WSJ: Has 5G Lived Up to Expectations?

Hundreds of billions of dollars have been invested worldwide in 5G. What was the return on that huge investment? As we forecasted five years ago and ever since then, 5G hasn’t revolutionized whole swaths of the economy the way past mobile technologies did.

…………………………………………………………………………………………………………………………….

Opinion: Network operators and 5G vendors promised too much and under delivered. 3GPP and ITU-R WP 5D are partially to blame for the commercial failure of 5G.

In particular, URLLC- the key 5G use case- could not be realized because 3GPP Release 16 spec for Enhancements for URLLC in the RAN wasn’t complete and so could not be implemented. Those enhancements were to enable URLLC end points to realize ITU-R M.2410 performance requirements, e.g. <1 ms latency in the data plane and <10 ms latency in the control plane.

Also, the 3GPP specs for 5G Architecture did not include implementation of 5G SA Core network, but instead provided many options. Hence, there are many versions of 5G SA Core networks, with many major network operators, e.g. AT&T and Verizon, still using 5G NSA (with LTE infrastructure for everything but the RAN).

ITU-R M2150, the terrestrial 5G RIT/SRIT recommendation, did not meet the M.2410 URLLC performance requirements (due to absence of 3GPP Rel 16 URLLC in the RAN spec), Also, it was not accompanied by the companion recommendation M.1036 issue 6 IMT Frequency Arrangements, which could not be agreed upon till a few months ago (it’s expected to be approved by ITU-R SG 5 meeting this November). As a result, there were no standard frequencies for 5G. That resulted in a “frequency free for all” where administrations like the FCC chose frequencies for 5G that were not agreed upon at WRC’19 and assigned to ITU-R WP 5D to specify the frequency arrangements.

For sure, the U.S. wireless carriers offering 5G service have not had anywhere near a good ROI. That’s indicative of the decline in their stock prices this year. Despite an 8.67% dividend, Verizon (VZ) stock has lost -16.39% YTD through Friday Oct 13th. AT&T (T) stock has performed slightly worse with a -16.74% YTD total return. The Dow Jones U.S. Telecommunications Index is -17.34% YTD through Friday.

…………………………………………………………………………………………………………………………….

In markets with widespread 5G, cellphone users often fail to notice a difference in service compared with 4G-LTE. This author has had a 5G Samsung Galaxy phone for over one year and does not notice any difference from 4G-LTE.

A key growth opportunity for 5G—businesses installing private networks in places such as manufacturing plants and arenas—has yet to take off.

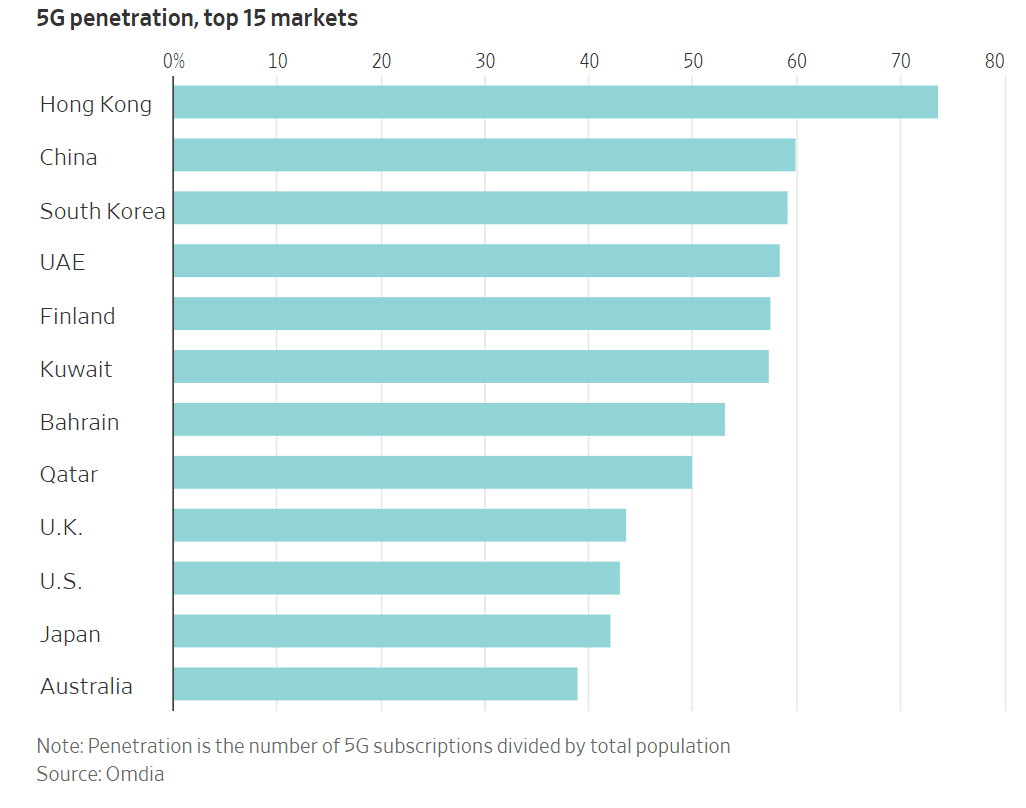

In the U.S., about 43% of people had 5G mobile subscriptions as of June, ranking 10th worldwide, according to estimates from research firm Omdia. Hong Kong had the world’s highest 5G penetration rate, with 74% of its population subscribed to the mobile service. Ranked second- and third-highest in the world were mainland China and South Korea, which registered 5G mobile-subscription rates of 60% and 59%, respectively.

