5G in Korea

SKT-Samsung Electronics to Optimize 5G Base Station Performance using AI

SK Telecom (SKT) has partnered with Samsung Electronics to use AI to improve the performance of its 5G base stations in order to upgrade its wireless network. Specifically, they will use AI-based 5G base station quality optimization technology (AI-RAN Parameter Recommender) to commercial 5G networks.

The two companies have been working throughout the year to learn from past mobile network operation experiences using AI and deep learning, and recently completed the development of technology that automatically recommends optimal parameters for each base station environment. When applied to SKT’s commercial network, the new technology was able to bring out the potential performance of 5G base stations and improve the customer experience.

Mobile base stations are affected by different wireless environments depending on their geographical location and surrounding facilities. For the same reason, there can be significant differences in the quality of 5G mobile communication services in different areas using the same standard equipment.

Accordingly, SKT utilized deep learning, which analyzes and learns the correlation between statistical data accumulated in existing wireless networks and AI operating parameters, to predict various wireless environments and service characteristics and successfully automatically derive optimal parameters for improving perceived quality.

Samsung Electronics’ ‘Network Parameter Optimization AI Model’ used in this demonstration improves the efficiency of resources invested in optimizing the wireless network environment and performance, and enables optimal management of mobile communication networks extensively organized in cluster units.

The two companies are conducting additional learning and verification by diversifying the parameters applied to the optimized AI model and expanding the application to subways where traffic patterns change frequently.

SKT is pursuing advancements in the method of improving quality by automatically adjusting the output of base station radio waves or resetting the range of radio retransmission allowance when radio signals are weak or data transmission errors occur due to interference.

In addition, we plan to continuously improve the perfection of the technology by expanding the scope of targets that can be optimized with AI, such as parameters related to future beamforming*, and developing real-time application functions.

* Beamforming: A technology that focuses the signal received through the antenna toward a specific receiving device to transmit and receive the signal strongly.

SKT is expanding the application of AI technology to various areas of the telecommunications network, including ‘Telco Edge AI’, network power saving, spam blocking, and operation automation, including this base station quality improvement. In particular, AI-based network power saving technology was recently selected as an excellent technology at the world-renowned ‘Network X Award 2024’.

Ryu Tak-ki, head of SK Telecom’s infrastructure technology division, said, “This is a meaningful achievement that has confirmed that the potential performance of individual base stations can be maximized by incorporating AI,” and emphasized, “We will accelerate the evolution into an AI-Native Network that provides differentiated customer experiences through the convergence of telecommunications and AI technologies.”

“AI is a key technology for innovation in various industrial fields, and it is also playing a decisive role in the evolution to next-generation networks,” said Choi Sung-hyun, head of the advanced development team at Samsung Electronics’ network business division. “Samsung Electronics will continue to take the lead in developing intelligent and automated technologies for AI-based next-generation networks.”

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

…………………………………………………………………………………………………………………………………….

SKT said it is expanding the use of AI to various areas of its communications network, such as “Telco Edge AI,” network power reduction, spam blocking and operation automation, including basestation quality improvement.

…………………………………………………………………………………………………………………………………….

References:

SK Telecom (SKT) and Nokia to work on AI assisted “fiber sensing”

South Korea has 30 million 5G users, but did not meet expectations; KT and SKT AI initiatives

SKT Develops Technology for Integration of Heterogeneous Quantum Cryptography Communication Networks

India Mobile Congress 2024 dominated by AI with over 750 use cases

WSJ: 5G in South Korea has not lived up to expectations

Four years ago, South Korea led the world’s biggest rollout of 5G, promising a huge increase in network speeds that would help usher in a flurry of new technologies such as autonomous cars, augmented reality and remote surgeries. South Koreans are still waiting for that to happen.

