No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!

Once again, AT&T ranked #1 in the U.S. Fiber Lit Buildings Leaderboard fromVertical Systems Group (VSG) for a seventh consecutive year. The fiber focused U.S. carrier retained the top spot with the highest number of fiber lit buildings across its footprint in 2022. But there’s a whole lot more AT&T #1 rankings that the carrier has not gotten proper credit for achieving:

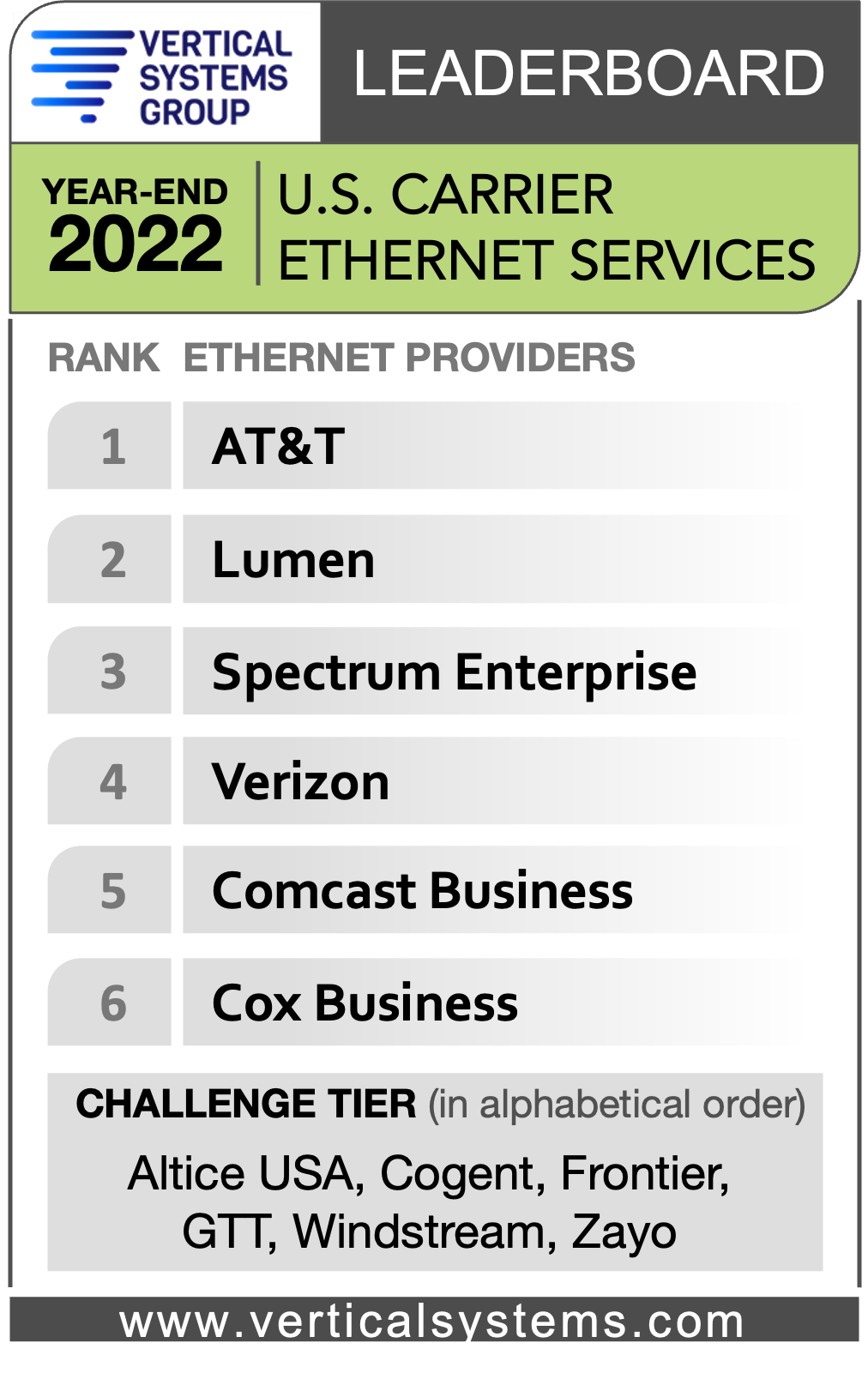

- AT&T also holds the #1 ranking in VSG 2022 U.S. Carrier Ethernet LEADERBOARD.

- AT&T ranked #1 for the fifth consecutive year in VSG’s year end 2022 U.S. managed carrier SD-WAN leaderboard.

–>Please see the images below, courtesy of VSG.

Major mobile operators like AT&T and Verizon are actively installing new fiber for their 5G network backhaul, which facilitates new fiber connectivity to nearby commercial sites. T-Mobile no longer has any fiber assets from their Sprint acquisition. They were sold to Cogent along with all other wireline assets in a deal that closed May 1, 2023.

Verizon, Spectrum Enterprise, Lumen, Comcast Business, Cox Business, Zayo, Crown Castle, Frontier, Brightspeed, Breezeline and Optimum followed. Those retail and wholesale fiber providers qualified for the leaderboard with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2022.

