Dell’Oro: OpenRAN revenue forecast revised down through 2027

No surprise that the global Open RAN market share forecast to 2027 has been revised downward by market research firm Dell’ Oro Group. This is the first downward forecast revision since the firm started tracking Open RAN, reflecting some hesitancy about these next generation architectures.

What is complicating the analysis is the fact that Open RAN adoption has been mixed across the greenfield and the brownfield operators. With greenfield and early adopter brownfield deployments maturing, the reality the industry is now facing is that it will take some time for the other segments to match and offset the more stable trends with the early adopters.

“We can think of this revision more as a near-term calibration than a change in the long-term growth trajectory,” said Stefan Pongratz, Vice President and Analyst at the Dell’Oro Group. “This journey of “re-shaping” the RAN was never expected to be smooth and many challenges remain. Even so, our long-term position has not changed. We continue to believe that Open RAN is here to stay, and the growing support by the incumbent suppliers bolsters this thesis, “continued Pongratz.

Additional highlights from the July 2023 Open RAN Report:

- Cumulative Open RAN revenues have been revised downward by 5 percent to 10 percent through the forecast period.

- Open RAN revenues are projected to account for more than 15 percent of global RAN by 2027.

- The European operators are ahead of the rest of the world when it comes to announcing Open RAN targets, but they have been more cautious with deploying Open RAN, focusing on building out 5G using traditional RAN. The baseline forecast, which assumes more delays in Europe, is for the European Open RAN market to surpass $1 B by 2027 and eventually be one of the leading markets from an Open RAN/RAN perspective.

Light Reading previously reported that prominent greenfield network operator Open RAN deployments to date have failed to impress, leaving many Open RAN equipment and software vendors to look to brownfield operations to make an industry impact. But so far not many have achieved any significant product swaps, nor does it look like there are many progressing at a pace that would accelerate Open RAN maturity among brownfield operators.

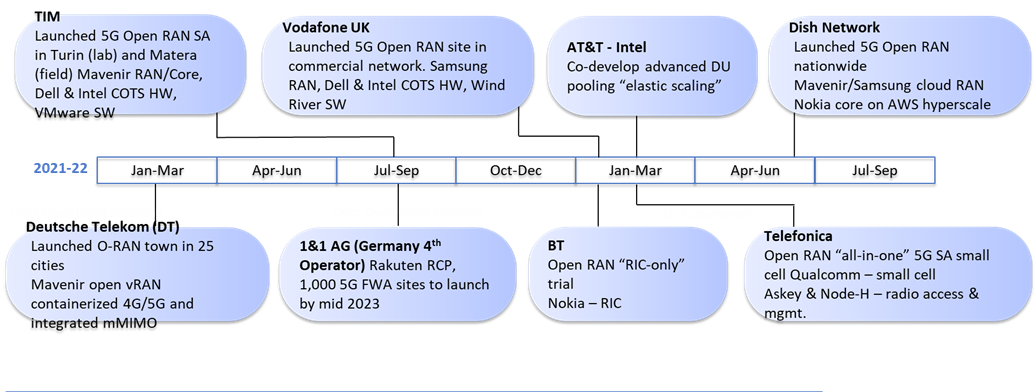

This chart below shows a timeline of Open RAN advances:

Source: 5G Americas

……………………………………………………………………………………………………………………….

Opinion: This author expects further downward revisions to come, mainly because the O-RAN Alliance, which creates the OpenRAN specifications, is not a standards body. Nor have they liaised their specs to ITU-R WP 5D which is responsible for all terrestrial IMT recommendations/standards. They do have an alliance with ATIS which has yet to contribute their specifications to either 3GPP or ITU.

………………………………………………………………………………………………………………..

The Dell’Oro Group Open RAN Advanced Research Report offers an overview of the Open RAN and Virtualized RAN potential with a 5-year forecast for various Open RAN segments including macro and small cell, regions, and baseband/radio. The report also includes projections for virtualized RAN along with a discussion about the vision, the ecosystem, the market potential, and the risks. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, networks, and data center markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

5-Year Open RAN Forecast Revised Downward, According to Dell’Oro Group

https://telecoms.com/522778/global-open-ran-market-share-by-2027-revised-downward/

LightCounting: Open RAN/vRAN market is pausing and regrouping

https://strandconsult.dk/category/open-ran/

5 thoughts on “Dell’Oro: OpenRAN revenue forecast revised down through 2027”

Comments are closed.