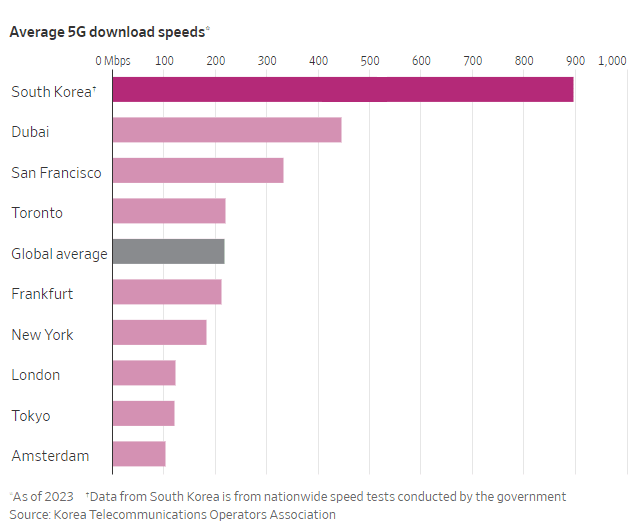

In 2022, South Korea’s average 5G download speed was 896Mbps -roughly six times that of the country’s average 4G download speed and more than double the 5G speeds of the United Arab Emirates and the U.S., according to the Korea Telecommunications Operators Association, a trade group. Despite those achievements, the network has fallen short of what was promised.

South Korea’s three major mobile carriers—SK Telecom, KT, and LG Uplus—advertised speeds up to 20 times faster than 4G LTE as they rolled out the new service, one of the world’s first commercial 5G networks, in April 2019. But, so far, such speeds can be achieved only on localized networks with limited coverage, and aren’t being pursued for wider use. Many consumers in South Korea were left underwhelmed by the minor improvements in speed and spotty connections. The network’s quality and speed have since improved with technologies such as “standalone 5G” (5G SA) that runs on its own network infrastructure rather than relying in part on those of 4G. Still, subscriber growth for 5G service has been slower than it was for 4G, and many of the visionary services talked about in the country haven’t come around.

South Korea’s nationwide 5G network experience has improved since the new network’s introduction, and driven more data usage. But technical hurdles and cost constraints have limited the ability to offer on a wide scale the type of 5G capable of even faster speeds, according to industry analysts and some of the South Korean carriers themselves.

Some of the difficulties stem from the frequencies at which radio waves travel. Countries around the world have enabled their 5G networks on different frequency bands, with most choosing low- or mid-frequency bands. South Korea’s main telecom firms developed their public 5G networks on the 3.5-gigahertz band, a mid-frequency band.

At the same time, 5G can be enabled on the high-frequency bands supporting millimeter wave, the type touted at 5G’s inception that can provide more-extreme boosts in speed. But a significant downside is that millimeter waves don’t travel well across long distances and through obstacles such as trees, buildings and glass. Thus, networks with the highest speeds are more challenging and expensive to deploy at scale.

South Korean telecom firms chose not to use the 28-gigahertz band, a high-frequency band supporting millimeter waves, in deploying nationwide 5G networks. Under this network environment, the latest smartphones currently sold in the country also do not come with the antenna system supporting this band.

The three telecom firms recently lost their licenses for the 28-gigahertz band after they didn’t meet the mandatory set number of 5G base stations using that band that needed to be built in order to keep the licenses. Now, the government is looking to grant 28-gigahertz licenses to nontelecom entities looking to use the band for 5G services in locations they deem as fit.

In May, South Korea’s Fair Trade Commission collectively fined the country’s three carriers about $24.8 million for allegedly using misleading advertising that exaggerated the speed of their 5G networks at their launch. The promoted speeds were a target that couldn’t be achieved in everyday usage environments, the South Korean FTC said in its decision.

South Korea’s apparent retreats in millimeter-wave 5G development put the country’s 5G leadership at risk, says a recent report from OpenSignal, a mobile-analytics company that monitors and analyzes the global telecom industry.

- LG Uplus says that the 28-gigahertz band’s properties made it costly and technologically difficult to deploy at a mass scale, and that the company would continue to work on improving the quality of its 5G services.

- SK Telecom says it will continue improving its 5G services, though it notes that South Korea boasts the world’s top 5G services in terms of speed and coverage and that consumers are using more data at lower costs.

- KT declined to comment.

This doesn’t mean the millimeter-wave band has lost its commercial appeal. Today, it is being used around the world—albeit in only a handful of cases—to enable ultrafast 5G in a fixed area, such as a sports arena, airport or smart factory, industry analysts say. Major telecom operators in the U.S. and Japan are using high-frequency mmWave bands for Fixed Wireless Access (FWA) or as one of the ways of enabling their 5G networks in dense urban locations, though coverage made available through these bands is limited to small areas and line of sight communications.

