Optical Network Architecture

Infinera, DZS, and Calnex Successfully Demonstrate 5G Mobile xHaul with Open XR

Infinera announced today a successful multi-vendor demonstration of 5G mobile broadband xHaul using coherent open XR optics point-to-multipoint optical transmission. The multi-vendor interoperability testing, conducted with DZS and Calnex, represents a key step toward enabling mobile operators to greatly simplify and cost-reduce 5G and next-generation mobile transport network rollouts through the reduction of the number of optical transceivers, resulting in significant total cost of ownership savings.

Hosted in the European Open Test & Integration Center in Torino by TIM, the high-capacity xHaul application testing included fronthaul, midhaul, and backhaul transport scenarios with XR-based coherent pluggable optics deployed in third-party hosts supporting point-to-point and point-to-multipoint optical transmission. Results of the performance testing included successful demonstration of xHaul synchronization and timing distribution in a point-to-multipoint optical transport architecture.

“It is not only the significant bandwidth demands of 5G that create challenges for mobile operators, but also the fundamental misalignment between actual 5G network traffic patterns and the underlying transport technology,” said Ron Johnson, SVP and General Manager, Optical Subsystems and Global Engineering Group, Infinera. “Working in close collaboration with industry-leading mobile operators such as TIM, this testing validates the critical role that XR optics innovation can play in transforming the economics of 5G transport and paving the way for efficient 6G networks.”

Equipment used in the interoperable xHaul testing included Infinera ICE-X intelligent coherent pluggables, the DZS Saber 2200, and Calnex Paragon-NEO. Part of the work carried out by TIM and Infinera was supported by the EU project ALLEGRO, GA No. 101092766.

About DZS:

DZS (Nasdaq: DZSI) is a developer of Network Edge, Connectivity and Cloud Software solutions enabling broadband everywhere.

About Infinera:

Infinera is a global supplier of innovative open optical networking solutions and advanced optical semiconductors that enable carriers, cloud operators, governments, and enterprises to scale network bandwidth, accelerate service innovation, and automate network operations. Infinera solutions deliver industry-leading economics and performance in long-haul, submarine, data center interconnect, and metro transport applications. To learn more about Infinera, visit www.infinera.com, follow us on X and LinkedIn, and subscribe for updates.

References:

Telenor Deploys 5G xHaul Transport Network from Cisco and NEC; xHaul & ITU-T G.8300 Explained

Orange Deploys Infinera’s GX Series to Power AMITIE Subsea Cable

Infinera trial for Telstra InfraCo’s intercity fiber project delivered 61.3 Tbps between Melbourne and Sydney, Australia

Fiber Build-Out Boom Update: GTT & Ziply Fiber, Infinera in Louisiana, Bluebird Network in Illinois

Orange Deploys Infinera’s GX Series to Power AMITIE Subsea Cable

Optical network equipment maker Infinera announced today that Orange deployed Infinera’s GX Series-based ICE6 “coherent optical engine” on its new AMITIE subsea cable, which is ready for service today from an end-to-end point of view and offers network operators unique and robust transatlantic connectivity with ultra-low latency.

Orange owns two pairs of fiber optic cables as part of the AMITIE subsea cable system, offering capacity up to 23 Tbp/s each.

………………………………………………………………………………………………………………..

Orange selected Infinera’s solution based on its industry-leading optical performance to offer up to 400 GbE services to its customers from the U.S. to France, and across its long-haul terrestrial backhaul network from Boston to New York and Le Porge to Bordeaux in France.

The sixth-generation Infinite Capacity Engine (ICE6), from Infinera’s Advanced Coherent Optical Engines and Subsystems, is a 1.6 Tb/s optical engine that delivers two independently programmable wavelengths at up to 800 Gb/s each. Utilizing a 7-nm CMOS process node DSP and advanced PIC technology, ICE6 leverages ultra-high baud rates, high modem SNR, and innovative features to break performance and spectral efficiency barriers, including 800G single-wavelength performance over 1000+ km in a commercial network.

Infinera’s ICE6- 800G Generation Optical Engine Photo credit: Infinera

………………………………………………………………………………………………………………..

Orange powers fully resilient global connectivity capability along the world’s busiest route, using two state-of-the-art subsea mega cables, Dunant and AMITIE, to connect France and the U.S. Deploying Infinera’s innovative ICE6 technology on the GX Series Compact Modular Platform enables Orange to keep pace with future generations of optical transmission technologies while maintaining a high level of performance for the next 20 years. This deployment also significantly reduces Orange’s energy cost per megabit and minimizes its carbon footprint.