The high uptake in China and its neighbors is no accident. Smartphone users in several Asian countries have benefited from affordable next-generation devices, strong fiber-optic infrastructure and government policies that encouraged broad 5G cellular coverage. China and South Korea also host technology giants like Huawei and Samsung that are spearheading the wireless technology’s advancement.

Finland had the highest 5G penetration rate in Europe, at 58%, while the United Arab Emirates led the Middle East, also with 58%.

Getting “4G for all, not 5G for few,” has been the mantra for the past two years at Veon, a network operator that serves cash-strapped markets from Ukraine to Bangladesh.

The Amsterdam-based company has already covered 90% of the six countries it serves with 4G signals. Some areas lack the fiber-optic-cable infrastructure to support 5G-capable cellphone towers, and roughly half of the population in those markets lacks even a smartphone, let alone one capable of picking up 5G connections. Some countries also impose high taxes on smartphones, which puts the devices out of reach for many consumers, says Veon Chief Executive Kaan Terzioğlu.

“This is really matching the needs of the markets with the technologies that are available,” Terzioğlu told the WSJ. Spending money on 5G infrastructure before the people it covers are ready to tap it “would be irresponsible,” he added.

Business owners and executives in many poorer countries say they wouldn’t plan around ultrafast wireless connections in places where 2010 technology is still the norm. “There’s not enough coverage or towers here,” says Nicholas Lutchmiah, retail manager at Topbet, a licensed gambling bookmaker and sports-betting company in South Africa, which has most of its shops in poorer townships and rural areas. “That’s the biggest problem that we face. In rural areas and townships, we get 3G, which is rather slow.”

Business owners and executives in many poorer countries say they wouldn’t plan around ultrafast wireless connections in places where 2010 technology is still the norm. “There’s not enough coverage or towers here,” says Nicholas Lutchmiah, retail manager at Topbet, a licensed gambling bookmaker and sports-betting company in South Africa, which has most of its shops in poorer townships and rural areas. “That’s the biggest problem that we face. In rural areas and townships, we get 3G, which is rather slow.”

Despite the limitations, some developing countries have invested heavily in 5G technology. Indian telecom companies have committed tens of billions of dollars to the latest network technology and making a push for ultracheap smartphones, for instance. Domestic conglomerate Reliance Industries has led much of its country’s aggressive telecom investments through its Jio brand, the spearhead of leader Mukesh Ambani’s ambition “to connect everyone and everything, everywhere.”

The wireless companies that invested in 5G technology early paid handsomely to refresh their networks. and they have the balance sheets to prove it. The world’s biggest wireless companies—excluding China’s state-backed operators—carried $1.211 trillion of corporate debt at the end of 2022, up from $1.072 trillion four years earlier, according to Moody’s Investors Service.

The credit-rating service said that those companies spent more than in past years building up their wireless networks and issued more debt to finance big spectrum purchases. The price of that spectrum has varied but generally risen. One auction raised $19 billion in India while another group of licenses fetched $81 billion in the U.S.

Debt is nothing new to big telephone networks. The capital-intensive companies have historically run through cycles of heavy upfront spending on new equipment and installation before paying down the tab over time through reliable subscription fees; phone and internet service is a modern necessity, after all.

But securing airwaves for new 5G signals has forced companies to speed up their borrowing. “There’s a lot of debt on these companies,” Moody’s analyst Emile El Nems says. “We’re not ringing the alarm bells, but we’re saying there’s limited flexibility for an accident.”

Executives at telecom companies that borrowed the most to amass 5G-friendly spectrum licenses have said that they made prudent investments to meet customers’ demand for mobile bandwidth, and that their biggest spending is behind them, at least in the near term.

China moved early to enhance its national infrastructure, blanketing the country with 5G base stations as soon as manufacturers started making them. The country’s three major mobile-phone carriers anchored those transmitters to a dense network of fiber-optic cables and encouraged a range of businesses from seaports to coal mines to use the ultrafast connections. It has also provided subsidies and regulatory support to telecom operators and tech companies, facilitating their growth and enabling them to compete on a global scale.

At the end of June, 5G base stations in the country connected 676 million 5G phones and more than 2.12 billion Internet of Things devices, China’s central-government officials said in a press conference in July.