In South Korea, meanwhile, the 28-gigahertz band is being used to support some private 5G networks serving specific needs. One network, for example, supports autonomous robots at a local tech company and another assists augmented-reality technologies in surgery. Special licenses were issued in both cases. The 28-gigahertz band also is being used inside parts of Seoul’s subways, a government-led project that involved the three telecom companies. But whether that network will continue to operate, given the revocation of the three carriers’ 28-gigahertz licenses, remains to be seen.

At its beginnings, 5G was touted as a technology that would usher in a new era of smart cities, autonomous driving and holograms. But even in South Korea, where 5G adoption is higher than elsewhere, those new services are being pursued but haven’t taken off widely. Low market demand, the limited availability of devices that would support 5G as well as regulatory barriers all made it difficult for related services to go mainstream, said SK Telecom, the largest of South Korea’s three telecom firms, in a rare 6G white paper that outlined some key takeaways from 5G.

That is partly a chicken-and-egg problem, says Julian Gorman, head of Asia-Pacific for GSMA, a trade association for mobile carriers. Developers are often reluctant to invest in new products for a developing technology like 5G, especially the type using millimeter waves on the high-frequency bands. In turn, telecom providers see a weaker business rationale for investing aggressively in widespread millimeter-wave 5G coverage, he says.

The usage scenarios presented at 5G’s inception were more of a demonstration of the technology rather than solid proof that there was a business need to do so, Gorman says, adding that the 5G ecosystem is still trying to determine what types of new services and technologies are wanted in the market.

The lack of 5G killer apps also feeds into a bigger trend: 5G has been a harder sell than 4G. That’s mainly because URLLC does not meet the advertised ITU-R M.2410 performance requirements. So there are no mission critical, ultra low latency/real time applications that can use 5G.

In South Korea, the number of 5G subscribers surpassed 30 million in April this year, roughly four years after 5G’s initial introduction. But with 4G, that same milestone was reached after about 2½ years, according to data from the Ministry of Science and ICT (information and communication technology).

That is a trend echoed globally as well. As of 2022, about 32% of smartphones in circulation worldwide were 5G-capable, but just 45% of those phones were activated on a 5G network, down from 55% a year earlier, according to Omdia. This partly shows that more people are upgrading to 5G phones without necessarily choosing a 5G plan, in addition to 5G not being available yet in some places, it said.

“People are simply not ready to pay more for 5G, because they’re totally content with 4G,” which many consider sufficient for doing things like streaming video, says De Renesse of Omdia. “Many still ask, why would I pay more for doing the same thing?” he says.

References:

https://www.wsj.com/business/telecom/south-korea-5g-what-happened-9790b873

South Korea has 30 million 5G users, but did not meet expectations; KT and SKT AI initiatives

South Korea government fines mobile carriers $25M for exaggerating 5G speeds; KT says 5G vision not met

Omdia: ARPU declining or flat for South Korean 5G network operators

Opensignal: South Korea leads in 5G download speed; Philippines posts highest improvement in 5G video experience

South Korea government fines mobile carriers $25M for exaggerating 5G speeds; KT says 5G vision not met

South Korea’s antitrust regulator said it had imposed a total of 33.6 billion won ($25.06 million) in fines on three domestic mobile carriers for exaggerating their 5G network speeds. The Korea Fair Trade Commission (KFTC) said the three South Korean firms – SK Telecom Co Ltd, KT Corp, and LG Uplus Corp – had also unfairly advertised that they were the fastest relative to their competitors.

“The three telecom companies advertised that consumers could use target 5G network speeds, which cannot be achieved in real-life environment … companies advertised that their 5G network speed was faster than competitors without evidence,” the KFTC said in a statement.

In support of ongoing civil lawsuits filed by consumers, the advertisements released by the three mobile carriers have been presented by the regulator to a local court.

SK Telecom and KT Corp declined to comment. A spokesperson at LG Uplus said the company is reviewing the sanctions.

The KFTC imposed a fine of 16.8 billion won on SK Telecom, 13.9 billion won on KT and 2.8 billion won on LG Uplus.

There were 30.76 million 5G network users in South Korea in June, accounting for about 38% of the total 80.23 million mobile subscriptions in the country, according to data from the Ministry of Science and ICT.