-

“Fiber installations at U.S. commercial sites increased in 2022, driven by escalating requirements for gigabit-speed connectivity to support cloud-based services, data centers, 5G rollouts, and other applications,” said Rosemary Cochran, principal of Vertical Systems Group. “New fiber investments in the U.S. will continue to be impacted by pending federal programs and funding initiatives. Opportunities in the commercial segment include monetizing the millions of small buildings underserved.”

U.S. Fiber Lit Buildings LEADERBOARD Highlights:

- The 2022 LEADERBOARD roster increases to twelve commercial fiber providers, up from eleven in 2021.

- AT&T retains the #1 rank on the 2022 U.S. Fiber Lit Buildings LEADERBOARD for the seventh consecutive year.

- Rankings for the top six companies on the 2022 LEADERBOARD are unchanged from 2021, which includes AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast Business, and Cox Business.

- The next six LEADERBOARD provider rankings change as compared to the previous year. Zayo advances to rank seventh ahead of Crown Castle, which dips to eighth. Frontier moves up to ninth position from tenth. Brightspeed debuts in tenth position with fiber assets acquired from Lumen. Breezeline (formerly Atlantic Broadband) falls to eleventh position from ninth. Optimum (Altice USA brand) drops from eleventh to the twelfth and final position.

- The number of 2022 Challenge Tier citations expands from eight to nine with the addition of Ritter Communications.

Market Players include all other fiber providers with fewer than 5,000 U.S. commercial fiber lit buildings. The 2022 Market Players tier covers more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): 11:11 Systems, ACD, Alaska Communications, American Telesis, Armstrong Business Solutions, Astound Business, C Spire, Centracom, Cogent, Conterra, DFN, DQE Communications, Everstream, ExteNet Systems, Fatbeam, FiberLight, First Digital, Flo Networks, Fusion Connect, Google Fiber, GTT, Horizon, Hunter Communications, Logix Fiber Networks, LS Networks, Mediacom Business, MetroNet Business, Midco, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Sparklight Business, Syringa, T-Mobile, TDS Telecom, TPx, U.S. Signal, Vast Networks, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

……………………………………………………………………………………………………………………………………..

References:

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

https://www.verticalsystems.com/2023/02/15/2022-u-s-ethernet-leaderboard/

AT&T tops VSG’s U.S. Carrier Managed SD-WAN Leaderboard for 4th year

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

2 thoughts on “No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!”

Comments are closed.

AT&T overtakes T-Mobile and Verizon in customer satisfaction

The American Customer Satisfaction Index (ACSI) has released its latest study on wireless providers and smartphones. In an interesting outcome, AT&T has beaten out both T-Mobile and Verizon for customer satisfaction even though it usually ranks third when it comes to performance and more.

AT&T jumped 3% this year to a score of 75 out of 100 for customer satisfaction. That put AT&T one point ahead of T-Mobile at 74 and two points ahead of Verizon at 73.

https://9to5mac.com/2023/05/16/att-overtakes-t-mobile-verizon-customer-satisfaction/

The top management of AT&T Inc. T recently debriefed investors about the current business situation, the underlying growth opportunities and its progress on various operational metrics. John Stankey, the company’s chief executive officer, also shed some light on the continued business transformation initiatives to create long-term value for shareholders.

Stankey observed that AT&T is well on course to generate a cash flow in excess of $16 billion in 2023, led by an adjusted EBITDA growth of more than 3% driven by diligent execution of operational plans and ongoing cost-reduction efforts. In addition, he expected a healthy growth momentum in the postpaid wireless business with a lower churn rate and increased adoption of higher-tier unlimited plans.

With a customer-centric business model, the company is likely to benefit from the increased deployment of mid-band spectrum and greater fiber densification. AT&T expects to deploy mid-band spectrum to 200 million users by year-end 2023 and reach more than 30 million customer and business locations with fiber by the end of 2025. The extensive fiber footprint is likely to minimize its maintenance and repair costs while generating higher ARPU.

The Gigapower LLC, the joint venture initiative with BlackRock Alternatives, is likely to further enhance its capability to provide the best-in-class fiber network to Internet Service Providers and other businesses across the country. Leveraging its extensive fiber network and nationwide sales capabilities, AT&T aims to utilize Gigapower to commercially deploy a fiber network at 1.5 million customer locations outside the perimeter of its traditional 21-state wireline service footprint.

AT&T plans to deploy a standard-based nationwide mobile 5G network for a seamless transition to Wi-Fi, 5G devices and Long-Term Evolution. It intends to deploy 5G on low and mid-band spectrum holding.

AT&T has presented its 5G policy framework that will stand on three vital pillars — fixed wireless, edge computing and 5G. It is focusing on a fiber densification strategy, which is anticipated to enhance broadband connectivity for consumers and enterprises, alongside 5G deployments boosting the end-user experience.

AT&T has acquired 80MHz of mid-band spectrum in the C-Band auction for a total consideration of $27.4 billion. These airwaves offer better propagation characteristics for optimum coverage in urban and rural areas. Through its Multi-access Edge Compute solution, the company offers the flexibility to manage data more appropriately. It leverages an indigenous software-defined network to provide low-latency, high-bandwidth applications for faster access to data processing.

https://finance.yahoo.com/news/t-t-management-updates-shareholders-112000122.html