“We are pleased to integrate Infinera’s industry-leading technology for the first time on one of our key transatlantic routes and terrestrial backhaul. With this future-proof technology, Orange is well-positioned to continue to be a major player in the global wholesale market, developing our infrastructure to connect continents together and delivering a unique, high-performance, and robust solution to our customers,” said Aurélien Vigano, VP International Transmission Network at Orange.

“Infinera is delighted to partner with Orange to deliver our innovative ICE6 solution across Orange’s critical subsea and terrestrial backhaul routes, offering network operators, wholesale carriers, and enterprise customers resilient and reliable global connectivity capability,” said Nick Walden, Senior Vice President, Worldwide Sales, Infinera.

References:

https://www.infinera.com/innovation/ice6-800g-wavelengths/

Infinera trial for Telstra InfraCo’s intercity fiber project delivered 61.3 Tbps between Melbourne and Sydney, Australia

Orange Telco Cloud to use Equinix Bare Metal to deliver virtual services with <10 ms latency

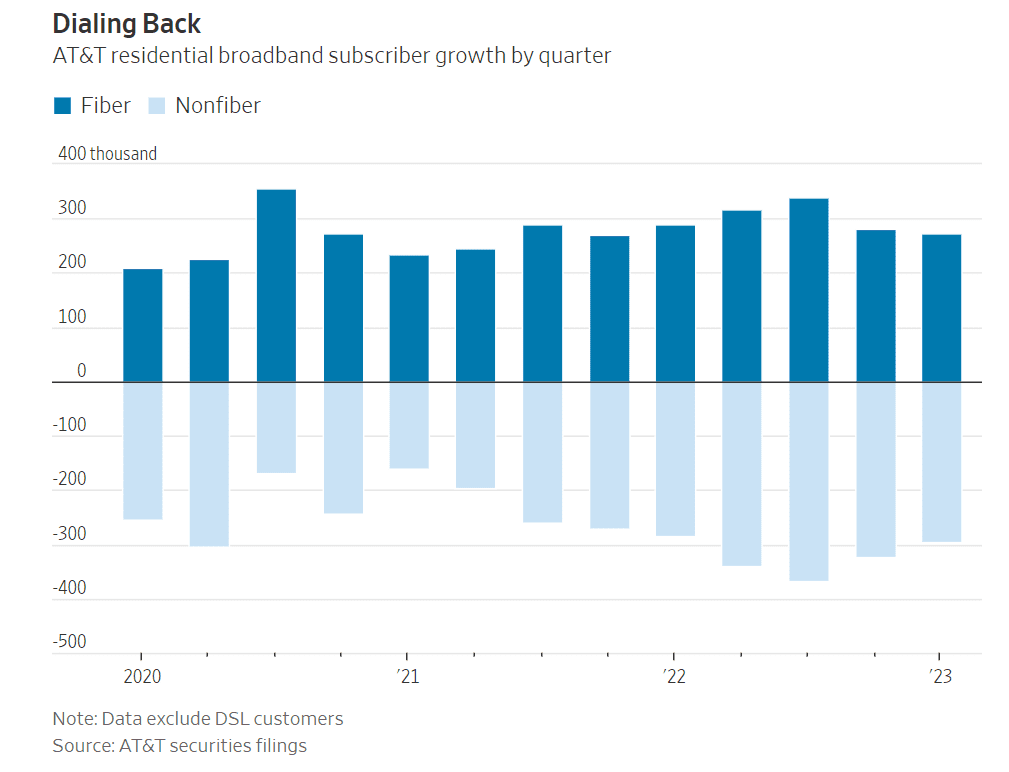

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

AT&T is expanding its network of fiber-optic cables to deliver fast internet speeds for customers, including those in places where it doesn’t already provide broadband. The plan will cost billions of dollars over the next several years, a price tag that the company—whose debt load outstrips its annual revenue—will not carry alone. AT&T formed a joint venture with BlackRock to fund the project and also wants to access government funding to accelerate the build-out. AT&T and BlackRock have collectively invested $1.5 billion in the venture—named Gigapower—to date, the company said.

Gigapower plans to provide a state-of-the-art fiber network to internet service providers and other businesses in parts of select metro areas throughout the country using a commercial wholesale open access platform. Both companies believe now is the time to create the United States’ largest commercial wholesale open access fiber network to bring high-speed connectivity to more Americans.

AT&T will serve as the anchor tenant of the Gigapower network, but other companies could also provide internet service over the network. That so-called open-access model has become common throughout Europe, but has yet to be widely embraced in the U.S. Gigapower recently introduced plans to build out fiber in Las Vegas, northeastern Pennsylvania and parts of Arizona, Alabama and Florida.

