WSJ: 5G in South Korea has not lived up to expectations

Four years ago, South Korea led the world’s biggest rollout of 5G, promising a huge increase in network speeds that would help usher in a flurry of new technologies such as autonomous cars, augmented reality and remote surgeries. South Koreans are still waiting for that to happen.

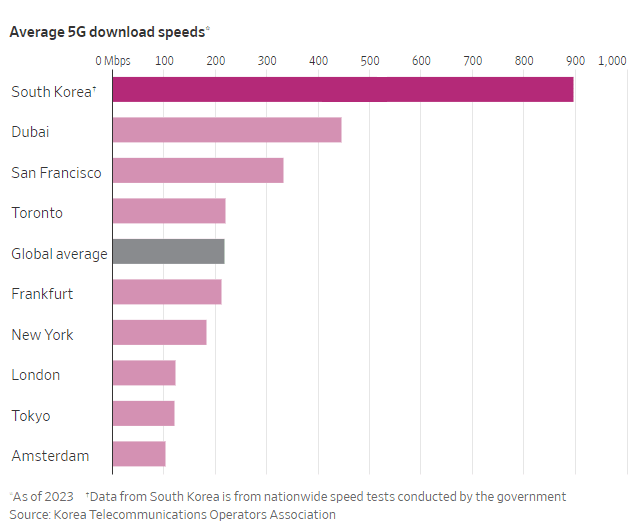

In 2022, South Korea’s average 5G download speed was 896Mbps -roughly six times that of the country’s average 4G download speed and more than double the 5G speeds of the United Arab Emirates and the U.S., according to the Korea Telecommunications Operators Association, a trade group. Despite those achievements, the network has fallen short of what was promised.

South Korea’s three major mobile carriers—SK Telecom, KT, and LG Uplus—advertised speeds up to 20 times faster than 4G LTE as they rolled out the new service, one of the world’s first commercial 5G networks, in April 2019. But, so far, such speeds can be achieved only on localized networks with limited coverage, and aren’t being pursued for wider use. Many consumers in South Korea were left underwhelmed by the minor improvements in speed and spotty connections. The network’s quality and speed have since improved with technologies such as “standalone 5G” (5G SA) that runs on its own network infrastructure rather than relying in part on those of 4G. Still, subscriber growth for 5G service has been slower than it was for 4G, and many of the visionary services talked about in the country haven’t come around.

South Korea’s nationwide 5G network experience has improved since the new network’s introduction, and driven more data usage. But technical hurdles and cost constraints have limited the ability to offer on a wide scale the type of 5G capable of even faster speeds, according to industry analysts and some of the South Korean carriers themselves.

Some of the difficulties stem from the frequencies at which radio waves travel. Countries around the world have enabled their 5G networks on different frequency bands, with most choosing low- or mid-frequency bands. South Korea’s main telecom firms developed their public 5G networks on the 3.5-gigahertz band, a mid-frequency band.

At the same time, 5G can be enabled on the high-frequency bands supporting millimeter wave, the type touted at 5G’s inception that can provide more-extreme boosts in speed. But a significant downside is that millimeter waves don’t travel well across long distances and through obstacles such as trees, buildings and glass. Thus, networks with the highest speeds are more challenging and expensive to deploy at scale.

South Korean telecom firms chose not to use the 28-gigahertz band, a high-frequency band supporting millimeter waves, in deploying nationwide 5G networks. Under this network environment, the latest smartphones currently sold in the country also do not come with the antenna system supporting this band.

The three telecom firms recently lost their licenses for the 28-gigahertz band after they didn’t meet the mandatory set number of 5G base stations using that band that needed to be built in order to keep the licenses. Now, the government is looking to grant 28-gigahertz licenses to nontelecom entities looking to use the band for 5G services in locations they deem as fit.