U.S. officials offered their national cellphone carriers fewer direct subsidies than their Beijing counterparts, but policy makers granted many requests on the companies’ wish lists. Trump administration appointees fast-tracked auctions of 5G-capable wireless frequencies and consolidated the wireless sector by approving T-Mobile’s takeover of rival Sprint, a deal that the company and government leaders said would accelerate long-planned network upgrades.

At the same time, the U.S. has tried to persuade other countries to not buy Chinese gear—an effort that prompted some governments to ban its telecom equipment. But China’s homegrown supplier, Huawei, has weathered the U.S. efforts and played a pivotal role in both the domestic and global 5G markets. At the same time, they have turned away from Western suppliers like Qualcomm for some components and are now relying on domestic suppliers.

Huawei remains the world’s largest seller of telecom equipment, commanding about a third of the global market, with sales about twice those of the second- and third-ranked suppliers, Nokia and Ericsson, according to market-research firm Dell’Oro Group.

What happened to businesses being big 5G consumers?

One of 5G’s most alluring promises remains the private network: a system built to the same standard as a high-speed cellphone service but tailored for a business operating in a smaller area like an office, farm or factory. Those networks can connect a range of computers, sensors and robotics without the hassle and cost of hooking them up with wires.

For now, though, companies have been slow to adopt private networks. Consider “the factory of the future” that Ford and Vodafone previewed outside London in 2020. The companies detailed plans for a swarm of mobile robot welders receiving orders over superfast 5G connections, so they could assemble electric cars more quickly and precisely than traditional equipment.

Three years later, the factory of the future is still just a concept. Ford doesn’t use the high-tech wireless standard on its production line, and Vodafone says it ended its proof-of-concept project with the American automaker. A Ford spokesman didn’t respond to a request for comment.

In total, organizations have built more than 750 private cellular networks around the world, according to Besen Group, a private-network consultancy. Installations run the gamut from college campuses to open-pit mines, though many of them use less-advanced 4G gear instead of the latest-generation electronics.

That is partly because of a chicken-or-the-egg problem with private networks. A device maker might not want to create 5G gear for factories until more factories have installed cellular networks. But factory owners don’t want to invest in those networks unless there are enough 5G-ready devices on the market to justify the upgrade.

“This is actually fairly typical for new network equipment,” says Vodafone cloud and private-network chief Jenn Didoni. “The devices will certainly come, but there aren’t as many as in 4G, and they aren’t as tested and understood.”

Dell’Oro estimates that private networks make up less than 1% of the market for the relevant 5G equipment, but the research firm predicts that early revenue will grow, on average, at a 25% annual rate over the next five years as more connected gadgets hit the market.

“In the beginning, a lot of the conversations used to be about feasibility,” says Durga Malladi, a senior vice president at chip maker Qualcomm. “If I am interested in moving robots and overhead cranes using 5G, can I even get the same level of reliability and latency that I have expected from just wired? And the answer to that is, in almost all instances, absolutely yes.”

Many industries have yet to experience the market disruption that 5G’s boosters promised. A notable exception: Some telecom companies are enjoying a windfall from wireless bandwidth improvements at the expense of their cable-internet rivals.

Mobile network carriers like T-Mobile and Verizon have used new high-speed wireless equipment to beam internet service straight into customers’ homes, racking up more than five million new subscriptions altogether in under three years. The over-the-air service has dented cable-industry revenue and forced companies to compete in areas where they were once the only game in town.

Telecom companies have long known how to beam internet connections into people’s homes without the considerable expense of new wires and equipment. But wireless companies faced an uphill fight against their hard-wired competitors until 5G improvements brought advances such as more-efficient signals that could run through the same cell-tower antennas that companies were already installing to connect cellphones.

That helped mobile-network operators quickly rack up home-internet customers at much lower variable costs, especially in America, where cable companies’ dissatisfied customers offer a juicy target.

“The U.S. is very unusual because we pay so much for home broadband,” says Jeff Heynen, an analyst for Dell’Oro. “The way T-Mobile and Verizon are addressing the service, clearly you know who they’re going after.”

Markets with many far-flung customers, like Australia and Saudi Arabia, could soon follow the U.S. lead in 5G home-internet service, Heynen adds. Industry experts warn that the booming wireless-broadband business isn’t going to replace cable soon, however.

Capacity is the main factor holding back wireless internet services. A single cellular tower can only handle so many videogames, TV streams and Zoom calls at once, even after 5G upgrades offer those towers more bandwidth to go around.

T-Mobile CEO Mike Sievert has even played down his company’s booming home-internet business, telling investors at a Goldman Sachs conference in September that the service would eventually reach a customer base in the single-digit millions. That is a sliver of the more than 100 million U.S. households that could use broadband service. “It’s a very mainstream offer, but we don’t think it’s going to take over cable and fiber,” Sievert said.