Doubling down on fiber optics sets AT&T on a different path than its rivals Verizon and T-Mobile US, which are relying on improved technology that beams broadband internet service from the same cellular towers that link their millions of mobile smartphone customers. AT&T is testing a similar fixed wireless access service but on a smaller scale, but executives say fiber remains the long-term focus.

AT&T updated shareholders on its vision for fiber internet and 5G cellular networks at its annual meeting, but the documentation/replay was not available at press time. AT&T spent about $24 billion on its fiber and 5G networks last year, and it forecast a similar level of spending this year. The company is confident it will get a very good return on investment (ROI).

The Dallas-based company and its peers face heightened competition in the cellphone business—their core profit engine. After the Covid-19 pandemic brought a surge in new accounts, the cellphone business has cooled, pushing companies to seek alternate paths for growth. AT&T, which has nearly 14 million consumer broadband customers, has provided internet service for years, and executives say that keeping customers plugged in requires faster connections as more data is used.

“We should be putting more fiber out faster, quicker and in more places than anybody else,” AT&T Chief Executive John Stankey said in a recent interview. “If we do that, that means our network is always going to be ahead of anybody else’s.”

Fiber-optic cables, wired directly to or near Americans’ homes, contain easy-to-upgrade glass strands that can carry much more data than radio waves. That higher capacity is crucial for video calls, streaming, videogames and other services, which use more internet data than most smartphone apps. As of last year, fiber was available at some 63 million homes, or more than half of primary residences, according to the Fiber Broadband Association.

AT&T wants its fiber network to cover more than 30 million homes and businesses within its current service area by the end of 2025. In many cases, fiber will replace internet connections over copper wirelines.

Laying the fiber is one thing, but progress in getting customer sign-ups has been slower than some analysts expected. In the first three months of the year, AT&T signed up 272,000 home fiber subscribers, a deceleration from the December quarter and the same period last year.

The results also marked the fourth straight quarter during which residential fiber sign-ups failed to offset declines in broadband customers overall. Stankey said he isn’t expecting the trend to reverse this year.

AT&T offers its fiber service at various speed tiers, starting at $55 a month for downloads up to 300 megabits a second. Prices run as high as $180 a month for 5-gigabit speeds.

In the March quarter, the average AT&T fiber internet customer paid about $66 a month. That total was up 9% from last year but still slightly less than the sums paid by customers of cable rivals Charter Communications and Comcast, according to Roger Entner, the founder of Recon Analytics.

While AT&T’s fiber build-out continues, it hopes its Internet Air service—which uses cell towers to beam broadband to homes—can stem customer defections in the short term. The service, which costs $55 a month, isn’t yet widely available, said Stankey, who took over as CEO in 2020 and unwound AT&T’s bet on entertainment.

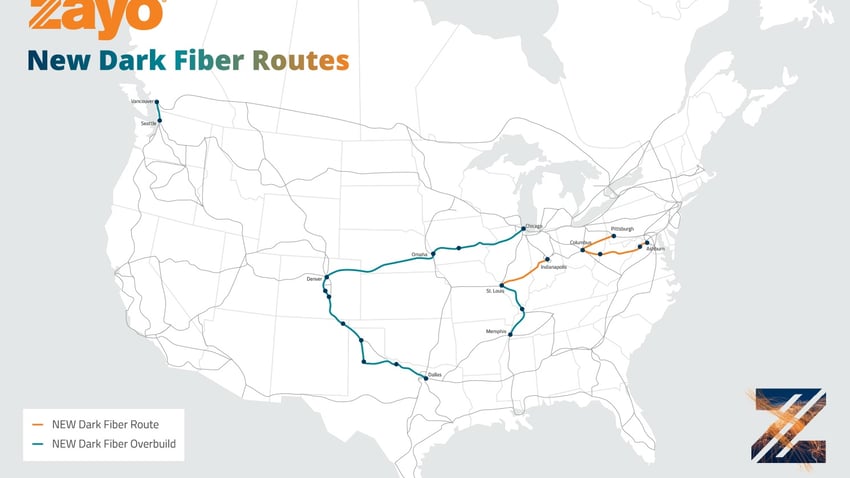

Zayo announces “Waves on Demand,” security enhancements, and network growth

Zayo Group Holdings, Inc (Zayo) today announced a series of expansions and enhancements to its network and services. These include enhanced network protection and an industry-first, on-demand connectivity service, as well as significant growth of its long-haul dark fiber and 400G-enabled routes and modernization of its IP core network. In particular, Zayo plans to build eight new long-haul fiber routes and debuted a new Waves on Demand service for customers looking to rapidly light up added bandwidth. Waves on Demand will initially focus on providing 100G services across eight routes, though a 400G route between Newark, NJ and New York is available. Five additional routes are planned. More details below.

