its debt.

The stock is a bit of a contrarian buy right now, but at such a low earnings multiple, investors look to be more than sufficiently compensated to take on a bit of risk. As a top telecom company in the country, AT&T is still a good business for long-term investors to consider holding in their portfolios.

https://www.fool.com/investing/2023/05/23/2-dirt-cheap-stocks-to-buy-right-now/

Gigapower is NOT a commodity product!

Don’t confuse wholesale enterprise fiber with fiber to the home. When a company is the first fiber provider to the home there’s a mote there as the up-front capital to be the second fiber provider to the home is substantial. There are lots of wholesale fiber providers but not all the way to the home. There’s real money there and far from a commodity.

AT&T overtakes T-Mobile and Verizon in customer satisfaction

The American Customer Satisfaction Index (ACSI) has released its latest study on wireless providers and smartphones. In an interesting outcome, AT&T has beaten out both T-Mobile and Verizon for customer satisfaction even though it usually ranks third when it comes to performance and more.

AT&T jumped 3% this year to a score of 75 out of 100 for customer satisfaction. That put AT&T one point ahead of T-Mobile at 74 and two points ahead of Verizon at 73.

https://9to5mac.com/2023/05/16/att-overtakes-t-mobile-verizon-customer-satisfaction/

AT&T and Charter Communications are best positioned to benefit from the multi-billion-dollar Broadband Equity Access and Deployment (BEAD) program based on state-by-state allocations and the presence of each operator in those states, reckon analysts that have broken down the numbers.

“The larger the presence an operator has in a state with a sizable allocation of BEAD funding, the greater the opportunity there is for it to see benefits from a build-out near its existing footprint and fill-in additional pockets across its DMAs [designated market areas] with edge-outs,” the analysts at ISI Evercore surmised in a research note. “In that context, we highlight that AT&T and Charter over-index to states that received the lion’s share of BEAD allocation.”

AT&T and Charter have 33% and 27%, respectively, of their residential broadband subs, come from the two top BEAD states – Texas and California – ISI Evercore pointed out.

https://www.lightreading.com/cable-tech/atandt-charter-have-biggest-bead-opportunity—studies/d/d-id/785515?