Source: Reuters

In a paper issued last week, SK Telecom states correctly the industry is far from achieving its 5G goals even four years after commercialization. There were “misunderstandings” about network performance and problems such as device form factors and lack of market demand, it said. “A variety of visionary services were expected, but there was no killer service,” the paper stated. “We should have taken a more objective perspective,” it added. In particular:

A variety of visionary services were expected, but there was no killer service Even at the time when preparing for 5G, services such as autonomous driving, UAM, XR, hologram, and digital twin had appeared and expected, but most of them did not live up to expectations. We should have taken a more objective perspective. For example, whether 5G technology alone could change the future, or whether the overall environment constituting the service was prepared together. If so, the gap between the public’s expectations for 5G and the reality would not have been large. 3D video, UHD streaming, AR/VR, autonomous driving, remote surgery, etc. are representative services that are not still successful presented by the 5G Vision Recommendation. Most of them are the result of a combination of factors such as form factor constraints, immaturity of device and service technology, low or absent

market demand, and policy/regulation issues, rather than a single factor of the lack of 5G performance.

The authors concluded that instead of expecting that the new technology alone could create successful services, it would have been more effective to have collaborated with partners to build a broader 5G ecosystem.

Gap between 5G Vision Recommendations and customer expectations:

Although the usage scenarios and capability goals presented in the 5G Vision Recommendation are future goals to be achieved in the long term, misunderstandings have been created that can lead to excessive expectations of 5G performance and innovative services based on it from the beginning of commercialization. To prevent this misunderstanding from recurring in 6G, it is necessary to consider various usage scenarios of 6G, set achievable goals, and communicate accurately with the public. In particular, there were issues raised about the maximum transmission speed of 20Gbps, which was considered an icon of 5G key performance indicators. As 3G evolved into LTE, the radio access technology also evolved from WCDMA to OFDMA, and with the introduction of CA and multi-antenna technology, it became possible to use a much wider bandwidth than 3G. This can be seen as a ‘revolutionary’ improvement. On the other hand, 5G is considered as an ‘evolutionary’ improvement that supplements the performance of LTE based on the same radio access technology, CA, and multi-antenna system technology. Due to this, it was difficult to implement the increase in transmission speed shown in LTE in 5G at once. Moreover, the difference in technology perception was further revealed in the initial stage of 5G commercialization. Early commercialization was promoted for 5G, however, 5G required more base station compared to LTE to build a nationwide network due to frequency characteristics, requiring more efforts in terms of cost and time.

SK Telecom has made significant efforts to expedite 5G nationwide rollout, but customers wanted the same level of coverage as LTE in a brief period.

References:

https://newsroom-prd-data.s3.ap-northeast-2.amazonaws.com/wp-content/uploads/2023/08/SKT6G-White-PaperEng_v1.0_web.pdf

South Korea has 30 million 5G users, but did not meet expectations; KT and SKT AI initiatives

South Korea is arguably one of the leading countries that has deployed 5G. According to the Ministry of Science and ICT, the country had 29.6 million users as of this March, and given that number of subscribers has increased to around 500,000 per month up to now, it is more than likely that as of early May, there are 30 million 5G users. This milestone comes four years after 5G became available in smartphones in the country in April 2019 (based on 3GPP Release 15 specs).

South Korea started 2G code division multiple access (CDMA) services in 1996 and 3G wide CDMA in 2003, starting the cell phone era. This allowed South Korean telecommunication companies to expand abroad. The launch of WCDMA also allowed Qualcomm and Samsung to become leaders in application processors and smartphones, respectively, today. Then in 2011 came 4G long-term evolution (LTE) services. This truly enabled smartphones which could now stream videos in real time. South Korean wireless network operators SK Telecom, KT and LG Uplus became board members of GSMA, the global telecommunications suppliers organization.

Expectations were high for 5G. The government and telcos claimed in marketing before launch that 5G will be, compared to 4G, 20 times faster, 100 times better simultaneous access and 10 times shorter delays. They claimed new augmented reality, virtual reality, 3D content and IoT services would be introduced. However, the reality after 5G launched was quite different and none of the promises were kept.

According to the Ministry of Science and ICT, 5G download speed on average was 896.10Mbps as of October. Upload speed was on average 93.16Mbps. This was only faster by 5.9 times and 2.8 times faster, respectively than 4G LTE in the same month.

Image Credit: TheElec (http://thelec.net)

5G coverage was also only around 33.1% of the country, which means on a national level, most people were using non-standalone 5G services (5G NR with LTE infrastructure and EPC).