“Yesterday’s network can’t deliver tomorrow’s ideas,” said Andrés Irlando, President of Zayo. “Zayo’s global network provides game-changing performance, scale, security, resilience and value for our customers. Our goal is to revolutionize the industry by constantly improving our network and prioritizing our customers’ needs. Our teams are focused on providing them with the best possible experience.”

Providing an On-Demand Network:

For large bandwidth customers who need data center connectivity quickly and easily, Zayo is launching Waves on Demand to enable same-day turn-up on the most in-demand routes, with significantly shortened delivery times. Zayo will be the only provider to enable customers to provision wavelengths within a day.

This industry-first means customers can quickly provision “Wavelength on Demand” between key data center locations across its market-leading network footprint, including its highest-demand routes. In 2023, Zayo launched 8 new Waves on Demand routes, with 5 additional routes planned for the future.

Zayo’s Completed Waves on Demand routes include:

- Newark, NJ – New York, NY (up to 400G)

- Ashburn, VA – New York, NY

- Hillsboro, OR – Seattle, WA

- Ashburn, VA – Newark, NJ

- Atlanta, GA – Dallas, TX

- Los Angeles, CA – San Jose, CA

- Inter-Los Angeles, CA

- Los Angeles, CA – San Jose, CA (alt)

Zayo’s Planned Waves on Demand Routes include:

- Toronto, ON – Chicago, IL

- San Jose, CA – Seattle, WA

- Newark, NJ – Chicago, IL

- Chicago, IL – Secaucus, NJ

- Englewood, FL – Chicago, IL

Chaz Kramer, Zayo’s VP of Product Management, told Fierce that Waves on Demand will cut the time required to add wavelengths from 45 days or more to just hours. said, “80% of our services right now are 100G services at the moment. Our focus is trying to solve the customer requirement for that time lag in terms of service delivery,” he said.

“The only way to stay ahead of the digital curve is to continuously transform. Transformative ideas need a reliable, resilient and on-demand network,” said Bill Long, Chief Product Officer at Zayo. “Zayo is leading the industry with network automation and self-service options, ensuring customers have unprecedented speed and resilience with more flexibility and elasticity, while enhancing security and value, so our customers can focus on making progress toward their business goals instead of worrying about their network.”

Security Enhancements:

Security has never been more important across the tech industry, and beyond. As more and more companies face the realities of route hijacking, Zayo has taken security protection for customers one step further.

In addition to deploying Resource Public Key Infrastructure (RPKI) filtering – a component of Mutually Agreed Norms for Routing Security (MANRS) compliance designed to secure the internet’s routing infrastructure – Zayo now requires two-factor authentication process for Border Gateway Protocol (BGP) route management. As one of the first communications infrastructure providers to implement a two-factor authentication process for BGP updates, this will provide improved security for the broader internet community and prevent inadvertent or malicious route hijacks from bad actors.

Network Growth and Modernization

This year Zayo began IP Core upgrades to support 400G connectivity, providing better routing performance, stability, high bandwidth and reduced pricing for customers. Zayo has partnered with Juniper Networks®, a global leader in IP networking, cloud and connected security solutions for next-gen IP Core connectivity.

“Juniper Networks is dedicated to delivering state-of-the-art solutions, including systems optimized for our customers’ current and future core throughput demands. We are pleased to partner with Zayo as they construct and fortify their next-generation IP Core network, equipped with 400G,” said Sally Bament, Vice President of Service Provider Marketing at Juniper Networks. “By employing Juniper’s core routers, Zayo can ensure their customers enjoy high-speed bandwidth services that can support growing performance and capacity demands of end users.”

The Growth of Zayo’s Network:

- In 2022, Zayo added 5,200 route miles to its network, resulting in more than 1.35M fiber miles.

- Zayo now has 224 400G-enabled wavelength points of presence (PoPs) and 145 100G-enabled PoPs.

- Zayo deployed 24 long-haul waves routes in 2022 with 926TB of wavelength capacity, enabling 400G services across these routes, spanning more than 20,000 route miles. In 2023, Zayo will exceed the number of new Long Haul Dark Fiber routes deployed in 2022.