In May, South Korea’s Fair Trade Commission collectively fined the country’s three carriers about $24.8 million for allegedly using misleading advertising that exaggerated the speed of their 5G networks at their launch. The promoted speeds were a target that couldn’t be achieved in everyday usage environments, the South Korean FTC said in its decision.

South Korea’s apparent retreats in millimeter-wave 5G development put the country’s 5G leadership at risk, says a recent report from OpenSignal, a mobile-analytics company that monitors and analyzes the global telecom industry.

- LG Uplus says that the 28-gigahertz band’s properties made it costly and technologically difficult to deploy at a mass scale, and that the company would continue to work on improving the quality of its 5G services.

- SK Telecom says it will continue improving its 5G services, though it notes that South Korea boasts the world’s top 5G services in terms of speed and coverage and that consumers are using more data at lower costs.

- KT declined to comment.

This doesn’t mean the millimeter-wave band has lost its commercial appeal. Today, it is being used around the world—albeit in only a handful of cases—to enable ultrafast 5G in a fixed area, such as a sports arena, airport or smart factory, industry analysts say. Major telecom operators in the U.S. and Japan are using high-frequency mmWave bands for Fixed Wireless Access (FWA) or as one of the ways of enabling their 5G networks in dense urban locations, though coverage made available through these bands is limited to small areas and line of sight communications.

In South Korea, meanwhile, the 28-gigahertz band is being used to support some private 5G networks serving specific needs. One network, for example, supports autonomous robots at a local tech company and another assists augmented-reality technologies in surgery. Special licenses were issued in both cases. The 28-gigahertz band also is being used inside parts of Seoul’s subways, a government-led project that involved the three telecom companies. But whether that network will continue to operate, given the revocation of the three carriers’ 28-gigahertz licenses, remains to be seen.

At its beginnings, 5G was touted as a technology that would usher in a new era of smart cities, autonomous driving and holograms. But even in South Korea, where 5G adoption is higher than elsewhere, those new services are being pursued but haven’t taken off widely. Low market demand, the limited availability of devices that would support 5G as well as regulatory barriers all made it difficult for related services to go mainstream, said SK Telecom, the largest of South Korea’s three telecom firms, in a rare 6G white paper that outlined some key takeaways from 5G.

That is partly a chicken-and-egg problem, says Julian Gorman, head of Asia-Pacific for GSMA, a trade association for mobile carriers. Developers are often reluctant to invest in new products for a developing technology like 5G, especially the type using millimeter waves on the high-frequency bands. In turn, telecom providers see a weaker business rationale for investing aggressively in widespread millimeter-wave 5G coverage, he says.

The usage scenarios presented at 5G’s inception were more of a demonstration of the technology rather than solid proof that there was a business need to do so, Gorman says, adding that the 5G ecosystem is still trying to determine what types of new services and technologies are wanted in the market.

The lack of 5G killer apps also feeds into a bigger trend: 5G has been a harder sell than 4G. That’s mainly because URLLC does not meet the advertised ITU-R M.2410 performance requirements. So there are no mission critical, ultra low latency/real time applications that can use 5G.

In South Korea, the number of 5G subscribers surpassed 30 million in April this year, roughly four years after 5G’s initial introduction. But with 4G, that same milestone was reached after about 2½ years, according to data from the Ministry of Science and ICT (information and communication technology).

That is a trend echoed globally as well. As of 2022, about 32% of smartphones in circulation worldwide were 5G-capable, but just 45% of those phones were activated on a 5G network, down from 55% a year earlier, according to Omdia. This partly shows that more people are upgrading to 5G phones without necessarily choosing a 5G plan, in addition to 5G not being available yet in some places, it said.

“People are simply not ready to pay more for 5G, because they’re totally content with 4G,” which many consider sufficient for doing things like streaming video, says De Renesse of Omdia. “Many still ask, why would I pay more for doing the same thing?” he says.

References:

https://www.wsj.com/business/telecom/south-korea-5g-what-happened-9790b873