Spending to obtain 28 GHz mmWave spectrum has effectively ended. KT and LG Uplus had their spectrum cancelled in December; SK Telecom is also expected to lose theirs within the year (SEE UPDATE BELOW)! Without spending on 28GHz, there will be no “20 times faster 5G.” The country’s Fair Trade Commission is expected to penalize the three South Korean telcos for violating advertisement laws.

………………………………………………………………………………………………………………………………………………………………………………..

On the positive side, 5G is being combined with AI. KT announced the commercial launch of a new solution, which it calls its “5G Infrastructure Intelligent Control Solution”, that is based on artificial intelligence (AI) technology. The South Korean network operator noted that this solution is designed to control 5G infrastructure with the aim of making that infrastructure more efficient and stable.

KT’s new solution is equipped with AI technology to detect abnormalities in the status of networks and equipment in real-time. By comparing dozens of equipment quality data in real-time with pre-learned data, the new solution can determine whether the equipment is abnormal or not with a single indicator, KT said. Also, the solution also displays the status of access and core equipment in five stages, making it easy to “intuitively check the equipment and the degree of abnormality” that occurred, the Korean telco added.

The company highlighted that companies and institutions without expertise in network management can use KT’s 5G solution to operate 5G networks without any “burden.” KT said it has already implemented the solution in four institutions, including Bundang Seoul National University Hospital, Samsung Seoul Hospital, Korea Aerospace Industries Co., Ltd. and Navy Headquarters.

“When KT’s 5G specialized network testbed is established, it will be possible to perform a one-stop service for testing equipment for 5G specialized network, interworking with terminals, and conducting network trial operation and inspection. It is expected to greatly reduce the cost and technical burden of companies considering the introduction of a 5G specialized network,” KT said.

“SK Telecom (SKT) is stepping up efforts on all fronts to transform itself into an AI company,” CFO Kim Jin Won told a results briefing Wednesday. Its strategy is to grow through partnerships with local and global top-tier AI companies while also continuing to develop its own AI technology.

SKT has been trialing generative AI in its A. (pronounced “A-dot”) service, built on its own technology and capable of holding complex conversations and developing long-term memories. Last month the telco invested 15 billion Korean won (US$11.4 million) in local startup Scatter Lab, which has used deep learning to create a chatbot that can hold empathetic conversations. SKT wants to work with Scatter Lab to develop an AI agent that can have human-like conversations with A. customers. The two companies also aim to develop a hyperscale language model equipped with emotions and knowledge domains.

May 15 2023 Update:

On Friday, May 12th South Korea’s Ministry of Science and ICT cancelled SKT’s 28 GHz 5G license. The Korean network operator’s major rivals KT Corp and LG U+ had their 28 GHz licences cancelled last year for the same reason, but SKT held on to its concession by the skin of its teeth and escaped with a warning.

“It is regrettable that this result has finally come about despite the government’s active efforts so far,” said Choi Woo-hyuk, director of radio wave policy at the Ministry of Science and ICT, in a Korean language statement confirming the licence withdrawal.

The three South Korean mobile operators each acquired 800 MHz of 28 GHz spectrum, alongside 3.5 GHz frequencies, in 2018, with the band being available for use by the end of that year. The licence conditions required them to deploy 15,000 base stations using 28 GHz within three years. But an investigation on the part of the last year Ministry showed that the telcos had built only 10% of the number of sites they had committed to, which led to it pulling the licences of the worst offenders: KT and LG U+.

https://telecoms.com/521670/south-korea-cancels-skts-28-ghz-5g-licence/

References:

https://www.thelec.net/news/articleView.html?idxno=4524

https://irsvc.teletogether.com/skt/pdf/skt2023Q1_Subtitles_eng.pdf?2

Omdia: ARPU declining or flat for South Korean 5G network operators

3 South Korean mobile operators to share 5G networks in remote areas

Omdia: ARPU declining or flat for South Korean 5G network operators

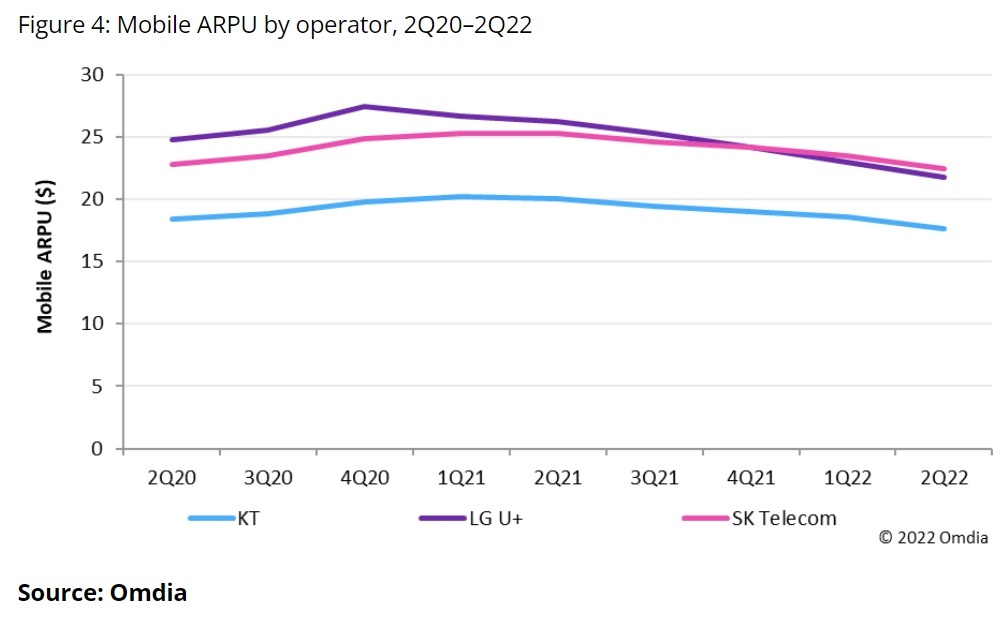

A new research report from Informa owned consulting firm Omdia finds that the average revenues per user (ARPU) are now falling for the three big South Korean 5G network providers. That follows two previous years of rising ARPU.

“After two years of consistent growth, mobile ARPU is back in decline for KT Corp and LG U+ while maintaining relatively flat for SK Telecom, with 5G subscription growth and revenue growth stalled,” wrote Omdia analyst Anshika Gandotra in a recent report.

“Initially, the launch of 5G stopped the declining ARPU trend. However, mobile ARPU has been declining since 1Q21. Mobile operators made diverse efforts to meet customers’ varying needs. SK Telecom started offering new 5G price plans at a 30% cut in rates for online-only mobile plans.”

“Additionally, LG U+ reduced the cost of 5G plans. South Korea has shown early signs of 5G market maturation because the top-tier customers have now upgraded to 5G services. Other customers seem more resistant to upgrading at the moment, thereby slowing down 5G growth.”

South Korea is often viewed as a bellwether for the 5G business, largely because the country was first in widescale 5G deployment and its regulator collects detailed information about the adoption of the technology. As of August 2022, there were 24.53 million 5G subscribers in South Korea, accounting for around 33% of all mobile subscriptions in South Korea. Perhaps more importantly, 5G networks are now carrying roughly 70% of all mobile data traffic in the country. That’s mainly because the average 5G user consumes around 27GB per month, or nearly 3.1x the average 4G user.

This September, Mobile World reported that ARPU at:

- SK Telecom, with the highest 5G penetration (38.7 per cent), was flat in Q2-2022.

- LG U+, with 34 per cent on 5G plans, posted a third consecutive quarterly dip in ARPU in the quarter, falling 4.1 per cent.

- KT with 32 per cent of subscribers using 5G services bucked the downward trend. ARPU rose for the fourth straight quarter, increasing 3.2 per cent.

Loud and Clear Message:

Obviously, there is no pent up demand for faster 5G services. App makers have not brought to mass market services like autonomous driving that would require more firepower. Customers can watch Netflix and surf the net well enough with existing 5G technology. Telcos have adapted by diversifying. To make the quantum leap to the highest-speed 5G will require the roll-out of essential services that need such fast connections.

“When households begin to have robots at their homes, for instance, telcos would then start ramping up infrastructure investments, so the highest-speed 5G will be partially available around 2025,” said Kim Hyun-yong, an analyst at Hyundai Motor Securities.

The lesson for other countries racing toward 5G may be: curb your enthusiasm. The new technology holds great promise, but for now there will still be as much evolution as revolution in the high-speed internet future.

References:

https://omdia.tech.informa.com/OM025134/5G-in-South-Korea–2022

https://www.lightreading.com/5g/a-concerning-arpu-trend-shows-up-in-south-koreas-5g/d/d-id/780403?