- Zayo will complete 8 long-haul construction projects in 2023, totaling 2,951 route miles and 708,000 fiber miles.

- Zayo is estimated to complete 32 400G routes in 2023 with 14 completed in the first half of the year.

Zayo’s 2023 planned new and augmented dark fiber routes:

- New – St. Louis, MO to Indianapolis, IN

- Overbuild – Denver, CO to Dallas, TX

- Overbuild – Chicago, IL to Omaha, NE

- Overbuild – Omaha, NE to Denver, CO

- Overbuild – Seattle, WA to Vancouver, WA

- New – Columbus, OH to Pittsburgh, PA

- Overbuild – St. Louis, MO to Memphis, TN

- New – Columbus, OH to Ashburn, VA

Zayo’s New Tier 1 400G Routes:

- Albany, NY – Newark, NJ

- Bend, OR – Umatilla, OR

- Chicago, IL – Cleveland, OH

- Albany, NY – Boston, MA

- Atlanta, GA – Washington, DC

- Dallas, TX – St. Louis, MO

- Denver, CO – Dallas, TX

- Kansas City, MO – Indianapolis, IN

- Las Vegas, NV – Phoenix, AZ

- Montreal, QC (Canada) – Quebec City, QC (Canada)

- Columbus, OH – Ashburn, VA

- Columbus, OH – Cleveland, OH

- Columbus, OH – Pittsburg, PA

- Chicago, IL – Clinton, KY

- Clinton, KY – Ponchatoula, LA

- Toronto, ON (Canada) – Waterloo, ON (Canada) (Crosslake)

- Toronto, ON (Canada) – Montreal, QC (South) (Canada)

- Toronto, ON (Canada) – Montreal, QC (North) (Canada)

- Indianapolis, IN – Columbus, OH

- Ashburn, VA – Baltimore, MD

- Salt Lake City, UT – Seattle, WA

- Los Angeles, CA – San Jose, CA

Additional tier 2 and 3 routes will also be added throughout 2023, totaling 32 new routes.

“We believe that technology plays a critical role in preparing students for the future. We chose Zayo’s future-ready network because of its resilience and performance,” said Dr. Thomas Weeks, Chief Technology Officer at Hillsborough County Public Schools. “We trust Zayo because they invest in their world-class network. The Zayo team worked with us to tailor a solution that met the unique needs of our school district and enhances our effectiveness to help students and staff achieve.”

Enhancing Service Delivery and Customer Experience:

Zayo has also set out to change the trajectory of customer experience. Zayo optimized its service delivery with rebuilt processes that utilize automation to make working with Zayo easier for customers. Since implementing these changes, Zayo had its largest install quarter in history in Q4 2022.

To learn more about Zayo’s network and how it can help you connect what’s next, please visit https://www.zayo.com/info/network-expansion/

About Zayo Group Holdings, Inc:

For more than 15 years, Zayo has empowered some of the world’s largest and most innovative companies to connect what’s next for their business. Zayo’s future-ready network spans over 16 million fiber miles and 139,000 route miles. Zayo’s tailored connectivity and edge solutions enable carriers, cloud providers, data centers, schools, and enterprises to deliver exceptional experiences, from core to cloud to edge. Discover how Zayo connects what’s next at www.zayo.com and follow us on LinkedIn and Twitter.

References:

https://www.fiercetelecom.com/telecom/zayo-slashes-time-turn-bandwidth-waves-demand

Zayo to deploy 400G b/s network across North America and Western Europe

Digital Realty & Zayo plan next gen fiber interconnection and security capabilities

Ethernet Alliance multi-vendor interoperability demo (10GbE to 800GbE) at OFC 2023

The Ethernet Alliance, a global consortium dedicated to progressing Ethernet technologies (albeit, only the MAC frame format is left from the original 10BaseT Ethernet standard), this week exhibited a multivendor interoperability demonstration at the OFC 2023 conference and exhibition in San Diego, CA.

–>Please see References 1. and 2. below for the detailed multi-vendor interoperability demo diagrams.

Featuring 18 different participating member companies, the Ethernet Alliance interoperability demo spans diverse Ethernet technologies ranging from 10 Gigabit Ethernet to 800GbE. The interoperability display features a live network between the booths of Ethernet Alliance and the Optical Internetworking Forum, Exfo, Spirent Communications, and Viavi Solutions.

The network leverages single-mode optical fibers with high-speed traffic originating from an array of switches, routers, interconnects, including copper and optical cables. It also employs various interconnects using multiple pluggable form factors such as OSFP, QSFP-DD, QSFP, and SFP, and multiple interface types including OIF 400ZR, OpenZR+ MSA 400ZR+, and 800G-ETC-CR8.