Network operators want MIMO, but OpenRAN can’t provide that right now….

https://www.lightreading.com/open-ran/open-rans-5g-course-correction-takes-it-into-choppy-waters/d/d-id/785678

Open RAN is last year’s technology and is not a standard.

Open radio access network (RAN) market growth continues to slow alongside the broader RAN market as operators take a breath from their initial 5G investments, but analysts note ongoing integration challenges need to be managed before the open RAN market can accelerate.

The open RAN market’s ongoing position as a sub-section of the broader RAN market also remains a barrier as operator timelines are impacting deployment and market dynamics.

Analysys Mason recently cited an outside influence from operators like Rakuten Mobile in Japan and Dish Network in the US. However, both are greenfield operators with limited overall market power.

LightCounting Market Research came to a similar conclusion, noting a handful of open RAN operators – Dish, Rakuten Mobile and some Rakuten Symphony customers – “kept the market flat year over year and produced double-digit sequential growth.”

From a vendor perspective, Dell’Oro Group has pointed to Samsung, NEC, Fujitsu, Rakuten Symphony and Mavenir as the top open RAN revenue generators over the past several quarters. Samsung is notably the only open RAN vendor that also gained a spot on Dell’Oro Group’s more broadly focused traditional RAN leadership board, placing No. 5 globally and No. 4 outside of China.

https://www.sdxcentral.com/articles/analysis/open-ran-growth-slows-to-a-crawl/2023/07/

Light Reading referred to OpenRAN as Vendor Lock-in 2.0: “trading 1 form of vendor lock-in for another” https://www.lightreading.com/open-ran/say-hello-to-open-ran-ecosystem-or-vendor-lock-in-20/d/d-id/767225

In another article, “If only open RAN components were truly “plug and play,” as easily replaceable as a broken bit of Lego….. Ensuring two suppliers can harmonize like choirboys takes lots of effort, and that probably helps to explain why single-vendor open RAN holds appeal.”

https://www.lightreading.com/open-ran/the-oxymoron-of-single-vendor-open-ran-is-on-rise/a/d-id/782542

Dell’Oro Group:

Both Open RAN and Virtualized RAN (vRAN) revenues declined in 2Q23, marking the first quarter of year-over-year (YoY) contractions since the firm began tracking these next generation architectures back in 2019.

“After a couple of years where Open RAN revenues exceeded expectations and advanced at an accelerated pace, the current slowdown doesn’t come as a surprise,” said Stefan Pongratz, Vice President with the Dell’Oro Group. “Projections for 2023 were more tempered, considering that it would take time for the early majority operators to balance out the more challenging comparisons with the early adopters who fueled the initial Open RAN wave. This is the trend we are witnessing now – growth decelerated in the first quarter and declined in the second quarter,” continued Pongratz.

Additional Open RAN and vRAN highlights from the 2Q 2023 RAN report:

*In Europe, Open RAN revenues are on the uptick, but this was insufficient to offset the declines in Asia Pacific and North America.

*The vendor landscape remains mixed, as many Open RAN-focused suppliers are not thriving as they had hoped. NEC experienced a material improvement in its Open RAN market share between 2022 and 1H23, whereas Mavenir’s Open RAN revenue share declined over the same period.

*The top 4 Open RAN suppliers by revenue for the 1H23 period were Samsung, NEC, Fujitsu, and Rakuten Symphony.

Open RAN revenues are still expected to account for 5 to 10 percent of the 2023 RAN market.

https://www.delloro.com/news/open-ran-and-vran-revenues-decline-for-first-time-in-2q23/

Nvidia could succeed where open RAN has mostly failed. In the early days of the O-RAN Alliance, the technology was heralded as a way for operators to break big vendors’ lock on expensive RAN components. But today most agree that open RAN hasn’t done much to upend the global RAN order – Ericsson, Nokia, Huawei and Samsung still sit at the top of the market.

“The concept of open and interoperable interfaces will live on in some form of incarnation, but the original vision is no longer viable,” wrote Chetan Sharma, an independent analyst, on social media.

https://www.lightreading.com/ai-machine-learning/nvidia-the-vendor-that-must-not-be-named