The Ethernet Alliance also spent time highlighting its roadmap, which sees continued advancement in the speed, reliability, and use cases for the networking protocol across multiple sectors. The goal of the organization is not to invent new standards, but rather to help foster their adoption and deployment in an interoperable approach.

Source: Ethernet Alliance

……………………………………………………………………………………………………………………………….

“We’re now at the half-century mark, and Ethernet’s star continues to rise. As a profoundly resilient technology that’s getting progressively faster, it is an innovation engine that drives market diversification and fuels business growth. If you think about the journey from invention to deployment, what we do is we try to show that the technology does work and it is mature enough that it can be deployed,” said Peter Jones, chairman, Ethernet Alliance.

In the enterprise market, demand for 10 GbE-based Ethernet remains strong and there is also some growth for 25 GbE, which is intended more for servers. Ethernet also has 100 GbE and 400 GbE speeds to support larger enterprise and campus needs.

Network operators are always looking for more network capacity and speed and to that end 800 GbE and soon 1.6 Tb/s Ethernet (TbE) will fit the bill.

Jones said that in the early days, the goal for each new set of specifications was to provide 10-times the speed, at only three-times the price of the existing specification. Over time what has occurred is the standards have not just been racing forward to ever faster speeds, but rather are being tailored to meet the price and performance characteristics that a given use case requires.

For example, work is ongoing to help bring Ethernet into more industrial use cases as a solution for serial connections. Ethernet is also increasingly finding its way into automotive use cases as modern vehicles rely on growing levels of compute capacity to operate and communicate.

The Ethernet Alliance is also working on certification efforts for Power-over-Ethernet (PoE). While there have long been PoE standards, there hasn’t been a full-scale certification effort in the same way that there is for Wi-Fi in the wireless world. Jones said that while PoE mostly works today, there have been some instances of vendor technologies that weren’t interoperable.

“We really want people to be able to buy certified devices because we want to preserve the idea that Ethernet just works and we were starting to see that breaking down with PoE,” Jones said. “Ethernet is the most important technology that no one ever sees. Very few people that use the internet understand that Ethernet is the key part of it,” he added.

“One of OFC’s highlights was live interoperability demonstrations from leading optics companies running over OFCnet,” said OFC chairs Chris Cole, Coherent Corporation; Ramon Casellas, Centre Tecnològic de Telecomunicacions de Catalunya; and Ming-Jun Li, Corning Incorporated.

References:

https://ethernetalliance.org/wp-content/uploads/2022/09/EA_Ecosystem-Demo.pdf

https://optics.org/news/14/3/17

https://www.sdxcentral.com/articles/analysis/why-you-should-never-bet-against-ethernet/2023/03/

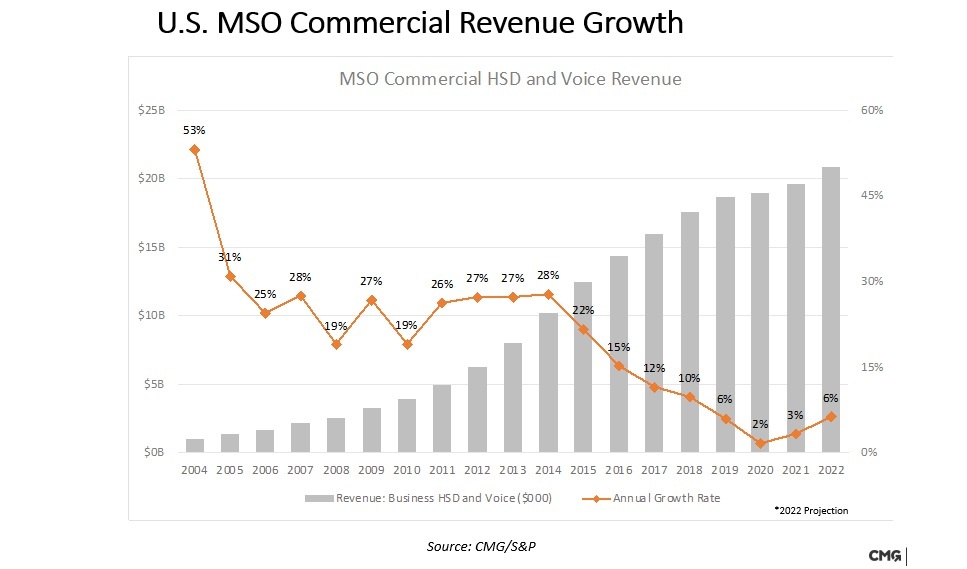

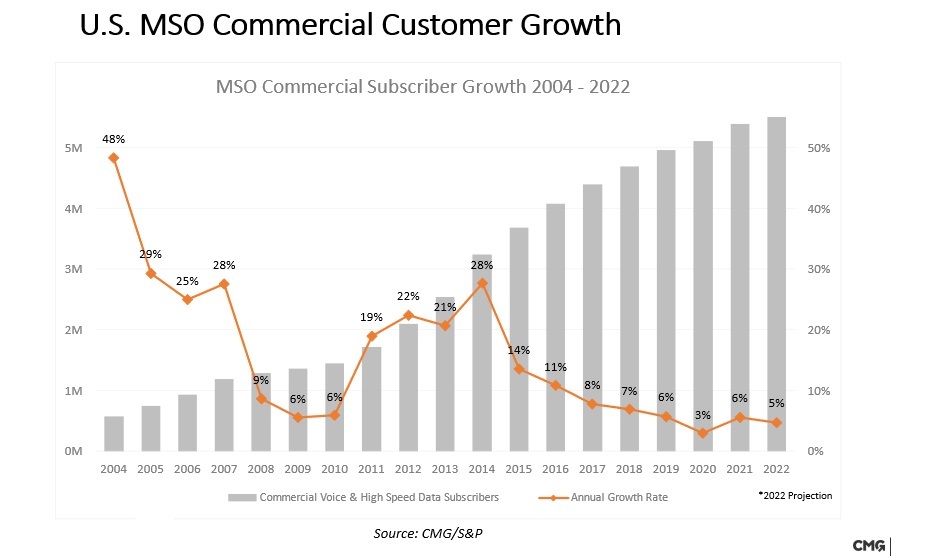

U.S. cable commercial revenue to grow 6% in 2022; Comcast Optical Network Architecture; HFC vs Fiber

U.S. cable multi-service operators (MSO’s) now generate more than $20 billion a year in business services revenues as the sector has emerged as one of the most profitable for the industry. However, cablecos face major challenges in maintaining their growth pace because of the economic meltdown wrought by COVID-19 and the emergence of new all-fiber and wireless competitors.

Cable business service revenues and customer growth each slowed during the first two years of the COVID-19 pandemic, but they are clearly increasing again at the end of 2022.

U.S. cablecos commercial revenue growth is set to hit 6% in 2022, up from just 2% in 2020 and 3% in 2021, Alan Breznick, cable/video practice leader at Light Reading and a Heavy Reading analyst said in opening remarks at Light Reading’s 16th-annual CABLE NEXT-GEN BUSINESS SERVICES DIGITAL SYMPOSIUM, which focused on cable business services. [The source of that data is CMG/S&P.]

“There are signs of things pointing up again for the [cable] industry,” Breznick told the virtual audience.

U.S. cable is expected to bring in $20.5 billion in total commercial services revenues in 2022. Broken down by segment, small businesses (up to 19 employees), at $14.6 billion, will continue to represent the lion’s share, followed by medium businesses (20-99 employees), at $3.3 billion, and large businesses (100-plus employees), at $2.6 billion.

Commercial customer growth is estimated to reach 5% in 2022, down slightly from 2021 levels, but almost doubling the growth rate seen in 2020, when businesses across the country were hit by pandemic-driven shutdowns and lockdowns. Breznick estimates that US cable has about 5.5 million commercial customers.

Christopher Boone, senior VP of business services and emerging markets at Cable One, acknowledged that the commercial services market is returning to a faster rate of growth. However, businesses – and smaller businesses, particularly – are feeling labor and inflationary pressure as things continue to open up.

“Everything is expensive, including labor, and it’s hard to find [workers],” Boone explained. “For the small business owner, I think it’s pretty tough right now.”

During the earlier phases of the pandemic, Boone said Cable One didn’t emphasize new work-from-home products but instead focused on the broader customer experience. For example, Cable One put some customers on a seasonable pause for the first time, forgave early termination fees, issued credits and, where appropriate, helped customers move to lower-level services.

“We really threw the rulebook out and just said, do what it takes to take care of the customers,” he said. Even if some small businesses fail, the hope is that those entrepreneurs will return and choose Cable One again, remembering that the company did right by them when times were tough. Moving forward, he said Cable One will stick to its knitting and focus on connectivity rather than look to expand its product line for the business segment.

“I think our product menu needs to look like In-N-Out and not The Cheesecake Factory,” Boone said, noting that Cable One has opted to sit on the sidelines with product categories such as SD-WAN. “We’re pretty cautious in terms of new product launches … We feel that connectivity is really our sweet spot.”

…………………………………………………………………………………………………………………………………………………………………………………………..

Comcast Business now serves, small, mid-range and enterprise-level customers with a variety of services including Metro Ethernet, wavelength services and Direct Internet Access. An important piece of the firm’s broader strategy revolves around a “unified optical network architecture” initiative that enables the MSO to serve a broad range of customer types, including those requiring that services are delivered to multiple locations in multiple markets.

Comcast’s unified optical architecture combines the access and metro optical networks using a set of items: network terminating equipment (NTE), a Wave Integration Shelf (WIS) and OTN (Optical Transport Network – ITU standard) “tails.”

The NTE is a small, optical shelf that today supports 10-Gig and 100-Gig up to a 400-Gig wavelength, and can reside at a single customer site or a data center. The WIS resides in the Comcast headend or hub, co-located with the metro optical line system, and serves as the demarcation point for commercial services. The OTN Tails are the key to connecting the access network to the metro network.

“We needed a way to provide commercial services to customers that were located in the access [network], but needed to reach the metro network to get to one of our routers for Internet access or possibly another segment of the access to connect their locations together,” Stephen Ruppa, senior principal engineer, optical architecture for Comcast’s TPX (technology, product and experience) unit, said this week during his keynote presentation.

The combining/meshing of the access and metro networks enables features such as remote management, performance monitoring data, alarming and a full “end-to-end circuit view,” including the customer sites themselves. “We use the same hardware, standards, configurations, designs, procurement, processes … in all the networks, regardless of the vendor,” Ruppa said.

And while there was once little need to connect two non-Comcast sites that resided in different areas or to provide connections greater than 10 Gbit/s, customer demands have changed. Ruppa said two products drove that demand and the desire to create the company’s unified optical architecture: wavelength services and high-bandwidth Metro Ethernet.

A modular, simplified, commoditized and easily repeatable architecture enables Comcast Business to “easily offer the next gen of 400-Gig wavelengths and Ethernet services with a very light lift,” he added.

………………………………………………………………………………………………………………………………………………….

Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia presented the final keynote.

The panel session “Fighting Fiber with Fiber” was moderated by Breznick with panelists:

- Christian Nascimento, VP, Product Management & Strategy, Comcast Business

- Brian Rose, Assistant VP, Product Internet, Networking & Carrier Services. Cox Communications

- Steve Begg, VP/GM, Business Services, Armstrong Business Solutions

- Mark Chinn, Partner, CMG Partners

- Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia

Decades old hybrid fiber-coax networks (HFC) drive fiber to the node outside of the premises, which is then hooked up using older cable (coaxial) technology. However, due to advances in cable technology such as the latest DOCSIS 4.0 technology, the cable industry has touted its newly developed technological capacity to support multi-gig symmetrical speeds over those hybrid networks. DOCSIS 4.0 currently supports speeds of up to 10 Gigabits (Gbps) per second download and 6 Gbps upload – its predecessor, DOCSIS 3.1, offered only 5 Gbps * 1.5 Gbps.

Christian Nascimento of Comcast stated that hybrid networks that deliver multi-gigabit speeds are “adequate” for smaller enterprises. “This is matter of matching the technology up with…the customer’s needs,” he said, adding that Comcast delivers these services in a “cost-effective way.”

For Cox Communications, the hybrid model is “an ‘and,’ not an ‘or,’” said Brian Rose, the assistant vice president of product internet for the cable company. While Cox may invest more heavily in fiber networks going forward, Rose said it will continue to invest in its cable networks as well. Rose said he welcomes market challenges from insurgent fiber deployers. “Competition is good for customers and the industry overall,” he said. “It pushes people to be better and to push the envelope.”

The panel wasn’t unanimously bullish on older cable technology, however. Ed Harstead of Nokia argued that a widespread transition to fiber is inevitable. “I don’t doubt that mom-and-pop businesses will be perfectly fine on [cable]. But to the extent that you need higher speeds and symmetrical speeds…it’s going to be fiber.”

The cable broadband industry faces an onslaught of criticism from fiber advocates. Organizations like the Fiber Broadband Association say their preferred technology performs better, last longer, and costs less in the long term than the competition. FBA President Gary Bolton has strongly opposed government support for all manner of non-fiber technology, including satellite and wireless.

……………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/cable-tech/cable-business-services-bounce-back/d/d-id/782175

Cable Providers Back Hybrid Fiber-Coax Networks in Face of Pure Fiber